Market Overview

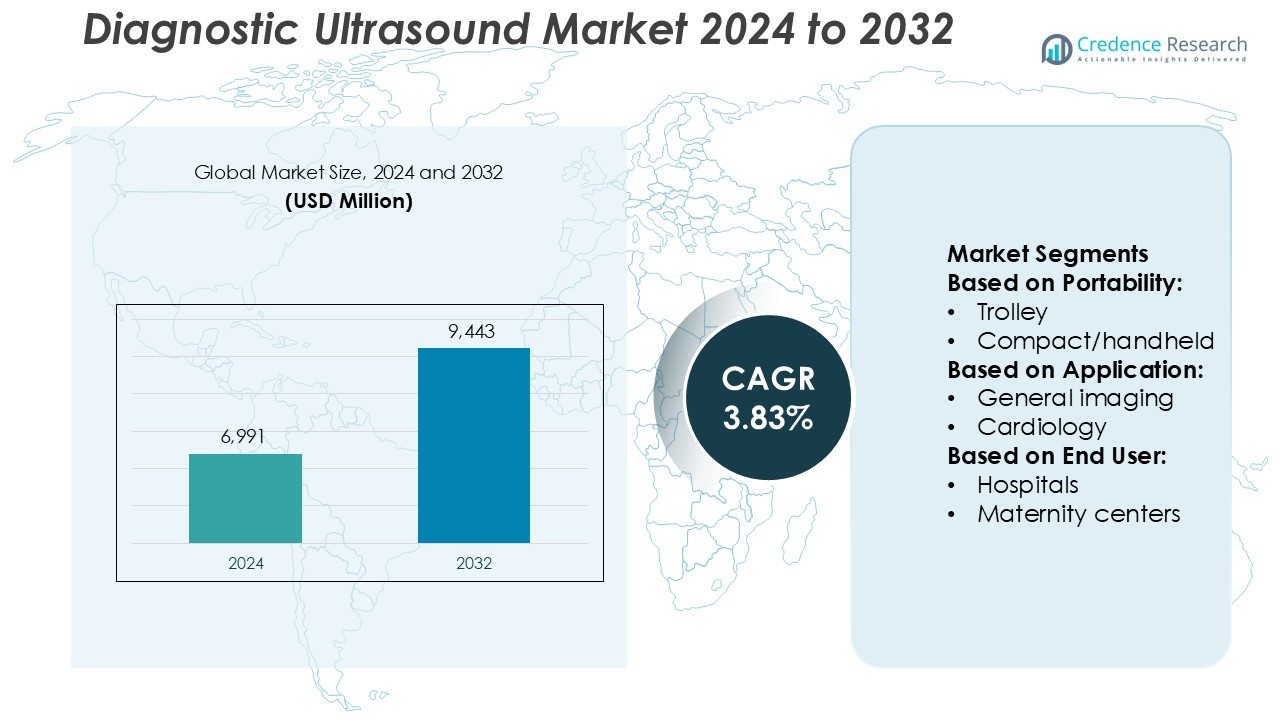

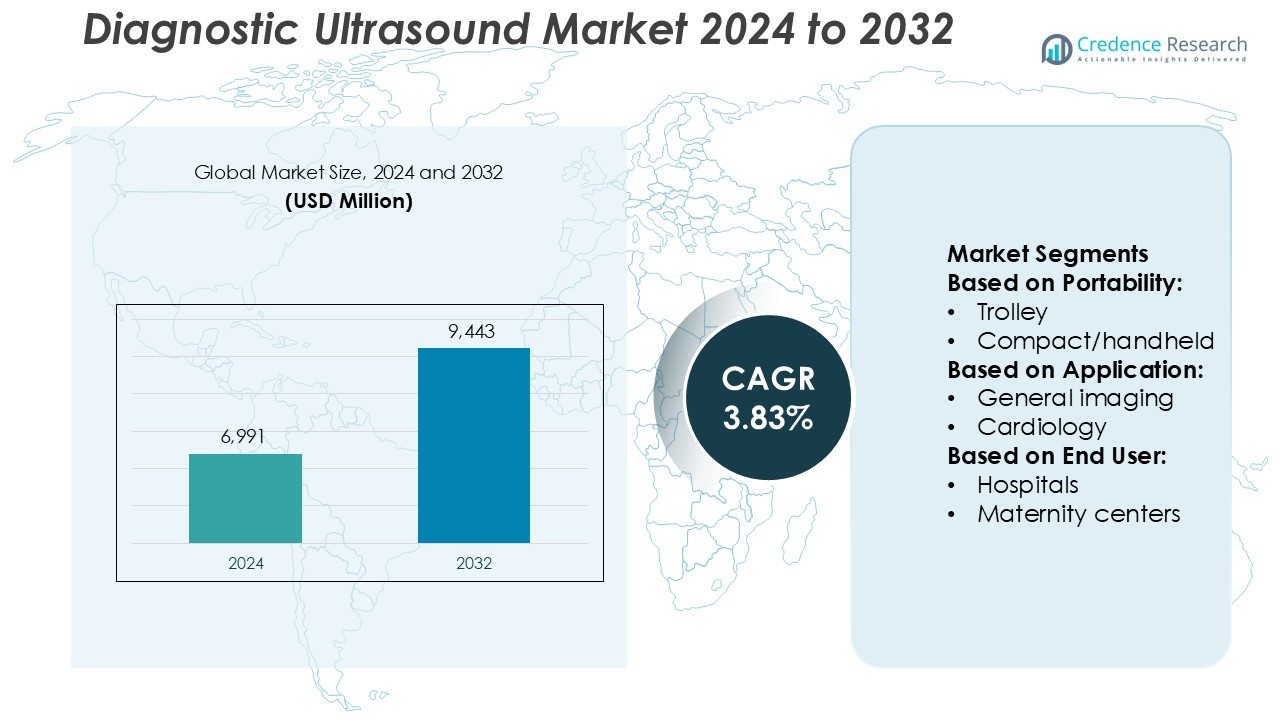

Diagnostic Ultrasound Market size was valued USD 6,991 million in 2024 and is anticipated to reach USD 9,443 million by 2032, at a CAGR of 3.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diagnostic Ultrasound Market Size 2024 |

USD 6,991 Million |

| Diagnostic Ultrasound Market, CAGR |

3.83% |

| Diagnostic Ultrasound Market Size 2032 |

USD 9,443 Million |

The Diagnostic Ultrasound Market is led by prominent players such as Siemens Healthineers AG, GE Healthcare, Canon Medical Systems Corporation, Samsung Electronics Co. Ltd., Konica Minolta Inc., Hologic, Inc., Esaote SpA, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Koninklijke Philips N.V. (BioTelemetry, Inc.), and FujiFilm Holdings Corporation. These companies focus on continuous innovation, expanding portfolios with AI-enabled imaging, 3D/4D visualization, and portable ultrasound solutions to meet diverse clinical requirements. Strategic initiatives, including partnerships, acquisitions, and regional expansions, strengthen their competitive positions and support penetration into emerging economies. North America emerges as the leading region, holding a 37% market share, driven by advanced healthcare infrastructure, high adoption of diagnostic imaging technologies, and strong investment in research and development. Robust service networks and emphasis on workflow efficiency further reinforce the dominance of these key players in the global diagnostic ultrasound landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Diagnostic Ultrasound Market was valued at USD 6,991 million in 2024 and is projected to reach USD 9,443 million by 2032, growing at a CAGR of 3.83% during the forecast period.

- Market growth is driven by increasing adoption of AI-enabled imaging, portable ultrasound devices, and advanced 3D/4D visualization systems in hospitals and diagnostic centers.

- Trends indicate rising demand for point-of-care solutions, cloud integration, and hybrid imaging technologies to improve diagnostic accuracy and workflow efficiency.

- Competition is intense, with key players like Siemens Healthineers, GE Healthcare, Canon Medical, and Samsung Electronics expanding through innovation, acquisitions, and regional penetration strategies.

- North America leads with a 37% market share, supported by advanced healthcare infrastructure, while segment analysis shows hospitals dominate end-use, and general imaging holds the largest application share globally.

Market Segmentation Analysis:

By Portability

The trolley-based segment dominates the diagnostic ultrasound market, accounting for the largest share due to its wide clinical use and advanced imaging capabilities. These systems offer higher resolution, multiple transducer options, and superior Doppler performance, making them ideal for hospitals and specialty clinics. The growing adoption of trolley-based systems in radiology and cardiology departments stems from their ability to handle complex imaging requirements. Compact and handheld ultrasounds are gaining momentum in point-of-care and emergency settings due to improved portability, battery life, and wireless connectivity, but trolley systems remain the primary choice for high-precision diagnostics.

- For instance, Siemens Healthineers offers its ACUSON NX3 system equipped with over 15 transducers for broad clinical application coverage.These systems provide higher resolution, multiple transducer options, and superior Doppler performance, making them ideal for hospitals and specialty clinics.

By Application

General imaging represents the leading application segment with the highest market share, driven by its broad use across abdominal, musculoskeletal, and vascular assessments. The demand for advanced 3D and 4D imaging, coupled with AI-enhanced image analysis, supports its dominance in hospitals and diagnostic centers. Cardiology and OB/GYN applications follow, supported by the rising prevalence of cardiovascular and prenatal care requirements. The integration of automated measurements and enhanced visualization tools further strengthens general imaging adoption for both routine and complex diagnostic evaluations.

- For instance, Konica Minolta’s AeroScan CD35 model features a 23‑inch HD monitor, a 4‑pinless probe connector setup and “5Q Probe Technology” integrating five image‑improving technologies (PZT crystal, element spacing filler, multiple matching layers, sound‑field optimisation and advanced crystal cutting).

By End-user

Hospitals hold the dominant share in the diagnostic ultrasound market, supported by high patient inflow and extensive imaging infrastructure. The integration of ultrasound into emergency, radiology, and surgical departments drives continuous equipment upgrades. Hospitals prefer multi-purpose systems capable of delivering rapid and accurate imaging across diverse clinical scenarios. Maternity centers also contribute significantly to market growth through specialized prenatal and fetal imaging. However, hospitals remain the key end-user due to their adoption of high-end systems with real-time analytics and compatibility with electronic medical record systems.

Key Growth Drivers

- Rising Prevalence of Chronic and Lifestyle Diseases

The increasing incidence of cardiovascular, musculoskeletal, and abdominal disorders is boosting demand for diagnostic ultrasound systems. Non-invasive imaging allows early detection and effective disease monitoring, making it essential in routine diagnostics. The growing elderly population further drives usage due to higher vulnerability to chronic diseases. Governments and healthcare providers are expanding screening programs, especially in developing countries, to improve early diagnosis. This ongoing medical need significantly contributes to the rising adoption of advanced ultrasound technologies across global healthcare systems.

- For instance, Hologic’s SuperSonic™ MACH 40 Ultrasound System offers an UltraFast™ imaging architecture capable of capturing up to 20,000 frames per second.

- Advancements in Imaging Technology and AI Integration

Technological innovation is transforming the diagnostic ultrasound market through enhanced image resolution, real-time analysis, and automation. The integration of AI and machine learning improves diagnostic accuracy by enabling automated measurements and anomaly detection. Vendors are developing 3D and 4D imaging solutions for detailed anatomical visualization, reducing human error in interpretation. Portable and wireless systems equipped with cloud-based connectivity are also expanding clinical accessibility. These advancements collectively strengthen diagnostic efficiency and drive continuous equipment upgrades in hospitals and imaging centers.

- For instance, Samsung’s HERA Z20 platform features automatic labelling of up to 47 anatomical structures and executes 46 essential measurements in one workflow.

- Expanding Applications in Point-of-Care and Home Healthcare

The increasing adoption of compact and handheld ultrasound systems is revolutionizing point-of-care diagnostics. These portable devices enable quick imaging in emergency departments, remote areas, and home care settings. Enhanced wireless connectivity and battery performance have made such devices more reliable for rapid diagnosis and teleconsultation. Rising healthcare digitization and emphasis on patient-centric care further support their expansion. As healthcare delivery shifts toward decentralized models, point-of-care ultrasound adoption continues to accelerate, creating strong growth opportunities for manufacturers and service providers.

Key Trends & Opportunities

- Growing Demand for Portable and Handheld Systems

Miniaturization and digitalization are driving strong demand for portable and handheld ultrasound systems. Clinicians prefer these devices for bedside diagnostics and field use due to their flexibility and cost-effectiveness. The integration of smartphone connectivity and cloud storage enables easy image sharing and remote consultation. Portable systems are particularly beneficial in rural and low-resource settings where traditional imaging infrastructure is limited. This trend highlights the growing shift toward mobility, accessibility, and faster diagnostic turnaround in modern healthcare environments.

- For instance, the MyLab™ Alpha weighs 12.4 lbs (system only, without battery) and supports a monitor resolution of 1280 × 800 pixels. Clinicians prefer these devices for bedside diagnostics and field use due to their flexibility and cost‐effectiveness.

- Integration of Artificial Intelligence and Automation

AI-powered ultrasound platforms are becoming a major trend in diagnostic imaging. Automation enhances image capture, interpretation, and reporting, significantly reducing operator dependency. AI algorithms assist in identifying abnormalities and quantifying organ structures with higher precision. Companies are embedding AI-based workflow optimization tools to streamline clinical operations and improve patient throughput. The technology not only enhances diagnostic confidence but also supports personalized healthcare by integrating imaging data with electronic medical records and predictive analytics systems.

- For instance, Vscan Air CL handheld ultrasound features a dual‑probe design: the curved array transducer covers 2–5 MHz (center 3.3 MHz) with a maximum scanning depth of 24 cm, while the linear array covers 3–12 MHz (center 7.7 MHz) with a depth up to 8 cm.

- Rising Adoption of Tele-Ultrasound and Remote Diagnostics

The emergence of telemedicine has expanded the scope of ultrasound usage beyond clinical facilities. Tele-ultrasound systems enable real-time consultations between remote operators and specialists, improving access to quality diagnostics in underserved areas. Cloud connectivity allows image transmission, review, and archiving, supporting continuous monitoring. The increasing need for decentralized healthcare, especially during emergencies and pandemics, is accelerating this trend. The combination of digital platforms and portable ultrasound devices represents a major opportunity for market growth in remote healthcare delivery.

Key Challenges

- High Equipment Cost and Maintenance Burden

Despite growing demand, the high cost of advanced ultrasound systems remains a major challenge for small clinics and emerging markets. Complex hardware, AI-enabled features, and 3D imaging modules increase initial investment and maintenance expenses. Budget constraints often restrict upgrades, especially in public hospitals and rural centers. Additionally, service and calibration costs add to operational challenges. These economic barriers limit widespread adoption and create disparities in diagnostic accessibility across regions with varying income levels and healthcare infrastructure.

- Shortage of Skilled Professionals and Operator Dependency

Accurate ultrasound diagnosis requires skilled sonographers and radiologists, which are in short supply globally. Many healthcare systems face challenges in training personnel to operate advanced systems effectively. Operator-dependent image acquisition and interpretation can result in diagnostic inconsistencies and errors. Although AI tools are addressing some issues, full automation remains limited. The lack of standardized training and certification programs further constrains system utilization efficiency. This skill gap continues to hinder optimal deployment and performance of diagnostic ultrasound technology across diverse clinical environments.

Regional Analysis

North America

North America holds the leading position in the diagnostic ultrasound market with a 36% share. The region’s dominance is driven by advanced healthcare infrastructure, high adoption of cutting-edge imaging systems, and strong reimbursement frameworks. Increasing prevalence of cardiovascular and obstetric conditions supports consistent equipment demand. The presence of major players, continuous R&D investments, and government focus on preventive healthcare further enhance market growth. The U.S. remains the key contributor due to rapid technological integration, while Canada benefits from expanding tele-ultrasound programs and improved diagnostic access in remote areas.

Europe

Europe accounts for 28% of the global diagnostic ultrasound market, supported by well-established healthcare systems and growing adoption of 3D and 4D imaging technologies. The region benefits from favorable government initiatives to upgrade diagnostic infrastructure and promote early disease detection. Germany, the U.K., and France lead the market owing to strong investments in hospital modernization and AI-driven imaging solutions. Rising demand for point-of-care ultrasound in emergency and outpatient departments further fuels regional growth. Continuous clinical research collaborations across European institutions enhance innovation and standardization in imaging protocols.

Asia-Pacific

Asia-Pacific represents a rapidly growing market, capturing a 25% share, driven by expanding healthcare access and rising diagnostic awareness. Countries such as China, Japan, and India are investing heavily in digital healthcare and hospital infrastructure upgrades. The increasing prevalence of chronic diseases and maternal health programs boosts ultrasound adoption in both urban and rural settings. Growing preference for portable and handheld devices enhances accessibility in remote areas. Local manufacturing initiatives, coupled with government support for affordable imaging solutions, position Asia-Pacific as a key growth hub for diagnostic ultrasound systems.

Latin America

Latin America holds a 7% share of the diagnostic ultrasound market, supported by healthcare expansion and improving access to medical imaging in emerging economies. Brazil and Mexico dominate the regional market due to ongoing public and private sector investments in diagnostic infrastructure. Growing awareness of early disease screening and the availability of low-cost portable systems contribute to demand. However, budget limitations and uneven healthcare distribution slow adoption in some countries. Continued partnerships with international manufacturers and telemedicine initiatives are expected to strengthen ultrasound accessibility across the region.

Middle East & Africa

The Middle East & Africa account for 4% of the global diagnostic ultrasound market, driven by increasing healthcare expenditure and modernization of hospital facilities. Gulf Cooperation Council (GCC) countries, including Saudi Arabia and the UAE, lead regional adoption due to robust investments in medical technology. Africa is witnessing gradual growth through donor-funded healthcare projects and portable imaging deployments. Rising government focus on maternal and child health further supports demand. However, limited technical expertise and high import costs remain challenges, highlighting the need for capacity building and affordable equipment solutions.

Market Segmentations:

By Portability:

By Application:

- General imaging

- Cardiology

By End User:

- Hospitals

- Maternity centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Diagnostic Ultrasound Market players such as Siemens Healthineers AG, Konica Minolta Inc., Hologic, Inc., Canon Medical Systems Corporation, Samsung Electronics Co. Ltd., Esaote SpA, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., General Electric Company (GE Healthcare), Koninklijke Philips N.V. (BioTelemetry, Inc.), and FujiFilm Holdings Corporation. The Diagnostic Ultrasound Market is highly competitive, driven by continuous innovation and technological advancements. Companies focus on developing AI-enhanced imaging, 3D/4D visualization, and portable ultrasound systems to meet diverse clinical needs. Strategic initiatives such as partnerships, acquisitions, and regional expansions strengthen market presence and support penetration into emerging economies. Investment in research and development enhances image quality, workflow efficiency, and diagnostic accuracy. Additionally, manufacturers prioritize customer support, training, and service networks to build brand loyalty and ensure seamless adoption in hospitals, clinics, and specialized care centers. The convergence of cost-effective solutions with advanced capabilities is intensifying market competition, compelling companies to differentiate through product performance, versatility, and reliability. Overall, innovation, operational excellence, and strategic market approaches define the competitive dynamics and shape the global growth trajectory of the diagnostic ultrasound industry.

Key Player Analysis

Recent Developments

- In June 2025, Philips launched a new point-of-care (POC) ultrasound system designed to broaden the accessibility of ultrasound for diagnostic and therapeutic interventions. The Flash 5100 POC system is applicable for use cases in anesthesia, critical care, emergency medicine, and musculoskeletal imaging.

- In March 2025, Evident Vascular, Inc, announced the successful closing of its Series B financing with new investors Shangbay Capital and two undisclosed multinational strategics joining founding investor Ventana Capital.

- In May 2024, Samsung Electronics Co. Ltd. acquired Sonio SAS, a company specializing in fetal ultrasound AI software. This acquisition combined Sonio’s advanced AI capabilities with Samsung’s cutting-edge ultrasound systems, leading to the introduction of groundbreaking AI-enhanced workflows and driving innovation in prenatal care and patient outcomes.

- In February 2024, Fujifilm launched a new endoscopic ultrasound machine in India, the ‘ALOKA ARIETTA 850’. This machine offers superior features such as enhanced image quality, HD-THI for deeper penetration, and combi-elastography.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Portability, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-powered imaging tools will increase accuracy and diagnostic efficiency.

- Portable and handheld ultrasound devices will see higher demand in remote and point-of-care settings.

- Integration of cloud-based systems will enhance data storage, sharing, and telemedicine applications.

- Expansion into emerging markets will drive overall market growth and accessibility.

- Continuous R&D will introduce advanced 3D/4D imaging and elastography technologies.

- Collaboration between manufacturers and healthcare providers will improve customized clinical solutions.

- Focus on cost-effective devices will support adoption in smaller clinics and developing regions.

- Regulatory approvals and standardization will facilitate faster deployment of innovative systems.

- Increasing awareness of preventive healthcare will boost routine diagnostic ultrasound usage.

- Hybrid imaging solutions combining ultrasound with other modalities will gain traction for complex diagnostics.