Market Overview

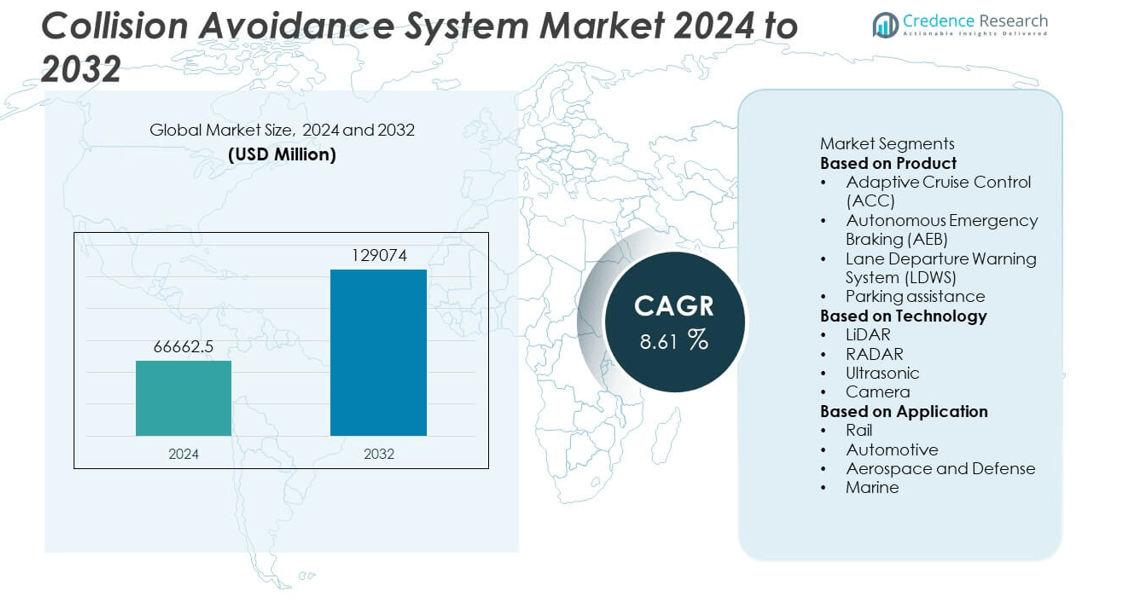

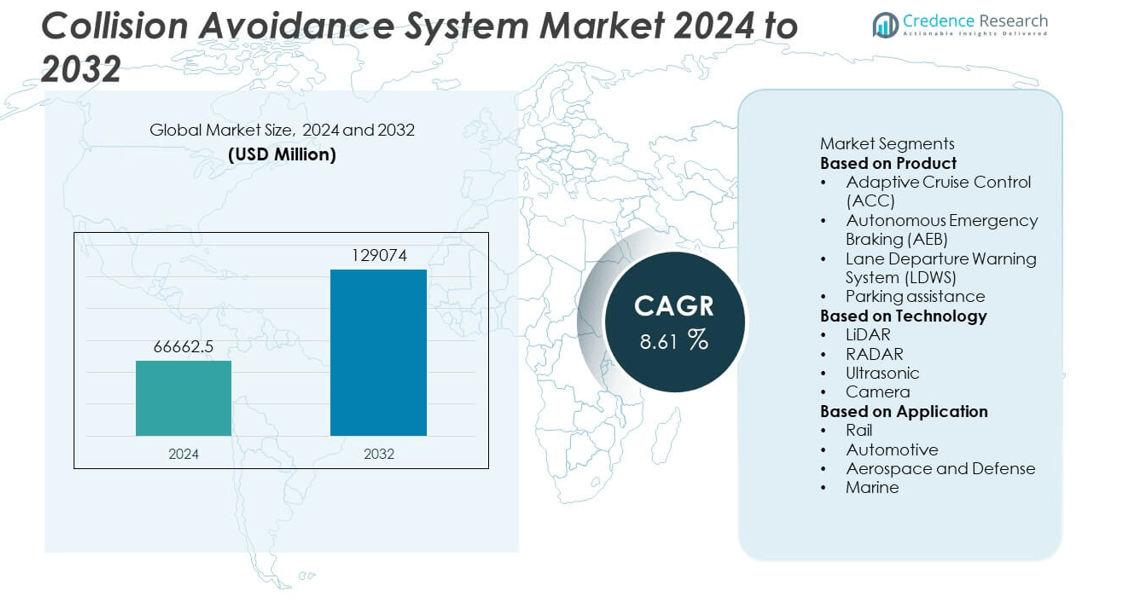

The Collision Avoidance System market was valued at USD 66,662.5 million in 2024 and is projected to reach USD 129,074 million by 2032, registering a compound annual growth rate (CAGR) of 8.61% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Collision Avoidance System Market Size 2024 |

USD 66,662.5 million |

| Collision Avoidance System Market, CAGR |

8.61% |

| Collision Avoidance System Market Size 2032 |

USD 129,074 million |

The Collision Avoidance System market grows due to increasing demand for vehicle safety driven by stringent government regulations and rising consumer awareness. Technological advancements in radar, lidar, and AI enhance system accuracy and responsiveness, boosting adoption. Integration with autonomous and connected vehicle technologies further supports market expansion.

The Collision Avoidance System market demonstrates strong growth across key regions such as North America, Europe, and Asia-Pacific, driven by varying regulatory frameworks and increasing automotive production. North America and Europe lead with advanced safety regulations and high consumer demand, fostering rapid adoption of collision avoidance technologies. Meanwhile, Asia-Pacific experiences accelerated growth due to rising vehicle sales and urbanization, encouraging manufacturers to introduce affordable safety solutions. Prominent players shaping the market include Robert Bosch Manufacturing Solutions GmbH, Continental AG, DENSO CORPORATION, and Infineon Technologies AG. These companies invest heavily in research and development to enhance sensor accuracy, AI integration, and system reliability. Their strategic partnerships and innovations position them as leaders in advancing collision avoidance technologies globally, addressing diverse regional requirements and driving the market’s evolution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Collision Avoidance System market was valued at USD 66,662.5 million in 2024 and is expected to reach USD 129,074 million by 2032, growing at a CAGR of 8.61% during the forecast period.

- Growing regulatory mandates worldwide require automakers to incorporate advanced safety features, significantly driving the adoption of collision avoidance systems in both passenger and commercial vehicles.

- Rapid technological advancements such as AI integration, sensor fusion combining radar, lidar, and cameras, and Vehicle-to-Everything (V2X) communication enhance system accuracy and predictive capabilities, fostering market growth.

- Increasing urbanization and traffic congestion raise the demand for advanced driver assistance systems, including collision avoidance, to improve road safety and reduce accident rates.

- High implementation costs and technical limitations in adverse weather conditions restrain market growth, especially in price-sensitive regions and emerging markets.

- North America, Europe, and Asia-Pacific lead the market due to strong regulatory support, rising vehicle production, and increasing consumer awareness about vehicle safety technologies.

- Leading companies such as Robert Bosch Manufacturing Solutions GmbH, Continental AG, DENSO CORPORATION, and Infineon Technologies AG focus on innovation, partnerships, and regional customization to maintain competitive advantages and expand their global presence.

Market Drivers

Increasing Demand for Vehicle Safety and Regulatory Compliance Driving Market Growth

The rising emphasis on vehicle safety standards propels the Collision Avoidance System market. Governments and regulatory bodies worldwide implement stricter safety regulations, compelling automotive manufacturers to integrate advanced safety technologies. These systems help reduce road accidents and fatalities, making them a crucial feature in modern vehicles. Consumer awareness about vehicle safety also encourages adoption, especially in developed regions. The market benefits from continuous improvements in sensor accuracy and system reliability. It supports manufacturers in meeting both regulatory requirements and consumer expectations, reinforcing the demand for collision avoidance technologies.

- For instance, Robert Bosch Manufacturing Solutions GmbH has produced over 200 million radar sensors globally, enabling enhanced vehicle safety compliance and widespread system adoption.

Technological Advancements and Integration of Artificial Intelligence Enhance System Capabilities

Technological progress, particularly in sensor technologies, radar, and camera systems, advances collision avoidance solutions. The integration of artificial intelligence (AI) enables real-time data processing, improving the detection of potential hazards. These enhancements increase the accuracy and responsiveness of the systems, making them more effective in complex driving environments. It enables predictive analysis that helps drivers prevent collisions proactively. Growing investments in research and development foster innovation, resulting in cost-effective and compact systems suitable for various vehicle types. The continuous evolution of these technologies expands the market reach across automotive segments.

- For instance, Continental AG introduced its scalable ADAS platform, Xelve, which supports Level 2 to Level 4 automation with real-time data processing capabilities of up to 1000 frames per second, improving hazard detection and collision avoidance effectiveness.

Rising Adoption of Autonomous and Semi-Autonomous Vehicles Supports Market Expansion

The growing adoption of autonomous and semi-autonomous vehicles fuels the demand for collision avoidance systems. These vehicles rely heavily on advanced driver assistance technologies to navigate safely. It acts as a foundational component that enables autonomous driving by detecting obstacles and managing collision risks. Increasing consumer interest in smart and connected vehicles creates further opportunities for market growth. Automotive manufacturers prioritize integrating these systems to enhance vehicle safety and comply with future mobility trends. This dynamic significantly contributes to the expansion of the Collision Avoidance System market.

Urbanization and Increasing Traffic Congestion Escalate the Need for Advanced Safety Systems

Rapid urbanization and escalating traffic congestion heighten the risk of road accidents, boosting the demand for collision avoidance systems. Urban areas experience complex traffic conditions that challenge driver response times. It provides essential support to drivers by offering timely alerts and automated interventions, reducing accident rates. The rising number of vehicles on roads, coupled with limited infrastructure improvements, emphasizes the need for intelligent safety solutions. Governments encourage adopting these systems to improve overall traffic safety and reduce economic losses from accidents. This environmental factor drives the widespread implementation of collision avoidance technologies.

Market Trends

Expansion of Advanced Driver Assistance Systems Fuels Adoption of Collision Avoidance Technologies

The integration of Collision Avoidance System market solutions within broader Advanced Driver Assistance Systems (ADAS) drives significant growth. Automakers increasingly bundle collision avoidance with features like lane departure warnings and adaptive cruise control. It enhances overall vehicle safety and improves driver convenience. This trend supports widespread adoption across different vehicle segments, from economy to luxury models. Consumer demand for comprehensive safety packages motivates manufacturers to invest in integrated systems. It also encourages standardization of these features in new vehicles, reinforcing market penetration.

- For instance, DENSO CORPORATION supplies ADAS modules equipped with integrated collision avoidance, lane departure warning, and adaptive cruise control systems installed in over 150 million vehicles globally, demonstrating large-scale adoption.

Shift Towards Sensor Fusion and Multimodal Detection Improves System Performance

The trend toward sensor fusion, combining radar, lidar, and camera technologies, enhances collision avoidance capabilities. It improves detection accuracy by compensating for limitations inherent in individual sensors. The market witnesses growing adoption of multimodal detection approaches, offering robust performance in various environmental conditions. This advancement supports higher safety standards and adapts to complex traffic scenarios. It enables real-time decision-making, reducing false alarms and improving driver trust. The fusion of multiple sensors represents a key technological trend shaping the market’s future.

- For instance, Infineon Technologies AG’s radar sensors operate at frequencies up to 77 GHz and integrate with camera and lidar inputs to process more than 20,000 data points per second, significantly enhancing object detection and collision prediction accuracy.

Increasing Integration of Vehicle-to-Everything Communication Enhances Predictive Collision Avoidance

The deployment of Vehicle-to-Everything (V2X) communication networks advances the Collision Avoidance System market by enabling predictive safety measures. It allows vehicles to communicate with infrastructure, other vehicles, and pedestrians. This connectivity improves hazard anticipation and facilitates cooperative collision prevention strategies. V2X integration supports the development of smarter traffic ecosystems and aids in reducing traffic congestion. Manufacturers and technology providers invest in this trend to offer enhanced situational awareness and timely alerts. The expansion of connected vehicle technology represents a transformative shift in collision avoidance.

Growing Focus on Cost Reduction and Scalability Drives Market Accessibility

Market participants increasingly focus on developing cost-efficient collision avoidance solutions to target mass-market vehicles. It involves optimizing hardware components and software algorithms to reduce production costs without compromising performance. This trend enables manufacturers to offer these systems in affordable vehicle models, broadening consumer access. It encourages partnerships between automotive OEMs and technology firms to streamline development processes. Greater scalability supports rapid market expansion, especially in emerging economies. The focus on affordability and scalability remains a critical trend shaping the market trajectory.

Market Challenges Analysis

High Implementation Costs and Complex Integration Limit Wider Adoption Across Vehicle Segments

The Collision Avoidance System market faces challenges due to the high cost of advanced sensors and related hardware components. These expenses increase the overall vehicle price, limiting accessibility, especially in entry-level and mid-range models. It requires sophisticated integration with existing vehicle electronics, which adds complexity and development time. Manufacturers must ensure system compatibility with diverse vehicle platforms, increasing engineering efforts. The demand for continuous software updates and maintenance further elevates operational costs. These factors create barriers for widespread implementation, particularly in emerging markets with price-sensitive consumers. Cost and integration complexities remain significant obstacles for market growth.

Technical Limitations and Regulatory Variability Impact System Effectiveness and Market Expansion

Technical challenges such as sensor performance in adverse weather conditions affect the reliability of collision avoidance systems. It struggles to maintain consistent accuracy in fog, heavy rain, or snow, which reduces driver confidence. Variations in global regulatory standards create inconsistencies in system requirements and deployment timelines. The market experiences delay due to the need for compliance with region-specific safety and data privacy laws. It also faces challenges in managing false alarms and ensuring user-friendly interfaces to prevent driver distraction. Overcoming these technical and regulatory hurdles is critical for accelerating market penetration and enhancing consumer trust.

Market Opportunities

Expansion in Emerging Markets and Increasing Vehicle Production Present Significant Growth Potential

The Collision Avoidance System market can capitalize on the rapid growth of the automotive sector in emerging economies. Rising disposable incomes and increasing urbanization drive demand for safer vehicles in regions such as Asia-Pacific and Latin America. It offers manufacturers an opportunity to introduce affordable and region-specific collision avoidance technologies tailored to these markets. Expanding vehicle production volumes in these areas create a broad customer base. It enables companies to leverage economies of scale and increase adoption rates. Market players who customize solutions for local needs and regulatory environments can strengthen their competitive advantage.

Integration with Next-Generation Technologies and Smart Infrastructure Opens New Avenues for Innovation

The growing focus on connected and autonomous vehicles creates opportunities for advanced collision avoidance systems integrated with Vehicle-to-Everything (V2X) communication. It can enhance predictive safety features by sharing real-time data between vehicles and infrastructure. Collaboration with smart city initiatives and intelligent transportation systems supports this integration. These advancements improve traffic management and reduce accident rates, driving demand for sophisticated safety solutions. Investment in artificial intelligence and machine learning further enables system evolution with better hazard detection and decision-making. The market can benefit from partnerships between automotive manufacturers, technology providers, and government agencies focused on future mobility solutions.

Market Segmentation Analysis:

By Product Type

The Collision Avoidance System market divides primarily by product type, technology, and application, each reflecting distinct growth drivers and adoption patterns. By product type, the market includes forward collision warning systems, blind-spot detection systems, lane departure warning systems, and pedestrian detection systems. Forward collision warning systems dominate due to their critical role in preventing front-end collisions, which constitute a large percentage of road accidents. Blind-spot detection systems also gain traction as consumers prioritize all-around vehicle safety. Pedestrian detection systems show rising adoption, especially in urban environments with heavy foot traffic, contributing to increased demand in safety-conscious markets.

- For instance, Robert Bosch Manufacturing Solutions GmbH has supplied forward collision warning systems installed in over 180 million vehicles worldwide, underscoring its dominance and effectiveness in reducing frontal collisions.

By Technology

By technology, the market segments into radar-based, lidar-based, ultrasonic sensor-based, and camera-based systems. Radar-based technology leads the market owing to its effective range and reliability in adverse weather and low visibility conditions. Camera-based systems support detailed image processing and object recognition, enhancing detection accuracy. Lidar technology gains momentum due to its precision in mapping surroundings, critical for integration with autonomous vehicle platforms. Ultrasonic sensors mainly support short-range detection and parking assistance, complementing other technologies. The convergence of multiple sensor technologies improves overall system performance and broadens application scope.

- For instance, Continental AG produces radar sensors operating at 77 GHz with detection ranges exceeding 200 meters, integrated alongside lidar and cameras in over 15 million vehicles to enable accurate, multimodal environment sensing.

By Application

The application segment categorizes the market into passenger vehicles, commercial vehicles, and two-wheelers. Passenger vehicles represent the largest share given the growing emphasis on personal safety and regulatory mandates for advanced safety features. Commercial vehicles, including trucks and buses, increasingly incorporate collision avoidance systems to reduce accident-related costs and improve driver safety in logistics operations. Two-wheelers present an emerging application segment with rising interest, particularly in densely populated urban areas where accident rates are high. It offers significant growth potential through customized systems addressing unique challenges faced by motorcycle riders.

Segments:

Based on Product

- Adaptive Cruise Control (ACC)

- Autonomous Emergency Braking (AEB)

- Lane Departure Warning System (LDWS)

- Parking assistance

Based on Technology

- LiDAR

- RADAR

- Ultrasonic

- Camera

Based on Application

- Rail

- Automotive

- Aerospace and Defense

- Marine

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

The Collision Avoidance System market shows significant regional variations in market share, driven by differing regulatory environments, technological adoption rates, and automotive production volumes. North America holds a substantial share of approximately 30% of the global market. The region’s strong regulatory framework around vehicle safety standards and high consumer awareness fuel demand. Leading automotive manufacturers in the U.S. and Canada actively incorporate advanced safety systems to comply with stringent regulations and meet consumer expectations. Investments in connected vehicle infrastructure and autonomous driving technologies further enhance market growth. North America benefits from a mature automotive ecosystem and widespread adoption of collision avoidance technologies across passenger and commercial vehicles.

Europe

Europe accounts for about 28% of the global market share, ranking closely behind North America. The region enforces some of the world’s most rigorous vehicle safety regulations, compelling automakers to integrate collision avoidance systems as standard features. Countries such as Germany, France, and the U.K. lead in adoption due to high vehicle production and stringent safety norms set by the European Union. The focus on reducing road fatalities and promoting intelligent transport systems supports sustained market expansion. Innovation hubs in Europe drive advancements in sensor technologies and vehicle-to-everything (V2X) communication, further strengthening the market presence.

Asia-Pacific

The Asia-Pacific region holds the second-largest share, approximately 32%, reflecting rapid growth driven by expanding automotive manufacturing and increasing vehicle sales. China, India, Japan, and South Korea emerge as key markets due to rising disposable incomes and urbanization. It faces a growing demand for enhanced vehicle safety amid rising road accidents. Governments promote safety regulations and incentivize the adoption of collision avoidance technologies, particularly in newly produced vehicles. The expanding middle-class population and growing awareness of vehicle safety features propel adoption in passenger vehicles. The region also sees increasing investment in infrastructure to support connected vehicle technologies, enabling future-ready collision avoidance solutions.

Latin America

Latin America represents around 5% of the global market share with moderate growth prospects. Brazil, Mexico, and Argentina dominate this regional market due to relatively high vehicle production and improving safety regulations. The adoption rate remains lower than in developed regions due to cost sensitivity and slower regulatory enforcement. However, increasing government initiatives aimed at reducing traffic fatalities and improving road safety create opportunities for market growth. Economic growth and rising automotive demand provide a positive outlook for the region’s collision avoidance system market.

Middle East and Africa

The Middle East and Africa region holds approximately 5% market share. The market here experiences slower growth relative to other regions due to infrastructural challenges and variable regulatory frameworks. Countries like the UAE, Saudi Arabia, and South Africa lead regional adoption, driven by increasing demand for luxury and commercial vehicles equipped with advanced safety systems. Government efforts focus on enhancing road safety and smart city projects, which positively influence market penetration. The region’s potential lies in infrastructure modernization and rising investments in automotive safety technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Robert Bosch Manufacturing Solutions GmbH

- Panasonic Holdings Corporation

- Continental AG

- ZF Friedrichshafen AG (TRW automotive)

- BorgWarner Inc.

- Murata Manufacturing Co., Ltd.

- Analog Devices, Inc.

- NXP Semiconductors (Freescale Semiconductor, Inc.)

- Infineon Technologies AG

- DENSO CORPORATION

Competitive Analysis

The Collision Avoidance System market features intense competition among key industry players, including Robert Bosch Manufacturing Solutions GmbH, Continental AG, DENSO CORPORATION, Infineon Technologies AG, and NXP Semiconductors. These companies focus on innovation, technological advancements, and strategic partnerships to maintain and expand their market share. They invest heavily in research and development to improve sensor accuracy, AI integration, and system reliability, addressing the increasing demand for advanced safety features. Robert Bosch leads with its extensive product portfolio and strong global presence, continuously enhancing system capabilities through cutting-edge technology. Continental AG leverages its expertise in automotive electronics and sensor solutions to offer comprehensive collision avoidance systems. DENSO CORPORATION emphasizes innovation in radar and camera technologies to meet stringent regulatory requirements and customer expectations. Infineon Technologies provides advanced semiconductor solutions that support high-performance sensor fusion, critical for collision avoidance systems. NXP Semiconductors focuses on connectivity and secure vehicle communication, enabling integration with broader intelligent transport ecosystems. These players adopt aggressive strategies such as mergers, acquisitions, and collaborations with automotive manufacturers and technology firms to strengthen their competitive positioning. Their ability to tailor solutions for diverse vehicle segments and regional markets helps them address evolving regulatory landscapes and consumer preferences. This competitive landscape drives continuous innovation, supporting the growth and technological advancement of the Collision Avoidance System market worldwide.

Recent Developments

- In May 2025, ZF showcased its latest intelligent ADAS safety solutions and mobility innovations for autonomous projects and digital fleet management, demonstrating its expanding role in collision avoidance systems

- In February 2025, Bosch unveiled its next‑generation long‑range radar sensor designed for ADAS. It enhances object detection accuracy over greater distances and supports 360‑degree environmental awareness, improving collision mitigation in both highway and urban scenarios.

- In January 2025, Continental introduced Xelve, a scalable ADAS and automated driving system portfolio—from Level 2 to Level 4 automation—at CES 2025, targeting both mass‑market and premium vehicle segments

Market Concentration & Characteristics

The Collision Avoidance System market exhibits a moderately concentrated competitive landscape, dominated by a few key players such as Robert Bosch Manufacturing Solutions GmbH, Continental AG, DENSO CORPORATION, and Infineon Technologies AG. These established companies leverage their extensive research and development capabilities, robust distribution networks, and strong relationships with automotive manufacturers to maintain market leadership. It encourages continuous innovation in sensor technology, artificial intelligence, and system integration to meet evolving safety regulations and consumer demands. The market also features numerous smaller and emerging players focusing on niche applications and regional markets, increasing competition and fostering technological advancements. High entry barriers exist due to the complexity of system development, stringent regulatory requirements, and significant capital investment needed for production and certification. The market’s growth depends on the ability of players to offer scalable, cost-effective solutions adaptable to various vehicle segments, including passenger cars, commercial vehicles, and two-wheelers. Regional market dynamics and evolving standards further influence competitive strategies, requiring companies to customize offerings to meet localized needs. It remains critical for market participants to balance innovation with affordability to capture expanding opportunities globally while maintaining compliance with safety and performance standards.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Collision Avoidance System market will experience steady growth driven by increasing safety regulations worldwide.

- Integration of AI and machine learning will enhance system accuracy and predictive capabilities.

- Expansion of autonomous and semi-autonomous vehicles will significantly boost demand for collision avoidance technologies.

- Sensor fusion combining radar, lidar, and cameras will become a standard feature to improve detection reliability.

- Growing urbanization and traffic congestion will increase the need for advanced safety solutions.

- Cost reduction in sensor technologies will enable wider adoption in mid-range and entry-level vehicles.

- Vehicle-to-Everything (V2X) communication will improve real-time hazard detection and preventive responses.

- Emerging markets will offer significant growth opportunities due to rising vehicle sales and regulatory focus on safety.

- Collaboration between automotive manufacturers and technology providers will accelerate innovation and deployment.

- Continuous advancements will focus on minimizing false alarms and enhancing user experience to increase consumer trust.