Market Overview

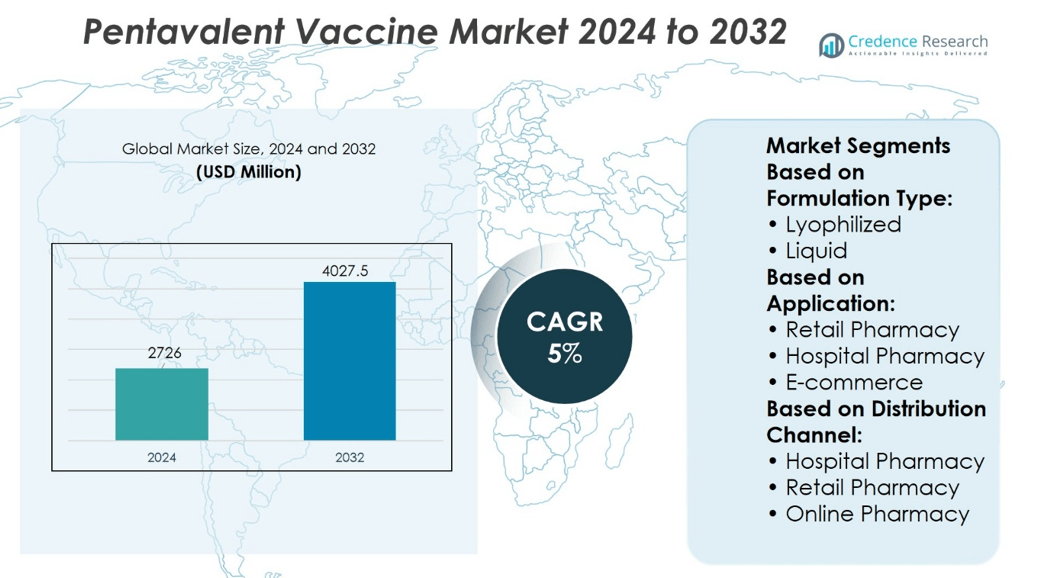

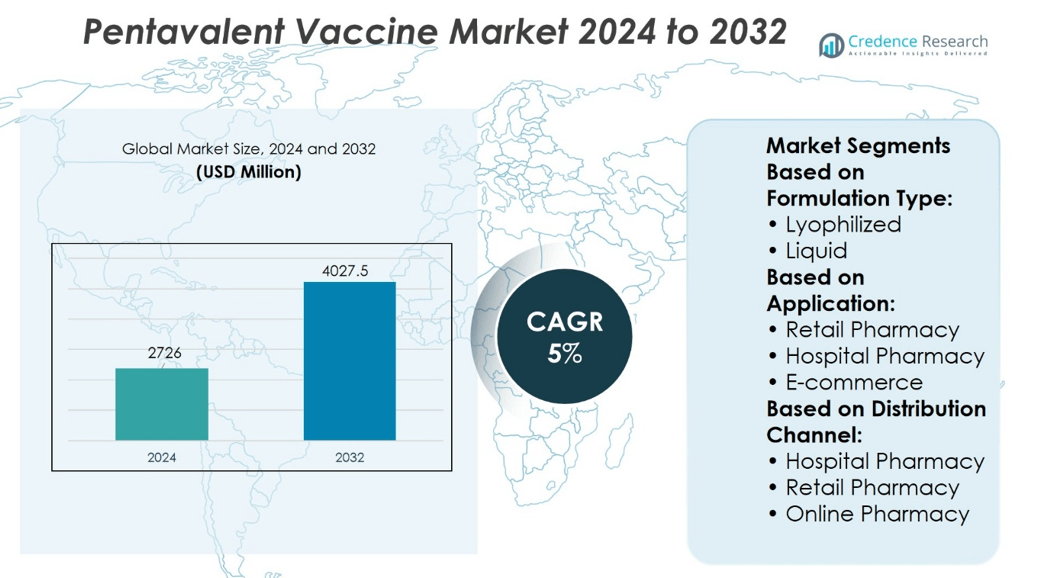

Pentavalent Vaccine Market size was valued at USD 2726 million in 2024 and is anticipated to reach USD 4027.5 million by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pentavalent Vaccine Market Size 2024 |

USD 2726 million |

| Pentavalent Vaccine Market, CAGR |

5% |

| Pentavalent Vaccine Market Size 2032 |

USD 4027.5 million |

The Pentavalent Vaccine Market grows through strong government immunization initiatives, support from global health organizations, and rising demand for cost-effective combination vaccines. It reduces logistical challenges by combining protection against multiple diseases in a single dose, improving coverage and compliance. Advancements in formulation and packaging enhance stability, enabling distribution in regions with limited cold chain infrastructure. Strategic collaborations between manufacturers and public health programs strengthen supply chains and expand reach. Increasing inclusion in national immunization schedules and adoption of innovative delivery methods drive long-term growth, while digital procurement systems improve transparency and efficiency in vaccine distribution.

The Pentavalent Vaccine Market has strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific emerging as a high-growth region due to large pediatric populations and expanding immunization programs. Established markets in North America and Europe benefit from advanced healthcare infrastructure and stable procurement systems. Key players include Panacea Drugs Pvt. Ltd., Shantha Biotechnics, Bio Farma, Novartis AG, Crucell, and Biological E. Ltd., each leveraging production capacity, partnerships, and distribution networks to strengthen market position.

Market Insights

- The Pentavalent Vaccine Market size was valued at USD 2726 million in 2024 and is expected to reach USD 4027.5 million by 2032, at a CAGR of 5%.

- Government immunization initiatives and support from global health organizations drive consistent demand.

- Adoption of cost-effective combination vaccines reduces logistical challenges and improves coverage.

- Advancements in formulation and packaging improve stability for regions with limited cold chain infrastructure.

- Competition remains strong with key players leveraging production capacity, partnerships, and distribution networks.

- Dependence on limited manufacturing sources and stringent regulatory approvals restrain market growth.

- Asia-Pacific shows fastest growth due to large pediatric populations, while North America and Europe maintain stable demand through advanced healthcare systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Immunization Initiatives Driving Demand

The Pentavalent Vaccine Market benefits from strong support from global health agencies and national immunization programs. Governments and organizations such as WHO and UNICEF expand coverage to reduce preventable childhood diseases. Large-scale procurement agreements secure consistent supply in low- and middle-income countries. It addresses multiple infections in a single dose, reducing the logistical burden on healthcare systems. Funding from international partnerships ensures affordability and wider distribution. Strategic campaigns target high-risk regions, increasing awareness and acceptance.

- For instance, UNICEF procured 65.5 million doses of pentavalent vaccines through its global supply operations, supporting large-scale immunization efforts in multiple regions.

Cost Efficiency and Reduced Healthcare Burden Supporting Adoption

Combining protection against five diseases in one shot makes the Pentavalent Vaccine Market appealing for cost-conscious healthcare systems. It minimizes the need for multiple clinic visits, lowering transportation and operational expenses. Fewer injections reduce medical waste and streamline cold chain management. This consolidation improves patient compliance and coverage rates. Health ministries recognize its role in optimizing limited resources without compromising quality. Procurement efficiency also encourages sustained demand from public health authorities.

- For instance, UNICEF’s global supply division sourced 235 million pentavalent vaccine doses through its multi‑manufacturer procurement process, significantly easing the workload on cold‑chain infrastructure and reducing logistical strain on national healthcare systems.

Strong Clinical Efficacy and Safety Profile Enhancing Trust

The Pentavalent Vaccine Market benefits from a proven safety record and consistent immunogenicity data. Clinical trials demonstrate high antibody response levels across varied demographic groups. It maintains efficacy even in resource-limited settings with challenging storage conditions. Healthcare professionals view it as a reliable solution for integrated immunization schedules. Regulatory approvals from multiple countries reinforce confidence in its quality. Positive post-market surveillance data further supports its continued inclusion in routine vaccination programs.

Technological Advancements in Formulation and Delivery Expanding Reach

Ongoing innovation strengthens the Pentavalent Vaccine Market by improving stability and ease of administration. Formulation enhancements extend shelf life and maintain potency in diverse climates. It enables safe transport to remote areas without advanced cold chain infrastructure. Simplified dosing schedules reduce complexity for healthcare workers. Manufacturers focus on needle-free delivery systems to improve patient comfort and acceptance. These advancements open opportunities for broader global deployment.

Market Trends

Growing Focus on Combination Vaccines for Immunization Programs

The Pentavalent Vaccine Market reflects a clear shift toward combination vaccines that address multiple diseases in a single dose. Governments and global health bodies adopt these solutions to streamline immunization schedules. It reduces the logistical challenges of delivering separate vaccines for each disease. Health systems value the efficiency and reduced patient visits. Procurement strategies increasingly favor integrated products for cost and operational benefits. This trend aligns with broader public health goals of expanding immunization coverage.

- For instance, Panacea Biotec has supplied 12.5 million doses of its WHO-prequalified Easyfive-TT pentavalent vaccine to support large-scale immunization programs in multiple countries.

Expansion of Public-Private Partnerships in Vaccine Distribution

Collaborations between vaccine manufacturers, NGOs, and government agencies strengthen the Pentavalent Vaccine Market. These partnerships focus on securing sustainable supply and equitable access. It ensures that underserved regions receive consistent vaccine availability. Joint initiatives also drive local manufacturing capabilities to meet domestic demand. Such frameworks enhance long-term program sustainability. The coordinated approach builds resilience in national immunization infrastructures.

- For instance, Gavi’s partnership with Biological E has enabled the distribution of 600 million pentavalent vaccine doses through coordinated public-private supply programs.

Innovation in Formulation and Packaging Enhancing Accessibility

Ongoing advancements in vaccine formulation improve stability and storage conditions in the Pentavalent Vaccine Market. Enhanced thermal tolerance reduces dependence on advanced cold chain facilities. It enables delivery to rural and remote regions without compromising efficacy. Packaging improvements simplify handling for healthcare providers. Single-dose vials and pre-filled syringes support safety and efficiency. These developments expand the market’s reach into challenging environments.

Rising Inclusion in Global Immunization Guidelines

International health organizations increasingly include pentavalent vaccines in their recommended schedules, supporting the Pentavalent Vaccine Market. Policy endorsements accelerate adoption across developing and emerging economies. It standardizes protection against multiple diseases in a single immunization. National health agencies adjust procurement and training programs accordingly. This integration strengthens disease prevention strategies at the population level. The growing alignment between global guidelines and national policies fuels steady market expansion.

Market Challenges Analysis

Supply Chain Limitations and Cold Storage Requirements Restricting Access

The Pentavalent Vaccine Market faces constraints from complex supply chain demands and cold storage needs. Maintaining optimal temperatures throughout transport is critical to preserve potency. It creates challenges in regions with limited refrigeration infrastructure. Disruptions in global logistics can delay deliveries and affect immunization schedules. Remote and rural areas remain the most affected due to inadequate distribution networks. These factors increase operational costs and reduce the speed of deployment. Addressing these bottlenecks is essential to maintain consistent vaccination coverage.

Regulatory Hurdles and Dependence on Limited Manufacturing Sources

The Pentavalent Vaccine Market encounters delays from lengthy regulatory approvals and quality certification processes. Stringent compliance standards ensure safety but can slow product introduction in new markets. It also faces risk from dependence on a small number of manufacturers. Production disruptions at these facilities can cause significant supply shortages. Limited diversification of production sites amplifies vulnerability to geopolitical or operational issues. High production costs linked to advanced formulation further restrict scalability. Overcoming these challenges requires coordinated efforts from industry stakeholders and policymakers.

Market Opportunities

Expansion into Emerging Economies with Growing Immunization Programs

The Pentavalent Vaccine Market holds strong potential in emerging economies that are scaling national immunization programs. Governments are increasing healthcare investments to address preventable diseases in children. It offers a cost-effective and streamlined solution for expanding vaccine coverage in these regions. Public health initiatives backed by international funding create avenues for bulk procurement. Partnerships with local distributors and manufacturers can strengthen last-mile delivery. Rising public awareness of the benefits of combination vaccines further supports adoption. This environment positions the market for accelerated penetration in underserved areas.

Advancements in Manufacturing and Distribution Infrastructure

Technological improvements in production processes create new growth opportunities for the Pentavalent Vaccine Market. Enhanced formulation techniques increase stability and extend shelf life under varied storage conditions. It enables greater flexibility in distribution to regions with limited cold chain capabilities. Automation and quality control innovations improve output efficiency and product consistency. Expansion of regional manufacturing hubs can reduce dependency on centralized facilities. Investments in scalable production capacity allow rapid response to shifts in demand. These developments support broader global availability and sustainable long-term growth.

Market Segmentation Analysis:

By Formulation Type

The Pentavalent Vaccine Market includes lyophilized and liquid formulations, each addressing different storage and administration needs. Lyophilized vaccines offer extended shelf life and better stability under variable temperature conditions, making them suitable for remote and resource-limited settings. They require reconstitution before administration, which demands trained healthcare personnel and careful handling. Liquid formulations provide ready-to-use convenience, reducing preparation time and minimizing the risk of dosing errors. It is preferred in high-volume immunization drives where efficiency is critical. Both formats maintain immunogenicity and safety profiles, allowing flexibility in procurement strategies depending on regional infrastructure and healthcare capabilities.

- For instance, GSK has supplied 128 million doses of its lyophilized pentavalent vaccine through UNICEF-supported immunization programs, ensuring stable delivery in variable temperature conditions.

By Application

The Pentavalent Vaccine Market addresses hospital pharmacy, retail pharmacy, and online pharmacy applications, aligning with the operational scope of each healthcare segment. Hospital pharmacies focus on managing immunization schedules for inpatients and conducting outreach vaccination drives in collaboration with public health authorities. Retail pharmacies cater to individuals seeking convenient, on-demand vaccination services in local communities. Online pharmacies support procurement for healthcare providers, NGOs, and vaccination centers, facilitating access to bulk supplies through centralized ordering systems. It supports streamlined stock management and reduces delays in vaccine delivery. The diversity in application settings ensures broad market coverage and supports multiple healthcare delivery models across regions.

- For instance, Biological E has distributed 18 million pentavalent vaccine doses through hospital pharmacy networks in multiple countries, ensuring timely administration for inpatient immunization programs.

By Distribution Channel

The Pentavalent Vaccine Market operates through retail pharmacy, hospital pharmacy, and e-commerce channels, each serving distinct patient access points. Retail pharmacies play a role in community-level vaccine availability, ensuring accessibility for walk-in patients and scheduled immunization programs. Hospital pharmacies manage large-scale storage and distribution for inpatient and outpatient services, often supplying vaccination campaigns in collaboration with public health agencies. E-commerce platforms are emerging as a viable distribution channel, particularly in urban areas with advanced logistics support. It enables bulk ordering and direct delivery, supporting private healthcare providers and NGOs. The growing adoption of digital procurement systems enhances transparency and traceability in vaccine supply chains.

Segments:

Based on Formulation Type:

Based on Application:

- Retail Pharmacy

- Hospital Pharmacy

- E-commerce

Based on Distribution Channel:

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 32% in the Pentavalent Vaccine Market, driven by advanced healthcare infrastructure and strong public immunization programs. The United States and Canada maintain high vaccination coverage through government-funded initiatives and robust supply chain networks. It benefits from established procurement frameworks that ensure uninterrupted availability of combination vaccines. Strategic partnerships between manufacturers and public health agencies support large-scale immunization drives targeting pediatric populations. Research and development investment remains strong, with companies focusing on improved formulations and delivery methods. Regulatory compliance is streamlined through well-defined approval pathways, enabling quicker market access for new vaccine versions. The presence of leading biotechnology firms further reinforces the region’s capacity for innovation and production scalability.

Europe

Europe accounts for 28% of the Pentavalent Vaccine Market, supported by universal healthcare coverage and coordinated vaccination policies across member states. National health systems integrate pentavalent vaccines into mandatory immunization schedules, ensuring consistent demand. It benefits from a mature cold chain infrastructure that allows effective distribution across diverse climates. Cross-border collaborations within the European Union facilitate bulk procurement and cost efficiency. The region also demonstrates strong adoption of both lyophilized and liquid formulations to meet varying country-specific storage capabilities. Public health campaigns are reinforced by funding from regional authorities, enhancing awareness and compliance. Strategic investments in domestic manufacturing help reduce reliance on external supply sources.

Asia-Pacific

Asia-Pacific commands a 25% share of the Pentavalent Vaccine Market, driven by expanding healthcare access and government-led immunization initiatives. Countries such as India, China, and Indonesia represent high-growth markets due to large pediatric populations. It experiences strong procurement activity through partnerships with organizations like Gavi, the Vaccine Alliance. Rural and semi-urban regions present unique challenges in distribution, encouraging investment in extended shelf-life formulations. The region’s growing manufacturing base contributes to reduced production costs and improved supply reliability. National vaccination schedules increasingly incorporate pentavalent vaccines to address multiple diseases efficiently. Expanding public-private collaborations accelerate distribution in underserved areas, further strengthening market presence.

Latin America

Latin America holds a 9% share of the Pentavalent Vaccine Market, driven by government-supported immunization programs and targeted outreach in rural communities. Countries such as Brazil and Mexico have integrated pentavalent vaccines into national schedules with strong uptake rates. It benefits from international aid programs that help finance vaccine procurement for low-income areas. Challenges remain in maintaining cold chain integrity across remote regions, prompting adoption of lyophilized formulations. Regional health ministry’s work closely with suppliers to ensure consistent stock levels and timely replenishment. Collaborative partnerships with NGOs facilitate awareness campaigns that improve community participation. Continued investment in infrastructure is expected to strengthen market growth in the region.

Middle East & Africa

The Middle East & Africa region holds a 6% share of the Pentavalent Vaccine Market, characterized by uneven access to healthcare services across countries. It relies heavily on global health initiatives and donor funding to support vaccine availability in low-income nations. Political stability and infrastructure development play a role in determining market penetration. The adoption of pentavalent vaccines is increasing in countries with established immunization frameworks. Efforts to improve cold chain logistics are underway to expand reach into remote and underserved areas. Partnerships with international organizations help secure large-scale procurement agreements. Ongoing public health education campaigns aim to raise awareness and boost immunization coverage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Pentavalent Vaccine Market features include Panacea Drugs Pvt. Ltd., Shantha Biotechnics, Bio Farma, Novartis AG, Crucell, and Biological E. Ltd. The Pentavalent Vaccine Market is characterized by intense competition, with manufacturers focusing on innovation, cost efficiency, and reliable supply to strengthen their market positions. Companies compete on factors such as formulation stability, production scalability, and the ability to meet diverse storage and distribution requirements. Compliance with international quality standards, including WHO prequalification, remains essential for securing large procurement contracts from governments and global health agencies. Strategic collaborations with public health programs, NGOs, and global alliances enhance distribution reach, particularly in emerging economies. Continuous investment in research and development supports improvements in shelf life, delivery methods, and ease of administration. Expanding regional manufacturing capacity and optimizing supply chains are critical strategies to ensure consistent availability and maintain a competitive edge.

Recent Developments

- In Aug 2025, Merck & Co. Inc. And IAVI (International AIDS Vaccine Initiative) entered into a technological collaboration to develop a mRNA-based HIV vaccine.

- In March 2025, Johnson & Johnson expanded its vaccine manufacturing capacity by investing in a new facility in the United States.

- In May 2024, Novavax and Sanofi disclosed a co-exclusive licensing agreement to co-commercialize a COVID-19 vaccine and collaborate on developing novel combination vaccines for COVID-19 and influenza.

- In April 2024, Pfizer announced data from phase 3 trials of its RSV shots. The trial conducted in adult patients demonstrated that the shot was more effective in preventing infections with two related symptoms.

Market Concentration & Characteristics

The Pentavalent Vaccine Market demonstrates a moderately concentrated structure, with a limited number of global and regional manufacturers supplying the majority of demand. It is characterized by high entry barriers due to stringent regulatory requirements, complex manufacturing processes, and the need for WHO prequalification to access international procurement programs. Established players maintain competitive advantage through large-scale production capabilities, diversified distribution networks, and strong partnerships with government and non-government health organizations. The market places emphasis on consistent quality, stability of formulations, and the capacity to meet varied storage and transportation conditions across geographies. Demand is sustained by inclusion of pentavalent vaccines in national immunization schedules and support from global health initiatives. Competitive dynamics are influenced by tender-based procurement, cost efficiency, and the ability to adapt formulations to meet local infrastructure constraints. Long-term supply agreements and investments in regional manufacturing facilities further shape the market’s operational landscape.

Report Coverage

The research report offers an in-depth analysis based on Formulation Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow in emerging economies through expanded national immunization programs.

- Manufacturers will invest in advanced formulations to improve stability in varied climates.

- Regional production facilities will increase to reduce dependence on centralized supply chains.

- Digital procurement systems will streamline vaccine ordering and distribution processes.

- Public-private partnerships will strengthen supply reliability in underserved regions.

- Needle-free delivery systems will gain traction to improve patient comfort and compliance.

- Inclusion of pentavalent vaccines in more national schedules will drive consistent demand.

- Global health agencies will continue funding large-scale procurement for low-income countries.

- Cold chain innovations will expand reach into remote and rural areas.

- Continuous R&D will enhance immunogenicity and broaden protection coverage.