Market Overview

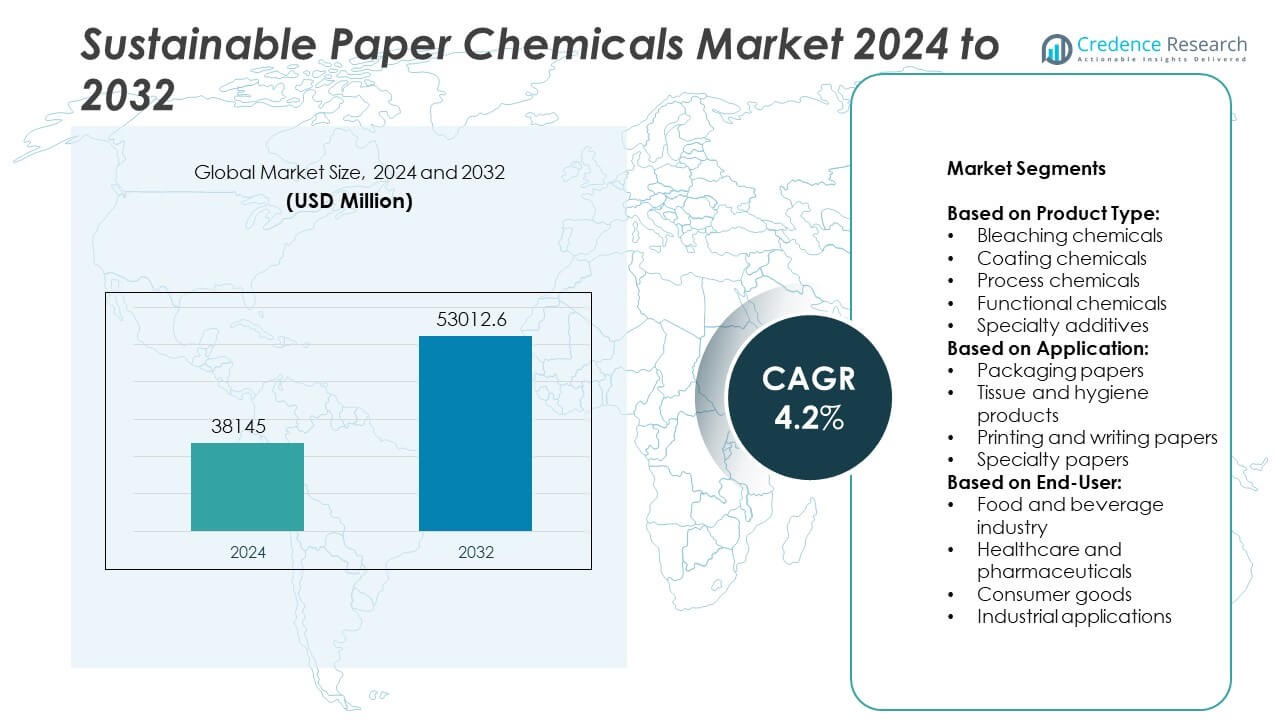

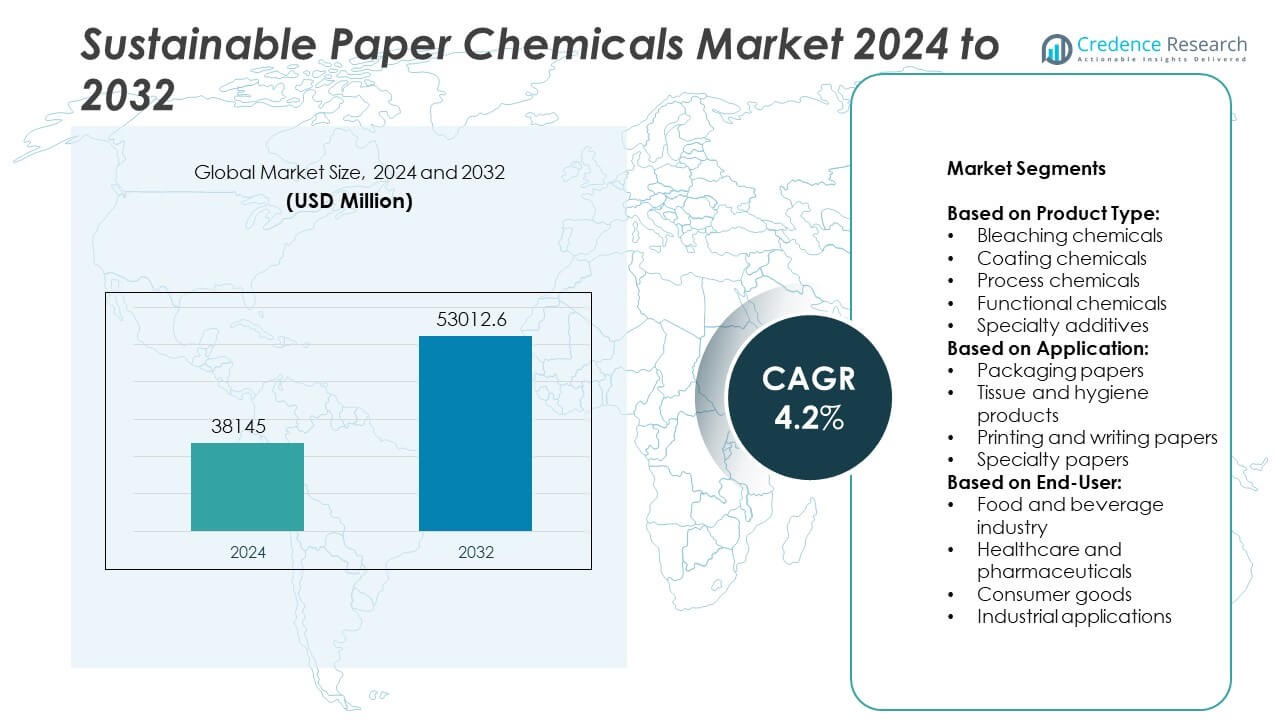

The Sustainable paper chemical market size was valued at USD 38,145 million in 2024 and is anticipated to reach USD 53,012.6 million by 2032, growing at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sustainable paper chemical market Size 2024 |

USD 38,145 Million |

| Sustainable paper chemical market, CAGR |

4.2% |

| Sustainable paper chemical market Size 2032 |

USD 53,012.6 Million |

The sustainable paper chemical market is driven by rising demand for eco-friendly packaging, strict environmental regulations, and growing consumer awareness of sustainability. Industries are shifting from conventional to biodegradable materials, increasing the need for advanced, non-toxic chemical formulations. Water-based and bio-based alternatives are gaining traction due to their low environmental impact and regulatory compliance.

The sustainable paper chemical market shows strong geographical presence across Europe, North America, and Asia Pacific, with Europe leading due to stringent environmental regulations and widespread adoption of eco-friendly paper production practices. North America follows closely, supported by advanced manufacturing capabilities and rising demand for sustainable packaging in consumer goods. Asia Pacific is emerging as a high-growth region, driven by expanding industrialization, increasing environmental awareness, and supportive government policies in countries like China and India. Leading companies such as Kemira Oyj, BASF SE, Solenis LLC, and Ecolab Inc. are actively expanding their global footprint through product innovation, regional partnerships, and investments in sustainable technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The sustainable paper chemical market was valued at USD 38,145 million in 2024 and is projected to reach USD 53,012.6 million by 2032, growing at a CAGR of 4.2%.

- Rising demand for recyclable and biodegradable packaging materials is driving the adoption of eco-friendly paper chemicals across packaging, printing, and hygiene industries.

- Water-based, solvent-free, and bio-based formulations are gaining momentum due to stricter environmental regulations and increased consumer focus on sustainability.

- Leading players such as Kemira Oyj, BASF SE, Solenis LLC, and Ecolab Inc. are focusing on product innovation, sustainability certifications, and regional expansion to strengthen their market presence.

- High production costs, limited scalability of bio-based alternatives, and inconsistent global regulations remain key challenges for broader market adoption.

- Europe leads the market due to strong regulatory support and established recycling infrastructure, while Asia Pacific shows high growth potential supported by industrial expansion and evolving environmental policies.

- Companies are investing in R&D to create high-performance paper chemicals that improve recyclability, print quality, and water resistance while meeting environmental standards.

Market Drivers

Rising Global Demand for Eco-Friendly Packaging Solutions

The shift toward sustainable and biodegradable packaging materials is significantly driving the demand for sustainable paper chemicals. Regulatory restrictions on single-use plastics and increasing consumer awareness are pushing industries to adopt greener alternatives. The food and beverage, personal care, and e-commerce sectors are actively seeking sustainable packaging solutions, creating a strong pull for paper-based materials. The sustainable paper chemical market benefits directly from this demand, as these chemicals enhance the performance and durability of recyclable and compostable papers. Governments across various regions are introducing mandates for the use of eco-certified packaging, further reinforcing market growth. It helps companies meet sustainability targets without compromising on functionality or safety.

- For instance, Kemira’s FennoFlot deinking solutions enable paper mills to incorporate up to 100% deinked pulp into final products while minimizing residual ink and preventing ink buildup on machinery.

Stringent Environmental Regulations and Industry Compliance

Regulatory frameworks aimed at reducing the environmental impact of industrial processes are encouraging the adoption of low-impact chemical formulations in paper manufacturing. Countries in Europe and North America are enforcing stringent environmental norms that limit the use of conventional, harmful chemicals in paper processing. The sustainable paper chemical market is responding with innovations that comply with these evolving standards. Manufacturers are investing in research to develop non-toxic, biodegradable chemicals that minimize water pollution and energy consumption. It aligns with the broader goals of reducing the carbon footprint of pulp and paper production. Compliance is not only a legal necessity but also a competitive advantage in many regions.

- For instance, Kemira’s FennoClean PFA achieves virtually complete microbial control at just 2.8 ppm, compared to the negligible effect of an equal amount of monochloramine, and operates without causing corrosion or producing harmful byproducts.

Increased Focus on Sustainable Supply Chains and Circular Economy Models

Companies are placing greater emphasis on building sustainable supply chains that align with circular economy principles. The use of renewable raw materials and recyclable paper products is accelerating across multiple industries. The sustainable paper chemical market supports this transition by providing additives that improve paper recyclability, fiber retention, and water resistance. It helps in reducing waste generation while maintaining material efficiency. Businesses are adopting lifecycle assessments to ensure their end-to-end processes support environmental stewardship. These practices are becoming essential to meet investor expectations and international sustainability benchmarks.

Technological Advancements Supporting High-Performance Green Chemicals

Innovations in green chemistry and process optimization are contributing to the development of advanced paper chemicals with superior environmental profiles. Research institutions and private firms are collaborating to produce high-performance solutions that maintain paper quality while reducing ecological impact. The sustainable paper chemical market is witnessing new product launches that cater to specialized needs, including barrier coatings and dry strength resins. It enables paper producers to meet rising technical standards for performance and biodegradability. Such advancements are also reducing the overall cost of production, making sustainable options more viable for mass-market applications. Continuous innovation is a key driver of market competitiveness.

Market Trends

Growing Integration of Bio-Based Raw Materials in Paper Chemical Formulations

The use of bio-based raw materials is becoming a key trend in the sustainable paper chemical market. Companies are shifting away from petroleum-derived substances to plant-based alternatives to meet environmental and safety standards. Starch, cellulose, and other natural polymers are now widely used in coating and sizing applications. It supports the push for renewable inputs while maintaining paper strength and printability. This trend aligns with corporate sustainability goals and regulatory requirements in key markets. Research is expanding the scope of bio-derived ingredients that can match or exceed traditional chemical performance.

- For instance, Kemira’s newly launched biomass-balanced wet strength resins, certified by ISCC PLUS, incorporate at least 50% renewable carbon, with some FennoStrength™ variants reaching up to 75% to nearly 100% renewable carbon, depending on the product specification.

Increased Adoption of Water-Based and Solvent-Free Paper Chemicals

Water-based and solvent-free formulations are gaining traction due to their low environmental impact and safer handling properties. The sustainable paper chemical market is responding with products that reduce emissions and waste during production and application. Manufacturers are investing in technologies that minimize the need for volatile organic compounds and hazardous additives. It helps improve workplace safety and aligns with stricter air quality regulations. These formulations also facilitate easier recycling of paper materials, supporting circular practices. Their rising popularity reflects a broader industry preference for clean and efficient chemical solutions.

- For instance, Solenis’ TopScreen™ oil‑ and grease‑resistant barrier coatings are water‑based polymers containing up to 70 percent bio‑renewability content, enabling recyclable and repulpable paper and molded fiber packaging suited for greasy or oily food applications—while avoiding traditional solvents and PFAS-based additives.

Rising Demand from Recycled Paper and Fiber-Based Product Manufacturers

Recycling initiatives are expanding globally, increasing the demand for chemicals that enhance the quality and usability of recycled paper. The sustainable paper chemical market is supplying deinking agents, dry strength additives, and retention aids that improve the appearance and durability of recycled products. It ensures consistent performance even when using lower-quality or mixed wastepaper inputs. End users, including packaging and printing companies, are placing greater emphasis on recycled content. This trend is driving chemical innovation focused on maintaining product standards while maximizing the reuse of raw materials. Sustainability goals are closely tied to recycled content utilization.

Focus on Digital Printing Compatibility and Specialty Paper Applications

Digital printing technologies require papers with specific chemical treatments for optimal ink absorption and image clarity. The sustainable paper chemical market is evolving to meet these requirements while adhering to eco-friendly standards. It supports the growth of specialty papers used in packaging, labels, and personal care applications. Formulators are developing barrier coatings and surface treatments that improve printability without relying on harmful substances. This shift caters to the growing personalization and branding needs of modern businesses. The intersection of performance and sustainability continues to shape product development in this space.

Market Challenges Analysis

High Production Costs and Limited Scalability of Eco-Friendly Alternatives

The high cost of raw materials and production processes continues to challenge the scalability of green chemical solutions. Many bio-based and solvent-free alternatives require specialized technologies and supply chains, which increase manufacturing expenses. The sustainable paper chemical market is affected by these economic pressures, especially in price-sensitive regions. It remains difficult for small and medium-sized producers to compete with established suppliers using conventional formulations. Without economies of scale, the transition to sustainable chemicals can be financially burdensome for manufacturers. This cost disparity limits broader adoption despite growing environmental awareness.

Complex Regulatory Environment and Supply Chain Instability

Varying environmental regulations across countries create compliance challenges for global producers. The sustainable paper chemical market faces inconsistencies in policy enforcement, certification standards, and chemical registration procedures. It complicates cross-border trade and slows product approvals, delaying time-to-market for innovative solutions. Supply chain disruptions, including raw material shortages and transportation delays, add another layer of complexity. These uncertainties hinder the ability of producers to maintain consistent quality and delivery timelines. Market players must continuously adapt strategies to manage operational risks and regulatory uncertainty.

Market Opportunities

Expansion into Emerging Economies with Growing Sustainability Policies

Emerging markets in Asia, Latin America, and Africa are introducing environmental regulations and incentives that encourage sustainable industrial practices. Governments are supporting eco-friendly initiatives through subsidies, tax benefits, and public procurement policies. The sustainable paper chemical market has an opportunity to expand in these regions by offering products that align with evolving compliance requirements. It can support local manufacturers in transitioning from traditional chemicals to greener alternatives. Rising middle-class populations and increased consumer awareness are also fueling demand for sustainable packaging and printing solutions. Companies that establish early partnerships and local production facilities may gain a competitive edge.

Innovation in High-Performance and Multi-Functional Paper Chemicals

Advancements in green chemistry present new opportunities to create paper chemicals that offer both environmental benefits and enhanced functional properties. Manufacturers are exploring multi-functional additives that improve strength, water resistance, and printability without compromising biodegradability. The sustainable paper chemical market can leverage these innovations to serve high-growth sectors like food packaging, hygiene products, and specialty papers. It opens new revenue streams and allows companies to differentiate through performance and compliance. Custom formulations tailored to industry-specific needs can further increase market penetration. Continuous R&D investment will play a critical role in capturing these opportunities.

Market Segmentation Analysis:

By Product Type:

Coating chemicals hold a significant share due to their role in enhancing barrier properties and surface finish of paper, especially in sustainable packaging applications. Bleaching chemicals are widely used in eco-friendly pulp production processes to reduce environmental impact. Process chemicals and functional chemicals support improved fiber retention, water resistance, and sheet formation, helping manufacturers meet both quality and sustainability standards. Specialty additives are gaining traction in premium and niche paper applications where enhanced performance is required.

- For instance, BASF has developed the new Joncryl 953X portfolio for water-based 1K systems to protect and highlight the beauty of wood while meeting sustainability needs.

By Application:

Packaging papers dominate the market due to rising demand for biodegradable and recyclable packaging solutions across multiple industries. The sustainable paper chemical market benefits from this trend as manufacturers seek alternatives to plastic-based materials. Tissue and hygiene products represent another growing segment driven by the need for safe, soft, and skin-friendly paper products. Printing and writing papers continue to require performance additives that improve printability, ink absorption, and sheet smoothness, while specialty papers demand tailored formulations for high-value use cases such as labeling and filtration.

- For instance, India generates a massive 9.4 million tonnes of plastic waste annually; out of which approximately 5.6 million tonnes go for recyclingand 3.8 million tonnes are left uncollected or leaked from after-use collection systems.

By End-User:

The food and beverage industry leads demand due to regulatory pressure to replace plastic with sustainable packaging. It uses paper chemicals that ensure grease resistance, moisture control, and product safety. The healthcare and pharmaceutical sectors rely on hygienic and durable paper materials for packaging and labeling, driving demand for specialty chemicals. Consumer goods and industrial applications also use paper chemicals to meet sustainability targets while ensuring product protection and visual appeal.

Segments:

Based on Product Type:

- Bleaching chemicals

- Coating chemicals

- Process chemicals

- Functional chemicals

- Specialty additives

Based on Application:

- Packaging papers

- Tissue and hygiene products

- Printing and writing papers

- Specialty papers

Based on End-User:

- Food and beverage industry

- Healthcare and pharmaceuticals

- Consumer goods

- Industrial applications

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds approximately 28% of the global sustainable paper chemical market share and remains a mature and innovation-driven region. The United States and Canada are at the forefront of adopting eco-friendly paper chemicals due to well-established pulp and paper industries, advanced technological infrastructure, and growing sustainability initiatives across end-use sectors. Food packaging, hygiene products, and specialty printing segments show strong demand for sustainable paper chemicals in this region. Government regulations such as the U.S. Environmental Protection Agency’s (EPA) guidelines on green chemistry and corporate sustainability mandates are encouraging the transition from conventional to bio-based and water-based chemical formulations. Manufacturers are also investing in process improvements and product customization to meet evolving consumer expectations. Strategic collaborations and R&D investments continue to enhance the region’s capability to produce safe, efficient, and environmentally responsible paper chemical solutions.

Europe

Europe holds the largest share of the sustainable paper chemical market, accounting for nearly 35% in 2024. The region’s leadership is driven by robust environmental regulations, progressive circular economy policies, and high adoption of sustainable manufacturing practices. Countries like Germany, Sweden, Finland, and France are prominent contributors, supported by strong R&D ecosystems and government incentives for eco-friendly production. European consumers and regulators place a high value on recyclability, biodegradability, and non-toxicity in paper products. The widespread use of paper-based alternatives in food packaging, personal care, and retail is accelerating demand for advanced functional and specialty chemicals. European paper manufacturers benefit from long-standing expertise in sustainable operations, and the region continues to pioneer innovations in green paper chemistry.

Asia Pacific

Asia Pacific holds around 22% of the global market and is emerging as the fastest-growing region in the sustainable paper chemical space. China, India, Japan, and South Korea lead regional growth, driven by rising industrial output, increasing domestic consumption, and evolving environmental policies. The shift away from single-use plastics and the rise of eco-conscious consumer behavior are key factors fueling demand. Governments are implementing stricter pollution control measures and encouraging cleaner production methods, pushing companies to invest in sustainable alternatives. In India and China, particularly, the growing e-commerce and food delivery sectors are creating new opportunities for sustainable paper packaging. While cost sensitivity remains a factor, local and global players are expanding their presence through strategic investments, joint ventures, and partnerships focused on green chemical manufacturing.

Latin America

Latin America accounts for about 9% of the sustainable paper chemical market. Brazil and Mexico represent the most active markets, supported by ongoing industrial growth and a gradual shift toward eco-conscious production. Although regulatory frameworks are less developed than in North America or Europe, rising awareness of environmental impact and participation in global sustainability dialogues are promoting change. Key end-use sectors such as consumer goods, packaging, and healthcare are beginning to integrate sustainable practices into their supply chains. Multinational companies operating in the region are encouraging local suppliers to align with global environmental standards, creating demand for certified sustainable paper chemicals. Improvements in manufacturing infrastructure and growing investor interest are expected to support future growth.

The Middle East and Africa

The Middle East and Africa collectively contribute around 6% of the global market share and represent an emerging opportunity within the sustainable paper chemical sector. Countries such as the UAE, Saudi Arabia, and South Africa are making early moves toward sustainability through policy development and corporate environmental goals. Increasing demand for sustainable consumer products and packaging is prompting regional manufacturers to explore eco-friendly chemical alternatives. Import dependence is high, but efforts are underway to localize production and improve access to green technologies. Rising urbanization, economic diversification, and environmental education initiatives are expected to gradually boost adoption of sustainable paper chemicals in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dow Inc.

- Clariant AG

- Kemira Oyj

- Buckman Laboratories International, Inc.

- BASF SE

- Solenis LLC

- Ashland Global Holdings Inc.

- SNF Group

- Ecolab Inc.

- Nouryon (formerly AkzoNobel Specialty Chemicals)

Competitive Analysis

The sustainable paper chemical market features strong competition among leading players including Kemira Oyj, BASF SE, Solenis LLC, Nouryon, Ecolab Inc., SNF Group, Ashland Global Holdings Inc., Clariant AG, Dow Inc., and Buckman Laboratories International, Inc. These companies are actively investing in research and development to introduce eco-friendly and high-performance solutions that meet the growing demand for sustainable paper production. They focus on enhancing product portfolios with bio-based, water-efficient, and recyclable formulations to comply with strict environmental regulations. Strategic partnerships with pulp and paper manufacturers, along with regional expansion, enable these players to strengthen their market presence. Companies are also leveraging advanced process technologies to improve production efficiency and reduce environmental impact. Innovation in multifunctional chemicals, including dry strength agents, sizing agents, and barrier coatings, supports their competitiveness in various end-use segments. The market remains dynamic, with a focus on sustainability, cost-efficiency, and performance optimization shaping competitive strategies.

Recent Developments

- In July 2025, Dow India received the Golden Peacock Award for Eco-Innovation 2025 for its post-consumer recycled PE resin, REVELOOP™, highlighting its leadership in advancing circular economy practices and sustainable plastic waste solutions through innovative technologies.

- In 2025, Mitsui Chemicals has begun to consider splitting off its Basic & Green Materials business (B&GM), which is primarily engaged in petrochemicals, which is primarily engaged in petrochemicals, in order to transition to a more robust business structure and promote the shift to green society.

- In Oct 2023, Ashland recently announced the next generation of modified methyl cellulose derivatives for premium cement adhesives.

Market Concentration & Characteristics

The sustainable paper chemical market exhibits moderate to high market concentration, with a few global players holding a significant share due to their established product portfolios, technical expertise, and integrated supply chains. It is characterized by strong emphasis on innovation, regulatory compliance, and environmental performance. Companies operate in a highly specialized landscape where product differentiation through eco-friendly formulations and customized solutions is critical. The market serves diverse applications such as packaging, printing, hygiene products, and specialty papers, each requiring tailored chemical inputs. Demand is driven by both regulatory mandates and consumer preferences for sustainable materials, encouraging continuous development of biodegradable and non-toxic alternatives. Market participants must navigate complex environmental standards while ensuring cost-effectiveness and operational scalability. The competitive environment supports strategic partnerships and regional expansion, especially in fast-growing emerging economies.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased demand for bio-based and biodegradable paper chemicals across packaging and printing sectors.

- Companies will focus on reducing carbon footprint by adopting cleaner production technologies.

- Water-based and solvent-free formulations will gain wider acceptance due to safety and regulatory advantages.

- Investments in R&D will support the development of high-performance sustainable additives.

- Demand from emerging economies will grow as governments implement stricter environmental policies.

- Recycled paper production will drive the need for specialty chemicals that enhance fiber strength and durability.

- Strategic collaborations between chemical suppliers and paper manufacturers will become more common.

- Customization of paper chemicals for digital printing and specialty applications will expand.

- Supply chain resilience and raw material sourcing will remain critical to long-term growth.

- Market players will increase focus on lifecycle analysis and sustainability certifications to meet consumer and regulatory expectations.