Market Overview

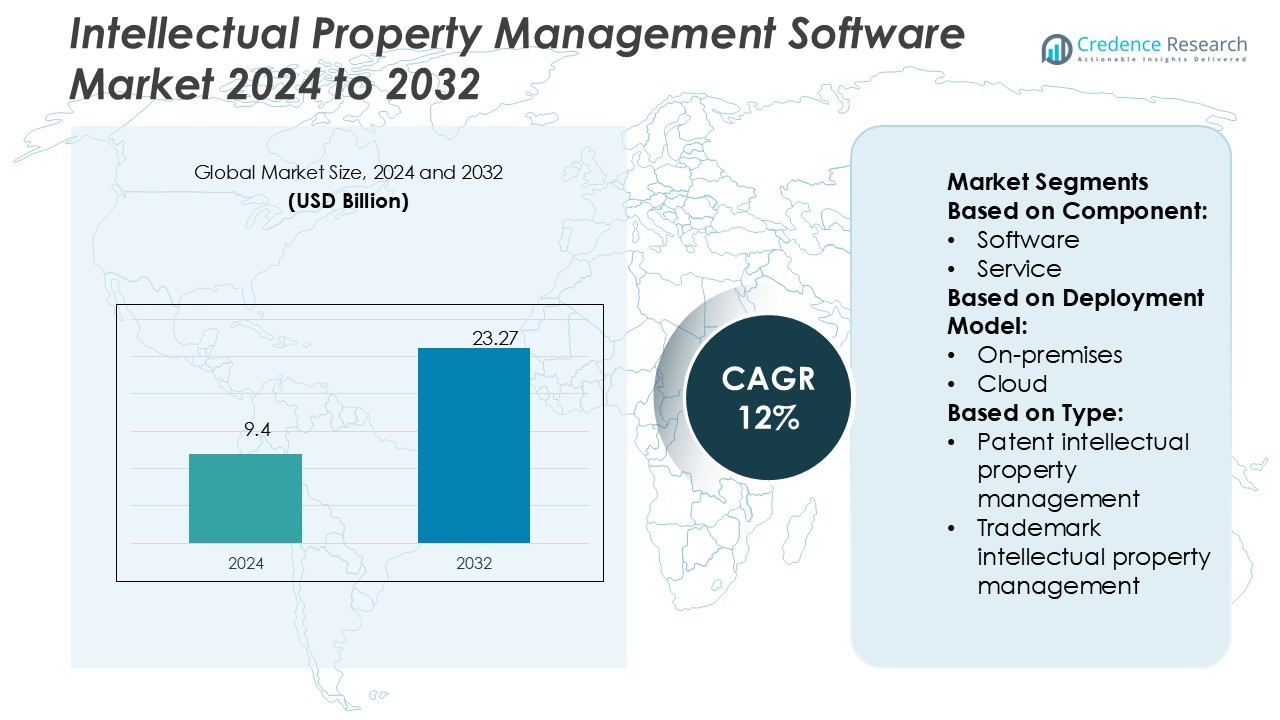

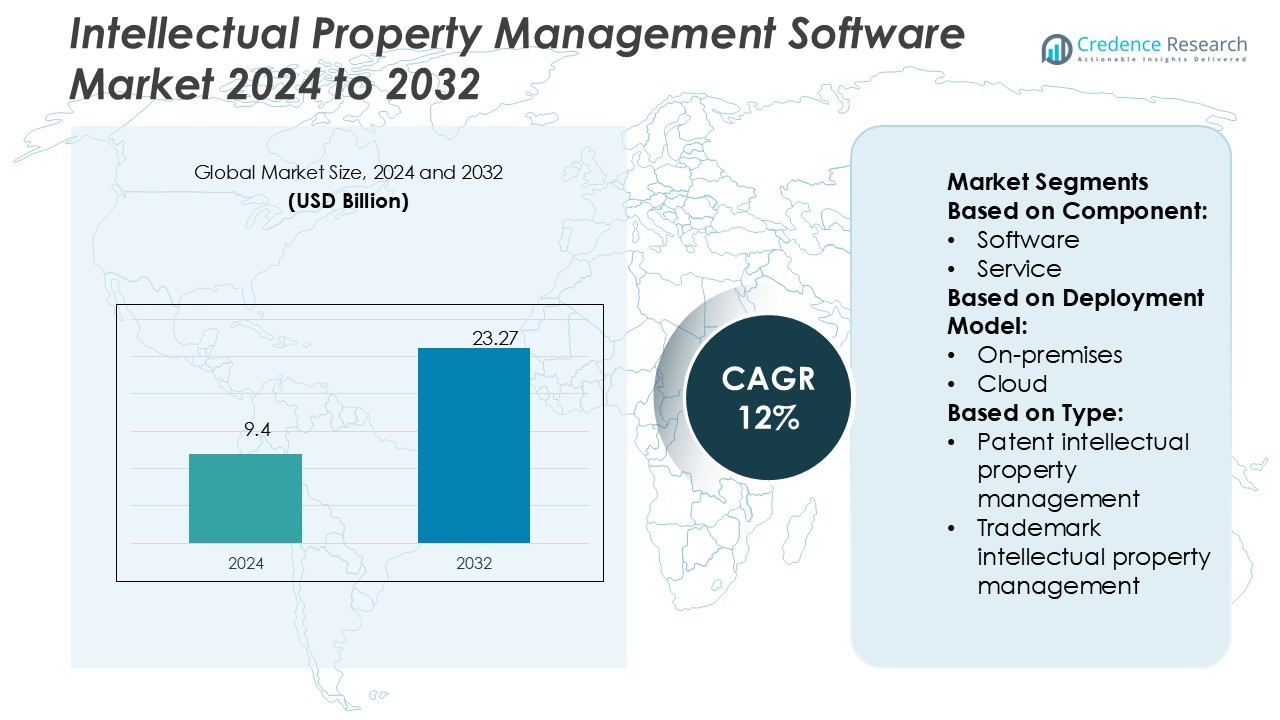

Intellectual Property Management Software Market size was valued USD 9.4 billion in 2024 and is anticipated to reach USD 23.27 billion by 2032, at a CAGR of 12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intellectual Property Management Software Market Size 2024 |

USD 9.4 Billion |

| Intellectual Property Management Software Market, CAGR |

12% |

| Intellectual Property Management Software Market Size 2032 |

USD 23.27 Billion |

The Intellectual Property Management Software Market features strong competition from leading players such as Clarivate PLC, LexisNexis, Anaqua Inc., Questel, Dennemeyer, Patsnap Pte Ltd, PatSeer Technologies Pvt. Ltd, Cardinal IP, WebTMS Limited, and Wellspring Worldwide. These companies compete by offering advanced IP lifecycle management platforms, AI-driven analytics, and cloud-based deployment models to meet rising global demand. North America dominates the market with a 37% share, supported by high patent activity, strong regulatory frameworks, and early adoption of digital IP solutions. The region’s innovation-driven industries and investments in advanced compliance systems solidify its leadership in the global market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Intellectual Property Management Software Market size was USD 9.4 billion in 2024 and will reach USD 23.27 billion by 2032, at a CAGR of 12%.

- Key drivers include rising global patent filings, digital transformation of IP workflows, and growing demand for brand protection in e-commerce and technology sectors.

- Market trends highlight the shift toward cloud-based platforms, AI-powered analytics, and integration with enterprise systems, enabling real-time compliance and predictive portfolio management.

- Competition is strong among leading players offering end-to-end IP solutions, though high implementation costs and data security concerns act as restraints to wider adoption.

- North America leads with 37% share, driven by innovation-intensive industries and advanced regulatory frameworks, while the software segment dominates with nearly 65% share, supported by automation and centralized IP lifecycle management solutions.

Market Segmentation Analysis:

By Component

The Intellectual Property Management Software Market by component is divided into software and service. The software segment dominates with a market share of nearly 65%, supported by rising demand for integrated IP management platforms. Organizations prefer centralized solutions that streamline patent, trademark, and copyright tracking while offering analytics for decision-making. Key drivers include automation of IP workflows, cost reduction through digital platforms, and compliance with global IP regulations. The service segment continues to grow, led by consulting and managed services that enhance adoption and integration.

- For instance, WebTMS Limited provides a comprehensive IP management platform with automated docketing capabilities. Its Data Sync tool can access trademark data from over 180 jurisdictions, and the system includes features such as workflow management and automated updates from official registries.

By Deployment Model

In deployment, cloud-based solutions lead with 58% market share, outpacing on-premises adoption. Cloud deployment is driven by scalability, lower upfront costs, and the ability to support global collaboration. Enterprises benefit from faster updates, real-time data access, and integration with AI-enabled tools for IP portfolio analysis. On-premises models remain relevant for industries with strict data security needs, particularly in pharmaceuticals and defense. However, the shift to cloud is accelerating as organizations focus on operational efficiency and cross-border IP rights management.

- For instance, Dennemeyer selected Managed SD-WAN with NTT to interconnect 20 international offices, creating secure and optimized cloud connectivity across its network.

By Type

Among types, patent intellectual property management is the dominant sub-segment with 42% market share. This growth is driven by the rising number of patent filings across technology, healthcare, and manufacturing sectors. Patent software enables companies to manage applications, monitor lifecycles, and avoid costly lapses in renewals. Trademark and copyright management solutions also show strong growth, propelled by digital branding and content protection needs. Design IP management and other categories are gaining momentum with increasing innovation in consumer goods and creative industries, expanding the market scope.

Key Growth Drivers

Rising Global Patent Filings

The increasing volume of global patent filings is a major growth driver for the Intellectual Property Management Software Market. Companies across technology, pharmaceuticals, and manufacturing sectors seek efficient tools to track, process, and manage intellectual property assets. The complexity of global IP regulations necessitates software solutions that automate filing processes and ensure compliance. As businesses compete to secure innovation leadership, the demand for platforms that manage large patent portfolios, streamline renewals, and protect against infringement risks continues to grow steadily.

- For instance, Questel Orbit Intelligence platform the database included over 100,000 patent families declared essential to 2G, 3G, 4G, and 5G standards. It also included thousands of families with manual essentiality reviews. The database is continually updated.

Shift Toward Digitalization and Automation

Organizations are rapidly digitalizing IP workflows to replace manual processes and outdated systems. Intellectual property management software enables automation in areas such as docketing, renewal tracking, and portfolio analytics. This shift enhances accuracy, reduces administrative costs, and improves decision-making through real-time data insights. The integration of AI and machine learning further strengthens predictive analysis, enabling companies to assess IP valuation and identify infringement risks. Businesses adopting automation gain a competitive edge by increasing efficiency and strengthening IP lifecycle management strategies.

- For instance, Patsnap fully opened 140 data product types across Patent, Bio-Chemical, and Innovation data, supporting 178 million patent entries from 170 patent offices.

Growing Importance of Brand Protection

The rise of e-commerce, digital media, and cross-border trade has intensified the need for brand protection. Trademark and copyright infringements are more frequent, driving demand for advanced IP management solutions. Companies rely on software tools to monitor brand usage, detect violations, and enforce rights across multiple jurisdictions. As digital businesses expand, safeguarding brand assets becomes crucial to maintaining market reputation and revenue streams. The growing awareness of IP as a strategic asset positions brand protection as a critical driver of software adoption.

Key Trends & Opportunities

Adoption of Cloud-Based Platforms

Cloud-based IP management platforms are emerging as a leading trend due to their scalability and cost-effectiveness. Enterprises benefit from centralized data access, real-time collaboration, and seamless integration with AI-driven tools. The cloud also enables cross-border portfolio management, which is increasingly important as companies expand globally. Vendors are enhancing cloud solutions with advanced security features, making them suitable for industries handling sensitive IP. This trend presents opportunities for providers to capture enterprises transitioning from on-premises models to flexible cloud-based systems.

- For instance, IP Pragmatics Wellspring expanded its services to over 900 clients, including universities, research institutions, and government bodies, on a global scale.

Integration of AI and Predictive Analytics

Artificial intelligence and predictive analytics are transforming intellectual property management by providing deeper insights into portfolio performance. These technologies enable predictive renewal forecasting, infringement detection, and valuation analysis. Companies leverage AI tools to identify trends in patent filings, competitive activity, and potential litigation risks. This enhances strategic planning and resource allocation, reducing exposure to costly disputes. The opportunity lies in the increasing adoption of AI-driven platforms that support proactive IP decision-making and help organizations optimize their innovation strategies.

- For instance, LexisNexis launched the Protégé™ AI Assistant in PatentSight+, which draws on a harmonized global database of over 90 million patent family records and more than 100 baked-in patent metrics to answer natural language queries with visual insights.

Key Challenges

High Implementation Costs

The adoption of intellectual property management software often involves significant upfront investments in licensing, customization, and training. Small and medium-sized enterprises may find these costs prohibitive, limiting adoption across diverse sectors. While cloud-based solutions reduce infrastructure expenses, the total cost of ownership remains high due to ongoing subscription fees and integration with existing enterprise systems. This financial barrier slows market penetration in cost-sensitive regions, creating a key challenge for vendors aiming to expand their customer base.

Data Security and Compliance Risks

Managing sensitive intellectual property data across global jurisdictions presents serious security and compliance challenges. Cloud deployment, while efficient, raises concerns over data breaches, unauthorized access, and regulatory non-compliance. Industries such as pharmaceuticals and defense face heightened risks due to the strategic value of their IP assets. Vendors must ensure robust encryption, compliance with regional data laws, and reliable backup systems. Failure to address these risks can lead to loss of client trust and limit the adoption of digital IP management platforms.

Regional Analysis

North America

North America leads the Intellectual Property Management Software Market with 37% share in 2024, supported by strong patent activity in technology and pharmaceuticals. The United States drives adoption due to its large IP-intensive industries, stringent regulatory frameworks, and rising need for patent and trademark portfolio management. Software providers in the region focus on integrating AI and cloud solutions to enhance automation and compliance. Canada contributes steadily, with growing investments in innovation and R&D. The region’s emphasis on safeguarding intellectual property positions it as the dominant market, attracting both established vendors and emerging solution providers.

Europe

Europe accounts for 29% of the Intellectual Property Management Software Market, fueled by robust IP frameworks and cross-border trade within the European Union. Countries such as Germany, the United Kingdom, and France demonstrate strong adoption due to advanced manufacturing, automotive, and pharmaceutical industries. The European Patent Office’s initiatives to streamline filings further support the adoption of digital IP solutions. The region’s emphasis on compliance with GDPR and other regulations encourages vendors to offer secure and integrated platforms. Growing awareness of brand protection and digital innovation sustains demand for advanced IP management tools across Europe.

Asia-Pacific

Asia-Pacific holds 22% market share and is the fastest-growing region in the Intellectual Property Management Software Market. Rapid innovation in China, Japan, South Korea, and India drives strong patent and trademark filings. Expanding technology, electronics, and pharmaceutical industries fuel demand for software that ensures IP protection and lifecycle management. Cloud-based adoption is rising as enterprises seek cost-efficient, scalable solutions for managing large IP portfolios. Governments across the region are strengthening intellectual property laws, encouraging businesses to invest in digital management tools. Asia-Pacific’s growth trajectory highlights its emergence as a major hub for IP-driven industries.

Latin America

Latin America represents 7% of the Intellectual Property Management Software Market, with adoption led by Brazil and Mexico. Rising awareness of IP rights in industries such as consumer goods, agriculture, and healthcare is creating opportunities for software providers. While the region faces challenges like limited IP enforcement and high implementation costs, growing participation in international trade is increasing demand for reliable IP management solutions. Cloud deployment is gaining traction, particularly among SMEs seeking affordable platforms. Vendors targeting localized solutions and compliance support will find strong opportunities in strengthening Latin America’s IP protection ecosystem.

Middle East & Africa

The Middle East & Africa region accounts for 5% market share in the Intellectual Property Management Software Market. Adoption is concentrated in countries such as the United Arab Emirates, Saudi Arabia, and South Africa, where governments are investing in innovation ecosystems and IP frameworks. Industries like oil & gas, healthcare, and technology are driving gradual uptake of IP solutions. Challenges include low awareness and limited digital infrastructure in certain parts of the region. However, rising startup activity, coupled with government-backed IP initiatives, is expected to expand adoption and enhance regional growth prospects over the forecast period.

Market Segmentations:

By Component:

By Deployment Model:

By Type:

- Patent intellectual property management

- Trademark intellectual property management

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Intellectual Property Management Software Market is highly competitive, with key players including WebTMS Limited, Anaqua Inc., Dennemeyer, Questel, Clarivate PLC, Patsnap Pte Ltd, Cardinal IP, Wellspring Worldwide, LexisNexis, and PatSeer Technologies Pvt. Ltd. The Intellectual Property Management Software Market is characterized by intense competition, driven by rising innovation, digital adoption, and globalization of intellectual property rights. Vendors differentiate themselves through AI-driven analytics, cloud-based platforms, and end-to-end lifecycle management solutions that enhance efficiency and compliance. The market is witnessing a strong shift toward automation, enabling organizations to streamline complex processes such as patent filing, trademark monitoring, and renewal management. Companies also focus on delivering scalable platforms that cater to both large enterprises and SMEs. Strategic collaborations, product enhancements, and integration with predictive analytics remain critical factors shaping the competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- WebTMS Limited

- Anaqua Inc.

- Dennemeyer

- Questel

- Clarivate PLC

- Patsnap Pte Ltd

- Cardinal IP

- Wellspring Worldwide

- LexisNexis

- PatSeer Technologies Pvt. Ltd

Recent Developments

- In February 2025, Eventdex.com, a provider of event management software, launched an integrated event suite to enhance event experience, operational efficiency, and event planning. The suite combines three tools: Gala Event Seating Software, Custom Event Badge Printing Software, and Event Floor Plan Software.

- In September 2024, Stova, an event management technology provider, launched an exhibitor management solution named Exhibitor Resource Center (ERC) for event professionals, sponsors, and exhibitors. ERC features include task management, sponsorship management, actionable insights, and seamless integration with other systems and tools.

- In May 2023, Accenture and Blue Yonder, Inc. announced the expansion of their strategic partnership to enhance organizations’ supply chains by leveraging Accenture’s technology and industry expertise. Accenture’s cloud-native platform engineers and industry experts will collaborate with Blue Yonder to develop new solutions on the Blue Yonder Luminate Platform, offering end-to-end supply chain synchronization.

- In April 2023, Oracle introduced advanced artificial intelligence (AI) and automation capabilities designed to assist customers in optimizing their supply chain management processes. These new features leveraged AI and automation technologies to enhance efficiency, streamline operations, and enable better decision-making within supply chain management for its customers.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Model, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising patent and trademark filings across industries.

- Cloud-based IP management platforms will continue to gain wider adoption.

- AI and machine learning will play a central role in predictive portfolio analysis.

- Enterprises will demand stronger compliance solutions to meet global IP regulations.

- Brand protection tools will see higher adoption due to digital content growth.

- SMEs will increasingly invest in cost-effective and scalable IP management solutions.

- Integration of IP tools with enterprise systems will strengthen decision-making processes.

- Data security will remain a priority, driving innovation in encrypted platforms.

- Cross-border IP management will grow as businesses expand internationally.

- Vendors will focus on partnerships and acquisitions to expand service offerings.