Market Overview

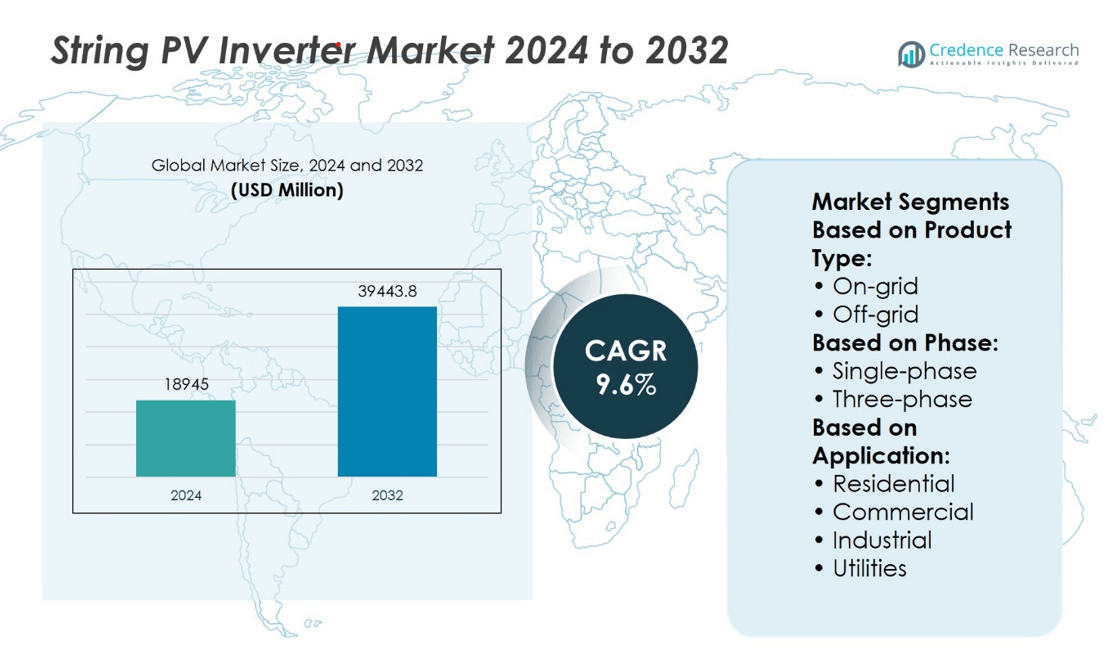

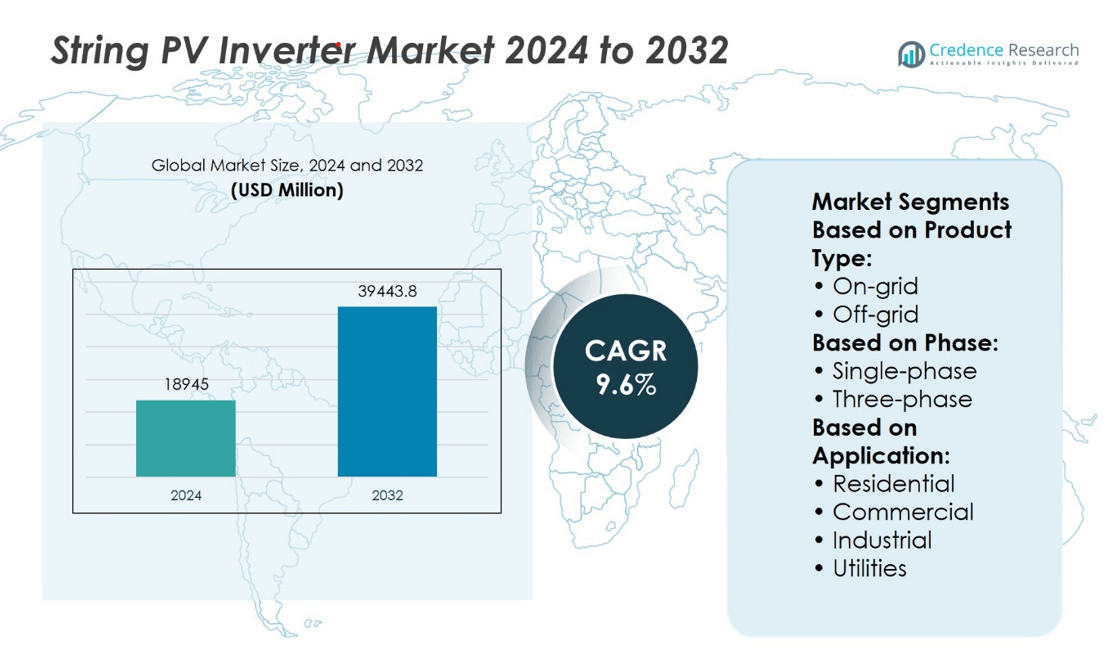

String PV Inverter Market size was valued at USD 18945 million in 2024 and is anticipated to reach USD 39443.8 million by 2032, at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| String PV Inverter Market Size 2024 |

USD 18945 million |

| String PV Inverter Market, CAGR |

9.6% |

| String PV Inverter Market Size 2032 |

USD 39443.8 million |

The string PV inverter market is driven by the global shift toward renewable energy, rising solar PV installations, and supportive government policies promoting clean power generation. It benefits from falling solar system costs and growing demand for efficient, grid-compatible inverters across residential, commercial, and utility segments. Market trends include increased adoption of smart inverters with real-time monitoring, multi-MPPT configurations, and AI-enabled diagnostics. Hybrid inverters integrated with energy storage systems are gaining popularity. Technological innovation, digitalization, and the push for decentralized energy systems continue to shape product development and influence purchasing decisions across key regional markets.

The string PV inverter market shows strong presence across North America, Europe, and Asia Pacific, with North America leading in revenue share due to advanced solar infrastructure and policy support. Europe follows closely with high solar adoption in Germany and the UK, while Asia Pacific, led by China and India, shows rapid growth. Key players in the market include Huawei Technologies, Sungrow, SMA Solar Technology, SolarEdge Technologies, GoodWe, Growatt, Delta Electronics, Canadian Solar, Solis Inverter, Siemens, and Ingeteam Power Technology.

Market Insights

- The string PV inverter market was valued at USD 18,945 million in 2024 and is expected to reach USD 39,443.8 million by 2032, growing at a CAGR of 9.6%.

- Rising solar PV installations and supportive government policies drive market growth globally.

- Falling solar system costs and demand for efficient, grid-compatible inverters boost adoption across residential, commercial, and utility sectors.

- Trends include smart inverters with real-time monitoring, multi-MPPT designs, AI diagnostics, and growing use of hybrid inverters with energy storage.

- Market competition is intense, with key players focusing on innovation, global reach, and strong service networks.

- Challenges include regulatory complexity, high initial investments, and intermittent solar generation impacting grid integration.

- North America leads in revenue share due to advanced infrastructure and policies, followed by Europe and rapidly growing Asia Pacific markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Renewable Energy Sources Drives Product Adoption Across Utility and Commercial Segments

The string PV inverter market is gaining momentum due to the growing global emphasis on clean energy transition. Governments across major economies are implementing renewable energy targets and incentivizing solar power generation. Utility-scale and commercial solar installations are expanding, fueling the demand for reliable and efficient inverters. The market benefits from regulatory support, including feed-in tariffs, tax rebates, and net metering policies. These programs make solar installations more economically viable and push investors toward high-efficiency solutions. The string PV inverter market stands out due to its cost-effectiveness and ease of integration in large-scale solar systems.

- For instance, Huawei Technologies has deployed over 200 GW of string inverter capacity worldwide as of 2023, with its SUN2000 series string inverters offering maximum efficiency

Technological Advancements Enhance Efficiency, Grid Compatibility, and Monitoring Capabilities

Manufacturers are introducing advanced features such as multi-MPPT designs, remote diagnostics, and real-time monitoring to improve system performance. The string PV inverter market reflects these developments through enhanced grid compliance and higher power conversion efficiency. Integration of AI and IoT technologies into inverter systems enables predictive maintenance and faster response times. These features reduce operational downtime and improve the long-term value proposition for solar project developers. It allows users to manage energy production efficiently while ensuring compatibility with smart grid infrastructure. Improved inverter performance directly influences overall solar plant output.

- For instance, SMA Solar Technology’s Sunny Tripower CORE2 inverter includes 12 maximum power point tracker (MPPT) and supports up to 110 kW of input power

Declining Solar PV System Costs Encourage Broader Deployment in Residential Sector

The global decrease in solar photovoltaic system costs has made rooftop solar installations more accessible to homeowners. The string PV inverter market benefits from this trend, especially in regions experiencing rapid urbanization and increased electricity demand. Cost-conscious consumers are opting for compact and modular inverter solutions to support small-scale systems. It supports scalability and is suitable for partial or full-home solar integration. The availability of financing models such as leasing and power purchase agreements further supports adoption. Markets in Asia-Pacific and Latin America are witnessing a sharp rise in residential installations.

Stringent Environmental Regulations and Emission Targets Support Long-Term Market Growth

Governments are enforcing strict carbon emission limits, prompting industries to shift toward sustainable energy solutions. The string PV inverter market aligns with decarbonization goals by enabling clean electricity generation. Energy policies are prioritizing grid stability and integration of renewable power sources, increasing the need for advanced inverters. It plays a critical role in grid-tied solar systems, helping maintain voltage and frequency within acceptable limits. Regulatory compliance ensures product standardization and boosts end-user confidence. Market players are focusing on innovation to meet evolving standards and secure long-term contracts.

Market Trends

Rapid Shift Toward Decentralized Energy Systems Boosts Demand for Flexible Inverter Solutions

The global energy landscape is moving away from centralized grids toward decentralized solar installations. Consumers and businesses are adopting rooftop and community solar systems to reduce dependency on traditional power sources. The string PV inverter market reflects this shift by offering compact and modular solutions suited for distributed energy applications. It supports localized power generation while ensuring grid stability and safety. System owners prefer inverters that allow easy monitoring, efficient energy conversion, and future scalability. This trend encourages manufacturers to develop smart, network-enabled inverters optimized for diverse installation environments.

Integration of Digital Technologies Enhances Monitoring, Control, and Predictive Maintenance Capabilities

The digitalization of energy infrastructure has created opportunities for intelligent inverter systems with enhanced control features. The string PV inverter market is evolving with the integration of IoT, cloud computing, and AI to enable real-time performance tracking. It empowers users to detect faults early, schedule timely maintenance, and optimize output. Inverters with advanced communication interfaces and software compatibility are gaining preference across commercial and residential segments. These features help streamline operations and ensure minimal energy loss. Stakeholders are investing in platforms that offer analytics and remote diagnostics as standard functions.

- For instance, ABB UNO-DM-6.0-TL-PLUS-Q inverter supports remote monitoring through the Aurora Vision platform, which transmits operational data at intervals of 5 seconds.

Growing Adoption of Three-Phase Inverters in Commercial and Industrial Installations

Larger commercial and industrial solar systems are opting for three-phase string inverters due to their ability to handle higher loads efficiently. The string PV inverter market is witnessing strong uptake in this segment, driven by demand for stable, high-capacity solutions. It helps reduce installation costs by eliminating the need for multiple smaller units and minimizing energy loss. Installers and EPCs favor three-phase models for their robust performance and easy grid integration. Product portfolios are expanding to meet the rising need for power-dense and durable inverters. Manufacturers are aligning their R&D focus with evolving commercial requirements.

- For instance, Fronius’ Symo 20.0-3-M three-phase string inverter offers a maximum AC output power of 20,000 VA, supports a maximum DC input voltage of 1,000 V, and is equipped with 2 independent MPPTs.

Emphasis on Compliance with International Standards Encourages Technological Innovation

Governments and certification bodies are enforcing stringent safety, performance, and grid compliance standards for inverter systems. The string PV inverter market is responding by prioritizing innovation in design and functionality to meet these regulations. It ensures compatibility with evolving grid codes while improving overall reliability. Manufacturers are incorporating surge protection, anti-islanding functions, and enhanced thermal management into their products. These innovations not only support regulatory compliance but also increase customer trust. The focus on quality assurance and certification is shaping future product development strategies.

Market Challenges Analysis

Intermittent Solar Generation and Grid Integration Issues Create Operational Complexity

The intermittent nature of solar energy generation poses a challenge for stable grid operations. Sudden fluctuations in sunlight due to weather changes can affect inverter performance and disrupt energy flow. The string PV inverter market faces technical limitations when balancing energy output with real-time grid demands. It requires advanced grid support features and adaptive control systems to maintain voltage and frequency levels. Utilities often demand strict compliance with dynamic grid codes, which vary by region and frequently change. This creates barriers for manufacturers and project developers seeking to deploy standardized solutions across multiple markets.

High Initial Investment and Limited Availability of Skilled Workforce Affect Deployment

Upfront costs related to quality inverters, installation, and system integration remain a major constraint, especially in emerging economies. The string PV inverter market must address pricing concerns while maintaining performance standards. It often competes with cheaper, lower-quality alternatives that compromise reliability and lifespan. Limited access to trained professionals capable of installing and maintaining advanced inverter systems adds to deployment challenges. Delays in permitting and lack of clear policy frameworks further hinder large-scale adoption in several regions. These obstacles slow market expansion and reduce the return on investment for stakeholders.

Market Opportunities

Government-Led Solar Initiatives and Electrification Programs Unlock Growth Potential

Many countries are launching solar development schemes to expand renewable capacity and reduce fossil fuel dependence. These initiatives often include subsidies, tax incentives, and regulatory support for solar equipment deployment. The string PV inverter market stands to benefit from public investments in rural electrification and off-grid systems. It enables cost-effective integration of distributed solar solutions in remote areas with limited infrastructure. National clean energy targets are driving utility and commercial solar projects that require efficient and scalable inverter systems. This policy-driven demand offers strong growth potential across developing and developed economies.

Rising Demand for Smart Energy Solutions Opens New Product Development Avenues

The shift toward smart grids and digital energy management presents significant opportunities for inverter innovation. The string PV inverter market can expand by offering intelligent, software-enabled solutions that support two-way communication and energy optimization. It allows users to monitor performance, manage load, and respond to real-time energy price signals. Increasing use of energy storage systems alongside solar installations creates demand for hybrid inverters with advanced grid support features. Urban infrastructure projects and smart city initiatives also call for high-efficiency inverters compatible with automated energy systems. These developments open pathways for partnerships between inverter manufacturers, utilities, and digital solution providers.

Market Segmentation Analysis:

By Product:

The market divides into two product types: on-grid and off-grid string inverters. The on-grid segment dominates current adoption, particularly in industrial and commercial settings, due to its ability to produce a pure sine wave and maintain safety and efficiency for connected appliances. Off-grid inverters serve remote areas and self-sufficient setups. It provides energy independence where grid connections lack. Manufacturers emphasise on-grid offerings for mainstream applications while off-grid remains niche yet crucial for rural and standalone systems.

- For instance, Growatt MAX 100KTL3-X LV on-grid string inverter delivers a maximum AC output power of 100,000 VA, supports up to 10 MPPTs, and has a maximum DC input voltage of 1,100 V.

By Phase:

The market also segments by phase into single-phase and three-phase units. Single-phase inverters capture the largest share, mainly through use in residential and small commercial installations. It offers operational simplicity and lower upfront cost. Three-phase units find favour in larger installations. It eliminates the need for inverter sub-panels and maintains compact form with higher capacity. This segment growth reflects demand for efficient, scalable solutions in growing solar deployments.

- For instance, Delta’s M125HV three-phase inverter delivers 124000 VA of output, supports 1500 V DC input, includes 10 MPPTs, connects 20 strings

By Application:

By application, the market covers residential, commercial, industrial, and utilities categories. The utilities segment currently leads in value and growth potential owing to rising demand for large-scale photovoltaic power plant installations. It supports distributed solar generation within grid infrastructure. Residential installations follow, driven by rooftop solar adoption. Commercial and industrial sectors also play an expanding role, driven by cost-saving and green-energy goals. It underscores how string inverters support system versatility across sectors.

Segments:

Based on Product Type:

Based on Phase:

Based on Application:

- Residential

- Commercial

- Industrial

- Utilities

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounted for the largest share in the string PV inverter market, contributing approximately 40% of the global revenue. The region benefits from supportive federal and state-level policies, such as investment tax credits (ITC), net metering, and renewable portfolio standards. The United States leads the regional market due to robust residential, commercial, and utility-scale solar deployment. Canada also plays a growing role, backed by incentives at the provincial level and rising interest in distributed solar generation. It continues to attract investments from manufacturers and project developers focused on advanced inverter technologies. Demand for smart inverters and grid-supportive solutions remains strong across urban and rural regions, positioning North America as a mature and innovation-driven market.

Europe Maintains

Europe holds a significant share of around 30% in the global string PV inverter market. Countries such as Germany, the United Kingdom, France, Italy, and Spain drive market growth through ambitious renewable energy targets and well-established solar infrastructure. Germany remains a leader in solar PV capacity and mandates inverter compliance with dynamic grid codes. The UK has emerged as a fast-growing market due to rising rooftop installations and smart energy programs. It is also supported by the EU’s focus on decarbonization and grid modernization. Strong regulatory frameworks, government-backed incentives, and the adoption of digital energy systems enhance Europe’s role in shaping global inverter trends.

Asia Pacific

Asia Pacific contributes approximately 25% of the global market share, showing rapid expansion in countries like China, India, Japan, and Australia. China leads in solar capacity deployment and local inverter manufacturing, driven by government subsidies and strategic energy planning. India is witnessing strong growth in residential and utility-scale installations supported by national solar missions and favorable tariff structures. Japan and Australia contribute with advanced technology adoption and increasing residential solar penetration. It reflects strong momentum due to declining solar system costs, rising electricity demand, and growing urbanization. The region presents vast opportunities for expansion across both off-grid and grid-connected applications.

Latin America

Latin America accounts for around 5% of the global string PV inverter market. Brazil and Mexico lead in regional installations due to increasing energy demand and supportive net metering policies. Chile also contributes significantly with utility-scale solar farms and strong government backing. It is gradually developing as a promising region with high solar irradiance and favorable investment conditions. Challenges such as policy uncertainty and financing barriers exist but do not overshadow the region’s long-term potential.

Middle East and Africa

The Middle East and Africa (MEA) region holds the remaining 5% share. Countries like the UAE, Saudi Arabia, and South Africa are investing in solar infrastructure to diversify energy sources and improve grid reliability. It gains importance as energy security and sustainability become key national priorities. The market is gradually expanding through public-private partnerships and utility-driven projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sungrow

- Siemens

- Growatt New Energy

- SolarEdge Tec

- Ingeteam Power Technology

- Delta Electronics

- Canadian Solar

- SMA Solar Technology

- Solis Inverter

- GoodWe

- Huawei Technologies

Competitive Analysis

The string inverter market remains highly competitive, with leading players including Huawei Technologies, Sungrow, SMA Solar Technology, SolarEdge Technologies, GoodWe, Growatt New Energy, Canadian Solar, Delta Electronics, Solis Inverter, Siemens, and Ingeteam Power Technology. The string inverter market is highly competitive, driven by rapid technological innovation, regional expansion strategies, and increasing demand for efficient solar solutions. Companies focus on enhancing product performance, integrating digital features such as remote monitoring and AI-based diagnostics, and ensuring compliance with evolving grid standards. The market sees strong competition across residential, commercial, and utility-scale segments, with players differentiating through pricing strategies, after-sales service, and energy management capabilities. Emphasis on high-efficiency, multi-MPPT configurations and hybrid inverter models supports market positioning. Global distribution networks, strategic collaborations, and continuous R&D investments remain critical for maintaining competitiveness. The dynamic nature of solar policies and the push for decentralized energy systems further intensify the competitive environment.

Recent Developments

- In April 2025, Sungrow announced the launch of its fully compatible Commercial & Industrial (C&I) PV inverter range at the Solar & Storage Live London event held on April 2nd and 3rd. This new inverter range is compatible with module-level optimizers, enhancing the performance and safety of PV projects by maximizing energy yield, even under shading or mismatched module conditions.

- In April 2025 Announced a new range of Commercial & Industrial (C&I) PV inverters fully compatible with optimizers, launched at Solar & Storage Live London 2025.

- In January 2025, at Intersolar Europe Sungrow highlighted their latest advancements in solar and energy storage, including innovative modular inverters and energy storage solutions.

Market Concentration & Characteristics

The string PV inverter market exhibits a moderately concentrated structure, with a few global players commanding significant market share while several regional and niche manufacturers compete across specific segments. It features strong brand loyalty driven by performance reliability, technological innovation, and regulatory compliance. Companies differentiate through product efficiency, smart energy features, and service capabilities tailored to residential, commercial, and utility applications. The market reflects high entry barriers due to strict certification standards, capital-intensive R&D, and evolving grid requirements. It shows a fast pace of innovation, with growing demand for hybrid, multi-MPPT, and AI-integrated inverters that support real-time monitoring and grid stability. The market favors manufacturers with global supply chains, strategic partnerships, and the ability to adapt to local regulatory conditions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Phase, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with increasing global solar PV installations across residential, commercial, and utility sectors.

- Technological advancements will focus on enhancing inverter efficiency, digital connectivity, and grid compliance.

- Demand for hybrid inverters will rise with the integration of solar PV and energy storage systems.

- Smart inverters with remote monitoring and AI-based diagnostics will gain wider adoption.

- Governments will introduce stricter regulations, driving innovation in grid-supportive features.

- The shift toward decentralized energy systems will increase demand for compact and modular inverters.

- Emerging markets in Latin America, Southeast Asia, and Africa will create new growth opportunities.

- Price competition will intensify, pushing companies to optimize manufacturing and supply chain efficiency.

- Strategic collaborations between inverter manufacturers, utilities, and tech firms will become more common.

- Product differentiation based on service reliability and energy management capabilities will define competitive success.