Market Overview:

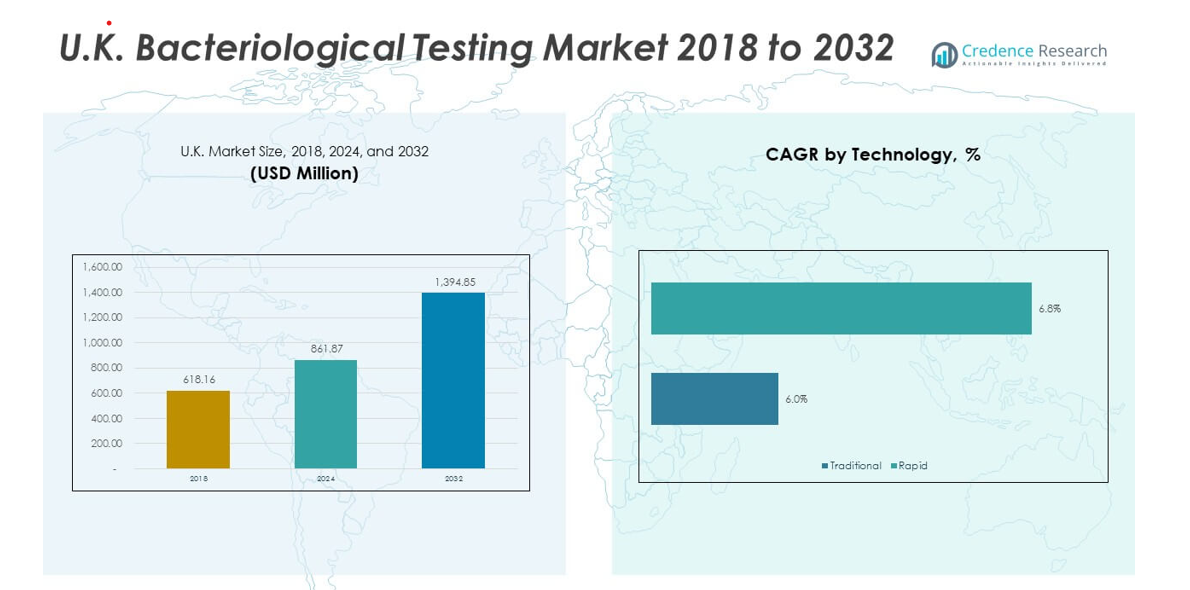

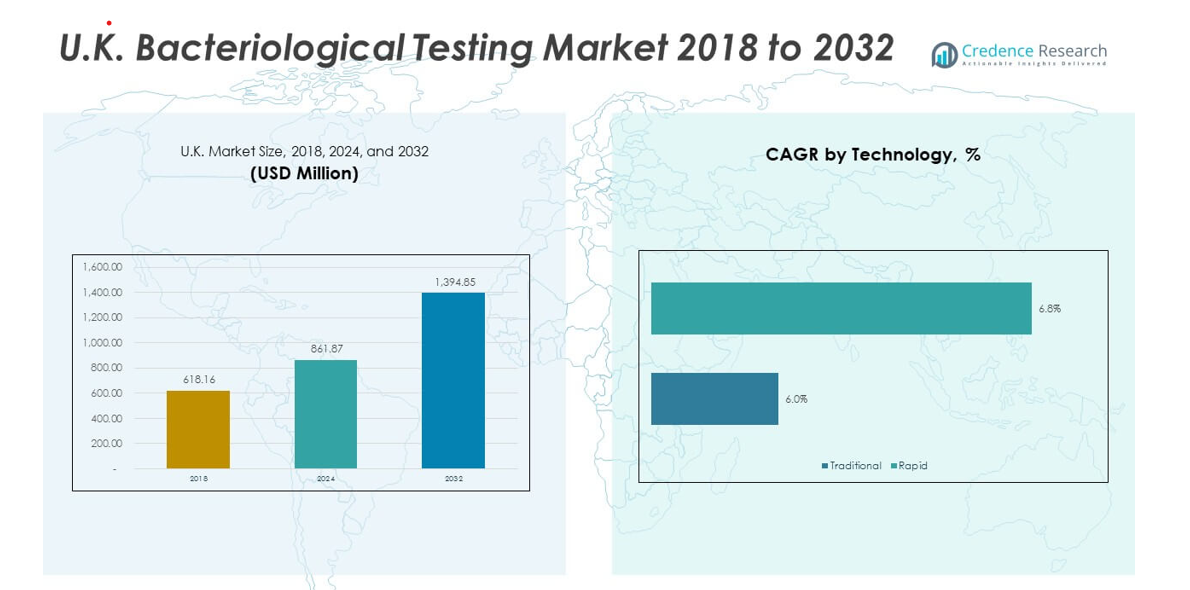

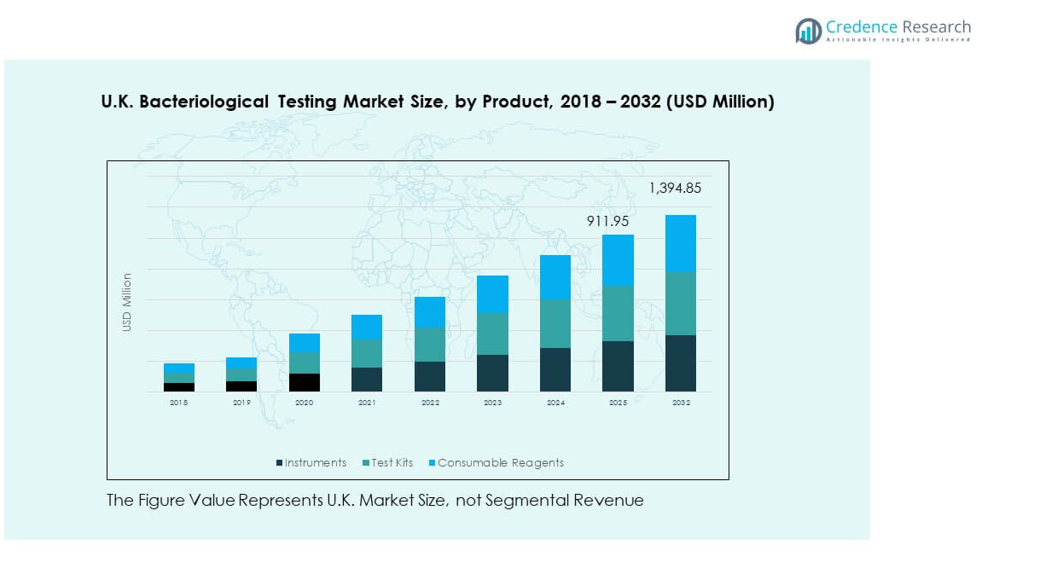

The U.K. Bacteriological Testing Market size was valued at USD 618.16 million in 2018 to USD 861.87 million in 2024 and is anticipated to reach USD 1,394.85 million by 2032, at a CAGR of 6.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Bacteriological Testing Market Size 2024 |

USD 861.87 million |

| U.K. Bacteriological Testing Market, CAGR |

6.29% |

| U.K. Bacteriological Testing Market Size 2032 |

USD 1,394.85 million |

The market is driven by growing awareness of foodborne illnesses, stricter regulatory standards, and expansion of healthcare services. Rising demand for packaged and processed foods increases the need for frequent bacteriological testing to ensure safety. The pharmaceutical sector relies heavily on testing to maintain sterile production environments. Adoption of automated and rapid testing methods is improving efficiency across laboratories. Rising consumer expectations for safe products further accelerates demand. Strong investment in diagnostic facilities supports ongoing market expansion.

Geographically, England leads the U.K. Bacteriological Testing Market due to its advanced healthcare infrastructure and strong food and beverage industry. Scotland shows steady growth supported by investments in water safety and pharmaceutical activities. Wales demonstrates rising adoption of testing services with expansion of manufacturing industries. Northern Ireland remains an emerging region where gradual industrial development and stricter safety practices create fresh opportunities. The presence of both established and growing regions ensures nationwide progress in bacteriological testing adoption

Market Insights:

- The U.K. Bacteriological Testing Market was valued at USD 618.16 million in 2018, reached USD 861.87 million in 2024, and is projected to hit USD 1,394.85 million by 2032, growing at a CAGR of 6.29%.

- England led with 42% share in 2024, supported by advanced healthcare infrastructure, strong food and beverage demand, and widespread adoption of rapid testing methods.

- Scotland accounted for 26% share, driven by water safety testing and growing pharmaceutical activity, while Wales held 18%, supported by expanding food processing and industrial sectors.

- Northern Ireland, with 14% share, is the fastest-growing region, fueled by manufacturing expansion, rising food exports, and government-backed safety initiatives.

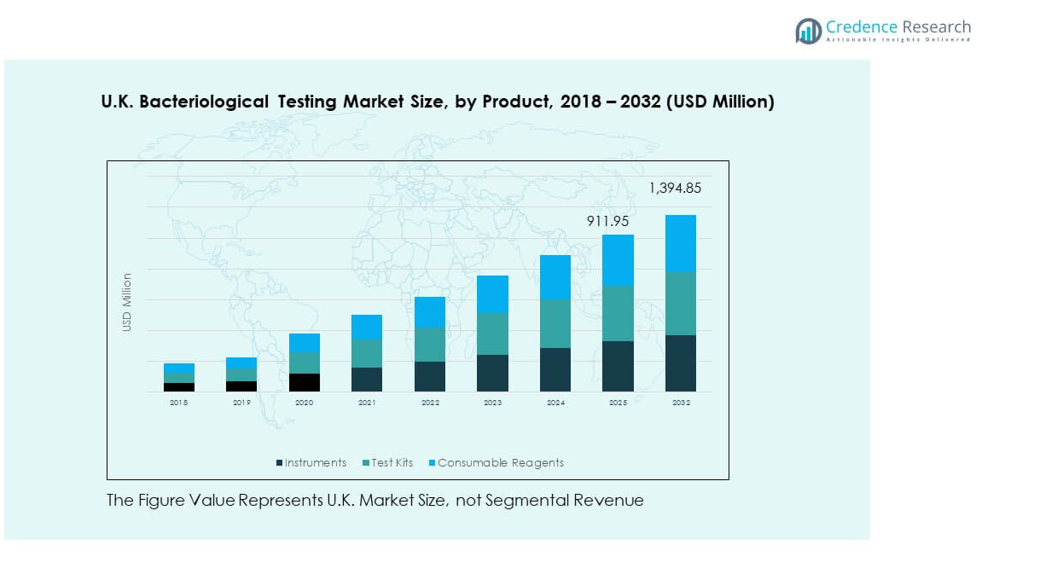

- Instruments contributed the largest share at 46% in 2024, followed by test kits at 32%, while consumable reagents maintained 22%, reflecting steady recurring demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Food Safety Regulations and Rising Consumer Awareness of Contamination Risks

The U.K. Bacteriological Testing Market is strongly influenced by strict food safety regulations and higher consumer awareness. Government authorities enforce compliance to minimize risks from foodborne illnesses. Food manufacturers depend on bacteriological testing to meet domestic and international standards. Rising demand for processed and packaged food increases the need for frequent testing. It ensures safe distribution of food across retail and export markets. Awareness campaigns about contamination risks further strengthen industry reliance on testing solutions. Strong regulatory frameworks continue to drive long-term adoption.

- For instance, companies in the food safety industry, such as those within the Mérieux group, commonly deploy automated systems like the TEMPO® automated microbial testing system to enhance efficiency and accelerate testing times.

Healthcare Expansion and Growing Demand for Disease Diagnostics

The expansion of healthcare infrastructure drives significant growth in the U.K. Bacteriological Testing Market. Hospitals and laboratories increasingly depend on bacteriological testing to detect infections accurately. The growing incidence of infectious diseases heightens demand for rapid and precise diagnostic methods. It supports effective treatment decisions and improves patient outcomes. Public and private investments strengthen diagnostic capacity nationwide. Advanced laboratories improve adoption of automated testing systems. Healthcare sector expansion ensures bacteriological testing remains integral for clinical safety and efficiency.

- For instance, Abbott Laboratories’ ID NOW™ molecular point-of-care testing devices have been deployed in NHS facilities in the U.K. for the rapid detection of viral respiratory illnesses, such as COVID-19, with results available in minutes. The system provides speedy molecular results.

Technological Advancements Driving Automation and Accuracy in Laboratories

The U.K. Bacteriological Testing Market benefits from continuous innovation in diagnostic technologies. Automated instruments and digital systems improve testing speed and accuracy. Laboratories invest in rapid testing platforms to handle growing sample volumes. It reduces manual workload and ensures consistency across results. Integration of robotics and artificial intelligence transforms laboratory operations. Advanced solutions also enhance compliance with regulatory standards. Innovation in testing methods positions automation as a key driver for market growth.

Industrial Applications Across Food, Pharmaceutical, and Beverage Sectors

Industry-wide adoption supports growth in the U.K. Bacteriological Testing Market. Food and beverage producers rely on testing to meet safety regulations. Pharmaceutical firms adopt it to ensure sterile production environments. Demand from water testing facilities strengthens usage in environmental monitoring. Rising consumer demand for safety and quality pushes industries to invest more. It reduces risks of recalls, penalties, and product failures. Industrial reliance on bacteriological testing reinforces its role as a vital market driver.

Market Trends:

Integration of Digital Platforms and Cloud-Based Data Management in Testing

The U.K. Bacteriological Testing Market is witnessing rapid adoption of digital platforms for data handling. Cloud systems improve traceability, compliance reporting, and accessibility. Laboratories share results with stakeholders in real time. It ensures efficiency in large-scale testing operations. Digital platforms also strengthen monitoring of laboratory workflows. Remote connectivity creates opportunities for decentralized testing models. Digitalization continues to reshape the way bacteriological testing is managed across industries.

- For instance, in July 2025, Thermo Fisher Scientific and Sanofi expanded their strategic partnership. Thermo Fisher agreed to acquire Sanofi’s sterile drug manufacturing site in New Jersey to increase U.S. manufacturing capacity.

Rising Focus on Personalized and Precision-Based Diagnostic Solutions

The shift toward personalized healthcare is influencing the U.K. Bacteriological Testing Market. Precision-based diagnostics help doctors design targeted treatments. Testing platforms provide detailed microbial data for improved decision-making. It reduces risks associated with generalized treatment approaches. Demand for personalized healthcare expands the role of bacteriological testing in hospitals. Laboratories develop solutions to address patient-specific needs. The trend highlights a strong move toward individualized testing and treatment.

- For instance, in December 2021, BD (Becton, Dickinson and Company) announced the European CE Mark for the BD COR™ MX instrument. The system supports multiplex bacterial pathogen detection and can deliver up to 1,000 sample results in a 24-hour period.

Sustainable Laboratory Practices and Green Testing Solutions Adoption

The U.K. Bacteriological Testing Market is aligning with sustainability initiatives. Laboratories focus on reducing chemical waste and adopting eco-friendly methods. Green technologies minimize the environmental impact of testing. It supports compliance with environmental regulations. Companies design energy-efficient instruments to limit emissions. Eco-friendly reagents and biodegradable kits gain acceptance. The focus on sustainability adds a new dimension to testing practices.

Expansion of Remote Testing and Portable Devices for Field Applications

The U.K. Bacteriological Testing Market is adapting to demand for portable solutions. Remote testing devices allow on-site use in food plants and healthcare facilities. It reduces dependency on central laboratories. Real-time detection strengthens decision-making for critical cases. Portable kits improve accessibility in remote areas. Integration with digital platforms supports result validation. Remote testing solutions reflect a shift toward faster and more flexible systems.

Market Challenges Analysis:

High Operational Costs and Shortage of Skilled Workforce Impacting Market Expansion

The U.K. Bacteriological Testing Market faces challenges from high operating costs and workforce shortages. Advanced laboratories require large capital investments in equipment and infrastructure. Consumables and reagents also add recurring expenses. It creates financial pressure for small and medium-sized enterprises. Workforce shortages limit testing capacity across laboratories. Recruiting trained professionals with expertise in automation and molecular diagnostics is difficult. These issues slow down adoption in industries with limited resources. Cost pressures and workforce gaps remain central challenges.

Regulatory Complexity and Limited Adoption in Small Enterprises

The U.K. Bacteriological Testing Market operates under complex regulatory frameworks. Compliance requires continuous upgrades in testing processes. Small enterprises delay adoption due to lack of awareness and funds. It creates uneven growth across industries and regions. Lengthy approval cycles for new testing technologies slow innovation adoption. Laboratories face reduced flexibility when integrating modern systems. Limited awareness among small food processors adds to barriers. Regulatory complexity and uneven adoption restrict full-scale expansion.

Market Opportunities:

Diversification of Testing Applications in Emerging Industrial Segments

The U.K. Bacteriological Testing Market presents opportunities in emerging industries. Cosmetics and personal care firms increasingly adopt bacteriological testing for quality assurance. Water treatment and environmental monitoring also expand demand. It encourages companies to design solutions tailored for diverse sectors. Broader applications reduce reliance on traditional markets. Rising demand from new segments supports steady diversification. The trend ensures sustainable long-term opportunities.

Investments in Research and Development for Innovative Testing Solutions

Ongoing R&D activities create new opportunities in the U.K. Bacteriological Testing Market. Companies focus on developing portable, rapid, and cost-efficient diagnostic platforms. Collaboration between research institutions and industry accelerates product innovation. It enables next-generation testing solutions to meet stricter regulatory standards. Investment in AI-powered platforms enhances accuracy and efficiency. These initiatives strengthen global competitiveness of U.K. firms. Expanding R&D efforts open avenues for future market growth.

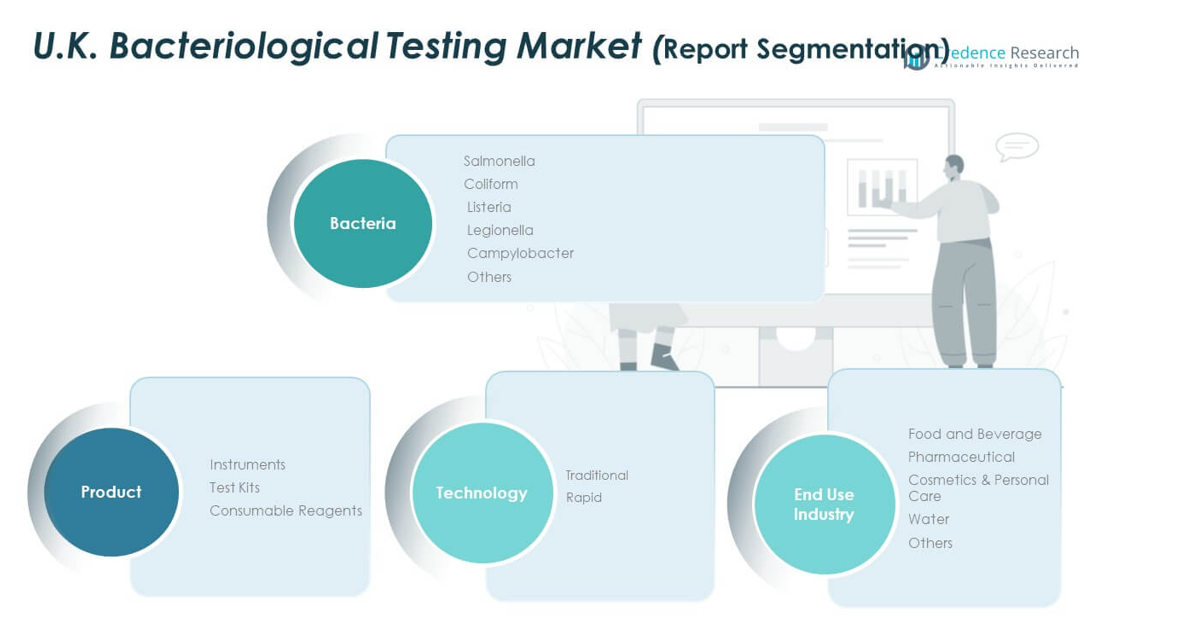

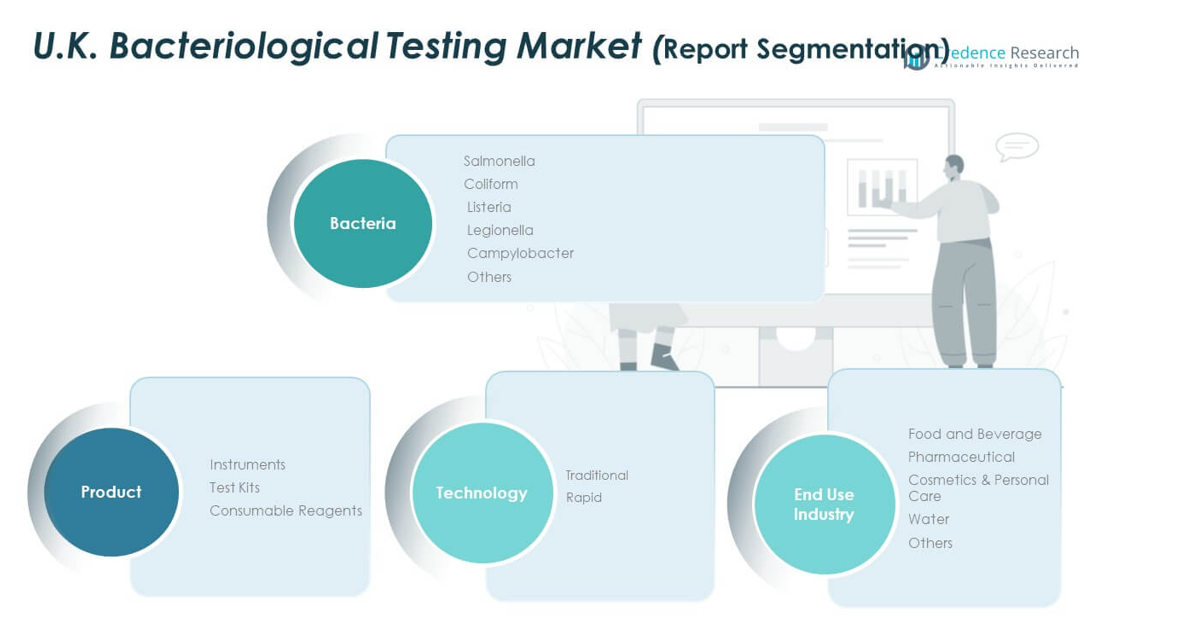

Market Segmentation Analysis:

By Product

The U.K. Bacteriological Testing Market is segmented into instruments, test kits, and consumable reagents. Instruments dominate with advanced automation and reliable performance in laboratories. Test kits show rapid adoption due to their convenience and faster results. Consumable reagents contribute steady recurring revenue, ensuring continuous demand. It reflects a balanced product landscape supporting diverse end users.

- For instance, Bio-Rad Laboratories offers rapid food safety testing products, such as its iQ-Check PCR Detection Kits, which are designed to provide quick and accurate results for bacterial contaminants like Salmonella and Listeria. Unlike the inaccurate claim about a “RAPID’Bac” kit, these validated PCR kits can deliver results in a significantly shorter time frame than traditional culture methods.

By Bacteria

Testing spans Salmonella, Coliform, Listeria, Legionella, Campylobacter, and others. Salmonella and Coliform remain the most tested due to frequent outbreaks and foodborne contamination risks. Listeria and Campylobacter testing gain momentum across the food industry. Legionella monitoring supports water safety management in healthcare and hospitality sectors. Broader categories allow flexibility in specialized applications.

- For instance, in the first half of 2025, Eurofins Scientific expanded its UK laboratory network and testing portfolio, potentially improving environmental analysis services that include Legionella Eurofins continues to invest in technology to improve quality and turnaround time.

By Technology

Traditional methods maintain strong usage in established laboratories. Rapid testing technologies are expanding with rising demand for speed and efficiency. It improves real-time decision-making in healthcare and food processing industries. This transition highlights a shift toward modern, technology-driven testing practices across the country.

By End User

Food and beverage companies dominate adoption due to strict compliance requirements. Pharmaceuticals rely heavily on testing to ensure sterile production. Cosmetics and personal care brands use it to safeguard product safety. Water testing ensures public health across utilities and industries. Other sectors also contribute by integrating testing for regulatory and operational needs.

Segmentation:

- By Product

- Instruments

- Test Kits

- Consumable Reagents

- By Bacteria

- Salmonella

- Coliform

- Listeria

- Legionella

- Campylobacter

- Others

- By Technology

- By End User

- Food and Beverage

- Pharmaceutical

- Cosmetics & Personal Care

- Water

- Others

Regional Analysis:

England

England holds the dominant position in the U.K. Bacteriological Testing Market with a 42% share in 2024. Strong healthcare infrastructure and the presence of leading diagnostic laboratories drive adoption. The food and beverage sector in London and surrounding industrial areas relies heavily on bacteriological testing to meet domestic and export standards. It benefits from advanced technology adoption and strict regulatory oversight, ensuring consistent market growth. Pharmaceutical and biotechnology industries also contribute significantly to demand. Continuous investments in laboratory automation and rapid testing methods reinforce England’s leadership.

Scotland

Scotland accounts for a 26% share of the U.K. Bacteriological Testing Market. Its focus on water testing, food production, and healthcare diagnostics supports steady market expansion. Regional authorities emphasize public safety, encouraging widespread adoption of bacteriological testing solutions. It also benefits from research collaborations between universities and private laboratories. Growing pharmaceutical activities in cities like Edinburgh and Glasgow further increase demand. Scotland’s strong focus on sustainability and environmental safety strengthens its role in the market. The region maintains consistent growth supported by regulatory compliance and innovation.

Wales and Northern Ireland

Wales holds an 18% share of the market, driven by growing demand in food processing and water testing facilities. Industrial expansion and stricter safety standards are increasing adoption of testing technologies. Northern Ireland represents 14% share, with rising demand from manufacturing and healthcare services. It shows strong potential due to increasing food exports and government-backed safety initiatives. Both regions are investing in infrastructure to support wider use of rapid testing solutions. Their steady contributions enhance nationwide market balance. The combined progress of Wales and Northern Ireland ensures wider coverage of bacteriological testing across the U.K.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.K. Bacteriological Testing Market is defined by strong competition between global corporations and domestic firms. Leading players such as Thermo Fisher Scientific Inc., Eurofins, Agilent Technologies Inc., Bio-Rad Laboratories Inc., and BioMérieux dominate with advanced technologies and wide product portfolios. Local companies including Labtron Equipment and Fison Instruments Ltd. provide cost-effective solutions and strengthen regional supply. It remains competitive with firms investing in automation, rapid testing methods, and consumables. Strategic partnerships, acquisitions, and expansion of testing facilities reinforce competitive positioning. Strong demand from food, pharmaceutical, and healthcare sectors ensures continuous rivalry among key players.

Recent Developments:

- In September 2025, Thermo Fisher Scientific announced the completion of its acquisition of Solventum’s Purification and Filtration Business, bringing highly complementary technologies that enhance its purification and filtration solutions portfolio relevant to U.K. laboratory and bacteriological testing capacities.

- In September 2025, Agilent Technologies entered a collaboration agreement with Lunit to co-develop AI-based companion diagnostic tools, advancing biomarker testing and precision medicine for U.K. research and diagnostic laboratories.

- In July 2025, Bio-Rad Laboratories launched four new Droplet Digital PCR platforms, including the QX Continuum™ ddPCR system, after a strategic acquisition that strengthens its offerings in precision bacteriological testing for clinical and food safety applications in the U.K..

- In May 2025, Intertek expanded its pharmaceutical services laboratory in Melbourn, U.K. by adding 6,000 square feet of purpose-built space, enhancing capabilities for biologics and advanced bacteriological analysis in support of pharmaceutical development programs.

Report Coverage:

The research report offers an in-depth analysis based on product, bacteria, technology, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for bacteriological testing will increase with stricter food safety standards.

- Rapid testing technologies will gain adoption in food, water, and healthcare sectors.

- Expansion of healthcare infrastructure will support advanced diagnostic testing growth.

- Automation and AI-driven platforms will improve efficiency in laboratories.

- Cosmetic and personal care industries will emerge as new demand generators.

- Water quality monitoring will strengthen adoption across public utilities.

- Research and development will focus on innovative and portable test kits.

- Strategic collaborations will expand the market reach of leading companies.

- Regional growth in Scotland and Wales will enhance market balance across the U.K.

- Regulatory enforcement will continue to define stability and competitiveness in the market.