Market Overview

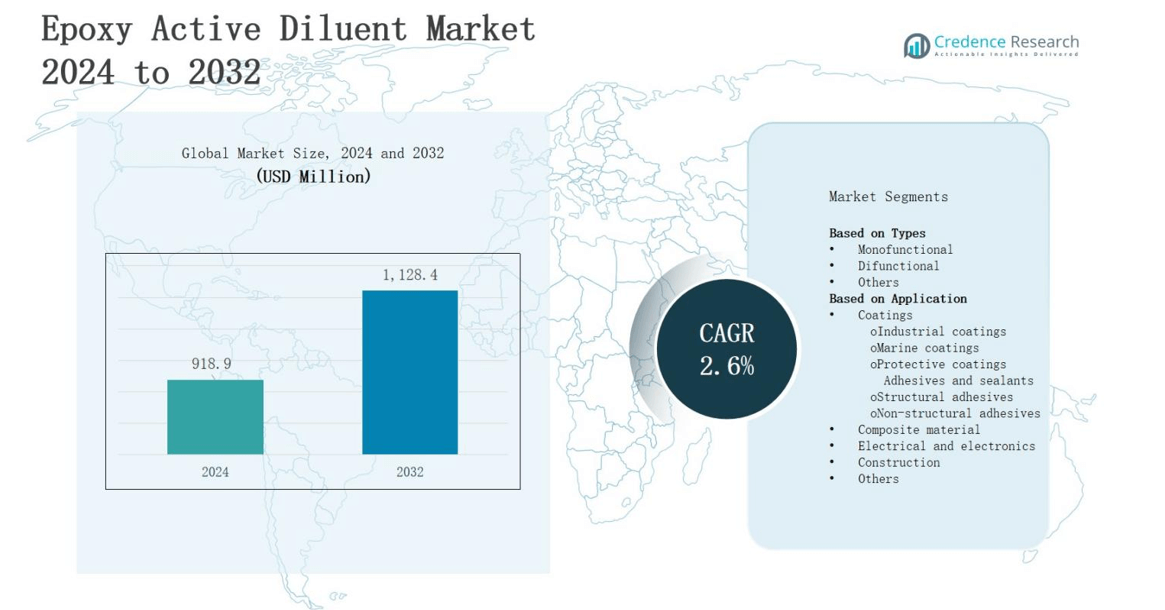

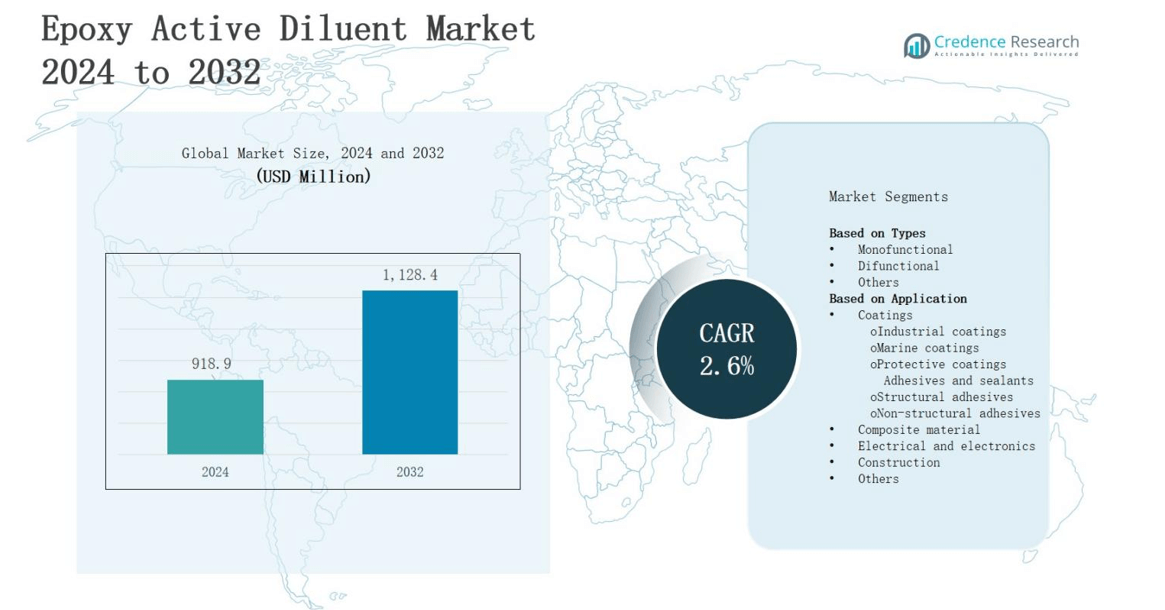

The epoxy active diluent market is projected to grow from USD 918.9 million in 2024 to USD 1,128.4 million by 2032, registering a CAGR of 2.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Epoxy Active Diluent Market Size 2024 |

USD 918.9 million i |

| Epoxy Active Diluent Market, CAGR |

2.6% |

| Epoxy Active Diluent Market Size 2032 |

USD 1,128.4 million |

The epoxy active diluent market is driven by the rising demand for lightweight, durable, and chemical-resistant materials across industries such as automotive, construction, electronics, and marine. Increasing adoption of epoxy resins in high-performance coatings, adhesives, and composites boosts the need for active diluents to enhance processing efficiency and reduce viscosity. The shift toward sustainable, low-VOC formulations aligns with stringent environmental regulations, fostering innovation in bio-based and eco-friendly diluents. Trends include advancements in reactive diluent chemistry for improved mechanical properties, expanding applications in wind energy and aerospace, and the integration of tailored diluents to meet specific performance and curing requirements.

The epoxy active diluent market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific leading due to rapid industrialization and infrastructure growth. North America and Europe follow, driven by advanced manufacturing and stringent environmental standards. Latin America sees demand from construction and marine sectors, while the Middle East & Africa benefit from oil, gas, and infrastructure projects. Key players include Adeka Corporation, Aditya Birla Chemicals, Anhui Hengyuan (Group), EMS-GRILTECH, Evonik Industries, Hexion Inc., Hubei Green Home Chemical, Huntsman Corporation, Kukdo Chemical, Leuna Harze GmbH, Olin Corporation, and Sanmu Group.

Market Insights

- The epoxy active diluent market is projected to grow from USD 918.9 million in 2024 to USD 1,128.4 million by 2032, at a CAGR of 2.6%.

- Rising demand from automotive, aerospace, construction, electronics, and marine sectors drives adoption of active diluents for improved processing and durability.

- Growing preference for low-VOC and bio-based solutions aligns with global environmental regulations, fostering sustainable product innovation.

- Technological advancements in reactive chemistry enhance mechanical strength, curing speed, and thermal resistance.

- Market challenges include fluctuating petrochemical-based raw material prices and stringent VOC emission regulations.

- Asia-Pacific leads with 34% market share, followed by North America (28%), Europe (25%), Latin America (7%), and the Middle East & Africa (6%).

- Key players include Adeka Corporation, Aditya Birla Chemicals, Anhui Hengyuan (Group), EMS-GRILTECH, Evonik Industries, Hexion Inc., Hubei Green Home Chemical, Huntsman Corporation, Kukdo Chemical, Leuna Harze GmbH, Olin Corporation, and Sanmu Group.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand from Automotive and Aerospace Industries

The epoxy active diluent market benefits from rising use in automotive and aerospace sectors, where lightweight yet strong materials are critical for fuel efficiency and performance. It enables epoxy resins to achieve lower viscosity, improving application in coatings, adhesives, and composites. The increasing need for corrosion resistance and structural integrity supports wider adoption. Expanding production of electric vehicles and aircraft drives further demand, aligning with industry trends toward advanced material solutions.

- For instance, Huntsman Corporation launched a new line of low-VOC epoxy active diluents in 2020, targeting stricter environmental regulations and improving the sustainability of epoxy formulations used in automotive and aerospace industries.

Expansion in Construction and Infrastructure Projects

The epoxy active diluent market gains momentum from large-scale infrastructure development and urbanization, particularly in emerging economies. It supports the production of high-performance floor coatings, sealants, and adhesives, enhancing durability and resistance to harsh conditions. Growing demand for protective coatings in bridges, industrial facilities, and commercial buildings boosts consumption. The shift toward long-lasting, low-maintenance materials in construction increases the importance of epoxy formulations enhanced by active diluents.

- For instance, in North America, manufacturers are developing eco-friendly, low-emission epoxy formulations to meet stringent EPA guidelines, supporting durable coatings used in construction and infrastructure projects.

Advancements in Sustainable and Low-VOC Formulations

The epoxy active diluent market is shaped by stricter environmental regulations driving demand for low-VOC and eco-friendly solutions. It enables manufacturers to develop safer, more sustainable products without compromising performance. Increased focus on bio-based reactive diluents is prompting innovation in renewable raw materials. Regulatory frameworks in Europe, North America, and Asia-Pacific push industries toward greener chemistry. Rising consumer awareness reinforces the market’s shift to sustainable epoxy resin systems.

Technological Innovations Enhancing Product Performance

The epoxy active diluent market is advancing through innovations in reactive chemistry, enabling improved mechanical strength, curing speed, and thermal resistance. It allows manufacturers to tailor epoxy systems for specific end-use requirements, from electronics encapsulation to marine coatings. R&D investments focus on diluents that enhance compatibility with diverse resin systems. Growing need for precise performance characteristics in industrial applications accelerates adoption. Advanced solutions are capturing demand in high-value manufacturing sectors.

Market Trends

Rising Adoption of Bio-Based and Sustainable Diluents

The epoxy active diluent market is witnessing a notable shift toward bio-based and renewable raw materials. It addresses growing regulatory pressure to reduce VOC emissions and reliance on petrochemical sources. Manufacturers are investing in plant-derived reactive diluents that maintain performance standards while meeting environmental goals. This trend aligns with global sustainability commitments and corporate ESG targets. End-use industries are increasingly prioritizing eco-friendly alternatives, creating opportunities for innovation and market expansion.

- For instance, Cardolite, a major specialty chemicals manufacturer, has launched a line of bio-based epoxy active diluents of renewable origin that reduce reliance on fossil fuels while enhancing performance in coatings and composites.

Integration of Advanced Formulation Technologies

The epoxy active diluent market benefits from advancements in formulation techniques designed to enhance mechanical strength, thermal resistance, and curing efficiency. It enables the customization of epoxy systems for demanding applications, including aerospace, marine, and electronics. Innovations in nanotechnology and hybrid resin systems are improving product capabilities. R&D efforts focus on achieving balanced viscosity reduction without compromising durability. Such developments are strengthening the competitiveness of high-performance epoxy products.

- For instance, J Li developed a monoglycidyl silyl etherated eugenol (GSE) reactive epoxy diluent that significantly improved thermal stability, toughness, and processing properties of anhydride-cured epoxy systems used in composites.

Expanding Applications in Renewable Energy Sectors

The epoxy active diluent market is expanding into renewable energy applications, particularly wind turbine blade manufacturing and solar panel assembly. It supports the need for lightweight, durable, and weather-resistant materials. Growing investments in wind and solar infrastructure are increasing demand for optimized epoxy formulations. It enhances resin workability and application precision in large-scale composite structures. This sector’s rapid growth is reinforcing the relevance of specialized active diluents.

Focus on High-Performance Industrial Coatings

The epoxy active diluent market is experiencing growth in demand for high-performance coatings across industrial, marine, and oil and gas sectors. It improves adhesion, chemical resistance, and long-term durability of epoxy coatings. Industries are seeking solutions that withstand extreme temperatures, moisture, and corrosive environments. Advancements in reactive diluents are enabling faster application times and extended service life. This trend is reshaping competitive strategies and product portfolios in the coatings segment.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Disruptions

The epoxy active diluent market faces challenges from volatility in raw material prices, particularly those derived from petrochemicals. It is vulnerable to fluctuations in crude oil markets, which directly affect production costs. Geopolitical tensions, trade restrictions, and transportation bottlenecks add uncertainty to supply availability. Manufacturers often struggle to maintain pricing stability while ensuring consistent quality. This environment pressures profit margins and complicates long-term procurement strategies, impacting both global and regional players.

Regulatory Compliance and Environmental Concerns

The epoxy active diluent market is constrained by stringent environmental regulations governing VOC emissions and chemical safety. It must adapt to evolving compliance requirements in major markets such as North America, Europe, and parts of Asia-Pacific. Transitioning to low-VOC or bio-based alternatives requires significant R&D investment, which can increase operational costs. Balancing performance standards with environmental responsibility remains a key hurdle. Failure to meet regulatory standards risks market access limitations and reputational damage.

Market Opportunities

Growth Potential in Emerging Economies and Infrastructure Development

The epoxy active diluent market holds strong opportunities in emerging economies experiencing rapid industrialization and infrastructure expansion. It can support the demand for high-performance coatings, adhesives, and composites in transportation, construction, and energy sectors. Large-scale investments in urban development projects across Asia-Pacific, Latin America, and the Middle East are driving the need for durable, cost-effective materials. Increasing government spending on public infrastructure and smart city initiatives further enhances market potential in these regions.

Advancements in Specialty Applications and Sustainable Solutions

The epoxy active diluent market is well-positioned to benefit from innovations targeting niche, high-value applications such as aerospace, electronics encapsulation, and renewable energy systems. It offers opportunities to develop bio-based and low-VOC diluents that align with evolving environmental standards and customer preferences. Rising adoption of wind and solar technologies expands the scope for tailored resin systems. Continuous product innovations that improve curing speed, adhesion, and resistance properties will create competitive advantages for market participants.

Market Segmentation Analysis:

By Types

The epoxy active diluent market is segmented into monofunctional, difunctional, and others. Monofunctional diluents dominate due to their ability to reduce viscosity effectively and improve processing in coatings, adhesives, and composites. Difunctional variants offer higher reactivity and enhanced mechanical strength, making them suitable for structural applications. The “others” category includes multifunctional and specialty diluents designed for specific performance needs. It reflects growing demand for tailored chemistries that balance processing ease with end-use durability.

- For instance, Nagase ChemteX offers monofunctional diluents like EX-121 (2-ethylhexylglycidyl ether) that feature low viscosity and hydrophobicity, enabling improved resin stabilization and ease of processing.

By Application

The epoxy active diluent market covers coatings, adhesives and sealants, composite material, electrical and electronics, construction, and others. Industrial, marine, and protective coatings account for a significant share due to the need for corrosion resistance and long-term durability. Structural adhesives benefit from high bonding strength, while non-structural adhesives focus on flexibility. Composite materials gain from improved processing in automotive and aerospace sectors. It also finds demand in electronics encapsulation and construction materials where performance and reliability are critical.

- For instance, Huntsman has developed low-VOC epoxy diluents that enhance corrosion resistance and durability in industrial and marine coatings. Evonik’s structural adhesives utilize active diluents to achieve superior bonding strength for automotive and aerospace composites.

Segments:

Based on Types

- Monofunctional

- Difunctional

- Others

Based on Application

-

- Industrial coatings

- Marine coatings

- Protective coatings

- Adhesives and sealants

- Structural adhesives

- Non-structural adhesives

- Composite material

- Electrical and electronics

- Construction

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 28% of the epoxy active diluent market, driven by strong demand from construction, aerospace, automotive, and marine sectors. It benefits from advanced manufacturing capabilities, high R&D investment, and stringent performance standards in coatings, adhesives, and composites. Growing adoption of low-VOC and bio-based solutions aligns with regulatory requirements from the U.S. Environmental Protection Agency. The presence of leading manufacturers supports technological advancements and consistent supply. It also gains traction from the expanding renewable energy sector, particularly wind energy projects in the United States.

Europe

Europe holds 25% of the epoxy active diluent market, supported by strict environmental regulations and growing emphasis on sustainable material solutions. The region’s strong automotive, marine, and industrial base fuels demand for high-performance coatings and adhesives. Countries like Germany, France, and Italy lead in engineering and composite manufacturing, boosting the need for advanced diluents. It benefits from ongoing infrastructure modernization and marine sector growth. The adoption of eco-friendly formulations is reinforced by EU Green Deal objectives.

Asia-Pacific

Asia-Pacific commands 34% of the epoxy active diluent market, making it the largest regional segment. Rapid industrialization, urbanization, and infrastructure development in China, India, and Southeast Asia drive strong demand. It finds widespread use in construction, electronics manufacturing, automotive production, and renewable energy equipment. Government investments in industrial expansion and large-scale infrastructure projects support consistent growth. Increasing manufacturing competitiveness and rising exports of epoxy-based products further strengthen the market position in this region.

Latin America

Latin America represents 7% of the epoxy active diluent market, driven by demand from construction, marine, and oil and gas industries. Brazil and Mexico lead regional consumption due to robust industrial and infrastructure activities. It benefits from growing automotive assembly and energy projects. The region is adopting higher-quality coatings and adhesives to meet performance expectations. Expansion in renewable energy projects also supports usage in composites and electrical systems.

Middle East & Africa

The Middle East & Africa accounts for 6% of the epoxy active diluent market, supported by oil and gas, marine, and construction activities. Gulf countries invest heavily in infrastructure and industrial projects, boosting demand for high-performance materials. It also gains from the marine coatings segment for shipbuilding and offshore operations. The region’s gradual shift toward renewable energy and diversification strategies creates opportunities in composites and protective coatings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Leuna Harze GmbH

- Hubei Green Home Chemical

- Huntsman Corporation

- Adeka Corporation

- Sanmu Group

- Hexion Inc.

- Anhui Hengyuan (Group)

- Olin Corporation

- Aditya Birla Chemicals

- Kukdo Chemical

- EMS-GRILTECH

- Evonik Industries

Competitive Analysis

The epoxy active diluent market is highly competitive, with players focusing on innovation, product diversification, and strategic expansions to strengthen their market position. It features global leaders such as Adeka Corporation, Aditya Birla Chemicals, Anhui Hengyuan (Group), EMS-GRILTECH, Evonik Industries, Hexion Inc., Hubei Green Home Chemical, Huntsman Corporation, Kukdo Chemical, Leuna Harze GmbH, Olin Corporation, and Sanmu Group. These companies invest in R&D to develop low-VOC, bio-based, and high-performance diluents tailored for diverse end-use industries. Strategic mergers, capacity expansions, and regional partnerships enhance supply capabilities and customer reach. It benefits from the integration of advanced production technologies, enabling consistent quality and cost efficiency. Strong distribution networks and long-term relationships with industrial clients allow leading manufacturers to maintain competitive advantages. The market dynamics are influenced by regulatory compliance, raw material availability, and the ability to deliver customized solutions. Companies emphasizing sustainability and application-specific performance are gaining stronger footholds, especially in high-growth regions like Asia-Pacific and North America, where demand from construction, automotive, and renewable energy sectors continues to rise.

Recent Developments

- In June 2024, Denacol (Nagase ChemteX) launched a new range of epoxy reactive diluents offering improved stability and sustainable performance for high-end applications.

- In February 2025, Olin unveiled epoxy blends D.E.R.® 3111 and D.E.R.® 3561, developed to address the 2024 reclassification of many epoxy reactive diluents and updated hazard labeling requirements.

- In August 2024, Hexion collaborated with Clariant to develop high-performance intumescent coatings compatible with epoxy systems utilizing reactive diluents.

- In July 2025, Evonik transitioned all epoxy curing agent production sites to 100% green electricity, reducing Scope 1 and 2 emissions and supporting sustainable epoxy value chains.

Market Concentration & Characteristics

The epoxy active diluent market exhibits moderate concentration, with a mix of global leaders and regional players competing on product performance, cost efficiency, and application-specific solutions. It is characterized by steady demand from diverse industries, including automotive, aerospace, construction, electronics, and marine, creating a broad customer base. Leading companies focus on R&D to develop low-VOC, bio-based, and high-performance formulations that comply with evolving environmental regulations. Competitive advantage often stems from strong distribution networks, technical expertise, and long-term partnerships with industrial clients. It is influenced by raw material price volatility, regulatory compliance requirements, and the ability to deliver consistent quality at scale. Technological advancements in reactive chemistry and the push for sustainability are reshaping competitive strategies. Market growth opportunities are concentrated in Asia-Pacific due to rapid industrialization, while North America and Europe maintain strong positions through innovation and stringent performance standards.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will increase in automotive and aerospace sectors due to the need for lightweight, durable materials.

- Adoption of bio-based and low-VOC diluents will expand to meet stricter environmental regulations.

- Technological advancements will enhance mechanical strength, curing efficiency, and thermal resistance.

- Asia-Pacific will maintain its lead, driven by industrial growth and infrastructure development.

- North America and Europe will strengthen positions through innovation and sustainability-focused products.

- Renewable energy applications will create new opportunities, particularly in wind and solar projects.

- The marine and protective coatings segment will see steady growth from industrial and offshore projects.

- Strategic collaborations and capacity expansions will shape competitive dynamics.

- Fluctuations in petrochemical raw material prices will continue to influence production strategies.

- Customization of epoxy systems for niche industrial applications will become a key competitive differentiator.