Market Overview:

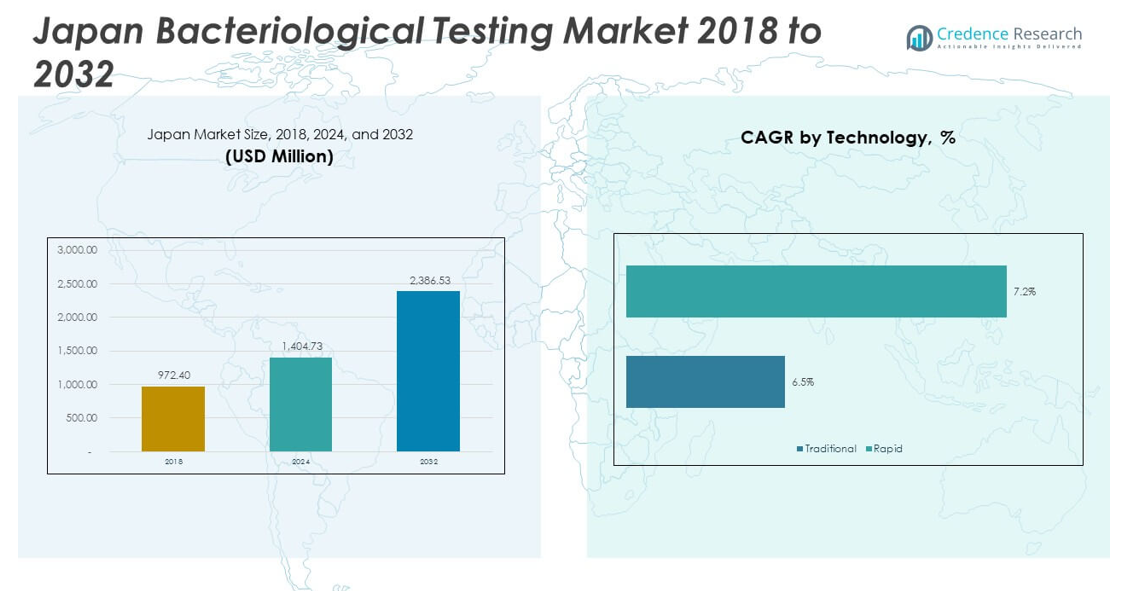

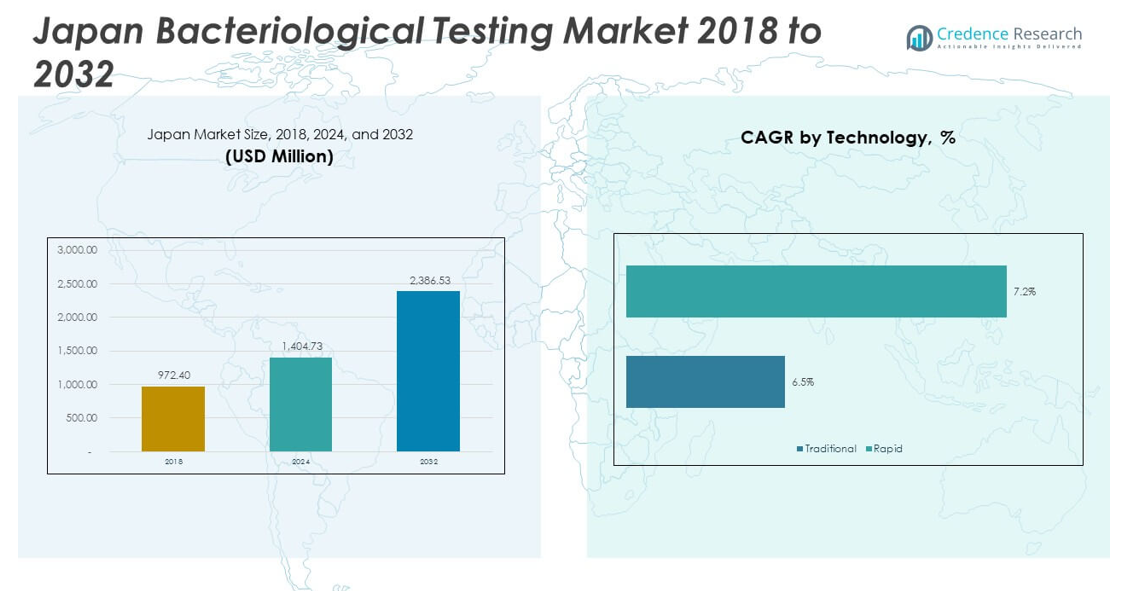

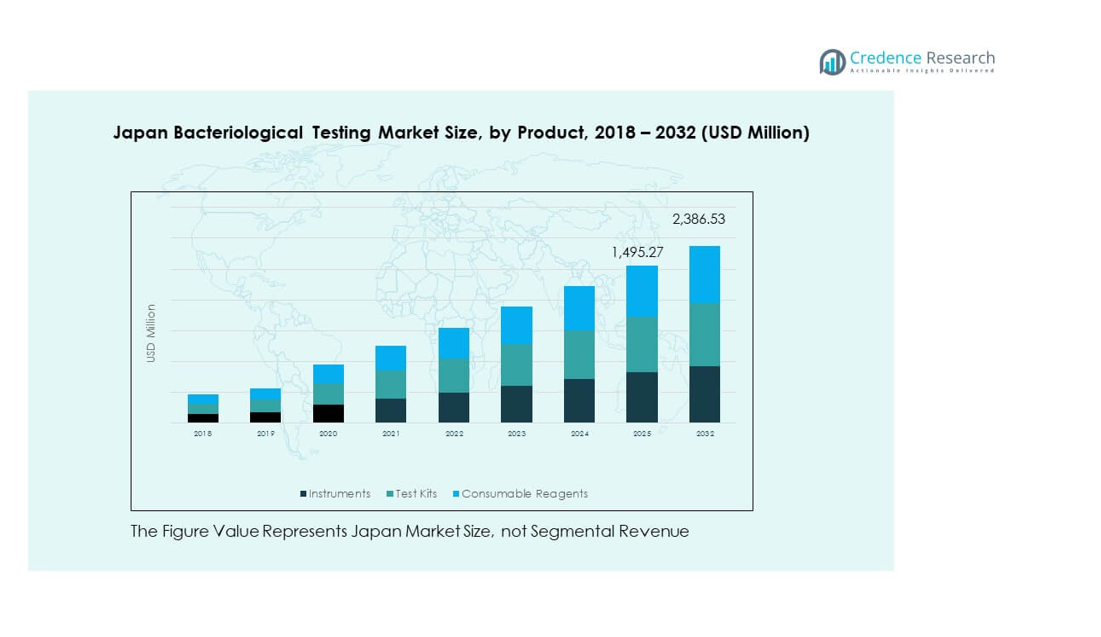

The Japan Bacteriological Testing Market size was valued at USD 972.4 million in 2018 to USD 1404.73 million in 2024 and is anticipated to reach USD 2,386.53 million by 2032, at a CAGR of 6.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Bacteriological Testing Market Size 2024 |

USD 1404.73 million |

| Japan Bacteriological Testing Market, CAGR |

6.85% |

| Japan Bacteriological Testing Market Size 2032 |

USD 2,386.53 million |

The market growth is driven by increasing food safety concerns, strict regulatory standards, and rising demand for quality assurance across industries. Rapid urbanization and changing consumer dietary preferences heighten the risk of contamination, prompting greater reliance on bacteriological testing. Expansion of the healthcare sector, coupled with advanced diagnostic techniques, supports broader adoption. Investments in automated systems and research laboratories further enhance efficiency, ensuring timely detection of harmful bacteria across multiple applications.

Regionally, developed economies within Asia-Pacific, including Japan, remain at the forefront due to strong regulatory frameworks and advanced infrastructure. Japan leads in innovation and testing adoption, while emerging Asian countries are steadily increasing their market presence through expanding food production and healthcare services. Growing industrialization and heightened awareness in these markets continue to fuel adoption of bacteriological testing solutions, reinforcing Japan’s role as a benchmark for reliability and safety.

Market Insights:

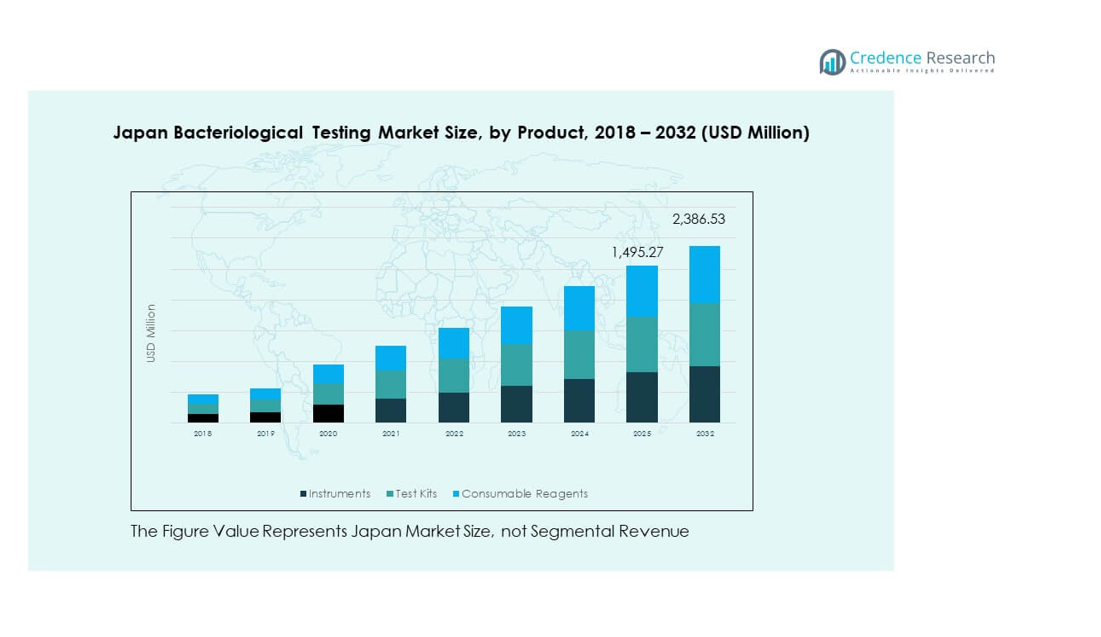

- The Japan Bacteriological Testing Market was valued at USD 972.4 million in 2018, reached USD 1,495.27 million in 2024, and is projected to hit USD 2,386.53 million by 2032, growing at a CAGR of 6.85%.

- Kanto led with 38% share due to Tokyo’s urban concentration, Kansai followed with 27% supported by strong food and pharma industries, while Chubu held 20% share driven by manufacturing and exports.

- The fastest-growing region was Northern areas including Hokkaido, Kyushu, and Shikoku with 15% share, driven by rising water testing investments and healthcare infrastructure improvements.

- Test kits accounted for the largest share of product demand in 2024, reflecting rapid adoption for convenience and speed.

- Instruments contributed a significant portion, supported by automation in laboratories, while consumable reagents ensured recurring demand through continuous usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Food Safety Regulations and Stringent Compliance Requirements

The Japan Bacteriological Testing Market experiences strong growth due to strict food safety regulations. Government bodies enforce compliance to prevent contamination in processed foods and beverages. It ensures producers adopt reliable testing methods to safeguard consumer health. Rising consumer awareness about foodborne illnesses also strengthens the demand for advanced testing. Manufacturers invest in accredited laboratories to meet export requirements and maintain reputation. These regulations encourage continuous innovation in testing technologies. The emphasis on public safety makes regulatory compliance a core market driver.

- For instance, Shimadzu Corporation launched the Nexera FV ultra-high-performance liquid chromatograph in March 2024. It is equipped with advanced online analysis and automated sample preparation capabilities, streamlining processes for chemical and dissolution testing primarily in the pharmaceutical industry. Its automated features reduce the potential for human error and substantially lower the burden on analysts.

Expansion of Healthcare Infrastructure and Diagnostic Applications

Healthcare expansion contributes significantly to the Japan Bacteriological Testing Market. Hospitals, clinics, and diagnostic centers rely on bacteriological testing for accurate disease detection. Rising cases of infectious diseases increase the demand for rapid testing solutions. Improved healthcare infrastructure enables wider adoption of automated testing equipment. It supports early diagnosis and effective treatment planning for patients. The sector also benefits from advanced testing kits that reduce turnaround times. Rising investments in laboratory services further push the market forward. Healthcare’s critical role ensures bacteriological testing remains a growing necessity.

- For instance, in April 2025, Sysmex Corporation announced that its new manufacturing base in India had begun full-scale operations and had commenced manufacturing the XQ™-Series automated hematology analyzer.

Technological Advancements in Testing Methods and Automation Adoption

The Japan Bacteriological Testing Market benefits from continuous innovation in testing technologies. Automated systems improve efficiency and accuracy in detecting harmful microorganisms. Advanced diagnostic platforms support faster results, reducing waiting time for critical decisions. It also lowers manual errors and enhances consistency in outcomes. Integration of artificial intelligence in testing processes is gaining traction. Laboratories adopt robotics and data management tools to streamline workflows. These technological shifts increase capacity to handle rising test volumes. Innovation-driven automation remains a vital driver for long-term growth.

Growing Demand from Food, Beverage, and Pharmaceutical Industries

Industrial adoption plays a vital role in the Japan Bacteriological Testing Market. Food and beverage companies use testing to ensure product safety and compliance. The pharmaceutical sector depends on it for sterile manufacturing and safe drug production. Rising consumer demand for packaged and processed foods drives more testing requirements. Export-oriented industries also strengthen adoption to meet global standards. It helps companies avoid recalls, penalties, and brand damage. High reliance on microbiological testing across industries ensures steady demand growth. Expanding industrial sectors reinforce bacteriological testing as a market necessity.

Market Trends:

Integration of Artificial Intelligence and Data Analytics in Testing Processes

The Japan Bacteriological Testing Market witnesses growing adoption of artificial intelligence and data analytics. AI-driven platforms help laboratories analyze vast data with speed and accuracy. It reduces manual intervention and strengthens predictive insights for infection control. Data analytics supports better resource allocation in testing facilities. Integration with digital systems ensures traceability and compliance reporting. Cloud-based platforms make results accessible across multiple stakeholders. These innovations transform traditional testing into intelligent, connected ecosystems. Smart integration defines the modern trend shaping future market growth.

- For instance, in May 2025, Fujitsu utilized its AI service, Fujitsu Kozuchi, to enable the Tokai National Higher Education and Research System to structure and use medical data for accelerating clinical trials in Japan. Later, in August 2025, Fujitsu announced a new AI agent platform for the healthcare sector, developed in collaboration with NVIDIA, to enhance operational efficiency in hospitals, particularly in Japan.

Increasing Focus on Personalized Healthcare and Precision Diagnostics

Personalized healthcare is influencing the Japan Bacteriological Testing Market. Rising demand for patient-specific diagnostics drives advanced bacteriological testing solutions. Precision medicine requires detailed microbial data to design tailored treatments. It also helps identify infection risks unique to each patient. Testing technologies are evolving to support genomic and molecular studies. Healthcare providers adopt these methods for accurate and efficient outcomes. Demand for personalized diagnostic solutions continues to increase steadily. The trend highlights a shift from generalized testing to targeted healthcare support.

- For instance, Kaneka Corporation began selling the DermaQuick® Onychomycosis Trichophyton Antigen Test Kit on February 3, 2025, which provides a rapid and easy method for detecting the fungus that causes onychomycosis, primarily at dialysis facilities in Japan. The test uses immunochromatography to help prevent serious lower-limb symptoms in dialysis patients, who often have weakened immune systems.

Rising Demand for Sustainable and Eco-Friendly Testing Practices

The Japan Bacteriological Testing Market adapts to sustainability goals with eco-friendly practices. Laboratories focus on reducing waste from chemical reagents and disposable materials. It encourages adoption of green technologies that limit environmental impact. Sustainable testing solutions align with Japan’s national focus on green development. Manufacturers design energy-efficient testing systems that minimize carbon emissions. Biodegradable testing kits are also gaining attention for routine applications. Sustainable laboratory management strengthens corporate responsibility in the industry. Environmental priorities continue to shape testing processes and investments.

Digital Transformation and Growth of Remote Testing Services

The Japan Bacteriological Testing Market observes rising demand for remote testing solutions. Digital transformation drives adoption of mobile-based and portable testing devices. It allows on-site testing in food plants, hospitals, and field locations. Real-time results improve decision-making for urgent cases. Remote testing also reduces the pressure on central laboratories. It expands testing accessibility across urban and rural areas. Cloud integration supports data transfer and compliance validation. Remote and digital solutions highlight a long-term trend of decentralized testing.

Market Challenges Analysis:

High Operational Costs and Skilled Workforce Shortage Impacting Growth

The Japan Bacteriological Testing Market faces challenges from high operational costs and skill shortages. Establishing advanced laboratories requires heavy investments in equipment and infrastructure. Routine testing also demands expensive reagents and consumables. Small and medium enterprises struggle with affordability in compliance testing. It limits the market’s ability to expand rapidly across all sectors. Skilled workforce shortages add another layer of complexity. Laboratories face difficulties in finding experts trained in advanced technologies. These constraints delay adoption and increase reliance on outsourcing. Rising costs and talent shortages remain critical hurdles.

Complex Regulatory Framework and Slow Adoption in Smaller Enterprises

The Japan Bacteriological Testing Market operates under a complex regulatory environment. Strict compliance requirements demand constant upgrades in testing processes. Smaller enterprises often delay adoption due to lack of resources and expertise. It restricts uniform market growth across industries and regions. Complicated approval systems for new testing methods create time delays. It reduces flexibility for companies aiming to adopt innovations quickly. Lack of awareness in smaller food businesses also limits testing demand. This uneven adoption creates challenges in ensuring consistent product safety. Regulatory and adoption barriers continue to slow market progress.

Market Opportunities:

Expansion of Testing Applications in Emerging Industrial Sectors

The Japan Bacteriological Testing Market offers growth opportunities in emerging industries. Cosmetics, biotechnology, and water treatment sectors are increasingly adopting testing. Expanding applications support safety assurance beyond traditional food and healthcare areas. It creates new demand for specialized bacteriological testing solutions. Companies diversify portfolios to meet sector-specific requirements. Rising focus on environmental monitoring further enhances opportunities. The diversification of applications ensures sustainable future growth.

Growing Investments in Research and Development for Advanced Testing Solutions

Rising R&D activities create strong opportunities in the Japan Bacteriological Testing Market. Companies invest in next-generation diagnostic technologies for faster and more reliable outcomes. It supports the development of portable, cost-efficient, and user-friendly solutions. Universities and research institutes collaborate with industries to accelerate innovation. Demand for precision testing stimulates funding in biotechnology projects. Expanding R&D efforts drive continuous improvement in accuracy and efficiency. These initiatives open opportunities for global competitiveness and expansion.

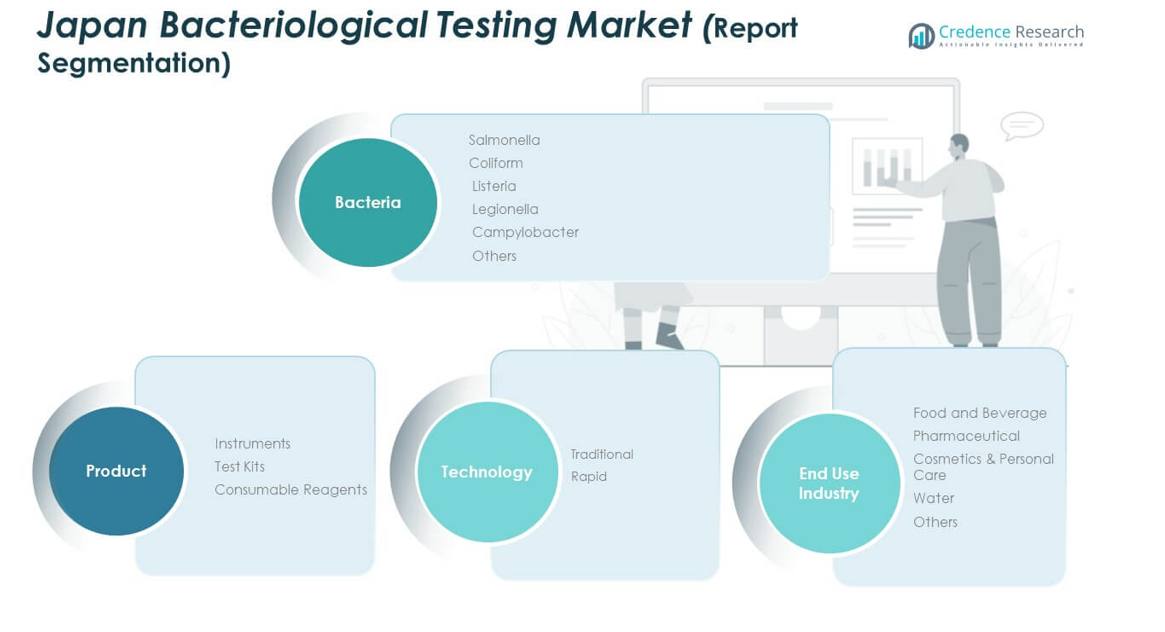

Market Segmentation Analysis:

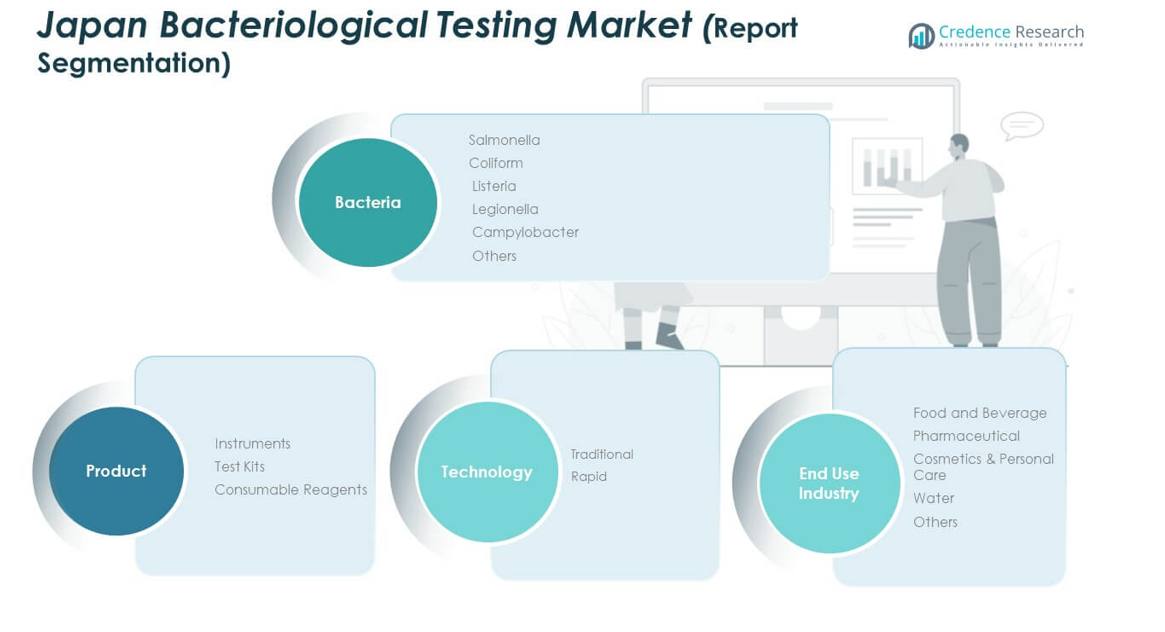

By Product

The Japan Bacteriological Testing Market is segmented into instruments, test kits, and consumable reagents. Instruments account for significant adoption due to automation and precision in laboratories. Test kits gain traction with their rapid usability in on-site testing. Consumable reagents continue to generate steady demand as they form recurring revenue streams. Together, these products ensure reliability and scalability across industries.

- For instance, as of September 2025, HORIBA’s Yumizen series of hematology analyzers are being equipped with new software for early sepsis detection through a partnership with GeodAIsics. This technology, integrated into existing Yumizen analyzers, uses AI to automatically flag patterns in routine blood tests that could indicate sepsis, a system designed to improve operational efficiency and patient outcomes.

By Bacteria

Testing focuses on detecting Salmonella, Coliform, Listeria, Legionella, Campylobacter, and others. Salmonella and Coliform dominate due to their prevalence in food and water contamination. Listeria and Campylobacter tests grow in demand within food safety frameworks. Legionella testing remains critical for water quality management. Broader bacteria categories support niche applications and specialized studies.

By Technology

Traditional methods retain a strong presence in established laboratories due to trust and cost control. Rapid testing technologies show stronger growth with increasing demand for speed and accuracy. It enhances efficiency for healthcare, pharmaceuticals, and high-volume food industries. This segment highlights a transition toward faster, technology-driven approaches.

By End User

Food and beverage companies remain the largest adopters due to strict safety standards. Pharmaceutical industries rely heavily on bacteriological testing for sterile production. Cosmetics and personal care companies use it to ensure consumer protection. Water testing drives consistent adoption across public utilities and private facilities. Other sectors also integrate testing for quality and compliance.

Segmentation:

- By Product

- Instruments

- Test Kits

- Consumable Reagents

- By Bacteria

- Salmonella

- Coliform

- Listeria

- Legionella

- Campylobacter

- Others

- By Technology

- By End User

- Food and Beverage

- Pharmaceutical

- Cosmetics & Personal Care

- Water

- Others

Regional Analysis:

Kanto Region

The Kanto region dominates the Japan Bacteriological Testing Market with a 38% share in 2024. Tokyo and surrounding urban centers create strong demand for food safety, healthcare, and pharmaceutical testing. High population density drives stringent monitoring across food processing and water quality systems. The presence of advanced healthcare institutions and diagnostic laboratories strengthens adoption of modern bacteriological testing technologies. International trade activity in the region also accelerates the use of standardized testing to meet export requirements. It continues to lead the market with strong infrastructure, regulatory enforcement, and industrial concentration.

Kansai Region

The Kansai region holds a 27% share of the market, supported by its strong food and beverage industry. Osaka and Kyoto serve as central hubs for packaged food production and consumer goods. Manufacturers emphasize bacteriological testing to comply with domestic and international safety standards. Pharmaceutical companies in the region increase demand for sterile testing solutions to support production facilities. Growing tourism activity also drives reliance on water and food safety testing. It benefits from strong industrial activity and contributes significantly to market expansion across western Japan.

Chubu and Other Regions

The Chubu region commands a 20% share, driven by its role in manufacturing and export-oriented industries. Nagoya and surrounding areas integrate bacteriological testing in food exports and pharmaceutical manufacturing. Rising urbanization in smaller prefectures increases awareness of foodborne illness prevention. Other regions, including Hokkaido, Kyushu, and Shikoku, collectively account for the remaining 15% share. These areas experience gradual growth due to rising investment in water testing and healthcare infrastructure. It remains important to address regional disparities to ensure nationwide standardization in bacteriological testing practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Japan Bacteriological Testing Market is characterized by strong competition among global and domestic players. Leading companies such as Fujirebio Inc., Thermo Fisher Scientific Inc., Eurofins, Agilent Technologies Inc., and Bio-Rad Laboratories Inc. hold significant presence with broad product portfolios and advanced technologies. It remains highly competitive with continuous investments in automation, rapid testing kits, and consumable reagents. Local firms like Eiken Chemical Co., Ltd. and Denka Seiken Co., Ltd. strengthen domestic supply and regional innovation. International players emphasize partnerships and acquisitions to expand market access. The presence of advanced healthcare and food industries fuels demand, ensuring that competition remains intense across all product segments.

Recent Developments:

- In June 2025, Fujirebio Inc. announced the acquisition of Plasma Services Group, strengthening its position in the Japanese market as a leader in next-generation in vitro diagnostics and expanding access to high-quality biological samples for advanced bacteriological testing solutions.

Report Coverage:

The research report offers an in-depth analysis based on product, bacteria, technology, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising healthcare investments will support expansion of advanced bacteriological testing technologies.

- Increasing food and beverage safety requirements will remain a key market growth factor.

- Rapid testing adoption will accelerate in industries needing faster results and accuracy.

- Emerging demand from cosmetics and personal care will create new testing opportunities.

- Water safety monitoring will strengthen testing demand across public utilities and industries.

- Integration of artificial intelligence and automation will enhance efficiency in laboratories.

- Strategic partnerships between global and domestic players will increase market penetration.

- Expanding research and development will drive innovation in next-generation test kits.

- Regional disparities will reduce as testing infrastructure expands in rural and smaller prefectures.

- Strong regulatory frameworks will continue to guide market stability and long-term growth.