Market Overview

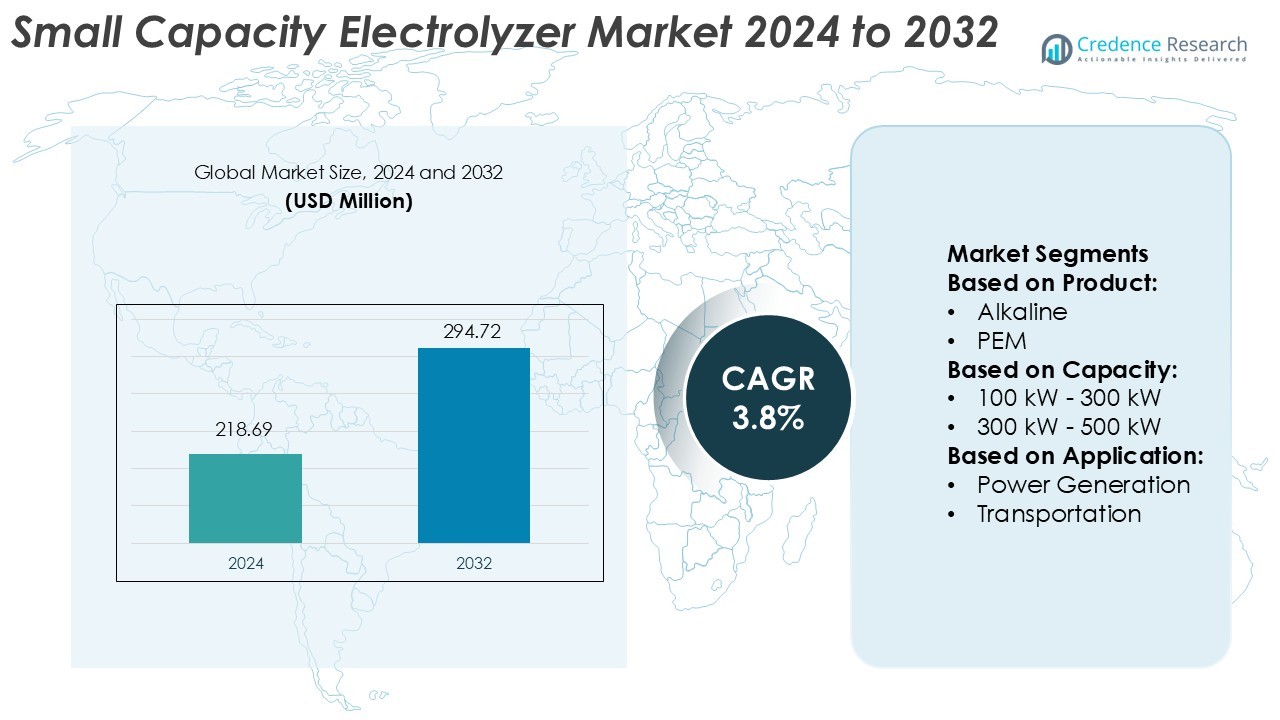

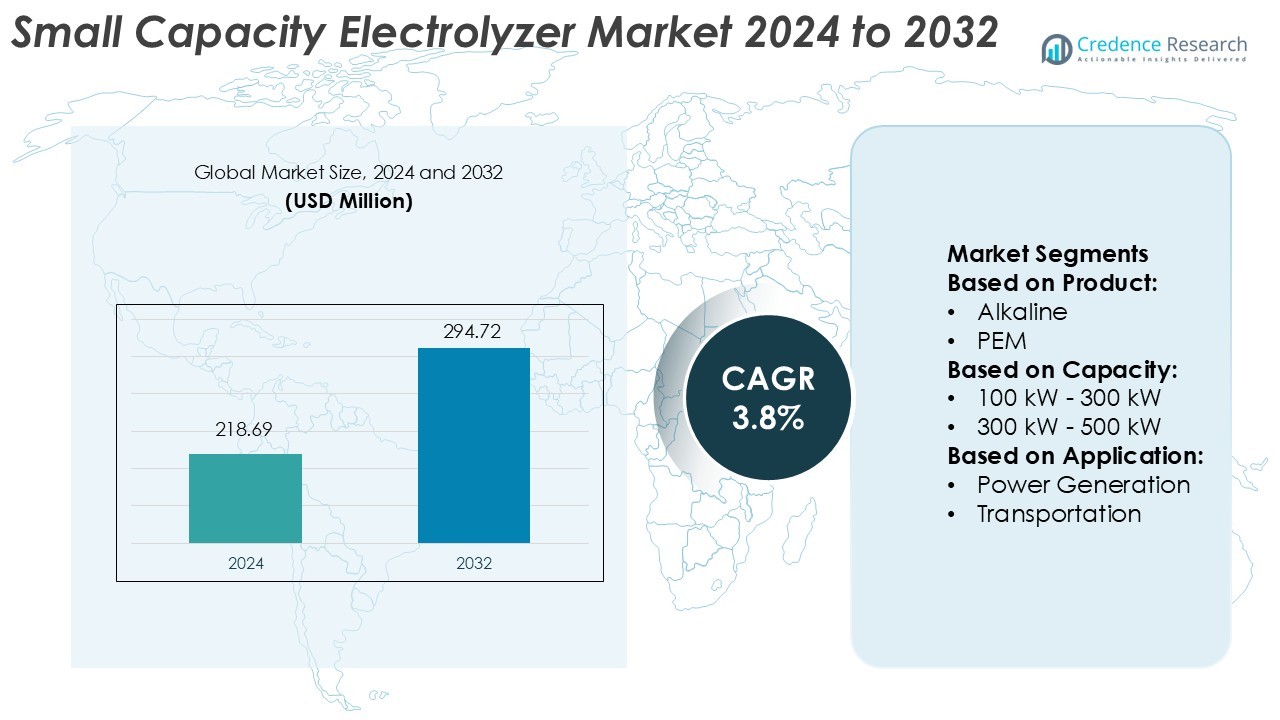

Small Capacity Electrolyzer Market size was valued USD 218.69 million in 2024 and is anticipated to reach USD 294.72 million by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Capacity Electrolyzer Market Size 2024 |

USD 218.69 Million |

| Small Capacity Electrolyzer Market, CAGR |

3.8% |

| Small Capacity Electrolyzer Market Size 2032 |

USD 294.72 Million |

The Small Capacity Electrolyzer Market is dominated by globally recognized players driving innovation and scale. Companies such as Siemens AG, Plug Power Inc., ITM Power plc, Cummins Inc., Nel ASA, thyssenkrupp AG, Haldor Topsoe A/S, Enapter AG, Bloom Energy Corporation, and John Cockerill Group lead the competition through strategic partnerships, technological upgrades, and efficient hydrogen generation solutions. These players emphasize modularity, compact design, and cost optimization to cater to diverse applications across industries. North America leads the market with a 37% share, supported by strong policy frameworks, rising investment in clean hydrogen infrastructure, and active deployment of renewable energy projects. Continuous R&D investment and favorable government incentives further solidify regional dominance and attract new entrants into the small capacity electrolyzer segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Small Capacity Electrolyzer Market was valued at USD 218.69 million in 2024 and is expected to reach USD 294.72 million by 2032, registering a CAGR of 3.8%.

- Growing demand for green hydrogen and supportive government initiatives are driving the adoption of small-scale electrolyzers for decentralized energy applications.

- Advancements in compact system design, improved membrane efficiency, and renewable integration are shaping major market trends and promoting cost competitiveness.

- Strong competition among leading players focusing on modularity, automation, and strategic collaborations continues to accelerate innovation and market penetration.

- North America holds a 37% market share, leading the global landscape due to its clean hydrogen programs, while the low-capacity segment dominates within overall electrolyzer installations for distributed energy production.

Market Segmentation Analysis:

By Product

The alkaline segment dominates the small capacity electrolyzer market with a major market share. Its technological maturity, lower installation costs, and long operational lifespan make it the preferred choice for hydrogen generation. Alkaline electrolyzers use liquid alkaline solutions, such as potassium hydroxide, providing reliable performance for steady power inputs. Their wide-scale adoption in industrial and research applications supports demand across decentralized hydrogen projects. The increasing integration of renewable energy sources further strengthens their market position due to high efficiency and compatibility with fluctuating power supply.

- For instance, John Cockerill Group has developed modular alkaline electrolyzers capable of producing up to 1,300 normal cubic meters of hydrogen per hour (Nm³/h). These systems operate at 30 bar pressure with energy consumption close to 4.4 kWh per Nm³ of hydrogen.

By Capacity

The ≤100 kW segment holds the largest market share in the small capacity electrolyzer market. This range is widely used for pilot projects, laboratories, small-scale hydrogen refueling stations, and distributed renewable energy systems. Its compact design, low maintenance, and adaptability to on-site energy generation make it ideal for localized hydrogen production. Growing investments in hydrogen-based microgrids and residential fuel cell systems are key growth drivers. The increasing preference for low-power electrolyzers in remote or off-grid regions enhances segment expansion globally.

- For instance, Plug Power’s “Allagash Stack” 1 MW block specification provides up to 200 Nm³/h hydrogen output or 425 kg/day output with start-up times of 30 seconds warm and < 5 minutes cold from standby.

By Application

The power generation segment leads the small capacity electrolyzer market with the highest share. These electrolyzers are integrated into renewable energy systems to store excess electricity as hydrogen, ensuring grid stability and energy security. Hydrogen produced through small electrolyzers serves as a clean energy carrier for solar and wind farms. This segment’s growth is supported by the global push for decarbonization and rising renewable integration. Government initiatives promoting hydrogen-based energy storage further accelerate deployment in distributed generation setups and backup power systems.

Key Growth Drivers

Rising Demand for Decentralized Hydrogen Production

The growing focus on on-site and decentralized hydrogen generation is driving demand for small capacity electrolyzers. These systems enable localized energy production, reducing transportation losses and dependency on centralized plants. Industries and research institutions prefer compact electrolyzers for pilot-scale hydrogen generation and power-to-gas projects. The push toward green hydrogen and renewable energy integration further strengthens adoption across distributed applications, enhancing system efficiency and sustainability in hybrid energy networks.

- For instance, Haldor Topsoe’s proprietary solid oxide electrolyzer cell (SOEC) technology achieved a 2,000-hour demonstration run using 12 stacks (1,200 cells) under full industrial conditions.

Supportive Government Policies and Incentives

Governments worldwide are offering subsidies, tax benefits, and funding programs to promote hydrogen production through electrolysis. National hydrogen strategies in regions such as Europe, Japan, and the U.S. support small-scale electrolyzer deployment for energy transition goals. These policies encourage public-private partnerships, pilot installations, and R&D investments. Such supportive frameworks accelerate technological adoption, improve affordability, and enhance competitiveness, making small capacity electrolyzers vital for achieving decarbonization targets and long-term renewable energy integration.

- For instance, Siemens Energy (a subsidiary of Siemens AG) reported that its “Silyzer 300” PEM electrolyser achieves a plant efficiency greater than 75.5% and produces up to 335 kg of hydrogen per hour in the 17.5 MW module design.

Technological Advancements in Electrolyzer Efficiency

Advancements in proton exchange membrane (PEM) and alkaline electrolyzer technologies are improving system efficiency and durability. Manufacturers focus on optimizing catalyst materials, reducing maintenance costs, and enhancing output stability under variable renewable power. Compact, modular designs make installation easier in off-grid and hybrid power systems. The development of solid oxide electrolyzers capable of operating at high temperatures further increases energy conversion efficiency. These innovations strengthen the market’s ability to deliver scalable, low-emission hydrogen generation solutions.

Key Trends & Opportunities

Integration with Renewable Energy Systems

The integration of small capacity electrolyzers with renewable energy sources like solar and wind is a major trend. These systems store excess renewable power as hydrogen, enhancing grid flexibility and reducing curtailment losses. Growth in microgrid projects and rural electrification programs creates new opportunities for hybrid hydrogen systems. The combination of clean energy generation and storage improves system reliability and accelerates the adoption of sustainable hydrogen ecosystems globally.

- For instance, Nel’s A485 atmospheric alkaline electrolyser achieves a hydrogen output of 485 Nm³/h (≈ 1,046 kg/day) with a stack power consumption as low as 4.5 kWh/Nm³.

Expansion in Transportation and Industrial Applications

Small capacity electrolyzers are finding increasing use in hydrogen fueling stations, laboratories, and industrial pilot projects. The transition toward cleaner fuels in transportation and the development of hydrogen-based mobility infrastructure support this expansion. Additionally, industries such as chemicals, semiconductors, and metal processing adopt compact electrolyzers for on-site feedstock generation. This versatility across end-use sectors presents opportunities for product diversification and technological innovation among market players.

- For instance, Bloom Energy’s “Bloom Electrolyzer™” demonstrated an energy consumption of 37.5 kWh per kg H₂ in a high-temperature solid-oxide electrolysis pilot.

Key Challenges

High Initial Capital Investment

Despite technological progress, the high upfront cost of small capacity electrolyzers remains a key barrier. Expenses related to catalysts, membranes, and balance-of-plant components increase overall system costs. Limited economies of scale and the need for high-purity materials also restrict affordability for small and medium-scale users. Reducing production costs through mass manufacturing and material innovation is crucial to making electrolyzers commercially viable across emerging hydrogen applications.

Limited Hydrogen Storage and Infrastructure

The lack of robust hydrogen storage and distribution infrastructure challenges the scalability of small electrolyzer systems. Many regions lack the logistics and refueling networks required for efficient hydrogen handling. This limitation affects widespread adoption, particularly in developing economies. Developing advanced storage materials, pipeline systems, and decentralized distribution networks is essential to support long-term market growth and enable reliable hydrogen utilization.

Regional Analysis

North America

North America holds a 33% share of the small capacity electrolyzer market, driven by strong government incentives and renewable integration initiatives. The U.S. leads regional adoption through federal hydrogen programs and funding under the Infrastructure Investment and Jobs Act. Canada’s focus on green hydrogen and decentralized energy systems further enhances market expansion. Technological advancements from key manufacturers and collaborations between research institutions and energy developers strengthen the region’s ecosystem. Increasing use in mobility, industrial pilot projects, and microgrid applications continues to boost the deployment of small-scale electrolyzers across North America.

Europe

Europe accounts for a 38% share, making it the leading region in the small capacity electrolyzer market. The region’s dominance stems from extensive renewable energy integration, strong policy frameworks, and investments under the EU Hydrogen Strategy. Countries like Germany, France, and the Netherlands actively promote on-site hydrogen generation through government-funded pilot projects. Manufacturers in Europe emphasize advanced PEM and alkaline technologies optimized for compact operations. Rising demand for hydrogen in clean mobility and grid-balancing applications continues to strengthen Europe’s leadership in the adoption of small capacity electrolyzers.

Asia-Pacific

Asia-Pacific represents a 24% market share, supported by growing investments in hydrogen infrastructure and renewable integration. Japan, South Korea, and China lead in deploying small electrolyzers for hydrogen mobility, residential power systems, and industrial testing. National hydrogen roadmaps encourage domestic production and the use of compact electrolyzers to reduce reliance on imported fuels. Advancements in manufacturing and government-backed R&D programs are improving efficiency and cost competitiveness. Increasing awareness of sustainable energy systems drives expansion across Asia-Pacific, positioning it as a high-growth market for small capacity electrolyzers.

Latin America

Latin America holds a 3% share in the small capacity electrolyzer market, with emerging opportunities in Chile and Brazil. The region’s strong renewable energy base, especially in solar and wind, provides a foundation for hydrogen generation. Governments are implementing green hydrogen initiatives to support sustainable industrial development. Pilot projects for localized hydrogen production are expanding, primarily in off-grid and remote regions. Although adoption remains in early stages, rising investments in clean energy technologies and growing partnerships with international players are expected to drive gradual market growth in the region.

Middle East & Africa

The Middle East & Africa account for a 2% share of the small capacity electrolyzer market, with increasing attention on renewable-driven hydrogen projects. Countries such as Saudi Arabia, the UAE, and South Africa are exploring small electrolyzer systems to complement large-scale hydrogen production. The focus on diversifying energy portfolios and reducing carbon emissions supports adoption. Growing interest in decentralized energy solutions and rural electrification projects in Africa also contributes to regional development. As policy support strengthens, small capacity electrolyzers are expected to play a larger role in sustainable energy ecosystems.

Market Segmentations:

By Product:

By Capacity:

- 100 kW – 300 kW

- 300 kW – 500 kW

By Application:

- Power Generation

- Transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Small Capacity Electrolyzer Market features prominent players such as John Cockerill Group, Plug Power Inc., ITM Power plc, Haldor Topsoe A/S, Siemens AG, Nel ASA, Bloom Energy Corporation, thyssenkrupp AG, Enapter AG, and Cummins Inc. The Small Capacity Electrolyzer Market is characterized by rapid technological advancements and increasing R&D investments. Companies are focusing on developing compact, modular, and efficient systems suitable for decentralized hydrogen production. Strategic collaborations with renewable energy providers and industrial partners enhance integration across applications such as mobility, energy storage, and small-scale industrial use. Market participants emphasize cost optimization through automation, improved electrode materials, and innovative membrane technologies to boost performance and durability. The growing emphasis on green hydrogen and government-backed decarbonization initiatives further intensifies competition, encouraging continuous innovation and global expansion strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Accelera by Cummins secured a contract to deliver a 100 MW PEM electrolyzer system for bp’s Lingen Green Hydrogen Project in Germany. The system comprises 20 HyLYZER 1000 units and will be produced at Accelera’s new manufacturing facility in Guadalajara, Spain.

- In February 2025, Air Liquide and TotalEnergies unveiled two major electrolyzer projects in the Netherlands aimed at boosting renewable and low carbon hydrogen production. The flagship ELYgator 200 MW electrolyzer in Maasvlakte (Rotterdam) will generate up to 23,000 ton/year of green hydrogen to supply TotalEnergies’ industrial site and regional mobility customers.

- In May 2024, Nel Hydrogen Electrolyzer AS, a fully owned subsidiary of Nel ASA entered into a technology licensing agreement with Reliance Industries Limited (RIL). The agreement provides RIL with an exclusive license for Nel’s alkaline electrolyzers in India and also allows RIL to manufacture Nel’s alkaline electrolyzers for captive purposes globally.

- In May 2024, Asahi Kasei opened a new hydrogen pilot plant in Kawasaki, Japan. Operation start of this commercial-scale facility was in March 2024. The trial operation of four 0.8 MW modules is another milestone toward the realization of a commercial multi-module 100 MW-class alkaline water electrolysis system for green hydrogen production.

Report Coverage

The research report offers an in-depth analysis based on Product, Capacity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for small capacity electrolyzers will grow with rising interest in decentralized hydrogen production.

- Integration with renewable energy sources will expand as green hydrogen adoption accelerates.

- Advancements in membrane and catalyst technologies will enhance efficiency and reduce maintenance needs.

- Modular and portable system designs will gain traction in industrial and mobility applications.

- Partnerships between electrolyzer manufacturers and energy companies will drive large-scale deployment.

- Government incentives and clean energy policies will support new installations across developed economies.

- Falling renewable energy costs will make small-scale hydrogen generation more commercially viable.

- Digital monitoring and automation will improve operational reliability and performance optimization.

- Increased R&D investment will focus on reducing system costs and improving energy conversion rates.

- Asia Pacific and Europe will continue leading market growth due to strong clean energy infrastructure.