Market Overview:

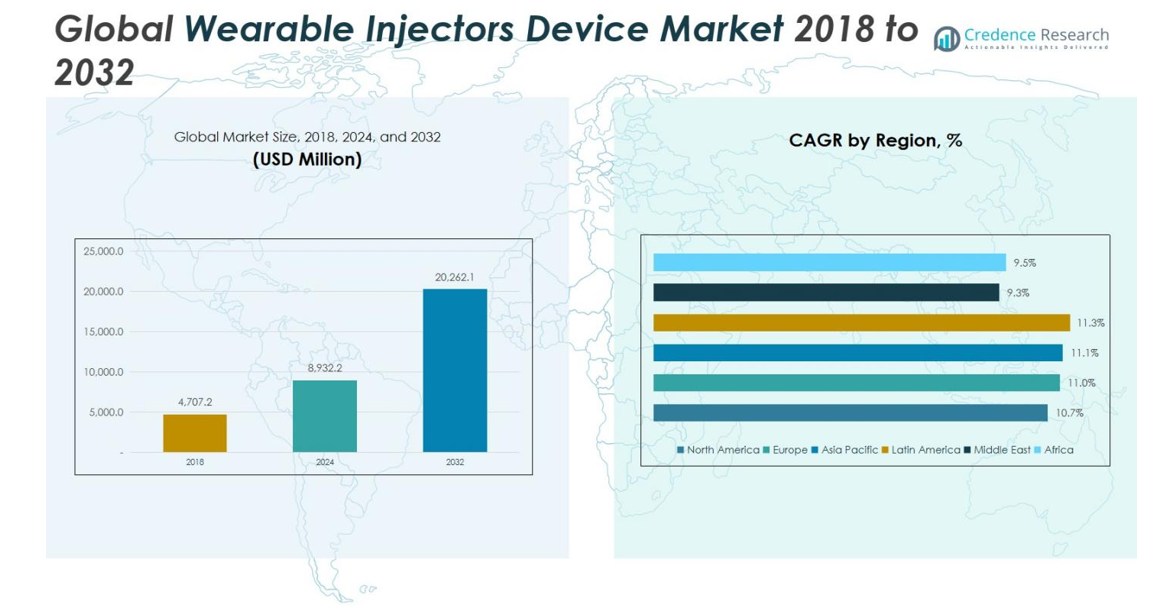

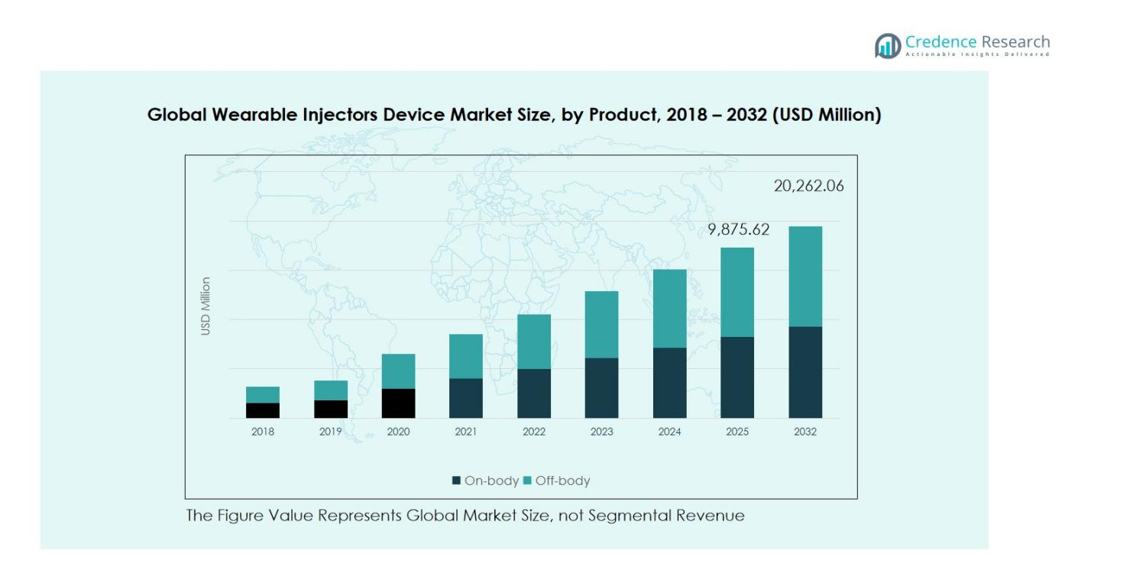

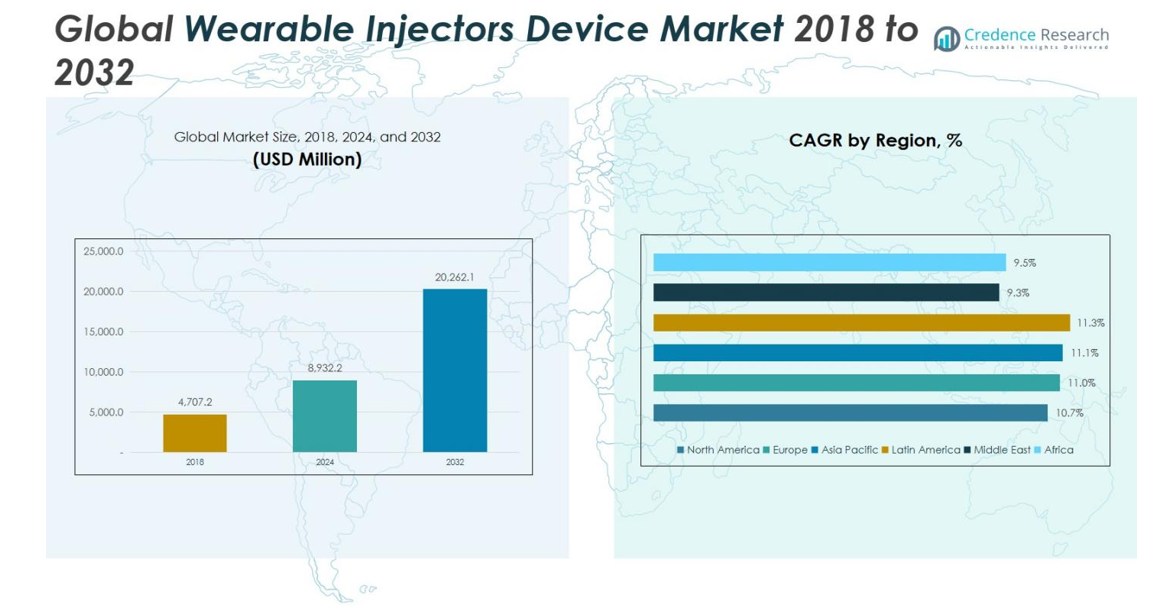

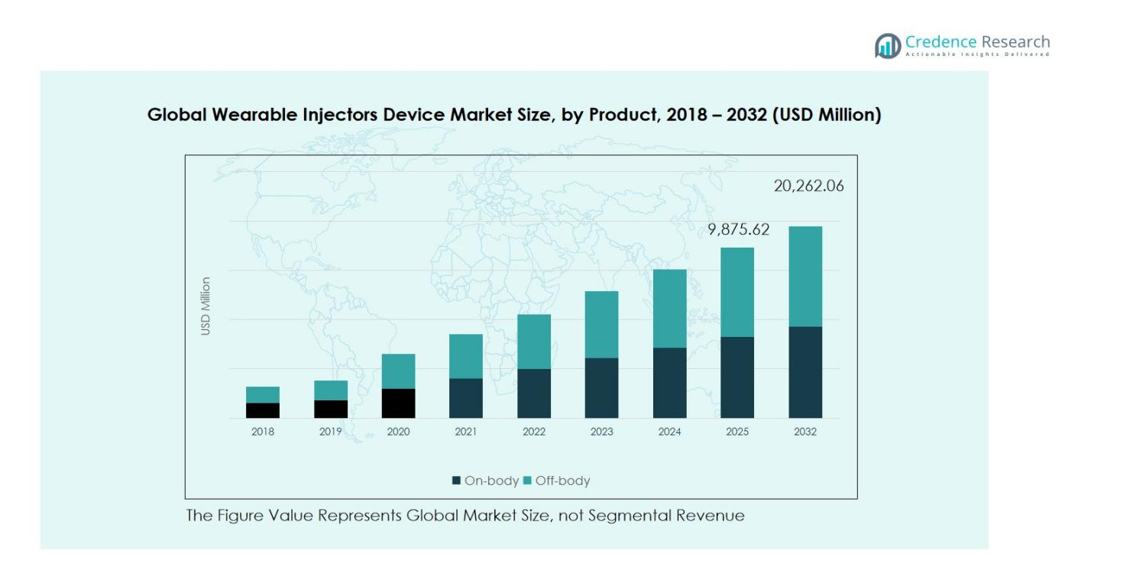

Wearable Injectors Device Market size was valued at USD 4,707.2 Million in 2018 and grew to USD 8,932.2 Million in 2024. It is anticipated to reach USD 20,262.1 Million by 2032, registering a CAGR of 10.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wearable Injectors Device Market Size 2024 |

USD 8,932.2 Million |

| Wearable Injectors Device Market, CAGR |

10.81% |

| Wearable Injectors Device Market Size 2032 |

USD 20,262.1 Million |

The Wearable Injectors Device Market is highly competitive, led by key players such as Ypsomed, Amgen Inc., Enable Injections, Becton, Dickinson and Company, Insulet Corporation, Steady Med Therapeutics, F. Hoffmann-La Roche Ltd., CeQur SA, West Pharmaceutical Services, and Bühler Motor GmbH. These companies are focusing on product innovation, strategic collaborations, and expansion into emerging markets to strengthen their market presence. North America emerges as the leading region, commanding a 32% market share in 2024, driven by advanced healthcare infrastructure, high adoption of homecare therapies, and rising chronic disease prevalence. Europe follows with 27% share, supported by strong R&D, regulatory frameworks, and digital healthcare integration, while Asia Pacific holds 22% share, benefiting from expanding healthcare infrastructure and increasing awareness of self-administered therapies. Collectively, these players and regions drive technological advancements, enhance patient-centric care, and ensure steady growth in the global wearable injectors device market.

Market Insights

- The Wearable Injectors Device Market was valued at USD 8,932.2 Million in 2024 and is projected to reach USD 20,262.1 Million by 2032, growing at a CAGR of 10.81%. On-Body devices lead the market with a 62% share, while Disposable injectors hold 58% share by usages.

- Rising prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders is driving demand, along with increased patient preference for homecare and self-administered therapies.

- Market trends indicate growing adoption of smart and connected injectors, integrating digital features like wireless connectivity, dosing reminders, and remote monitoring to enhance adherence and patient convenience.

- The competitive landscape is dominated by players including Ypsomed, Amgen Inc., Enable Injections, Becton, Dickinson and Company, and Insulet Corporation, focusing on product innovation, partnerships, and regional expansion.

- Regionally, North America leads with 32% market share, followed by Europe 27%, Asia Pacific 22%, Latin America 11%, Middle East 5%, and Africa 3.6%, driven by infrastructure, awareness, and regulatory support.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

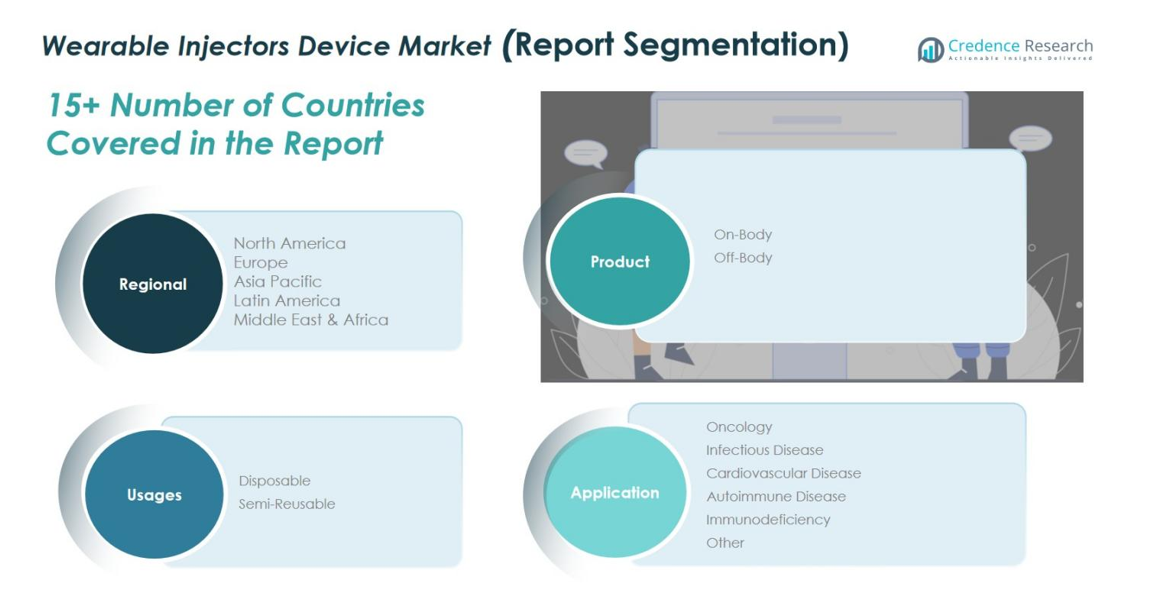

By Product

The wearable injectors device market by product is divided into On-Body and Off-Body devices. On-Body devices lead with a 62% market share, driven by patient preference for homecare, ease of use, and ability to deliver high-volume drugs over extended periods. Technological advancements, including smart dosing features and connectivity, further enhance adherence. Off-Body devices, holding 38% share, are primarily adopted in hospital or clinical settings due to their flexibility and capacity for larger doses, supporting therapies that require controlled administration.

- For instance, Nemera’s Symbioze® is an innovative large-volume on-body injector designed with smart features for enhanced patient adherence and ease of use, offering a seamless injection experience with connectivity and sustainability aspects.

By Application

The market by application includes oncology, infectious disease, cardiovascular disease, autoimmune disease, immunodeficiency, and other therapeutic areas. Oncology dominates with a 34% share, fueled by the increasing prevalence of cancer and demand for self-administration of biologics. Infectious disease and autoimmune therapies follow, benefiting from patient-centric care trends and homecare adoption. Growth is further supported by the rising use of high-volume biologics that require safe, reliable, and convenient delivery solutions for outpatient settings.

- For instance, Roche’s oncology biologic, Herceptin, has facilitated self-administration through innovative subcutaneous formulations that improve patient convenience and adherence.

By Usages

The wearable injectors market by usages is segmented into Disposable and Semi-Reusable devices. Disposable injectors hold the dominant 58% market share, driven by convenience, reduced infection risk, and simplified operation, making them ideal for chronic disease management at home. Semi-Reusable devices, with 42% share, offer cost efficiency and sustainability benefits, appealing to healthcare providers and patients seeking multiple-use solutions. Both segments benefit from rising patient awareness, technological improvements, and regulatory support for safer, user-friendly drug delivery systems.

Key Growth Drivers

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases such as diabetes, cancer, and autoimmune disorders drives demand for wearable injectors. Patients require long-term, self-administered treatments, and wearable devices offer convenience, portability, and improved adherence. The ability to administer high-volume biologics outside hospital settings reduces healthcare burdens and enhances patient quality of life. Rising awareness of homecare therapies and patient-centric treatment approaches further boost adoption, positioning wearable injectors as an essential solution for managing chronic conditions effectively while minimizing the need for frequent hospital visits.

- For instance, BD’s Libertas™ Wearable Injector supports the delivery of high-viscosity biologics up to 50 centipoise in subcutaneous injections, available in 2 to 10 mL configurations, enabling flexible dosing outside hospital settings.

Advancements in Biologics and Drug Formulations

Innovations in biologic therapies and high-volume drug formulations fuel the growth of wearable injectors. These devices enable precise, controlled delivery of complex biologics that cannot be administered through conventional injection methods. The integration of smart technologies, such as connected dosing systems and real-time monitoring, enhances treatment accuracy and patient compliance. Pharmaceutical companies increasingly collaborate with device manufacturers to develop customized solutions, expanding therapeutic applications and strengthening market adoption across oncology, autoimmune, and infectious disease segments.

- For instance, Enable Injections’ enFuse technology delivers biologics via controlled, subcutaneous flow from a small, body-worn device, allowing patients to self-administer treatments without sitting for hours, thus improving convenience and compliance.

Shift Toward Home Healthcare and Patient-Centric Care

The growing preference for home healthcare and outpatient treatment models drives the wearable injectors market. Patients seek self-administered solutions that reduce hospital visits, lower treatment costs, and offer flexibility. Healthcare providers encourage home-based therapy for chronic and complex conditions, boosting demand for user-friendly and safe wearable devices. Regulatory support and reimbursement policies for homecare delivery further facilitate adoption. This shift aligns with the broader trend of personalized medicine, ensuring that wearable injectors become a preferred choice for efficient, patient-centered drug administration.

Key Trends and Opportunities

Trend Toward Smart and Connected Devices

Wearable injectors increasingly incorporate digital features, including wireless connectivity, dosing reminders, and remote monitoring, creating a trend toward smart drug delivery. These innovations improve patient adherence, provide real-time data to healthcare providers, and enhance treatment outcomes. Integration with mobile apps and telehealth platforms supports remote patient management, aligning with digital health initiatives. The adoption of connected devices opens opportunities for personalized therapies, predictive analytics, and post-market data collection, positioning wearable injectors as a technologically advanced solution in the evolving healthcare landscape.

- For instance, Ypsomed’s SmartPilot is a reusable connected add-on for its YpsoMate autoinjector that captures injection events, detects user errors, and provides real-time, step-by-step guidance during administration, including drug authentication at the point of use.

Opportunities in Emerging Markets

Expanding healthcare infrastructure and rising chronic disease prevalence in emerging markets create significant growth opportunities for wearable injectors. Countries in Asia Pacific, Latin America, and the Middle East are witnessing increased adoption of homecare therapies and self-administered biologics. Affordable device solutions and local manufacturing collaborations further stimulate market penetration. Investors and manufacturers can capitalize on unmet medical needs, increasing awareness, and regulatory support, positioning wearable injectors as a scalable and cost-effective solution in regions with growing healthcare demand and expanding patient populations.

- For instance, Philips-Medisize collaborates with Subcuject to develop an affordable wearable injector platform targeting at-home treatment, leveraging Philips’ manufacturing and design expertise to meet the growing homecare needs in Asia Pacific and beyond.

Key Challenges

Regulatory and Compliance Challenges

The wearable injectors market faces strict regulatory requirements for device approval, safety, and efficacy. Compliance with diverse regional standards, including FDA, EMA, and ISO regulations, increases development costs and prolongs time-to-market. Manufacturers must conduct extensive clinical trials and post-market surveillance to ensure patient safety, particularly for high-volume biologics. Navigating these regulatory frameworks while maintaining innovation and affordability poses a challenge, limiting the entry of smaller players and slowing adoption rates in certain markets despite strong demand for wearable injector solutions.

Technical Limitations and Device Reliability

Device design, usability, and reliability present ongoing challenges in the wearable injectors market. Issues such as inaccurate dosing, mechanical failure, or skin irritation can affect patient confidence and adherence. Developing devices that accommodate various drug viscosities, volumes, and administration durations while maintaining compact, comfortable, and easy-to-use designs remains complex. Manufacturers must invest in R&D to ensure precision, durability, and safety, addressing both patient and healthcare provider concerns. Overcoming these technical barriers is essential to sustaining market growth and widespread adoption.

Regional Analysis

North America

North America’s wearable injectors device market was valued at USD 1,511.49 million in 2018, increased to USD 2,844.76 million in 2024, and is projected to reach USD 6,382.55 million by 2032, growing at a CAGR of 10.7%. The region holds a 2024 market share of 32%, driven by advanced healthcare infrastructure, high adoption of homecare therapies, and rising prevalence of chronic diseases. Innovations in on-body and disposable injectors, favorable reimbursement policies, and strong patient preference for self-administered treatments support robust growth, with the U.S. leading regional adoption.

Europe

Europe’s market grew from USD 1,245.06 million in 2018 to USD 2,384.76 million in 2024 and is expected to reach USD 5,476.83 million by 2032, at a CAGR of 11.0%. The region holds a 2024 market share of 27%, driven by oncology and autoimmune therapies, patient-centric care, and advanced healthcare systems. Germany, France, and the UK lead adoption due to robust R&D, integration of smart devices, and regulatory support. Increased outpatient treatment and digital healthcare initiatives further contribute to Europe’s growth in wearable injectors.

Asia Pacific

Asia Pacific’s market was USD 1,025.23 million in 2018, reached USD 1,972.99 million in 2024, and is projected to grow to USD 4,558.96 million by 2032, with a CAGR of 11.1%. The region accounts for a 2024 market share of 22%, fueled by increasing chronic disease prevalence, expanding healthcare infrastructure, and adoption of homecare therapies. China, India, and Japan lead growth through investments in medical technology and collaborations with global manufacturers. Affordable wearable injectors and rising patient awareness of self-administered therapies drive adoption across urban and semi-urban populations.

Latin America

Latin America’s market grew from USD 518.74 million in 2018 to USD 1,009.21 million in 2024, and is projected to reach USD 2,364.58 million by 2032, at a CAGR of 11.3%. The region holds a 2024 market share of about 11%, led by Brazil and Argentina. Growth is supported by improved healthcare access, rising awareness of chronic disease management, and adoption of self-administered therapies. Collaborations between local and global companies and government initiatives promoting advanced drug delivery solutions enhance penetration in both urban and semi-urban areas.

Middle East

The Middle East market was valued at USD 225.01 million in 2018, increased to USD 397.10 million in 2024, and is expected to reach USD 810.48 million by 2032, growing at a CAGR of 9.3%. The region holds a 2024 market share of 4.5%, driven by rising chronic disease prevalence and healthcare investments in GCC countries. Adoption is supported by government initiatives, patient-centric care programs, and collaborations with global device manufacturers. Saudi Arabia, UAE, and Israel are key markets leading regional growth.

Africa

Africa’s market was USD 181.70 million in 2018, rose to USD 323.34 million in 2024, and is projected to reach USD 668.65 million by 2032, at a CAGR of 9.5%. The region holds a 2024 market share of 3.6%, driven by improving healthcare infrastructure, rising awareness of chronic disease management, and increasing adoption of homecare therapies. South Africa and Egypt lead growth. Collaborations with international manufacturers and government support for advanced medical technologies further enable market expansion, despite challenges in rural healthcare access.

Market Segmentations:

By Product

By Application

- Oncology

- Infectious Disease

- Cardiovascular Disease

- Autoimmune Disease

- Immunodeficiency

- Other

By Usages

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the wearable injectors device market includes key players such as Ypsomed, Amgen Inc., Enable Injections, Becton, Dickinson and Company, Insulet Corporation, Steady Med Therapeutics, F. Hoffmann-La Roche Ltd., CeQur SA, West Pharmaceutical Services, and Bühler Motor GmbH. These companies are actively focusing on product innovation, strategic collaborations, and acquisitions to strengthen their market position. The market is highly competitive due to the growing demand for patient-centric drug delivery solutions and technological advancements such as on-body and off-body injectors, disposable and semi-reusable devices, and connected smart features. Players are expanding geographically, especially into emerging markets, to capitalize on rising chronic disease prevalence and homecare adoption. Continuous R&D investment, regulatory approvals, and partnerships with pharmaceutical companies allow these firms to offer reliable, high-volume biologic delivery solutions, driving sustained growth and enhancing market penetration across diverse therapeutic applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ypsomed

- Amgen Inc.

- Enable Injections

- Becton, Dickinson and Company

- Insulet Corporation

- Steady Med Therapeutics, Inc.

- Hoffmann-La Roche Ltd.

- CeQur SA

- West Pharmaceutical Services, Inc.

- Bühler Motor GmbH

- Others

Recent Developments

- In October 2025, Ypsomed launched the YpsoLoop, the first autoinjector platform designed for circularity. The device features automated disassembly for efficient recycling and integrates ClickGuide™ technology to enhance patient usability.

- In August 2025, Enable Injections received regulatory approval for its enFuse® System in Brazil and obtained Medical Device Registration from the UK MHRA, enabling expanded market access and adoption.

- In September 2025, Ypsomed received FDA clearance for its SmartPilot digital add-on, which captures injection data and transmits it via Bluetooth to smartphones, supporting therapy management and clinical development.

- In May 2024, Enable Injections expanded its strategic partnership with Roche, allowing Roche to utilize the enFuse® delivery technology in specific development programs, enhancing drug delivery options for patients.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Usage and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The wearable injectors device market is expected to grow steadily due to rising chronic disease prevalence.

- Increased adoption of homecare therapies will drive demand for self-administered drug delivery solutions.

- Technological advancements in on-body and off-body devices will enhance patient convenience and adherence.

- Integration of smart and connected features will improve real-time monitoring and remote patient management.

- Growth in biologics and high-volume drug formulations will expand therapeutic applications for wearable injectors.

- Emerging markets will present new opportunities due to improving healthcare infrastructure and awareness.

- Disposable devices will remain preferred for convenience and infection control, while semi-reusable options gain popularity for cost efficiency.

- Strategic partnerships and collaborations between device manufacturers and pharmaceutical companies will accelerate market penetration.

- Regulatory support and reimbursement policies will facilitate broader adoption in homecare settings.

- Continuous R&D and product innovation will strengthen competitive positioning and address evolving patient needs.