Market Overview

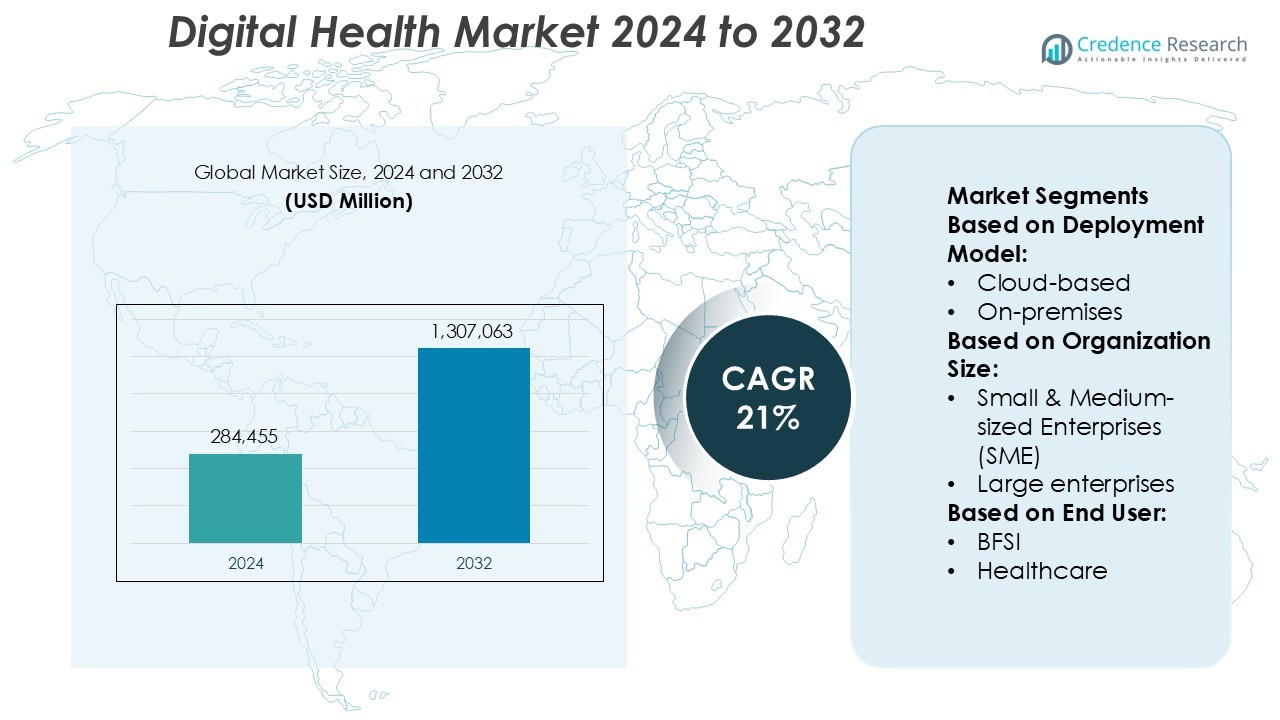

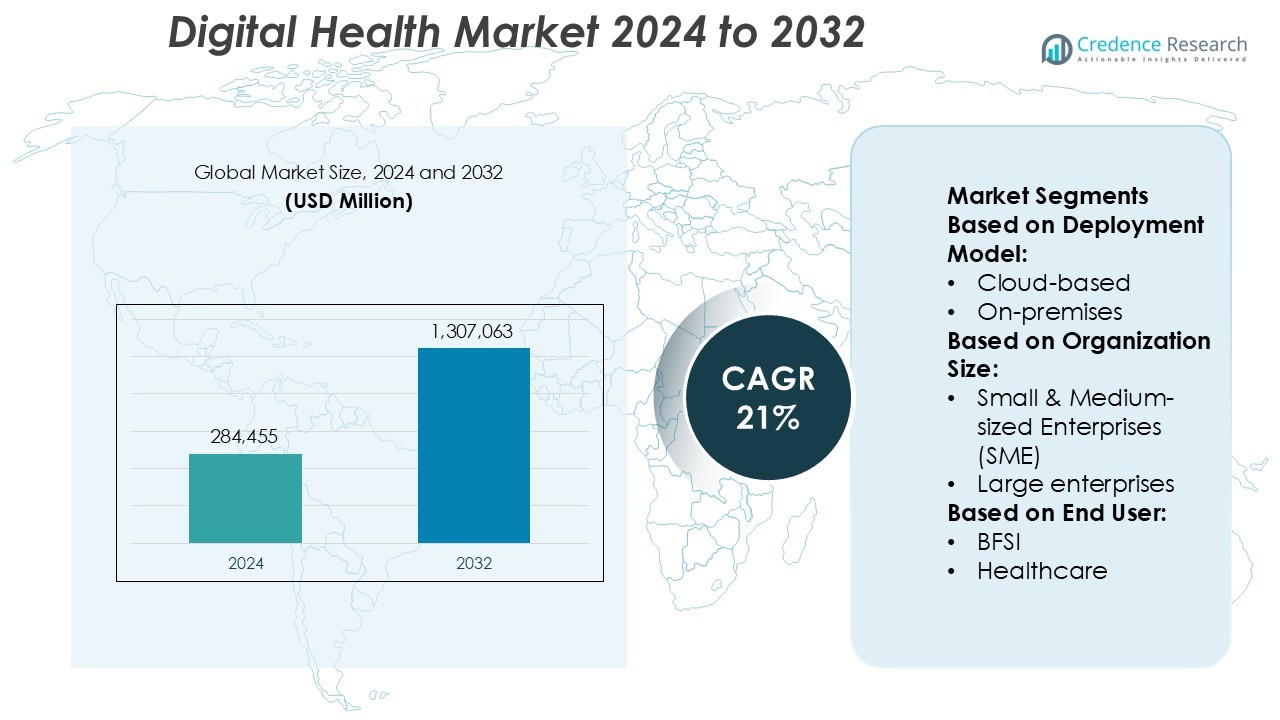

Digital Health Market size was valued USD 284,455 million in 2024 and is anticipated to reach USD 1,307,063 million by 2032, at a CAGR of 21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Health Market Size 2024 |

USD 284,455 Million |

| Digital Health Market, CAGR |

21% |

| Digital Health Market Size 2032 |

USD 1,307,063 Million |

The digital health market is highly competitive, driven by the presence of global technology firms and healthcare innovators advancing digital transformation. Leading players focus on expanding their product portfolios, integrating AI and cloud solutions, and forming cross-sector partnerships to strengthen service delivery. Companies are investing in telemedicine, digital therapeutics, and remote monitoring technologies to meet the rising demand for accessible healthcare. North America leads the market with a 39% share, supported by advanced infrastructure, favorable regulations, and early adoption of digital platforms. Strong R&D investments, strategic collaborations, and growing consumer awareness continue to define the competitive dynamics of the global digital health landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The digital health market was valued at USD 284,455 million in 2024 and is projected to reach USD 1,307,063 million by 2032, registering a CAGR of 21% during the forecast period.

- Key drivers include increasing adoption of telemedicine, AI-based diagnostics, and digital therapeutics enhancing remote patient management and real-time care.

- The market trends highlight rapid integration of cloud-based platforms and wearable health technologies supporting data-driven personalized healthcare solutions.

- Competitive dynamics are shaped by strategic collaborations, R&D investments, and expansion by major global technology firms and healthcare innovators.

- North America leads with a 39% market share, supported by strong infrastructure and regulatory frameworks, while the cloud-based deployment segment continues to dominate due to scalability and interoperability advantages.

Market Segmentation Analysis:

By Deployment Model

The cloud-based segment dominates the digital health market with a market share of 68%. Its growth is driven by scalable data storage, remote accessibility, and lower infrastructure costs. Healthcare providers increasingly prefer cloud platforms for integrating telemedicine, electronic health records, and patient monitoring systems. The adoption of AI-enabled cloud analytics enhances real-time diagnostics and personalized treatment plans. On-premises solutions remain relevant for institutions requiring tighter data control, yet the rapid expansion of hybrid and multi-cloud models strengthens the cloud segment’s leadership in the digital health ecosystem.

- For instance, AirStrip Technologies uses Microsoft Azure’s HIPAA-compliant cloud to enable secure access to patient waveform data through its mobile platform. The system processes over 3 terabytes of patient monitoring data daily, allowing physicians to review ECG and fetal heart rate patterns remotely within seconds.

By Organization Size

Large enterprises hold a major share of 61% in the digital health market. Their dominance stems from higher investments in digital transformation, cybersecurity, and enterprise-level data integration systems. These organizations leverage advanced analytics and IoT-enabled devices to streamline workflows and improve patient engagement. Meanwhile, small and medium-sized enterprises (SMEs) are adopting modular SaaS-based platforms due to affordability and flexibility. Government incentives and cloud-based healthcare ecosystems further enable SMEs to close the digital gap, but large enterprises continue to lead through comprehensive adoption of health IT infrastructure.

- For instance, Orange Healthcare, a subsidiary of Orange Group, operates over 40 secure data centers across Europe to support large-scale healthcare digitization. The company’s Flexible Engine Cloud, built on OpenStack architecture, processes more than 100 million healthcare transactions annually for hospitals and research institutions.

By End User

The healthcare segment leads the digital health market with a 54% share. Rising adoption of telehealth, remote diagnostics, and AI-driven patient management tools fuels this dominance. Hospitals and clinics are investing in digital platforms to enhance clinical efficiency and patient outcomes. BFSI and IT & telecom sectors follow, integrating wellness programs and employee health monitoring systems. The retail and e-commerce sectors are expanding digital wellness offerings, while manufacturing and travel industries adopt health management apps for workforce well-being. However, healthcare remains the primary growth driver due to continuous innovation in digital therapeutics and connected care.

Key Growth Drivers

- Rising Adoption of Telemedicine and Remote Patient Monitoring

The growing demand for telemedicine and remote patient monitoring drives digital health market expansion. Increasing internet penetration and smartphone adoption enable patients to access healthcare from anywhere. Providers use digital platforms to monitor chronic conditions, reducing hospital visits and costs. The integration of IoT-based medical devices and wearables allows real-time health tracking and early intervention. This digital shift enhances healthcare accessibility, especially in rural and underserved regions, supporting efficient management of large patient populations while improving treatment outcomes.

- For instance, QSI Management, LLC, through its subsidiary NextGen Healthcare, operates one of the largest connected care platforms in the U.S., supporting over 100,000 providers and 150 million patient records.

- Increasing Integration of Artificial Intelligence in Healthcare

Artificial intelligence (AI) is revolutionizing digital health through predictive analytics, imaging diagnostics, and personalized treatment. AI-powered algorithms process massive healthcare datasets to detect diseases faster and improve accuracy. Hospitals and research institutions utilize machine learning tools for early disease detection, optimizing patient care pathways. AI chatbots and virtual assistants improve engagement and support telehealth services. As healthcare digitization accelerates, AI integration enhances operational efficiency and clinical decision-making, driving adoption across diagnostic imaging, drug discovery, and patient management applications.

- For instance, Hims & Hers Health, Inc. leverages AI within its virtual care platform to optimize clinical matching and prescription accuracy. The company’s proprietary CareAI Engine analyzes over 400,000 anonymized patient interactions weekly to personalize treatment recommendations for dermatology, sexual health, and mental wellness.

- Government Initiatives and Digital Infrastructure Development

Government investments in digital health infrastructure significantly propel market growth. Many countries are implementing national electronic health record (EHR) systems and telehealth reimbursement policies to enhance healthcare delivery. Regulatory support for digital platforms and interoperability standards promotes innovation. Public-private partnerships further drive the development of secure data exchange networks and connected care systems. Initiatives such as digital health missions and e-health programs encourage hospitals and clinics to transition from manual systems to cloud-based solutions, ensuring improved access, transparency, and continuity of care.

Key Trends & Opportunities

- Expansion of Wearable Health Technologies

Wearable devices are becoming central to preventive healthcare and patient engagement. Smartwatches, fitness bands, and biosensors continuously monitor parameters like heart rate, glucose, and oxygen levels. Data collected from wearables supports predictive analytics and personalized treatment. Technology firms and healthcare providers are partnering to create connected ecosystems integrating wearables with digital platforms. The rising consumer interest in self-monitoring and fitness tracking presents strong opportunities for companies developing advanced wearable sensors and AI-driven health monitoring applications.

- For instance, AT&T provides the foundational secure network connectivity (including 5G and IoT services) that numerous third-party healthcare companies use to power their remote patient monitoring and connected health solutions, enabling real-time collection of biometric data from various FDA-cleared devices.

- Growth of Cloud-Based Healthcare Solutions

The migration toward cloud-based digital health systems offers scalability, interoperability, and cost efficiency. Cloud platforms support centralized data management, enabling secure access to patient information across multiple providers. Healthcare organizations benefit from reduced IT overheads and enhanced collaboration between teams. The use of cloud infrastructure also facilitates big data analytics, AI model deployment, and telehealth scalability. This trend creates new business models for health IT providers and strengthens digital transformation efforts across global healthcare networks.

- For instance, Google launched its Cloud Healthcare API, a fully-managed service that ingests, stores and transforms clinical data in FHIR, HL7v2 and DICOM formats, supporting thousands of requests per second and delivering 11-9-9 (99.999999999%) annual data durability for healthcare datasets.

Key Challenges

- Data Privacy and Cybersecurity Concerns

The growing volume of sensitive medical data increases vulnerability to cyberattacks and breaches. Ensuring compliance with regulations such as HIPAA and GDPR remains a top priority for healthcare providers. Weak encryption, inadequate access control, and poor cybersecurity infrastructure create major risks. Data theft and ransomware incidents undermine patient trust and slow digital adoption. Companies must invest in advanced encryption, multi-factor authentication, and real-time threat detection systems to maintain security and safeguard healthcare information.

- Interoperability and System Integration Issues

Interoperability challenges among healthcare systems hinder seamless data exchange and clinical coordination. Many hospitals use outdated software that lacks compatibility with modern digital platforms. The absence of standardized protocols complicates integration across devices, EHRs, and telehealth applications. As a result, data silos and inefficiencies persist within healthcare networks. Achieving interoperability requires unified frameworks, open APIs, and consistent data formats, enabling smooth communication between healthcare providers and improving overall digital ecosystem performance.

Regional Analysis

North America

North America dominates the digital health market with a 39% share. Strong healthcare infrastructure, early adoption of advanced technologies, and supportive government policies drive regional growth. The U.S. leads due to its extensive use of telemedicine, AI-driven diagnostics, and electronic health record (EHR) systems. Major players such as Teladoc Health and Cerner Corporation continue to invest in AI and data analytics for personalized care. Increasing healthcare digitization, favorable reimbursement frameworks, and rising demand for remote patient monitoring reinforce North America’s leadership in global digital health innovation.

Europe

Europe accounts for 27% of the digital health market share, supported by strong regulatory frameworks and digital transformation initiatives. Countries like Germany, the U.K., and France are advancing telehealth and e-prescription systems to enhance accessibility. The European Commission’s Digital Health Strategy and investments in cross-border health data exchange promote interoperability. Growing aging populations and rising chronic disease prevalence accelerate digital adoption. Healthcare providers increasingly integrate AI-enabled tools and cloud solutions, while strict data protection under GDPR ensures patient trust. These factors collectively strengthen Europe’s position as a key digital health hub.

Asia-Pacific

Asia-Pacific holds a 24% share of the digital health market and exhibits the fastest growth rate globally. Rapid urbanization, rising healthcare expenditure, and strong government support for telemedicine drive market expansion. Countries such as China, India, Japan, and South Korea are heavily investing in mobile health apps and AI-based diagnostics. Start-ups and tech giants collaborate to enhance digital accessibility in rural regions. Increasing smartphone penetration and growing awareness of preventive healthcare contribute to the adoption of digital platforms. The region’s dynamic digital ecosystem positions it as a major growth frontier in healthcare technology.

Latin America

Latin America captures an 6% share of the digital health market, with Brazil and Mexico leading adoption. Governments across the region are introducing telehealth regulations to extend medical access in underserved areas. The growing use of mobile health platforms and wearable technologies supports chronic disease management. However, infrastructure gaps and data security concerns remain challenges. Private investments in health tech start-ups are increasing, aiming to modernize healthcare systems. As digital literacy improves and public initiatives expand, Latin America continues to emerge as an evolving digital healthcare landscape.

Middle East & Africa

The Middle East & Africa region represents 4% of the global digital health market. Increasing government investments in smart hospitals and e-health platforms drive market progress. The UAE and Saudi Arabia lead with strong national digital health strategies and telemedicine adoption. Expanding internet connectivity and mobile-based healthcare services support remote patient care. Despite limited healthcare infrastructure in parts of Africa, international partnerships and funding initiatives are bridging gaps. The region’s ongoing focus on healthcare modernization positions it for gradual yet sustained growth in digital health technologies.

Market Segmentations:

By Deployment Model:

By Organization Size:

- Small & Medium-sized Enterprises (SME)

- Large enterprises

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The digital health market features strong competition among key players such as AirStrip Technologies, Orange, QSI Management, LLC, Hims & Hers Health, Inc., AT&T, Epic Systems Corporation, Google, Inc., Telefónica S.A., Computer Programs and Systems, Inc., and Softserve. The digital health market is defined by continuous innovation, strategic collaborations, and rapid technological advancement. Companies are investing heavily in AI, big data analytics, and cloud computing to enhance patient care and optimize healthcare operations. Partnerships between technology firms and healthcare providers are expanding access to telemedicine and remote monitoring services. The focus on interoperability and secure data sharing strengthens system efficiency and compliance with global health standards. Additionally, the rise of digital therapeutics, mobile health applications, and wearable integration is reshaping healthcare delivery models, fostering patient-centered and data-driven ecosystems worldwide.

Key Player Analysis

- AirStrip Technologies

- Orange

- QSI Management, LLC

- Hims & Hers Health, Inc.

- AT&T

- Epic Systems Corporation

- Google, Inc.

- Telefónica S.A.

- Computer Programs and Systems, Inc.

- Softserve

Recent Developments

- In March 2025, Prudential Group Holdings (UK) and Vama Sundari Investments (Delhi) Private Limited, an HCL Group promoter company, announced to enter a joint venture to launch a standalone health insurance business in India. This strategic move aims to capitalize on India’s rapidly growing health insurance market and contribute to the Indian government’s vision of “Insurance for All by 2047”.

- In March 2025, Adobe launched the Adobe Experience Platform Agent Orchestrator, enabling businesses to use AI agents for optimizing websites, automating content production, refining audiences, and scaling digital media. The company also introduced Brand Concierge, an AI-driven app that delivers personalized, brand-centric customer experiences by leveraging a company’s unique attributes and customer data.

- In February 2025, Bajaj Allianz’s launched HERizon Care, a comprehensive health insurance plan specifically designed for women. It is notable for being the first health insurance plan in India to integrate multiple specialized benefits tailored to women’s unique healthcare needs within a single policy. HERizon Care is structured around two primary covers:Vita Shield and Cradle Care.

- In August 2024, ICICI Lombard partnered with seven institutions to enhance its distribution network. The partnership aims to increase the company’s reach and provide insurance products to a wider audience. This partnership is likely to have a positive impact on ICICI Lombard’s business, enabling the company to expand its customer base and increase its market share in the insurance industry.

Report Coverage

The research report offers an in-depth analysis based on Deployment Model, Organization Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Artificial intelligence will enhance predictive diagnostics and personalized treatment plans.

- Telemedicine adoption will expand with stronger broadband and 5G infrastructure.

- Cloud-based healthcare platforms will dominate data management and interoperability.

- Wearable devices will play a greater role in preventive and continuous health monitoring.

- Integration of digital therapeutics will become a standard in chronic disease management.

- Blockchain technology will improve data security and patient record transparency.

- Virtual and augmented reality tools will advance remote training and rehabilitation programs.

- Governments will increase investments in digital health infrastructure and e-health policies.

- Partnerships between tech firms and healthcare providers will accelerate digital innovation.

- Patient-centric digital ecosystems will redefine care delivery through connected health solutions.