Market Overview:

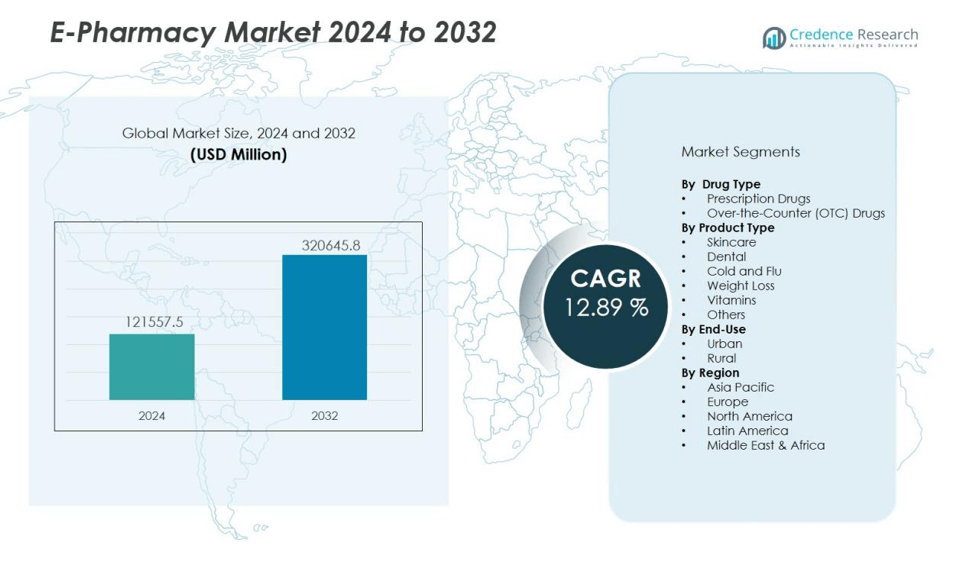

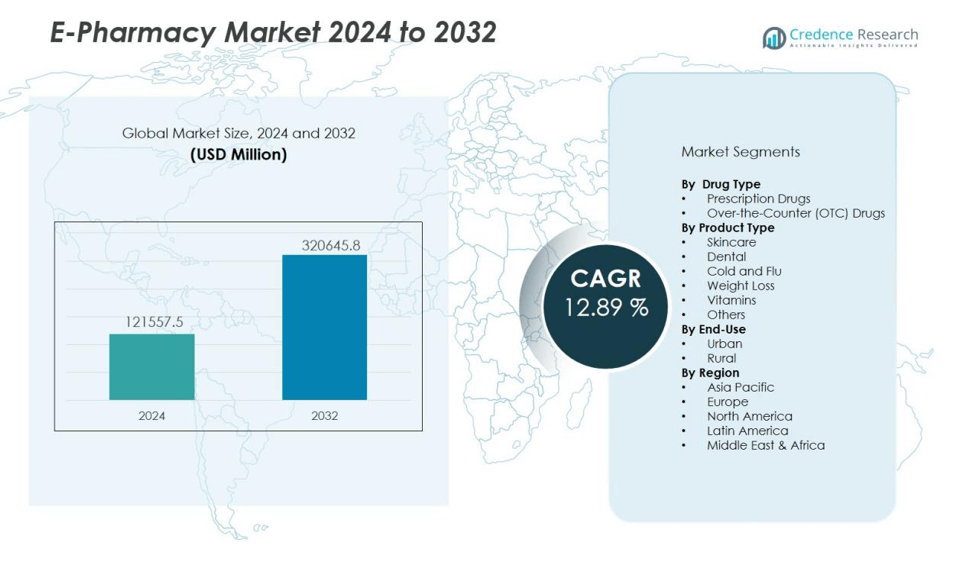

The e pharmacy market size was valued at USD 121557.5 million in 2024 and is anticipated to reach USD 320645.8 million by 2032, at a CAGR of 12.89 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| E-Pharmacy Market Size 2024 |

USD 121557.5 million |

| E-Pharmacy Market, CAGR |

12.89% |

| E-Pharmacy Market Size 2032 |

USD 320645.8 million |

Key drivers include the rising prevalence of chronic diseases, increased healthcare spending, and expanding demand for over-the-counter (OTC) and prescription medicines through online channels. Technological advancements such as AI-powered prescription verification, automated drug dispensing, and integrated teleconsultation services are enhancing service efficiency. Regulatory support in several countries for online medicine sales and growing awareness of e-health platforms are further accelerating adoption. The COVID-19 pandemic also significantly boosted consumer reliance on digital healthcare services, solidifying e-pharmacy as a mainstream channel.

Regionally, North America holds a dominant share due to advanced healthcare infrastructure, high digital literacy, and strong regulatory frameworks. Asia-Pacific is expected to witness the fastest growth, driven by rapid urbanization, rising smartphone usage, and expanding healthcare access in countries like India and China. Europe maintains steady growth supported by well-established e-health ecosystems and increasing cross-border e-commerce in pharmaceuticals.

Market Insights:

- The e-pharmacy market was valued at USD 121,557.5 million in 2024 and is projected to reach USD 320,645.8 million by 2032, growing at a CAGR of 12.89% from 2024 to 2032.

- Rising internet penetration, smartphone adoption, and consumer preference for convenience are shifting pharmaceutical purchases toward online channels.

- Increasing prevalence of chronic diseases and an aging population is driving recurring demand for prescription and home-delivered medicines.

- Technological innovations, including AI-powered prescription verification, real-time inventory management, and teleconsultation integration, are enhancing service efficiency and accuracy.

- Regulatory clarity in several countries is encouraging investment, while government-backed healthcare digitization initiatives in emerging economies are boosting adoption.

- Key challenges include navigating complex international regulations, combating counterfeit drugs, maintaining cold chain logistics, and building sustained consumer trust.

- Regionally, North America holds 38% market share, Europe accounts for 29%, and Asia-Pacific captures 24%, with Asia-Pacific expected to grow fastest due to rapid urbanization, rising healthcare spending, and strong digital adoption in countries like India and China.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Internet Penetration and Digital Healthcare Adoption:

The e-pharmacy market benefits significantly from the rapid expansion of internet access and the increasing use of smartphones. A growing number of consumers are turning to online platforms for purchasing medicines due to convenience, time savings, and access to a wider product range. It leverages user-friendly mobile applications and secure payment gateways to enhance the buying experience. This shift toward digital healthcare solutions is transforming the traditional pharmacy model into a more accessible and efficient system.

Increasing Prevalence of Chronic Diseases and Aging Population:

The global rise in chronic conditions such as diabetes, cardiovascular disorders, and respiratory diseases drives consistent demand for prescription medications. The e-pharmacy market addresses this need by enabling easy and recurring access to medicines, reducing the burden on patients with limited mobility or time constraints. An aging population further amplifies the demand for home delivery of medicines, particularly in developed and urban markets. It ensures timely access to essential treatments, supporting better patient adherence.

- For instance, Express Scripts achieved remarkable adherence improvements, with 81% of patients receiving 90-day supplies of oral diabetes medication through home delivery maintaining adherence compared to 68% at retail pharmacies.

Integration of Technology to Enhance Service Efficiency:

Technological innovation plays a central role in advancing the e-pharmacy market. Platforms are incorporating AI-driven prescription verification, real-time inventory management, and teleconsultation features to improve accuracy and speed. It supports safer transactions, minimizes errors in dispensing, and enables personalized medicine recommendations. These advancements strengthen consumer trust and encourage repeat purchases.

- For instance, PlanetPharmacy’s AI-enabled pharmacy solution manages a massive inventory of 300,000 drugs across over 700 pharmacies simultaneously while processing 50,000+ orders daily. These advancements strengthen consumer trust and encourage repeat purchases.

Regulatory Support and Expanding Healthcare Infrastructure:

Government policies in several regions are evolving to support the legal framework for online medicine sales. The e-pharmacy market benefits from this regulatory clarity, which fosters investment and expansion. It aligns with the broader trend of strengthening healthcare infrastructure, especially in emerging economies. The combination of regulatory backing and infrastructure development creates an environment conducive to long-term market growth.

Market Trends:

Expansion of Omnichannel Strategies and Personalized Healthcare Solutions:

The e-pharmacy market is witnessing a shift toward omnichannel models, where online platforms integrate with physical stores to provide a seamless customer experience. Companies are enhancing digital interfaces while offering in-store pickup, same-day delivery, and subscription-based medication plans. This approach ensures wider reach and better accessibility for both urban and rural customers. It also supports personalized healthcare by using data analytics to recommend products, track patient adherence, and offer tailored wellness plans. Growing demand for over-the-counter products, wellness supplements, and preventive healthcare items is further expanding product portfolios. Strategic partnerships between e-pharmacies, hospitals, and telemedicine providers are reinforcing customer loyalty and service efficiency.

- For instance, 9000 CVS Health maintains omnichannel capabilities with 85% of Americans living within 10 miles of a CVS location, resulting in same-store prescription volume increases of 5.9% in Q4 2024.

Adoption of Advanced Technologies and Strengthened Regulatory Frameworks:

Rapid adoption of AI, big data analytics, and blockchain is shaping the operational efficiency and security of the e-pharmacy market. These technologies improve prescription validation, optimize supply chains, and enhance drug authenticity verification. It also facilitates real-time inventory tracking and automated reminders for prescription refills. Growing consumer trust is supported by stringent regulatory measures that define standards for online medicine sales, ensuring compliance and patient safety. The trend toward cross-border e-commerce in pharmaceuticals is expanding global reach, especially in markets with established regulatory agreements. Sustainable packaging initiatives and eco-friendly delivery practices are gaining momentum, aligning with broader environmental goals in the healthcare sector.

- For Instance, DuPont’s Tyvek® also drives healthcare packaging sustainability, supporting United Nations Sustainable Development Goals and its own 2030 sustainability targets with lifecycle innovations for circular economy, including wide-scale deployment in sterile medical packaging since 1972.

Market Challenges Analysis:

Regulatory Complexity and Compliance Issues:

The e-pharmacy market faces significant challenges due to varying regulations across countries and regions. Inconsistent legal frameworks for online medicine sales create barriers to cross-border operations and limit market expansion. It must navigate strict prescription validation processes, patient data protection laws, and drug safety requirements. Delays in obtaining necessary licenses and approvals can slow down entry into new markets. Regulatory uncertainty also deters potential investors and restricts innovation in certain jurisdictions.

Counterfeit Drugs, Logistics Barriers, and Consumer Trust:

The risk of counterfeit or substandard medicines remains a critical concern for the e-pharmacy market. Ensuring product authenticity requires robust supply chain monitoring and partnerships with verified manufacturers. It must also address logistics challenges such as last-mile delivery delays, cold chain maintenance for temperature-sensitive drugs, and high shipping costs in remote areas. Consumer trust can be impacted by negative experiences, data breaches, or delivery errors. Building and maintaining a reliable brand image is essential for long-term competitiveness in this evolving sector.

Market Opportunities:

Rising Demand in Emerging Markets and Underserved Regions:

The e-pharmacy market has significant growth potential in emerging economies with expanding internet access and rising healthcare awareness. Increasing smartphone penetration and digital payment adoption are enabling wider access to online pharmaceutical services in rural and semi-urban areas. It can address gaps in physical pharmacy infrastructure by offering home delivery and a broader product range. Governments and private players are investing in healthcare digitization, creating favorable conditions for expansion. Partnerships with local healthcare providers and logistics firms can further strengthen market presence in underserved regions.

Integration with Telemedicine and Preventive Healthcare Solutions:

The growing adoption of telemedicine presents a strong opportunity for the e-pharmacy market to expand its service offerings. Integrating online consultations with prescription fulfillment creates a comprehensive digital healthcare ecosystem. It can leverage health data analytics to recommend preventive care products, wellness supplements, and chronic disease management plans. Increasing consumer interest in personalized health solutions and subscription-based medicine delivery enhances long-term revenue potential. Collaborations with insurers, hospitals, and health-tech firms can open new revenue streams and boost customer loyalty.

Market Segmentation Analysis:

By Drug Type:

The e-pharmacy market is segmented into prescription drugs and over-the-counter (OTC) drugs. Prescription drugs hold a dominant share, driven by rising demand for chronic disease treatments and regulatory acceptance of online prescription fulfillment. It offers patients greater convenience through digital prescription uploads and home delivery. The OTC segment is growing steadily, supported by increasing consumer interest in self-medication, wellness products, and preventive healthcare solutions.

- For instance, Tata 1mg achieved remarkable growth with its omnichannel delivery model, reducing median delivery time to just 25 minutes in Gurugram while testing sub-15-minute deliveries in three additional cities.

By Product Type:

Based on product type, the market includes skincare, dental, cold and flu, weight loss, vitamins, and other health-related products. Skincare and vitamins segments are expanding rapidly due to rising health awareness and beauty-oriented consumer preferences. Cold and flu medicines maintain stable demand, particularly during seasonal peaks. It benefits from cross-selling opportunities across diverse product categories on unified platforms.

- For instance, Debut Biotechnology’s BeautyORB AI platform screened 50billion molecules to launch two novel, bio-based ingredients annually, resulting in clinically-proven skin barrier repair solutions validated through three professional dermatological studies as of April 2025.

By End-Use:

The market is categorized into urban and rural end-users. Urban consumers represent the largest segment due to higher internet penetration, faster delivery infrastructure, and greater adoption of digital health services. Rural demand is accelerating with improved connectivity, digital payment adoption, and expanding logistics networks. It has the potential to bridge healthcare accessibility gaps in underserved areas through reliable online channels.

Segmentations:

By Drug Type:

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

By Product Type:

- Skincare

- Dental

- Cold and Flu

- Weight Loss

- Vitamins

- Others

By End-Use:

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America;

North America holds a market share of 38% in the global e-pharmacy market, supported by advanced healthcare infrastructure and high internet penetration. The region benefits from strong regulatory oversight that ensures safe and compliant online medicine distribution. It has a mature customer base that values convenience, quick delivery, and competitive pricing. The presence of leading players with well-developed digital platforms drives adoption. Demand for chronic disease management solutions and prescription refill services is expanding the customer base. Strategic collaborations with healthcare providers and insurers are further integrating e-pharmacy services into mainstream healthcare delivery.

Europe:

Europe accounts for a market share of 29%, driven by established e-health systems and stringent pharmaceutical regulations. Harmonized EU policies are facilitating cross-border e-commerce in the pharmaceutical sector. It benefits from high trust in digital healthcare services and robust logistics networks. Key markets such as Germany, the UK, and France lead in adoption due to favorable legislation and consumer confidence. Growth in online prescription and OTC medicine sales is strengthening revenue streams. Partnerships between e-pharmacies and local pharmacies are enhancing accessibility and service quality.

Asia-Pacific:

Asia-Pacific holds a market share of 24% and remains the fastest-growing region in the e-pharmacy market. Rapid urbanization, rising healthcare expenditure, and expanding internet access are key drivers. It is witnessing a surge in demand for online medicine orders, especially in populous markets like India and China. Digital payment adoption and supportive government policies are improving market conditions. Domestic and global players are investing heavily to capture emerging opportunities. Increasing adoption of wellness products and chronic disease care solutions is further accelerating regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- The Kroger Co.

- DocMorris

- Apollo Pharmacy

- Walgreen Co.

- Giant Eagle, Inc.

- Rowlands Pharmacy

- Optum Rx, Inc.

- CVS Health

- Walmart, Inc.

- Netmeds

- Express Scripts Holding Company

Competitive Analysis:

The e-pharmacy market is characterized by strong competition among global and regional players focusing on technological innovation, service expansion, and customer retention. Key companies include The Kroger Co., DocMorris, Apollo Pharmacy, Walgreen Co., Giant Eagle, Inc., Rowlands Pharmacy, Optum Rx, Inc., and CVS Health. It is shaped by strategies such as integrating telemedicine, enhancing mobile applications, and expanding product portfolios to include wellness and preventive care items. Leading players invest in AI-driven prescription management, real-time inventory systems, and secure payment platforms to improve operational efficiency. Strategic partnerships with healthcare providers, insurers, and logistics firms strengthen market presence and service reliability. Competitive differentiation is increasingly driven by delivery speed, product authenticity, and personalized healthcare solutions.

Recent Developments:

- In July 2024, Kroger expanded its technology partnership with Ocado Group, deploying automated fulfillment solutions across its network.

- In July 2025, Apollo Hospitals approved a major demerger to list its digital and pharmacy businesses, with plans for the new entity to acquire the remaining 74.5% stake in Apollo Medicals Pvt Ltd.

- In June 2025, Giant Eagle completed the sale of its GetGo convenience store business to Alimentation Couche-Tard, establishing a shared myPerks loyalty program and refocusing on supermarket and pharmacy businesses.

Market Concentration & Characteristics:

The e-pharmacy market exhibits moderate to high concentration, with a mix of established global players and rapidly expanding regional firms. Leading companies leverage strong brand recognition, extensive product portfolios, and advanced digital platforms to maintain competitive advantage. It is characterized by price competitiveness, strategic partnerships, and integration with telehealth and logistics services. Technological adoption, including AI-driven prescription validation and personalized recommendations, is a defining feature. The market demonstrates high entry potential in emerging economies, though regulatory compliance and supply chain reliability remain critical success factors. Consumer trust, secure transactions, and efficient delivery models continue to shape competitive positioning.

Report Coverage:

The research report offers an in-depth analysis based on Drug Type, Product Type, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The e-pharmacy market will expand with growing digital healthcare adoption and rising consumer preference for online medicine purchases.

- Integration of telemedicine services with e-pharmacy platforms will create comprehensive virtual healthcare ecosystems.

- AI, big data analytics, and blockchain will enhance prescription accuracy, inventory management, and drug authenticity verification.

- Subscription-based medicine delivery models will gain popularity, improving patient adherence and retention.

- Expansion into rural and underserved areas will increase market penetration, supported by improving internet infrastructure.

- Strategic partnerships with insurers, hospitals, and pharmaceutical manufacturers will strengthen service offerings and customer reach.

- Demand for over-the-counter health products, wellness supplements, and preventive care items will drive diversification of product portfolios.

- Regulatory harmonization in certain regions will facilitate cross-border e-commerce growth in pharmaceuticals.

- Eco-friendly packaging and sustainable delivery solutions will become integral to competitive strategies.

- Consumer trust, data security, and reliable last-mile delivery will remain decisive factors for long-term success.