Market Overview

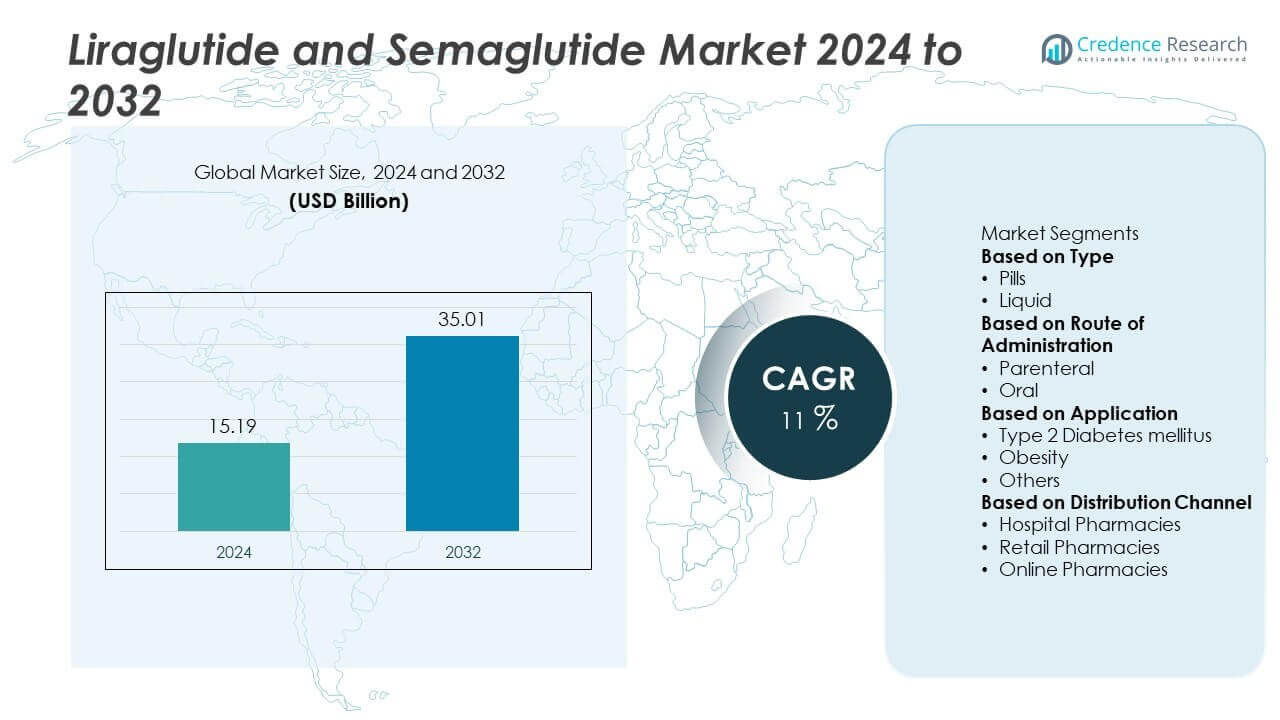

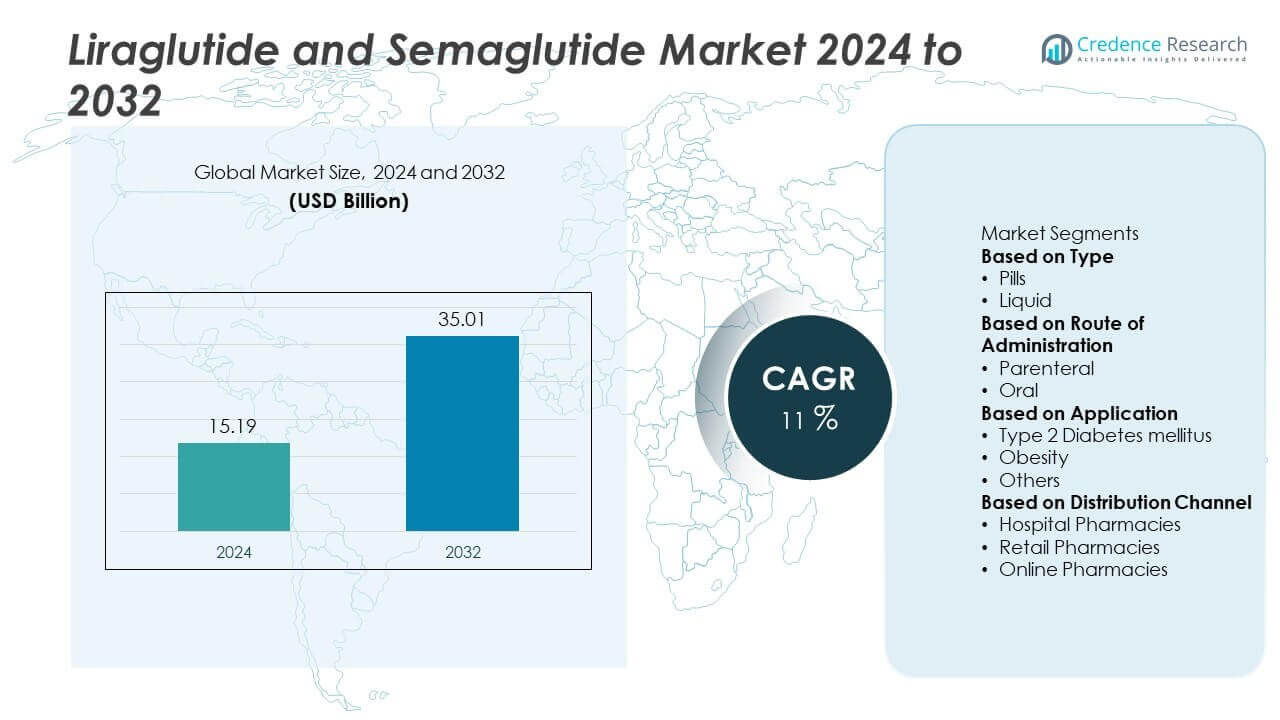

The Liraglutide and Semaglutide Market was valued at USD 15.19 billion in 2024 and is projected to reach USD 35.01 billion by 2032, expanding at a CAGR of 11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liraglutide and Semaglutide Market Size 2024 |

USD 15.19 Billion |

| Liraglutide and Semaglutide Market, CAGR |

11% |

| Liraglutide and Semaglutide Market Size 2032 |

USD 35.01 Billion |

The Liraglutide and Semaglutide market is driven by top players including Bachem Holding AG, Novo Nordisk A/S, Eli Lilly and Company, HEC Pharma Co., Pfizer Inc., Boehringer Ingelheim International GmbH, Shenzhen JYMed Technology Co. Ltd., Teva Pharmaceutical Industries Ltd., Sanofi, and Sun Pharmaceutical Industries Ltd. These companies focus on expanding GLP-1 portfolios, developing biosimilars, and advancing oral formulations to strengthen market presence. Regionally, North America led the market in 2024 with 44% share, supported by high diabetes and obesity prevalence and strong adoption of injectable and oral therapies. Europe held 28% share, driven by strict treatment guidelines and widespread access, while Asia-Pacific accounted for 19%, emerging as the fastest-growing region due to rising healthcare investments and increasing disease burden.

Market Insights

Market Insights

- The Liraglutide and Semaglutide market was valued at USD 15.19 billion in 2024 and is projected to reach USD 35.01 billion by 2032, growing at a CAGR of 11% during 2024–2032.

- Rising prevalence of type 2 diabetes and obesity fuels demand, with the type 2 diabetes segment leading at 64% share in 2024, supported by proven efficacy in glycemic control and cardiovascular risk reduction.

- Key trends include the growing adoption of oral semaglutide, expanded approvals for obesity management, and strong pipeline developments in advanced GLP-1 formulations.

- The market is competitive with players such as Bachem Holding AG, Novo Nordisk A/S, Eli Lilly and Company, HEC Pharma Co., Pfizer Inc., Boehringer Ingelheim International GmbH, Shenzhen JYMed Technology Co. Ltd., Teva Pharmaceutical Industries Ltd., Sanofi, and Sun Pharmaceutical Industries Ltd. focusing on innovation and biosimilars.

- Regionally, North America led with 44% share, followed by Europe at 28% and Asia-Pacific at 19%, while Latin America and Middle East & Africa accounted for 6% and 3%, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The liquid formulation segment dominated the Liraglutide and Semaglutide market in 2024, holding 82% share. Its leadership stems from the widespread use of injectable pens for both diabetes and obesity management, offering reliable dosing and high patient acceptance. Pharmaceutical companies prioritize liquid-based products due to established delivery methods and proven efficacy. Pills, while emerging as an alternative, face challenges related to absorption and bioavailability. However, ongoing research into oral semaglutide formulations indicates potential for future growth. Despite this, liquid injectables remain the preferred and dominant segment in current treatment landscapes.

- For instance, Novo Nordisk’s Ozempic liquid injectable pen, containing the active ingredient semaglutide, has an absolute bioavailability of approximately 89% when administered subcutaneously.

By Route of Administration

Parenteral administration led the market in 2024 with 85% share, driven by the established use of subcutaneous injections in managing type 2 diabetes and obesity. Injectable delivery ensures higher bioavailability and faster therapeutic action, making it the preferred choice among healthcare providers. The strong adoption of pre-filled injection devices also supports patient compliance. Oral administration is gradually expanding, fueled by the introduction of oral semaglutide, which provides a more convenient alternative for patients reluctant to use injections. Still, the parenteral route continues to dominate due to proven clinical outcomes and widespread adoption.

- For instance, Eli Lilly’s once-weekly injectable GLP-1 receptor agonist, Trulicity (dulaglutide), is used along with diet and exercise to manage type 2 diabetes and reduce cardiovascular risk.

By Application

The type 2 diabetes mellitus segment held the largest share of 64% in 2024, making it the dominant application area for Liraglutide and Semaglutide. Rising global prevalence of diabetes, increasing awareness of early intervention, and proven efficacy of GLP-1 receptor agonists in glycemic control fuel this dominance. Obesity treatment is the fastest-growing segment, supported by growing recognition of GLP-1 drugs in weight management beyond diabetes care. While “others,” including cardiovascular risk reduction, contribute marginally, the large diabetic patient base ensures that type 2 diabetes continues to drive the majority of prescriptions and market demand.

Key Growth Drivers

Rising Prevalence of Diabetes and Obesity

The increasing global burden of type 2 diabetes and obesity is a major driver for the Liraglutide and Semaglutide market. Sedentary lifestyles, poor diets, and rising obesity rates have fueled demand for effective GLP-1 receptor agonists. These drugs not only improve glycemic control but also promote significant weight loss, making them attractive for dual indications. With the World Health Organization reporting a surge in diabetes prevalence worldwide, demand for effective therapies such as Liraglutide and Semaglutide continues to grow, supporting strong market expansion.

- For instance, Novo Nordisk reported that its obesity care drugs, Wegovy (semaglutide) and Saxenda (liraglutide), effectively aid weight loss and improve glycemic control. In 2024, the company’s entire obesity care portfolio reached 2.2 million people.

Proven Clinical Efficacy and Expanded Indications

The robust clinical outcomes of Liraglutide and Semaglutide drive their adoption across diverse patient groups. Both drugs demonstrate superior results in glycemic control, weight reduction, and cardiovascular risk management, compared to conventional therapies. Regulatory approvals for expanded indications, including obesity management and cardiovascular risk reduction, further strengthen demand. Physicians prefer these therapies for their ability to address multiple comorbidities simultaneously. The growing body of clinical evidence supports long-term use, enhancing physician confidence and patient adoption, which boosts overall market growth.

- For instance, Eli Lilly’s GLP-1 receptor agonist, Trulicity (dulaglutide), demonstrated dose-dependent reductions in HbA1c and body weight during the AWARD-11 clinical trial. For the 4.5 mg dose, trial data showed a superior reduction in HbA1c of 1.9 percentage points and a weight decrease of 4.7 kg (\(10.4\) pounds) after 36 weeks compared to the 1.5 mg dose

Advancements in Drug Delivery and Formulations

Innovation in drug delivery systems, including oral semaglutide, significantly enhances market potential. While injectables dominate, the availability of oral formulations provides a convenient alternative for patients reluctant to use injections, improving treatment adherence. Pharmaceutical companies are investing heavily in developing next-generation formulations with improved absorption and extended-release profiles. These advancements are increasing accessibility and broadening the patient pool. With oral formulations gaining regulatory approvals and commercial traction, advancements in drug delivery represent a critical driver shaping the future growth of this market.

Key Trends & Opportunities

Growing Adoption Beyond Diabetes Care

A significant trend in the market is the rising adoption of Liraglutide and Semaglutide for obesity management beyond diabetes treatment. Clinical trials and real-world evidence demonstrate their strong efficacy in weight loss, leading to growing prescriptions for non-diabetic patients with obesity. This trend opens new commercial opportunities, as obesity is a global health challenge with limited effective therapies. Pharmaceutical companies are leveraging this shift by seeking broader regulatory approvals, further strengthening their market position in weight management.

- For instance, Sun Pharmaceutical launched a generic formulation of liraglutide (approved by Australia’s Therapeutic Goods Administration) in Australia across three brands-Benedo, Liraglutide RBX, and Liraglutide Sun in March 2025. The product’s launch was supported by bioequivalence data, and the medication is used for the treatment of diabetes and obesity management

Expansion in Emerging Markets

Emerging markets present major opportunities due to rising diabetes prevalence and improving healthcare infrastructure. Countries in Asia-Pacific and Latin America are witnessing increasing adoption of GLP-1 drugs, supported by rising health awareness and government initiatives for chronic disease management. Although high costs remain a barrier, expanding availability of generics and strategic partnerships with local distributors are enhancing accessibility. As healthcare investments rise, these regions provide significant growth prospects for companies seeking to expand their global footprint in the Liraglutide and Semaglutide market.

- For instance, Lupin Pharmaceuticals is developing a generic semaglutide for launch in India by 2026 for the injectable version and fiscal year 2027 for the oral version. The company is positioning itself to be among the first generics launched in India after key patents expire, with plans to make the injectable version available through a partnership and the oral version developed in-house.

Key Challenges

High Cost and Limited Accessibility

The high pricing of Liraglutide and Semaglutide remains a major challenge, particularly in developing economies. Despite their proven efficacy, affordability issues limit adoption among middle- and low-income populations. Reimbursement restrictions in several regions further reduce patient access, slowing overall uptake. This cost barrier forces healthcare providers in cost-sensitive markets to rely on cheaper alternatives, impacting the growth potential of GLP-1 drugs. To expand reach, companies must focus on pricing strategies, insurance coverage negotiations, and developing affordable formulations.

Patient Adherence and Side Effects

Ensuring long-term adherence remains a challenge, as many patients discontinue treatment due to gastrointestinal side effects such as nausea and vomiting. Reluctance toward injectable formulations also contributes to poor compliance, particularly in patients with needle aversion. Even with the introduction of oral semaglutide, maintaining consistent adherence over prolonged treatment cycles is difficult. Addressing these challenges requires robust patient education, support programs, and continued improvements in drug formulations to minimize side effects and enhance tolerability for sustained therapy success.

Regional Analysis

North America

North America dominated the Liraglutide and Semaglutide market in 2024 with 44% share, supported by high prevalence of type 2 diabetes and obesity. Strong healthcare infrastructure, favorable reimbursement policies, and early adoption of GLP-1 therapies drive growth in the region. The U.S. leads with robust clinical research, high prescription rates, and broad availability of branded and oral formulations. Rising awareness of obesity-related risks further boosts uptake. The presence of major pharmaceutical companies and continuous product innovation solidify North America’s position as the leading regional market for Liraglutide and Semaglutide therapies.

Europe

Europe accounted for 28% share of the Liraglutide and Semaglutide market in 2024, driven by strict clinical guidelines for diabetes and obesity management. Countries such as Germany, the UK, and France lead adoption due to strong healthcare coverage and physician preference for GLP-1 drugs. Government-funded screening programs and initiatives targeting obesity prevention enhance early diagnosis and treatment rates. Statin-resistant and high-risk patients are increasingly prescribed Liraglutide and Semaglutide due to proven cardiovascular benefits. Expanding reimbursement frameworks and ongoing clinical trials support further growth across Europe, strengthening its position as the second-largest market globally.

Asia-Pacific

Asia-Pacific captured 19% share of the Liraglutide and Semaglutide market in 2024 and is projected to be the fastest-growing region during the forecast period. The rising prevalence of diabetes and obesity, particularly in China, India, and Japan, is fueling demand for GLP-1 therapies. Increasing healthcare investments, government-led chronic disease initiatives, and expanding access to generic options strengthen adoption. Although high costs limit widespread use of advanced biologics, oral formulations of semaglutide are creating new opportunities. Rapid urbanization and lifestyle-related disorders continue to expand the patient base, making Asia-Pacific a critical growth engine for this market.

Latin America

Latin America represented 6% share of the Liraglutide and Semaglutide market in 2024, supported by growing obesity and diabetes prevalence in countries such as Brazil and Mexico. Expanding healthcare access and government programs promoting chronic disease management are increasing treatment uptake. Cost-effective generics and localized distribution strategies improve accessibility, although limited reimbursement coverage remains a barrier. Awareness campaigns and physician training are strengthening prescription trends, particularly for obesity care. Despite infrastructure challenges, the region is experiencing steady growth as more patients are screened and treated with advanced GLP-1 therapies.

Middle East & Africa

The Middle East & Africa accounted for 3% share of the Liraglutide and Semaglutide market in 2024, with adoption concentrated in urban centers of the UAE, Saudi Arabia, and South Africa. Rising prevalence of diabetes and obesity, combined with government-driven preventive healthcare initiatives, supports market expansion. Wealthier Gulf countries invest heavily in advanced diabetes treatments, driving higher adoption of branded GLP-1 therapies. However, limited affordability and healthcare infrastructure challenges slow uptake in lower-income areas. Increasing collaborations with international pharmaceutical companies and expanding access to oral formulations are expected to gradually improve penetration in this region.

Market Segmentations:

By Type

By Route of Administration

By Application

- Type 2 Diabetes mellitus

- Obesity

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Liraglutide and Semaglutide market includes major players such as Bachem Holding AG, Novo Nordisk A/S, Eli Lilly and Company, HEC Pharma Co., Pfizer Inc., Boehringer Ingelheim International GmbH, Shenzhen JYMed Technology Co. Ltd., Teva Pharmaceutical Industries Ltd., Sanofi, and Sun Pharmaceutical Industries Ltd. Novo Nordisk leads with strong dominance through its GLP-1 product portfolio, particularly with Semaglutide, which has gained significant traction for both diabetes and obesity management. Competitors are focusing on expanding oral formulations, improving delivery mechanisms, and developing biosimilars to capture market share. Strategic collaborations, manufacturing expansions, and pipeline diversification are central strategies as demand for GLP-1 drugs rises globally. Rising obesity and diabetes prevalence creates a strong growth environment, but high pricing pressures encourage companies to balance innovation with affordability. The market is highly dynamic, with established leaders and emerging players competing to enhance accessibility, broaden indications, and maintain clinical advantages.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Eli Lilly released data showing orforglipron lowered A1C by 2.2 % vs 1.4 % for oral semaglutide at highest doses.

- In September 2025, Novo Nordisk said it will test its obesity/GLP-1 drugs in conditions like sleep apnea and knee osteoarthritis.

- In August 2025, Eli Lilly announced that its experimental oral GLP-1 orforglipron achieved better weight loss and blood sugar control than oral semaglutide in a head-to-head late-stage trial.

- In June 2025, Novo Nordisk presented data (STEP UP) for a higher dose of Wegovy (7.2 mg semaglutide) for greater weight loss.

Report Coverage

The research report offers an in-depth analysis based on Type, Route of Administration, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with rising global cases of diabetes and obesity.

- Type 2 diabetes will remain the leading application, supported by high patient prevalence.

- Obesity treatment will grow faster as GLP-1 drugs gain approvals for weight management.

- Injectable formulations will continue to dominate, though oral semaglutide will gain strong traction.

- North America will maintain leadership with high adoption and advanced healthcare systems.

- Asia-Pacific will record the fastest growth due to expanding healthcare access and rising awareness.

- Companies will invest in biosimilars to increase accessibility in cost-sensitive markets.

- Research will focus on improving tolerability and reducing side effects to boost adherence.

- Strategic partnerships and acquisitions will expand manufacturing and global distribution capabilities.

- Digital health tools and patient support programs will play a vital role in long-term compliance.

Market Insights

Market Insights