Market Overview:

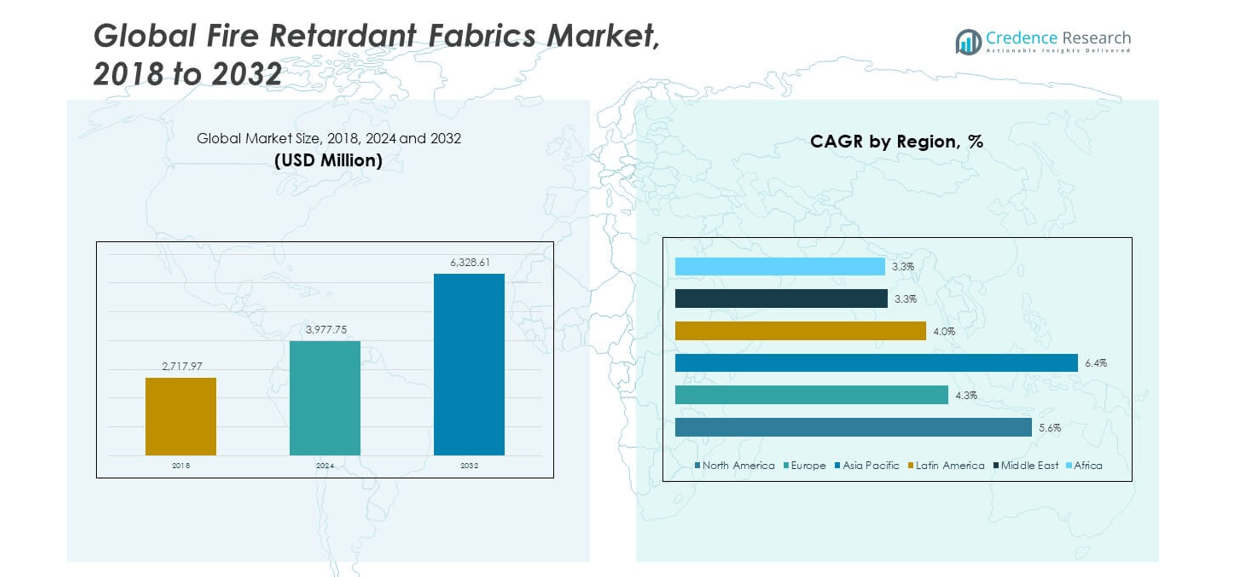

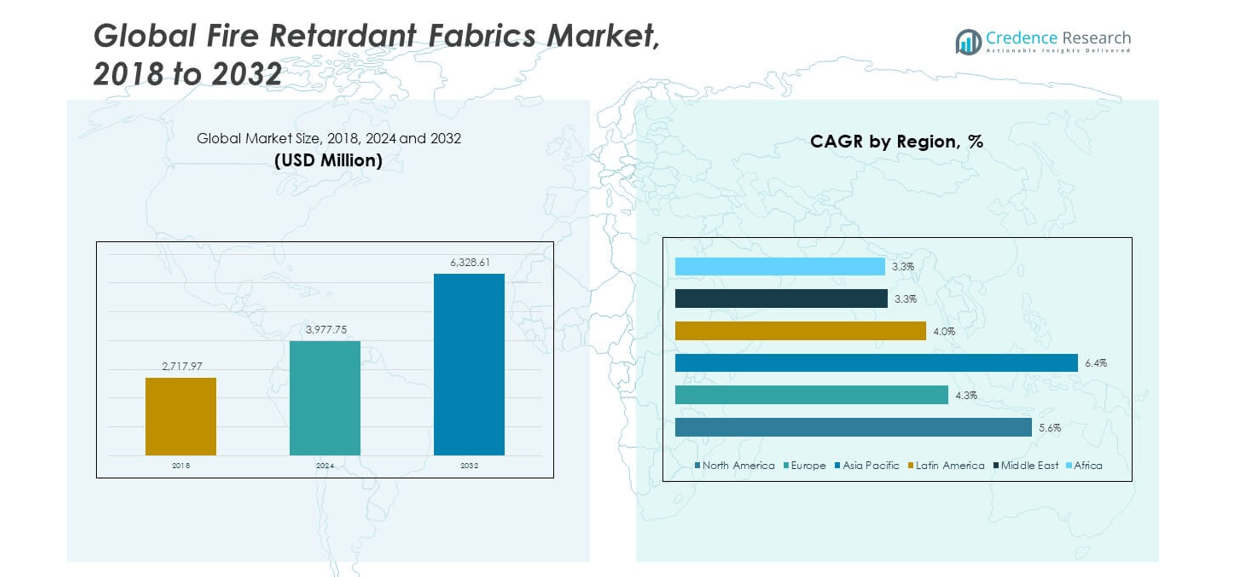

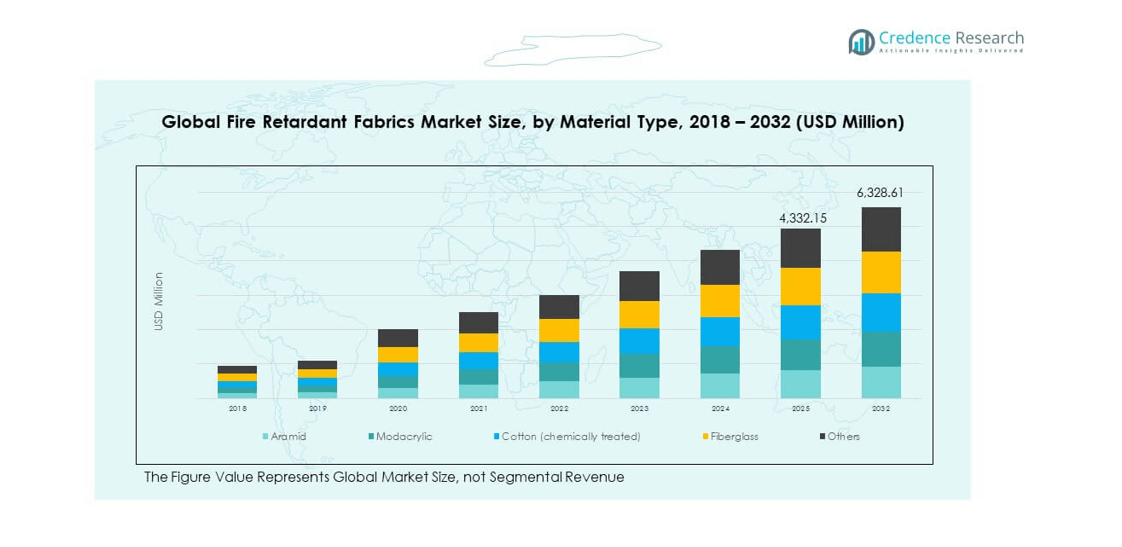

The Global Fire Retardant Fabrics Market size was valued at USD 2,717.97 million in 2018, rising to USD 3,977.75 million in 2024, and is anticipated to reach USD 6,328.61 million by 2032, registering a CAGR of 5.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fire Retardant Fabrics Market Size 2024 |

USD 3,977.75 million |

| Fire Retardant Fabrics Market, CAGR |

5.56% |

| Fire Retardant Fabrics Market Size 2032 |

USD 6,328.61 million |

Rising fire safety regulations across industries such as oil & gas, defense, automotive, and construction are driving demand for fire-retardant fabrics. Increasing awareness of workplace safety, coupled with stringent compliance standards like NFPA and OSHA, fuels adoption. Advancements in treated and inherent fabric technologies improve durability, comfort, and resistance, supporting their use in protective clothing, home furnishings, and transport interiors. Manufacturers are also investing in eco-friendly and lightweight flame-resistant textiles to meet sustainability goals while maintaining performance standards.

Regionally, North America dominates due to strong regulatory enforcement and early industrial safety adoption. Europe follows, driven by the expanding defense and industrial sectors. Asia-Pacific is an emerging growth hub, supported by industrialization, infrastructure expansion, and growing demand for protective workwear in manufacturing and construction. Countries like China, India, and Japan are leading production and consumption, while Latin America and the Middle East & Africa show increasing adoption in industrial safety applications.

Market Insights:

- The Global Fire Retardant Fabrics Market was valued at USD 2,717.97 million in 2018, reached USD 3,977.75 million in 2024, and is projected to hit USD 6,328.61 million by 2032, growing at a CAGR of 5.56%.

- Asia Pacific leads with about 33% share, driven by rapid industrialization, manufacturing expansion, and strong safety enforcement across China, India, and Japan.

- North America follows with 28% due to strict workplace safety standards and early adoption of high-performance protective fabrics; Europe holds 22%, supported by sustainability policies and strong defense sectors.

- The fastest-growing region, Asia Pacific, benefits from urban infrastructure growth, cost-efficient production, and expanding end-use industries, positioning it as a global manufacturing hub for flame-retardant textiles.

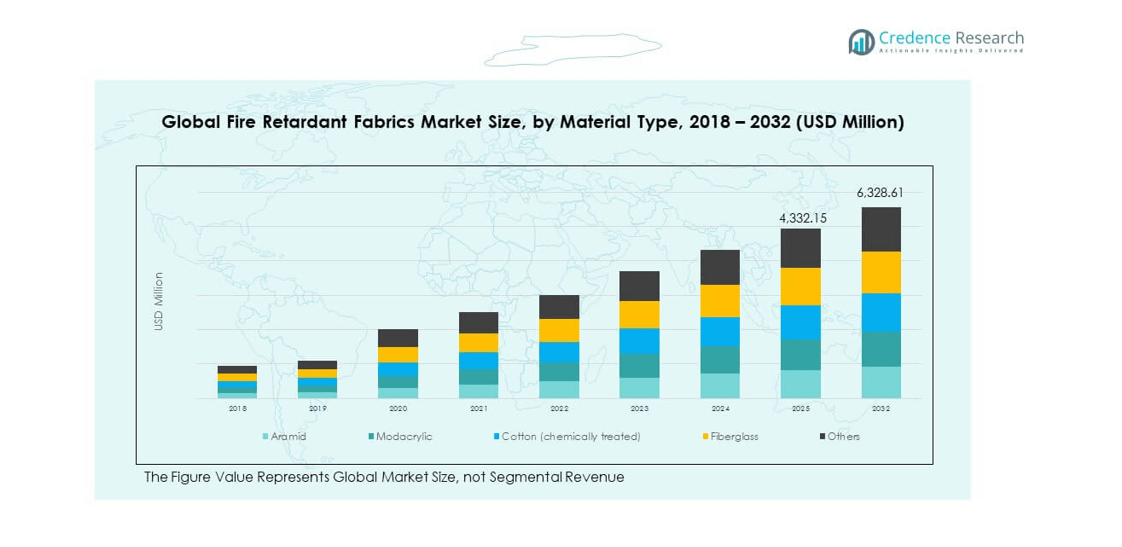

- By material type, Aramid contributes roughly 35–40% of market share for its superior thermal resistance, while Cotton (Chemically Treated) accounts for about 25–30%, favored for affordability and comfort in industrial and residential use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Enforcement of Industrial Fire Safety Regulations

Stringent global safety standards are accelerating the adoption of flame-resistant textiles across industries. Regulatory frameworks like OSHA, NFPA, and EN ISO push manufacturers to ensure compliance through certified fabrics in protective workwear. Industries such as oil and gas, chemical, and construction are major consumers, focusing on worker protection and safety certification. The demand is further strengthened by government-led initiatives for occupational safety awareness. The Global Fire Retardant Fabrics Market is benefiting from these mandatory standards that promote reliable and durable safety materials. Manufacturers continue to innovate by improving fabric performance under high temperatures. This ensures safety without compromising comfort or flexibility. The market’s expansion aligns with the rising emphasis on workplace safety compliance worldwide.

- For instance, DuPont’s Nomex® fabric is widely used in personal protective equipment (PPE) for its high heat and flame resistance, with material documentation confirming its ability to maintain structural integrity and protective properties during short-term exposure to temperatures as high as 370°C.

Expanding Use in Defense, Automotive, and Aerospace Applications

Growing demand from defense, automotive, and aerospace sectors is driving production of high-performance fire-retardant textiles. Defense uniforms, aircraft interiors, and automotive seats require fabrics with strong flame resistance and thermal stability. Governments are investing in advanced protective gear to enhance personnel safety and operational readiness. The market benefits from steady defense budgets and rising focus on equipment modernization. In the automotive sector, fire-resistant seat covers and insulation materials are becoming standard for passenger safety. The Global Fire Retardant Fabrics Market supports evolving safety needs in these sectors by offering cost-effective and certified solutions. Manufacturers are diversifying their portfolios to cater to specialized performance and weight requirements. This expansion is reinforcing the global supply chain for advanced fire-retardant materials.

- For instance, Teijin Automotive Technologies and Italian company Aeronautical Service formed a strategic alliance, announced on September 10, 2025, to industrialize and commercialize the “FireAlt” composite material. The composite, based on ceramic matrix composite technology, is intended for various applications, including aerospace. Aeronautical Service licensed the proprietary FireAlt technology to Teijin.

Technological Advancements in Fabric Treatments and Manufacturing Processes

Continuous innovation in fiber treatment and production methods is transforming the fire-retardant fabrics landscape. Modern techniques improve durability, comfort, and breathability while maintaining superior resistance to ignition and melting. Chemical treatment innovations like halogen-free retardants offer environmental and safety advantages. The Global Fire Retardant Fabrics Market is adopting digital weaving, nanotechnology, and hybrid fiber blends for better performance. These innovations reduce production costs while enhancing quality consistency. Sustainable processes using low-emission coatings are gaining preference among manufacturers. The integration of inherent fire-resistant fibers further reduces dependency on external treatments. The push for advanced material science is setting new industry standards in protective clothing and industrial textiles.

Growing Awareness of Sustainability and Eco-Friendly Fire Protection

Rising environmental awareness is prompting textile manufacturers to develop eco-conscious flame-retardant fabrics. Consumers and industries seek materials that deliver safety without compromising environmental integrity. Companies are shifting toward bio-based fibers, recyclable materials, and non-toxic flame retardants. The Global Fire Retardant Fabrics Market reflects this shift by promoting sustainability across product design and manufacturing. Sustainable production practices help companies meet global environmental goals and regulatory expectations. R&D initiatives now prioritize low-carbon and circular textile models. This approach aligns with the increasing preference for greener workplace and defense solutions. The movement toward eco-safety integration is becoming a defining feature of next-generation fire-retardant textiles.

Market Trends:

Integration of Smart and Functional Textile Technologies

Smart textile innovations are redefining the capabilities of flame-retardant fabrics. Embedded sensors and conductive fibers allow real-time temperature and exposure monitoring in industrial environments. These features enhance worker safety and enable predictive maintenance alerts. The Global Fire Retardant Fabrics Market is integrating such technologies to improve protective apparel functionality. Smart uniforms with adaptive resistance or self-extinguishing properties are entering specialized industries. Manufacturers are focusing on IoT-enabled garments that support performance tracking. This integration supports data-driven safety protocols and higher operational efficiency. The adoption of intelligent textile technologies is positioning the market toward advanced protective solutions.

- For instance, Peratech Holdings Ltd. has integrated its Quantum Tunnelling Composite (QTC) sensor fabrics into prototype wearable technology, which, in certain applications, could be used for monitoring parameters like pressure and force fluctuations.

Shift Toward Lightweight and Comfort-Oriented Fire-Resistant Fabrics

Comfort, flexibility, and design aesthetics are becoming critical factors in material selection. Industries demand fabrics that balance protection with wearability for long-duration use. The Global Fire Retardant Fabrics Market is witnessing growth in lightweight, breathable, and stretchable materials. Workers prefer apparel that maintains fire safety without adding bulk or heat stress. Manufacturers are optimizing fiber compositions to reduce fabric weight while ensuring durability. Development of aramid, modacrylic, and PBI-based blends supports these needs. Product innovation is leading to enhanced moisture control and air permeability in protective gear. The trend toward comfort-based fire protection is reshaping product design strategies globally.

- For instance, Kaneka Corporation manufactures the flame-retardant modacrylic fibers Kanecaron™ and Protex™. The properties of these fibers, such as inherent flame resistance and excellent blending compatibility with other fibers like cotton, have been documented in company materials and technical resources. Kaneka publishes official news releases on its corporate website, with recent announcements from June 2025 detailing the use of its biodegradable polymer Green Planet™.

Rising Use of Inherent Fire-Resistant Fibers Over Treated Materials

A growing shift from treated fabrics to inherent fire-resistant fibers is evident across industries. Inherent fabrics retain flame resistance throughout their lifespan without losing effectiveness after washing. This reliability drives adoption in critical applications such as firefighting and defense. The Global Fire Retardant Fabrics Market is expanding its base with these materials due to lower maintenance and higher longevity. Manufacturers emphasize consistent performance across extreme conditions. Inherent fibers reduce dependency on chemical coatings, meeting stricter environmental standards. End users recognize their cost-efficiency over time despite higher upfront prices. This transition is influencing material sourcing and supply chain strategies worldwide.

Increased Customization and Multi-Functional Fabric Development

The market is moving toward tailored fire-retardant fabrics designed for specific industrial and climatic needs. End users demand materials that combine flame resistance with water repellence, UV protection, or antimicrobial properties. The Global Fire Retardant Fabrics Market is evolving through multipurpose innovations catering to construction, mining, and aviation sectors. Manufacturers are developing fabrics with dual or triple functionalities for higher application value. Customization allows better alignment with client safety protocols and operational conditions. Growth in technical textile engineering supports these advances. Product differentiation through functionality is becoming a key competitive advantage. This shift strengthens the position of global and regional players focusing on application-driven designs.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Standards

Producing high-performance flame-retardant textiles requires specialized raw materials and complex processing. High costs of aramid, modacrylic, and other engineered fibers make large-scale production expensive. The Global Fire Retardant Fabrics Market faces pricing pressure as industries demand cost-effective yet compliant solutions. Manufacturers must also meet stringent international safety standards and certification requirements. These add layers of testing, increasing time and production costs. Smaller manufacturers struggle to compete due to the capital-intensive nature of compliance. Maintaining consistency in flame resistance across batches remains another challenge. Balancing affordability and premium performance continues to limit widespread market penetration.

Environmental Concerns and Raw Material Availability Constraints

Sustainability regulations are restricting the use of halogen-based flame retardants due to their environmental impact. Sourcing eco-friendly alternatives increases production complexity and costs. The Global Fire Retardant Fabrics Market encounters supply challenges with specialty fibers needed for high-resistance fabrics. Limited availability of raw materials and reliance on specific chemical treatments hinder production flexibility. Waste management and recycling of fire-resistant textiles pose additional hurdles. Manufacturers face growing pressure to transition to non-toxic, recyclable materials. These environmental and supply constraints require long-term innovation to maintain market stability and regulatory compliance.

Market Opportunities:

Emergence of Sustainable and Circular Textile Ecosystems

The growing demand for eco-certified fabrics creates strong opportunities for sustainable product lines. The Global Fire Retardant Fabrics Market can leverage innovations in biodegradable fibers and water-based coatings. Manufacturers focusing on closed-loop recycling gain a competitive advantage in green procurement programs. Governments and industries encourage sourcing from suppliers following sustainable practices. Eco-label certifications and carbon-neutral operations open new market channels. The focus on circularity ensures long-term growth potential and brand differentiation in environmentally conscious markets.

Expanding Industrial Applications in High-Growth Regions

Rapid industrialization across Asia-Pacific, Latin America, and the Middle East is boosting the need for fire-safe fabrics. Construction, oil and gas, and manufacturing sectors are adopting advanced safety materials. The Global Fire Retardant Fabrics Market finds strong expansion prospects through partnerships and local production facilities. Regional textile hubs benefit from labor availability and favorable trade policies. Growing safety awareness among small and medium enterprises strengthens demand. International brands are entering joint ventures to expand distribution networks in these emerging economies. This regional momentum presents long-term opportunities for growth and innovation.

Market Segmentation Analysis:

By Material Type

The Global Fire Retardant Fabrics Market is segmented by material type into aramid, modacrylic, cotton (chemically treated), fiberglass, and others. Aramid dominates the segment due to its superior heat resistance, strength, and durability, making it ideal for high-performance protective clothing. Modacrylic fabrics are preferred for their self-extinguishing properties and comfort in workwear applications. Chemically treated cotton offers an affordable solution for industrial and residential use, balancing protection with breathability. Fiberglass fabrics provide excellent insulation and are used in environments requiring extreme heat resistance. Other materials, including blends and specialty fibers, cater to niche industrial and decorative applications demanding customized safety performance.

- For instance, JPS Composite Materials is a manufacturer of para-aramid composite fabrics, which are commonly used in military and civilian applications requiring high strength and flame resistance, as reported on the manufacturer’s website.

By Application

The market is categorized by application into industrial protective clothing, defense and military uniforms, firefighting gear, residential furnishings, and others. Industrial protective clothing holds the largest share, driven by mandatory safety regulations in oil, gas, and construction sectors. Defense and military uniforms require advanced flame-resistant textiles for combat and training operations. Firefighting gear uses multi-layered composites to ensure thermal stability and moisture control. Residential furnishings apply fire-retardant fabrics in upholstery and curtains to enhance home safety. Other applications include transportation interiors, public infrastructure, and specialty environments where compliance and fire safety remain critical to operational standards.

- For instance, PrimaLoft’s UltraPeak insulation, launched in October 2025, represents a significant development for the outdoor clothing industry. The material, which is made from 100% recycled fibers using the company’s P.U.R.E. manufacturing technology, is the brand’s warmest synthetic insulation to date. It was made available to brand partners in late 2025, with apparel for consumers expected to hit the market in the Fall/Winter 2027 season.

Segmentation:

By Material Type

- Aramid

- Modacrylic

- Cotton (Chemically Treated)

- Fiberglass

- Others

By Application

- Industrial Protective Clothing

- Defense and Military Uniforms

- Firefighting Gear

- Residential Furnishings

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Fire Retardant Fabrics Market size was valued at USD 775.26 million in 2018 to USD 1,116.55 million in 2024 and is anticipated to reach USD 1,784.03 million by 2032, at a CAGR of 5.6% during the forecast period. North America holds an estimated 28% market share, driven by strong industrial safety standards and advanced manufacturing practices. The region’s regulatory bodies, including OSHA and NFPA, enforce stringent safety norms across oil, gas, and defense sectors. High adoption of protective workwear in aerospace and automotive industries supports consistent demand. It benefits from well-established textile manufacturing hubs in the U.S. and Canada. Growing investments in eco-friendly and lightweight fire-retardant materials enhance competitiveness. Defense contracts and technological collaborations strengthen market presence. The region continues to lead innovation in aramid and modacrylic applications across multiple end-use industries.

Europe

The Europe Fire Retardant Fabrics Market size was valued at USD 506.18 million in 2018 to USD 700.11 million in 2024 and is anticipated to reach USD 1,012.62 million by 2032, at a CAGR of 4.3% during the forecast period. Europe commands roughly 22% of the global share, backed by strict fire safety regulations and advanced industrial standards. Countries like Germany, the UK, and France prioritize high-performance protective fabrics in defense and construction. It benefits from the presence of established textile companies and innovation centers. The growing emphasis on sustainability drives adoption of eco-friendly fibers. Expansion in aerospace and public transportation sectors contributes to rising demand. Government initiatives for worker safety and green manufacturing further shape growth. European manufacturers focus on producing non-toxic, recyclable materials aligned with EU environmental policies.

Asia Pacific

The Asia Pacific Fire Retardant Fabrics Market size was valued at USD 1,175.39 million in 2018 to USD 1,784.36 million in 2024 and is anticipated to reach USD 3,013.84 million by 2032, at a CAGR of 6.4% during the forecast period. Asia Pacific holds the largest 33% market share, supported by rapid industrialization and rising infrastructure development. China, India, Japan, and South Korea drive production and consumption due to their robust manufacturing bases. It benefits from cost-effective raw materials and growing awareness of worker safety regulations. Expansion in oil, gas, and construction sectors fuels consistent demand for protective clothing. Regional governments are enforcing stricter fire safety policies in industrial workplaces. The availability of low-cost labor enhances export competitiveness. Increasing adoption of flame-resistant textiles in transportation and residential sectors strengthens long-term growth potential.

Latin America

The Latin America Fire Retardant Fabrics Market size was valued at USD 128.68 million in 2018 to USD 185.99 million in 2024 and is anticipated to reach USD 261.99 million by 2032, at a CAGR of 4.0% during the forecast period. Latin America accounts for around 7% of the global share, supported by industrial modernization and safety compliance initiatives. Brazil and Mexico lead demand due to expanding oil, gas, and mining industries. It benefits from the gradual enforcement of worker protection laws. The textile industry is adopting flame-resistant materials for uniforms and industrial applications. Regional players focus on affordable and durable product options suitable for tropical climates. Growth in construction and energy sectors supports steady consumption. Cross-border trade partnerships with North American suppliers improve technology access. The region’s long-term potential lies in its shift toward standardized industrial safety norms.

Middle East

The Middle East Fire Retardant Fabrics Market size was valued at USD 76.74 million in 2018 to USD 102.74 million in 2024 and is anticipated to reach USD 138.14 million by 2032, at a CAGR of 3.3% during the forecast period. The region represents about 5% market share, driven by extensive oil, gas, and petrochemical operations. It benefits from rising safety investments in industrial and defense sectors. GCC countries are leading adopters of certified flame-retardant clothing for hazardous environments. Construction projects and energy exploration drive continuous fabric demand. Regional manufacturers are partnering with global brands to enhance production capabilities. Import reliance remains high, though local textile clusters are expanding in the UAE and Saudi Arabia. Increasing government focus on safety training and certification supports sustained growth.

Africa

The Africa Fire Retardant Fabrics Market size was valued at USD 55.73 million in 2018 to USD 88.00 million in 2024 and is anticipated to reach USD 117.99 million by 2032, at a CAGR of 3.3% during the forecast period. Africa contributes roughly 5% market share, driven by industrial expansion and infrastructure development. South Africa and Egypt are key markets adopting flame-resistant textiles in construction and mining. It benefits from growing awareness of occupational hazards in heavy industries. Local manufacturers are increasingly collaborating with global players for technology transfer. Urbanization and public infrastructure growth stimulate use in residential and transport applications. Limited local production and reliance on imports affect scalability. However, ongoing government safety initiatives and regulatory alignment with global standards indicate gradual market maturity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- DuPont

- Teijin Limited

- Kaneka Corporation

- PrimaLoft

- AdvanSix Inc.

- Parkdale Inc.

- JPS Elastomerics

- Albemarle Corporation

- Huntsman Corporation

- Peratech Holdings Ltd.

Competitive Analysis:

The Global Fire Retardant Fabrics Market features several established players competing on innovation, quality, and geographic reach. Major companies such as DuPont, Teijin Limited and Huntsman Corporation hold substantial shares through diversified product portfolios and global operations. These firms invest in advanced fiber technologies, sustainable materials and certified performance to maintain leadership. Smaller regional companies differentiate through localised production, cost-effective offerings and agile service models. It faces moderate fragmentation, but high barriers in raw materials and regulatory certification limit new entrants. Competitive success depends on R&D intensity, supply-chain robustness and compliance with evolving safety standards. End-users often select suppliers based on fabric performance, certification and delivery reliability. This dynamic drives players to expand their innovation pipelines and global footprint to gain a competitive edge.

Recent Developments:

- In October 2025, PrimaLoft introduced UltraPeak™, a high-performance insulation product aimed at outdoor apparel, alongside the launch of its ReRun™ circular technology platform, which transforms textile waste into sustainable insulation for fire-retardant and thermal applications. The six new insulation products embody PrimaLoft’s commitment to responsible manufacturing while elevating fire-protection and environmental stewardship in textiles.

- In September 2025, Teijin Limited announced a strategic alliance with Aeronautical Service S.r.l. focusing on commercializing next-generation fireproof composite materials based on proprietary ceramic matrix composite (CMC) technology. Teijin Automotive Technologies has acquired exclusive production rights for these fire-retardant composites, suitable for use in the automotive, marine, aerospace, and industrial sectors, with the “FireAlt” material capable of withstanding temperatures up to 2000°C and meeting stringent international fire safety certifications.

- In August 2025, DuPont signed an agreement to divest its Aramids business, which includes the renowned Kevlar® and Nomex® brands, to Arclin for approximately $1.8 billion. This acquisition is expected to close in Q1 2026 and will strengthen Arclin’s portfolio in protective fire-retardant materials for aerospace, electrical infrastructure, personal protection, and defense applications. Through this move, DuPont signals a new phase for its legacy brands, ensuring continued growth and expanded industry impact under Arclin’s leadership.

Report Coverage:

The research report offers an in-depth analysis based on Material Type and Application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion in emerging economies will drive demand for protective fabrics in oil, gas and construction sectors.

- Sustainability will become a key differentiator with growth of bio-based and recyclable fire-retardant textiles.

- Smart fabrics with embedded sensors and adaptive flame-resistance will gain traction in industrial and defense applications.

- Lightweight and comfort-oriented fabrics will become standard for long-duration protective wear.

- Inherent flame-resistant fiber blends will gradually replace chemically treated fabrics in critical applications.

- Regional manufacturing hubs in Asia Pacific will expand, reducing dependency on imports.

- Customization of fabrics for multi-hazard environments (fire, chemical, arc-flash) will increase.

- Industry convergence with transportation and aerospace sectors will create cross-application opportunities.

- Digital textile manufacturing and nanotech treatments will reduce production cost and increase performance.

- Regulatory tightening globally will sustain growth momentum and drive demand for certified materials.