Market Overview

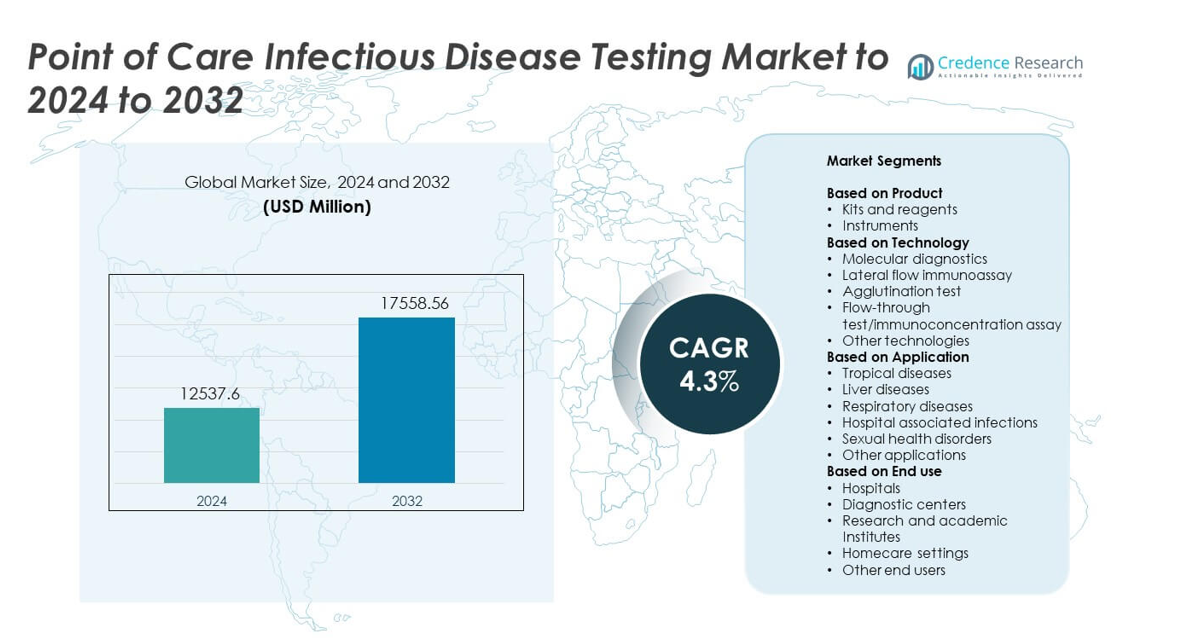

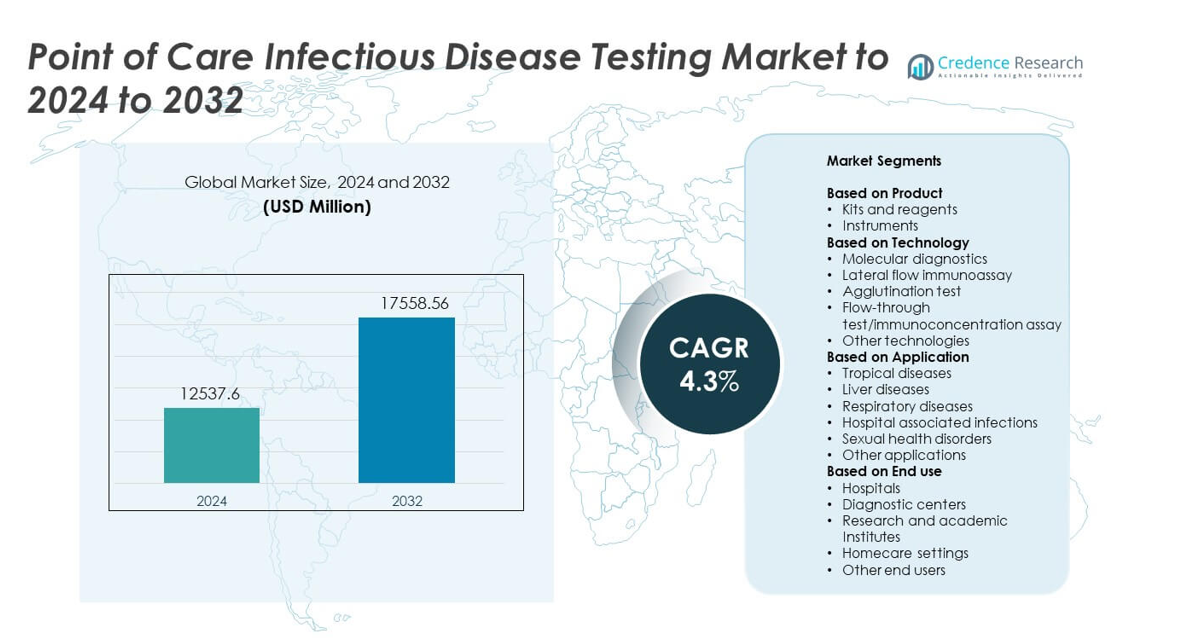

Point of Care Infectious Disease Testing Market size was valued at USD 12537.6 million in 2024 and is anticipated to reach USD 17558.56 million by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Point of Care Infectious Disease Testing Market Size 2024 |

USD 12537.6 million |

| Point of Care Infectious Disease Testing Market, CAGR |

14.3% |

| Point of Care Infectious Disease Testing Market Size 2032 |

USD 17558.56 million |

The Point of Care Infectious Disease Testing Market is shaped by leading players such as Abbott Laboratories, F. Hoffmann-La Roche, Becton, Dickinson and Company, Danaher Corporation, Siemens Healthineers, Bio-Rad Laboratories, Biomerieux, QuidelOrtho Corporation, Chembio Diagnostics, Trinity Biotech, Trivitron Healthcare, Cardinal Health, and OJ-Bio. These companies compete through rapid molecular platforms, advanced immunoassays, and expanded test menus that support early detection in decentralized settings. North America emerged as the leading region in 2024 with a 38.5% share, supported by strong adoption of rapid diagnostics, established healthcare systems, and continuous product innovation across clinical and community care environments.

Market Insights

- The Point of Care Infectious Disease Testing Market reached USD 12537.6 million in 2024 and is projected to hit USD 17558.56 million by 2032, registering a CAGR of 4.3%.

• Market growth is driven by rising infectious disease cases and strong demand for rapid, decentralized testing, with kits and reagents holding about 62% share in 2024.

• Key trends include rapid adoption of multiplex testing, digital connectivity, and expansion of home-based diagnostics across major countries.

• Competition remains strong as global manufacturers focus on advanced molecular platforms, improved immunoassays, and broader test menus tailored for point-of-care use.

• North America led the market with 38.5% share in 2024, while Europe accounted for 27.4% and Asia Pacific held 24.1%, reflecting rising screening programs and improved diagnostic access across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Kits and reagents held the dominant share in 2024 with around 62% of the market. High demand came from rapid infectious disease testing in clinics, emergency rooms, and remote settings. These consumables support frequent testing for influenza, COVID-19, HIV, and other acute infections. Strong adoption also reflects improved sensitivity and ease of use, which help clinicians deliver quick decisions. Instruments grew at a steady pace due to upgrades in molecular point-of-care systems, but kits and reagents remained the preferred choice for fast screening and broad test availability.

- For instance, Abbott Laboratories manufactured 50,000 ID NOW COVID-19 tests per day in early 2020. By mid-April 2020, the company had shipped over 1,700,000 of these rapid tests in the United States.

By Technology

Lateral flow immunoassay led this segment in 2024 with nearly 48% share. The technology gained traction because it offers quick turnaround, low cost, and simple operation in decentralized environments. Strong use in rapid tests for malaria, dengue, influenza, and COVID-19 supported this lead. Molecular diagnostics expanded as accuracy improved and compact PCR platforms entered the market, but lateral flow tests stayed dominant due to wide distribution and minimal training needs. Their portability and ability to deliver results within minutes continued to drive adoption.

- For instance, SD Biosensor joined a global agreement for antigen rapid tests in 2020. It helped plan supply of 120,000,000 rapid tests for low- and middle-income countries.

By Application

Respiratory diseases accounted for the largest share in 2024 with about 41%. Higher incidence of influenza, RSV, and lingering COVID-19 testing needs kept demand strong. Healthcare systems relied on rapid point-of-care tools to triage patients and reduce hospital burden during peak seasons. The segment grew as new multiplex respiratory panels offered faster identification of multiple pathogens. Other key areas like tropical diseases and sexual health disorders also expanded, but respiratory testing maintained leadership due to high testing volume and year-round clinical demand.

Key Growth Drivers

Rising burden of infectious diseases

Growing cases of respiratory, tropical, and sexually transmitted infections continue to raise testing demand across community clinics and hospitals. Healthcare providers rely on rapid tools to speed diagnosis and reduce transmission. Point-of-care platforms help manage outbreaks and support early treatment, which strengthens adoption. Higher testing frequency and wider screening programs also boost market expansion.

- For instance, Cepheid’s GeneXpert rapid tests were purchased for national SARS-CoV-2 programs. One Canadian agreement covered up to 1,200,000 GeneXpert rapid tests for deployment.

Shift toward decentralized and rapid diagnostics

Healthcare systems now prefer fast, near-patient testing to reduce delays linked to central laboratories. Rapid turnaround supports better triage and clinical decisions in emergency and primary-care settings. Portable devices and easy-to-use kits help expand access in rural and resource-limited regions. This shift enhances market growth as providers integrate faster workflows into routine care.

- For instance, Quidel reported a growing installed base of Sofia analyzers in 2022. The company disclosed more than 76,000 Sofia instrument placements across care sites worldwide, by 2022.

Advances in molecular and immunoassay platforms

New compact PCR systems and improved immunoassays increase accuracy and sensitivity for infectious disease detection. Technology upgrades allow detection of multiple pathogens in a single test and reduce hands-on time for operators. These innovations help address both acute and chronic disease needs. Wider availability of high-performance platforms encourages broader adoption in hospitals and point-of-care clinics.

Key Trends & Opportunities

Expansion of multiplex testing panels

Multiplex panels allow simultaneous detection of several pathogens, which improves diagnostic clarity during complex or overlapping infections. These panels support faster treatment decisions and reduce unnecessary antibiotic use. Their adoption grows as healthcare providers seek efficient tools for respiratory, gastrointestinal, and sexually transmitted infections. Rising investment in advanced assay development strengthens this trend.

- For instance, BioFire Diagnostics offers multiplex respiratory panels on its FilmArray systems. The RP2.1-EZ panel detects 19 respiratory targets in a single automated test.

Growth of home-based and remote testing models

Demand for self-testing kits increases as patients seek convenience and reduced clinical visits. Improved digital reporting and smartphone-linked test platforms support remote monitoring and follow-up care. This trend opens strong commercial opportunities in retail and e-commerce channels. Wider acceptance of at-home diagnostics expands the reach of point-of-care infectious disease testing.

- For instance, Cue Health expanded home and point-of-care use of its compact analyzers. In early 2022, Cue shipped about 72,000 analyzers in one quarter, contributing to a total of over 235,000 cumulative analyzers shipped by the end of the first quarter of 2022.

Integration of digital connectivity and data tools

Connected point-of-care devices help automate result recording and improve surveillance systems during outbreaks. Cloud-linked solutions support real-time reporting for infectious disease monitoring. These tools enhance accuracy and reduce manual errors in care settings. Growing digital health adoption creates new opportunities for integrated diagnostic ecosystems.

Key Challenges

Variable test accuracy in decentralized settings

Performance variations may occur when tests are used outside controlled laboratory environments. Operator errors, environmental factors, and limited training can reduce accuracy. Such issues impact clinical confidence and slow adoption in some regions. Addressing standardization and improving device usability remain essential to overcome this barrier.

Cost barriers and reimbursement gaps

High costs of molecular point-of-care systems limit adoption among smaller clinics and low-income markets. Reimbursement inconsistencies create further challenges for routine testing. Limited budget allocation in public healthcare facilities restricts procurement of advanced platforms. Cost-effective solutions and expanded reimbursement policies are needed to sustain long-term growth.

Regional Analysis

North America

North America held the largest share in 2024 with around 38.5% of the market. The region benefited from strong healthcare infrastructure, advanced diagnostic technologies, and high adoption of molecular point-of-care platforms. Frequent testing for respiratory, sexually transmitted, and hospital-associated infections supported steady market expansion. Favorable reimbursement systems and strong regulatory approvals helped companies introduce new rapid testing products across clinics and emergency departments. Growing integration of connected diagnostic devices and high awareness of early detection further sustained regional leadership.

Europe

Europe accounted for nearly 27.4% of the market in 2024, supported by strong government screening programs and broad clinical adoption of rapid infectious disease tests. Demand increased across hospitals and primary-care centers as providers focused on early diagnosis to reduce disease spread. Regulations promoting high-quality testing standards encouraged adoption of both molecular and immunoassay-based platforms. Rising cases of respiratory infections and antimicrobial resistance boosted the need for fast point-of-care solutions. Ongoing digitalization of diagnostic workflows further strengthened the region’s market position.

Asia Pacific

Asia Pacific captured about 24.1% share in 2024, driven by high infectious disease prevalence and rising healthcare investments in emerging economies. Countries in Southeast Asia and South Asia increased procurement of rapid tests for dengue, malaria, and respiratory infections. Expanding diagnostic networks and growing adoption of decentralized testing supported strong market growth. The region also benefited from the presence of local manufacturers offering cost-effective kits. Increased focus on early detection, along with government-led disease surveillance initiatives, continued to boost demand across diverse care settings.

Latin America

Latin America held an estimated 6.3% share in 2024 as healthcare systems expanded access to rapid testing for tropical and vector-borne diseases. Growing awareness of early diagnosis for dengue, Zika, and respiratory infections supported market uptake. Public health agencies increased distribution of low-cost point-of-care kits in rural and underserved regions. Adoption of molecular platforms remained slower due to budget constraints, but demand for lateral flow tests stayed strong. Strengthening disease surveillance programs and improving clinic-level infrastructure continued to push market development.

Middle East and Africa

Middle East and Africa accounted for about 3.7% of the market in 2024, driven by high incidence of infectious diseases such as malaria, tuberculosis, and HIV. The region relied heavily on affordable rapid tests due to limited laboratory capacity in many countries. International healthcare initiatives supported wider access to point-of-care solutions in remote areas. Uptake of advanced molecular platforms grew gradually in urban centers with better resources. Rising investment in public health programs and improved diagnostic outreach contributed to steady regional growth.

Market Segmentations:

By Product

- Kits and reagents

- Instruments

By Technology

- Molecular diagnostics

- Lateral flow immunoassay

- Agglutination test

- Flow-through test/immunoconcentration assay

- Other technologies

By Application

- Tropical diseases

- Liver diseases

- Respiratory diseases

- Hospital associated infections

- Sexual health disorders

- Other applications

By End use

- Hospitals

- Diagnostic centers

- Research and academic Institutes

- Homecare settings

- Other end users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Point of Care Infectious Disease Testing Market features companies such as QuidelOrtho Corporation, Trivitron Healthcare, Bio-Rad Laboratories, OJ-Bio, Siemens Healthineers, Chembio Diagnostics, Danaher Corporation, Trinity Biotech, Becton, Dickinson and Company, Cardinal Health, Biomerieux, Abbott Laboratories, and F. Hoffmann-La Roche. The market shows strong competition as manufacturers focus on rapid, accurate, and portable diagnostic platforms designed for decentralized care. Companies invest in molecular and immunoassay technologies to improve sensitivity and shorten turnaround times. Many players also expand digital connectivity features that support real-time data sharing and outbreak tracking. Product differentiation increasingly depends on ease of use, test menu breadth, and ability to operate in low-resource environments. Strategic partnerships with hospitals, public health agencies, and global health programs strengthen market access, while continuous regulatory approvals enable faster introduction of advanced testing solutions across various clinical settings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- QuidelOrtho Corporation

- Trivitron Healthcare

- Bio-Rad Laboratories

- OJ-Bio

- Siemens Healthineers

- Chembio Diagnostics

- Danaher Corporation

- Trinity Biotech

- Becton, Dickinson and Company

- Cardinal Health

- Biomerieux

- Abbott Laboratories

- Hoffmann-La Roche

Recent Developments

- In 2025, bioMérieux launched the VETFIRE 6 CAP/5 CAP PCR tests on the SPOTFIRE platform for equine respiratory pathogens, bringing syndromic infectious disease diagnostics to point-of-care veterinary settings.

- In 2025, Bio-Rad received an EU IVDR quality management certificate enabling CE-IVDR marking of 40 Exact Diagnostics infectious disease molecular quality control products.

- In 2022, Siemens Healthineers introduced the CLINITEST Rapid COVID-19 + Influenza Antigen Test for point-of-care use, providing results in about 15 minutes.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as healthcare providers increase reliance on rapid decentralized testing.

- Molecular point-of-care platforms will gain wider adoption due to higher accuracy.

- Multiplex assays will become standard for detecting multiple pathogens in a single test.

- Home-based infectious disease testing will grow with better digital connectivity.

- AI-driven diagnostic interpretation will support faster and more reliable results.

- Emerging economies will boost demand through stronger public health programs.

- Portable and battery-operated devices will see rising use in remote regions.

- Integration with electronic health records will improve outbreak monitoring.

- Manufacturers will focus on developing cost-effective kits for high-volume screening.

- Innovations in immunoassay sensitivity will enhance early detection capabilities.