Market Overview

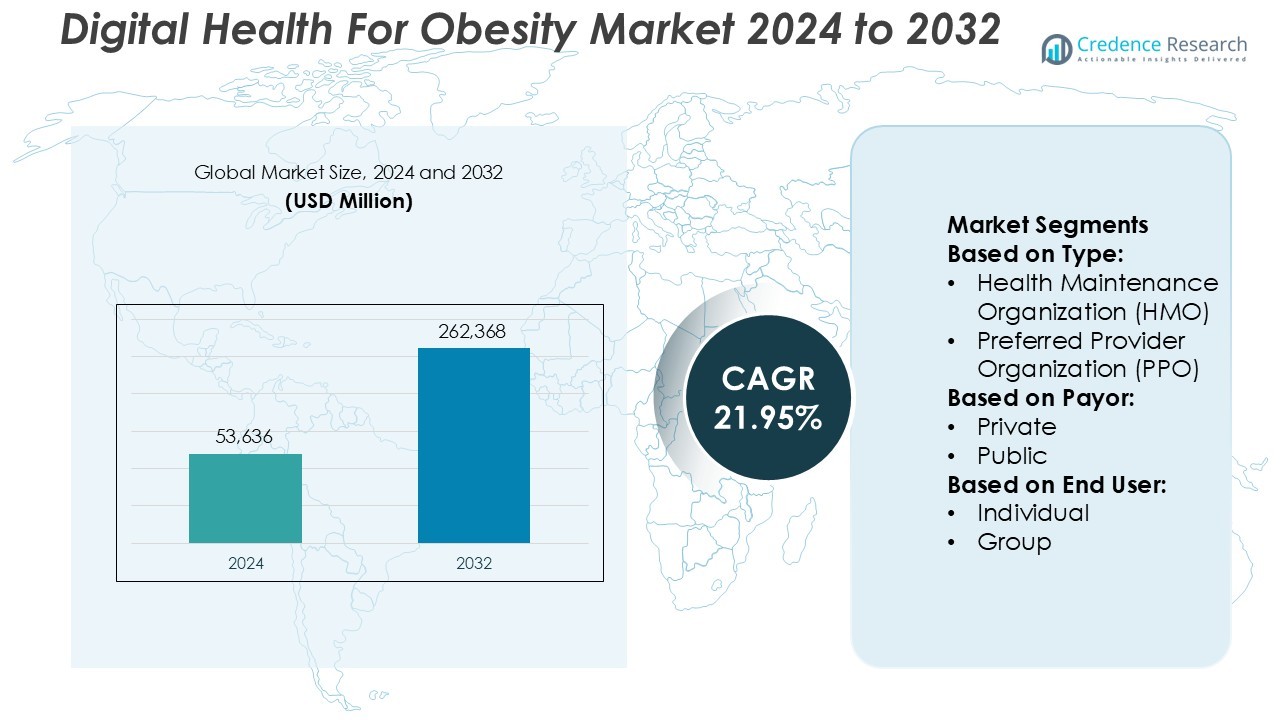

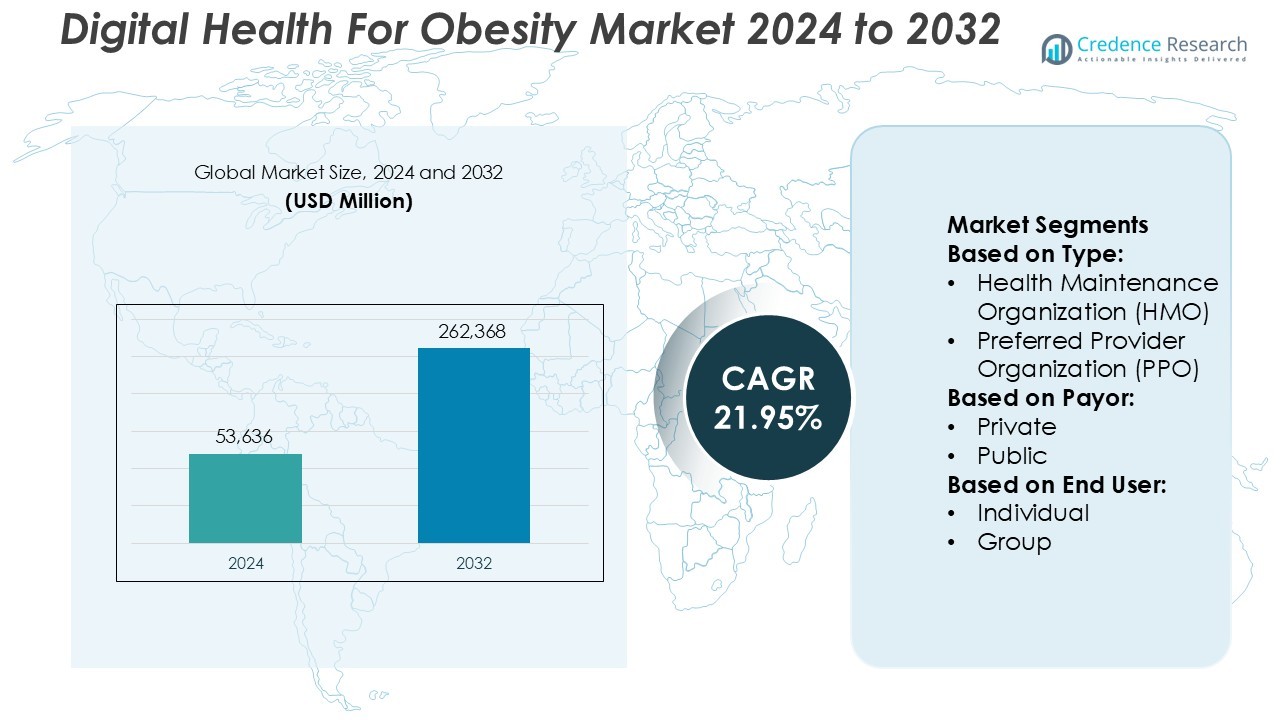

Digital Health For Obesity Market size was valued USD 53,636 million in 2024 and is anticipated to reach USD 262,368 million by 2032, at a CAGR of 21.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Health For Obesity Market Size 2024 |

USD 53,636 Million |

| Digital Health For Obesity Market, CAGR |

21.95% |

| Digital Health For Obesity Market Size 2032 |

USD 262,368 Million |

The Digital Health for Obesity Market is marked by strong competition among global technology-driven healthcare providers and digital wellness platforms. Companies are focusing on innovation in AI-driven analytics, behavioral modification tools, and connected wearable technologies to enhance user engagement and treatment precision. Strategic collaborations between digital health firms and healthcare institutions are enabling integrated obesity management solutions. North America leads the global market with a 39% share, supported by advanced digital infrastructure, widespread telehealth adoption, and strong insurance support. Growing demand for personalized weight management and preventive healthcare continues to shape competitive dynamics across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Digital Health for Obesity Market was valued at USD 53,636 million in 2024 and is projected to reach USD 262,368 million by 2032, growing at a CAGR of 21.95%.

- Rising obesity rates and lifestyle-related health conditions drive demand for digital health platforms offering AI-based monitoring and personalized management solutions.

- Key market players focus on wearable technology, behavioral modification tools, and data-driven healthcare integration to improve user engagement and treatment accuracy.

- High development costs, data security concerns, and limited digital literacy in developing regions restrain wider market adoption.

- North America dominates with a 39% share, supported by strong telehealth adoption and reimbursement policies, while the Health Maintenance Organization (HMO) segment leads by type due to its integrated preventive care model.

Market Segmentation Analysis:

By Type

The Health Maintenance Organization (HMO) segment holds the dominant share in the Digital Health for Obesity Market. HMOs lead due to their integrated care approach, preventive focus, and cost-efficient management of obesity-related conditions. These organizations use telehealth and remote monitoring tools to enhance patient engagement and ensure compliance with personalized weight management plans. The adoption of digital health platforms by HMO providers supports continuous patient tracking, improving health outcomes and reducing hospital visits. This structure encourages preventive care, making HMO the preferred model for obesity treatment management.

- For instance, WellDoc’s BlueStar® digital platform integrates with over 150 devices and supports AI-driven analytics that analyze 400+ behavioral and biometric data points daily, enabling physicians to customize obesity treatment plans in real time and improve adherence rates among users.

By Payor

The private payor segment accounts for the largest market share owing to greater flexibility, faster adoption of digital healthcare technologies, and better reimbursement structures. Private insurers invest heavily in digital obesity management programs that integrate wearable devices, AI-driven coaching, and nutrition tracking applications. These initiatives promote early intervention and sustained weight loss outcomes. Increased awareness of lifestyle diseases and rising employer-based health programs also strengthen private payor dominance. Enhanced user engagement and measurable health improvements further drive participation in digital obesity solutions under private insurance schemes.

- For instance, PlateJoy Health’s precision nutrition platform leverages over 5,000 algorithmic data inputs, including metabolic rate and activity level, to deliver hyper-personalized meal plans.

By End User

The individual segment dominates the market with the highest share, driven by growing consumer awareness and accessibility of mobile health applications. Individuals increasingly use digital platforms for self-monitoring, fitness tracking, and virtual consultations to manage obesity. The convenience of smartphone-based interventions and personalized health analytics has accelerated this adoption. Moreover, rising interest in preventive healthcare and behavior modification tools fuels continuous platform engagement. The availability of subscription-based programs offering customized dietary and exercise recommendations further enhances user retention, supporting sustained market growth in the individual segment.

Key Growth Drivers

- Rising Prevalence of Obesity and Lifestyle Disorders

The growing global obesity rate remains a major driver for the Digital Health for Obesity Market. Sedentary lifestyles, unhealthy diets, and limited physical activity contribute to rising obesity cases. Digital health platforms offer continuous monitoring, virtual counseling, and behavior modification tools to address these factors effectively. Health apps, wearable devices, and AI-based solutions help individuals manage weight proactively. Governments and healthcare providers increasingly adopt such technologies to reduce obesity-related healthcare costs and promote preventive wellness programs.

- For instance, FitnessKeeper Inc., the developer of the Runkeeper app, introduced advanced motion-tracking algorithms that analyze over 200 movement data points per minute to assess user performance and calorie expenditure.

- Growing Adoption of Telehealth and Remote Monitoring

The expanding use of telehealth and remote patient monitoring significantly drives market growth. These solutions enable patients to access virtual consultations, personalized nutrition plans, and real-time progress tracking. Healthcare professionals leverage data from connected devices to adjust treatment plans efficiently. Integration of digital tools with existing healthcare systems enhances accessibility and continuity of care. This approach benefits individuals in rural or underserved regions by reducing travel needs and providing affordable, on-demand obesity management support.

- For instance, BioAge Labs utilizes multi-omics data derived from over 1.2 million biological markers to predict metabolic aging patterns that influence obesity risk.

- Increasing Integration of Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and advanced data analytics are transforming digital obesity management. AI algorithms personalize treatment plans by analyzing behavioral patterns, physical activity, and dietary habits. Predictive analytics help identify risk factors and provide timely interventions. Companies are incorporating AI-driven chatbots, virtual coaches, and adaptive learning platforms to boost user engagement. These innovations improve adherence rates and enhance treatment outcomes. The integration of AI with digital health ecosystems supports precision medicine approaches, leading to higher adoption among healthcare providers and consumers.

Key Trends & Opportunities

- Expansion of Wearable and Connected Health Devices

The rising use of wearable devices presents significant growth opportunities in the digital obesity sector. Smartwatches, fitness bands, and biosensors provide continuous health tracking and deliver real-time insights on calorie intake, heart rate, and activity levels. Integration of these devices with mobile applications enables comprehensive obesity management. Manufacturers are advancing sensor accuracy and connectivity features to improve data reliability. The growing consumer preference for personalized, data-driven weight management solutions supports ongoing innovation in wearable health technology.

- For instance, Teladoc Health, Inc. integrates its Livongo platform with more than 400 FDA-cleared connected devices, including continuous glucose monitors and digital blood pressure cuffs, to capture over 3 billion biometric data points annually.

- Growing Focus on Personalized Digital Therapies

Personalized digital therapy programs are emerging as a major trend in obesity care. These platforms use machine learning algorithms to create customized weight management plans based on user data and lifestyle patterns. Virtual coaching, AI-powered feedback, and adaptive goal setting enhance patient adherence and motivation. Healthcare providers are collaborating with digital health firms to integrate personalized treatment modules within existing clinical workflows. This trend strengthens patient outcomes while expanding the role of precision medicine in digital obesity treatment.

- For instance, Noom’s behavior-change platform utilizes a proprietary AI model that analyzes more than 250 million anonymized user data entries daily to deliver hyper-personalized cognitive behavioral therapy (CBT) interventions.

Key Challenges

- Data Privacy and Security Concerns

Data security remains a major challenge in the Digital Health for Obesity Market. Digital platforms collect sensitive health data that must comply with strict privacy regulations such as HIPAA and GDPR. Breaches or unauthorized access can undermine patient trust and hinder platform adoption. Companies face increasing pressure to invest in encryption, secure cloud storage, and transparent data policies. Maintaining user confidence while ensuring data interoperability across multiple systems remains a critical challenge for long-term market sustainability.

- Limited Accessibility and Digital Literacy

Low digital literacy and limited internet access in developing regions restrict market penetration. Many users lack awareness or technical skills to operate digital health platforms effectively. Furthermore, inadequate infrastructure and high device costs reduce adoption among low-income populations. Governments and private organizations are working to improve digital inclusion through awareness programs and subsidized technology initiatives. However, bridging the digital divide remains essential to achieving equitable access and maximizing the benefits of digital obesity management solutions globally.

Regional Analysis

North America

North America dominates the Digital Health for Obesity Market with a 39% share, driven by high obesity prevalence and widespread digital health adoption. The U.S. leads due to advanced healthcare infrastructure, high smartphone penetration, and strong insurance support for digital weight management programs. Major players are integrating telehealth, AI, and wearable technologies to offer personalized obesity management solutions. Federal initiatives promoting preventive healthcare and digital transformation in clinical settings further strengthen regional growth. Continuous innovation and consumer awareness sustain North America’s leadership in the global market.

Europe

Europe accounts for a 28% market share, supported by increasing government focus on digital health and chronic disease prevention. Countries such as Germany, the U.K., and France are investing in telemedicine platforms and mobile-based obesity management tools. The European Commission’s emphasis on eHealth interoperability promotes data-driven healthcare solutions. Rising healthcare costs and an aging population encourage the use of remote monitoring and virtual care for obesity management. Strong public-private partnerships and favorable reimbursement policies further drive regional market expansion.

Asia-Pacific

Asia-Pacific holds a 22% market share and represents the fastest-growing region in the Digital Health for Obesity Market. Rapid urbanization, lifestyle shifts, and a rising incidence of obesity are key drivers. China, Japan, and India lead adoption, supported by expanding digital infrastructure and government-backed telehealth programs. Mobile health applications and wearable device integration are gaining traction among tech-savvy consumers. Increasing investments from global health tech firms and growing public awareness of obesity-related risks position Asia-Pacific as a major future growth hub.

Latin America

Latin America captures a 7% share of the global market, driven by increasing healthcare digitalization and awareness of obesity-related conditions. Brazil and Mexico lead the region, supported by rising smartphone usage and public health campaigns. Local healthcare providers are partnering with technology firms to deploy affordable digital obesity management platforms. However, limited reimbursement coverage and disparities in digital literacy challenge growth. Ongoing initiatives promoting mobile health adoption and preventive care are expected to improve accessibility and market penetration in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 4% share, showing gradual growth in digital health adoption for obesity management. Wealthier nations such as the UAE and Saudi Arabia are leading with government-backed eHealth strategies and wellness programs. Increasing urbanization and sedentary lifestyles are fueling obesity rates, driving demand for digital interventions. Despite infrastructure limitations in parts of Africa, expanding telemedicine access and mobile health initiatives are creating opportunities. Efforts to improve healthcare digitalization and promote preventive wellness are expected to support steady regional growth.

Market Segmentations:

By Type:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

By Payor:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Digital Health for Obesity Market features key players such as WellDoc, PlateJoy HEALTH, Fitnesskeeper Inc., BioAge Labs, Teladoc Health, Inc., Noom, FitBit, Inc., Healthify (My Diet Coach), Sidekick Health, and Tempus. The Digital Health for Obesity Market is characterized by rapid technological innovation, strategic collaborations, and growing investment in AI-driven health platforms. Companies are focusing on developing integrated digital ecosystems that combine telehealth, wearable technology, and personalized nutrition management. The market is witnessing strong partnerships between healthcare providers, insurers, and technology firms to expand accessibility and improve patient engagement. Product differentiation is increasingly based on user experience, real-time analytics, and clinically validated results. Continuous advancements in data integration, behavioral insights, and remote monitoring solutions are driving competition, fostering innovation, and shaping the future of digital obesity management globally.

Key Player Analysis

- WellDoc

- PlateJoy HEALTH

- Fitnesskeeper Inc.

- BioAge Labs

- Teladoc Health, Inc.

- Noom

- FitBit, Inc.

- Healthify (My Diet Coach)

- Sidekick Health

- Tempus

Recent Developments

- In February 2024, Ease Healthcare, a leading women’s health ecosystem in Asia, launched Elevate, the latest digital health platform, which aims to address metabolic health and weight management issues specifically tailored for women.

- In January 2024, Eli Lilly and Company announced LillyDirect™, a new digital healthcare experience for patients in the U.S. living with obesity, migraine, and diabetes.

- In December 2023, Hims & Hers, a digital health company, has recently introduced its weight loss program, featuring digital monitoring tools, informative content, and medication access. Notably, the current offering does not encompass prescriptions for the trendy weight loss medications referred to as GLP-1s.

- In December 2023, Knownwell, a comprehensive healthcare provider seamlessly integrating virtual and in-person services, has introduced knownwell teens, an early intervention clinical program specifically crafted to assist the children and adolescents grappling with obesity in the U.S.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Payor, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth driven by rising obesity rates worldwide.

- Integration of AI and machine learning will enhance personalized treatment plans.

- Wearable devices and mobile applications will play a greater role in continuous monitoring.

- Telehealth platforms will expand access to obesity management in remote areas.

- Data analytics will support predictive modeling for early intervention and prevention.

- Collaborations between healthcare providers and technology firms will strengthen digital ecosystems.

- Government support for preventive healthcare will boost digital adoption across regions.

- Virtual coaching and gamification will improve patient engagement and adherence.

- Cloud-based platforms will enable secure data sharing and interoperability between systems.

- Ongoing innovation in behavioral health tools will redefine long-term obesity care management.