Market Overview

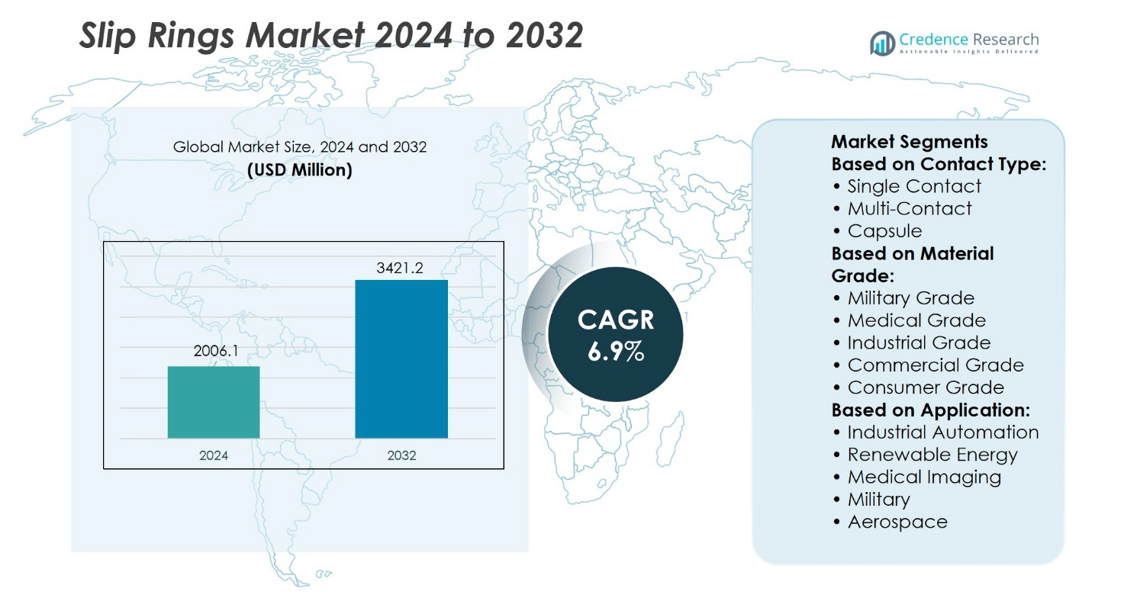

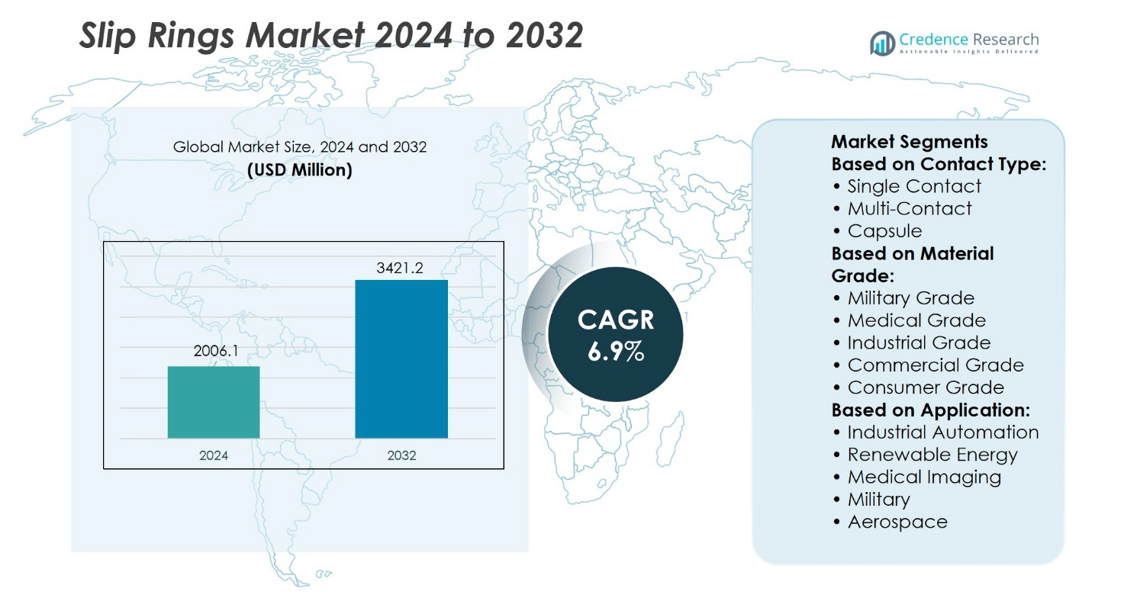

Slip Rings Market size was valued at USD 2006.1 million in 2024 and is anticipated to reach USD 3421.2 million by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Slip Rings Market Size 2024 |

USD 2006.1 million |

| Slip Rings Market, CAGR |

6.9% |

| Slip Rings Market Size 2032 |

USD 3421.2 million |

The Slip Rings Market grows through rising demand in industrial automation, renewable energy, aerospace, and medical imaging, where reliable power and signal transmission in rotating systems is essential. It benefits from the expansion of wind energy projects, increasing adoption of high-precision medical equipment, and advancements in defense and satellite systems. Trends include the integration of hybrid slip rings combining electrical, fiber optic, and fluid channels, the shift toward contactless designs for reduced maintenance, and the development of miniaturized models for compact applications. Continuous innovation in materials and engineering supports enhanced durability, higher data rates, and adaptability to harsh environments.

The Slip Rings Market has strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific leading due to large-scale manufacturing, renewable energy projects, and automation growth. North America and Europe follow, driven by aerospace, defense, and industrial applications. Key players include Asian Tool Technologies Ltd., AS PL Sp. z o.o., Auto Brite International, BorgWarner Inc., ELECTRAACE, Electromags Automotive Products Pvt. Ltd., Faurecia SE, Hangzhou Grand Technology Co. Ltd., Maniac Electric Motors, and Mersen Corporate Services SAS.

Market Insights

- The Slip Rings Market was valued at USD 2006.1 million in 2024 and is expected to reach USD 3421.2 million by 2032, growing at a CAGR of 6.9%.

- Demand grows through industrial automation, renewable energy, aerospace, and medical imaging sectors requiring reliable rotary power and signal transmission.

- Hybrid slip rings integrating electrical, fiber optic, and fluid channels gain adoption for advanced and multifunctional applications.

- Competition focuses on innovation, customization, and durability, with global and regional players targeting diverse industry needs.

- High maintenance needs and susceptibility to environmental interference remain challenges in performance-critical sectors.

- Asia-Pacific leads the market due to manufacturing capacity, renewable projects, and automation growth, followed by North America and Europe with strong aerospace and defense industries.

- Key companies include Asian Tool Technologies Ltd., AS PL Sp. z o.o., Auto Brite International, BorgWarner Inc., ELECTRAACE, Electromags Automotive Products Pvt. Ltd., Faurecia SE, Hangzhou Grand Technology Co. Ltd., Maniac Electric Motors, and Mersen Corporate Services SAS.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand from Wind Energy Sector

The Slip Rings Market benefits from expanding wind energy projects worldwide. Slip rings enable efficient power and data transmission between stationary and rotating components in wind turbines. It supports higher turbine capacities by maintaining reliable signal integrity under variable load conditions. Manufacturers focus on advanced designs that withstand harsh environmental factors such as moisture, dust, and extreme temperatures. Increasing adoption of offshore wind farms drives the need for corrosion-resistant and maintenance-free slip rings. Long operational lifecycles and reduced downtime improve cost efficiency for energy operators. Integration into both onshore and offshore projects reinforces its role in renewable energy infrastructure.

- For instance, UEA Incorporated has delivered more than 15,000 slip rings for large-scale wind turbines in recent years, underscoring how industry‑specific manufacturers are meeting this growing demand with substantial unit volumes.

Rising Adoption in Industrial Automation

The Slip Rings Market grows through rising automation in manufacturing, robotics, and process control systems. Slip rings facilitate uninterrupted signal and power transfer in automated machinery with rotating interfaces. It enhances productivity by ensuring minimal wear and consistent performance in high-speed operations. Industries invest in compact, high-capacity slip rings to optimize equipment design and operational efficiency. Demand increases from packaging, assembly, and material handling systems that rely on precise motion control. Customization for voltage, current capacity, and data rate supports diverse industrial needs. Strong growth in smart manufacturing environments sustains market expansion.

- For instance, ABB offers its IRP A workpiece positioner models capable of handling fixtures weighing up to 750 kg, and these can be supplied or retrofitted with slip‑rings that transmit 10 power signals, illustrating a concrete deployment of slip‑ring technology in industrial robotics and automation environments.

Expanding Applications in Aerospace and Defense

The Slip Rings Market advances with higher integration into aerospace and defense systems. Slip rings are essential for radar systems, satellite communications, and weapon platforms that require continuous rotation without signal loss. It enables high-speed data transfer and power delivery in mission-critical operations. Defense programs invest in ruggedized designs capable of withstanding shock, vibration, and extreme temperatures. Growing use in unmanned aerial vehicles and surveillance systems boosts demand. Enhanced electromagnetic shielding improves performance in complex electromagnetic environments. Suppliers focus on low-maintenance and high-reliability models to meet stringent operational standards.

Technological Innovations and Miniaturization Trends

The Slip Rings Market evolves through advancements in design, materials, and manufacturing techniques. Development of fiber optic rotary joints and hybrid slip rings expands application capabilities. It supports higher data transmission rates and integration with modern sensor networks. Miniaturized slip rings address space constraints in medical devices, robotics, and compact machinery. Improved contact materials reduce wear and extend service life. Manufacturers adopt precision machining and automated assembly for consistent quality. The shift toward smart and modular slip ring designs enables easier maintenance and scalability.

Market Trends

Integration of Hybrid Slip Ring Technologies

The Slip Rings Market experiences a growing shift toward hybrid models that combine electrical, fiber optic, and fluid rotary transmission capabilities. It enables simultaneous transfer of power, data, and media in a single compact unit. Hybrid designs cater to advanced industrial automation, offshore energy systems, and defense applications requiring high versatility. Manufacturers invest in precision engineering to ensure minimal signal loss and low torque operation. The demand for integrated solutions reduces system complexity and improves operational efficiency. Enhanced sealing and corrosion-resistant materials extend service life in challenging environments. Hybrid configurations strengthen adoption in sectors with multi-functional rotary requirements.

- For instance, Moog Components Group has produced over 2 million units of hybrid FORJ modules combining electrical slip rings and fiber optic rotary joints demonstrating substantial deployment of hybrid slip ring technology across industries.

Advancements in Contactless Slip Ring Designs

The Slip Rings Market sees increased adoption of contactless designs that use magnetic or capacitive coupling for transmission. It eliminates physical wear between components, extending maintenance intervals and operational reliability. These systems are particularly suited for high-speed applications in medical imaging, semiconductor manufacturing, and wind turbines. Manufacturers focus on optimizing bandwidth and reducing electromagnetic interference in such designs. The absence of traditional brushes supports cleaner operation in sensitive environments. Higher initial costs are offset by lower lifetime maintenance expenses. The trend aligns with industries prioritizing long-term reliability and uninterrupted operation.

- For instance, Schleifring GmbH has supplied over 1.2 million contactless slip ring channels for aerospace radar and satellite communication systems, reflecting large-scale adoption of non-contact transmission solutions in high-reliability applications.

Miniaturization for Space-Constrained Applications

The Slip Rings Market advances with the development of compact, lightweight models for use in robotics, UAVs, and medical devices. It meets the need for high performance in applications with strict space and weight limitations. Advances in micro-machining and high-density circuit design enable greater functionality within smaller form factors. Demand rises from surgical robotics and portable imaging equipment requiring precise rotary connectivity. High-speed data handling capabilities are integrated without compromising durability. Lightweight materials contribute to energy efficiency in aerospace and mobile platforms. Miniaturization expands deployment possibilities in next-generation compact systems.

Enhanced Customization and Modular Designs

The Slip Rings Market benefits from a trend toward fully customizable and modular configurations. It allows users to specify voltage, current, channel count, and data protocols to match operational needs. Modular assemblies simplify maintenance and upgrades, reducing downtime. Manufacturers introduce quick-swap modules that improve field serviceability. Industry adoption grows in sectors with rapidly changing technological requirements, such as industrial automation and renewable energy. Advanced CAD and simulation tools enable faster design cycles and more precise engineering. Customization ensures that slip rings meet the exact performance and environmental standards of specialized applications.

Market Challenges Analysis

High Maintenance Requirements and Operational Downtime

The Slip Rings Market faces the challenge of frequent maintenance needs due to mechanical wear between contact surfaces. It impacts operational continuity in industries where equipment operates continuously under demanding conditions. Brush and ring contact degradation can cause signal noise, power loss, or complete system failure if not addressed promptly. Maintenance intervals increase operational costs and require skilled technicians for inspection and repair. Harsh environments with dust, moisture, or corrosive elements accelerate wear and reduce service life. Manufacturers work to improve contact materials and lubrication systems, yet maintaining reliability over extended periods remains complex. Industries with high uptime requirements view these limitations as significant operational risks.

Susceptibility to Electrical and Environmental Interference

The Slip Rings Market also contends with challenges related to electrical noise, signal distortion, and susceptibility to environmental interference. It becomes critical in applications such as radar, medical imaging, and satellite communication where precision data transmission is essential. Electromagnetic interference, temperature fluctuations, and vibration can degrade performance and require protective design measures. Shielding, advanced sealing, and vibration damping increase production complexity and cost. Failure to address these factors can lead to reduced efficiency or compromised system integrity. Integrating advanced protection features without adding excessive size or weight is a technical challenge for manufacturers. These limitations influence adoption in highly sensitive and mission-critical systems.

Market Opportunities

Rising Demand from Renewable Energy Projects

The Slip Rings Market holds strong growth potential through expanding renewable energy infrastructure, particularly in wind power generation. It enables efficient transmission of electrical signals and power between stationary and rotating parts in wind turbines, supporting higher capacity installations. Offshore wind projects present opportunities for advanced slip rings with enhanced corrosion resistance and long service life. The shift toward large-scale turbines drives demand for high-current, low-maintenance designs. Governments and private investors increase funding for renewable projects, creating consistent procurement needs. Manufacturers focusing on durable, high-performance slip rings can secure long-term supply contracts in this sector. Expanding green energy adoption strengthens the market’s role in sustainable power generation.

Growth in Advanced Industrial and Defense Applications

The Slip Rings Market can expand through rising integration in industrial automation, aerospace, and defense systems. It supports high-speed data transfer, precision control, and continuous operation in robotics, radar systems, and satellite communication platforms. Increasing adoption of unmanned aerial vehicles and advanced surveillance systems generates demand for compact and rugged slip ring solutions. Industries seeking customized designs for extreme environments create niche opportunities for specialized manufacturers. The trend toward integrating fiber optic and hybrid technologies further enhances the value proposition. Companies investing in R&D to meet complex application requirements can capture emerging high-value segments. Expanding technological capabilities position the market for broader adoption across critical industries.

Market Segmentation Analysis:

By Contact Type

The Slip Rings Market segments by contact type into single contact, multi-contact, and capsule designs. Single contact slip rings offer straightforward power or signal transmission for applications with minimal circuit requirements. Multi-contact designs provide multiple independent channels, enabling simultaneous transmission of power, data, and control signals in complex systems. Capsule slip rings deliver compact, lightweight solutions suited for space-constrained equipment such as medical devices and small robotics. It meets the needs of diverse operational environments by offering tailored designs for torque, channel capacity, and electrical performance. Demand for multi-contact and capsule variants grows with advancements in automation, aerospace, and portable imaging technologies.

- For instance, Stemmann-Technik GmbH has manufactured over 3.5 million single contact slip ring units for rail transit and industrial equipment, highlighting the scale of production for high-reliability, low-circuit applications.

By Material Grade

The market divides by material grade into military grade, medical grade, industrial grade, commercial grade, and consumer grade slip rings. Military-grade products are engineered for extreme durability, shock resistance, and performance under harsh environmental conditions. Medical-grade slip rings prioritize precision, low noise, and contamination-free operation for imaging systems and surgical devices. Industrial-grade options balance high load capacity with resistance to wear for manufacturing and process control applications. Commercial-grade models address moderate performance needs in sectors such as packaging or display systems. Consumer-grade slip rings support low-voltage, cost-sensitive applications like home appliances and small recreational equipment. It adapts material selection and construction quality to match the operational demands of each segment.

- For instance, Moog Inc. developed its SRM Series military-grade slip rings with an operational lifespan exceeding 30 million revolutions and the ability to withstand shock levels.

By Application

The Slip Rings Market serves applications across industrial automation, renewable energy, medical imaging, military, and aerospace. In industrial automation, slip rings enable uninterrupted signal and power transfer for rotating machinery, enhancing productivity and precision. Renewable energy projects, particularly wind turbines, rely on slip rings for efficient power and data transmission between stationary and rotating components. Medical imaging equipment uses high-precision slip rings to maintain continuous rotation and accurate image data transfer in CT and MRI systems. Military applications demand ruggedized designs for radar, surveillance, and communications systems that operate in challenging environments. Aerospace use cases include satellite communications and onboard systems requiring compact, lightweight, and reliable slip rings. It aligns with the technical and environmental specifications of each application to ensure operational reliability and performance.

Segments:

Based on Contact Type:

- Single Contact

- Multi-Contact

- Capsule

Based on Material Grade:

- Military Grade

- Medical Grade

- Industrial Grade

- Commercial Grade

- Consumer Grade

Based on Application:

- Industrial Automation

- Renewable Energy

- Medical Imaging

- Military

- Aerospace

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share of the Slip Rings Market, accounting for 27.4% of global revenue. The region benefits from advanced industrial automation, strong aerospace and defense programs, and widespread adoption of renewable energy systems. The United States leads demand through extensive investments in wind power projects, automated manufacturing lines, and military radar systems. Canada contributes through growing renewable energy infrastructure and aerospace manufacturing. The presence of leading technology providers and R&D centers accelerates innovation in high-performance slip ring designs. Regulatory emphasis on energy efficiency and operational reliability supports market growth. Increasing investments in hybrid and contactless slip rings strengthen the region’s technological leadership.

Europe

Europe represents 25.1% of the Slip Rings Market, supported by a strong manufacturing base, advanced engineering capabilities, and robust renewable energy programs. Germany, the UK, and France drive adoption through industrial automation, offshore wind farms, and high-tech medical imaging systems. Offshore wind energy expansion in the North Sea and Baltic Sea significantly contributes to slip ring demand, particularly for corrosion-resistant and long-life designs. Aerospace manufacturing hubs in France and Germany integrate advanced slip rings into satellite communication systems and aircraft platforms. Medical equipment manufacturers across the region adopt precision slip rings for CT and MRI scanners. Strict quality and environmental standards promote the use of durable, high-efficiency solutions.

Asia-Pacific

Asia-Pacific dominates the Slip Rings Market with a 32.8% share, driven by large-scale industrial production, rapid urbanization, and growing renewable energy capacity. China leads with extensive wind power installations, expanding manufacturing automation, and rising aerospace production. Japan contributes through advanced robotics, precision medical equipment, and satellite systems. India shows growing adoption in industrial automation, defense systems, and energy projects. Regional manufacturers focus on cost-effective designs without compromising quality to serve both domestic and export markets. Government support for renewable energy and high-tech industries fuels demand for specialized slip rings. The region’s ability to produce at scale while innovating in hybrid and miniaturized designs reinforces its market dominance.

Latin America

Latin America holds 7.3% of the Slip Rings Market, with Brazil and Mexico as primary contributors. The market grows through investment in wind energy projects, industrial automation, and mining equipment modernization. Brazil’s expanding renewable energy portfolio, including offshore wind initiatives, creates opportunities for high-durability slip rings. Mexico’s manufacturing sector increasingly adopts automation, requiring reliable power and signal transmission in rotating machinery. Defense procurement programs in select countries also generate demand for ruggedized slip rings. Local manufacturing capabilities remain limited, prompting reliance on imports from North America, Europe, and Asia-Pacific. Strategic partnerships with global suppliers help meet regional quality and performance requirements.

Middle East & Africa

The Middle East & Africa account for 7.4% of the Slip Rings Market, with demand concentrated in defense, aerospace, and energy sectors. The Gulf states invest in advanced radar and surveillance systems, integrating high-performance slip rings for continuous operation in harsh environments. South Africa leads adoption in the African continent through mining equipment and renewable energy applications. The region’s emerging offshore wind projects offer long-term growth opportunities. Harsh environmental conditions drive the need for corrosion-resistant, sealed slip rings capable of reliable operation in extreme temperatures and dusty conditions. Limited domestic production encourages imports from established global manufacturers. Expanding infrastructure projects and defense modernization programs support steady market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BoHrgWarner Inc.

- Hangzhou Grand Technology Co. Ltd.

- Mersen Corporate Services SAS

- Faurecia SE

- Auto Brite International

- Maniac Electric Motors

- Electromags Automotive Products Pvt. Ltd.

- ELECTRAACE

- AS PL Sp. z o.o.

- Asian Tool Technologies Ltd.

Competitive Analysis

The Slip Rings Market features include Asian Tool Technologies Ltd., AS PL Sp. z o.o., Auto Brite International, BorgWarner Inc., ELECTRAACE, Electromags Automotive Products Pvt. Ltd., Faurecia SE, Hangzhou Grand Technology Co. Ltd., Maniac Electric Motors, and Mersen Corporate Services SAS. The Slip Rings Market remains highly competitive, with companies focusing on innovation, customization, and performance optimization to meet diverse industry requirements. Market participants invest in advanced technologies such as hybrid slip rings, contactless transmission systems, and fiber optic rotary joints to enhance power and data transfer capabilities. Product development strategies emphasize durability, compact design, and resistance to harsh environmental conditions, catering to applications in industrial automation, renewable energy, aerospace, and medical imaging. Manufacturers aim to expand their global footprint through strategic partnerships, targeted distribution networks, and tailored solutions for specialized sectors. Continuous R&D efforts enable the introduction of slip rings with higher channel capacity, improved signal integrity, and longer service life. The competitive environment drives consistent advancements in design and materials, ensuring that suppliers can address the evolving demands of high-performance, mission-critical applications worldwide.

Recent Developments

- In February 2024, leading automotive components manufacturer, Schaeffler, announced the launch of its new generation of alternator slip rings, featuring advanced materials and improved electrical conductivity.

- In March 2024, HOERBIGER’s Rotary Business Unit announced its expansion into maintenance free slip rings through the acquisition of Diamond-Roltran, LLC. Known for their Roll-Rings®, Diamond Roltran specializes in high-performance slip rings with minimal friction and reduced electrical noise, ideal for demanding industrial environments.

- In May 2024, the European Union’s new regulation on CO2 emissions from heavy-duty vehicles came into effect. This regulation is expected to boost the demand for advanced slip rings in electric and hybrid heavy-duty vehicles, as they offer improved energy efficiency and reduced emissions (European Commission press release).

- In 2024,Moog Inc. introduced a next-generation slip ring integrated with a fiber-optic rotary joint (FORJ) for GE wind turbines, specifically targeting 2.5 MW and larger models.

Market Concentration & Characteristics

The Slip Rings Market displays a moderately fragmented structure, with competition shaped by a mix of global manufacturers and specialized regional suppliers. It features companies that differentiate through technological innovation, customization capabilities, and application-specific expertise. Market concentration is influenced by the ability to serve high-growth sectors such as renewable energy, industrial automation, aerospace, and medical imaging with reliable and durable solutions. Leading producers leverage advanced materials, precision engineering, and hybrid designs to meet performance requirements under challenging operating conditions. Smaller participants focus on niche applications, offering tailored products that meet specific voltage, current, or size constraints. The market is characterized by ongoing R&D investment, increasing integration of fiber optic and contactless technologies, and growing demand for compact, high-capacity designs. It benefits from long-term contracts with OEMs, strong aftersales support, and compliance with industry-specific standards, ensuring consistent adoption across mission-critical and high-reliability applications.

Report Coverage

The research report offers an in-depth analysis based on Contact Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for hybrid slip rings integrating electrical, fiber optic, and fluid transmission will rise across advanced industrial and defense applications.

- Adoption of contactless slip rings will increase in high-speed and maintenance-sensitive environments.

- Miniaturized slip ring designs will gain traction in robotics, UAVs, and portable medical devices.

- Renewable energy projects, particularly offshore wind farms, will drive higher demand for corrosion-resistant slip rings.

- Aerospace and satellite communication sectors will expand usage of lightweight, high-reliability slip rings.

- Manufacturers will invest more in R&D to enhance durability, signal integrity, and operational lifespan.

- Customization for voltage, current, and data protocol requirements will become a primary competitive factor.

- Emerging markets will experience higher adoption due to industrial automation and infrastructure development.

- Integration of smart monitoring features in slip rings will improve predictive maintenance capabilities.

- Global supply chain optimization will be a priority to meet growing cross-regional demand efficiently.