Market Overview:

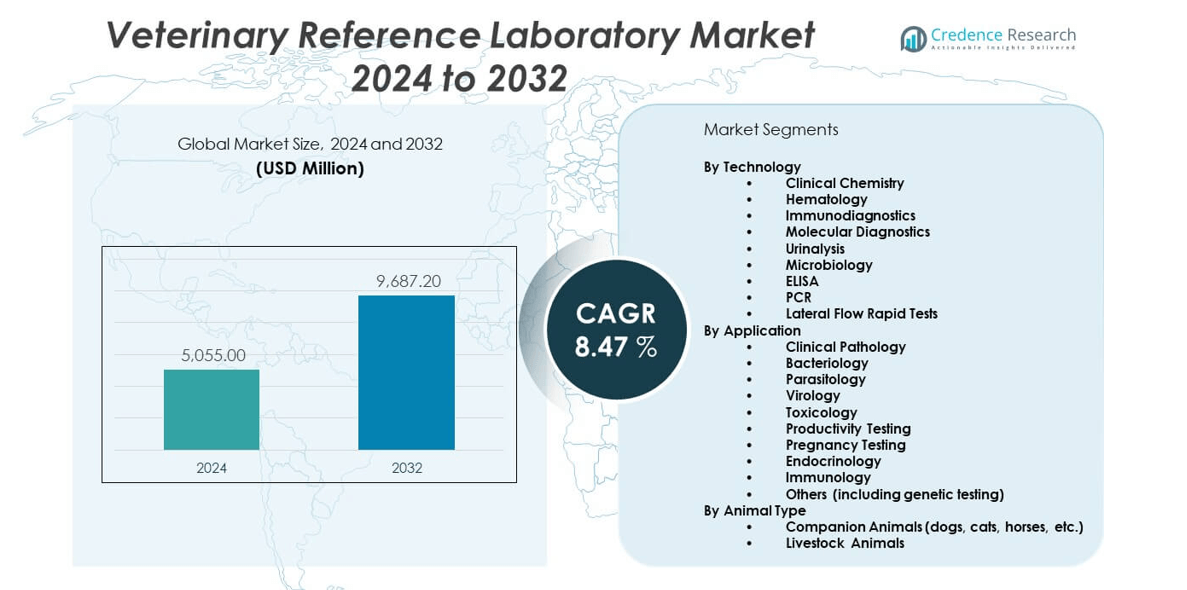

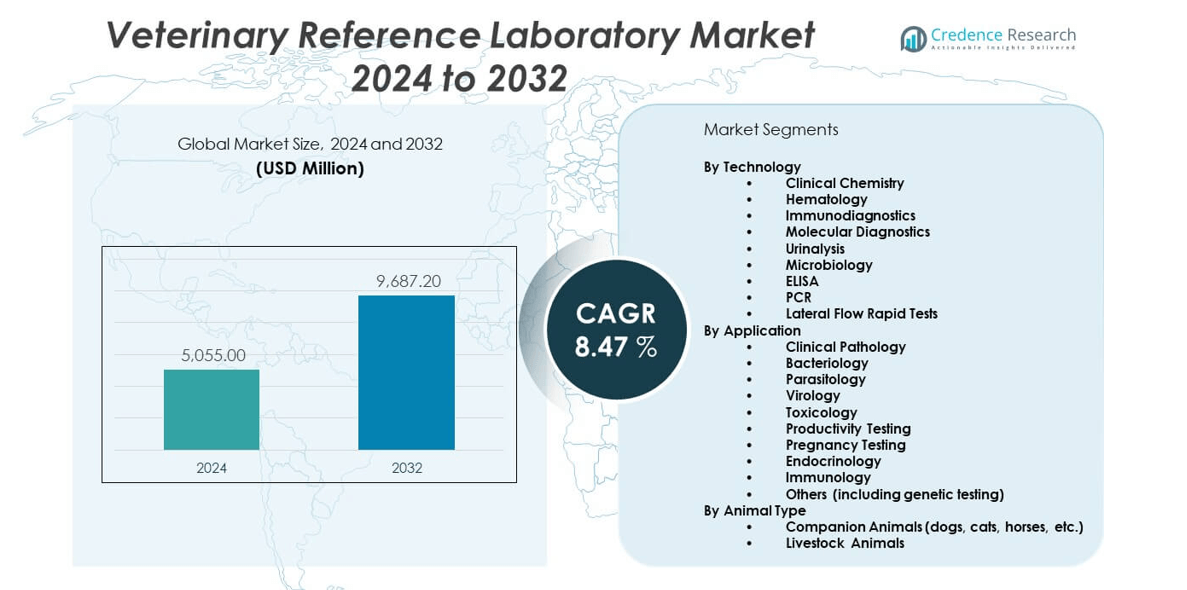

The veterinary reference laboratory market is projected to grow from USD 5,055 million in 2024 to an estimated USD 9,687.2 million by 2032, with a compound annual growth rate (CAGR) of 8.47% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veterinary Reference Laboratory Market Size 2024 |

USD 5,055 million |

| Veterinary Reference Laboratory Market, CAGR |

8.47% |

| Veterinary Reference Laboratory Market Size 2032 |

USD 9,687.2 million |

Rising incidence of zoonotic diseases, combined with increased animal healthcare spending, is driving the demand for advanced diagnostic capabilities. Veterinary reference laboratories are increasingly adopting molecular diagnostics, next-generation sequencing, and high-throughput testing technologies to improve disease detection and treatment outcomes. Expanding companion animal populations, driven by urbanization and changing lifestyles, are further fueling the need for regular diagnostic screenings. Strategic collaborations between veterinary labs and research institutions are enhancing service portfolios and accelerating the introduction of innovative testing solutions.

North America leads the veterinary reference laboratory market, supported by well-established veterinary healthcare infrastructure, high adoption of advanced diagnostic technologies, and strong pet care expenditure. Europe follows closely, benefiting from stringent animal health regulations and robust livestock management systems. The Asia-Pacific region is emerging as a high-growth market, driven by rapid economic development, growing awareness of animal health, and expanding pet care industries in countries such as China, India, and Australia. Latin America and the Middle East & Africa are witnessing gradual growth, supported by improving veterinary services and increased disease surveillance initiatives.

Market Insights:

- The veterinary reference laboratory market was valued at USD 5,055 million in 2024 and is projected to reach USD 9,687.2 million by 2032, growing at a CAGR of 8.47% from 2025 to 2032.

- Rising prevalence of zoonotic and infectious diseases is driving demand for advanced diagnostic testing across both companion and livestock animals.

- Increasing pet ownership, higher veterinary healthcare spending, and growing adoption of molecular and immunodiagnostic technologies are strengthening market growth.

- High costs of advanced diagnostic equipment and services, along with a shortage of skilled veterinary diagnostic professionals, limit adoption in cost-sensitive and rural regions.

- North America leads the market with approximately 38% share, supported by strong veterinary infrastructure and major industry players.

- Europe holds around 30% market share, driven by stringent animal health regulations and growing pet insurance coverage.

- Asia-Pacific accounts for about 22% of the market and is the fastest-growing region, supported by expanding veterinary infrastructure and rising companion animal ownership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Zoonotic and Infectious Diseases Driving Diagnostic Demand:

The veterinary reference laboratory market is witnessing strong growth due to the increasing prevalence of zoonotic and infectious diseases in both companion and livestock animals. Disease outbreaks such as avian influenza, rabies, and foot-and-mouth disease are prompting greater emphasis on rapid and accurate diagnostics. Governments and animal health authorities are enforcing stringent disease control measures, which increases the need for reliable laboratory testing services. It benefits from a growing awareness among pet owners and livestock farmers about preventive healthcare and early disease detection. The integration of advanced molecular diagnostics has improved detection speed and accuracy, boosting adoption. Demand is further supported by the globalization of trade in animals and animal products, which heightens the need for comprehensive health screening. Veterinary labs are expanding service portfolios to address a wider spectrum of pathogens and emerging threats. Strategic collaborations between veterinary clinics, universities, and diagnostic companies are strengthening testing capabilities.

- For instance, Thermo Fisher Scientific’s VetMAX real-time PCR kits are widely used for the rapid detection of over eight bluetongue virus genotypes and have played a crucial role in outbreak detection in several European countries.

Increasing Companion Animal Ownership and Rising Veterinary Expenditure:

A surge in companion animal adoption is contributing significantly to market growth, particularly in urban regions. Pet owners are increasingly prioritizing animal wellness, driving the demand for regular diagnostic screenings and preventive care. The veterinary reference laboratory market benefits from higher spending on advanced veterinary healthcare services, supported by rising disposable incomes. Growing pet humanization trends encourage the use of sophisticated diagnostic tests similar to those in human healthcare. Veterinary practices rely on specialized labs for tests requiring advanced equipment and expertise. This growing reliance supports consistent test volumes and revenue growth for the sector. Expansion in pet insurance coverage is also making high-quality diagnostics more accessible. Urbanization and changing lifestyles are amplifying the importance of companion animal healthcare. Cross-industry partnerships with pharmaceutical companies are enhancing test offerings and treatment recommendations.

For instance, Zoetis’ VETSCAN rapid test portfolio enables clinics to run various point-of-care tests—including canine vector-borne diseases (Dirofilaria, Anaplasma, Borrelia, Ehrlichia spp.), feline leukemia and FIV, parvovirus, giardia, and canine pancreatic lipase—producing results within minutes and minimizing operator subjectivity through automated Wi-Fi-enabled analysis.

Technological Advancements Enhancing Diagnostic Accuracy and Efficiency:

Continuous innovation in diagnostic technologies is accelerating the expansion of laboratory capabilities. It benefits from next-generation sequencing, PCR-based tests, immunohistochemistry, and high-throughput analyzers, which provide rapid and precise results. Automation in sample handling and processing reduces turnaround times and minimizes human error. Laboratories are investing in advanced IT systems for efficient data management and result reporting. Integration with telemedicine platforms is enabling remote consultations and faster decision-making for veterinarians. The development of portable diagnostic tools is complementing centralized lab services, allowing quick preliminary results. Advanced imaging and histopathology techniques are strengthening disease characterization and treatment planning. Global players are launching specialized test panels to address emerging health threats. Strategic investment in R&D is ensuring continuous enhancement of diagnostic methodologies.

Regulatory Support and Strengthening of Animal Health Infrastructure:

Government policies supporting veterinary healthcare are creating a favorable environment for market expansion. It is driven by stricter regulations on disease monitoring, testing, and reporting, especially for livestock trade and food safety. International organizations such as the OIE and WHO are working with countries to improve veterinary diagnostic capabilities. Funding programs are enabling labs to acquire advanced equipment and upgrade facilities. Public–private partnerships are fostering wider diagnostic coverage in rural and underserved regions. National surveillance programs for endemic and exotic diseases are generating consistent demand for laboratory testing. Enhanced veterinary education and training are strengthening workforce capabilities. Regional integration of animal health networks is improving information sharing and outbreak response times. Regulatory compliance requirements are encouraging continuous quality improvement in diagnostic services.

Market Trends:

Integration of Artificial Intelligence and Data Analytics in Diagnostic Workflows:

The veterinary reference laboratory market is witnessing rapid integration of AI and data analytics to enhance diagnostic accuracy and speed. AI-powered algorithms are being applied to imaging, pathology slides, and genomic sequencing data for faster interpretation. Data analytics platforms are enabling trend identification in disease patterns, supporting early outbreak warnings. Machine learning tools are improving the precision of test result analysis, reducing the risk of false positives or negatives. Cloud-based platforms are facilitating secure storage and real-time sharing of diagnostic results. Integration with veterinary practice management systems is streamlining workflows for clinics and laboratories. Predictive analytics is helping veterinarians develop targeted treatment plans. The adoption of these technologies is positioning laboratories as advanced decision-support partners in animal healthcare.

- For instance, IDEXX’s SediVue Dx analyzer leverages AI to reduce the time for urine sediment analysis from up to 20 minutes to less than 3 minutes—improving efficiency and diagnostic accuracy by highlighting subtle abnormalities that human review may miss.

Expansion of Specialized and Species-Specific Diagnostic Panels:

Veterinary reference laboratories are increasingly offering specialized diagnostic panels tailored to specific animal species. These panels address unique health concerns of companion animals, livestock, and exotic pets. It is enabling faster and more relevant disease detection by combining multiple related tests into a single package. Customized testing for species such as equines, poultry, and aquaculture animals is gaining prominence. Laboratories are also developing condition-specific panels for oncology, endocrinology, and infectious diseases. This trend is improving testing efficiency, reducing costs for clinics, and enhancing clinical decision-making. Species-specific panels are also supporting research in veterinary epidemiology. The market is seeing strong uptake of these solutions from both large-scale livestock operations and specialized veterinary practices.

- For instance, Antech Diagnostics has developed species-specific panels such as the KeyScreen® GI Parasite PCR for cats and dogs, capable of detecting 20 parasites—including emerging threats and drug-resistant strains—from a single sample, with results delivered the next day.

Growth of Telepathology and Remote Diagnostic Services:

Advancements in digital pathology are driving the adoption of telepathology in veterinary diagnostics. High-resolution slide scanners and secure digital platforms are enabling pathologists to review cases remotely. It is reducing geographic barriers, allowing access to specialized expertise regardless of location. Telepathology is proving valuable for urgent cases requiring rapid interpretation. Remote consultations are supporting rural veterinarians who lack access to in-house pathology services. This approach is also helping manage workforce shortages in the veterinary diagnostics sector. Cloud-based image storage and AI-assisted image analysis are further improving turnaround times. Growing acceptance of remote diagnostics is expected to expand service coverage globally.

Sustainability Practices and Eco-Friendly Laboratory Operations:

The veterinary reference laboratory market is embracing sustainability as part of its operational strategy. Laboratories are adopting energy-efficient equipment and optimizing workflows to reduce waste. The use of biodegradable consumables and recyclable packaging materials is increasing. Sustainable practices are being integrated into procurement policies, ensuring suppliers also follow environmental standards. Water and chemical usage in testing processes are being minimized through advanced techniques. Solar-powered facilities and green building certifications are gaining interest among larger labs. Digital reporting is reducing paper consumption across operations. These efforts are improving brand reputation and aligning with growing environmental awareness among veterinary clients.

Market Challenges Analysis:

High Cost of Advanced Diagnostic Equipment and Testing Services:

The veterinary reference laboratory market faces the challenge of high investment requirements for advanced diagnostic equipment. Sophisticated analyzers, molecular testing systems, and imaging devices carry substantial acquisition and maintenance costs. These expenses often translate into higher testing fees, which can limit accessibility for smaller veterinary clinics and pet owners. Budget constraints in rural or developing regions further restrict adoption. Laboratories must also allocate funds for skilled personnel training to operate specialized equipment. Price-sensitive customers may opt for basic testing options, impacting revenue growth for high-end diagnostics. Competition from in-house testing solutions offered by large clinics is intensifying. Balancing advanced service offerings with affordability remains a critical challenge for the industry.

Shortage of Skilled Veterinary Diagnostic Professionals:

A lack of adequately trained veterinary diagnostic specialists is creating operational bottlenecks for laboratories. It is particularly evident in advanced disciplines such as molecular diagnostics, histopathology, and bioinformatics. Limited talent availability increases recruitment costs and impacts turnaround times for complex tests. In many regions, skilled professionals migrate to human healthcare diagnostics due to higher pay and career prospects. This talent gap is affecting the ability of labs to scale operations and expand service portfolios. Workforce shortages are more pronounced in emerging markets where training facilities are limited. Laboratories are investing in continuous education programs to retain skilled personnel. Building a sustainable talent pipeline is essential to meet rising diagnostic demands.

Market Opportunities:

Expansion of Veterinary Diagnostics in Emerging Economies:

The veterinary reference laboratory market has significant opportunities in emerging economies where animal healthcare infrastructure is rapidly improving. Growing livestock production, increasing companion animal ownership, and rising awareness of preventive healthcare are creating new demand. Governments in these regions are initiating disease surveillance programs that require advanced diagnostics. Foreign investment and public–private partnerships are helping establish modern laboratory facilities. The lower market penetration of specialized diagnostics presents scope for rapid growth. Tailoring cost-effective services for local markets can accelerate adoption. Building strategic alliances with local veterinary associations can strengthen outreach. These economies offer long-term growth potential for both global and regional players.

R&D Focus on Point-of-Care and Portable Diagnostic Solutions:

Rising demand for faster results is driving research and development in portable veterinary diagnostic devices. These point-of-care solutions can complement central lab services by providing preliminary results within minutes. It is especially beneficial in rural and field settings where immediate decision-making is required. Handheld analyzers for blood, urine, and infectious disease testing are gaining traction. Combining portability with digital connectivity enables seamless result sharing with reference labs. Veterinary practices benefit from reduced sample transportation costs and faster case management. R&D efforts are also focusing on making portable devices cost-effective and user-friendly. This segment offers strong commercial potential for manufacturers and service providers.

Market Segmentation Analysis:

By Technology

The veterinary reference laboratory market covers a broad range of diagnostic technologies addressing diverse veterinary needs. Clinical chemistry and hematology are widely used for routine health assessments and disease monitoring. Immunodiagnostics and molecular diagnostics are gaining traction for their high precision in detecting infectious and chronic conditions. Urinalysis plays an essential role in evaluating metabolic and renal health, while microbiology remains central to identifying bacterial and fungal infections. ELISA and PCR are preferred for their sensitivity in detecting pathogens, and lateral flow rapid tests provide quick, cost-effective solutions for field use and urgent screenings.

- For instance, IDEXX Reference Laboratories offers hundreds of real-time PCR panels and individual tests, including next-generation cancer screening tests that demonstrate 79% sensitivity and 99% specificity in canine patients.

By Application

Clinical pathology holds a dominant position due to its wide applicability across companion and livestock species. Bacteriology and parasitology are vital for identifying infectious agents that threaten animal health and agricultural productivity. Virology is crucial in controlling viral diseases, while toxicology helps detect harmful environmental and feed-related substances. Productivity testing supports livestock efficiency, and pregnancy testing is key to reproductive management. Endocrinology addresses hormonal imbalances, and immunology evaluates immune system performance. The segment of others, including genetic testing, is growing with increased adoption of precision veterinary medicine.

- For instance, Antech Diagnostics’ Accuplex™ vector-borne disease screening panel for dogs delivers 98% overall agreement with reference lab methods and integrates advanced PCR updates to detect both endemic and emerging pathogens—providing actionable insights within routine wellness panels.

By Animal Type

Companion animals, including dogs, cats, and horses, represent a major share of diagnostic demand, driven by rising pet ownership and heightened healthcare awareness. Livestock animals remain an equally important segment, with testing focused on herd health monitoring, disease prevention, and productivity optimization. Both segments benefit from advancements in diagnostic technologies, improved accessibility of veterinary services, and the rising emphasis on preventive healthcare practices.

Segmentation:

By Technology

- Clinical Chemistry

- Hematology

- Immunodiagnostics

- Molecular Diagnostics

- Urinalysis

- Microbiology

- ELISA

- PCR

- Lateral Flow Rapid Tests

By Application

- Clinical Pathology

- Bacteriology

- Parasitology

- Virology

- Toxicology

- Productivity Testing

- Pregnancy Testing

- Endocrinology

- Immunology

- Others (including genetic testing)

By Animal Type

- Companion Animals (dogs, cats, horses, etc.)

- Livestock Animals

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the veterinary reference laboratory market, accounting for approximately 38% of global revenue. The region benefits from well-established veterinary healthcare infrastructure, high pet ownership rates, and significant spending on companion animal health. It is supported by advanced diagnostic capabilities, strong adoption of molecular and immunodiagnostic tests, and extensive networks of veterinary clinics and hospitals. The presence of major players such as IDEXX Laboratories and Zoetis strengthens market dominance. Government and private sector initiatives for disease surveillance in livestock further drive testing demand. Rising prevalence of zoonotic diseases and growing awareness of preventive care continue to sustain market growth.

Europe

Europe represents around 30% of the market share, supported by stringent animal health regulations and widespread adoption of advanced diagnostic techniques. Countries such as Germany, the UK, and France lead the regional market with strong veterinary service networks. It benefits from high awareness of animal welfare, mandatory disease testing for livestock trade, and government-backed vaccination programs. The growing pet insurance sector in the region is expanding access to premium diagnostic services. European laboratories are also at the forefront of developing species-specific test panels and genetic testing capabilities. The focus on sustainability in laboratory operations is gaining traction, aligning with regional environmental goals.

Asia-Pacific

Asia-Pacific accounts for approximately 22% of the veterinary reference laboratory market and is the fastest-growing regional segment. Rising disposable incomes, growing companion animal ownership, and expanding livestock production are key growth drivers. It is witnessing increased investment in veterinary infrastructure, especially in China, India, and Australia. Governments are implementing stricter disease control measures to protect food safety and livestock productivity, boosting demand for advanced diagnostics. The region also presents opportunities for portable and cost-effective diagnostic solutions to serve rural areas. Expansion of international veterinary chains and partnerships with local providers is accelerating the adoption of specialized testing services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- IDEXX Laboratories, Inc.

- VCA Animal Diagnostic Services (Mars)

- Antech Diagnostics (Mars)

- Zoetis Inc.

- GD Animal Health (Royal GD)

- Heska Corporation

- SYNLAB Vet

- Laboklin GmbH & Co. KG

- Greencross Vets

- Virbac Diagnostics

- Thermo Fisher Scientific

- Neogen Corporation

- Randox Laboratories Ltd.

- Veterinary Pathology Group (VPG)

- NationWide Laboratories

Competitive Analysis:

The veterinary reference laboratory market is moderately consolidated, with leading players such as IDEXX Laboratories, VCA Animal Diagnostic Services, Antech Diagnostics, Zoetis, and GD Animal Health holding substantial market shares. It is characterized by strong brand presence, extensive testing portfolios, and advanced diagnostic capabilities. Key players compete through continuous innovation, geographic expansion, and strategic collaborations with veterinary clinics and research institutions. Global companies are investing in molecular diagnostics, AI-based analysis, and portable testing solutions to enhance service speed and accuracy. Regional laboratories focus on niche services and species-specific testing to strengthen competitiveness. The growing demand for high-quality diagnostics is encouraging investments in automation, telepathology, and integrated digital platforms. Competitive differentiation often depends on turnaround time, service quality, and the ability to provide specialized panels for emerging diseases.

Recent Developments:

- In March 2025, Antech Diagnostics (Mars) launched TryRapid FOUR, an in-house canine vector-borne disease screening test that detects antibodies to Anaplasma spp., Lyme C6, Ehrlichia spp., and heartworm antigens using lateral flow technology, enabling rapid and precise in-clinic diagnostics.

- In January 2025, IDEXX Laboratories, Inc. introduced IDEXX Cancer Dx—a first-of-its-kind diagnostic panel for the early detection of canine lymphoma. The test is available at IDEXX Reference Laboratories in the U.S. and Canada, enabling veterinarians to incorporate advanced cancer screening into routine wellness visits, with results delivered in 2–3 days and more than 1,000 practices already enrolled shortly after its launch.

- In January 2025, Zoetis Inc. globally launched Vetscan OptiCell at the VMX conference in Orlando. This cartridge-based, AI-powered hematology analyzer delivers complete blood count (CBC) analysis within minutes at the point of care, featuring microfluidic technology for enhanced imaging and identification of blood cell abnormalities.

- On September 29, 2023, Mars Inc. announced the acquisition of SYNLAB Vet, a European provider of specialist veterinary laboratory diagnostics. This acquisition will enable Mars Petcare to expand its veterinary laboratory business across Europe, further strengthening its global diagnostics and technology platform.

Market Concentration & Characteristics:

The veterinary reference laboratory market shows a moderate to high concentration, with a few multinational corporations dominating alongside specialized regional players. It is defined by strong barriers to entry due to high capital requirements, regulatory compliance standards, and the need for skilled professionals. Service quality, diagnostic accuracy, and turnaround times are critical competitive factors. Continuous technological innovation, such as molecular diagnostics, AI-based analysis, and telepathology, drives differentiation. The market serves both companion and livestock segments, with testing demand influenced by disease prevalence, preventive healthcare trends, and regulatory mandates.

Report Coverage:

The research report offers an in-depth analysis based on Technology and Application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for advanced diagnostics will strengthen investments in molecular and genomic testing.

- AI and automation will enhance diagnostic accuracy and reduce turnaround times.

- Telepathology and remote consultations will expand access to specialist expertise.

- Companion animal diagnostics will see accelerated growth due to increased pet ownership.

- Livestock health testing will gain importance from stricter food safety regulations.

- Genetic testing and precision medicine will emerge as key growth segments.

- Expansion in emerging markets will drive new laboratory infrastructure projects.

- Sustainability and eco-friendly operations will influence procurement and process design.

- Integration of portable point-of-care devices will complement central lab services.

- Strategic mergers and acquisitions will reshape competitive positioning.