Market Overview

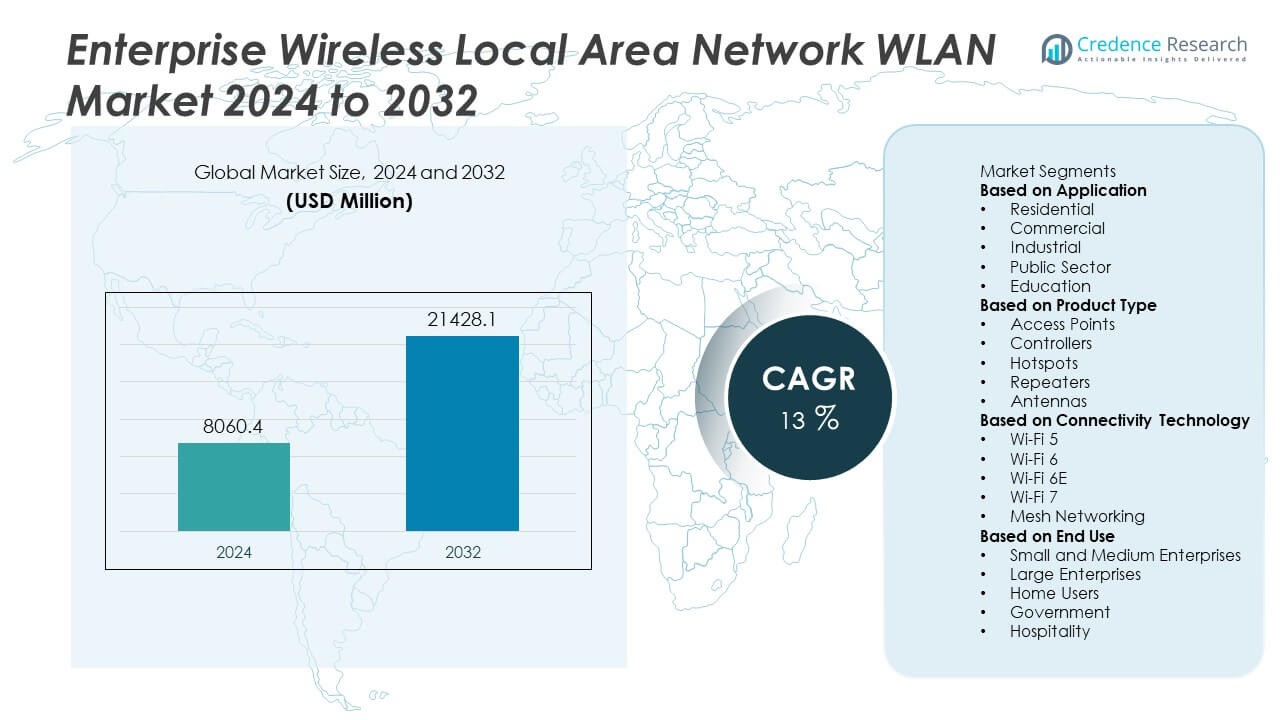

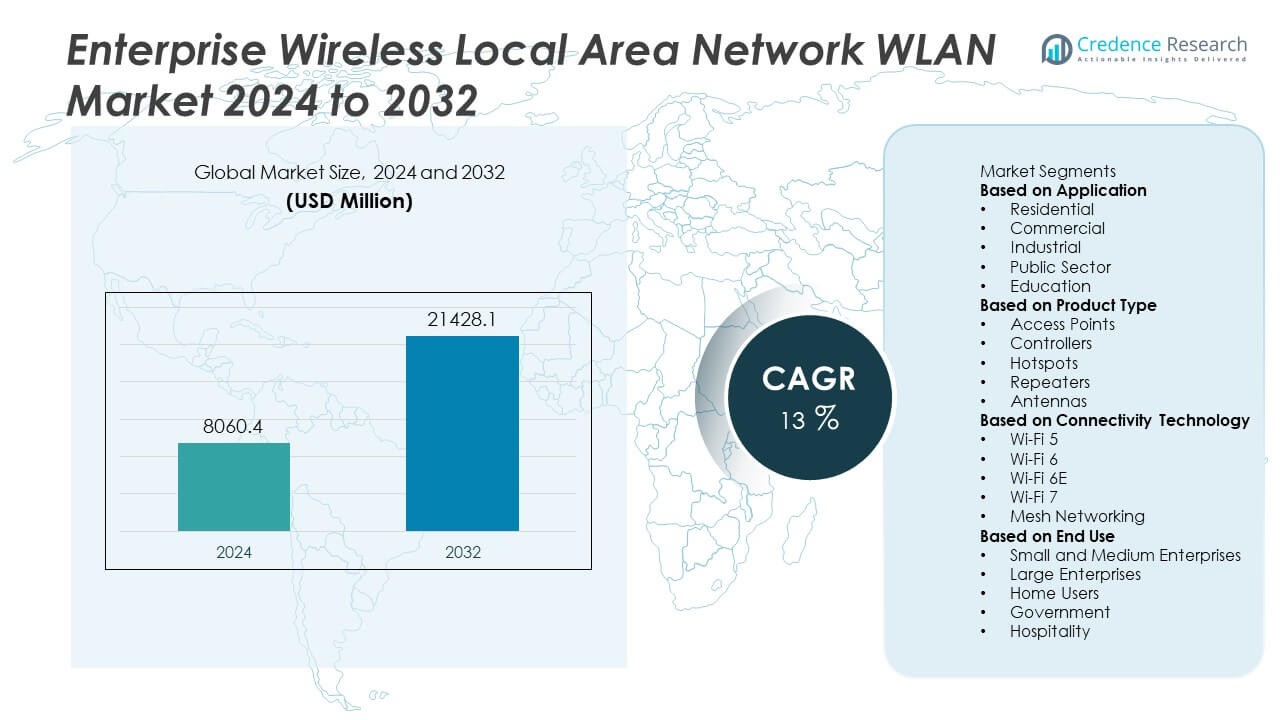

The Enterprise Wireless Local Area Network (WLAN) market was valued at USD 8,060.4 million in 2024. It is projected to grow to USD 21,428.1 million by 2032, reflecting a compound annual growth rate (CAGR) of 13% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enterprise Wireless Local Area Network (WLAN) Market Size 2024 |

USD 8,060.4 Million |

| Enterprise Wireless Local Area Network (WLAN) Market, CAGR |

13% |

| Enterprise Wireless Local Area Network (WLAN) Market Size 2032 |

USD 21,428.1 Million |

The Enterprise Wireless Local Area Network (WLAN) Market grows steadily due to increased adoption of advanced wireless technologies like Wi-Fi 6 and Wi-Fi 7, which enhance network speed, capacity, and reliability. Rising demand for seamless remote work connectivity and cloud-based applications drives enterprises to upgrade WLAN infrastructure. The market also trends toward integrating software-defined networking and network automation to simplify management and improve efficiency.

The Enterprise Wireless Local Area Network (WLAN) Market spans multiple regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each showcasing unique growth dynamics. North America and Asia-Pacific lead due to rapid technology adoption, strong industrialization, and increasing investments in digital infrastructure. Europe focuses on smart city projects and Industry 4.0 initiatives, while emerging markets in Latin America and the Middle East & Africa show steady progress driven by digital transformation efforts. Key players driving innovation and market expansion include Hewlett Packard Enterprise, Aruba Networks, Huawei, and Fortinet. These companies offer advanced WLAN solutions that emphasize high performance, scalability, and security to meet diverse enterprise requirements globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Enterprise Wireless Local Area Network (WLAN) Market was valued at USD 8,060.4 million in 2024 and is expected to reach USD 21,428.1 million by 2032, growing at a CAGR of 13% during the forecast period.

- Growing demand for high-speed, reliable wireless connectivity in enterprises drives market growth, fueled by increased remote work, cloud applications, and IoT device proliferation.

- Adoption of advanced technologies such as Wi-Fi 6 and emerging Wi-Fi 7 enhances network capacity, speed, and user experience, influencing market trends toward next-generation WLAN solutions.

- Enterprises increasingly implement software-defined networking and network automation to optimize WLAN management, reduce costs, and improve operational agility.

- Competitive pressure exists from established players like Hewlett Packard Enterprise, Aruba Networks, Huawei, and Fortinet, who focus on innovation, strategic partnerships, and expanding product portfolios.

- Market restraints include complexities in managing network scalability, security vulnerabilities, and compliance challenges, which can slow down WLAN adoption in certain industries.

- Regionally, North America and Asia-Pacific lead in adoption due to technological advancements and infrastructure investments, while Europe, Latin America, and the Middle East & Africa show steady growth driven by digital transformation and smart city initiatives.

Market Drivers

Increasing Adoption of Advanced Wireless Technologies in Enterprises

The Enterprise Wireless Local Area Network WLAN Market benefits significantly from the widespread adoption of advanced wireless technologies. Organizations seek to improve network efficiency and employee productivity by deploying high-speed, low-latency wireless solutions. The proliferation of Wi-Fi 6 and emerging Wi-Fi 7 standards enhances network capacity and reliability, making wireless LANs more attractive for large enterprises. It supports seamless connectivity for a growing number of devices, including IoT endpoints and mobile users. Enterprises face rising demand for scalable, secure wireless networks that accommodate evolving business needs. This demand fuels investments in upgrading legacy infrastructure to modern WLAN solutions.

- For instance, Hewlett Packard Enterprise introduced its Aruba Wi-Fi 6E access points capable of supporting over 1,024 concurrent users per device, significantly boosting network throughput and reducing latency in dense enterprise environments.

Growing Demand for Remote Work and Digital Collaboration Tools

Remote work trends drive the Enterprise Wireless Local Area Network WLAN Market by necessitating robust wireless connectivity both inside corporate campuses and branch offices. Companies adopt wireless LANs to support flexible work environments and ensure uninterrupted access to cloud-based collaboration platforms. It enables employees to connect securely to corporate resources without geographic constraints. Increased reliance on video conferencing, virtual meetings, and cloud applications creates pressure on network performance. Businesses prioritize WLAN solutions that offer enhanced bandwidth and strong security protocols to protect sensitive data.

- For instance, Fortinet’s FortiWLAN 60F appliance delivers up to 3.6 Gbps throughput and includes integrated security features, enabling enterprises to safeguard remote access while supporting high-quality video conferencing and cloud application usage.

Rising Focus on Network Security and Data Protection

The Enterprise Wireless Local Area Network WLAN Market experiences growth due to heightened emphasis on network security. Enterprises integrate wireless LANs with advanced encryption, multi-factor authentication, and intrusion detection systems. It mitigates risks associated with unauthorized access and cyber threats targeting wireless networks. Compliance with data privacy regulations further drives demand for secure WLAN deployments. Organizations prefer solutions that combine high performance with robust security features to safeguard business-critical information. This focus leads to the adoption of next-generation WLAN technologies with built-in security enhancements.

Expansion of Internet of Things (IoT) Applications in Enterprises

The increasing deployment of Internet of Things (IoT) devices across industries accelerates the Enterprise Wireless Local Area Network WLAN Market. Wireless LANs offer the necessary connectivity for IoT sensors, smart devices, and automation systems within enterprise environments. It supports diverse use cases, including asset tracking, environmental monitoring, and predictive maintenance. The ability to handle a high density of connected devices drives enterprises to invest in WLAN infrastructure upgrades. Efficient management and scalability of wireless networks remain crucial to accommodate expanding IoT ecosystems.

Market Trends

Rapid Integration of Wi-Fi 6 and Emergence of Wi-Fi 7 Technologies

The Enterprise Wireless Local Area Network WLAN Market witnesses a significant shift toward adopting Wi-Fi 6 technology, driven by its superior speed, capacity, and reduced latency. Enterprises leverage Wi-Fi 6 to support high-density environments and demanding applications. Emerging Wi-Fi 7 promises even greater throughput and lower latency, positioning itself as the next evolution in wireless networking. It enables enterprises to future-proof their infrastructure and accommodate growing device connectivity. The shift to these new standards reflects the demand for enhanced user experience and network reliability. Vendors increasingly develop solutions that incorporate these cutting-edge protocols to meet enterprise requirements.

- For instance, Aruba Networks launched its Wi-Fi 7 access points capable of delivering up to 46 Gbps throughput, supporting over 2,000 connected devices simultaneously, significantly enhancing performance in dense enterprise settings.

Growing Implementation of Software-Defined Networking (SDN) and Network Automation

The Enterprise Wireless Local Area Network WLAN Market experiences growing adoption of software-defined networking and network automation to simplify management and improve operational efficiency. It allows enterprises to centrally control, monitor, and optimize their wireless networks through software interfaces. This trend helps reduce manual configuration errors and speeds up network deployment and troubleshooting. Enterprises benefit from dynamic resource allocation and improved scalability by embracing automated network solutions. The focus on agility and flexibility drives demand for WLAN solutions integrated with SDN capabilities. This evolution supports the complex networking demands of modern enterprise environments.

- For instance, Cisco’s DNA Center offers automation capabilities that simplify network management by reducing downtime and errors. It allows for the management of thousands of network devices, automating tasks like configuration and fault management.

Increased Emphasis on Enhanced Security Features in WLAN Solutions

Security remains a critical trend shaping the Enterprise Wireless Local Area Network WLAN Market. Enterprises prioritize WLAN products that offer advanced encryption standards, intrusion detection, and zero-trust network access models. It addresses vulnerabilities introduced by expanding device ecosystems and remote connectivity requirements. Integration of AI-driven security analytics assists in real-time threat detection and response. Vendors focus on delivering WLAN solutions with comprehensive security frameworks to protect enterprise data and maintain regulatory compliance. This heightened security focus drives continuous innovation in wireless network protection technologies.

Expansion of Edge Computing and IoT-Driven Network Demands

The Enterprise Wireless Local Area Network WLAN Market aligns with the rise of edge computing and Internet of Things (IoT) adoption within enterprises. WLAN infrastructure supports data processing closer to the source, reducing latency and improving application performance. It accommodates a growing number of IoT devices requiring consistent and reliable wireless connectivity. Enterprises invest in WLAN upgrades that offer higher capacity and better device management to handle these demands. This trend fosters smarter, more connected environments across industries. WLAN solutions evolve to meet the complexity of managing diverse, edge-enabled enterprise networks.

Market Challenges Analysis

Complexities in Managing Network Scalability and Performance in Expanding Enterprise Environments

The Enterprise Wireless Local Area Network WLAN Market faces challenges related to managing network scalability while maintaining optimal performance. Enterprises increasingly deploy a large number of connected devices, including IoT endpoints, mobile users, and high-bandwidth applications. It demands robust WLAN infrastructure capable of handling high traffic volumes without compromising speed or reliability. Network administrators encounter difficulties in balancing capacity, coverage, and interference mitigation in complex environments. Legacy systems often require costly upgrades to meet current performance expectations. Enterprises also face challenges in integrating new wireless technologies with existing IT ecosystems, which can delay deployment and increase operational costs.

Persistent Security Concerns and Compliance Pressure Impacting WLAN Deployments

Security challenges remain a significant obstacle in the Enterprise Wireless Local Area Network WLAN Market. It faces constant threats from unauthorized access, data breaches, and sophisticated cyberattacks targeting wireless networks. Enterprises must implement advanced security protocols and continuously monitor networks to detect vulnerabilities promptly. Compliance with stringent data privacy regulations adds another layer of complexity, requiring WLAN solutions to align with legal standards across regions. The need for secure, reliable connectivity often slows down network expansion and increases investment requirements. These factors complicate decision-making and hinder the rapid adoption of new WLAN technologies.

Market Opportunities

Expansion of Cloud-Based Services and Integration with Advanced WLAN Solutions

The Enterprise Wireless Local Area Network WLAN Market benefits from growing adoption of cloud-based services that demand seamless and secure wireless connectivity. It provides enterprises with opportunities to deploy WLAN infrastructure optimized for hybrid and multi-cloud environments. Cloud integration enables centralized network management, reducing operational complexities and improving scalability. Enterprises seek WLAN solutions that support real-time analytics and AI-driven performance optimization to enhance user experience. Demand for flexible, on-demand network access drives innovation in WLAN architectures tailored to dynamic business needs. This trend opens avenues for vendors to offer subscription-based and managed WLAN services. It also promotes the development of solutions that support remote workforce connectivity efficiently.

Rising Adoption of Smart Building Technologies and Industry 4.0 Initiatives

The Enterprise Wireless Local Area Network WLAN Market stands to gain from increasing investments in smart building technologies and Industry 4.0 transformations. It enables enterprises to implement intelligent automation, energy management, and connected security systems through robust wireless networks. Industrial sectors adopt WLAN to support robotics, machine-to-machine communication, and predictive maintenance, improving operational efficiency. Enterprises expand WLAN capabilities to accommodate growing IoT ecosystems, fostering smarter and more connected workplaces. This shift creates opportunities for WLAN providers to deliver specialized solutions addressing industry-specific requirements. The trend also encourages partnerships between WLAN vendors and technology integrators to develop comprehensive smart enterprise offerings.

Market Segmentation Analysis:

By Application

The market includes sectors such as corporate offices, healthcare, education, manufacturing, retail, and hospitality. Corporate offices drive substantial demand due to the need for secure, high-speed wireless connectivity to support remote work and collaboration tools. Healthcare institutions prioritize WLAN solutions that enable reliable access to patient data and telemedicine applications. Education environments rely on wireless networks to facilitate digital learning and campus connectivity. Manufacturing and retail sectors adopt WLAN for operational automation and enhanced customer experiences. Hospitality uses wireless LANs to offer seamless guest connectivity, boosting customer satisfaction.

- For instance, Zebra Technologies deployed over 5,000 WLAN-enabled devices across major healthcare networks, improving real-time access to patient information and operational workflows.

By Product Type

The market comprises wireless access points, controllers, switches, and software solutions. Wireless access points hold a dominant position because they provide the critical interface for device connectivity and network access. Controllers manage traffic and security policies, ensuring efficient network operation. Switches offer robust wired backhaul support within WLAN infrastructure. Software solutions, including network management and security applications, gain traction by enabling centralized control and analytics. The demand for integrated product offerings that simplify deployment and maintenance increases among enterprises.

- For instance, Hewlett Packard Enterprise’s Aruba 9000 series controllers manage traffic for more than 20,000 connected devices simultaneously, providing centralized network visibility and enhanced security controls.

By Connectivity Technology

The Enterprise Wireless Local Area Network WLAN Market segments into Wi-Fi 5, Wi-Fi 6, and emerging Wi-Fi 7 standards. Wi-Fi 5 remains prevalent due to existing infrastructure installations, but enterprises increasingly invest in Wi-Fi 6 to benefit from higher speeds, improved capacity, and reduced latency. Wi-Fi 6’s ability to handle dense device environments makes it suitable for modern enterprise needs. The arrival of Wi-Fi 7 introduces potential for ultra-high throughput and advanced features, promising to transform wireless networking further. Enterprises plan upgrades strategically to balance performance gains with investment costs.

Segments:

Based on Application

- Residential

- Commercial

- Industrial

- Public Sector

- Education

Based on Product Type

- Access Points

- Controllers

- Hotspots

- Repeaters

- Antennas

Based on Connectivity Technology

- Wi-Fi 5

- Wi-Fi 6

- Wi-Fi 6E

- Wi-Fi 7

- Mesh Networking

Based on End Use

- Small and Medium Enterprises

- Large Enterprises

- Home Users

- Government

- Hospitality

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest market share of 36% in the Enterprise Wireless Local Area Network (WLAN) market, driven by strong enterprise adoption of cloud-managed Wi-Fi, advanced security features, and high-speed connectivity solutions. Large-scale deployments in sectors such as education, healthcare, and manufacturing sustain market leadership. Increasing demand for Wi-Fi 6 and 6E upgrades further accelerates growth, with U.S. enterprises investing heavily in campus-wide network modernization. Canada follows a similar trend, emphasizing secure WLAN architectures to support hybrid work environments and IoT integration. The region’s competitive landscape remains robust, with multiple vendors expanding managed service offerings.

Europe

Europe commands around 25% of the global Enterprise Wireless Local Area Network WLAN Market. Countries such as Germany, the United Kingdom, and France lead the adoption of WLAN technologies, driven by growing smart city projects and Industry 4.0 initiatives. Enterprises focus on integrating WLAN with automation and digital manufacturing processes to enhance operational efficiency. The region’s robust healthcare and education sectors require reliable wireless networks to support telemedicine and e-learning solutions. European enterprises also emphasize data privacy and compliance with stringent regulations such as GDPR, shaping WLAN deployment strategies. Continuous innovation and government support for technology infrastructure contribute to sustained market expansion in Europe.

Asia-Pacific

The Asia-Pacific region holds approximately 30% of the Enterprise Wireless Local Area Network WLAN Market share and exhibits rapid growth due to expanding industrialization and urbanization. Countries like China, India, Japan, and South Korea actively adopt WLAN solutions across various sectors, including manufacturing, retail, education, and healthcare. The rise in smart city initiatives and IoT adoption further accelerates demand for high-capacity, scalable wireless networks. Enterprises invest heavily in upgrading from legacy systems to advanced Wi-Fi 6 and Wi-Fi 7 technologies. The region’s large population base and growing digital economy create significant opportunities for WLAN vendors. Government policies promoting digital infrastructure and 5G integration also bolster market growth in Asia-Pacific.

Latin America

Latin America accounts for roughly 5% of the global Enterprise Wireless Local Area Network WLAN Market share. The region’s market growth is driven primarily by increased adoption of digital technologies in Brazil, Mexico, and Argentina. Enterprises seek to improve wireless connectivity in corporate, educational, and healthcare institutions. However, infrastructure challenges and economic fluctuations moderate the pace of WLAN adoption. Investments in network modernization and digital transformation initiatives provide growth opportunities. Latin America’s growing emphasis on remote work and cloud services also supports increased demand for enterprise WLAN solutions.

Middle East & Africa

The Middle East & Africa holds an estimated 5% share of the Enterprise Wireless Local Area Network WLAN Market. Key markets include the United Arab Emirates, Saudi Arabia, South Africa, and Israel. The region experiences growing WLAN deployment fueled by investments in smart infrastructure, digital government initiatives, and expanding enterprise networks. Oil and gas, finance, and telecommunications sectors lead WLAN adoption to enhance operational efficiency and connectivity. Challenges such as regulatory complexities and uneven technology penetration affect market growth. Nevertheless, ongoing infrastructure development and increased focus on cybersecurity present promising prospects for WLAN vendors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fortinet

- DLink

- Zebra Technologies

- TPLink

- Hewlett Packard Enterprise

- Ruckus Wireless

- Aruba Networks

- Huawei

- Dell Technologies

- Zyxel Communications

Competitive Analysis

The competitive landscape of the Enterprise Wireless Local Area Network (WLAN) Market features key players such as Hewlett Packard Enterprise, Aruba Networks, Huawei, Fortinet, Dell Technologies, TP-Link, DLink, Ruckus Wireless, Zebra Technologies, and Zyxel Communications. These companies focus on innovation in WLAN solutions, incorporating advanced Wi-Fi 6 and Wi-Fi 7 technologies, network security, cloud-managed WLAN, and efficient network management. Hewlett Packard Enterprise and Aruba Networks lead by offering comprehensive, secure wireless solutions, while Huawei targets high performance with competitive pricing. Fortinet stands out with integrated cybersecurity features, and Dell Technologies delivers scalable WLAN systems for diverse industries. TP-Link, DLink, and Ruckus Wireless cater to small and medium enterprises with affordable, easy-to-deploy solutions. Zebra Technologies specializes in vertical markets like healthcare and retail, whereas Zyxel Communications drives innovation in network automation and cloud management. Heavy investments in R&D, strategic partnerships, and customer-focused service models help these players maintain competitive advantage and fuel growth in the Enterprise WLAN Market.

Recent Developments

- In April 2024, Fortinet was recognized as a Leader in the Gartner Magic Quadrant for Enterprise Wired and Wireless LAN Infrastructure, highlighting its strong position in the market.

- In April 2024, Zebra introduced new industrial automation solutions at Automate 2024, aiming to optimize front-line workflows and enhance connectivity in enterprise environments.

- In March 2024, Aruba Networks was positioned as a Leader in the Gartner Magic Quadrant for Enterprise Wired and Wireless LAN Infrastructure, marking its 18th consecutive recognition.

Market Concentration & Characteristics

The Enterprise Wireless Local Area Network (WLAN) Market exhibits a moderately concentrated structure, dominated by a few global players that hold significant market share through advanced technology offerings and extensive distribution networks. It features a competitive environment where established companies such as Hewlett Packard Enterprise, Aruba Networks, Huawei, and Fortinet drive innovation and set industry standards. These key players leverage strong R&D capabilities and strategic partnerships to introduce high-performance WLAN solutions that address evolving enterprise requirements, including enhanced security, scalability, and seamless connectivity. The market also includes several mid-sized and emerging vendors who compete by focusing on niche segments, cost-effective solutions, and regional specialization. Customer demand for integrated wireless networks supporting IoT, cloud computing, and AI applications compels providers to continuously enhance product portfolios and service models. Market characteristics include rapid technology adoption cycles, growing importance of network automation, and increasing emphasis on cybersecurity features. The interplay of technological advancements and competitive strategies fosters a dynamic market landscape where differentiation relies on innovation, customer service, and the ability to meet complex enterprise networking needs. This environment encourages ongoing investment and collaboration among vendors to maintain relevance and capitalize on growth opportunities within the Enterprise WLAN Market.

Report Coverage

The research report offers an in-depth analysis based on Application, Product Type, Connectivity Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Enterprise Wireless Local Area Network WLAN Market will experience accelerated adoption of Wi-Fi 7 technology.

- Enterprises will prioritize integrating WLAN solutions with AI-driven network management tools.

- Demand for secure wireless networks will increase due to rising cybersecurity concerns.

- Cloud-managed WLAN services will gain traction for their scalability and ease of deployment.

- The expansion of IoT devices will drive the need for high-capacity and reliable WLAN infrastructure.

- Enterprises will invest more in network automation to reduce operational complexities.

- Hybrid work models will sustain the demand for flexible and robust wireless connectivity.

- Vendors will focus on developing energy-efficient and sustainable WLAN hardware.

- Integration of WLAN with 5G networks will open new opportunities for seamless connectivity.

- Strategic partnerships and mergers will intensify to enhance product portfolios and market reach.