Market Overview

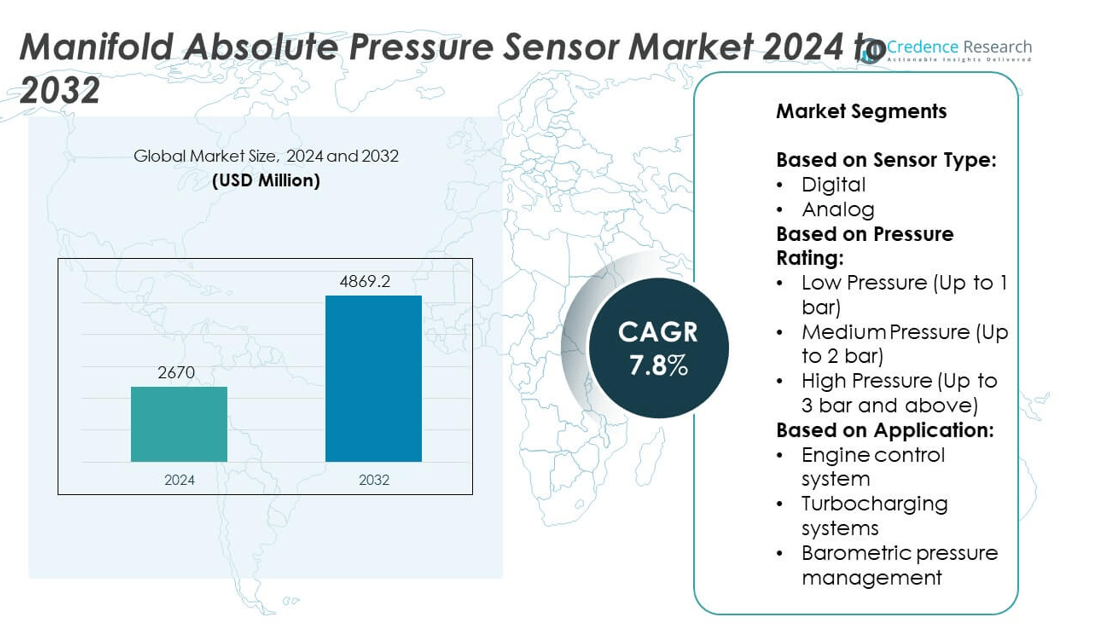

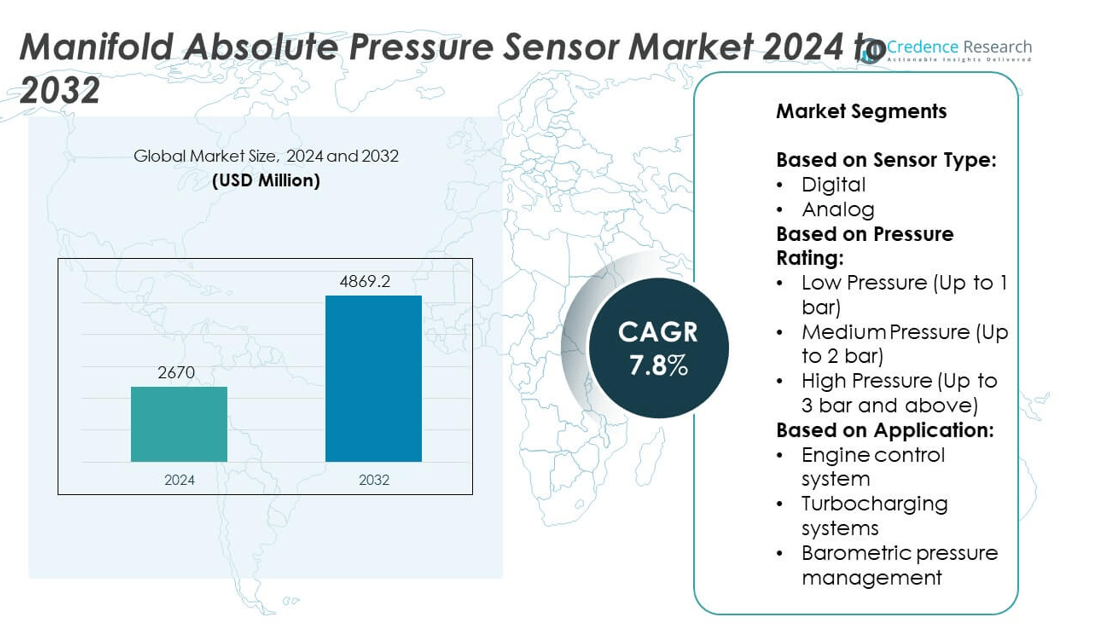

The Manifold Absolute Pressure Sensor market size was valued at USD 2670 million in 2024 and is projected to reach USD 4869.2 million by 2032, growing at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Manifold Absolute Pressure Sensor market Size 2024 |

USD 2670 million |

| Manifold Absolute Pressure Sensor market, CAGR |

7.8% |

| Manifold Absolute Pressure Sensor market Size 2032 |

USD 4869.2 million |

The Manifold Absolute Pressure Sensor market is driven by rising demand for advanced engine management systems, stringent global emission regulations, and the growing adoption of turbocharged and hybrid vehicles requiring precise intake pressure monitoring. It benefits from technological advancements in MEMS and digital sensing, enabling higher accuracy, durability, and integration with modern engine control units. Market trends include the integration of smart, connected sensor technologies, expansion into electrified powertrain applications, and increasing use in predictive maintenance systems. The shift toward compact, high-efficiency designs and the growth of aftermarket replacement demand further enhance the market’s growth.

The Manifold Absolute Pressure Sensor market spans key regions including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each influenced by automotive production levels, emission regulations, and technological adoption rates. North America and Europe lead in advanced sensor integration due to stringent emission norms, while Asia-Pacific shows rapid growth from expanding vehicle manufacturing in China, Japan, and India. Prominent players shaping the market include Robert Bosch GmbH, Denso Corporation, and Continental AG, alongside.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Manifold Absolute Pressure Sensor market was valued at USD 2670 million in 2024 and is projected to reach USD 4869.2 million by 2032, registering a CAGR of 7.8% during the forecast period.

- The market benefits from the rising adoption of advanced engine management systems and the enforcement of strict global emission norms, driving demand for high-precision intake pressure monitoring in passenger and commercial vehicles.

- Technological advancements in MEMS and digital sensing are improving sensor accuracy, durability, and integration with modern engine control units, while connected and predictive maintenance applications are expanding opportunities.

- The competitive landscape features established players such as Robert Bosch GmbH, Continental AG, and Denso Corporation, alongside companies like Sensata Technologies and Infineon Technologies AG, which are investing in innovation, miniaturization, and cost optimization.

- Challenges include vulnerability to harsh operating conditions, contamination risks, and price pressures from intense competition, forcing manufacturers to balance affordability with performance and regulatory compliance.

- Regional growth patterns show strong demand in North America and Europe due to advanced automotive technologies and regulatory frameworks, with Asia-Pacific emerging as the fastest-growing region driven by large-scale automotive production and evolving emission standards.

- Expanding hybrid and turbocharged vehicle production, combined with the growth of the global aftermarket for replacement and retrofit sensors, is expected to create sustained opportunities for market players across both developed and emerging economies.

Market Drivers

Rising Demand for Advanced Engine Management Systems in Automotive Industry

The automotive sector increasingly adopts advanced engine management systems to meet stringent emission regulations and enhance fuel efficiency. The Manifold Absolute Pressure Sensor market benefits from its critical role in measuring intake manifold pressure for accurate air-fuel ratio control. It supports improved combustion efficiency, enabling compliance with global emission standards such as Euro 6 and EPA Tier 3. Automotive OEMs integrate high-precision sensors to optimize engine performance in both passenger and commercial vehicles. The growing demand for electric and hybrid vehicles with advanced engine control modules further supports market expansion. Manufacturers focus on compact, durable sensor designs to ensure long-term operational stability in harsh conditions.

- For instance, Bosch delivers MAP sensors that achieve response times of less than 10 milliseconds, supporting rapid engine adjustment.

Stringent Government Regulations on Emission Reduction and Fuel Economy

Governments worldwide enforce strict emission norms and fuel economy targets, compelling vehicle manufacturers to implement precise air intake monitoring systems. The Manifold Absolute Pressure Sensor market experiences strong growth from its integration into emission control systems that reduce NOx and CO₂ levels. It helps maintain optimal combustion under varying load conditions, supporting compliance with regulatory frameworks in North America, Europe, and Asia-Pacific. Increasing environmental awareness drives accelerated adoption of advanced sensors in both conventional and alternative fuel vehicles. Automotive suppliers invest in high-sensitivity MEMS-based sensors to achieve improved responsiveness. The technology enables accurate measurements in low-pressure and high-temperature environments, meeting the evolving needs of modern engines.

- For instance, The Manifold Absolute Pressure Sensor market draws from these breakthroughs. Bosch Motorsport’s PST‑3 sensor offers an analog ratio‑metric output covering 0.2 to 3 bar, with a full‑scale tolerance of ±1.07 %, response time of 1 ms, and operating temperature range up to 130 °C.

Technological Advancements in MEMS and Digital Sensing Solutions

Rapid advancements in microelectromechanical systems (MEMS) and digital sensing technology enhance the accuracy and reliability of manifold absolute pressure sensors. The Manifold Absolute Pressure Sensor market gains from innovations that deliver faster signal processing and reduced error margins. It allows integration with vehicle onboard diagnostics to support predictive maintenance and performance optimization. Sensor miniaturization facilitates space-efficient designs for complex engine layouts. Leading manufacturers implement advanced signal conditioning circuits to reduce noise interference. The growing use of silicon-based piezoresistive technology boosts sensor lifespan and performance under fluctuating pressures.

Expansion of Automotive Production in Emerging Economies

Growing automotive production in emerging markets such as India, China, Brazil, and Indonesia drives sensor demand. The Manifold Absolute Pressure Sensor market benefits from increasing vehicle ownership and the shift toward technologically advanced models. It enables better engine control, which appeals to consumers seeking fuel efficiency and lower maintenance costs. Government initiatives supporting domestic automotive manufacturing further strengthen market growth. Global suppliers establish local production facilities to cater to rising regional demand. The expansion of aftermarket sensor sales complements OEM growth, ensuring continuous market opportunities.

Market Trends

Integration of Smart and Connected Sensor Technologies in Automotive Systems

Automotive manufacturers are increasingly integrating smart and connected sensor technologies into engine management systems. The Manifold Absolute Pressure Sensor market is evolving with sensors that support real-time data communication to advanced vehicle control units. It enables predictive diagnostics and improved engine tuning, enhancing overall vehicle efficiency. Wireless connectivity features are becoming more common, allowing remote monitoring of sensor performance. Manufacturers are focusing on sensors that can interface seamlessly with IoT-based automotive platforms. This integration supports faster data processing, enabling more responsive and adaptive engine control strategies.

- For instance, Infineon’s KP276A1201 digital MAP sensor converts pressure into a 12‑bit digital value and supports SENT protocol alongside an external NTC temperature sensor interface, offering diagnostic mode activation through power‑on testing.

Shift Toward Electrified and Hybrid Vehicle Applications

The growing adoption of hybrid and plug-in hybrid vehicles is influencing sensor technology requirements. The Manifold Absolute Pressure Sensor market benefits from sensors adapted to the unique air intake characteristics of electrified powertrains. It ensures precise pressure measurements in engines that operate intermittently or at variable loads. Manufacturers design sensors to maintain accuracy during frequent engine start-stop cycles. Demand for low-power, high-efficiency sensors is increasing to align with the energy-saving objectives of hybrid systems. This trend encourages innovation in compact and lightweight sensor designs to optimize integration in space-constrained engine compartments.

- For instance, Bosch Motorsport’s PST‑3 sensor weighs just 24 grams, offers a response time of 1 millisecond, and operates across temperatures from –40 °C to 130 °C, making it particularly suitable for hybrid systems with frequent engine cycling.

Advancements in MEMS and Piezoresistive Sensing Capabilities

Technological progress in microelectromechanical systems (MEMS) and piezoresistive sensing is enhancing performance standards. The Manifold Absolute Pressure Sensor market is witnessing improved accuracy, stability, and durability through the use of advanced silicon-based materials. It supports better resistance to vibration, temperature extremes, and contamination in harsh engine environments. New MEMS designs enable faster response times, which are critical for dynamic engine load conditions. Sensor calibration processes are becoming more sophisticated to ensure long-term accuracy without frequent maintenance. Integration with digital output formats is improving compatibility with modern engine control units.

Growing Demand for Aftermarket Replacement and Retrofit Solutions

The expansion of the global vehicle fleet is driving demand for aftermarket sensor replacements and retrofit solutions. The Manifold Absolute Pressure Sensor market gains from consumers upgrading older vehicles with more efficient and precise sensing technologies. It allows extended vehicle lifespan while improving performance and emissions compliance. Affordable, high-quality aftermarket sensors are increasingly available, meeting the needs of budget-conscious vehicle owners. E-commerce platforms are becoming key distribution channels for replacement sensors. This trend supports sustained market demand beyond OEM production cycles.

Market Challenges Analysis

High Sensitivity to Harsh Operating Conditions and Contamination Risks

Manifold absolute pressure sensors operate in demanding engine environments with exposure to high temperatures, vibrations, and contaminants. The Manifold Absolute Pressure Sensor market faces challenges from sensor degradation caused by dust, oil vapors, and fuel residues entering the intake manifold. It can lead to signal drift, inaccurate readings, and reduced efficiency in engine control systems. Manufacturers must invest in robust sealing techniques and advanced filtration to extend sensor life. Designing sensors with high thermal resistance and anti-corrosion properties increases production costs. The need for frequent calibration or replacement in extreme operating conditions affects user confidence and aftermarket demand.

Price Pressure from Intense Competition and OEM Cost Constraints

Strong competition among global and regional sensor manufacturers exerts downward pressure on prices. The Manifold Absolute Pressure Sensor market experiences reduced profit margins due to OEMs seeking cost-effective solutions without compromising performance. It forces suppliers to balance affordability with investment in advanced technologies such as MEMS-based sensing. High R&D expenditure for innovations in miniaturization, signal accuracy, and durability increases financial strain. Smaller manufacturers face difficulties in sustaining profitability while meeting stringent quality standards. The challenge intensifies with fluctuating raw material costs, impacting long-term pricing strategies.

Market Opportunities

Adoption of Advanced Engine Control Technologies in Emerging Automotive Markets

Rapid expansion of the automotive industry in emerging economies presents strong growth potential for sensor manufacturers. The Manifold Absolute Pressure Sensor market benefits from rising demand for vehicles equipped with advanced engine control technologies to meet stricter emission and fuel efficiency regulations. It enables precise monitoring of air intake pressure, supporting optimized combustion and lower exhaust emissions. Governments in countries such as India, China, and Brazil are implementing policies that encourage the use of cleaner and more efficient vehicles. Local manufacturing incentives create opportunities for global suppliers to establish regional production facilities. Expanding middle-class populations with increasing purchasing power further drive the shift toward technologically advanced vehicles.

Integration with Connected and Predictive Vehicle Maintenance Systems

The growing use of connected vehicle technologies opens opportunities for integrating manifold absolute pressure sensors with predictive maintenance platforms. The Manifold Absolute Pressure Sensor market gains from sensors capable of transmitting real-time diagnostic data to cloud-based analytics systems. It allows early detection of performance deviations, reducing repair costs and improving vehicle reliability. Fleet operators adopt such technologies to minimize downtime and extend asset life. Advancements in IoT-enabled automotive ecosystems create demand for sensors with wireless communication and enhanced data accuracy. This integration supports the development of smarter, more efficient vehicles aligned with future mobility trends.

Market Segmentation Analysis:

By Sensor Type:

The Manifold Absolute Pressure Sensor market is segmented into digital and analog types. Digital sensors are increasingly preferred for their high accuracy, fast signal processing, and compatibility with modern engine control units. It offers stable performance in varying environmental conditions, making them suitable for advanced automotive systems. Analog sensors maintain a significant presence due to their cost-effectiveness and simpler integration in older or budget vehicle models. They remain popular in certain aftermarket applications where digital upgrades are not essential. Growing adoption of MEMS-based technology in both sensor types is enhancing performance and reliability.

- For instance, Continental’s VDO 5WK9700Z MAP sensor covers a pressure range of 0.1 to 1.2 bar (10–120 kPa) with a 3-port configuration.

By Pressure Rating:

The market is categorized into low pressure (up to 1 bar), medium pressure (up to 2 bar), and high pressure (up to 3 bar and above) sensors. Low-pressure variants are commonly used in barometric pressure monitoring and naturally aspirated engines. Medium-pressure sensors serve a wide range of engine control and turbocharging applications where moderate boost levels are present. The Manifold Absolute Pressure Sensor market sees strong demand for high-pressure sensors in performance-oriented and heavy-duty engines, particularly in turbocharged and supercharged configurations. It supports precise control under extreme load and boost conditions, enhancing power output and efficiency. Advancements in materials and sealing techniques are improving durability across all pressure ratings.

- For instance, Denso’s T-MAP sensors combine manifold absolute pressure and intake air temperature measurement, covering a pressure range of 20 kPa to 250 kPa with an output voltage of 0.5 V to 4.5 V, ensuring precise boost control and altitude compensation in varying driving conditions.

By Application:

The market includes engine control systems, turbocharging systems, and barometric pressure management. Engine control systems represent the largest application segment, with sensors playing a critical role in maintaining optimal air-fuel ratios for efficiency and emissions compliance. Turbocharging systems rely on high-accuracy sensors to monitor and regulate boost pressure, preventing engine damage and ensuring performance consistency. The Manifold Absolute Pressure Sensor market also benefits from applications in barometric pressure management, enabling engines to adapt seamlessly to altitude changes. It provides real-time pressure feedback that supports smooth engine operation in diverse driving conditions. Integration with advanced diagnostics enhances reliability and long-term performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Sensor Type:

Based on Pressure Rating:

- Low Pressure (Up to 1 bar)

- Medium Pressure (Up to 2 bar)

- High Pressure (Up to 3 bar and above)

Based on Application:

- Engine control system

- Turbocharging systems

- Barometric pressure management

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 27% of the global Manifold Absolute Pressure Sensor market, driven by the presence of leading automotive manufacturers and a strong focus on advanced engine management systems. The region benefits from stringent emission regulations enforced by agencies such as the U.S. Environmental Protection Agency (EPA) and Transport Canada, which require precise air-fuel ratio monitoring for compliance. It sees high adoption of digital and MEMS-based manifold absolute pressure sensors in both passenger and commercial vehicles. The market is further supported by robust R&D activities from major automotive OEMs and Tier-1 suppliers based in the United States and Canada. Rising sales of hybrid and turbocharged vehicles increase the demand for high-accuracy, high-pressure sensors. The growing aftermarket sector in the U.S. also contributes to sustained demand for replacement and upgrade solutions.

Europe

Europe holds 31% of the Manifold Absolute Pressure Sensor market, making it the largest regional contributor. The market growth is driven by the European Union’s strict Euro 6 and upcoming Euro 7 emission standards, which necessitate advanced intake pressure monitoring. It benefits from the high penetration of turbocharged gasoline and diesel engines, where precise boost pressure measurement is critical. Germany, France, and Italy lead in sensor technology adoption due to their strong automotive manufacturing base. The shift toward electrified powertrains, particularly plug-in hybrids, also fuels demand for sensors capable of functioning effectively under intermittent engine operation. European suppliers are investing in lightweight, compact sensor designs to optimize integration in modern engine compartments. The region’s strong focus on sustainability and performance positions it as a hub for innovation in sensor technology.

Asia-Pacific

Asia-Pacific commands 33% of the Manifold Absolute Pressure Sensor market, representing the fastest-growing regional segment. The region’s growth is driven by large-scale automotive production in China, Japan, India, and South Korea. It benefits from government policies promoting fuel efficiency and low-emission vehicles, creating strong demand for advanced sensor solutions. China leads in vehicle output, generating significant OEM-level requirements for both low- and high-pressure sensors. Japan’s technological expertise fosters the development of MEMS-based sensors with enhanced durability and response time. India’s expanding passenger vehicle market, coupled with Bharat Stage VI emission norms, boosts sensor adoption. The combination of rapid urbanization, rising vehicle ownership, and local manufacturing incentives strengthens the market’s growth trajectory in this region.

Latin America

Latin America captures 6% of the Manifold Absolute Pressure Sensor market, supported by increasing automotive production in Brazil, Mexico, and Argentina. It sees gradual adoption of advanced engine control systems as governments implement tighter emission standards. Brazil’s ethanol-fueled vehicles and turbocharged gasoline models drive the need for accurate manifold pressure monitoring. The region’s aftermarket sector plays a crucial role in maintaining steady demand for replacement sensors. It faces challenges from slower economic growth compared to other regions, but infrastructure improvements and new assembly plants are expected to support future expansion. Local suppliers are also beginning to explore low-cost MEMS-based solutions to meet OEM requirements.

Middle East & Africa

The Middle East & Africa region holds 3% of the Manifold Absolute Pressure Sensor market, driven primarily by demand in South Africa, the UAE, and Saudi Arabia. It benefits from the growing popularity of high-performance and off-road vehicles, which require robust high-pressure sensors. Government-led diversification strategies in Gulf countries are encouraging local automotive assembly, indirectly supporting sensor demand. The aftermarket sector remains strong, with a high proportion of imported vehicles requiring sensor replacements. It faces constraints from limited local manufacturing capabilities, but rising investments in the automotive supply chain are expected to improve regional market participation over time. The adoption rate is projected to increase as more advanced vehicles enter these markets.

Key Player Analysis

- TE Connectivity

- Sensata Technologies

- Hitachi Automotive Systems, Ltd.

- Continental AG

- BorgWarner Inc.

- Honeywell Corporation

- Robert Bosch GmbH

- NXP Semiconductors

- Denso Corporation

- Infineon Technologies AG

Competitive Analysis

The leading players in the Manifold Absolute Pressure Sensor market include Robert Bosch GmbH, Continental AG, Denso Corporation, Sensata Technologies, Infineon Technologies AG, NXP Semiconductors, BorgWarner Inc., Honeywell Corporation, Hitachi Automotive Systems, Ltd., and TE Connectivity. These companies compete through technological innovation, product quality, and strategic partnerships with automotive OEMs. They focus on developing MEMS-based sensors with enhanced accuracy, faster response times, and improved durability to meet evolving emission standards and performance requirements. Strong R&D investments enable the integration of advanced signal processing and digital output capabilities, supporting seamless compatibility with modern engine control units. Market leaders leverage global manufacturing and distribution networks to serve diverse automotive markets, ensuring availability for both OEM and aftermarket segments. Competitive strategies include expanding product portfolios, localizing production to reduce costs, and adopting lightweight, compact designs for better integration in space-constrained engine compartments. Emerging competition from regional manufacturers intensifies price pressures, prompting established players to optimize manufacturing efficiency while maintaining quality. The focus on sustainability and compliance with stringent environmental regulations is driving the development of robust, long-life sensors suitable for harsh operating conditions, enabling market leaders to strengthen their position in both developed and rapidly growing automotive regions.

Recent Developments

- In 2024, Tata motors in India announced new stricter emission norms (BS-VII and CAFE-III), which is expected to increase MAP sensor adoption broadly.

- In April 2024, Honeywell introduced SmartLine STA700 and STA800 Absolute Pressure Transmitters with high accuracy for vacuum applications, which also relate to absolute pressure sensing technology relevant to MAP sensors.

- In October 2023, Niterra, a Japanese multinational, owner of the NGK and NTK brands and specializes in components for ignition systems and sensors for injection systems launched the new Manifold Absolute Pressure (MAP) sensors under the NTK brand. The new sensor is an absolute pressure sensor of the intake manifold that is important for the correct functioning of the injection system.

Market Concentration & Characteristics

The Manifold Absolute Pressure Sensor market exhibits a moderately concentrated structure, with a few global manufacturers holding significant influence due to their strong technological capabilities, established OEM partnerships, and extensive distribution networks. It is characterized by high entry barriers driven by stringent automotive quality standards, advanced manufacturing requirements, and the need for continuous innovation in MEMS and digital sensing technologies. Leading companies compete on performance, reliability, and cost efficiency, focusing on sensors with enhanced accuracy, durability, and integration compatibility with modern engine control units. The market demonstrates strong product standardization in core functionalities, though differentiation occurs through miniaturization, improved thermal resistance, and advanced signal processing features. It serves both OEM and aftermarket segments, with OEM demand dominating due to integration into new vehicle production, while aftermarket sales provide consistent revenue streams through replacement and retrofit needs. Rapid technological advancements and evolving emission regulations drive ongoing R&D investment, shaping a competitive environment that rewards innovation and operational efficiency. Global supply chains and localized production facilities play a critical role in cost management and responsiveness to regional demand shifts. The market’s long product lifecycle and critical role in vehicle performance ensure sustained demand across diverse automotive segments worldwide.

Report Coverage

The research report offers an in-depth analysis based on Sensor Type, Pressure Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow with the increasing adoption of advanced engine management systems in passenger and commercial vehicles.

- Stringent global emission regulations will continue to drive the integration of high-precision manifold absolute pressure sensors.

- MEMS and digital sensing technologies will see greater adoption for improved accuracy and reliability.

- Hybrid and turbocharged vehicle production will boost the requirement for high-pressure and responsive sensors.

- Integration with connected vehicle and predictive maintenance platforms will create new application opportunities.

- Localized manufacturing in emerging markets will expand to meet rising regional automotive demand.

- Aftermarket sales will remain strong due to replacement needs and retrofit installations in older vehicles.

- Competition will intensify, pushing manufacturers toward cost optimization and faster innovation cycles.

- Sensor miniaturization and lightweight designs will gain prominence to fit compact engine layouts.

- Long-term growth will be supported by the global shift toward cleaner, more efficient vehicle technologies.