Market Overview

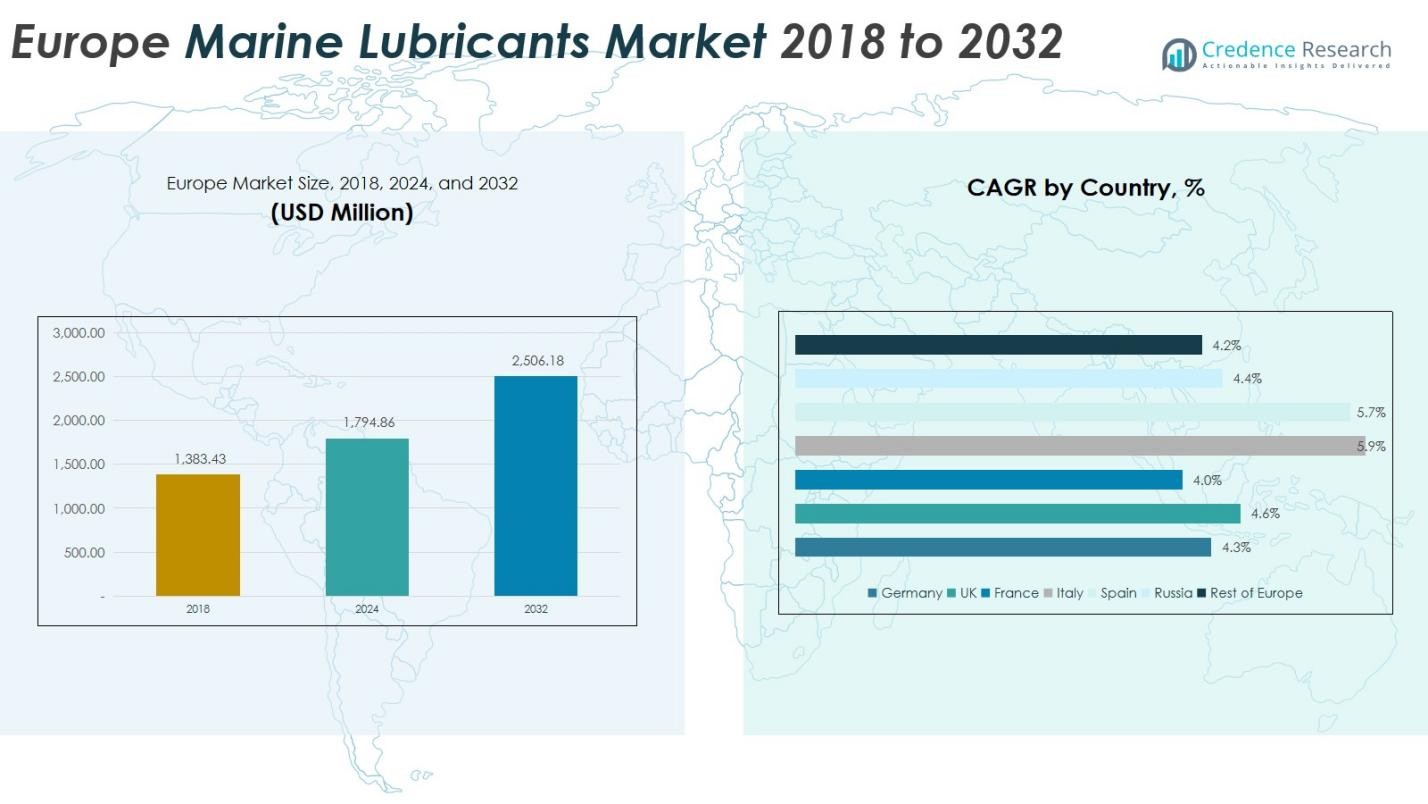

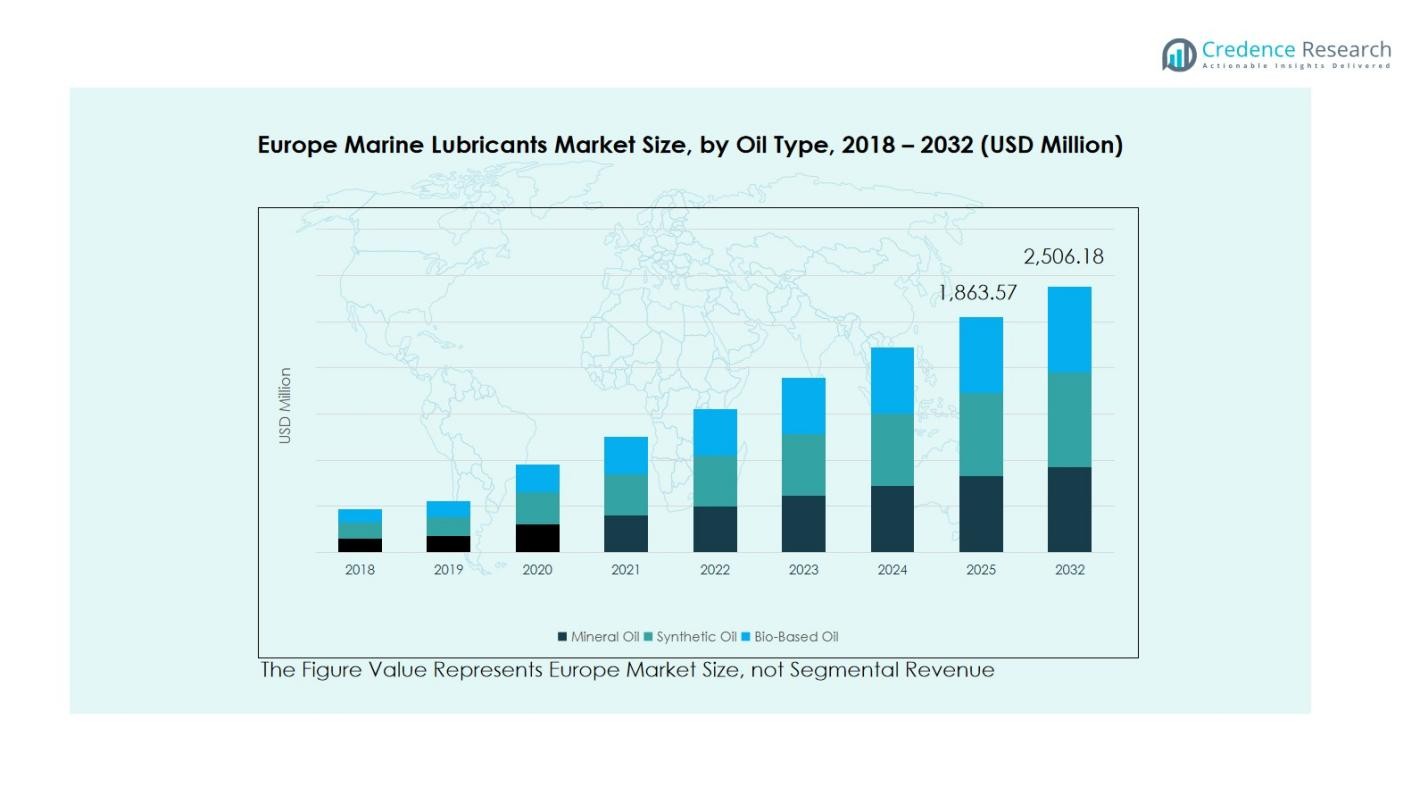

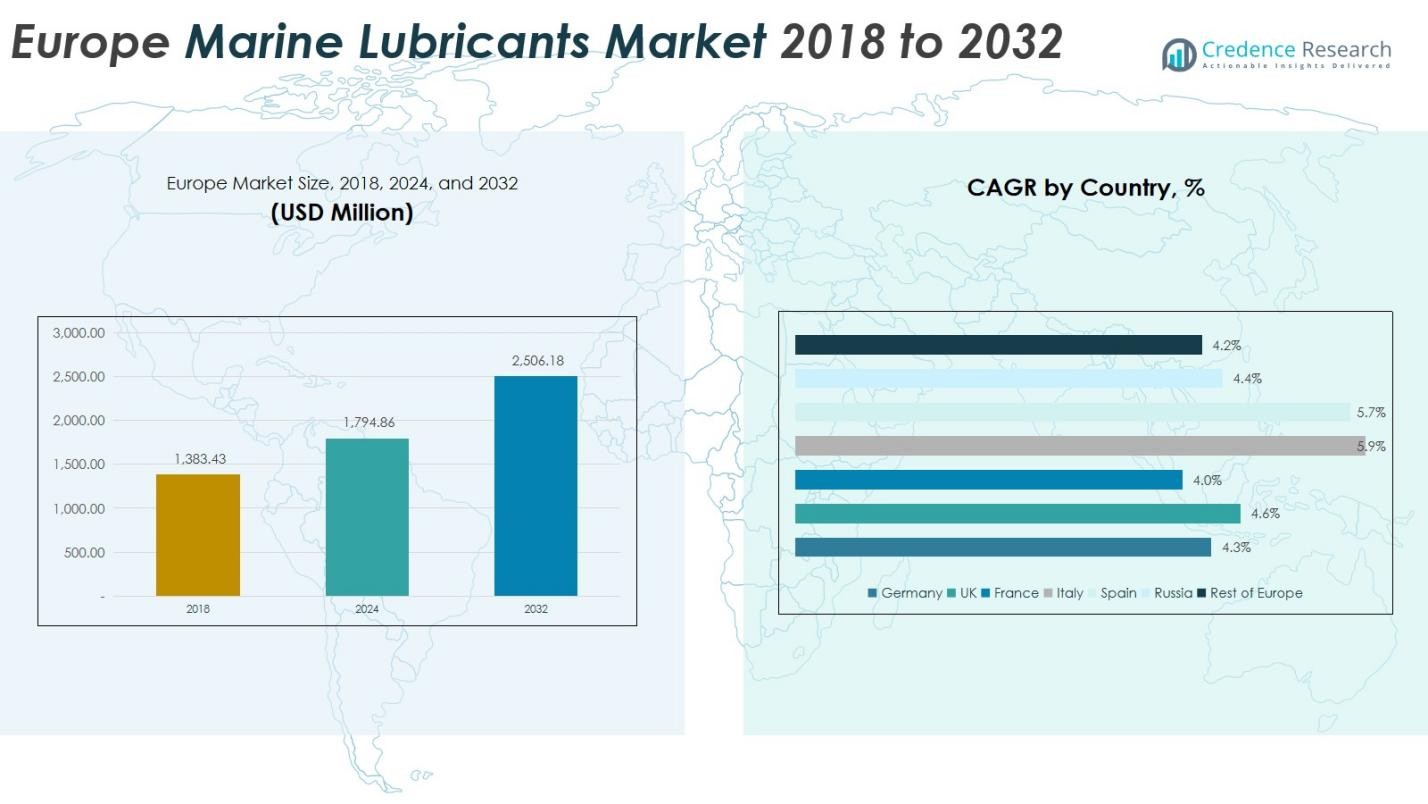

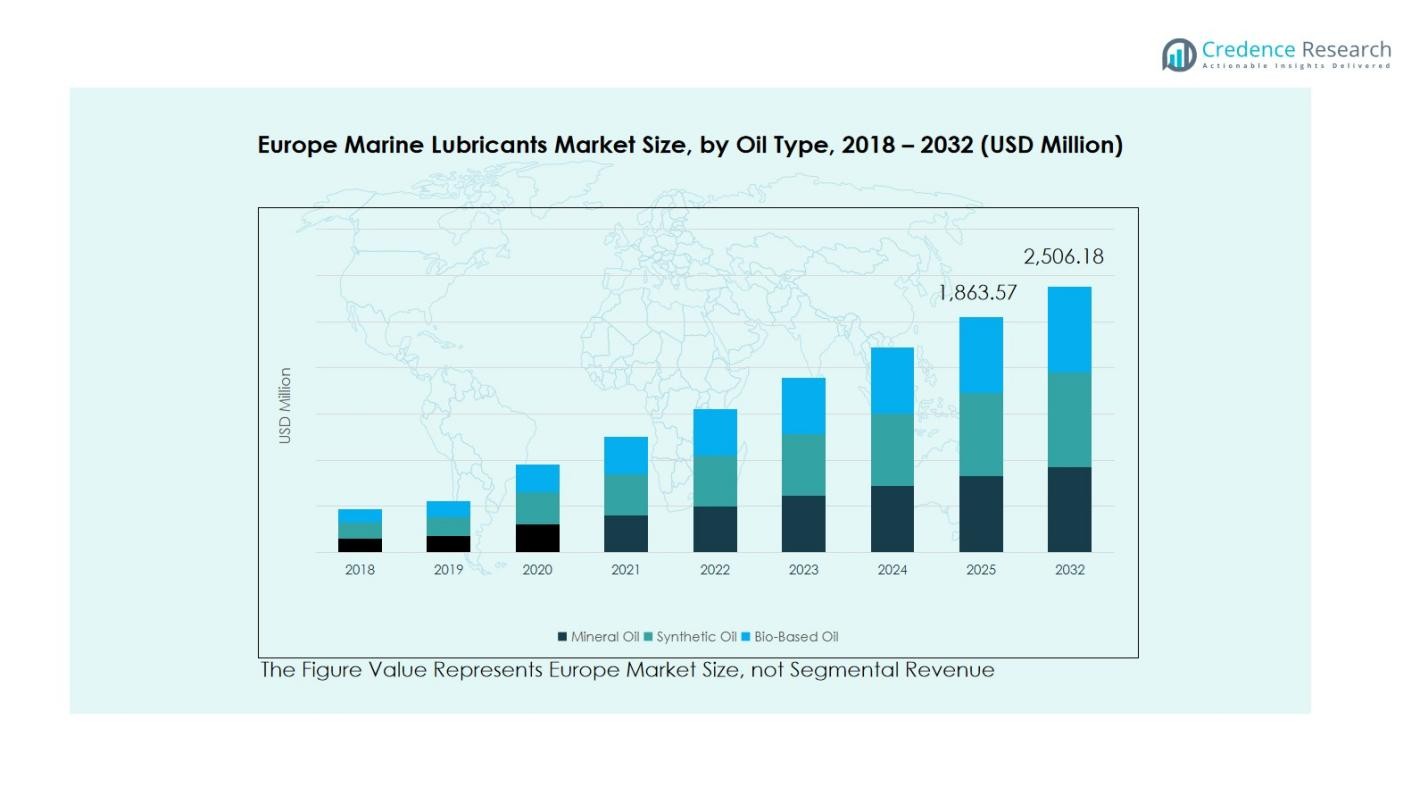

The Europe Marine Lubricants Market size was valued at USD 1,383.43 million in 2018, growing to USD 1,794.86 million in 2024, and is anticipated to reach USD 2,506.18 million by 2032, at a CAGR of 4.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Marine Lubricants Market Size 2024 |

USD 1,794.86 Million |

| Europe Marine Lubricants Market, CAGR |

4.23% |

| Europe Marine Lubricants Market Size 2032 |

USD 2,506.18 Million |

The Europe Marine Lubricants Market is dominated by major players such as BP p.l.c., Shell Plc, ExxonMobil Marine Limited, Chevron Corporation, TotalEnergies, Klüber Lubrication, Pennzoil, LUKOIL, and 77 Lubricants, which collectively maintain a strong market presence through extensive distribution networks, advanced formulations, and long-term collaborations with shipowners and fleet operators. These companies focus on developing synthetic and bio-based lubricants that comply with IMO 2020 and EU sustainability standards, supporting the transition toward cleaner marine operations. Germany leads the regional market with a 22.10% share in 2025, driven by its robust shipbuilding infrastructure, advanced port facilities, and early adoption of environmentally acceptable lubricants, reinforcing its position as the key hub for marine lubricant innovation and consumption in Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Marine Lubricants Market was valued at USD 1,794.86 million in 2024 and is projected to reach USD 2,506.18 million by 2032, expanding at a CAGR of 4.23% during the forecast period.

- Market growth is driven by rising maritime trade, fleet expansion, and the need for high-performance lubricants to enhance engine efficiency and reduce emissions across major European ports.

- Increasing adoption of bio-based and synthetic lubricants is a key trend, supported by stringent IMO 2020 regulations and Europe’s focus on sustainability and low-sulfur marine operations.

- The competitive landscape features leading companies such as BP p.l.c., Shell Plc, ExxonMobil Marine Limited, and TotalEnergies, emphasizing product innovation, digital monitoring systems, and port-based service networks.

- Regionally, Germany holds the largest share at 22.10%, while by product type, the engine oil segment dominates with 60% share in 2024, reflecting strong demand from commercial and cargo vessels.

Market Segmentation Analysis:

By Oil Type:

In the European marine lubricants market based on oil type, the mineral oil segment dominates with a 51.7% share in 2024. This dominance is attributed to its cost-effectiveness, easy availability, and proven reliability in heavy-duty marine engines. While synthetic and bio-based oils are witnessing steady growth due to their superior oxidation stability and lower environmental impact, mineral oil remains the most widely adopted choice among fleet operators seeking operational efficiency and affordability in large-scale shipping operations.

- For instance, Sinopec Lubricant Company reports that its marine branch in Singapore has an annual production capacity of 100,000 tons of marine-grade lubricant base oil.

By Product Type:

Within the product-type segmentation, the engine oil segment leads the market with a 60% share in 2024. Engine oils are essential for marine propulsion systems and auxiliary engines, ensuring efficient performance and extended service life under high-pressure conditions. The segment’s dominance is driven by the expanding commercial fleet size and tightening IMO emission standards, which encourage the use of high-performance, low-sulfur lubricants that reduce friction losses and enhance fuel economy in marine operations.

- For instance, Exxon Mobil Corporation’s “Mobilgard 570” cylinder oil was tested on a two-stroke engine over 3,532 hours with minimal piston deposits and wear.

By Application:

In terms of application, the bulk carriers segment holds the largest share of 32% in 2024 in the European marine lubricants market. Bulk carriers require extensive lubricant volumes for propulsion, cargo handling, and auxiliary machinery, making them the primary end-users in this sector. The segment’s dominance is propelled by rising dry-bulk trade volumes, particularly in raw materials and minerals, along with increased vessel sizes that demand regular lubrication maintenance to ensure engine efficiency and compliance with operational standards.

Key Growth Drivers

Rising Maritime Trade and Fleet Expansion

The continuous growth of maritime trade across Europe is a major driver for the marine lubricants market. Expanding commercial fleets and increased shipping activity, particularly in bulk carriers and container ships, have heightened the demand for high-performance lubricants to ensure efficient engine operation and reduced downtime. Europe’s strategic ports such as Rotterdam and Hamburg serve as key trading hubs, further accelerating lubricant consumption. The expansion of global logistics and seaborne trade volumes continues to reinforce lubricant requirements across regional shipping networks.

- For instance, Infineum International Limited reported a field trial in which a marine lubricant ran successfully for more than 20,000 hours on a vessel with a Wärtsilä 6L38B engine about five times longer than a typical trial.

Stringent Emission Regulations and Environmental Compliance

Stringent International Maritime Organization (IMO) emission standards are compelling ship operators to adopt low-sulfur and biodegradable lubricants. This regulatory shift drives innovation in lubricant formulations to reduce carbon footprints while maintaining high efficiency. Manufacturers are increasingly developing environmentally acceptable lubricants (EALs) and synthetic alternatives to meet these mandates. Compliance with IMO 2020 and European Green Deal targets has spurred investments in sustainable lubrication technologies, positioning eco-friendly products as a central growth factor in the regional marine lubricants market.

- For instance, LUKOIL Marine Lubricants launched the NAVIGO MCL Extra (a 40 BN cylinder oil) for ultra-low sulfur heavy fuel applications, and developed the iCOlube® on-board unit for intelligent lubrication, which has been recognised by two innovation awards.

Technological Advancements in Lubrication Systems

Advancements in lubricant monitoring and formulation technologies are significantly driving market growth. The integration of digital tools such as condition-based monitoring systems and smart sensors helps optimize lubricant usage, extend maintenance intervals, and enhance vessel reliability. Additionally, the development of high-performance synthetic and bio-based lubricants capable of operating under extreme marine conditions has improved operational efficiency. These technological innovations are enabling shipping companies to reduce operating costs and align with performance and sustainability goals across Europe’s maritime sector.

Key Trends and Opportunities

Shift Toward Bio-Based and Environmentally Acceptable Lubricants

The growing focus on sustainability is encouraging a shift toward bio-based and environmentally acceptable lubricants (EALs) in Europe. With ports and marine authorities promoting cleaner operations, shipowners are increasingly adopting biodegradable formulations that meet both performance and environmental standards. Manufacturers are capitalizing on this opportunity by expanding portfolios of renewable lubricants derived from natural esters. This trend aligns with Europe’s environmental policies and provides an opportunity for lubricant producers to capture market share through innovation and regulatory compliance.

- For instance, Vickers Oils’ Hydrox Bio range has been deployed on 600 vessels for sterntube and thruster applications, providing readily-biodegradable oil solutions in marine environments.

Increasing Adoption of Predictive Maintenance Technologies

The rise of digitalization in marine operations presents a significant opportunity for lubricant manufacturers. Predictive maintenance technologies that rely on real-time data analytics and condition monitoring are being adopted to minimize equipment failures and optimize lubricant life cycles. These systems enable early detection of engine wear and lubricant degradation, reducing downtime and maintenance costs. European shipping companies are increasingly investing in such smart maintenance solutions, driving demand for advanced lubricants designed to perform effectively within digitalized fleet management systems.

- For instance, Shell Marine introduced its LubeMonitor system, which integrates various data streams (such as onboard testing data and laboratory results) to provide a comprehensive overview of lubricant condition and machinery health.

Key Challenges

Volatility in Crude Oil Prices

Fluctuating crude oil prices pose a major challenge for the European marine lubricants market, as base oils derived from petroleum constitute a significant cost component. Price volatility affects production expenses and profit margins for lubricant manufacturers, creating uncertainty in supply chains. Companies are compelled to manage cost fluctuations while maintaining competitive pricing and quality standards. Although diversification into synthetic and bio-based alternatives can mitigate this impact, the industry remains sensitive to global oil market instability.

Environmental Regulations and Compliance Costs

Increasingly stringent environmental regulations across Europe have elevated compliance costs for lubricant producers and shipping operators. Meeting IMO and EU sustainability standards requires reformulation of lubricant products, adoption of cleaner technologies, and certification processes all of which add to operational expenses. Smaller manufacturers face challenges adapting to these evolving requirements, limiting their market competitiveness. While these regulations promote long-term sustainability, they present near-term financial and operational burdens, particularly for companies transitioning from conventional to eco-friendly lubricant solutions.

Regional Analysis

Germany

Germany leads the Europe marine lubricants market, holding 22.10% of the regional share in 2025. The country’s strong position reflects its advanced shipbuilding capabilities, deep maritime supply chains, and large port infrastructure that sustain high lubricant consumption across main and auxiliary engines. Demand in Germany is also propelled by early adoption of eco-friendly formulations and OEM-approved cylinder oils, which support stricter maintenance regimes and longer service intervals. Domestic shipyards and commercial fleets prioritize reliability and compliance, encouraging suppliers to offer high-performance and sustainable lubricants that align with national decarbonization goals.

United Kingdom

The United Kingdom accounts for 16.90% of the Europe marine lubricants market and remains a strategic hub for maritime services and lubricant distribution. The UK’s extensive port network, offshore activity, and merchant fleet underpin steady demand for engine, hydraulic, and specialty lubricants. Regulatory focus on emissions reduction and investments in digital vessel management drive uptake of higher-specification and condition-monitoring-compatible products. Suppliers in the UK emphasize value-added services such as technical support, oil analysis, and logistics, strengthening customer retention and encouraging the transition to lower-emission lubricant options.

France

France captures 10.95% of the Europe marine lubricants market, driven by its commercial shipping, cruise operations, and luxury yacht sectors. French shipowners and shipbuilders increasingly seek eco-compatible lubricants to meet both EU sustainability initiatives and port authority requirements. The market shows particular growth in biodegradable and synthetic formulations for sensitive operations such as cruises and coastal services. Manufacturers leverage technical partnerships with engine OEMs and local service networks to supply certified products and on-site oil management, supporting operational efficiency while meeting evolving environmental standards.

Italy

Italy holds 11.28% of the Europe marine lubricants market, supported by a strong shipbuilding tradition and active Mediterranean fleet operations. Italian demand is driven by both commercial shipping and a vibrant leisure-craft segment that requires diverse lubricant types, from heavy-duty engine oils to specialty marine greases. The market favors suppliers offering regional logistics, prompt technical support, and environmentally acceptable lubricants to comply with EU regulations. Ongoing modernization of Italian ports and growth in short-sea shipping further reinforce lubricant consumption and encourage adoption of higher-performance formulations.

Spain

Spain represents 7.29% of the Europe marine lubricants market, with demand anchored by merchant shipping, fisheries, and growing offshore services. Spanish ports and coastal logistics generate steady consumption of engine and hydraulic oils, while stricter emissions enforcement accelerates uptake of low-sulfur-compatible and biodegradable products. Local suppliers focus on supply chain resilience and tailored technical services for fleet operators, enabling efficient inventory management across dispersed coastal operations. Investment in port upgrades and Mediterranean trade routes supports incremental market growth and diversification of lubricant portfolios.

Russia

Russia contributes 3.80% to the Europe marine lubricants market, driven by significant Arctic and export-oriented maritime activity. The Russian fleet’s heavy-duty engine profile and long voyage operations create demand for durable, high-viscosity oils and cylinder lubrication solutions. Market dynamics reflect a mix of traditional petroleum-based products and a gradual shift toward synthetics where operational conditions demand extended drain intervals. Geopolitical and supply-chain factors influence sourcing and pricing, prompting regional suppliers to emphasize local manufacturing and inventory security.

Rest of Europe

The Rest of Europe collectively accounts for 10.74% of the Europe marine lubricants market, encompassing smaller but strategically important maritime nations across the Nordics, Balkans, and Eastern Europe. This grouping absorbs diverse lubricant demand from short-sea shipping, ferry operations, and niche shipbuilding activities. Growth in these markets is closely tied to port modernization, regional trade flows, and regulatory alignment with EU environmental standards. Suppliers serving this segment prioritize flexible logistics, technical training, and tailored product mixes such as bio-based options and OEM-approved oils to capture opportunities across fragmented national markets.

Market Segmentations:

By Oil Type

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Product Type

- Engine Oil

- Hydraulic Oil

- Compressor Oil

- Others

By Application

- Bulk Carriers

- Container Ships

- Oil Tankers

- Others

By Region

- Germany

- United Kingdom (UK)

- France

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The competitive landscape of the Europe Marine Lubricants Market is characterized by the presence of major players such as BP p.l.c., Shell Plc, ExxonMobil Marine Limited, Chevron Corporation, TotalEnergies, Klüber Lubrication, Pennzoil, LUKOIL, and 77 Lubricants. These companies dominate the market through extensive distribution networks, advanced product portfolios, and long-standing relationships with shipowners and fleet operators. Competition centers on innovation, product differentiation, and adherence to stringent environmental regulations. Leading manufacturers are focusing on developing synthetic and bio-based lubricants that meet IMO 2020 and EU sustainability standards, catering to growing demand for cleaner marine operations. Strategic alliances, port service expansions, and investments in research and digital monitoring technologies enhance operational efficiency and brand reliability. Furthermore, regional suppliers are strengthening their presence by offering tailored lubrication solutions, technical expertise, and value-added maintenance services, positioning themselves as key partners in Europe’s evolving and sustainability-driven maritime industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Castrol introduced its new MHP marine lubricant range (MHP 1-30 and MHP 1-40) in Europe, formulated for engines using alternative fuels such as LNG, distillate, and biofuels. The product enhances oxidation stability and supports longer oil-drain intervals, aligning with sustainability and efficiency goals in marine operations.

- On July 1 2024, TotalEnergies acquired Tecoil, a Finnish specialist in used-oil re-refining (RRBOs), to enhance circular-economy credentials in its lubricant base-oil supply chain and support the manufacturing of high-performance marine lubricants with lower carbon footprint.

- In September 2024, LENOL and FUCHS Lubricants Germany GmbH celebrated a two-year strategic partnership that led to the launch of a new marine lubricant brand tailored to meet IMO Tier III regulations and sustainable maritime demands.

- On September 11 2025, Lubmarine (part of TotalEnergies) signed a supply agreement with Dublin-based Finol Oils to distribute the full range of marine lubricants and greases in Ireland, expanding its service footprint across key Irish ports.

Report Coverage

The research report offers an in-depth analysis based on Oil Type, Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe marine lubricants market is expected to experience steady growth driven by expanding maritime trade and fleet modernization.

- Increasing adoption of environmentally acceptable lubricants will shape product innovation and market differentiation.

- Synthetic and bio-based lubricants will gain stronger traction due to performance efficiency and regulatory compliance.

- Digitalization in fleet management will enhance predictive maintenance and lubricant monitoring practices.

- Stricter emission standards will accelerate demand for low-sulfur and high-performance formulations.

- Port infrastructure upgrades across major European countries will boost lubricant consumption and supply chain efficiency.

- Collaboration between lubricant manufacturers and ship operators will strengthen after-sales services and technical support.

- Research and development will focus on enhancing lubricant durability and reducing maintenance frequency.

- Emerging economies in Eastern Europe will contribute to future regional demand expansion.

- Sustainable product development and circular economy practices will become key strategic priorities for market players.