Market Overview

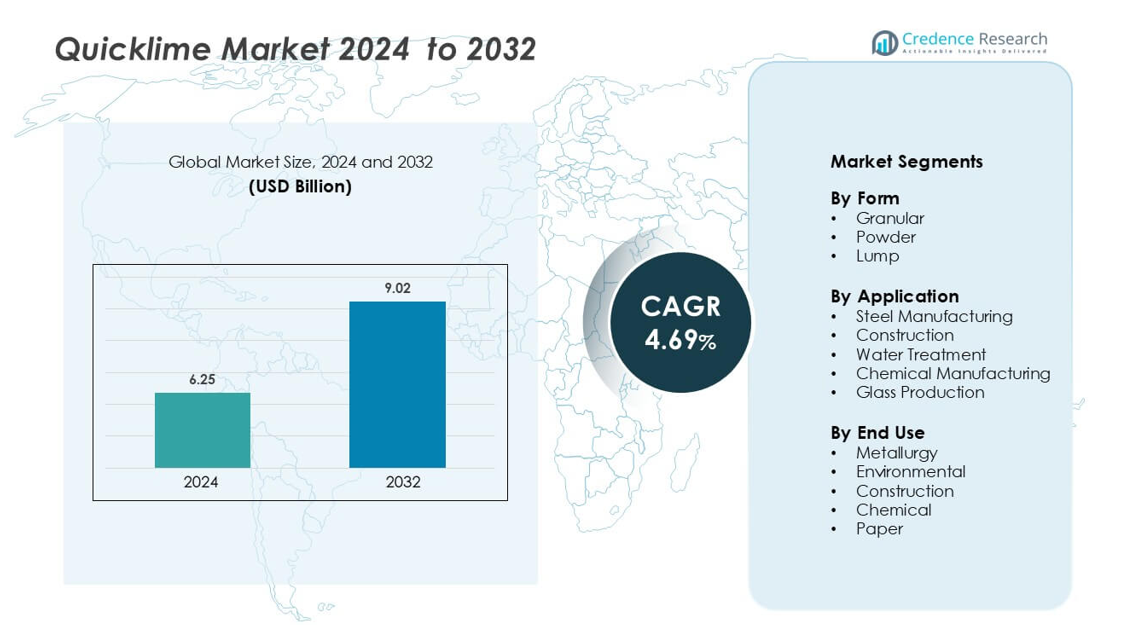

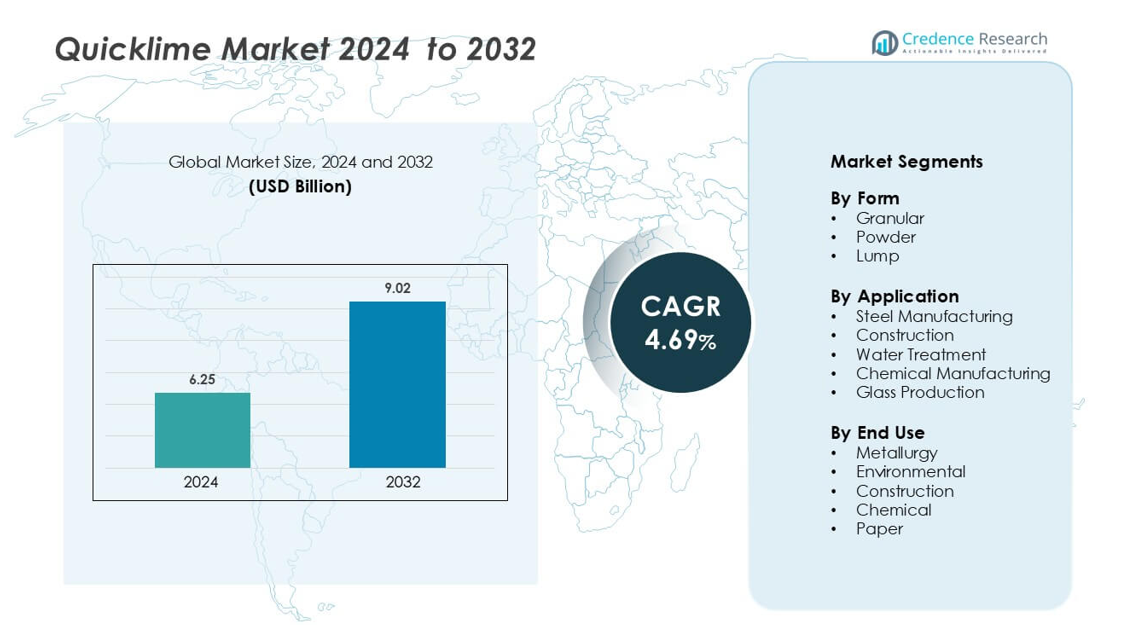

Quicklime Market size was valued USD 6.25 billion in 2024 and is anticipated to reach USD 9.02 billion by 2032, at a CAGR of 4.69 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Quicklime Market Size 2024 |

USD 6.25 billion |

| Quicklime Market, CAGR |

4.69% |

| Quicklime Market Size 2032 |

USD 9.02 billion |

The quicklime market features strong competition among major players emphasizing innovation, quality, and sustainability. Key companies include Graymont Limited, Lhoist Group, Carmeuse, Mississippi Lime Company, Minerals Technologies, Inc., Afrimat, Pete Lien & Sons, Inc., United States Lime & Minerals Inc., Linwood Mining & Minerals Corporation, and Cheney Lime & Cement Company. These companies focus on advanced kiln technologies, carbon-efficient production, and expanding supply networks to meet rising industrial demand. Asia Pacific leads the global quicklime market with a 38% share, supported by rapid industrialization, large-scale steel production, and extensive infrastructure projects across China, India, and Japan, ensuring continued regional dominance.

Market Insights

- The quicklime market was valued at USD 6.25 billion in 2024 and is projected to reach USD 9.02 billion by 2032, registering a CAGR of 4.69% during the forecast period.

- Rising demand from steel manufacturing and construction industries drives market growth, supported by quicklime’s critical role in purification, stabilization, and cement production.

- Technological advancements in kiln efficiency, automation, and emission control are shaping production trends toward sustainability and energy optimization.

- The market is competitive, with key players such as Graymont Limited, Lhoist Group, Carmeuse, and Mississippi Lime Company focusing on innovation and capacity expansion to maintain market presence.

- Asia Pacific leads with a 38% regional share, followed by North America at 28% and Europe at 25%, while the granular form segment holds 42% of total demand due to its widespread use in steel, construction, and environmental applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

The granular form dominates the quicklime market with a 42% share, driven by its superior reactivity and uniform particle distribution. Granular quicklime is widely used in metallurgical and construction applications due to its high efficiency in controlling process conditions and ease of handling. The product’s consistent quality and compatibility with automated feeding systems enhance productivity across various industries. Increasing demand from steel and environmental sectors further supports segment growth.

- For instance, Mississippi Lime Company reports a BET surface area of 2.0 m²/g and a dry bulk density of 40 lbs/ft³ for its granular product at Ste. Genevieve.

By Application

Steel manufacturing is the leading application segment, accounting for 48% of the market share. Quicklime plays a vital role in removing impurities like sulfur and phosphorus during steel production, improving yield and quality. Its use in basic oxygen furnaces and electric arc furnaces has surged with rising global steel output. The growing infrastructure and automotive industries continue to drive demand for high-grade quicklime in steelmaking processes.

- For instance, Lhoist Group’s “Booster™” lime-based slag conditioner underwent industrial trials in 190-ton BOF converters at Dillinger Hütte, where it delivered an additional desulfurization benefit of 8 ppm sulfur and improved manganese yield by 1.1 wt% compared to standard quicklime

By End Use

The metallurgy segment leads the quicklime market with a 44% share, fueled by its extensive role in refining and smelting operations. Quicklime aids in slag formation, impurity removal, and metal purification, ensuring superior metallurgical efficiency. The expansion of steel and non-ferrous metal industries across Asia-Pacific significantly contributes to segment growth. Environmental and construction end uses also show increasing demand due to applications in wastewater treatment and soil stabilization

Key Growth Drivers

Rising Demand from Steel Manufacturing Industry

The steel industry remains the largest consumer of quicklime, driving consistent market growth. Quicklime plays a crucial role in purifying molten steel by removing impurities such as sulfur, phosphorus, and silica during production. Increasing global steel output, especially in Asia-Pacific, boosts quicklime consumption in basic oxygen and electric arc furnaces. The demand for high-purity lime aligns with the surge in infrastructure, construction, and automotive manufacturing. Furthermore, steelmakers are investing in energy-efficient and low-emission production processes that rely on optimized flux materials like quicklime. Expanding steel capacity in countries such as India and China strengthens the segment’s long-term growth outlook.

- For instance, Lhoist Group’s Calexor® quicklime product achieves a CaO content exceeding 95 % and a reactivity T60 below 50 seconds, enabling faster slag formation and improved impurity removal.

Expanding Construction and Infrastructure Development

The rising pace of construction and urban infrastructure development significantly fuels quicklime demand. Quicklime is essential in producing cement, mortars, and plasters due to its superior binding and setting properties. It also aids in soil stabilization and foundation reinforcement, improving durability and load-bearing strength. Governments across emerging economies are investing in smart city projects, transportation corridors, and housing programs, which increase lime consumption in cement and concrete production. Additionally, the product’s ability to enhance water resistance in building materials supports its adoption in large-scale civil engineering projects. Growing infrastructure budgets and private sector investments in commercial real estate further strengthen the quicklime market.

- For instance, Carmeuse’s “Construction Quicklime (CQL)” product features particles roughly half the diameter of traditional quicklime fines and enabled a mellow period of just 4 hours in a soil-reclaimer trial, accelerating subgrade stabilization.

Increasing Application in Water Treatment and Environmental Management

Quicklime usage in water treatment and environmental applications is expanding rapidly due to its effectiveness in neutralizing acidity and removing heavy metals. It is widely applied in municipal wastewater treatment, flue gas desulfurization, and industrial effluent control. Growing environmental regulations aimed at reducing water pollution and air emissions are promoting the adoption of lime-based treatment systems. Quicklime’s ability to reduce biological oxygen demand (BOD) and chemical oxygen demand (COD) enhances its role in sustainable industrial operations. The growing emphasis on circular economy principles and eco-friendly waste management technologies further increases product demand from environmental service providers and manufacturing sectors.

Key Trends and Opportunities

Shift Toward Energy-Efficient and Sustainable Lime Production

Sustainability is becoming a central focus in the quicklime industry, with producers adopting low-carbon manufacturing technologies. Companies are integrating renewable energy sources, waste heat recovery systems, and carbon capture techniques into lime kilns to minimize CO₂ emissions. The development of hybrid fuel kilns using hydrogen and natural gas blends is gaining traction in Europe and North America. Moreover, regulatory frameworks supporting cleaner industrial production, such as the EU Emissions Trading System (ETS), encourage innovation in lime calcination. This shift creates opportunities for manufacturers to differentiate through eco-friendly production processes while meeting global climate targets.

- For instance, Lhoist Group’s CalCC project at its Réty site aims to capture and store over 600,000 tons of CO₂ annually via its Cryocap™ FG system.

Technological Advancements in Lime Processing and Automation

Technological innovation is reshaping quicklime production through automation, digital monitoring, and optimized resource utilization. Advanced kiln designs, predictive maintenance software, and AI-based quality control systems are improving operational efficiency and product uniformity. These technologies reduce fuel consumption, lower maintenance costs, and enhance temperature control during calcination. Companies adopting Industry 4.0 frameworks can track emissions and energy use in real-time, aligning with sustainability and efficiency goals. The integration of automation in logistics and bulk handling further reduces supply chain costs, creating new opportunities for global competitiveness in the quicklime industry.

- For instance, Lhoist Group installed a Maerz R4S type parallel-flow regenerative kiln in Montevallo, USA, with a nominal production rate of 600 tons per day, enabling smoother plant operations under digital monitoring systems.

Key Challenges

Environmental Regulations and Emission Control Requirements

Stringent environmental laws present a major challenge for quicklime manufacturers due to high carbon emissions from limestone calcination. Regulatory bodies, including the EPA and EU Commission, enforce strict limits on CO₂ output and dust emissions, increasing operational costs. Companies must invest heavily in emission control technologies such as scrubbers and carbon capture systems to comply. These investments raise capital expenditure and may impact profitability for small and medium producers. Transitioning to renewable or hybrid fuels also involves infrastructure upgrades, making sustainability compliance a costly process for many producers worldwide.

Volatility in Raw Material and Energy Costs

Limestone and fuel costs significantly influence quicklime production economics. Market fluctuations in natural gas, coal, and electricity prices directly affect kiln operations and product pricing. Supply chain disruptions, energy crises, or geopolitical tensions can further exacerbate cost instability. In addition, transportation costs remain high due to quicklime’s bulk density and regional sourcing constraints. Manufacturers face pressure to maintain competitive pricing while ensuring profitability. The need to secure stable raw material supply contracts and adopt energy-efficient technologies is essential to mitigate the impact of these cost fluctuations on long-term market sustainability.

Regional Analysis

North America

North America holds a 28% share of the global quicklime market, driven by strong demand from steel, construction, and environmental sectors. The United States dominates regional consumption due to expanding infrastructure projects and advanced water treatment facilities. Quicklime is extensively used in soil stabilization, wastewater management, and flue gas desulfurization. Increasing adoption of sustainable lime production methods and technological upgrades in lime kilns also support market expansion. Canada contributes through mining and industrial applications, while Mexico’s rapid construction growth further strengthens regional demand.

Europe

Europe accounts for 25% of the quicklime market, supported by established steel and chemical industries. Countries such as Germany, France, and Italy lead production, emphasizing energy-efficient and low-carbon manufacturing processes. Quicklime is crucial in construction materials and environmental management, particularly in wastewater treatment and emission control. The European Union’s Green Deal initiatives promote cleaner industrial operations, accelerating investment in advanced lime technologies. Demand from the paper and glass sectors also contributes to steady market growth across the region, ensuring long-term stability.

Asia Pacific

Asia Pacific dominates the global quicklime market with a 38% share, led by China, India, and Japan. The region’s rapid industrialization, infrastructure development, and high steel output are key growth drivers. Quicklime demand is fueled by construction projects, cement production, and metal refining activities. China remains the largest producer and consumer, supported by abundant limestone reserves and large-scale industrial capacity. India’s growing urbanization and government infrastructure programs further enhance market expansion. Advancements in lime calcination technologies and rising environmental compliance are expected to sustain the region’s leadership position.

Latin America

Latin America captures 6% of the global quicklime market, with Brazil and Mexico as leading contributors. The region’s demand is primarily driven by construction, mining, and metallurgical sectors. Quicklime is widely used for ore processing, steel refining, and water treatment applications. Infrastructure modernization initiatives and increased investment in mining projects continue to fuel growth. Brazil’s expanding steel industry and Chile’s mining operations strengthen market potential. Regional producers are focusing on cost-efficient production methods and improved distribution networks to meet the rising demand across diverse industrial applications.

Middle East & Africa

The Middle East & Africa region accounts for 3% of the quicklime market, driven by growth in construction, metallurgy, and water treatment. The UAE, Saudi Arabia, and South Africa lead regional consumption, supported by ongoing infrastructure and industrialization projects. Quicklime’s role in wastewater management and steel refining is gaining prominence with expanding industrial bases. Government initiatives promoting non-oil sector growth further stimulate market development. Increasing investments in cement and steel production facilities, along with improved trade networks, are enhancing quicklime adoption across the region’s emerging economies.

Market Segmentations:

By Form

By Application

- Steel Manufacturing

- Construction

- Water Treatment

- Chemical Manufacturing

- Glass Production

By End Use

- Metallurgy

- Environmental

- Construction

- Chemical

- Paper

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The quicklime market is moderately consolidated, with key players such as Graymont Limited, Lhoist Group, Pete Lien & Sons, Afrimat, Mississippi Lime Company, Carmeuse, Minerals Technologies Inc., United States Lime & Minerals Inc., Linwood Mining & Minerals Corporation, and Cheney Lime & Cement Company dominating global supply. These companies focus on expanding production capacity, enhancing purity levels, and improving energy efficiency in lime processing. Strategic initiatives such as mergers, acquisitions, and regional expansions strengthen their market presence across construction, metallurgy, environmental, and chemical sectors. Investments in carbon capture and waste heat recovery technologies reflect the industry’s shift toward sustainable lime production. Leading manufacturers are also adopting digital process control systems to optimize kiln operations and product consistency. Continuous product innovation and strategic geographic positioning allow these players to maintain strong competitiveness in both mature and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Graymont Limited (Canada)

- Lhoist Group (Belgium)

- Pete Lien & Sons, Inc. (U.S.)

- Afrimat (South Africa)

- Mississippi Lime Company (U.S.)

- Carmeuse (Belgium)

- Minerals Technologies, Inc. (U.S.)

- United States Lime & Minerals Inc. (U.S.)

- Linwood Mining & Minerals Corporation (U.S.)

- Cheney Lime & Cement Company (U.S.)

Recent Developments

- In January 2024, Mississippi Lime Company (MLC) has invested in constructing a state-of-the-art, sustainable kiln at its newly acquired lime operation in Bonne Terre, Missouri. The construction began in early 2024, and commissioning will be completed by 2026.

- In September 2023, Lohist Group announced its decision to expand its lime production capacity in Texas, U.S. The purpose of the production expansion was to establish the company’s business presence in the U.S. and maximize its revenue from the lime segment

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The quicklime market will witness steady growth driven by increasing steel and construction activities.

- Rising adoption of eco-friendly and energy-efficient lime production technologies will enhance sustainability.

- Expansion of wastewater treatment and flue gas desulfurization plants will boost product demand.

- Technological advancements in kiln automation and digital monitoring will improve production efficiency.

- Asia Pacific will continue leading the global market due to strong industrial and infrastructure growth.

- Europe will focus on low-carbon manufacturing and regulatory compliance to maintain competitiveness.

- North America will benefit from industrial modernization and growing demand in environmental applications.

- Strategic mergers and capacity expansions will strengthen supply chains and global presence.

- Research on carbon capture in lime kilns will support emission reduction targets.

- Increasing application diversity across metallurgy, paper, and chemical industries will ensure long-term market stability.