Market Overview

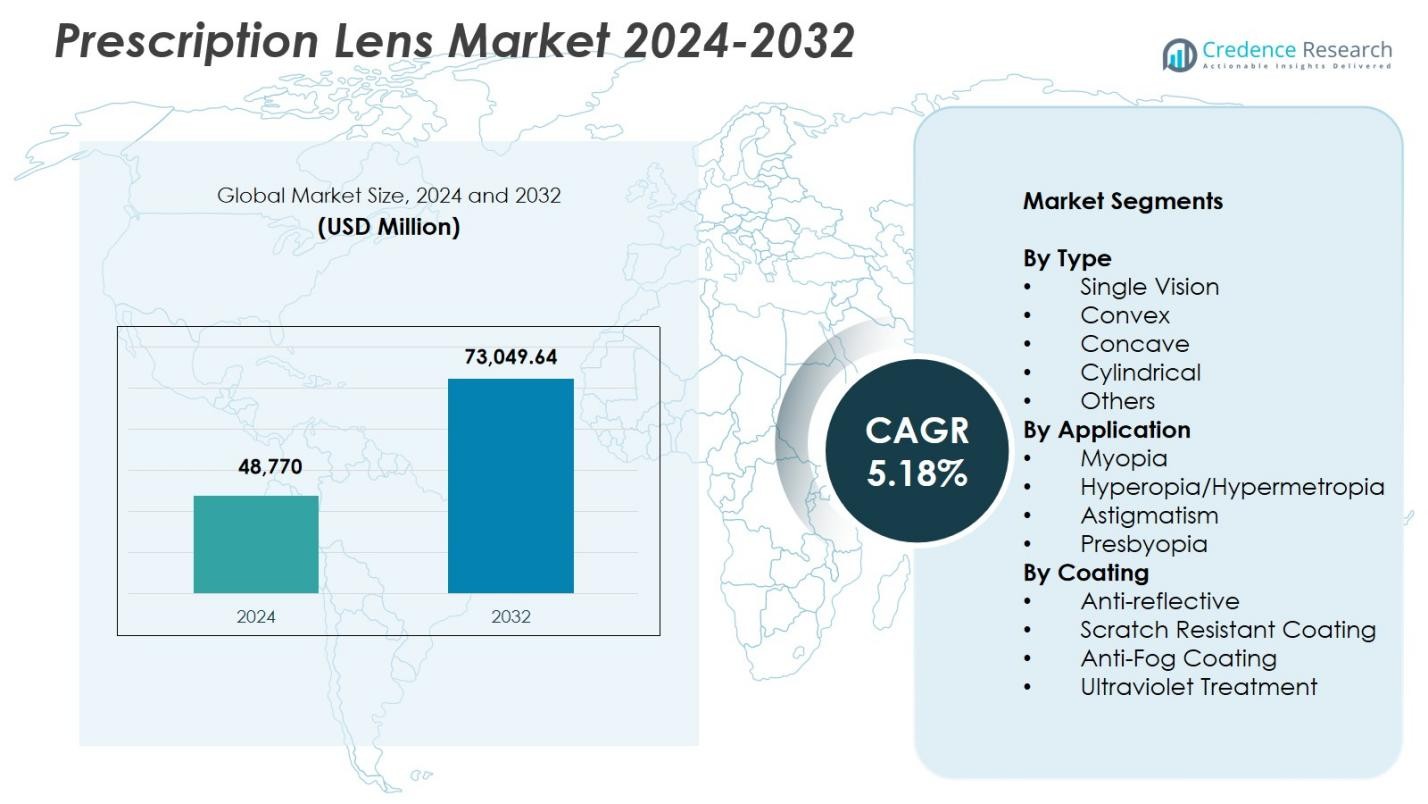

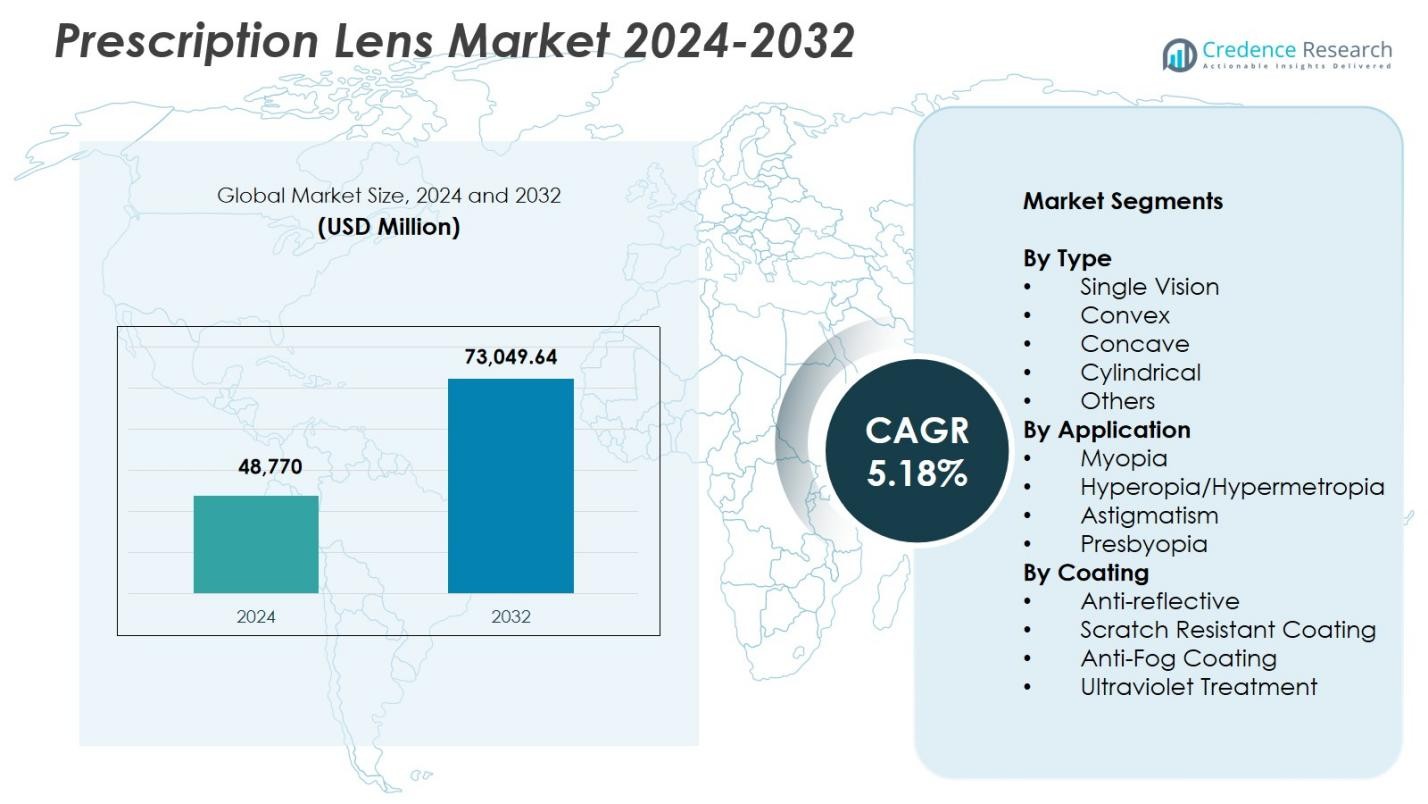

Prescription Lens Market size was valued at USD 48,770 Million in 2024 and is anticipated to reach USD 73,049.64 Million by 2032, at a CAGR of 5.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prescription Lens Market Size 2024 |

USD 48,770 Million |

| Prescription Lens Market, CAGR |

5.18% |

| Prescription Lens Market Size 2032 |

USD 73,049.64 Million |

Prescription Lens Market is driven by leading players such as EssilorLuxottica SA, Carl Zeiss Vision International GmbH, HOYA Corporation, Nikon Corporation, Rodenstock GmbH, Seiko Optical Products Co., Ltd., Shamir Optical Industry Ltd., BBGR SA, Vision-Ease Lens Technologies, Inc., and Younger Optics, Inc., all of which strengthen product portfolios with advanced coatings, digital surfacing, and personalized lens technologies. These companies focus on innovation, quality enhancement, and wider distribution to meet rising global vision correction needs. Regionally, North America led with 33.4% share in 2024, supported by strong adoption of premium lenses, followed by Europe and Asia Pacific, which continue to expand due to growing myopia prevalence and increased access to optical care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Prescription Lens Market reached USD 48,770 Million in 2024 and will grow at a CAGR of 5.18% to reach USD 73,049.64 Million by 2032.

- Strong demand is driven by rising cases of myopia, hyperopia, and presbyopia, with single-vision lenses holding 42.6% share due to widespread corrective needs across all age groups.

- Key trends include rapid adoption of blue-light protection, premium coatings, and personalized free-form lenses as consumers seek greater comfort, clarity, and digital eye-strain reduction.

- Leading players such as EssilorLuxottica, Carl Zeiss, HOYA, Nikon, and Rodenstock expand portfolios through innovation, advanced materials, and wider distribution networks to strengthen global presence.

- North America led with 33.4% share in 2024, followed by Europe at 28.7% and Asia Pacific at 26.9%, reflecting strong optical infrastructure, rising screen exposure, and expanding access to eye-care services across major regions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type:

In the Prescription Lens Market, the Single Vision segment dominated with 42.6% share in 2024, driven by rising cases of myopia and hyperopia among adults and children. Growing digital device usage increases visual strain, supporting the demand for single-vision corrective lenses. Convex and concave lenses continue gaining adoption due to improved optical designs and customization options, while cylindrical lenses address rising astigmatism prevalence. The “Others” category benefits from niche requirements such as occupational and sports lenses. Advancements in lightweight materials and digitally surfaced lens technologies further support segment-wide growth.

- For instance, ZEISS Single Vision Superb lenses employ advanced freeform technology to eliminate optical compromises in conventional designs, providing sharp focus across the entire lens surface

By Application:

The Myopia segment held the largest share at 47.3% in 2024, primarily driven by the global surge in near-work activities, prolonged screen exposure, and rising childhood myopia rates. The market also benefits from strong adoption of advanced corrective lenses offering wider fields of vision and reduced distortion. Hyperopia/Hypermetropia and Presbyopia segments expand steadily with aging populations, while Astigmatism lenses grow due to improved toric designs. Increasing awareness of eye health and wider access to optometric services further reinforce demand across all application categories.

- For instance, EssilorLuxottica’s Stellest lenses slowed myopia progression by 1.95 D (57%) and axial elongation by 0.81 mm (52%) on average over six years in clinical studies.

By Coating:

The Prescription Lens Market saw the Anti-reflective coating segment lead with 39.8% share in 2024, supported by its ability to enhance visual clarity, reduce glare, and improve night-time visibility. Demand is amplified by the growing need for digital screen protection and comfort during extended work hours. Scratch-resistant coatings record strong adoption due to durability requirements, while anti-fog coatings gain traction in healthcare, industrial, and humid environments. Ultraviolet treatment lenses maintain steady demand as consumers prioritize long-term eye protection, driven by increasing awareness of UV-related ocular risks.

Key Growth Drivers

Rising Prevalence of Vision Disorders

The Prescription Lens Market experiences strong growth due to the increasing prevalence of myopia, hyperopia, astigmatism, and presbyopia across global populations. Prolonged screen exposure, urban lifestyle changes, and reduced outdoor activities significantly elevate the incidence of refractive errors among both adults and children. This trend drives consistent demand for corrective lenses, particularly single-vision and advanced digital lenses. Expanding optometric screening programs and rising awareness of preventive eye care further strengthen market adoption, ensuring sustained long-term growth across developed and emerging regions.

- For instance, HOYA employs Integrated Dual Side freeform technology in its iD Single Vision lenses, enabling bi-aspheric designs with pixel-perfect precision calculated for every point on the lens surface to deliver clear eyesight and maximum comfort.

Technological Advancements in Lens Materials and Designs

Continuous innovation in lens manufacturing technologies drives market expansion by improving optical performance, comfort, and durability. Digitally surfaced lenses, blue-light-filter coatings, lightweight polycarbonate materials, and adaptive photochromic solutions enhance customer preference for premium prescription lenses. These advancements address modern lifestyle needs, including digital strain reduction and improved night vision. Manufacturers increasingly invest in customization technologies for precise correction, offering personalized visual experiences. The transition toward smart lens designs and enhanced protective coatings further boosts product differentiation and market penetration.

- For instance, Transitions Gen 8 lenses adapt fastest to UV light, darkening outdoors for glare reduction and filtering harmful blue light indoors across single-vision, bifocal, and progressive prescriptions.

Growing Aging Population and Increased Eye Care Awareness

Global demographic shifts, particularly the expansion of the aging population, significantly increase demand for presbyopia-correcting lenses and advanced multifocal solutions. Older consumers prioritize superior optical clarity, comfort, and specialized coatings for vision stability. Enhanced awareness initiatives by healthcare organizations and optical retailers encourage regular eye examinations, supporting earlier diagnosis of refractive errors. Rising disposable incomes and expanded access to vision care services in developing economies further stimulate lens purchases. Collectively, these factors position the aging population as a pivotal long-term driver for sustained market growth.

Key Trends & Opportunities

Expansion of Digital Lenses and Blue-Light Protection

A major trend reshaping the Prescription Lens Market is the rapid adoption of digital lenses and advanced blue-light-filter technologies. As consumers spend increasing hours on smartphones, tablets, and computers, demand intensifies for lenses that reduce digital eye strain and improve visual comfort. This shift creates opportunities for manufacturers offering next-generation coatings optimized for screen-heavy lifestyles. Retailers leverage this trend by promoting task-specific lenses engineered for office work, gaming, and e-learning environments. The continued digitalization of daily activities ensures prolonged market relevance for such innovations.

- For instance, CooperVision’s MyDay Energys contact lenses integrate DigitalBoost technology, an aspheric design supplying a +0.3D boost to ease ciliary muscle stress and accommodative burden when shifting focus from digital devices to the real world.

Growth of Customized and Premium Lens Solutions

The market sees growing opportunities in personalized and premium prescription lenses tailored to individual visual needs. Innovations in free-form manufacturing, AI-powered eye measurements, and adaptive focusing technologies enhance precision and user experience. Premium coatings, lightweight materials, and high-index lenses attract consumers seeking superior aesthetics and performance. Additionally, expanding e-commerce platforms support online customization and virtual try-on tools, improving accessibility. As consumers increasingly prefer differentiated and high-quality vision solutions, manufacturers that invest in advanced customization capabilities gain a strong competitive edge.

- For instance, Rodenstock uses its DNEye Scanner to measure over 7,000 points on the eye, including pupil reactions and aberrations, for biometric single vision and progressive lenses. This creates individualized lenses with sharper contrast, better night vision, and larger fields of clear sight.

Key Challenges

High Cost of Premium Lens Technologies

One of the major challenges in the Prescription Lens Market is the high cost associated with advanced lens materials, specialized coatings, and precision manufacturing technologies. Premium solutions such as progressive digital lenses or blue-light-filter coatings often remain unaffordable for price-sensitive consumers. Limited insurance coverage in several regions further restricts adoption. Manufacturers face pressure to balance innovation with affordability while sustaining margins. This cost barrier creates disparities in access to high-quality vision correction, particularly in low-income markets where cost-driven alternatives remain dominant.

Rising Competition from Low-Cost Alternatives

The increasing presence of low-cost lens manufacturers, particularly in emerging economies, creates pricing pressure and challenges brand differentiation for established players. Budget optical chains and online retailers offer inexpensive prescription lenses that attract cost-conscious consumers, reducing the demand for premium offerings. This intensifies competition and forces established brands to enhance product value through innovation, service quality, and brand positioning. Additionally, counterfeit and substandard lenses entering the market pose risks to consumer safety and erode trust. These dynamics make maintaining market share more challenging for premium manufacturers.

Regional Analysis

North America

North America dominated the Prescription Lens Market with 33.4% share in 2024, driven by high prevalence of refractive errors, strong adoption of premium lenses, and widespread access to advanced optometric services. The region benefits from extensive insurance coverage for vision care and rapid uptake of digital, blue-light, and anti-reflective lenses among working professionals. Major manufacturers and retail chains expand their portfolios with customized and high-index lenses, enhancing consumer choice. Growing awareness of preventive eye health and rising diagnoses of myopia among younger populations further strengthen regional demand.

Europe

Europe accounted for 28.7% share in 2024, supported by a mature optical industry, expanding geriatric population, and high adoption of multifocal and progressive lenses. Countries such as Germany, France, and the U.K. exhibit strong penetration of premium coatings and technologically advanced lens materials. Regulatory support for eye care accessibility and regular vision screenings boosts demand across the region. The presence of globally recognized lens manufacturers enhances innovation and product variety. Increasing digital device usage continues to elevate the need for specialized blue-light and ergonomic prescription lenses.

Asia Pacific

Asia Pacific emerged as the fastest-growing region with 26.9% share in 2024, propelled by rising myopia prevalence, large population base, and rapid urbanization. Countries such as China, Japan, South Korea, and India witness strong demand for single-vision correction lenses and advanced coatings due to high digital screen exposure. Expanding middle-class income levels and improving access to optometric services support continued market penetration. Local manufacturing expansion and partnerships with global brands further strengthen supply capabilities. Government initiatives promoting routine eye examinations also contribute to sustained growth across the region.

Latin America

Latin America captured 6.1% share in 2024, driven by increasing awareness of vision correction and growing availability of affordable prescription lenses. Countries such as Brazil, Mexico, and Argentina show rising adoption of single-vision and anti-reflective lenses as digital device usage surges. Expansion of optical retail chains and e-commerce platforms improves accessibility and supports market penetration. Investments in local optical manufacturing enhance product affordability. However, limited insurance coverage and price sensitivity among consumers continue to shape purchasing behavior across the region.

Middle East & Africa

The Middle East & Africa region accounted for 4.9% share in 2024, supported by rising urbanization, improving healthcare infrastructure, and increasing screening for refractive errors. Countries such as the UAE, Saudi Arabia, and South Africa show growing demand for anti-reflective and UV-protective lenses due to harsh climatic conditions. Expanding optical retail networks and partnerships with global brands enhance product availability. However, economic disparities and limited access to specialized eye care services in rural areas continue to challenge market growth, leading to slower adoption of premium lens solutions.

Market Segmentations:

By Type

- Single Vision

- Convex

- Concave

- Cylindrical

- Others

By Application

- Myopia

- Hyperopia/Hypermetropia

- Astigmatism

- Presbyopia

By Coating

- Anti-reflective

- Scratch Resistant Coating

- Anti-Fog Coating

- Ultraviolet Treatment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Prescription Lens Market is shaped by leading companies such as EssilorLuxottica SA, Carl Zeiss Vision International GmbH, HOYA Corporation, Nikon Corporation, Rodenstock GmbH, Seiko Optical Products Co., Ltd., BBGR SA, Shamir Optical Industry Ltd., Vision-Ease Lens Technologies, Inc., and Younger Optics, Inc. These players strengthen their market positions through continuous advancements in lens materials, digital surfacing technologies, and premium coatings that enhance visual comfort and clarity. Companies actively expand their global footprints by investing in R&D, introducing customized and blue-light-filter solutions, and accelerating production of high-index and lightweight lenses. Strategic partnerships with optical retailers, e-commerce channels, and eye-care professionals enable broader consumer reach and brand visibility. Many manufacturers also focus on sustainability initiatives, integrating eco-friendly materials and energy-efficient manufacturing practices. Growing demand for personalized vision correction encourages companies to enhance precision measurement technologies and offer tailored lens designs, further intensifying competition across global markets.

Key Player Analysis

Recent Developments

- In June 2025, Carl Zeiss Vision International GmbH announced the acquisition of Brighten Optix, bringing its specialty contact lens and myopia-management portfolio into Zeiss Vision Care.

- In September 2025, HOYA Corporation launched its new stock-lens outlet, LensesByHOYA.us, offering a wide range of HOYA lens designs, materials and treatments to eye-care professionals with high availability and fast supply.

- In June 2025, EssilorLuxottica SA signed an agreement to acquire major Malaysian optical-retail chain A‑Look / Seen / OWL stores, expanding its regional retail footprint in Southeast Asia.

- In July 2025, HOYA introduced a new line of polarized prescription lenses under the name Lumacore, aimed at offering enhanced lens performance and aesthetic appeal for polarized lens users.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Coating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced prescription lenses will rise as digital screen usage continues to increase globally.

- Adoption of blue-light protection and digital strain–reducing coatings will expand in both developed and emerging markets.

- Personalized and free-form lenses will gain stronger traction due to consumer preference for tailored visual correction.

- Photochromic and adaptive lenses will see higher uptake as users seek convenience and multifunctional solutions.

- Premium progressive and multifocal lenses will grow rapidly with the expanding aging population.

- E-commerce platforms will play a larger role in prescription lens distribution and customization.

- Smart lens technologies will emerge as manufacturers integrate sensors and digital features into optical products.

- Sustainable and eco-friendly lens materials will gain importance as companies prioritize green manufacturing.

- Increasing awareness of regular eye examinations will support early detection and higher prescription lens adoption.

- Partnerships between optical brands and technology companies will accelerate innovation and product diversification.

Market Segmentation Analysis:

Market Segmentation Analysis: