Market Overview

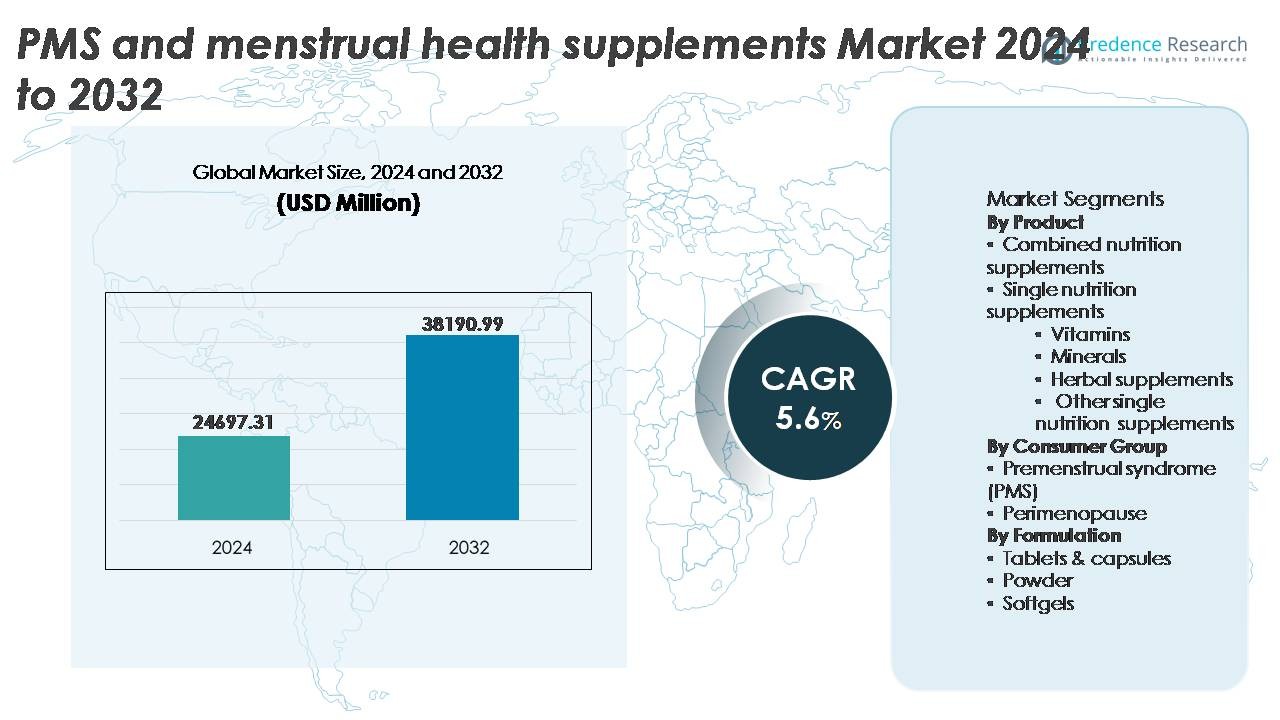

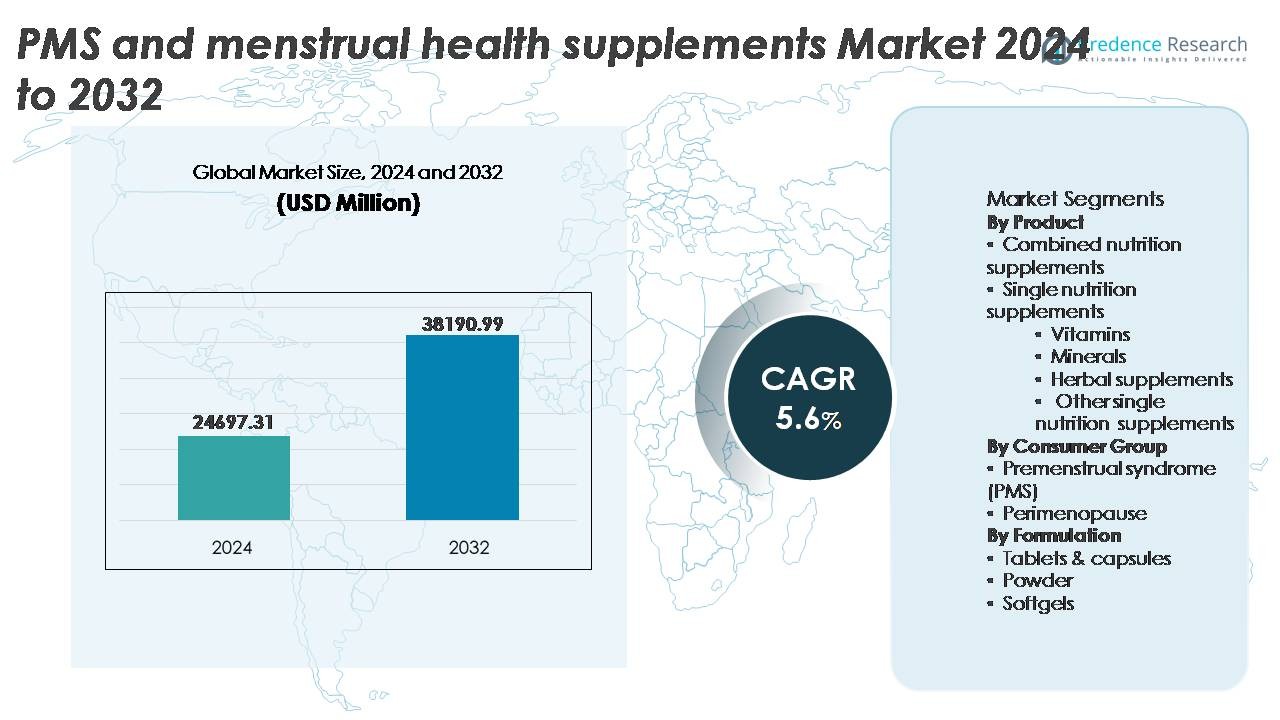

The PMS and menstrual health supplements market was valued at USD 24,697.31 million in 2024 and is projected to reach USD 38,190.99 million by 2032, reflecting a CAGR of 5.6% over the forecast period (2025-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PMS And Menstrual Health Supplements Market Size 2024 |

USD 24,697.31 Million |

| PMS And Menstrual Health Supplements Market, CAGR |

5.6% |

| PMS And Menstrual Health Supplements Market Size 2032 |

USD 38,190.99 Million |

The PMS and menstrual health supplements market is shaped by a diverse competitive ecosystem that includes established global players and emerging specialized brands such as Amway, Archer Daniels Midland, Country Life, CVS Health, DM Pharma, HealthBest, Herbalife International of America, Inc., InStrenghth, JS Health, and Looni. These companies compete through differentiated formulations, evidence-backed ingredients, strong retail footprints, and digital-first consumer engagement strategies. North America remains the leading region, commanding approximately 38% of the market share due to high awareness levels, access to premium products, and widespread adoption of personalized supplement plans. Europe follows as a key contributor, driven by demand for clean-label and plant-based formulations supported by stringent regulatory standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The PMS and menstrual health supplements market was valued at USD 24,697.31 million in 2024 and is projected to reach USD 38,190.99 million by 2032 at a CAGR of 5.6%.

- Rising awareness of natural, non-pharmaceutical solutions for PMS and hormonal balance drives consumer preference toward combined nutrition supplements, which currently hold the largest product segment share.

- Trends favor personalized nutrition, plant-based formulations, and subscription-based D2C models, with cycle-tracking digital platforms strengthening engagement and repeat purchases among younger demographics.

- Market competition intensifies as global brands and emerging women’s wellness companies focus on clean-label claims, clinical validation, and transparent ingredient sourcing, while regulatory restrictions on health claims remain a restraint.

- Regionally, North America leads with approximately 38% share, followed by Europe at 27% and Asia Pacific at 24%, supported by expanding e-commerce penetration and growing demand for evidence-backed supplement formulations.

Market Segmentation Analysis:

By Product:

The PMS and menstrual health supplements market is led by combined nutrition supplements, holding the dominant share as consumers increasingly prefer holistic blends addressing multiple symptoms such as mood fluctuation, bloating, fatigue, and sleep disruption. These formulations typically integrate vitamins, magnesium, omega fatty acids, herbal extracts, and probiotics, reducing the need for multiple purchases and improving adherence. Single nutrition supplements such as vitamins, minerals, and herbal solutions continue to expand, driven by personalized wellness trends; however, the value proposition of targeted, multi-benefit formulations reinforces the leading position of combined supplements in mainstream and premium consumer categories.

- For instance, Nature’s Way produces a standardized Black Cohosh supplement containing 540 mg root extract backed by clinical lot-to-lot HPLC fingerprinting, while Gaia Herbs delivers 2,250 mg organic Turmeric extract per serving, supported by dual-extraction technology to preserve curcuminoids and turmerones aimed at inflammation-induced PMS discomfort.

By Consumer Group:

Within the consumer group category, premenstrual syndrome (PMS) represents the dominant segment, accounting for the largest share due to its high prevalence among reproductive-age women and growing awareness of non-pharmaceutical symptom management. PMS supplements address concerns such as cramps, irritability, and hormonal imbalance more frequently reported compared to perimenopausal transitions. Meanwhile, the perimenopause segment is emerging as a high-growth niche fueled by earlier health planning and demand for natural hormone-support alternatives, yet its market scale remains smaller relative to PMS-driven consumption patterns in both retail and e-commerce channels.

- For instance, the Swiss-based Max Zeller Söhne AG developed a standardized Chasteberry extract (Ze 440) containing 20 mg of extract per tablet for use in its Prefemin® formulation, which has been studied in multi-center clinical trials to manage PMS symptoms.

By Formulation:

Tablets and capsules remain the leading formulation in PMS and menstrual health supplements, driven by extended shelf life, dose precision, portability, and established consumer familiarity. This format enables effective delivery for combined and single-nutrition compositions and supports clean-label and vegan capsule innovations. Softgels continue gaining traction for oil-based extracts such as evening primrose or omega-3s, while powders appeal to younger demographics favoring flavored blends and functional beverages. Despite this growth, tablets and capsules retain a majority share as they offer consistent dosing convenience and lower manufacturing cost advantages across mass and specialized brands.

Key Growth Drivers

Rising Awareness of Non-Pharmaceutical Solutions for Hormonal and Menstrual Support

Growing global awareness regarding natural and nutritional interventions for hormone balance and PMS symptom relief remains a primary growth catalyst for the PMS and menstrual health supplements market. Younger and more health-conscious consumers increasingly seek alternatives that reduce dependency on analgesics or prescription-based hormonal therapies, particularly for chronic conditions such as recurrent PMS and dysmenorrhea. Digital education platforms, women’s health campaigns, and telehealth consultations have broadened access to expert guidance, improving understanding of nutritional deficiencies associated with menstrual discomfort. Marketing strategies emphasizing clean-label, plant-based, and clinically validated ingredients further reinforce consumer transition from synthetic pharmaceuticals. Additionally, retailers and specialized women’s wellness brands have expanded product visibility through online marketplaces, subscription models, and influencer-led product advocacy. These developments collectively contribute to strong adoption momentum across urban and semi-urban markets, fueling rapid expansion of natural and nutraceutical menstrual health solutions.

- For instance, Pharmactive Biotech Products introduced Affron® – a patented saffron extract delivering 28 mg per capsule standardized to 5% lepticrosalides, supported by six peer-reviewed clinical trials demonstrating measurable improvements in PMS-related emotional symptoms.

Personalized Nutrition and Condition-Specific Supplementation

The growing shift toward personalized nutrition is driving targeted product innovations tailored to individual hormonal cycles, lifestyle patterns, and deficiency profiles. DNA-based assessments, microbiome testing, and app-driven cycle tracking enable supplement brands to design solutions that address specific symptoms such as mood imbalance, fluid retention, low energy, or cognitive irritability. Subscription-based supplement packs integrated with digital reminders enhance adherence and customer retention. Furthermore, professional recommendations from gynecologists, naturopaths, and nutritionists support acceptance of condition-specific formulations as part of preventive health plans. The emergence of PMS relief kits, cycle-syncing supplements, and phase-based nutritional plans reflects rising demand for scientifically aligned customization. As consumers increasingly value precision wellness over generic formulations, companies offering data-backed personalization models gain a competitive edge through perceived efficacy, brand loyalty, and premium pricing potential.

- For instance, UK-based supplement personalization platform Vitlutilizes at-home DNA and blood testing to inform personalized recommendations. Their DNA test analyzes numerous genetic traits (reportedly around 40, not specifically 28), while blood tests measure key biomarkers such as vitamin D and iron levels.

Expansion of E-Commerce and Direct-to-Consumer Women’s Health Brands

E-commerce-driven distribution models significantly contribute to market growth by improving product accessibility and enabling brand differentiation in a crowded competitive landscape. Women’s health supplement brands leverage digital platforms to offer educational content, symptom quizzes, and subscription perks that create personalized engagement and repeat purchases. Cross-border sales channels also facilitate the entry of international brands into emerging markets where PMS solutions remain underpenetrated. Social commerce trends, particularly influencer-led product demonstration and community validation via reviews, accelerate conversion in younger demographics. Direct-to-consumer brands reduce dependency on traditional pharmacies and expand SKU portfolios without retail limitations. Additionally, online platforms enable transparent disclosure of ingredient sourcing, clinical validation, and customer feedback critical trust-building factors in menstrual wellness categories. These combined factors amplify e-commerce’s role as a growth enabler in global menstrual supplement adoption.

Key Trends & Opportunities

Clinical Ingredient Validation and Evidence-Backed Formulations

A notable market trend is the growing demand for clinically validated ingredients such as magnesium, chasteberry extract, vitamin B6, probiotics, and omega fatty acids supported by research on hormone regulation, inflammation modulation, and mood stabilization. Brands increasingly highlight clinical trial references, standardized ingredient concentrations, and third-party testing in their product communication. This shift creates opportunities for manufacturers that invest in R&D, regulatory alignment, and science-backed health claims. Professional endorsements from healthcare providers further enhance credibility. As consumers prioritize informed decision-making, evidence-based differentiation offers a strong competitive advantage, particularly in premium product segments where transparency and efficacy drive purchasing behavior.

· For instance, Givaudan’s branded ingredient “Zanthosyn®” (astaxanthin) is produced using Haematococcus pluvialis microalgae through a closed photobioreactor system, delivering 12 mg astaxanthin per capsule with purity verified to ≥98% through HPLC testing, and has been evaluated in multiple clinical studies investigating its impact on oxidative markers related to PMS fatigue.

Growth in Plant-Based, Clean-Label, and Allergen-Free Formulations

Rising adoption of vegan, allergen-conscious, and chemical-free lifestyles presents substantial opportunities for clean-label menstrual health supplements. Consumers increasingly reject artificial preservatives, gelatin, synthetic dyes, and hormone-disrupting additives. The accelerated shift toward plant-based ingredients aligns with broader sustainability frameworks and ethical sourcing commitments. Clean-label claims such as non-GMO, gluten-free, soy-free, and sugar-free serve as high-impact differentiators driving brand loyalty. This trend expands market penetration beyond core PMS users into broader wellness segments including fitness, organic retail, and lifestyle-focused consumers. Manufacturers who adopt botanical derivatives, natural excipients, and biodegradable packaging stand to benefit from regulatory momentum favoring environment-safe product standards.

- For instance,Aenova Group offers its established VegaGels® line of plant-based softgels, utilizing a formulation based on plant-derived polysaccharides (such as starch and seaweed extracts) as an alternative to bovine- or porcine-based gelatin.

Key Challenges

Regulatory Oversight and Limitations on Health Claims

Regulatory scrutiny surrounding supplement categorization, permissible ingredient levels, and health claims represents a significant challenge for market participants. Variations in frameworks across regions spanning food, therapeutic, or nutraceutical classification complicate global product standardization and approval timelines. Restrictions on claims related to hormonal balance, psychological well-being, or reproductive health require brands to invest in extensive documentation, clinical validation, and compliant communication strategies. Small and emerging brands often face high compliance costs, labeling changes, and barriers to entry in regulated markets. Inconsistent consumer understanding of supplement regulation also fuels skepticism regarding safety, dosage, and results, limiting adoption potential without strong educational initiatives.

Market Saturation and Differentiation Barriers in a Highly Competitive Landscape

The PMS and menstrual health supplement sector is increasingly saturated with traditional nutraceutical companies, pharmacy brands, plant-based entrants, and D2C digital-first startups, creating intense competition and pricing pressure. Many formulations rely on similar ingredient stacks such as magnesium, vitamin B6, and botanicals making product differentiation difficult. Consumers face information overload, leading to decision fatigue and reliance on brand recognition rather than clinical merit. Additionally, high marketing expenditures for social visibility and influencer collaborations compress margins for new entrants. To overcome saturation challenges, brands must focus on unique formulations, proprietary blends, clinically validated claims, and technology-enabled personalization to reinforce relevance in a rapidly evolving marketplace.

Regional Analysis

North America

North America holds the leading position in the PMS and menstrual health supplements market, accounting for approximately 38% of global share, supported by high consumer awareness, strong purchasing power, and access to clinically validated women’s health products. The United States dominates regional demand with growing adoption of personalized supplement plans and subscription-based D2C brands. Healthcare practitioners increasingly recommend nutritional interventions to complement PMS and perimenopause symptom management. Extensive retail penetration across pharmacies, specialty wellness stores, and e-commerce further reinforces product visibility. Increasing advocacy around hormonal health and workplace wellness programs sustains momentum across long-term commercial channels.

Europe

Europe captures around 27% of the PMS and menstrual health supplements market, driven by stringent regulatory governance, clean-label consumer preferences, and rising demand for plant-based and non-pharmaceutical alternatives. Countries including Germany, the U.K., and France lead market adoption supported by awareness campaigns promoting menstrual education and nutritional supplementation. The region’s aging female population fuels demand for perimenopause-focused products, while emerging digital telehealth platforms facilitate access to professional guidance. Regulatory emphasis on ingredient transparency and scientific substantiation strengthens consumer trust, encouraging adoption of clinically backed formulations. E-commerce expansion and pharmacy-led distribution continue to shape competitive strategies.

Asia Pacific

Asia Pacific represents approximately 24% of the market and stands as the fastest-growing region due to expanding middle-class consumer bases, urbanization, and rising acceptance of women’s health supplements. Markets such as China, India, Japan, and South Korea demonstrate increasing openness toward nutritional solutions for PMS and hormonal balance, supported by cultural shifts and digital marketplace growth. Traditional herbal remedies integrated into modern supplement formulations boost product appeal. Growing participation of women in the workforce drives prioritization of mental and physical wellness management. Although brand consolidation is limited, international entrants leverage cross-border e-commerce to accelerate regional penetration.

Latin America

Latin America accounts for around 6% of the market, with adoption influenced by growing women’s health awareness campaigns and expansion of pharmaceutical-linked nutraceutical brands. Brazil and Mexico generate the majority of demand, supported by rising disposable incomes and improving access to branded supplements through online and retail pharmacies. Local manufacturing activities are expanding to meet demand for cost-effective PMS solutions. However, economic disparities and lower regulatory harmonization across countries create pricing sensitivity issues. Gradual normalization of women’s wellness conversations and emerging influencer-driven marketing campaigns are expected to strengthen long-term market opportunity.

Middle East & Africa

The Middle East & Africa region holds approximately 5% of the PMS and menstrual health supplements market, driven by progressive healthcare investment and an increasing focus on preventive wellness. Markets such as the UAE and Saudi Arabia demonstrate faster adoption attributed to premium product positioning and medical consultation-led recommendations. Public health initiatives and rising female workforce participation contribute to growing acceptance of nutritional supplementation. However, cultural barriers, lower awareness levels, and limited product variety in traditional retail channels temper widespread expansion. E-commerce access and higher education levels among younger consumers gradually propel demand for clinically supported formulations.

Market Segmentations:

By Product

- Combined nutrition supplements

- Single nutrition supplements

- Vitamins

- Minerals

- Herbal supplements

- Other single nutrition supplements

By Consumer Group

- Premenstrual syndrome (PMS)

- Perimenopause

By Formulation

- Tablets & capsules

- Powder

- Softgels

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The PMS and menstrual health supplements market features a competitive landscape defined by established nutraceutical companies, emerging D2C women’s health brands, and pharmaceutical-supported wellness players diversifying into hormonal support categories. Major brands emphasize clean-label formulations, clinical validation, and differentiated ingredient positioning such as chasteberry extract, magnesium blends, probiotics, and omega fatty acids to strengthen efficacy claims. Digital-native brands leverage cycle-tracking apps, subscription models, and personalized packs to drive recurring revenue and enhance consumer engagement. Meanwhile, multinational players expand distribution through pharmacies, retail chains, and e-commerce platforms to consolidate market footprint. Strategic partnerships with healthcare practitioners, telehealth providers, and fertility clinics are increasingly used to build trust and influence purchase decisions. Competitive activity also includes investments in R&D, regulatory compliance, and acquisition of niche supplement innovators. As consumer expectations evolve toward transparency, safety, and personalization, companies capable of pairing scientific credibility with digital engagement tools maintain a clear competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- JS Health

- HealthBest

- InStrenghth

- DM Pharma

- CVS Health

- Archer Daniels Midland

- Looni

- Country Life

- Amway

- Herbalife International of America, Inc.

Recent Developments

- In 2025, HealthBest offers a product labeled “PMS-Best Menstrual Dietary Supplement” positioned toward menstrual cycles and PMS support.

- In August 2022, Looni launched Balance Beam Mood Complex, a vegan menstrual health supplement that includes ingredients like 5-HTP, ashwagandha, L-theanine, and vitamin B to support hormone and neurotransmitter balance, helping to reduce mood swings and irritation. This helped the company expand its product offerings and increase sales.

Report Coverage

The research report offers an in-depth analysis based on Product, Consumer group, Formulation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt personalized and cycle-synced supplement protocols aligned with individual hormonal patterns.

- Evidence-backed formulations featuring clinically studied ingredients will become a priority for consumer trust and regulatory compliance.

- Plant-based, clean-label, and allergen-free products will gain stronger traction across global retail and e-commerce channels.

- Partnerships with telehealth platforms and women’s digital health apps will expand guided supplementation models.

- Brands will integrate AI-driven assessment tools to recommend customized supplement regimens and track symptom improvement.

- Functional combinations supporting mood, sleep, gut health, and inflammation will drive multipurpose innovation.

- Growing collaboration with gynecologists and nutritionists will increase clinical endorsement and adoption.

- Packaging sustainability and recyclable delivery formats will influence purchase decisions among environmentally conscious consumers.

- Expansion into perimenopause and reproductive wellness categories will diversify product demand beyond PMS-focused solutions.

- Cross-border e-commerce and globalization of women’s wellness brands will accelerate accessibility and market penetration.