Market Overview

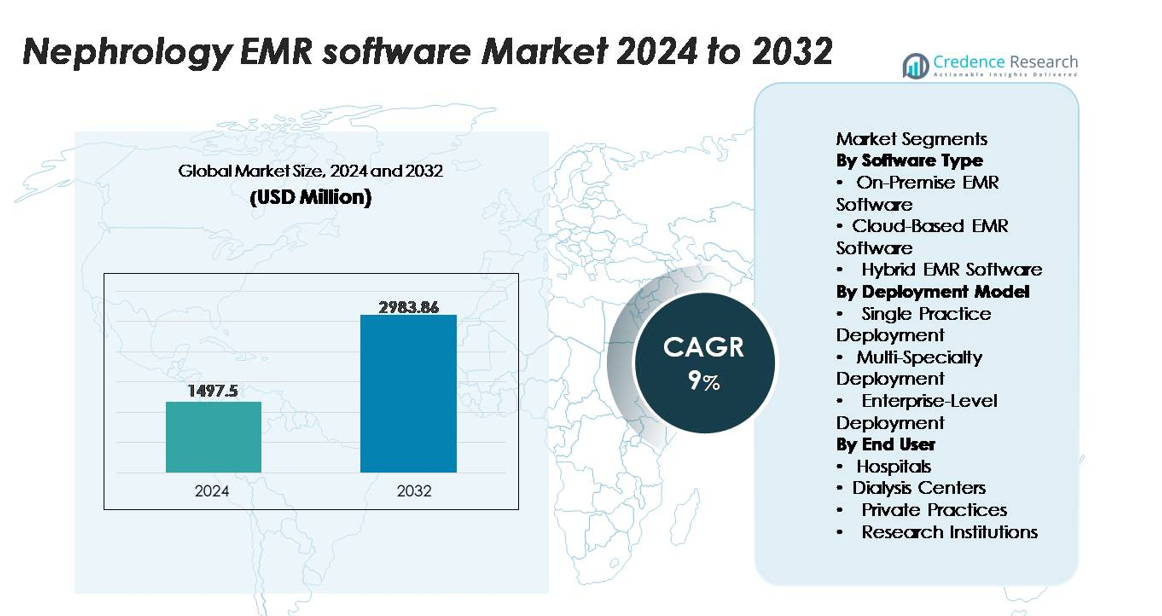

The global Nephrology EMR Software market was valued at USD 1,497.5 million in 2024 and is projected to reach USD 2,983.86 million by 2032, registering a CAGR of 9% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nanofiltration Membranes Market Size 2024 |

USD 1,497.5 million |

| Nanofiltration Membranes Market, CAGR |

9% |

| Nanofiltration Membranes Market Size 2032 |

USD 2,983.86 million |

Top players in the Nephrology EMR software market include leading healthcare IT vendors such as Epic, Greenway Health, AdvancedMD, NextGen Healthcare, Kareo, MEDITECH, eClinicalWorks, Allscripts, athenahealth, and PrognoCIS EHR (Bizmatics). These companies compete on specialty-driven workflow depth, dialysis integration, interoperability, and renal-focused clinical decision support. Their platforms enhance CKD and ESRD management through automated charting, lab connectivity, treatment tracking, and tele-nephrology capabilities. North America leads the global market with over 40% share, supported by advanced digital infrastructure, strong compliance frameworks, and widespread adoption of specialty EMR systems across hospitals, dialysis chains, and multi-facility kidney-care networks.

Market Insights

- The global Nephrology EMR Software market reached USD 1,497.5 million in 2024 and is projected to hit USD 2,983.86 million by 2032, growing at a CAGR of 9%, supported by rising digitization across renal-care settings.

- Growing CKD and ESRD prevalence drives adoption of nephrology-specific EMRs, with cloud-based platforms leading the software type segment due to scalability and interoperability advantages.

- Key trends include AI-enabled renal analytics, tele-nephrology integration, and enterprise-level deployments that streamline dialysis workflows and improve longitudinal CKD management.

- Competition intensifies as leading vendors expand renal-focused modules; however, high implementation costs and interoperability gaps restrain adoption among smaller practices and independent dialysis centers.

- North America dominates with over 40% market share, followed by Europe at 25–27% and Asia-Pacific at 22–24%, while hospitals remain the largest end-user segment due to complex renal-care workflows and high patient volumes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Software Type

Cloud-based EMR software holds the dominant share in the nephrology EMR market as providers increasingly prioritize remote accessibility, rapid scalability, and lower upfront infrastructure costs. Its adoption is driven by seamless interoperability with lab systems, automated updates, and strong data-backup capabilities essential for chronic kidney disease (CKD) management. On-premise solutions retain relevance among institutions with stringent data-sovereignty requirements, while hybrid EMR platforms gain traction for offering localized data control alongside cloud-enabled analytics. Collectively, the shift toward cloud-centric architectures reflects nephrology providers’ need for flexible, secure, and compliance-ready systems.

- For instance, Kareo offers automated, secure cloud backups for critical billing and patient data, protecting information for more than 85,000 active provider accounts managing various patient encounters.

By Deployment Model

Enterprise-level deployments account for the largest implementation share as large hospital networks and integrated kidney-care systems consolidate EMR workflows across nephrology units, dialysis centers, and multi-disciplinary teams. Their dominance is supported by centralized data repositories, enterprise analytics, and multi-location scheduling capabilities suited for high-volume CKD and ESRD patient management. Multi-specialty deployments expand steadily by enabling shared care coordination between nephrologists, cardiologists, endocrinologists, and transplant units. Single-practice deployments remain important for independent nephrologists seeking cost-efficient, specialty-focused workflow templates and decision-support functions tailored to renal diagnostics and dialysis planning.

By End User

Hospitals represent the dominant end-user segment, supported by their high patient throughput, integrated nephrology departments, and need for coordinated EMR workflows covering inpatient renal consults, acute kidney injury (AKI) monitoring, and chronic kidney disease management. Dialysis centers demonstrate strong adoption momentum as they rely on EMR systems optimized for session tracking, vascular access documentation, lab trending, and treatment-outcome reporting. Private practices prioritize streamlined documentation and quick charting tools to reduce administrative burden, while research institutions use EMRs to support structured data capture for nephrology trials, biobanking, and registry-based studies.

- For instance, Johns Hopkins developed a machine-learning AKI risk model that analyzes large volumes of creatinine and urine-output data each year, and the system integrates with Epic to deliver real-time alerts for kidney injury risk.

Key Growth Drivers

Rising CKD and ESRD Burden Fueling Digital Workflow Adoption

The global rise in chronic kidney disease (CKD) and end-stage renal disease (ESRD) cases continues to push nephrology providers toward EMR platforms that support high-volume patient management. As nephrologists handle recurring visits, complex diagnostic evaluations, and longitudinal care coordination, EMR systems optimize documentation, lab integration, and treatment monitoring. Automated alerts for eGFR decline, electrolyte abnormalities, and dialysis readiness enhance clinical decision-making and reduce manual workload. Increasing regulatory focus on outcomes reporting, quality-based reimbursement, and timely documentation further accelerates EMR adoption in nephrology. The need for real-time access to renal profiles, comorbidity trends, and integrated medication histories makes specialized EMRs essential for improving care efficiency and reducing clinical risks.

- For instance, MEDITECH’s Expanse EHR connects with a wide range of certified partner applications through its Alliance program, enabling third-party tools to integrate with clinical workflows such as lab-result processing and renal-panel monitoring.

Expansion of Dialysis Networks and Integrated Kidney-Care Models

The rapid expansion of dialysis chains, kidney-care centers, and integrated nephrology networks significantly boosts the demand for scalable EMR software. Providers require unified systems capable of handling large patient cohorts, scheduling multiple modalities, and tracking dialysis adequacy, vascular access status, and treatment compliance. EMR platforms offering interoperability with dialysis machines, lab systems, pharmacy interfaces, and imaging databases enable seamless data flow across facilities. The shift toward coordinated kidney-care ecosystems ranging from pre-dialysis counseling to in-center and home dialysis programs drives the adoption of EMRs that centralize clinical information. Enterprise-level nephrology networks increasingly rely on software solutions that standardize protocols, improve operational visibility, and support high-frequency monitoring essential for long-term renal management.

- For instance, Fresenius Medical Care uses connected dialysis systems that stream real-time treatment parameters including blood-flow rate, ultrafiltration rate, and arterial pressures into its clinical data platform, which supports predictive models for intradialytic hypotension validated across millions of dialysis sessions each year.

Increasing Regulatory Compliance Requirements and Quality Reporting Needs

Stricter data-governance standards and reporting obligations in kidney care act as a strong catalyst for EMR adoption. Nephrology practices must comply with frameworks covering electronic documentation, treatment audits, dialysis quality indicators, and chronic disease coding norms. EMR solutions equipped with automated reporting modules help providers meet payer submissions, accreditation checks, and government quality improvement programs. Enhanced audit trails, secure data-exchange protocols, and structured charting templates reduce administrative burdens while strengthening accountability. As healthcare systems transition toward value-based reimbursement tied to patient outcomes, EMRs enable standardized documentation for CKD progression, hospitalizations, and dialysis outcomes. The push for traceable, error-free records makes EMR platforms a critical component of compliant and transparent kidney-care delivery.

Key Trends & Opportunities

Growth of AI-Powered Clinical Decision Support and Predictive Analytics

Advanced AI-driven capabilities are emerging as a transformative opportunity in nephrology EMR platforms, enabling early detection and precision management of renal diseases. Predictive models that analyze longitudinal lab trends, imaging data, and comorbidity patterns help identify patients at risk of rapid eGFR decline, hospitalization, or dialysis initiation. Automated CDSS modules provide alerts for drug–renal interactions, anemia management timelines, and abnormalities in fluid or electrolyte balance. These tools enhance clinical accuracy and reduce preventable complications. EMR vendors increasingly integrate machine learning-based insights, enabling nephrologists to forecast outcomes and tailor treatment plans. As AI matures, providers gain opportunities to shift from reactive to proactive renal care, improving patient safety while reducing overall care costs.

- For instance, Balboa Nephrology Medical Group uses structured and unstructured EHR extraction tools within its population health platform to standardize biopsy reports, renal lab panels, and medication histories across its multi-site nephrology practices and affiliated dialysis centers.

Expansion of Tele-Nephrology and Remote Patient Monitoring Ecosystems

Tele-nephrology platforms are creating strong growth opportunities as providers extend care access beyond traditional clinical settings. EMR systems integrated with virtual consultation modules, remote lab data upload, and home-dialysis monitoring tools support continuous renal assessment. Remote patient monitoring (RPM) interfaces allow chronic kidney disease patients to share blood pressure, fluid retention, and treatment adherence data directly into EMRs. This connectivity enhances management of early-stage CKD, home dialysis programs, and post-transplant follow-up. With rising demand for virtual renal care due to accessibility barriers and workforce shortages, EMR vendors offering telehealth-enabled workflows stand to gain significant traction. The ecosystem fosters more frequent interactions, fewer emergency visits, and improved patient engagement

Key Challenges

Interoperability Constraints Across Renal Care Ecosystems

Despite rapid digital adoption, nephrology practices face persistent challenges in achieving interoperability across dialysis centers, hospitals, labs, and ancillary care systems. Fragmented platforms often struggle to exchange structured renal data such as dialysis session metrics, ultrafiltration volumes, and real-time lab results. Inconsistent EHR standards lead to duplicate documentation, delayed data reconciliation, and workflow inefficiencies. Limited compatibility with older dialysis machines, legacy hospital EMRs, or regional health information exchanges further complicates coordinated care. These interoperability constraints hinder the seamless management of CKD and ESRD patients who frequently transition across care settings. Overcoming this barrier requires stronger integration frameworks, standardized APIs, and multi-vendor collaboration.

- For instance, Cerner’s Ignite APIs for FHIR enable external developers to connect third-party applications to Oracle Health’s EHR ecosystem, but interoperability challenges persist for many renal-care platforms because dialysis-specific data elements are not yet represented within the U.S. Core Data for Interoperability (USCDI) standard.

High Implementation Costs and Operational Disruption During Transition

Implementing nephrology-specific EMR systems can impose considerable financial and operational pressures on organizations, especially smaller practices and stand-alone dialysis centers. Costs related to hardware upgrades, software licenses, workflow customization, and staff training often create adoption barriers. Transitioning from paper records or outdated EMRs also disrupts clinic operations, leading to temporary productivity loss. Providers may face challenges in migrating large volumes of legacy renal data, including dialysis histories, lab archives, and medication records. Resistance from clinicians accustomed to traditional workflows further delays optimization. These hurdles make it difficult for resource-constrained facilities to adopt advanced EMR solutions despite their long-term efficiency benefits.

- For instance, during Allscripts’ Sunrise deployment at Blessing Health System, the organization conducted extensive role-based training across its clinical and administrative teams, which temporarily reduced workflow throughput during the EHR transition period.

Regional Analysis

North America

North America holds the largest market share, accounting for over 40% of global nephrology EMR software adoption, driven by advanced healthcare digitization and widespread integration of specialty-specific EMRs across nephrology departments and dialysis networks. Strong EHR mandates, mature reimbursement frameworks, and the presence of major EMR vendors accelerate market penetration. High CKD and ESRD prevalence, coupled with early adoption of AI-enabled renal analytics and tele-nephrology modules, further strengthens regional dominance. Hospitals and enterprise-level kidney-care organizations increasingly deploy interoperable platforms that streamline documentation, dialysis workflow management, and chronic kidney disease monitoring.

Europe

Europe captures approximately 25–27% of the global market as hospitals and specialized renal-care centers continue transitioning to integrated digital infrastructures aligned with EU clinical documentation and data-governance standards. Countries such as Germany, the U.K., France, and the Nordics lead adoption due to strong regulatory compliance requirements and growing investments in specialty EMR modules. Expansion of dialysis chains and coordinated care programs supports uptake of cloud-enabled nephrology solutions. Increasing emphasis on quality reporting for renal outcomes, coupled with broad regional initiatives in interoperability and cross-border data exchange, enhances the appeal of standardized nephrology EMR platforms.

Asia-Pacific

Asia-Pacific represents one of the fastest-growing regions, holding roughly 22–24% market share, supported by rapid expansion of dialysis facilities and rising CKD incidence across China, India, Japan, and Southeast Asia. Governments are accelerating digital-health adoption, promoting cloud-based EMR deployment in both public and private renal-care ecosystems. Increasing investment by hospital chains and emerging tele-nephrology platforms fuels demand for scalable EMR solutions. Japan and South Korea lead with advanced clinical informatics, while India and China drive volume growth through large patient bases. The region’s increasing focus on specialized renal documentation and lab integration further strengthens market momentum.

Latin America

Latin America accounts for around 6–7% of market share, driven by steady modernization of hospital IT systems and expansion of dialysis services across Brazil, Mexico, Argentina, and Chile. Adoption remains uneven, but demand rises as providers seek EMR platforms capable of managing chronic kidney disease workloads and improving documentation accuracy. Government-led digital transformation programs and private-sector investment in renal-care centers support gradual uptake of cloud-based solutions. Increasing emphasis on interoperability, quality reporting, and remote patient monitoring enhances regional interest in specialized nephrology EMRs, although budget constraints and implementation costs continue to slow full-scale penetration.

Middle East & Africa

The Middle East & Africa region holds an estimated 5–6% of global market share, with growth concentrated in Gulf countries such as the UAE, Saudi Arabia, and Qatar, where hospitals invest heavily in advanced EMR infrastructures. Rising CKD burden, expansion of dialysis networks, and digital-health mandates accelerate adoption of nephrology-focused EMR systems. African markets remain in early stages, with adoption largely limited to private hospitals and international renal-care providers. Increasing deployment of cloud-based platforms, coupled with government initiatives to enhance clinical documentation standards, presents long-term growth opportunities despite infrastructural limitations.

Market Segmentations:

By Software Type

- On-Premise EMR Software

- Cloud-Based EMR Software

- Hybrid EMR Software

By Deployment Model

- Single Practice Deployment

- Multi-Specialty Deployment

- Enterprise-Level Deployment

By End User

- Hospitals

- Dialysis Centers

- Private Practices

- Research Institutions

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Nephrology EMR software market is characterized by a mix of established healthcare IT vendors and specialized nephrology-focused solution providers competing on interoperability, workflow depth, and analytics capabilities. Leading players emphasize advanced documentation tools, dialysis workflow automation, integrated lab connectivity, and AI-driven clinical decision support to differentiate their platforms. Cloud-based architectures, seamless data exchange with dialysis machines, and tele-nephrology compatibility have become core competitive levers. Vendors also strengthen their positions through partnerships with dialysis networks, hospital groups, and RCM service providers to expand deployment footprints. Continuous product enhancements—such as renal-specific templates, longitudinal CKD tracking dashboards, and predictive analytics modules—enhance value propositions. With increasing demand for enterprise-level deployments and multi-facility integration, market competition intensifies around scalability, implementation speed, and user training support. As regulatory compliance requirements tighten globally, vendors offering robust security frameworks and automated reporting maintain a significant competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Epic

- Greenway Health

- AdvancedMD

- NextGen Healthcare

- Kareo

- MEDITECH

- eClinicalWorks

- Allscripts

- athenahealth

- PrognoCIS EHR (Bizmatics)

Recent Developments

- In August 2025, NextGen announced that its “NextGen Enterprise EHR” version achieved HTI-1 compliance ahead of the regulatory deadline, enhancing its data/interoperability credentials relevant to specialty fields including nephrology.

- In August 2025, MEDITECH announced its “MEDITECH LIVE 2025” event featuring the Interoperability & Data Pavilion, where it showcased its Traverse Exchange interoperability network and FHIR-driven APIs enabling seamless data exchange across specialties, including renal care.

Report Coverage

The research report offers an in-depth analysis based on Software type, Deployment model, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- AI-driven decision support will increasingly guide early CKD detection, risk stratification, and treatment optimization.

- Cloud-based nephrology EMRs will expand further as providers prioritize scalability, mobility, and lower maintenance costs.

- Tele-nephrology and remote patient monitoring will integrate more deeply into EMR platforms to support continuous renal assessment.

- Enterprise-level deployments will accelerate as kidney-care networks consolidate multi-facility operations and standardize workflows.

- Interoperability improvements will enhance data flow between hospitals, dialysis centers, labs, and imaging systems.

- Predictive analytics tools will help forecast dialysis initiation, hospitalization risks, and disease progression patterns.

- Home dialysis programs will drive demand for EMRs capable of capturing real-time treatment and patient-reported data.

- EMR vendors will increasingly offer renal-specific templates, dashboards, and specialty-optimized interfaces.

- Regulatory compliance requirements will push adoption of systems with automated reporting and stronger security frameworks.

- Partnerships between EMR vendors, dialysis equipment makers, and health-tech innovators will shape next-generation nephrology ecosystem capabilities.