Market Overview

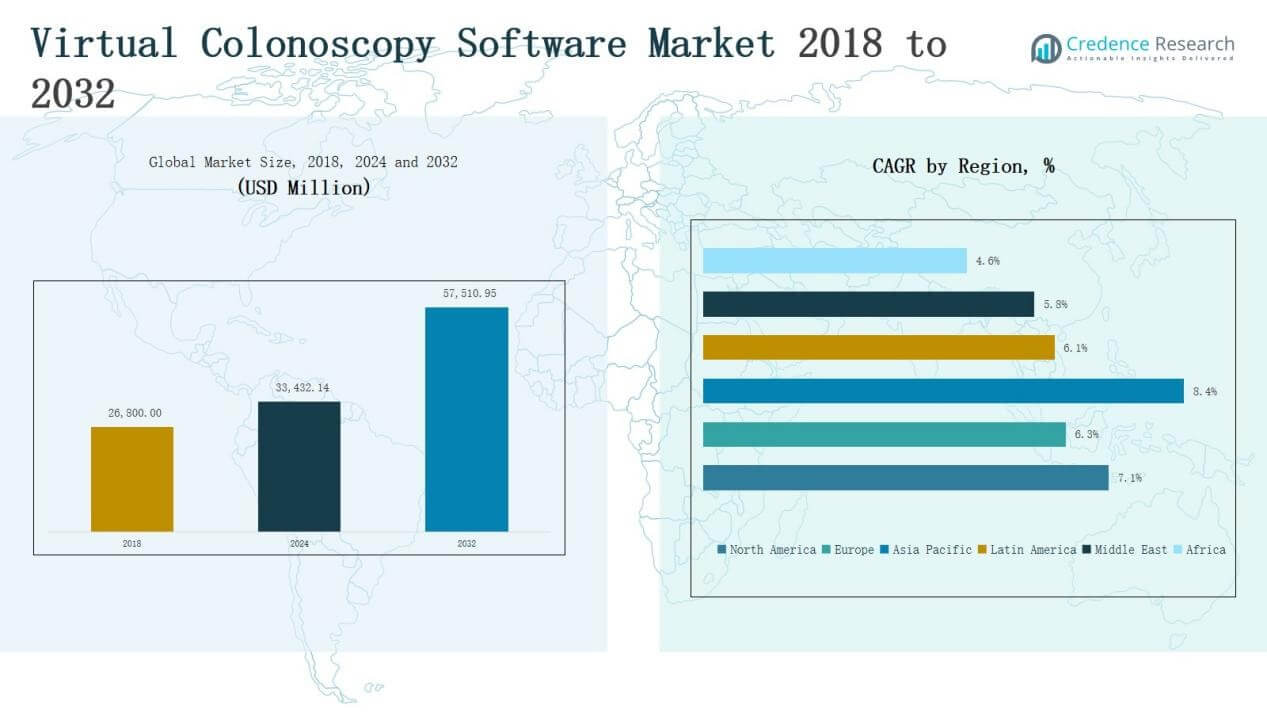

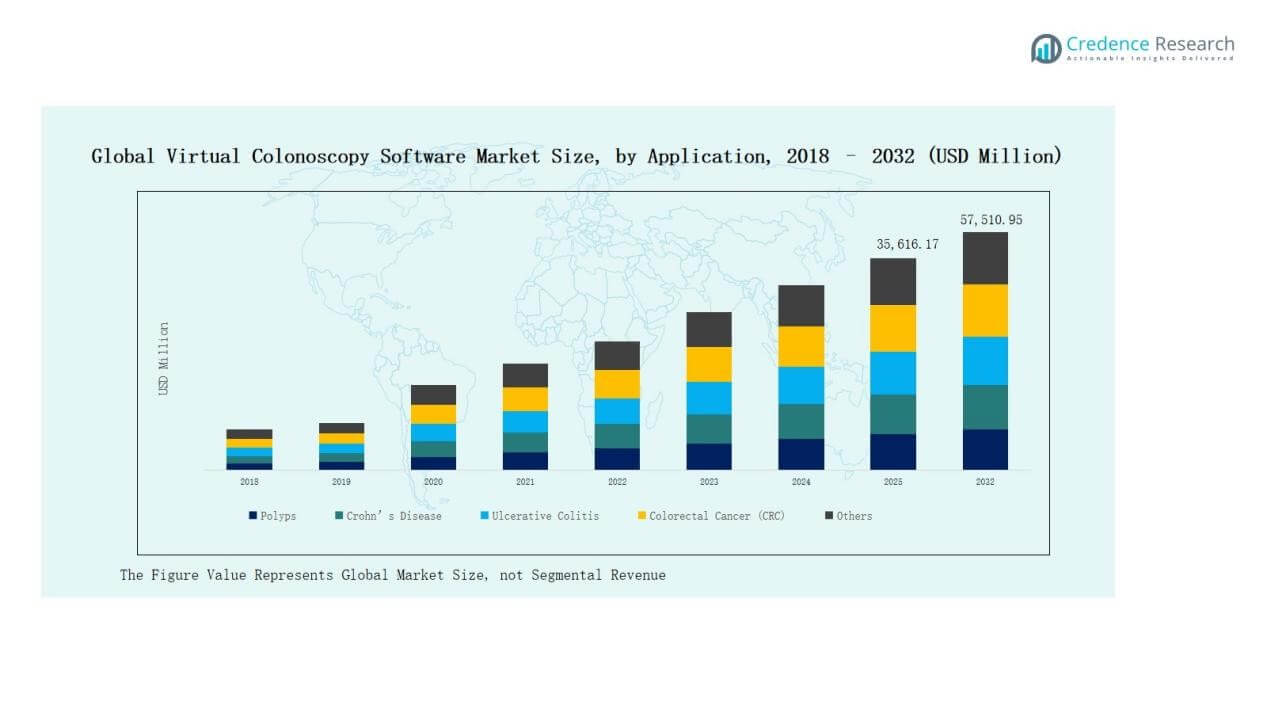

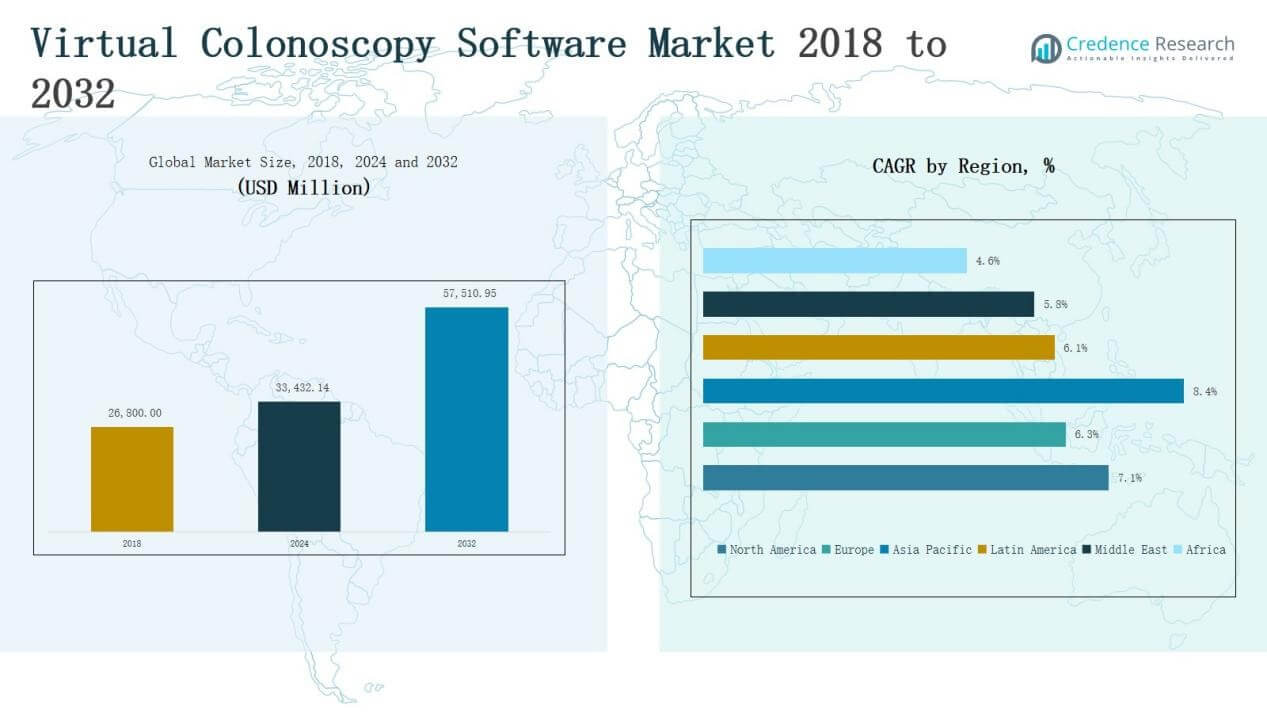

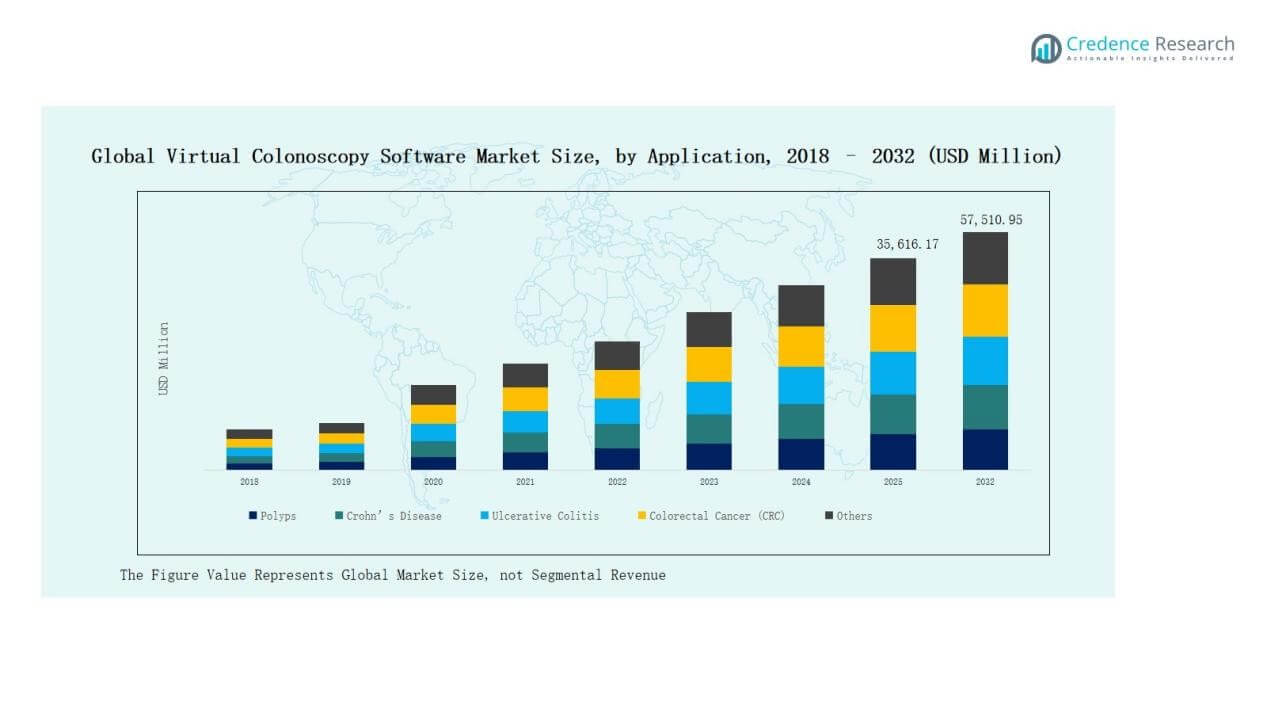

Virtual Colonoscopy Software Market size was valued at USD 26,800.00 million in 2018, reached USD 33,432.14 million in 2024, and is anticipated to reach USD 57,510.95 million by 2032, at a CAGR of 7.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Virtual Colonoscopy Software Market Size 2024 |

USD 33,432.14 Million |

| Virtual Colonoscopy Software Market, CAGR |

7.09% |

| Virtual Colonoscopy Software Market Size 2032 |

USD 57,510.95 Million |

The Virtual Colonoscopy Software Market is highly competitive, led by global medical imaging giants and specialized software providers. Siemens Healthineers, GE HealthCare Technologies, Koninklijke Philips N.V., and Canon Medical dominate with advanced 3D imaging solutions and broad distribution networks. Medtronic PLC, Boston Scientific Corporation, and Olympus Corporation strengthen their positions through integration of virtual colonoscopy into wider diagnostic platforms. Emerging innovators such as TeraRecon Inc., iCAD Inc., EDDA Technology Inc., and Viatronix Inc. enhance market dynamics with AI-driven visualization tools. Regionally, North America led with a 36.4% share in 2024, supported by robust healthcare infrastructure, reimbursement systems, and widespread adoption of advanced imaging technologies.

Market Insights

Market Insights

- The Virtual Colonoscopy Software Market grew from USD 26,800.00 million in 2018 to USD 33,432.14 million in 2024 and is projected at USD 57,510.95 million by 2032, reflecting a CAGR of 7.09%.

- The three-dimensional (3D) product type segment dominated with 62% share in 2024, driven by enhanced reconstruction and interactive tools, while two-dimensional (2D) solutions accounted for 38%

- Cloud-based deployment led with 57% share in 2024 due to scalability and telemedicine integration, whereas on-premises solutions retained 43% share, driven by security and compliance priorities.

- Hospitals remained the top end-user with 46% share in 2024, followed by diagnostic centers at 28%, clinics at 14%, ambulatory surgical centers at 8%, and others at 4%.

- North America led the market with 36.4% share in 2024, valued at USD 12,155.73 million, supported by advanced healthcare infrastructure, high awareness, and widespread adoption of 3D imaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

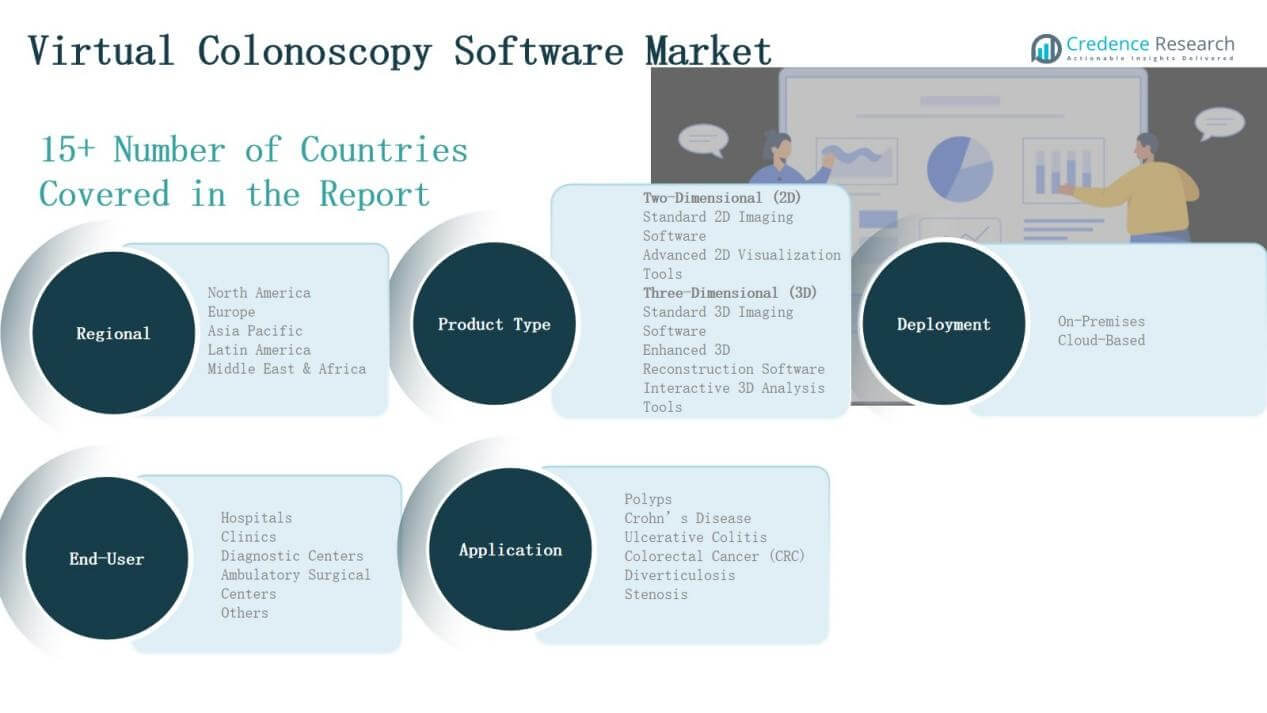

By Product Type

The three-dimensional (3D) segment held the dominant share of 62% in 2024, surpassing two-dimensional (2D) solutions. Enhanced 3D reconstruction software and interactive 3D analysis tools are widely preferred due to superior visualization and accuracy in polyp detection. Hospitals and diagnostic centers increasingly adopt 3D imaging to support early diagnosis and reduce false negatives. In contrast, standard 2D imaging software remains relevant for basic screenings but accounts for a smaller share of 38%, driven by cost efficiency and simpler workflows.

For instance, Olympus launched the EVIS X1 system, which includes advanced imaging technologies like Texture and Color Enhancement Imaging (TXI) and Red Dichromatic Imaging (RDI), to support improved endoscopic lesion detection and characterization.

By Deployment

Cloud-based deployment dominated the market with a 57% share in 2024, driven by its scalability, cost-effectiveness, and seamless integration with telemedicine platforms. Hospitals and clinics are rapidly adopting cloud systems to enable remote access, data storage, and collaboration across networks. On-premises solutions accounted for 43% share, remaining relevant in facilities prioritizing data security and strict compliance requirements. However, the market trend strongly favors cloud-based adoption, supported by growing investments in digital health infrastructure and rising demand for accessible imaging solutions worldwide.

For instance, GE HealthCare announced the integration of its Edison True PACS with AWS cloud to bring advanced diagnostic imaging insights and remote workflow management to healthcare providers.

By End-User

Hospitals represented the leading end-user segment with a 46% share in 2024, owing to advanced infrastructure, higher patient volumes, and greater integration of AI-based imaging. Diagnostic centers followed with a 28% share, reflecting their critical role in preventive screenings and outpatient care. Clinics accounted for 14%, while ambulatory surgical centers held 8%, highlighting their growing role in specialized treatments. The remaining 4% came from other healthcare facilities. Hospitals continue to drive market growth, supported by government programs promoting early colorectal cancer detection.

Key Growth Drivers

Key Growth Drivers

Rising Colorectal Cancer Screening Demand

The rising global incidence of colorectal cancer has accelerated the adoption of virtual colonoscopy software. Healthcare systems prioritize early detection programs to reduce mortality and treatment costs. Virtual colonoscopy offers a non-invasive alternative, increasing patient compliance compared to traditional colonoscopy. Governments and public health organizations are funding awareness campaigns and screening initiatives. Hospitals and diagnostic centers integrate advanced software into workflows, enabling efficient image analysis and broader screening coverage. This demand strongly supports sustained market expansion over the forecast period.

For instance, Philips has incorporated AI-driven image analysis in its virtual colonoscopy solutions, enhancing early detection accuracy and operational efficiency in diagnostic centers.

Technological Advancements in Imaging

Rapid improvements in 3D imaging, artificial intelligence, and reconstruction algorithms have strengthened the market. Enhanced software tools provide more accurate visualization of polyps, lesions, and abnormalities, reducing false positives and negatives. Integration with AI-based analysis ensures faster diagnosis and supports radiologists in decision-making. Improved image quality also boosts patient safety by minimizing unnecessary procedures. These advancements make virtual colonoscopy more reliable and cost-efficient, driving stronger adoption across hospitals, clinics, and diagnostic centers seeking modernized imaging solutions.

For instance, Fujifilm introduced its CAD EYE AI-powered software in Europe, which assists in detecting colorectal lesions during image-based procedures, improving diagnostic precision.

Shift Toward Non-Invasive Diagnostics

Growing patient preference for non-invasive screening techniques has become a significant growth driver. Traditional colonoscopy is often associated with discomfort and recovery time, discouraging patients from undergoing preventive tests. Virtual colonoscopy software reduces these barriers by offering a painless, outpatient-friendly alternative. The technology improves patient acceptance rates, especially for routine screenings. Healthcare providers leverage this advantage to expand preventive programs, aligning with global initiatives promoting early-stage cancer detection. This trend strengthens the role of virtual colonoscopy in mainstream diagnostic care.

Key Trends & Opportunities

Adoption of Cloud-Based Solutions

Cloud deployment of virtual colonoscopy software is rising as healthcare providers seek scalable, cost-effective solutions. Cloud platforms enable real-time collaboration, remote access, and integration with telemedicine services, enhancing diagnostic efficiency. This approach reduces infrastructure costs while supporting data management across networks. Growing reliance on digital healthcare ecosystems creates significant opportunities for vendors offering secure, compliant, and AI-powered cloud imaging solutions. The shift toward cloud adoption is expected to remain a strong trend, particularly in developed healthcare markets.

For instance, Siemens Healthineers integrates its long-standing syngo.CT Colonography software, which performs virtual colonoscopies, with its existing cloud-based platforms, like the teamplay digital health platform.

Integration of Artificial Intelligence (AI)

AI integration into virtual colonoscopy software presents a transformative opportunity. Machine learning algorithms improve accuracy in polyp detection and automate image interpretation, reducing radiologist workload. AI-driven analysis shortens diagnostic timeframes and enhances reliability, fostering greater adoption in busy healthcare facilities. Vendors are investing in R&D collaborations to expand AI-based functionalities and strengthen their product portfolios. This trend also aligns with precision medicine initiatives, offering customized insights for patient care. AI adoption is poised to redefine competitive dynamics in the market.

For instance, Medtronic partnered with Cosmo Pharmaceuticals to advance GI Genius™, an AI-powered polyp detection system cleared by the FDA, which supports real-time colorectal cancer screening.

Key Challenges

High Software and Implementation Costs

Despite strong benefits, high software licensing, implementation, and training costs hinder adoption. Smaller hospitals and clinics, especially in emerging economies, face budget limitations that restrict investment in advanced virtual colonoscopy tools. The need for specialized infrastructure further increases financial barriers. Vendors must develop flexible pricing models and cost-effective solutions to penetrate cost-sensitive markets. Without addressing affordability challenges, the pace of adoption may remain slower in regions with limited healthcare funding and resource constraints.

Limited Awareness and Patient Acceptance

A significant challenge lies in the lack of awareness about virtual colonoscopy among patients and even healthcare professionals. Many still prefer conventional colonoscopy due to familiarity, despite its invasive nature. Limited educational initiatives and cultural hesitancy slow down acceptance of advanced imaging tools. Addressing this challenge requires targeted awareness programs, medical training, and supportive guidelines from healthcare authorities. Expanding outreach will be crucial to ensuring broader market adoption and driving the transition toward non-invasive diagnostic methods.

Data Security and Regulatory Compliance

The adoption of cloud-based virtual colonoscopy software introduces concerns over data privacy and regulatory compliance. Handling sensitive patient health records requires strict adherence to international data protection standards such as HIPAA and GDPR. Breaches or compliance failures could damage trust and hinder adoption. Vendors must prioritize robust encryption, cybersecurity measures, and certifications to address these risks. Regulatory complexity across different regions adds to the challenge, requiring ongoing investment in compliance infrastructure and adaptive product strategies to remain competitive.

Regional Analysis

North America

North America led the virtual colonoscopy software market with a 36.4% share in 2024. The market was valued at USD 9,862.40 million in 2018, grew to USD 12,155.73 million in 2024, and is projected to reach USD 20,882.33 million by 2032, registering a CAGR of 7.1%. Growth is supported by advanced healthcare infrastructure, strong reimbursement frameworks, and high awareness of colorectal cancer screening. The U.S. dominates regional demand with widespread adoption of 3D imaging and cloud-based solutions. Canada and Mexico are witnessing steady growth, supported by digital health initiatives and improving diagnostic capabilities.

Europe

Europe accounted for 25.3% of the global market in 2024, valued at USD 7,053.76 million in 2018 and USD 8,457.42 million in 2024. It is expected to reach USD 13,742.39 million by 2032 at a CAGR of 6.3%. The region benefits from strong adoption in Germany, the UK, and France, driven by government-led cancer screening programs and advanced diagnostic facilities. Southern and Eastern Europe are catching up due to rising healthcare investments. Expanding research collaborations and early adoption of AI-powered diagnostic tools further strengthen Europe’s position in virtual colonoscopy adoption.

Asia Pacific

Asia Pacific held a 25.4% share of the market in 2024, valued at USD 6,517.76 million in 2018, USD 8,493.30 million in 2024, and expected to reach USD 16,131.87 million by 2032, at the fastest CAGR of 8.4%. China, Japan, and India are the leading markets, supported by growing awareness of preventive diagnostics and rising cancer incidence. Increasing government healthcare spending and rapid adoption of digital health technologies strengthen regional demand. Technological partnerships with global players and the expansion of cloud-based healthcare platforms enhance accessibility, positioning Asia Pacific as the fastest-growing market globally.

Latin America

Latin America captured 6.5% of the global market in 2024. It was valued at USD 1,747.36 million in 2018, reached USD 2,159.38 million in 2024, and is projected to grow to USD 3,454.68 million by 2032, at a CAGR of 6.1%. Brazil dominates the regional market due to strong adoption in urban healthcare facilities. Argentina and Mexico follow, supported by increasing awareness and expansion of diagnostic services. While limited infrastructure in rural areas slows progress, ongoing investment in digital healthcare and telemedicine creates significant opportunities for broader deployment of virtual colonoscopy software.

Middle East

The Middle East accounted for 3.7% of global revenue in 2024. The market was valued at USD 1,058.60 million in 2018, USD 1,240.12 million in 2024, and is expected to reach USD 1,932.68 million by 2032, growing at a CAGR of 5.8%. GCC countries dominate regional adoption due to advanced hospital infrastructure and increasing investment in preventive diagnostics. Israel is emerging as a hub for AI-driven medical imaging, supporting innovation in virtual colonoscopy solutions. Broader adoption in Turkey and other Middle Eastern countries is expected as healthcare modernization accelerates.

Africa

Africa held a 2.8% share of the global market in 2024, valued at USD 560.12 million in 2018 and USD 926.21 million in 2024. It is projected to reach USD 1,366.99 million by 2032, at the slowest CAGR of 4.6%. South Africa leads regional adoption, followed by Egypt, driven by growing awareness of colorectal cancer screening and improving diagnostic facilities. However, limited healthcare funding and infrastructure constraints hinder widespread adoption. Increasing government investment in digital health and partnerships with international healthcare providers are expected to improve accessibility over the forecast period.

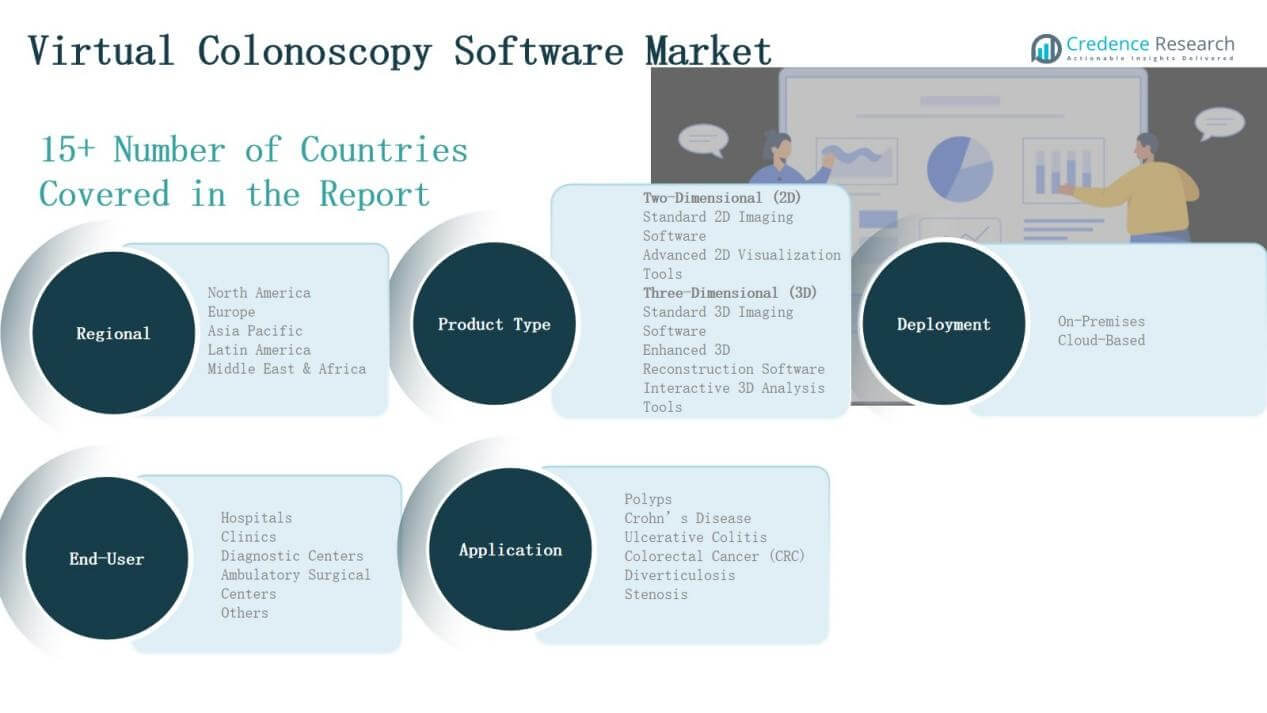

Market Segmentations:

Market Segmentations:

By Product Type

- Two-Dimensional (2D

- Standard 2D Imaging Software

- Advanced 2D Visualization Tools

- Three-Dimensional (3D)

- Standard 3D Imaging Software

- Enhanced 3D Reconstruction Software

- Interactive 3D Analysis Tools

By Deployment

By End-User

- Hospitals

- Clinics

- Diagnostic Centers

- Ambulatory Surgical Centers

- Others

By Application

- Polyps

- Crohn’s Disease

- Ulcerative Colitis

- Colorectal Cancer (CRC)

- Diverticulosis

- Stenosis

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The virtual colonoscopy software market is characterized by strong competition among global medical imaging leaders, specialized software providers, and research-driven institutions. Key players such as Siemens Healthineers, GE HealthCare Technologies, Philips, and Canon Medical dominate with extensive product portfolios, advanced 3D imaging solutions, and strong global distribution networks. Medtronic, Boston Scientific, and Olympus focus on integrating virtual colonoscopy tools into broader diagnostic and surgical platforms. Emerging companies like TeraRecon, iCAD, EDDA Technology, and Viatronix enhance competitiveness through AI-driven innovations and interactive visualization tools. Academic and research institutions, including Stony Brook University, also play a pivotal role in advancing imaging algorithms and clinical validation. Market participants compete on accuracy, workflow efficiency, data security, and regulatory compliance. Strategic collaborations, mergers, and technology licensing agreements remain common strategies to expand geographic reach and enhance product capabilities. Growing emphasis on cloud-based deployment and AI integration continues to redefine the competitive dynamics of this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Hitachi Medical Corporation

- Medtronic PLC

- Siemens Healthineers

- Koninklijke Philips N.V.

- Boston Scientific Corporation

- Olympus Corporation

- GE HealthCare Technologies Inc.

- Hologic Inc.

- Stony Brook University

- Carestream Health

- Toshiba Medical Systems Corporation

- Barco NV

- Agfa Healthcare

- Cybernet Systems Co. Ltd.

- Intelerad Medical Systems Incorporated

- Canon Medical Informatics Inc.

- TeraRecon Inc.

- iCAD Inc.

- Median Technologies

- LEXION Medical LLC

- Mentice Inc.

- Ziosoft USA Inc.

- EDDA Technology Inc.

- Viatronix Inc.

- Voxel-Q

Recent Developments

- In November 2024, ColoWatch partnered with Bracco Diagnostics to deliver a turnkey solution aimed at expanding the availability of virtual colonoscopy for early detection of colorectal cancer.

- In December 2024, Bracco Diagnostics and ColoWatch were highlighted in key gastrointestinal partnerships of the year, underscoring their joint efforts to strengthen virtual colonoscopy adoption.

- In July 2025, MAGENTIQ EYE Ltd. secured a Series A funding round to accelerate global expansion of its AI-powered colonoscopy platform MAGENTIQ-COLO™.

- In June 2025, Cosmo announced a clinical study combining GI Genius™ software with Apple Vision Pro to visualize AI insights during colonoscopy.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Deployment, End-User, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven imaging will improve diagnostic accuracy and reduce reporting time.

- Cloud-based platforms will gain wider acceptance for scalable and cost-efficient deployment.

- Hospitals will continue to dominate adoption due to infrastructure and screening volumes.

- Diagnostic centers will expand usage as outpatient demand for non-invasive screening rises.

- Patient preference for painless, outpatient-friendly procedures will fuel virtual colonoscopy demand.

- Integration with telemedicine platforms will strengthen accessibility in underserved regions.

- Vendors will invest in advanced 3D visualization and interactive analysis capabilities.

- Government initiatives promoting early cancer detection will support broader adoption.

- Emerging markets will see stronger growth with rising healthcare investments.

- Strategic collaborations among technology firms and healthcare providers will accelerate innovation.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: