Market Overview

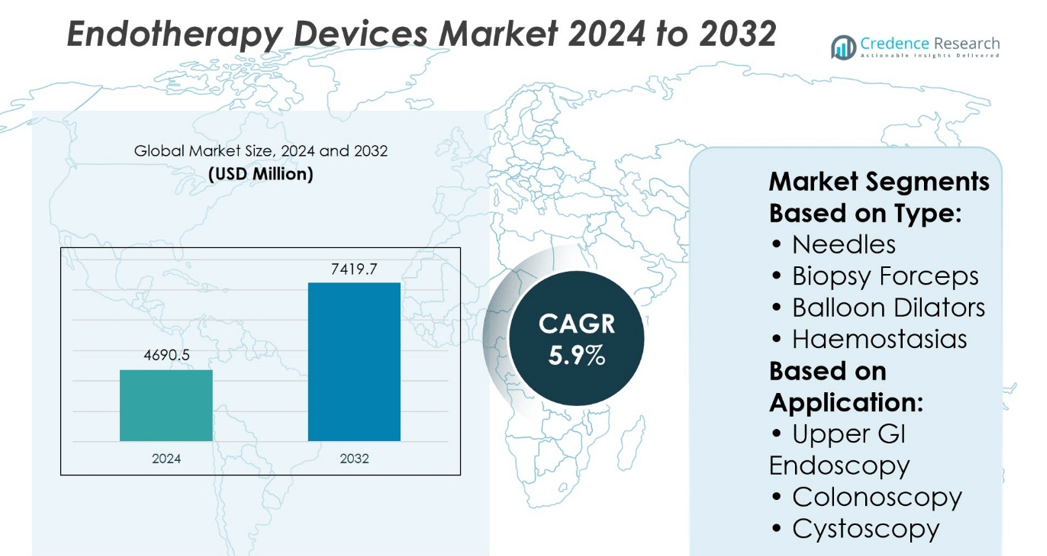

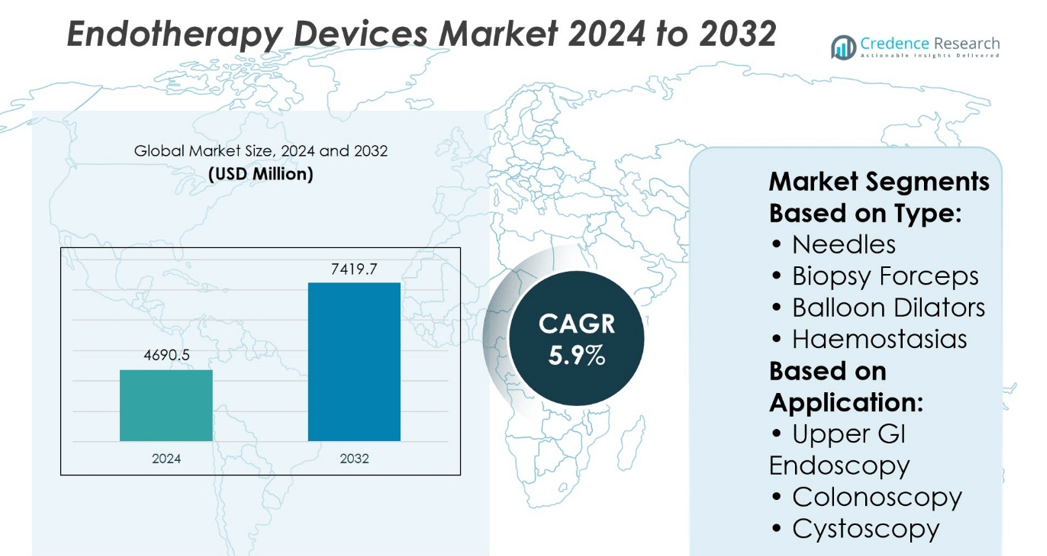

Endotherapy Devices Market size was valued at USD 4690.5 million in 2024 and is anticipated to reach USD 7419.7 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Endotherapy Devices Market Size 2024 |

SD 4690.5 million |

| Endotherapy Devices Market, CAGR |

5.9% |

| Endotherapy Devices Market Size 2032 |

USD 7419.7 million |

The Endotherapy Devices Market experiences strong growth driven by rising demand for minimally invasive procedures and increasing prevalence of gastrointestinal and urological disorders. It benefits from advancements in device technology, including enhanced precision, improved imaging, and integration of robotics. Expanding healthcare infrastructure and growing awareness of early diagnosis fuel adoption globally. The market trends toward development of disposable devices to reduce infection risks and the incorporation of smart manufacturing techniques to boost production efficiency. Growing investments in physician training and increasing preference for outpatient procedures further support market expansion, positioning it for sustained growth amid evolving clinical needs and regulatory landscapes.

The Endotherapy Devices Market shows strong regional growth, with Asia-Pacific leading due to rapid healthcare infrastructure expansion and rising disease prevalence, followed by significant shares in North America and Europe driven by technological innovation and stringent regulations. Emerging markets in Latin America and the Middle East offer growing opportunities. Key players leverage advanced technologies and strategic partnerships to maintain market leadership and address diverse regional demands. Their global presence and focus on innovation enable them to capitalize on expanding adoption of minimally invasive procedures worldwide.

Market Insights

- The Endotherapy Devices Market size was valued at USD 4690.5 million in 2024 and is expected to reach USD 7419.7 million by 2032, growing at a CAGR of 5.9%.

- Rising demand for minimally invasive procedures and increasing prevalence of gastrointestinal and urological disorders drive market growth.

- Advancements in device technology, such as enhanced precision, improved imaging, and robotics integration, support market expansion.

- Development of disposable devices reduces infection risks, while smart manufacturing techniques improve production efficiency.

- Growing investments in physician training and a shift toward outpatient procedures further fuel adoption.

- Asia-Pacific leads regional growth due to rapid healthcare infrastructure development and rising disease prevalence.

- North America and Europe hold significant shares driven by innovation and regulatory standards, while Latin America and the Middle East present emerging opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increasing Prevalence of Gastrointestinal Disorders Fuels Demand for Endotherapy Devices

The rising incidence of gastrointestinal disorders worldwide significantly propels the growth of the Endotherapy Devices Market. Conditions such as gastrointestinal bleeding, strictures, and early-stage cancers require minimally invasive therapeutic interventions, increasing the need for advanced endotherapy tools. It supports healthcare providers in offering effective treatments with reduced patient recovery times and complications. Growing awareness among patients and physicians about the benefits of endoscopic therapies further drives adoption. The increasing volume of diagnostic endoscopies coupled with therapeutic procedures boosts demand for sophisticated devices. This trend is particularly notable in regions with expanding healthcare infrastructure and aging populations.

- For instance, Boston Scientific reported performing over 120,000 endoscopic procedures using its advanced hemostasis devices in 2023, reflecting growing clinical adoption of minimally invasive solutions.

Technological Innovations Enhance Device Capabilities and Clinical Outcomes

Continuous technological advancements improve the efficiency, safety, and versatility of endotherapy devices, driving market expansion. Innovations such as high-definition imaging, advanced electrosurgical tools, and novel tissue resection techniques enable precise diagnosis and treatment. It allows physicians to perform complex procedures with greater accuracy and less invasiveness. The integration of robotics and AI into endoscopic platforms enhances procedural control and decision-making support. Manufacturers invest heavily in research and development to introduce multifunctional devices that reduce procedure time and enhance patient outcomes. These developments position the Endotherapy Devices Market for sustained growth.

- For instance, Medtronic introduced an electrosurgical generator capable of delivering up to 300 watts of controlled power in 2023, enhancing precision during complex tissue resections and reducing procedure time.

Growing Preference for Minimally Invasive Procedures Across Healthcare Settings

Increasing demand for minimally invasive therapeutic procedures significantly boosts the Endotherapy Devices Market. Patients prefer endoscopic interventions due to reduced pain, shorter hospital stays, and quicker recovery compared to traditional surgery. It encourages healthcare providers to adopt endotherapy solutions for treating various gastrointestinal conditions. Hospitals and outpatient centers expand their endoscopic service offerings to meet patient expectations and improve operational efficiency. Insurance coverage and reimbursement policies increasingly support minimally invasive procedures, further driving market penetration. The preference shift is especially strong in developed economies with advanced healthcare systems.

Expansion of Healthcare Infrastructure and Rising Procedure Volumes in Emerging Markets

Rapid expansion of healthcare infrastructure in emerging economies creates substantial growth opportunities for the Endotherapy Devices Market. Increasing investments in hospital modernization and medical equipment acquisition enable wider adoption of endotherapy technologies. It helps meet the growing demand generated by rising awareness and improved access to specialized care. The increasing number of trained gastroenterologists and endoscopic specialists contributes to higher procedure volumes. Emerging markets witness growing government initiatives to improve healthcare quality, further supporting device demand. This geographic diversification strengthens the market’s global footprint and growth potential.

Market Trends

Increasing Adoption of Advanced Imaging and Diagnostic Technologies

The Endotherapy Devices Market witnesses strong growth driven by the integration of advanced imaging technologies such as high-definition endoscopy, narrow-band imaging, and confocal laser endomicroscopy. These technologies improve visualization of gastrointestinal tissues, enabling earlier detection and more accurate diagnosis of diseases. It empowers clinicians to perform targeted therapeutic interventions, reducing procedure times and improving patient outcomes. Rising demand for real-time imaging tools encourages manufacturers to develop devices with enhanced optical capabilities. The trend also includes growing use of disposable endoscopes to prevent infections and improve safety. This focus on precision and safety shapes the competitive landscape of the market.

Expansion of Robotic-Assisted and AI-Enabled Endotherapy Systems

The incorporation of robotic assistance and artificial intelligence (AI) significantly transforms the Endotherapy Devices Market. Robotics enhance device maneuverability, stability, and precision during complex therapeutic procedures, improving procedural success rates. It supports minimally invasive techniques with greater dexterity and control. AI algorithms assist in image analysis, lesion detection, and treatment planning, providing clinicians with decision-making support. Continuous advancements in machine learning promote development of smarter endoscopic platforms capable of predictive analytics. This trend drives adoption in leading healthcare facilities and stimulates ongoing innovation in device capabilities.

- For instance, Intuitive Surgical’s da Vinci robotic systems have been utilized in over 14 million procedures globally, demonstrating their widespread adoption and effectiveness in minimally invasive surgeries.

Growing Preference for Minimally Invasive Therapeutic Procedures

The Endotherapy Devices Market benefits from a rising preference for minimally invasive treatments over traditional surgical methods. Patients and healthcare providers favor endoscopic interventions due to reduced pain, shorter hospital stays, and faster recovery periods. It encourages healthcare centers to expand their endotherapy service offerings, creating demand for a wider range of devices. Rising procedure volumes for gastrointestinal bleeding, polypectomy, and strictures contribute to market expansion. This shift also aligns with evolving insurance reimbursement policies that favor minimally invasive care. The trend supports sustained growth in device utilization globally.

- For instance, the TESSYS endoscopic spine surgery method uses an 8–10 mm incision and achieves immediate pain relief in 90 percent of cases, with documented success rates exceeding 93 percent.

Increasing Focus on Emerging Markets and Healthcare Infrastructure Development

Emerging markets represent a key trend shaping the Endotherapy Devices Market’s growth trajectory. Expanding healthcare infrastructure, rising disposable incomes, and improving access to specialized care drive increased demand for advanced endotherapy solutions. It motivates manufacturers to localize production and establish partnerships with regional distributors. Training programs for healthcare professionals in these regions enhance procedural adoption and patient outcomes. Government initiatives aimed at reducing gastrointestinal disease burden further stimulate market penetration. The growing presence in emerging economies diversifies revenue streams and strengthens the global market position.

Market Challenges Analysis

High Cost of Advanced Endotherapy Devices Limits Market Accessibility

The Endotherapy Devices Market faces challenges due to the high cost associated with advanced technologies and devices. These expenses restrict adoption, particularly in price-sensitive and emerging markets where healthcare budgets remain constrained. It demands significant capital investment from healthcare providers, slowing the replacement and upgrade cycles of existing equipment. High device costs also affect insurance reimbursements and out-of-pocket expenses for patients, limiting widespread acceptance. Smaller clinics and outpatient centers often struggle to afford sophisticated endotherapy systems, which hampers market penetration. The cost barrier encourages manufacturers to balance innovation with affordability to broaden access. Managing pricing while maintaining technological advancements remains a critical challenge.

Regulatory Complexities and Requirement for Skilled Professionals Impact Growth

The Endotherapy Devices Market contends with stringent regulatory requirements that prolong product approval timelines and increase compliance costs. It must navigate complex certification processes across different regions, which slows the introduction of new devices. The demand for highly skilled gastroenterologists and trained technicians further challenges market expansion. Limited availability of trained professionals in many regions restricts the adoption of advanced endotherapy techniques. Training programs and certifications require time and resources, impacting the speed at which healthcare facilities can integrate new technologies. This gap between technological capability and operator expertise poses a significant barrier to growth. Continuous efforts to enhance training and streamline regulatory pathways are essential to overcome these challenges.

Market Opportunities

Expansion of Healthcare Infrastructure and Rising Procedure Volumes in Emerging Economies

The Endotherapy Devices Market gains significant opportunities from rapid healthcare infrastructure development in emerging economies. Increasing investments in hospital modernization and the establishment of specialized gastroenterology centers drive demand for advanced endotherapy devices. It benefits from rising awareness of gastrointestinal diseases and improved access to minimally invasive treatments in these regions. Growing numbers of trained specialists and expanding insurance coverage support higher procedure volumes. Localization of manufacturing and supply chains helps reduce costs and improve availability. The increasing focus on early diagnosis and treatment further expands the market’s growth potential. These factors collectively create a favorable environment for sustained market expansion.

Technological Advancements and Diversification of Endotherapy Applications

Technological innovation opens new avenues for growth within the Endotherapy Devices Market. The development of multifunctional devices that combine diagnostic and therapeutic capabilities enhances clinical efficiency and patient outcomes. It supports the growing demand for treatments targeting a broader range of gastrointestinal disorders, including cancer, bleeding, and strictures. Emerging technologies such as robotic assistance and artificial intelligence improve precision and procedural safety, attracting adoption in advanced healthcare settings. The increasing use of disposable and single-use devices addresses infection control concerns and regulatory pressures. This diversification of applications and device types broadens market opportunities and encourages ongoing product development.

Market Segmentation Analysis:

By Type:

The Endotherapy Devices Market segments into various device types that cater to diverse therapeutic needs within gastrointestinal and urological procedures. Needle devices hold a critical position due to their essential role in injections and tissue sampling during endoscopic interventions. Biopsy forceps serve widespread applications in obtaining tissue samples for diagnostic purposes, contributing significantly to early disease detection. Balloon dilators support treatment of strictures by facilitating controlled expansion of narrowed passages. Haemostasias devices play a vital role in managing gastrointestinal bleeding, offering efficient and immediate control of hemorrhages. Snares assist in polypectomy and tissue removal, enhancing procedural effectiveness. Catheters, sphincterotomes, guide wires, and stents collectively enable intricate interventions such as bile duct drainage and sphincterotomies. Retrieval nets facilitate safe removal of foreign bodies or tissue fragments, ensuring comprehensive treatment. Each device type addresses specific clinical challenges, contributing to the market’s diverse product portfolio.

- For instance, Cook Medical reported producing approximately 0.8 million biopsy needles annually, reflecting strong clinical demand.

By Application:

The application segment of the Endotherapy Devices Market divides into upper gastrointestinal (GI) endoscopy, colonoscopy, and cystoscopy procedures. Upper GI endoscopy dominates demand due to its extensive use in diagnosing and treating esophageal, gastric, and duodenal disorders. The segment benefits from increasing prevalence of acid reflux, ulcers, and early-stage cancers that require minimally invasive treatment. Colonoscopy applications continue to expand owing to rising colorectal cancer screening programs and detection of polyps and inflammatory bowel diseases. Cystoscopy, while smaller in comparison, gains momentum through growing incidence of urinary tract disorders and bladder cancer interventions. It presents opportunities for device manufacturers to develop specialized tools that meet unique anatomical and procedural requirements. The market’s segmentation by application enables targeted innovation and customized device offerings to enhance clinical outcomes.

- For instance, Biopsy forceps, like those manufactured by Boston Scientific, are essential tools for tissue sampling during medical procedures. Boston Scientific produces approximately 1.2 million units annually to support various tissue excision procedures.

Segments:

Based on Type:

- Needles

- Biopsy Forceps

- Balloon Dilators

- Haemostasias

Based on Application:

- Upper GI Endoscopy

- Colonoscopy

- Cystoscopy

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America commands approximately 30% of the Endotherapy Devices Market, driven by its advanced healthcare infrastructure and high adoption of cutting-edge technologies. The United States leads the region due to substantial investments in research and development, growing prevalence of gastrointestinal diseases, and a well-established reimbursement framework. The market benefits from a strong presence of key device manufacturers and extensive use of minimally invasive procedures. Rising awareness of early diagnosis and treatment options fuels demand for sophisticated endotherapy devices. Canada and Mexico contribute through increasing healthcare expenditure and expanding specialty care centers. North America’s regulatory environment supports innovation while ensuring high safety standards, which encourages continuous product advancements.

Europe

Europe holds nearly 25% of the Endotherapy Devices Market, supported by countries such as Germany, France, and the UK that prioritize healthcare innovation and patient safety. Strict regulatory frameworks mandate the adoption of advanced devices that comply with high-quality standards. The region experiences growing prevalence of gastrointestinal and urological disorders, fueling demand for diagnostic and therapeutic endoscopy procedures. Investments in public and private healthcare infrastructure, alongside increasing geriatric population, sustain market growth. The presence of specialized research centers promotes continuous technological improvements. Expanding awareness campaigns and screening programs, particularly for colorectal cancer, also drive colonoscopy applications. The integration of robotics and AI in endotherapy devices further strengthens Europe’s market position.

Asia-Pacific

The Asia-Pacific region dominates the Endotherapy Devices Market with close to 35% share, propelled by rapid industrialization, rising healthcare spending, and expanding access to advanced medical technologies. Countries like China, India, Japan, and South Korea contribute significantly due to large patient populations and growing prevalence of digestive diseases. Improving healthcare infrastructure and government initiatives focused on early disease detection support increased procedural volumes. The rise in private healthcare facilities and growing medical tourism also enhance demand for state-of-the-art endotherapy devices. Local manufacturing capabilities are expanding, reducing costs and improving device availability. Training and awareness programs for medical professionals boost adoption rates. The region presents lucrative opportunities for manufacturers seeking market expansion.

Latin America and Middle East & Africa

Latin America and the Middle East & Africa collectively hold around 10% of the Endotherapy Devices Market. Latin America, led by Brazil, Mexico, and Argentina, experiences steady growth driven by increasing healthcare investments and expanding insurance coverage. Growing awareness of gastrointestinal diseases and rising procedure volumes contribute to market demand. However, economic fluctuations and infrastructural challenges limit rapid expansion. The Middle East & Africa region, including countries such as Saudi Arabia, UAE, South Africa, and Egypt, sees growing adoption due to healthcare modernization and rising incidences of chronic diseases. Government initiatives to improve medical facilities and enhance training for specialists support market growth. Both regions attract investments from global manufacturers seeking to tap into these emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medtronic plc

- Boston Scientific Corporation

- Fujifilm Corporation

- Conmed Corporation

- Johnson & Johnson

- Braun

- Karl Storz

- Intuitive Surgical

- I. Tech Co Ltd

- Cook Medical

Competitive Analysis

The Endotherapy Devices Market remains highly competitive, dominated by established global players such as Medtronic plc, Boston Scientific Corporation, Johnson & Johnson, Fujifilm Corporation, Karl Storz, Intuitive Surgical, B.Braun, Cook Medical, Conmed Corporation, and M.I. Tech Co Ltd. The Endotherapy Devices Market experiences intense competition driven by rapid technological advancements and increasing demand for minimally invasive procedures. Companies focus on innovation to develop devices with enhanced precision, improved patient safety, and greater procedural efficiency. The market emphasizes integrating smart technologies such as robotics, advanced imaging, and digital connectivity to differentiate products. Competitive strategies include expanding geographic presence, optimizing supply chains, and offering comprehensive customer support and training. Compliance with stringent regulatory standards and adaptability to evolving healthcare policies remain essential for maintaining market position. Pricing strategies and product customization to meet diverse clinical requirements also influence competitiveness. Overall, the market thrives on continuous innovation, operational excellence, and responsiveness to changing medical needs, fostering a dynamic environment for growth and development.

Recent Developments

- In June 2024, B. Braun announced the launch of its new ACCEL All-Purpose and Biliary Drainage Catheters with TrueGlide Hydrophilic Coating for percutaneous drainage. The catheter features large oval holes designed to maximize fluid drainage volume, while the TrueGlide Hydrophilic Coating helps with a smooth catheter insertion. This product launch may help the company to enhance its business revenue.

- In May 2024, Cook Medical launched the next-generation EchoTip AcuCore Endoscopic Ultrasound (EUS) Biopsy Needle in the U.S. The AcuCore needle is designed with a Franseen tip made of a cobalt chromium alloy, which allows physicians to puncture tissue with flexibility, minimum force and controlled precision.

- In April 2025, Medtronic announced a strategic distribution agreement to introduce the Dragonfly pancreaticobiliary endoscopy system in selected U.S. academic and clinical centers starting in 2025.

- In April 2024, Medtronic unveiled the ColonPRO™ software upgrade for its GI Genius™ intelligent endoscopy system at the Genius Summit 2024.

Market Concentration & Characteristics

The Endotherapy Devices Market exhibits a moderately concentrated structure dominated by several established global manufacturers that hold significant shares due to their technological expertise and extensive distribution networks. It operates within a competitive environment where innovation, quality, and regulatory compliance determine market positioning. High entry barriers arise from the need for advanced research and development capabilities, stringent safety standards, and substantial capital investment in manufacturing facilities. The market characteristics include a strong focus on product differentiation through the integration of cutting-edge technologies such as robotics and enhanced imaging. It maintains a balance between the demand for minimally invasive procedures and the increasing preference for advanced therapeutic solutions. While large players dominate original equipment manufacturing, numerous regional and specialized companies contribute to the aftermarket segment, addressing replacement and maintenance needs. The market’s dynamic nature requires continuous adaptation to evolving clinical practices and regulatory frameworks. It encourages collaboration between device manufacturers, healthcare providers, and regulatory bodies to ensure product safety and efficacy. Overall, the Endotherapy Devices Market combines technological sophistication with diverse applications, demanding that companies sustain innovation leadership and operational excellence to secure long-term growth.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow due to increasing demand for minimally invasive diagnostic and therapeutic procedures.

- Manufacturers will focus on developing devices with enhanced precision and improved patient safety.

- Integration of robotics and AI technologies will advance procedural efficiency.

- Expansion of healthcare infrastructure in emerging markets will create new growth opportunities.

- Rising prevalence of gastrointestinal and urological diseases will drive device adoption.

- Development of disposable and single-use devices will reduce infection risks and improve convenience.

- Collaboration between manufacturers and healthcare providers will accelerate innovation and product customization.

- Regulatory frameworks will continue to evolve, prompting companies to improve compliance and quality standards.

- Increasing investments in training programs will enhance physician proficiency in endotherapy procedures.

- The shift toward outpatient and ambulatory care settings will boost demand for portable and user-friendly devices.