Market Overview

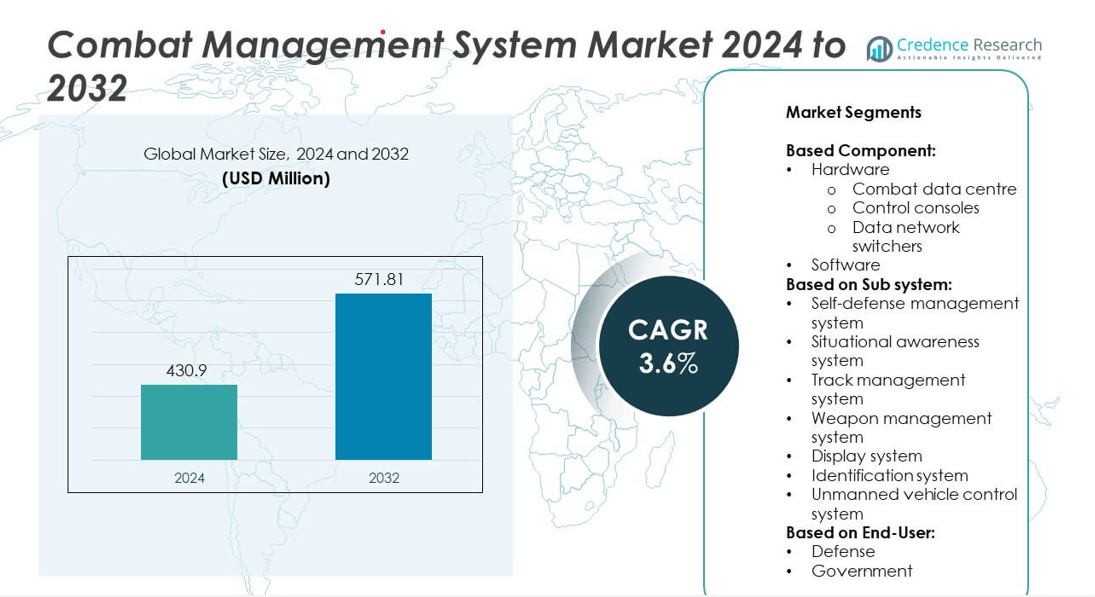

The Combat Management System market size was valued at USD 430.9 million in 2024 and is anticipated to reach USD 571.81 million by 2032, growing at a compound annual growth rate (CAGR) of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Combat Management System Market Size 2024 |

USD 430.9 million |

| Combat Management System Market, CAGR |

3.6% |

| Combat Management System Market Size 2032 |

USD 571.81 million |

Rising global defense expenditures and ongoing naval modernization programs drive the Combat Management System market, boosting demand for advanced, integrated solutions. Technological advancements, including artificial intelligence, sensor fusion, and network-centric warfare capabilities, enhance system effectiveness and operational coordination. The growing emphasis on interoperability and cybersecurity further supports market expansion. Emerging naval powers and increasing geopolitical tensions create additional demand for sophisticated combat management systems to address complex maritime threats.

The Combat Management System market sees significant activity across North America, Europe, Asia Pacific, the Middle East, and Latin America, driven by regional naval modernization and security needs. North America and Europe lead in technological innovation and procurement, while Asia Pacific experiences rapid growth due to expanding naval forces. Key players in this market include Lockheed Martin, Thales Group, Raytheon Technologies, and Saab AB. These companies focus on delivering advanced, integrated combat management solutions with enhanced automation, situational awareness, and network-centric capabilities to meet diverse operational requirements worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Combat Management System market was valued at USD 430.9 million in 2024 and is projected to reach USD 571.81 million by 2032, growing at a CAGR of 3.6% during the forecast period.

- Rising global defense budgets and naval fleet modernization programs drive demand for advanced combat management systems that improve operational efficiency and threat response.

- Integration of artificial intelligence, sensor fusion, and network-centric warfare capabilities enhances system performance and supports multi-domain operations, fueling market growth.

- The market experiences increased adoption of open architecture and modular designs, allowing easier upgrades, customization, and interoperability among allied naval forces.

- High development and implementation costs limit rapid adoption, especially among smaller navies and emerging markets, restricting overall market expansion.

- North America and Europe lead the market due to strong defense spending and technological innovation, while Asia Pacific shows rapid growth driven by expanding naval capabilities and regional security challenges.

- Key competitors such as Lockheed Martin, Thales Group, Raytheon Technologies, and Saab AB focus on innovation and strategic partnerships to maintain their market positions and address diverse customer needs.

Market Drivers

Rising Defense Expenditures Globally Drive Market Growth

Rising defense expenditures globally drive the growth of the Combat Management System market. Many countries increase their military budgets to modernize naval fleets and enhance maritime security capabilities. Governments focus on upgrading warships with advanced combat management solutions to improve operational efficiency and situational awareness. This trend creates a consistent demand for integrated systems that support real-time data processing and decision-making. Investments in naval defense technology remain a top priority for many nations aiming to strengthen their maritime defense posture. Consequently, defense modernization programs fuel continuous market expansion.

- For instance, Lockheed Martin’s Aegis Combat System has been deployed on more than 100 naval vessels worldwide, supporting integrated air and missile defense and improving situational awareness for fleet commanders. A central component is the SPY-1 multi-function phased array radar, recognized as one of the most advanced maritime radars.

Technological Advancements in Sensor Integration and Data Processing Enhance System Effectiveness

echnological advancements in sensor integration and data processing enhance the effectiveness of combat management systems. Modern systems incorporate sophisticated radar, sonar, and communication technologies to provide comprehensive threat analysis. Improved automation allows rapid response to complex combat scenarios, reducing human error and increasing mission success rates. The integration of artificial intelligence and machine learning further optimizes system performance. These innovations support multi-domain operations, enabling coordinated actions across air, surface, and underwater platforms. Such technological progress drives demand for upgraded combat management solutions.

- For instance, Thales Group’s TACTICOS combat management system integrates data from over 20 sensor types simultaneously and processes more than 5,000 tracks in real time, enhancing operational command and control.

Naval Fleet Modernization Programs Promote Adoption of Advanced Systems

The increasing focus on naval fleet modernization programs promotes the adoption of advanced combat management systems. Many navies prioritize replacing legacy systems with scalable and modular platforms that support future upgrades. This approach helps extend the operational life of naval vessels while enhancing combat capabilities. Fleet modernization efforts also emphasize interoperability among allied forces to enable joint operations. The growing trend toward digitalization within naval forces strengthens the need for state-of-the-art management systems. It creates a favorable environment for market growth by aligning with strategic defense initiatives.

Geopolitical Tensions and Maritime Security Challenges Boost Deployment Worldwide

Geopolitical tensions and maritime security challenges boost the deployment of combat management systems worldwide. Regional conflicts and territorial disputes drive navies to enhance surveillance and defense capabilities. Increasing incidents of piracy and illegal activities at sea require advanced situational awareness and rapid response tools. Nations seek to protect critical maritime infrastructure and trade routes through improved combat system integration. These security concerns elevate demand for reliable and effective management solutions. The persistent need for enhanced maritime defense capabilities underpins the market’s steady growth.

Market Trends

Integration of Artificial Intelligence and Machine Learning Enhances System Capabilities

The Combat Management System market shows a clear trend toward incorporating artificial intelligence (AI) and machine learning technologies. These technologies enable faster threat detection and more accurate decision-making by analyzing large volumes of data in real time. AI-driven automation reduces operator workload and improves response times in complex combat scenarios. Machine learning algorithms continuously adapt to new threat patterns, increasing system reliability. This integration supports advanced predictive maintenance and optimizes resource allocation. The growing emphasis on intelligent systems reflects the need for more adaptive and efficient combat management solutions. It strengthens the competitive edge of next-generation naval platforms.

- For instance, Saab AB’s 9LV Combat Management System utilizes a modular software framework enabling integration with over 30 different sensor and weapon systems, facilitating seamless upgrades and interoperability across multi-national naval fleets.

Shift Toward Open Architecture and Modular Designs for Greater Flexibility

Open architecture and modular designs gain significant traction within the Combat Management System market. These trends allow navies to customize and upgrade systems without replacing entire platforms. Modular components facilitate quick integration of new technologies and improve interoperability with allied forces’ equipment. Open standards support compatibility across multiple vendors, reducing dependency on single suppliers. This approach lowers lifecycle costs and simplifies maintenance procedures. The flexibility offered by modular and open systems aligns with evolving operational requirements and budget constraints. Navies increasingly adopt these designs to future-proof their combat management capabilities.

- For instance, Raytheon Technologies’ Sea Hunter autonomous vessel leverages AI algorithms capable of processing over 10,000 sensor inputs per second to identify and classify underwater threats, significantly enhancing real-time operational decision.

Increased Emphasis on Cybersecurity Within Naval Operations

Cybersecurity emerges as a critical trend in the Combat Management System market due to rising threats targeting naval networks. It involves implementing robust security protocols to protect sensitive information and prevent unauthorized access. Combat systems now incorporate advanced encryption, intrusion detection, and continuous monitoring solutions. The market sees greater collaboration between defense contractors and cybersecurity experts to develop resilient architectures. Ensuring system integrity during multi-domain operations remains a top priority. This trend highlights the importance of securing digital assets amid expanding connectivity and network complexity.

Growing Demand for Network-Centric Warfare Capabilities and Real-Time Data Sharing

The Combat Management System market experiences strong growth driven by demand for network-centric warfare capabilities. Real-time data sharing among naval units improves situational awareness and coordination during joint operations. Combat systems increasingly integrate with other military platforms, including airborne and ground assets, to create a unified battlespace. Enhanced communication networks and data fusion technologies enable seamless information flow. This trend supports rapid decision-making and precise targeting in dynamic threat environments. It reflects a strategic shift toward collaborative and multi-domain naval warfare strategies worldwide.

Market Challenges Analysis

High Development and Implementation Costs Limit Market Expansion

The Combat Management System market faces challenges due to the high costs associated with developing and implementing advanced solutions. Defense budgets often prioritize other critical areas, which restricts funding availability for comprehensive system upgrades. Complex integration requirements increase project timelines and expenses, especially when retrofitting older naval platforms. Procuring cutting-edge technologies such as AI, sensor fusion, and secure communication networks demands significant investment. It creates barriers for smaller navies and emerging markets with limited financial resources. Cost overruns and budget constraints frequently delay deployment and modernization efforts. This financial challenge slows overall market growth despite strong demand for advanced capabilities.

Complexity of Integration and Interoperability Hinders Seamless Operations

The growing complexity of combat environments poses integration and interoperability challenges within the Combat Management System market. Combining multiple subsystems, sensors, and communication platforms into a unified solution requires extensive technical expertise. Diverse vendor equipment and proprietary standards create compatibility issues that complicate system synchronization. It demands continuous software updates and rigorous testing to ensure reliable performance during operations. Interoperability among allied forces during joint missions remains difficult to achieve without standardized protocols. These challenges affect operational efficiency and raise concerns over system vulnerabilities. Overcoming integration complexities remains a critical hurdle for market stakeholders aiming to deliver seamless and effective combat management solutions.

Market Opportunities

Expansion of Emerging Naval Forces Presents Significant Growth Opportunities

The Combat Management System market benefits from increasing defense modernization efforts by emerging naval forces across Asia, Africa, and Latin America. These countries seek to upgrade their maritime capabilities to address evolving security threats and protect strategic waterways. It creates opportunities for vendors to offer cost-effective and scalable solutions tailored to specific regional requirements. The rising focus on indigenous production and technology transfer agreements further supports market penetration. New naval acquisitions and fleet expansions drive demand for integrated combat management systems. This growth potential encourages manufacturers to develop flexible platforms that cater to diverse operational needs. The expanding presence of emerging naval powers contributes to sustained market momentum.

Advancements in Network-Centric Warfare Enable New Market Segments

The growing emphasis on network-centric warfare and multi-domain operations unlocks new opportunities within the Combat Management System market. It drives demand for systems capable of seamless data sharing and real-time collaboration among naval, air, and ground forces. Enhanced connectivity and integration with unmanned platforms open avenues for innovative product development. Vendors can capitalize on this trend by delivering advanced communication networks, data fusion technologies, and secure command and control solutions. Increasing investments in joint military exercises and allied operations further expand market scope. The shift toward comprehensive battlespace awareness offers significant prospects for market growth. This evolving operational landscape motivates continuous innovation and strategic partnerships.

Market Segmentation Analysis:

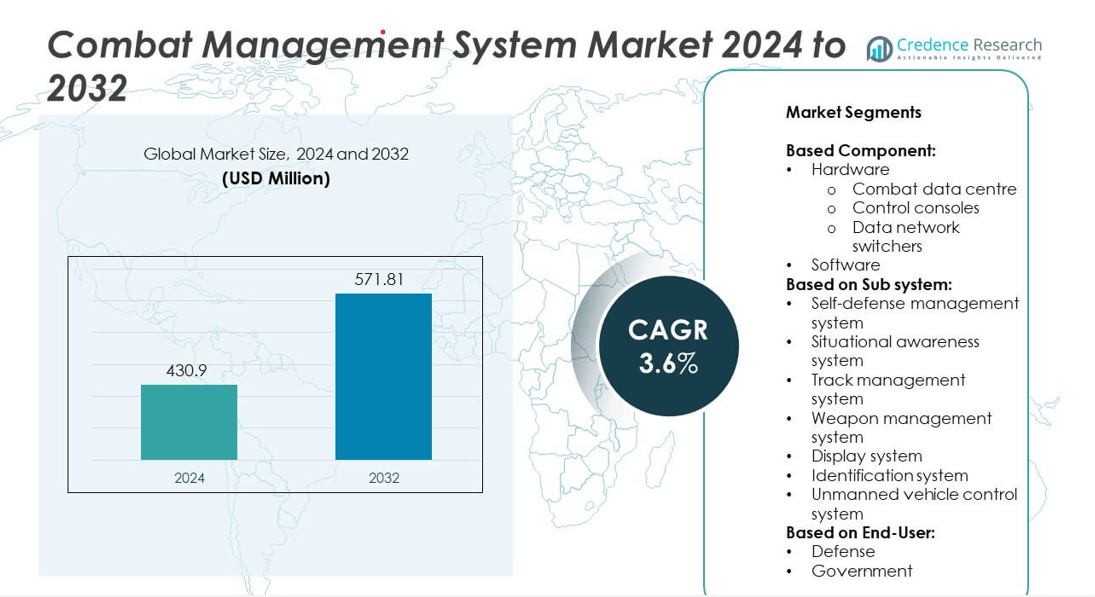

By Component:

The Combat Management System market segments by component into hardware and software, each playing a crucial role in overall system performance. Hardware includes critical elements such as combat data centers, control consoles, and data network switchers. Combat data centers serve as the core processing units, enabling real-time data analysis and command execution. Control consoles provide operators with interfaces to monitor and control various subsystems effectively. Data network switchers facilitate seamless communication between sensors, weapons, and command centers. Software components enhance system functionality by enabling data fusion, threat evaluation, and automated decision-making. The balance between hardware and software integration determines system efficiency and responsiveness in dynamic combat environments.

- For instance, Lockheed Martin’s Aegis Combat System features a combat data center capable of processing over 1,000 simultaneous radar tracks and coordinating actions across more than 20 weapon systems, ensuring rapid threat response and command control.

By Sub system:

Segmenting the market by subsystem reveals specialized areas that enhance naval combat operations. The self-defense management system focuses on threat detection and automatic countermeasure deployment to protect vessels. Situational awareness systems aggregate sensor data to provide commanders with a comprehensive operational picture. Track management systems monitor and prioritize multiple targets to optimize engagement strategies. Weapon management systems coordinate the selection, control, and firing of various armaments. Display systems present critical information through advanced visualization tools, improving operator situational understanding. Identification systems distinguish between friend and foe to reduce the risk of friendly fire. Unmanned vehicle control systems extend operational reach by managing autonomous platforms for reconnaissance and combat support. Each subsystem contributes distinct capabilities that collectively improve naval combat effectiveness.

- For instance, Thales Group’s TACTICOS combat management software processes input from more than 5,000 tracks in real time and integrates sensor data from over 20 sources, and 130 platforms, providing comprehensive situational awareness and automated threat prioritization that supports complex naval operations.

By End-User:

The Combat Management System market also segments by user into defense and government entities. Defense organizations represent the primary end-users, driving demand through fleet modernization and strategic upgrades. They require reliable, interoperable systems to enhance combat readiness and operational flexibility. Government agencies, including coast guards and maritime security forces, use these systems to enforce territorial sovereignty and ensure maritime safety. They prioritize surveillance and threat response capabilities to address non-military challenges such as piracy and smuggling. The diverse requirements of these user groups encourage vendors to tailor solutions to specific operational needs. It creates opportunities for customized offerings that align with varied mission profiles.

Segments:

Based on Component:

- Hardware

- Combat data centre

- Control consoles

- Data network switchers

- Software

Based on Sub system:

- Self-defense management system

- Situational awareness system

- Track management system

- Weapon management system

- Display system

- Identification system

- Unmanned vehicle control system

Based on End-User:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Combat Management System market, accounting for approximately 35% of the global revenue. The region benefits from substantial defense budgets, with the United States leading naval modernization efforts. The U.S. Navy continuously upgrades its fleet with state-of-the-art combat management systems to maintain technological superiority and operational readiness. Major defense contractors based in North America focus on delivering advanced, integrated solutions that meet evolving security demands. The region’s emphasis on research and development, combined with strong government support and long-term procurement programs, sustains its market leadership. Canada also contributes to growth through investments in coastal defense and maritime security. This robust demand and technological advancement ensure North America remains the dominant market.

Europe

Europe commands about 25% of the global Combat Management System market share. European navies prioritize fleet modernization to counter growing geopolitical tensions and enhance NATO interoperability. Leading countries such as the United Kingdom, France, and Germany actively upgrade legacy vessels with modular, scalable combat management solutions. The focus on joint operations and multi-domain warfare drives demand for systems that offer seamless integration across allied fleets. Europe’s defense industry, supported by well-established manufacturers, invests heavily in cybersecurity features and compliance with stringent regulations. The region’s coordinated defense initiatives and commitment to technological innovation maintain its strong market position.

The Asia Pacific

Asia Pacific region represents roughly 20% of the Combat Management System market. Rapid naval expansion in China, India, Japan, and Australia fuels demand for sophisticated combat management technologies. Heightened regional maritime disputes and increased naval patrols drive governments to equip new and existing vessels with advanced systems capable of multi-threat response. Local defense industries benefit from government incentives encouraging indigenous production and technology partnerships. This region experiences fast-paced modernization and procurement cycles, reflecting the strategic priority placed on maritime security. Asia Pacific offers significant growth potential as countries increase defense budgets and prioritize naval capabilities.

The Middle East and Africa

The Middle East and Africa region holds about 12% market share in the Combat Management System market. Middle Eastern nations invest heavily in naval modernization to safeguard critical shipping lanes and offshore energy infrastructure. Regional conflicts and evolving security threats create demand for reliable combat systems with enhanced situational awareness. The integration of advanced technologies into existing fleets and procurement of new vessels support market growth. African countries show emerging interest in maritime security solutions to combat piracy and illegal fishing. International defense partnerships and military aid programs contribute to steady development in this region.

Latin America

Latin America accounts for around 8% of the global market, reflecting a smaller but growing presence in Combat Management System adoption. Countries such as Brazil, Argentina, and Chile focus on modernizing naval capabilities to improve coastal defense and protect natural resources. Budget constraints slow rapid adoption, but increasing awareness of maritime security challenges sustains demand for advanced systems. Partnerships with global defense firms and participation in multinational exercises enhance regional capabilities. Latin America’s market is expected to expand steadily with growing investments in defense infrastructure and technology upgrades.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ASELSAN A.S.

- ATLAS ELEKTRONIK GmbH

- BAE System Plc

- Bharat Electronics Limited (BEL)

- Curtiss-Wright

- Elbit Systems Ltd.

- Hanwha Systems Co., Ltd.

- Israel Aerospace Industries Ltd.

- Kongsberg Gruppen ASA

- Kratos Defense & Security Solutions, Inc.

- LARSEN & TOUBRO LIMITED.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX Corporation

Competitive Analysis

Key players in the Combat Management System market include Lockheed Martin, Thales Group, Raytheon Technologies, Saab AB, and BAE Systems. These leading companies compete by focusing on technological innovation, system integration, and strategic partnerships to address evolving naval defense needs. They invest heavily in research and development to enhance system capabilities, including artificial intelligence, cybersecurity, and network-centric warfare. Their ability to provide customizable, scalable solutions strengthens their position in both established and emerging markets. These companies also pursue collaborations with governments and other defense contractors to secure large procurement contracts and expand their global footprint. Continuous upgrades to existing platforms and development of next-generation systems enable them to meet diverse operational requirements. Strong after-sales service, training programs, and lifecycle support further differentiate their offerings. Their competitive strategies emphasize balancing cutting-edge technology with cost-effective solutions to attract a wide range of naval customers. Overall, the competitive landscape remains dynamic, with these key players driving innovation and setting market standards while responding to shifting geopolitical and security challenges worldwide.

Recent Developments

- In July 2025, Kratos and Airbus Defence and Space announced a partnership to equip the XQ-58A Valkyrie unmanned combat aircraft with an Airbus-made mission system, with deployment targeted for the German Air Force by 2029.

- In June 2025, Kratos announced a new 50,000-square-foot manufacturing facility in Oklahoma focused on jet engine production and advanced C5ISR, expected to be operational by mid-2026.

Market Concentration & Characteristics

The Combat Management System market exhibits a moderately concentrated competitive landscape dominated by a few key multinational defense contractors. These companies possess significant technological expertise, extensive product portfolios, and strong relationships with government defense agencies. The market features high entry barriers due to the complexity of system integration, stringent regulatory requirements, and substantial investment in research and development. It demands continuous innovation to address evolving maritime threats and incorporate emerging technologies such as artificial intelligence and cybersecurity. The market’s characteristics include long sales cycles driven by government procurement processes and the need for customized, scalable solutions tailored to specific naval platforms. Vendors prioritize strategic partnerships, joint ventures, and technology licensing to expand their capabilities and geographic reach. The market also experiences regional variations in demand influenced by geopolitical factors, defense budgets, and modernization priorities. It values reliability, interoperability, and compliance with international defense standards. Overall, the Combat Management System market’s concentration and characteristics emphasize innovation, collaboration, and strategic positioning to maintain competitiveness and meet diverse customer requirements in a complex global defense environment.

Report Coverage

The research report offers an in-depth analysis based on Component, Sub system, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Combat Management System market will continue to grow steadily driven by increasing defense modernization efforts worldwide.

- Emerging technologies like artificial intelligence and machine learning will enhance system automation and decision-making.

- Integration of unmanned and autonomous platforms will expand the capabilities of combat management solutions.

- Demand for network-centric warfare systems will rise to support multi-domain operational coordination.

- Open architecture designs will gain prominence, enabling easier upgrades and interoperability among allied forces.

- Cybersecurity measures will become a critical focus to protect combat systems from evolving digital threats.

- Regional naval expansions, particularly in Asia Pacific, will drive significant market opportunities.

- Strategic partnerships and collaborations among defense contractors will accelerate technology development and market penetration.

- Governments will prioritize investing in scalable and modular systems to extend vessel service life and adaptability.

- The market will witness increased adoption of cloud-based and data fusion technologies to improve situational awareness and operational efficiency.