Market Overview

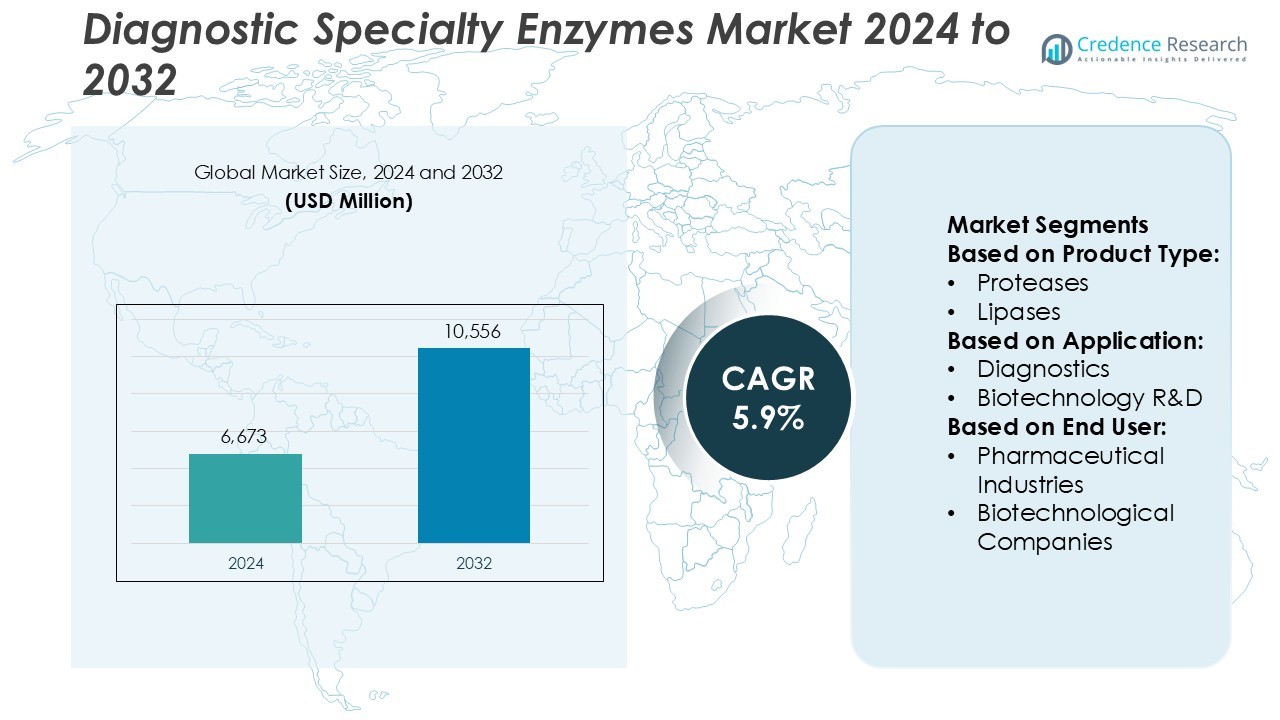

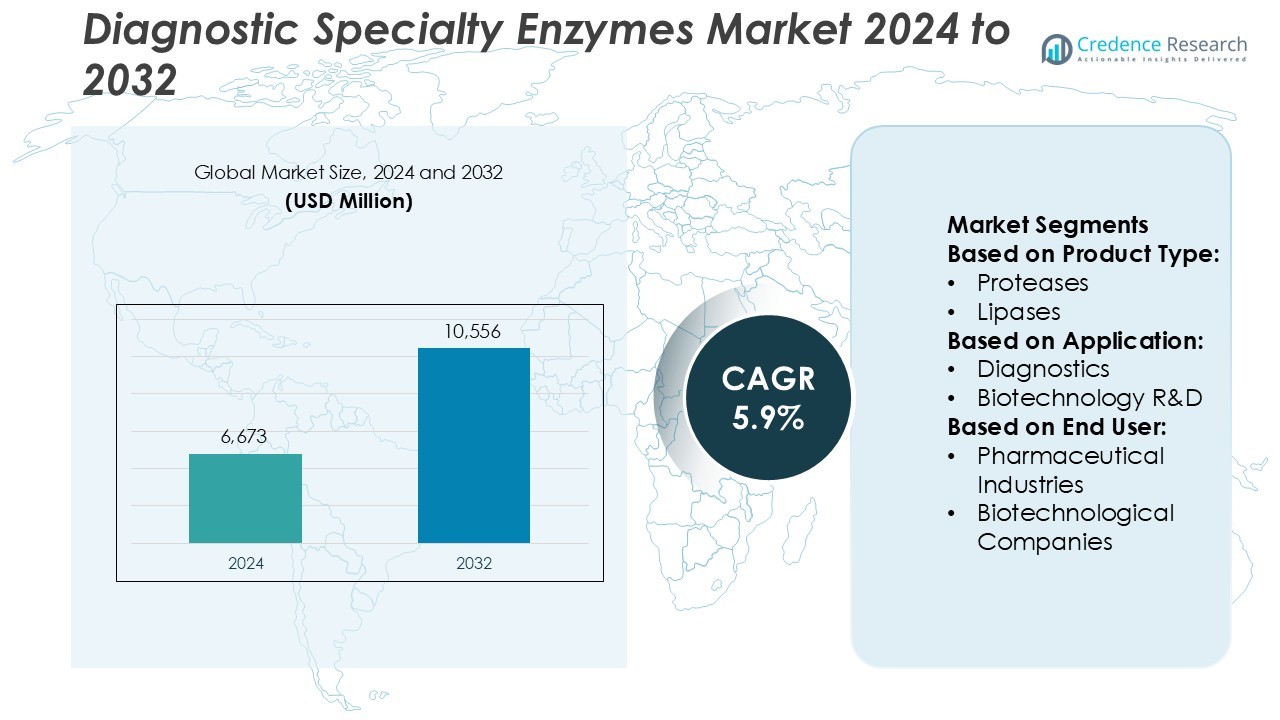

Diagnostic Specialty Enzymes Market size was valued USD 6,673 million in 2024 and is anticipated to reach USD 10,556 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diagnostic Specialty Enzymes Market Size 2024 |

USD 6,673 Million |

| Diagnostic Specialty Enzymes Market, CAGR |

5.9% |

| Diagnostic Specialty Enzymes Market Size 2032 |

USD 10,556 Million |

The Diagnostic Specialty Enzymes Market features strong competition among global and regional players focusing on innovation, strategic alliances, and product expansion. Leading participants are advancing recombinant enzyme technologies, molecular diagnostics, and assay development to meet growing healthcare demands. Continuous R&D investment enhances enzyme performance, stability, and specificity, catering to evolving diagnostic applications such as PCR and immunoassays. Companies emphasize partnerships with biotechnology and healthcare organizations to strengthen their market footprint and distribution networks. North America dominates the global landscape with a 37% market share, supported by advanced diagnostic infrastructure, high healthcare expenditure, and early adoption of enzyme-based diagnostic technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Diagnostic Specialty Enzymes Market was valued at USD 6,673 million in 2024 and is projected to reach USD 10,556 million by 2032, registering a CAGR of 5.9% during the forecast period.

- The market is driven by the growing demand for enzyme-based molecular diagnostics, especially in PCR and immunoassay applications, supported by increasing healthcare investments and technological advancements.

- A key trend includes the rapid adoption of recombinant enzyme technologies and automation, improving assay precision and production efficiency across clinical diagnostics.

- Competitive dynamics remain strong as major players focus on strategic alliances, R&D expansion, and partnerships with biotech and diagnostic firms to enhance global reach and innovation.

- North America leads with a 37% market share, followed by Europe and Asia-Pacific, while the proteases segment holds the largest share due to its wide application in disease diagnosis and biotechnological research.

Market Segmentation Analysis:

By Product Type

Proteases dominate the Diagnostic Specialty Enzymes Market with a 34% share, owing to their extensive use in clinical diagnostics and biotechnological research. These enzymes play a vital role in protein digestion and sample preparation in diagnostic assays. Their demand is driven by rising applications in cancer and infectious disease testing. Polymerases follow closely, supported by their essential use in PCR and molecular diagnostics. Continuous innovation in enzyme stability and substrate specificity further enhances their adoption across diagnostic laboratories and genetic testing platforms worldwide.

- For instance, Codexis reports that its enzyme engineering service portfolio holds more than 250 issued and pending patents and has contributed to 16 approved drugs via bespoke enzyme development.

By Application

The diagnostics segment holds the largest market share of 42%, fueled by the expanding demand for enzyme-based diagnostic kits and assays. Enzymes such as polymerases and nucleases are widely used in immunoassays, biosensors, and molecular diagnostics for disease detection. The growth of point-of-care testing and personalized medicine significantly strengthens this segment. Meanwhile, biotechnology R&D remains a fast-growing area as researchers increasingly rely on specialty enzymes for genetic analysis, protein engineering, and drug discovery applications.

- For instance, BBI Solutions supplies enzymes for immunoassays and molecular diagnostics under ISO 13485‑certified processes, and it reports that its glucose oxidase product drives over 5 billion test strips annually.

By End User

Pharmaceutical industries lead the market with a 39% share, driven by extensive utilization of diagnostic enzymes in drug discovery and clinical trial testing. The segment benefits from continuous investments in biomarker development and therapeutic monitoring. Biotechnological companies follow, focusing on enzyme engineering and assay optimization to enhance diagnostic accuracy. The presence of advanced infrastructure and increasing collaboration between pharmaceutical and diagnostic firms contribute to this dominance. Education and research institutes also support demand through ongoing academic studies in molecular biology and enzymology.

Key Growth Drivers

- Expanding Demand for Molecular Diagnostics

The growing use of molecular diagnostic tools for infectious disease detection and genetic testing drives the Diagnostic Specialty Enzymes Market. Enzymes such as polymerases, ligases, and nucleases are essential for PCR, sequencing, and amplification procedures. Rising cases of chronic and genetic disorders increase the need for rapid, enzyme-based assays. The surge in point-of-care diagnostics and personalized medicine also supports higher enzyme consumption, particularly in clinical laboratories and healthcare institutions adopting automated molecular platforms.

- For instance, Merck KGaA’s Life Science business launched the Aptegra™ CHO genetic stability assay platform which replaces five separate assays with one, reducing testing time by 66 % and cost by 43 % compared with traditional workflows.

- Advancements in Enzyme Engineering Technologies

Ongoing innovations in enzyme modification techniques are enabling higher stability, specificity, and efficiency. Engineered enzymes now withstand extreme pH and temperature conditions, improving their usability in diagnostic kits. Companies are investing in directed evolution and recombinant DNA technologies to create high-performance enzyme variants. These advancements reduce assay costs, improve sensitivity, and expand enzyme application across diverse diagnostic environments. Enhanced production scalability through microbial expression systems further accelerates market growth and technology adoption globally.

- For instance, Bio‑Rad expanded its digital PCR platform with the launch of its QX Continuum™ ddPCR system and the QX700™ series, which supports processing over 700 samples per day and seven‑color multiplexing.

- Rising Investment in Biotechnology and Healthcare Infrastructure

Increased government and private investments in biotechnology strengthen the diagnostic enzyme market. Funding supports advanced R&D projects, laboratory automation, and new test kit developments. Healthcare institutions worldwide are expanding diagnostic capabilities to manage growing disease burdens. The establishment of biotech hubs in North America, Europe, and Asia-Pacific enhances enzyme innovation and accessibility. Additionally, partnerships between enzyme manufacturers and diagnostic companies streamline technology transfer and accelerate commercialization, fueling sustained revenue expansion in the market.

Key Trends & Opportunities

- Integration of AI and Automation in Enzyme-Based Diagnostics

Automation and artificial intelligence are revolutionizing enzyme-based testing. AI-driven platforms improve enzyme selection, reaction monitoring, and data analysis accuracy. Automated analyzers using enzymes enhance testing throughput and reproducibility. The combination of robotics and machine learning helps laboratories handle large sample volumes efficiently. This trend supports real-time disease monitoring and faster diagnostics, reducing manual errors and operational costs while paving the way for fully integrated digital diagnostic systems.

- For instance, F. Hoffmann‑La Roche Ltd. now deliver enzyme‑based immunoassay results in 18 minutes on the cobas® e 801/analyzer range, supporting throughputs of 120‑300 tests per hour.

- Growing Use of Recombinant Enzymes in Diagnostic Kits

Recombinant enzyme production is rapidly replacing traditional extraction methods due to its consistency and scalability. These enzymes ensure high purity, batch-to-batch uniformity, and reduced contamination risks. Biotechnology firms leverage microbial and yeast expression systems for cost-effective mass production. The demand for recombinant polymerases and proteases is expanding in diagnostic and pharmaceutical testing. As the need for standardized reagents grows, recombinant enzyme adoption is set to become a major growth opportunity across diagnostic manufacturers.

- For instance, Amano Enzyme Inc. utilises microbial cultivation and recombinant DNA technology developed over 40 years to deliver diagnostic‑grade enzymes.

- Expansion into Personalized and Point-of-Care Diagnostics

Personalized medicine and point-of-care diagnostics are reshaping enzyme utilization. Portable diagnostic kits incorporating specialty enzymes enable real-time disease monitoring outside conventional labs. Growing consumer demand for rapid self-testing solutions supports enzyme-driven innovations in biosensors and wearable health devices. Enzymes with enhanced reaction kinetics and stability are critical to ensuring reliable field-based testing. The convergence of biotechnology and medical devices presents lucrative opportunities for enzyme manufacturers to diversify their product portfolios.

Key Challenges

- High Production and Purification Costs

The production of specialty enzymes requires complex biotechnological processes and stringent purification steps. Maintaining enzyme stability and activity during manufacturing significantly increases costs. Limited availability of high-quality substrates and reagents further escalates production expenses. Smaller companies often face difficulties competing with established manufacturers due to these cost barriers. Reducing production costs through microbial expression systems and improved downstream processing remains a key challenge for sustaining market competitiveness.

- Regulatory and Quality Standardization Barriers

Strict global regulations govern the production and application of diagnostic enzymes. Compliance with FDA, EMA, and ISO standards demands extensive validation and quality assurance, which delays product commercialization. Variability in regional approval processes adds complexity for global suppliers. Inconsistent standardization of enzyme formulations and labeling also creates confusion among end users. Establishing harmonized international guidelines and quality benchmarks is essential to streamline approval timelines and ensure product reliability across markets.

Regional Analysis

North America

North America leads the Diagnostic Specialty Enzymes Market with a 37% share, driven by advanced diagnostic infrastructure and high adoption of molecular testing technologies. The region benefits from strong healthcare spending and a robust presence of key players such as Thermo Fisher Scientific and Agilent Technologies. Extensive R&D in genomics, proteomics, and precision medicine accelerates enzyme utilization across laboratories and clinical facilities. Supportive regulatory frameworks and increasing investments in biotechnology startups further strengthen the market position of the U.S. and Canada in global enzyme innovation and commercialization.

Europe

Europe holds a 29% market share, supported by widespread adoption of enzyme-based diagnostics in healthcare and research institutions. Countries such as Germany, the U.K., and France drive regional growth through advanced laboratory automation and bioscience funding. The presence of established enzyme manufacturers like Roche Diagnostics and Merck KGaA promotes product development and regional competitiveness. Ongoing research in molecular biology and genetic testing boosts enzyme applications across diagnostic assays. Favorable reimbursement policies and collaborative R&D initiatives with academia enhance Europe’s contribution to global enzyme technology advancements.

Asia-Pacific

Asia-Pacific accounts for a 24% share of the Diagnostic Specialty Enzymes Market, experiencing strong growth due to rising healthcare modernization and diagnostic awareness. Countries including China, Japan, and India are rapidly expanding clinical testing capabilities. Government funding in biotechnology and genomics research supports enzyme innovation and local production. Increasing adoption of PCR-based and immunodiagnostic assays drives demand for polymerases and proteases. Growing investments from international players and the presence of emerging biotech firms make Asia-Pacific a key hub for affordable enzyme manufacturing and diagnostic expansion.

Latin America

Latin America captures an 6% share, fueled by growing investments in healthcare infrastructure and diagnostic laboratories. Brazil and Mexico are leading contributors, adopting enzyme-based diagnostic kits to address infectious disease burdens. The expanding pharmaceutical and biotechnology sectors are promoting enzyme research and imports. However, limited local manufacturing capacity and regulatory complexity pose growth challenges. International collaborations with diagnostic reagent suppliers and technology transfer programs are helping bridge capability gaps, positioning the region as an emerging market for diagnostic enzyme applications.

Middle East & Africa

The Middle East & Africa region holds a 4% market share, supported by growing healthcare digitization and laboratory upgrades. Countries such as Saudi Arabia, South Africa, and the UAE are investing in molecular diagnostic systems to strengthen early disease detection. Increasing awareness of enzyme-based diagnostics for oncology and infectious diseases drives gradual market penetration. Partnerships with global diagnostic companies and government-backed health programs improve access to enzyme-based solutions. Despite infrastructure limitations, the region shows strong potential for future growth through expanding private healthcare investments.

Market Segmentations:

By Product Type:

By Application:

- Diagnostics

- Biotechnology R&D

By End User:

- Pharmaceutical Industries

- Biotechnological Companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Diagnostic Specialty Enzymes Market is highly competitive, featuring key players such as Codexis, Inc., BBI Solutions, Merck KGaA, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., Biocatalysts Ltd. (BRAIN Biotech Group), Amano Enzymes Inc., New England Biolabs, American Laboratories, Inc., and Agilent Technologies, Inc. The Diagnostic Specialty Enzymes Market is characterized by strong competition and rapid innovation, driven by advancements in biotechnology and molecular diagnostics. Companies are focusing on developing high-performance enzymes with improved stability, specificity, and efficiency for diagnostic applications. Continuous investment in recombinant enzyme technologies and enzyme engineering supports product diversification and cost optimization. Strategic partnerships between enzyme manufacturers and diagnostic kit producers are fostering innovation in clinical assays and point-of-care testing. Additionally, the integration of automation and AI in enzyme-based workflows enhances testing accuracy and scalability, strengthening global market competitiveness and expanding application potential across healthcare and research sectors.

Key Player Analysis

- Codexis, Inc.

- BBI Solutions

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- Hoffmann-La Roche Ltd.

- Biocatalysts Ltd. (BRAIN Biotech Group)

- Amano Enzymes Inc.

- New England Biolabs

- American Laboratories, Inc.

- Agilent Technologies, Inc.

Recent Developments

- In September 2025, Promega announced a strategic partnership with Watchmaker Genomics to license a newly engineered reverse transcriptase. Optimized for improved accuracy and sensitivity in RNA analysis, the enzyme will strengthen Promega’s ability to produce both catalog and custom solutions for clinical, applied, and pharmaceutical molecular applications.

- In June 2025, Enzo Biochem, Inc. announced that it had entered into a definitive Agreement and Plan of Merger with Battery Ventures, a global technology-focused investment firm. Under the agreement, Battery, through its newly formed entity Bethpage Parent, Inc.

- In May 2024, Danaher collaborated with John Hopkins University to develop new methods to diagnose Traumatic Brain Injury. The scientists at the John Hopkins University would focus on evaluating new blood-based biomarkers leveraging highly sensitive technology from Beckmann Coulter.

- In January 2024, Novozymes A/S announced its merger with Chr. Hansen to establish new company, Novonesis. The merger aims to create a leading global biosolutions provider featuring a broad biological toolbox and a diversified product portfolio.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of enzyme-based molecular diagnostics worldwide.

- Recombinant enzyme production will gain momentum due to higher purity and batch consistency.

- Automation in diagnostic laboratories will drive demand for precision enzyme formulations.

- Increasing focus on personalized medicine will boost enzyme use in genetic testing.

- AI-driven enzyme design will accelerate innovation and shorten development cycles.

- Point-of-care diagnostics will become a key application area for specialty enzymes.

- Collaborations between biotech firms and diagnostic manufacturers will enhance global reach.

- Enzyme stability improvements will enable broader use in harsh diagnostic conditions.

- Regulatory harmonization will streamline global commercialization of diagnostic enzyme products.

- Emerging markets in Asia-Pacific and Latin America will offer strong growth opportunities.