Market Overview

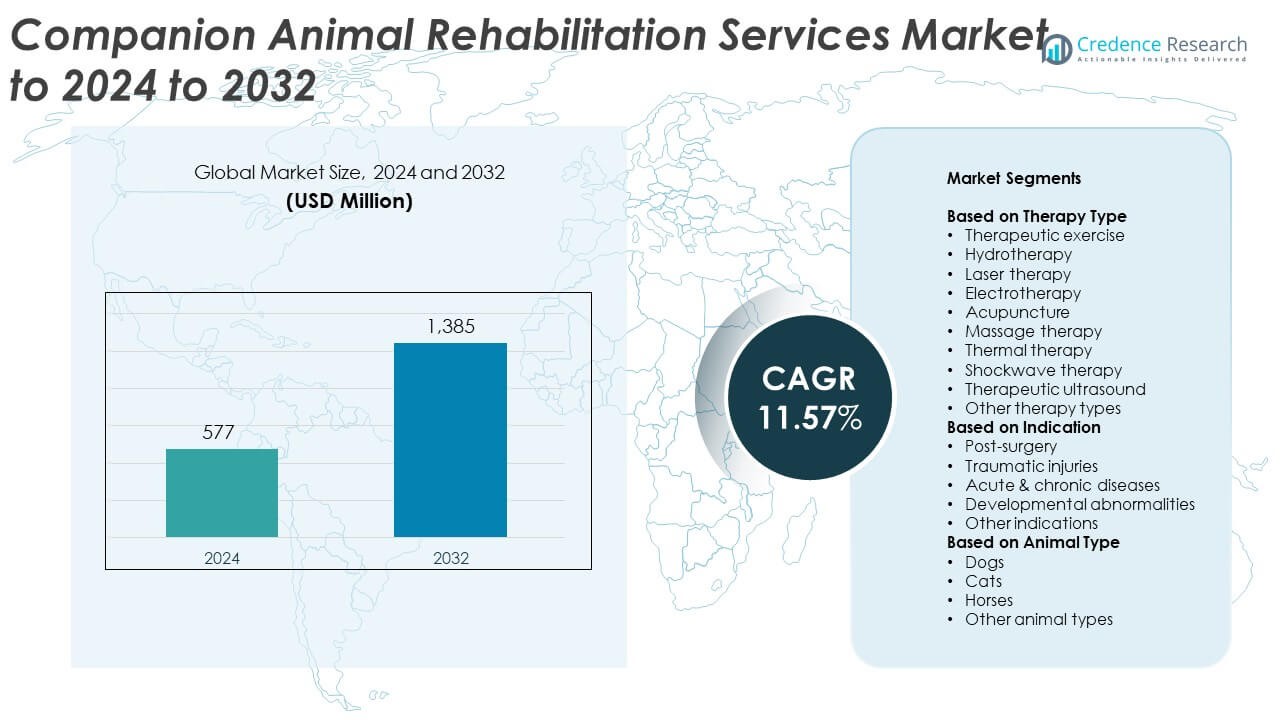

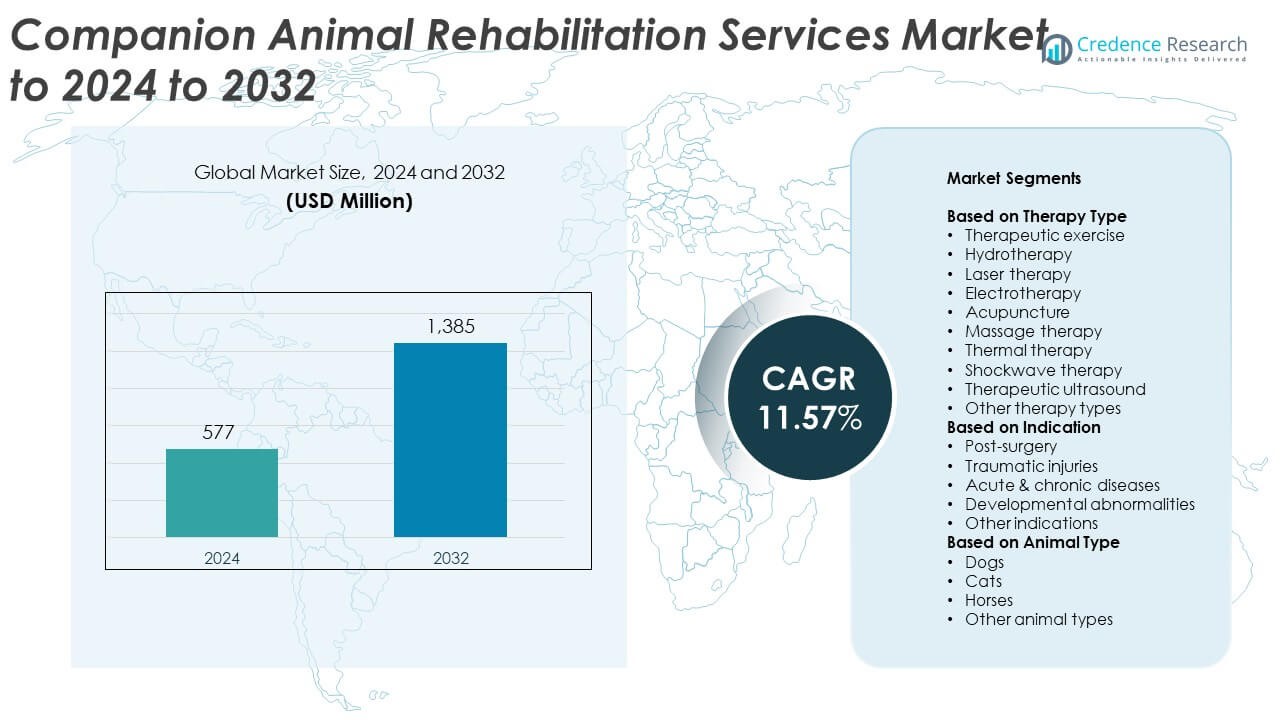

Companion Animal Rehabilitation Services Market size was valued at USD 577 million in 2024 and is anticipated to reach USD 1,385 million by 2032, at a CAGR of 11.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Companion Animal Rehabilitation Services Market Size 2024 |

USD 577 Million |

| Companion Animal Rehabilitation Services Market, CAGR |

11.57% |

| Companion Animal Rehabilitation Services Market Size 2032 |

USD 1,385 Million |

The Companion Animal Rehabilitation Services Market is moderately competitive, with leading participants such as Blue Springs Animal Rehabilitation Center, Companion Animal Hospital, Animal Rehab and Conditioning Center, Treasure Coast Animal Rehab & Fitness, Baseline Animal Rehab Center (BARC), Boundary Bay Veterinary Specialty Hospital, and Animal Rehab Center of Michigan. These facilities focus on integrating advanced therapies, including hydrotherapy, laser therapy, and acupuncture, to enhance recovery outcomes. North America led the global market in 2024, holding a 39.5% share, supported by a strong veterinary infrastructure and widespread adoption of rehabilitation practices. Europe followed with 28.4%, driven by expanding wellness-focused pet care services and trained veterinary professionals across major countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Companion Animal Rehabilitation Services Market was valued at USD 577 million in 2024 and is projected to reach USD 1,385 million by 2032, growing at a CAGR of 11.57% during the forecast period.

- Increasing prevalence of orthopedic disorders and post-surgical recovery needs are driving adoption of rehabilitation therapies such as hydrotherapy and laser therapy.

- Technological advancements, including digital monitoring and tele-rehabilitation, are shaping new service delivery models and enhancing treatment precision.

- The market remains moderately fragmented, with key facilities expanding therapy portfolios and training programs to improve service quality and regional outreach.

- North America led the market with a 39.5% share in 2024, followed by Europe at 28.4% and Asia Pacific at 20.7%, while therapeutic exercise accounted for the dominant segment with 32.4% of total revenue.

Market Segmentation Analysis:

By Therapy Type

Therapeutic exercise dominated the Companion Animal Rehabilitation Services Market in 2024, accounting for 32.4% of the total share. The segment’s leadership is driven by its proven ability to enhance mobility, strengthen muscles, and accelerate recovery in pets after surgery or injury. Increasing adoption of customized exercise programs using treadmills, balance boards, and resistance tools supports wider clinical use. Growing awareness among pet owners about preventive care and musculoskeletal health also encourages rehabilitation centers to prioritize therapeutic exercise as a core treatment offering for chronic orthopedic conditions.

- For instance, the Hydro Physio Canine 5 treadmill runs at a speed range of 0.2–12 kph (0.12-7.5 mph) with a maximum water depth of 0–600 mm (24″).

By Indication

Post-surgery rehabilitation held the largest share of 41.7% in 2024, reflecting the rising number of orthopedic and soft tissue surgeries in companion animals. The segment’s growth is fueled by the need for effective postoperative recovery protocols that restore limb function and minimize pain. Increasing veterinary recommendations for physical rehabilitation post procedures such as cruciate ligament repair and hip replacement drive demand. Expanding access to advanced recovery facilities across veterinary hospitals strengthens the segment’s dominance in the overall rehabilitation market.

- For instance, Zomedica’s PulseVet protocol uses 3 shock-wave sessions, 2–3 weeks apart. Clinics use it to manage tendon and ligament injuries post-op. Systems are applied across canine and feline cases.

By Animal Type

Dogs accounted for the largest market share of 57.8% in 2024, owing to their higher ownership rates and greater incidence of orthopedic and neurological disorders. Rising awareness of canine physiotherapy for post-surgical and mobility-related conditions supports strong adoption. Rehabilitation centers are increasingly integrating specialized dog-focused therapies such as hydrotherapy pools, treadmill exercises, and laser treatments. The growing demand for pain management and quality-of-life enhancement among aging dog populations continues to reinforce this segment’s leadership in the companion animal rehabilitation services market.

Key Growth Drivers

Rising Prevalence of Orthopedic and Neurological Disorders

The growing incidence of orthopedic and neurological conditions in pets, such as arthritis, hip dysplasia, and intervertebral disc disease, is driving demand for rehabilitation services. These disorders often require long-term therapeutic intervention to improve mobility and reduce pain. Increasing pet lifespans and obesity rates are further elevating the need for physiotherapy and supportive care. Veterinary clinics and hospitals are expanding rehabilitation programs to meet rising treatment requirements, strengthening this driver’s influence on market expansion.

- For instance, Zoetis’ Librela trial showed 43.5% treatment success at day 28 vs 16.9% placebo. Efficacy remained through days 56 and 84 in treated dogs. Results were statistically significant.

Increased Pet Humanization and Spending on Wellness

Pet owners are increasingly viewing animals as family members, leading to higher spending on preventive and rehabilitative care. The trend toward pet humanization promotes demand for advanced therapies like hydrotherapy, laser therapy, and acupuncture. Rising disposable incomes and growing awareness of rehabilitation benefits encourage investment in specialized facilities. This shift supports the development of holistic treatment approaches, combining physical therapy and pain management to enhance pets’ overall quality of life and recovery outcomes.

- For instance, Banfield operates more than 1,000 hospitals across the U.S., Puerto Rico, and Mexico.

Advancements in Veterinary Rehabilitation Technology

Technological innovations in rehabilitation equipment and treatment techniques are enhancing therapeutic outcomes. The introduction of underwater treadmills, shockwave therapy systems, and cold laser devices improves mobility restoration and muscle recovery in animals. Integration of data analytics and digital monitoring enables veterinarians to customize treatment plans based on patient progress. These advancements enhance precision, reduce recovery times, and attract more pet owners seeking evidence-based, effective rehabilitation care across specialized veterinary facilities.

Key Trends & Opportunities

Expansion of Multidisciplinary Veterinary Rehabilitation Centers

The establishment of integrated rehabilitation centers combining physiotherapy, hydrotherapy, and pain management is a growing trend. These facilities offer comprehensive care under one roof, improving convenience for pet owners. Collaboration between rehabilitation specialists, orthopedic surgeons, and veterinarians ensures personalized recovery programs. This multidisciplinary approach is gaining traction in developed markets, offering opportunities for service providers to expand and differentiate through quality-focused, outcome-driven rehabilitation solutions.

- For instance, VCA operates 1,000+ hospitals in the U.S. and Canada. These sites integrate primary, specialty, and rehab services. Network breadth enables standardized multimodal protocols.

Rising Adoption of Alternative and Complementary Therapies

Alternative therapies such as acupuncture, massage, and laser treatment are gaining popularity due to their non-invasive nature and effectiveness in chronic pain management. Pet owners increasingly prefer holistic care options that support faster recovery and minimize side effects. The inclusion of such therapies in mainstream veterinary care opens new opportunities for clinics and wellness centers to diversify service portfolios and attract a broader client base focused on preventive and long-term rehabilitation.

- For instance, Assisi Animal Health’s tPEMF runs at 27.12 MHz with 4 µT amplitude. A randomized trial reported improved 6-week wound scores and fewer owner-given analgesics; codeine use was 1.8× higher in controls.

Key Challenges

High Cost of Rehabilitation Treatments

The significant cost of advanced rehabilitation procedures limits accessibility, especially in low- and middle-income regions. Equipment such as hydrotherapy pools and laser systems require large investments, which increases treatment pricing for pet owners. Lack of insurance coverage for rehabilitation services further restricts affordability. This challenge constrains market penetration, particularly among pet owners seeking long-term therapy sessions for chronic conditions or post-surgical recovery.

Limited Availability of Skilled Veterinary Therapists

A shortage of trained veterinary physiotherapists and certified rehabilitation specialists hampers service delivery. Many regions lack standardized education programs or professional training in animal rehabilitation techniques. As a result, clinics struggle to maintain consistent care quality and therapeutic outcomes. Expanding professional training networks and certification initiatives is crucial to addressing this shortage and ensuring uniform standards across the global companion animal rehabilitation services market.

Regional Analysis

North America

North America dominated the Companion Animal Rehabilitation Services Market in 2024, accounting for 39.5% of the total share. The region’s growth is supported by high pet ownership, advanced veterinary infrastructure, and strong awareness of rehabilitation therapies. The presence of well-established service providers and insurance coverage for pet physiotherapy enhances accessibility. Increasing cases of obesity and orthopedic conditions in dogs further drive demand for physical rehabilitation. The United States leads regional growth, driven by technological adoption in hydrotherapy and laser treatment facilities across veterinary hospitals and specialty clinics.

Europe

Europe held a significant share of 28.4% in 2024, driven by widespread adoption of physiotherapy and holistic rehabilitation services for pets. Rising expenditure on animal health and supportive regulatory frameworks promoting welfare contribute to market expansion. Countries such as Germany, the United Kingdom, and France lead due to strong veterinary networks and specialized training programs in animal rehabilitation. Growing demand for hydrotherapy and shockwave therapy to manage chronic musculoskeletal disorders also supports growth. Increasing awareness of preventive care and post-surgical recovery drives continued service expansion across European rehabilitation centers.

Asia Pacific

Asia Pacific accounted for 20.7% of the total market share in 2024, showing strong potential for expansion. The region’s growth is fueled by rising pet adoption, increasing disposable incomes, and the growing establishment of advanced veterinary clinics. Countries like China, Japan, and Australia are witnessing rapid adoption of physiotherapy and hydrotherapy services for dogs and cats. Improved access to trained professionals and imported rehabilitation equipment enhances care quality. The expanding middle-class population and growing focus on animal wellness programs are expected to strengthen the region’s market position during the forecast period.

Latin America

Latin America captured 6.8% of the market share in 2024, supported by increasing awareness of pet rehabilitation and improving veterinary services. Brazil and Mexico are emerging as key markets due to the expansion of urban pet populations and growing demand for advanced post-surgical recovery therapies. The adoption of physiotherapy and hydrotherapy treatments is increasing as veterinary hospitals introduce dedicated rehabilitation units. Although service affordability remains limited in some areas, ongoing training initiatives and private clinic investments are expected to drive future market development across the region.

Middle East & Africa

The Middle East & Africa region accounted for 4.6% of the Companion Animal Rehabilitation Services Market in 2024. Market growth is influenced by the rising number of companion animals and gradual adoption of modern veterinary practices. South Africa and the United Arab Emirates lead regional demand with expanding pet care infrastructure and rising disposable incomes. However, limited access to skilled rehabilitation specialists and high service costs restrict wider adoption. Increasing efforts toward veterinary education and urban pet health awareness are likely to foster gradual market expansion in the coming years.

Market Segmentations:

By Therapy Type

- Therapeutic exercise

- Hydrotherapy

- Laser therapy

- Electrotherapy

- Acupuncture

- Massage therapy

- Thermal therapy

- Shockwave therapy

- Therapeutic ultrasound

- Other therapy types

By Indication

- Post-surgery

- Traumatic injuries

- Acute & chronic diseases

- Developmental abnormalities

- Other indications

By Animal Type

- Dogs

- Cats

- Horses

- Other animal types

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Companion Animal Rehabilitation Services Market features a diverse competitive landscape with key players including Blue Springs Animal Rehabilitation Center, Companion Animal Hospital, Animal Rehab and Conditioning Center, Treasure Coast Animal Rehab & Fitness, Baseline Animal Rehab Center (BARC), Boundary Bay Veterinary Specialty Hospital, Animal Rehab Center of Michigan, Western University of Health Sciences Pet Health Center, Triangle Veterinary Referral Hospital, Animal Acupuncture and Canine Sport Medicine Facility, Gold Coast Center for Veterinary Care, Back on Track Veterinary Rehabilitation Center, LLC, Butterwick Animal Rehab Clinic Ltd, and Essex Animal Hospital. Market participants focus on expanding service portfolios through advanced rehabilitation offerings such as hydrotherapy, laser therapy, and acupuncture. Growing investment in staff training, facility modernization, and digital therapy tracking enhances service quality. Partnerships with veterinary networks and educational institutions support knowledge transfer and innovation. Increasing emphasis on holistic, non-invasive, and preventive therapies is strengthening competition across established and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Blue Springs Animal Rehabilitation Center

- Companion Animal Hospital

- Animal Rehab and Conditioning Center

- Treasure Coast Animal Rehab & Fitness

- Baseline Animal Rehab Center (BARC)

- Boundary Bay Veterinary Specialty Hospital

- Animal Rehab Center of Michigan

- Western University of Health Sciences Pet Health Center

- Triangle Veterinary Referral Hospital

- Animal Acupuncture and Canine Sport Medicine Facility

- Gold Coast Center for Veterinary Care

- Back on Track Veterinary Rehabilitation Center, LLC

- Butterwick Animal Rehab Clinic Ltd

- Essex Animal Hospital

Recent Developments

- In 2025, Boundary Bay Veterinary Specialty Hospital Continued to provide comprehensive specialty veterinary services, likely including advanced rehabilitation options as part of its integrated care approach in the robust North American market.

- In 2024, Western University of Health Sciences Pet Health Center (PHC) opened a new Pet Rehabilitation Center, equipped with state-of-the-art tools to help companion animals recover from injuries.

- In 2023, Treasure Coast Animal Rehab & Fitness Continued to provide specialized rehab and fitness services, focusing on non-drug and non-invasive methods.

Report Coverage

The research report offers an in-depth analysis based on Therapy Type, Indication, Animal Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by rising demand for post-surgical recovery therapies.

- Increasing pet ownership and awareness of physiotherapy will boost rehabilitation service adoption.

- Technological advancements in hydrotherapy, laser, and electrotherapy will enhance treatment outcomes.

- Integration of digital monitoring tools will improve therapy precision and patient tracking.

- Expansion of multidisciplinary veterinary centers will strengthen the service network across regions.

- Training programs for veterinary physiotherapists will address the shortage of skilled professionals.

- Growing preference for non-invasive and holistic treatments will expand service diversity.

- Insurance inclusion for rehabilitation therapies will improve affordability and accessibility.

- Partnerships between veterinary hospitals and wellness centers will accelerate global market penetration.

- Rising focus on preventive healthcare and chronic pain management will sustain long-term market growth.