Market Overview:

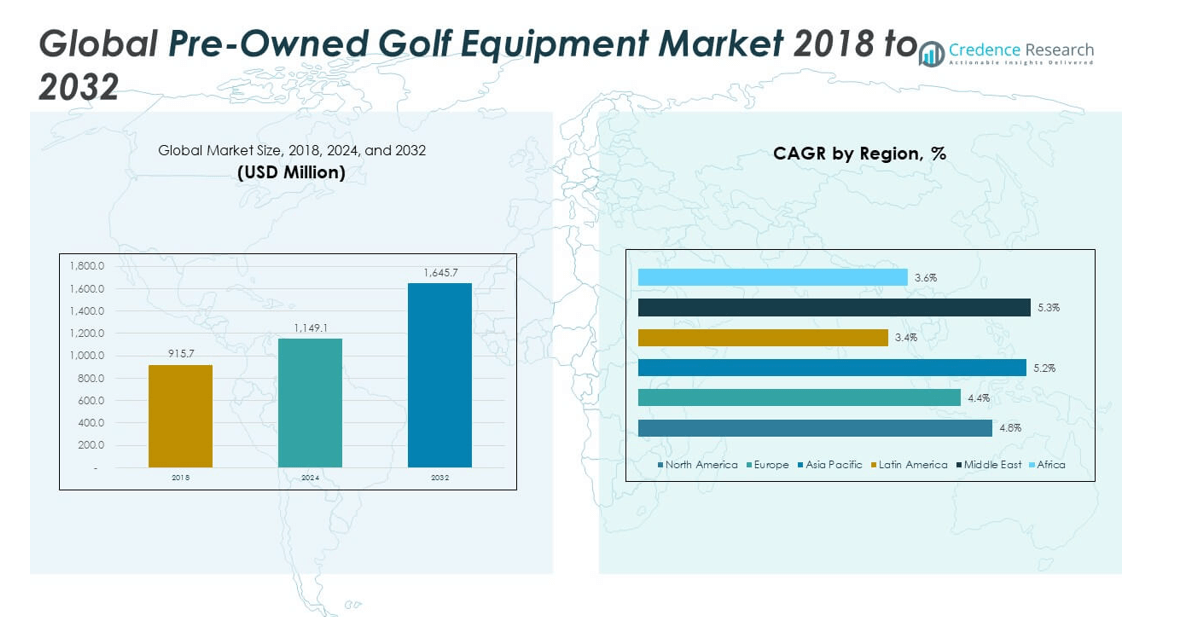

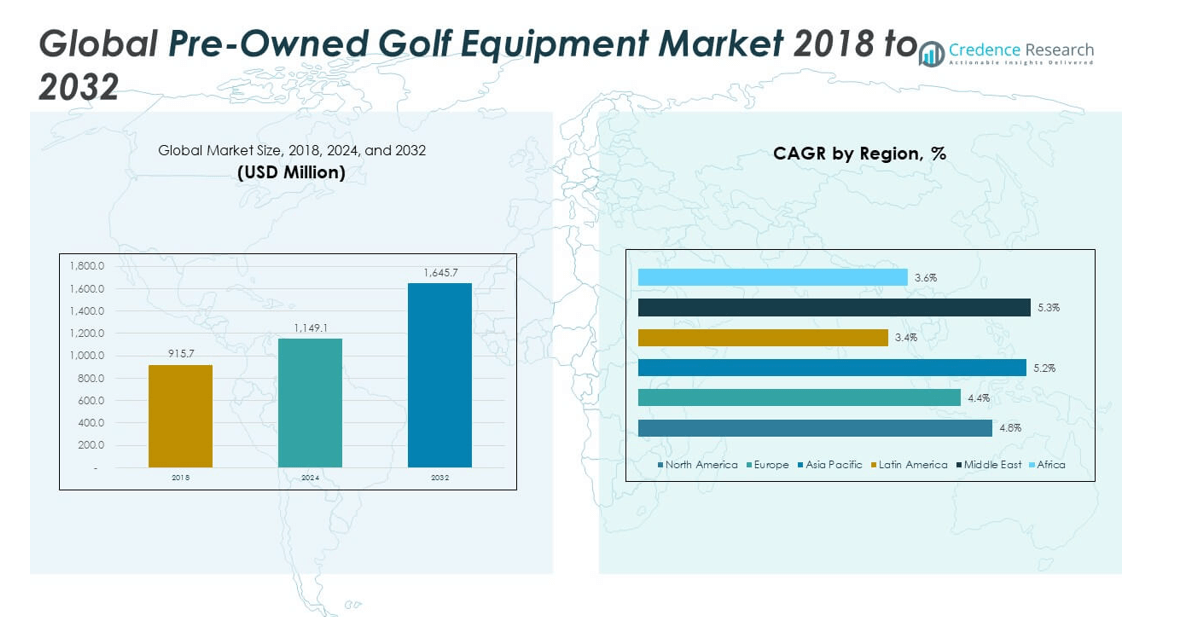

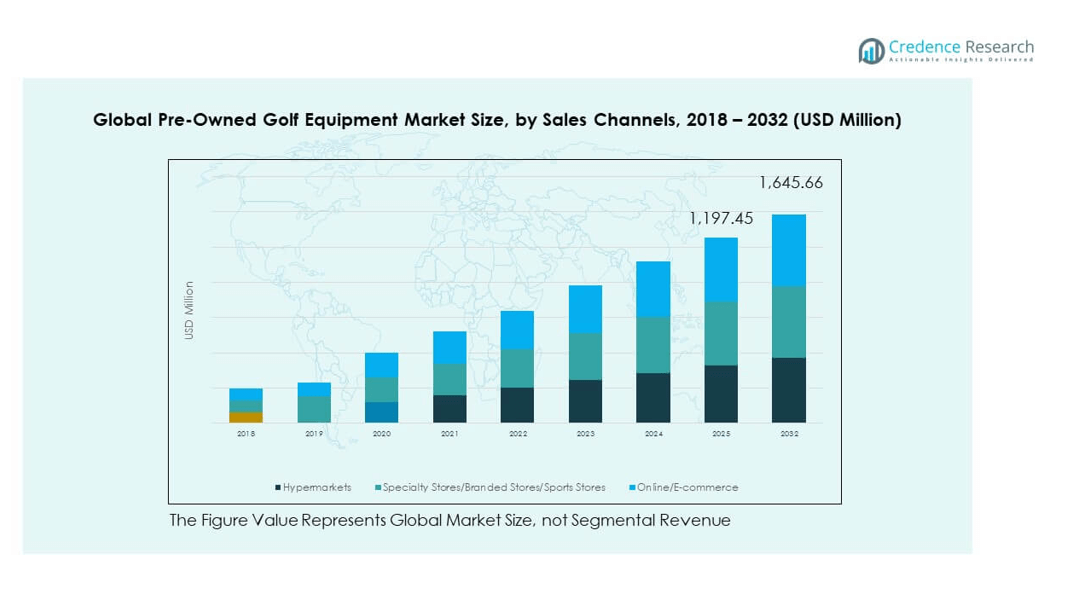

The Global Pre-Owned Golf Equipment Market size was valued at USD 915.7 million in 2018 to USD 1,149.1 million in 2024 and is anticipated to reach USD 1,645.7 million by 2032, at a CAGR of 4.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pre-Owned Golf Equipment Market Size 2024 |

USD 1,149.1 million |

| Pre-Owned Golf Equipment Market, CAGR |

4.65% |

| Pre-Owned Golf Equipment Market Size 2032 |

USD 1,645.7 million |

Growth in the pre-owned golf equipment market is driven by increasing participation in golf, rising consumer preference for affordable alternatives to new equipment, and expanding online resale platforms that offer authenticated products. The market also benefits from growing environmental awareness, as reusing equipment supports sustainability by reducing waste. Manufacturers and retailers are increasingly partnering with trade-in programs, while technological innovations in club fitting and refurbishment enhance the value proposition for second-hand purchases, attracting both amateur and professional golfers.

North America leads the market due to a strong golfing culture, a large base of active players, and established resale networks. Europe follows closely, supported by golf tourism and well-developed club facilities, particularly in the UK, Germany, and Spain. The Asia-Pacific region is emerging as a key growth hub, driven by increasing disposable incomes, growing interest in recreational sports, and rapid expansion of golf courses in countries like China, Japan, and South Korea. Emerging markets in Latin America and the Middle East are also witnessing increased adoption, fueled by golf’s rising popularity and infrastructural development.

Market Insights:

- The Global Pre-Owned Golf Equipment Market was valued at USD 1,149.1 million in 2024 and is projected to reach USD 1,645.7 million by 2032, growing at a CAGR of 4.65%.

- Rising golf participation among younger demographics and in emerging markets is driving demand for affordable, high-quality used equipment.

- Increased environmental awareness is encouraging consumers to choose refurbished and pre-owned gear as a sustainable alternative.

- Limited availability of high-quality inventory due to dependence on trade-in volumes remains a challenge for market growth.

- Europe holds the largest market share in 2024, supported by strong golf tourism and a mature club network.

- Asia Pacific is witnessing the fastest growth, driven by expanding golf course infrastructure and rising disposable incomes.

- North America maintains strong demand due to an extensive golfing culture and well-established resale platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Golf Participation and Expanding Consumer Base across Key Regions

The Global Pre-Owned Golf Equipment Market is benefiting from a steady increase in golf participation worldwide, particularly among younger demographics seeking affordable entry points into the sport. The sport’s rising popularity in developing economies is expanding the addressable consumer base. Seasonal golf tourism and amateur tournaments are also influencing demand for high-quality second-hand gear. Established golf markets in North America and Europe are experiencing sustained interest, creating consistent demand for premium used equipment. Affordable pricing compared to new products enables broader market access. Growing female participation is further widening the target audience. Golf associations and clubs are promoting inclusive events, encouraging first-time buyers to consider pre-owned options. The combination of affordability and expanding player demographics is reinforcing market momentum.

- For example, TaylorMade’s trade-in program processes transactions within 7–10 business days from the time the clubs are received at its facility, providing customers with a streamlined way to exchange eligible golf clubs for credit.

Environmental Awareness Driving Preference for Reused Sporting Goods

The Global Pre-Owned Golf Equipment Market is gaining traction from increasing awareness of sustainability in sports. Reusing golf clubs, balls, and accessories helps reduce manufacturing waste and carbon footprints. Eco-conscious consumers are choosing second-hand gear to align with their values without compromising on performance. Golf equipment brands are supporting this shift by offering certified refurbishment programs. Recycling initiatives from golf clubs and associations are further promoting sustainable consumption habits. Trade-in schemes allow players to update their gear while ensuring older equipment remains in circulation. The trend fits with broader consumer shifts toward circular economy practices. The market benefits from being positioned as both an affordable and environmentally responsible option.

Retailer Initiatives Enhancing Access and Authenticity Assurance

The Global Pre-Owned Golf Equipment Market is supported by retailers offering structured buyback and trade-in programs. These initiatives provide customers with value for their used products while ensuring a reliable supply of quality second-hand inventory. Authentication processes and refurbishment services build buyer confidence. Physical stores and pro shops are creating dedicated sections for pre-owned goods to cater to budget-conscious golfers. Online marketplaces are also integrating professional grading systems to maintain quality standards. Partnerships between golf brands and resale platforms are increasing inventory variety. Players gain the assurance that equipment meets performance expectations. Retailer-led efforts are bridging the trust gap and improving market credibility.

- For instance, 2nd Swing uses a proprietary 10-point inspection system on every club it resells, and offers payment via store credit, PayPal, or check once the evaluation is complete.

Technological Advancements in Equipment Refurbishment and Resale Platforms

The Global Pre-Owned Golf Equipment Market is being influenced by advanced refurbishment technologies that restore products to near-original condition. Precision cleaning, regripping, and shaft alignment tools ensure consistent quality. Online resale platforms are integrating AI-driven pricing tools to offer fair valuations. Virtual fitting tools help customers choose suitable gear without physical trials. Digital authentication methods, such as QR codes and blockchain tagging, improve traceability and buyer trust. Technology-driven enhancements are enabling faster inventory turnover. These developments strengthen the resale value of golf equipment and promote repeat transactions. The integration of technology into both refurbishment and sales channels is driving efficiency and customer satisfaction.

Market Trends

Growing Integration of Online-First Resale Platforms and Mobile Applications

The Global Pre-Owned Golf Equipment Market is witnessing a shift toward digital-first resale channels. Mobile applications are offering seamless listing, valuation, and purchase experiences for golfers. E-commerce integration with live chat support is improving customer engagement. Online auction features allow competitive bidding for premium equipment. Social media marketplaces are expanding brand visibility and peer-to-peer sales. Retailers are launching dedicated apps to consolidate trade-in and resale services. Subscription-based models for equipment trials are emerging in the digital space. Digital accessibility is creating more touchpoints between buyers and sellers, streamlining the resale process and expanding the market’s reach.

- For instance, GlobalGolf’s Utry® platform enabled golfers to trial up to two pre‑owned clubs for 14 days with a nominal fee return arranged via prepaid shipping—and customer reflections report smooth, hassle‑free experiences

Collaborations between Golf Brands and Professional Players for Endorsements

The Global Pre-Owned Golf Equipment Market is seeing strategic collaborations with professional golfers to endorse certified used gear. These endorsements help bridge perception gaps regarding quality and performance. Golf influencers are creating content demonstrating the value of pre-owned products in real play scenarios. Brands are leveraging such collaborations to strengthen trust among amateur players. Sponsored events now feature a mix of new and pre-owned gear, normalizing the concept in competitive environments. Retailers are inviting pro players for in-store events to promote resale programs. These initiatives enhance market credibility while appealing to aspirational buyers. The endorsement-driven trend is creating a higher acceptance rate for second-hand purchases.

Emergence of Specialized Pre-Owned Golf Equipment Boutiques

The Global Pre-Owned Golf Equipment Market is experiencing the rise of boutique-style stores dedicated exclusively to premium second-hand gear. These outlets focus on offering curated, high-end inventory for discerning golfers. Professional fitting services are being integrated into the shopping experience. Exclusive sourcing from tournaments and private collections differentiates these stores from general resale outlets. The boutique model provides a luxury shopping environment without the new-product price tag. Word-of-mouth recommendations are fueling interest in such specialized retail spaces. These stores often feature in-store simulators to test equipment before purchase. The concept is appealing to experienced golfers who value quality and performance.

Seasonal Promotions and Trade-In Events Boosting Resale Volumes

The Global Pre-Owned Golf Equipment Market is benefiting from structured seasonal campaigns. Retailers align trade-in events with major golf tournaments to capture heightened consumer interest. Limited-time discounts encourage customers to upgrade their equipment regularly. Seasonal promotions often coincide with product launches in the new equipment segment, making pre-owned gear a cost-effective alternative. Golf clubs are hosting swap meets to facilitate local resale activity. Email marketing campaigns target existing customers with personalized trade-in offers. These strategies improve inventory flow and encourage repeat purchases. The consistent scheduling of such events strengthens customer engagement throughout the year.

- For instance, PGA TOUR Superstore offers customers the option to trade in golf clubs both in-store and online, providing instant in-store credit or issuing an e-gift card within two business days of receiving shipped clubs, with periodic promotional offers that can increase trade-in value.

Market Challenges Analysis

Perception Barriers and Quality Concerns among Potential Buyers

The Global Pre-Owned Golf Equipment Market faces challenges in overcoming lingering perceptions about second-hand quality. Some golfers remain skeptical about the durability and performance of used products. Inconsistent grading standards across sellers contribute to buyer hesitation. Lack of detailed product histories can deter purchase decisions. Retailers must invest in transparent inspection and certification processes. Counterfeit risks in online marketplaces further erode trust. Many buyers still prefer new products despite the cost savings of pre-owned options. Building consumer education and trust mechanisms is essential for long-term growth. Addressing perception gaps will determine the pace of adoption.

Supply Constraints and Dependence on Trade-In Volumes

The Global Pre-Owned Golf Equipment Market is limited by the availability of high-quality used inventory. Supply depends heavily on trade-in volumes, which can fluctuate seasonally. Economic downturns may reduce new equipment purchases, indirectly lowering trade-in stock. High demand for specific brands and models can lead to inventory shortages. Retailers face challenges in maintaining a consistent product mix across price ranges. Sourcing equipment from international markets introduces logistical complexities. Without a reliable inflow of quality gear, maintaining customer satisfaction becomes difficult. Balancing supply and demand remains a central operational challenge for the industry.

Market Opportunities

Expansion into Untapped Emerging Golf Markets with Rising Affluence

The Global Pre-Owned Golf Equipment Market has growth opportunities in emerging economies where golf is gaining popularity. Rising disposable incomes in these regions are enabling more players to enter the sport. Pre-owned gear offers an accessible entry point for first-time buyers. Golf course developments in Asia, Latin America, and the Middle East are expanding the potential customer base. Partnerships with local distributors can enhance market penetration. Tailored marketing strategies can address regional preferences and cultural factors. Expanding into such markets allows brands to capture early loyalty and long-term sales potential.

Integration of Digital Tools to Enhance Consumer Buying Confidence

The Global Pre-Owned Golf Equipment Market can leverage advanced digital tools to strengthen buyer confidence. Virtual try-on and club-fitting solutions can replicate in-store experiences online. AI-driven pricing systems can ensure fair value for both buyers and sellers. Blockchain-based authentication can guarantee product originality. Enhanced online reviews and transparent grading can build credibility. E-commerce platforms can expand reach beyond traditional retail boundaries. Investing in digital enhancements will improve customer satisfaction and repeat purchase rates. This opportunity aligns with the increasing digital engagement of global consumers.

Market Segmentation Analysis:

By product, clubs hold the dominant share in the Global Pre-Owned Golf Equipment Market, driven by consistent demand from both amateur and professional players seeking cost-effective upgrades without sacrificing performance. It benefits from a wide variety of brands and models available in the resale ecosystem, catering to diverse skill levels. Carts represent a steady growth segment, supported by the rising adoption of personal golf transportation in courses with extended layouts. Balls form a recurring purchase category, with affordability encouraging bulk purchases and experimentation with different brands.

- For instance, Callaway Golf’s Certified Pre-Owned program offers refurbished clubs from its own lineup, each accompanied by a 12-month warranty and a Certificate of Authenticity to ensure quality and authenticity standards.

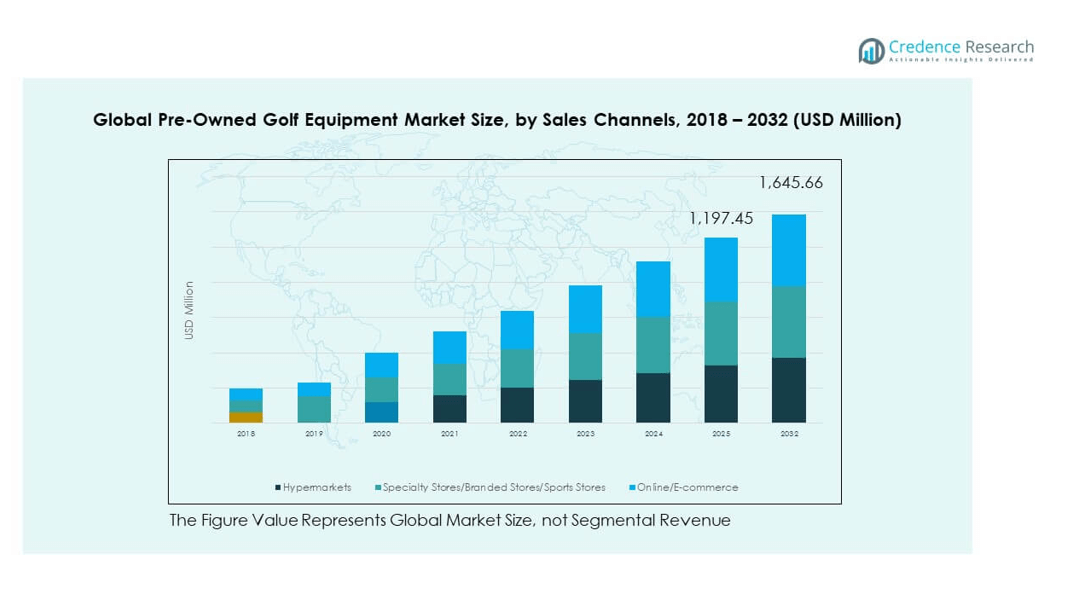

By sales channel, specialty stores, branded outlets, and sports stores account for the largest share due to their ability to provide product authentication, expert advice, and fitting services that build buyer confidence. Hypermarkets contribute to demand in regions with strong retail penetration, offering competitive prices and immediate product availability. Online and e-commerce channels are registering the fastest growth, supported by expanded digital platforms, secure payment systems, and wide product visibility. It is also benefiting from the integration of advanced search filters, digital authentication, and customer review systems, which enhance trust and streamline the buying process. The combination of diversified product availability and evolving retail formats is strengthening the market’s accessibility and consumer engagement.

- For instance, 2nd Swing’s e-commerce platform offers an AI-powered online fitting tool and club selector features, along with extensive search filters that allow customers to browse a wide range of pre-owned clubs by brand, loft, shaft, and condition.

Segmentation:

By Product

By Sales Channel

- Hypermarkets

- Specialty Stores / Branded Stores / Sports Stores

- Online / E-commerce

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global Pre-Owned Golf Equipment Market size was valued at USD 243.11 million in 2018 to USD 307.46 million in 2024 and is anticipated to reach USD 444.82 million by 2032, at a CAGR of 4.8% during the forecast period. It accounts for 26.75% of the 2024 global market share. Strong golfing culture, high disposable income, and an extensive network of golf courses drive consistent demand for pre-owned equipment. Well-established resale platforms and professional authentication services enhance buyer confidence. The region benefits from significant participation in amateur and professional tournaments, sustaining steady replacement cycles for clubs, balls, and carts. Specialty golf retailers and branded outlets dominate sales channels, offering expert fitting services. Online platforms are expanding their footprint through competitive pricing and extensive inventories. Trade-in programs run by leading brands continue to feed the resale ecosystem. North America remains a primary hub for high-quality second-hand golf gear.

Europe

The Europe Global Pre-Owned Golf Equipment Market size was valued at USD 288.98 million in 2018 to USD 356.81 million in 2024 and is anticipated to reach USD 499.79 million by 2032, at a CAGR of 4.4% during the forecast period. It represents 31.04% of the 2024 global market share. Golf tourism, particularly in the UK, Spain, and France, sustains steady demand for second-hand gear. An established network of golf clubs and country courses fosters replacement demand from frequent players. Specialty stores and sports chains dominate sales due to their quality assurance and personalized services. Growing environmental awareness encourages adoption of pre-owned equipment as a sustainable choice. Regional e-commerce platforms are improving market accessibility. Seasonal tournaments generate periodic surges in resale activity. Brand loyalty remains strong, with consumers often upgrading within the same manufacturer’s range. Europe maintains a mature yet steadily expanding resale market.

Asia Pacific

The Asia Pacific Global Pre-Owned Golf Equipment Market size was valued at USD 200.71 million in 2018 to USD 261.05 million in 2024 and is anticipated to reach USD 391.34 million by 2032, at a CAGR of 5.2% during the forecast period. It contributes 22.72% of the 2024 global market share. Rising disposable incomes and growing interest in golf as a leisure activity are fueling demand. Expanding golf course infrastructure in China, Japan, South Korea, and Southeast Asia is broadening the player base. The affordability of pre-owned gear attracts first-time players. Online sales channels are experiencing strong adoption due to wider product availability. Specialty retailers in developed markets like Japan maintain high refurbishment standards. Brand collaborations with local distributors are increasing market penetration. Seasonal promotions and sports tourism also contribute to market growth. Asia Pacific is emerging as a dynamic growth region for the sector.

Latin America

The Latin America Global Pre-Owned Golf Equipment Market size was valued at USD 93.49 million in 2018 to USD 109.74 million in 2024 and is anticipated to reach USD 142.68 million by 2032, at a CAGR of 3.4% during the forecast period. It accounts for 9.55% of the 2024 global market share. Growth is supported by the gradual expansion of golf infrastructure in Brazil, Argentina, and Mexico. Demand is primarily driven by mid- to high-income consumers seeking cost-effective options. Specialty stores and sports retailers lead sales channels in urban centers. Online platforms are gaining traction, offering access to international inventory. Seasonal tournaments and charity events help promote adoption. Logistics and import duties remain challenges for consistent supply. Brand awareness is rising as global players enter the market through partnerships. Latin America presents moderate but steady growth potential.

Middle East

The Middle East Global Pre-Owned Golf Equipment Market size was valued at USD 67.03 million in 2018 to USD 87.52 million in 2024 and is anticipated to reach USD 131.82 million by 2032, at a CAGR of 5.3% during the forecast period. It represents 7.62% of the 2024 global market share. Growing golf tourism, particularly in the UAE and Saudi Arabia, is fueling equipment demand. International tournaments hosted in the region raise awareness and interest in the sport. The luxury retail environment supports acceptance of premium refurbished products. Specialty and branded stores dominate sales channels, often located within golf resorts. E-commerce adoption is increasing among younger consumers. Investment in high-end golf courses drives repeat purchase cycles. The region benefits from a wealthy consumer base willing to invest in quality gear. Middle East markets are becoming a niche but profitable target for pre-owned equipment sellers.

Africa

The Africa Global Pre-Owned Golf Equipment Market size was valued at USD 22.34 million in 2018 to USD 26.56 million in 2024 and is anticipated to reach USD 35.22 million by 2032, at a CAGR of 3.6% during the forecast period. It accounts for 2.31% of the 2024 global market share. South Africa remains the dominant market due to its established golf culture and international tourism. Limited local manufacturing capacity increases reliance on imports for both new and pre-owned equipment. Affordability drives preference for second-hand gear among amateur players. Specialty stores in metropolitan areas cater to premium buyers. Online channels are emerging but remain constrained by logistics. Seasonal tournaments and corporate golf events stimulate periodic demand. Partnerships with golf clubs are creating resale opportunities. Africa offers niche growth prospects, especially in regions with expanding tourism infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Acushnet Company

- Ping

- Mizuno Corporation

- Sun Mountain Sports

- Motocaddy

- TaylorMade Golf

- Wilson Sporting Goods

- Callaway

- Cobra

- Other Key Players

Competitive Analysis:

The Global Pre-Owned Golf Equipment Market features a mix of established golf equipment manufacturers, specialized resale platforms, and regional retailers competing for market share. Leading companies such as Acushnet Company, Callaway, TaylorMade Golf, Ping, and Mizuno Corporation leverage strong brand recognition and extensive distribution networks to dominate the resale segment. It is witnessing increased competition from e-commerce players offering authenticated and refurbished products with competitive pricing. Partnerships between retailers and manufacturers strengthen trade-in programs, ensuring consistent inventory flow. Technological integration in refurbishment and digital sales platforms is becoming a key differentiator. Niche players focus on premium or collectible items to attract seasoned golfers, while large retailers target volume sales through promotional events and seasonal discounts.

Recent Developments:

- In June 2025, Acushnet Company launched the Acushnet Hub, an online product ordering platform specifically aimed at trade partners for their Titleist and FootJoy brands. This new platform, powered by RepSpark, introduces real-time inventory, simplified order entry, order tracking, and improved order fulfillment.

- In July 2025, F&F Co., a South Korean fashion retailer and the largest equity investor in TaylorMade Golf, retained its written Consent Rights and engaged Goldman Sachs to advise on its acquisition of TaylorMade, preparing to exercise its Right of First Refusal if necessary.

- In March 2025, KemperSports and Touchstone Golf announced a strategic partnership that integrates the operations of over 40 golf clubs primarily in the U.S. under KemperSports’ management framework, improving customer experience and strengthening their market presence.

Market Concentration & Characteristics:

The Global Pre-Owned Golf Equipment Market displays moderate concentration, with top global brands and specialized retailers accounting for a significant share. It is characterized by high brand loyalty, where consumers often seek pre-owned products from preferred manufacturers. The market thrives on strong authentication processes, value-driven purchasing behavior, and an expanding online resale ecosystem. Seasonal demand fluctuations, driven by tournaments and weather conditions, influence sales cycles. E-commerce penetration is accelerating, enabling broader market access across geographies. Competitive pricing, coupled with quality assurance, remains a central strategy for sustaining customer retention in this evolving landscape.

Report Coverage:

The research report offers an in-depth analysis based on Product and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of digital resale platforms will enhance accessibility for buyers across developed and emerging regions.

- Integration of AI-based valuation and authentication tools will improve buyer confidence and transaction speed.

- Growing golf participation in Asia Pacific and Middle East will create new demand for affordable pre-owned equipment.

- Collaborations between brands and retailers will strengthen trade-in programs and inventory consistency.

- Sustainability-focused consumer behavior will increase preference for refurbished and reused golf gear.

- Product innovation in refurbishment processes will extend equipment lifespan and resale value.

- Increased adoption of mobile commerce will boost sales among younger and tech-savvy golfers.

- Seasonal tournaments and global golf events will drive spikes in resale activity.

- Customization services for pre-owned clubs and carts will appeal to experienced players.

- Cross-border e-commerce expansion will enable wider product variety and competitive pricing options.