Market Overview:

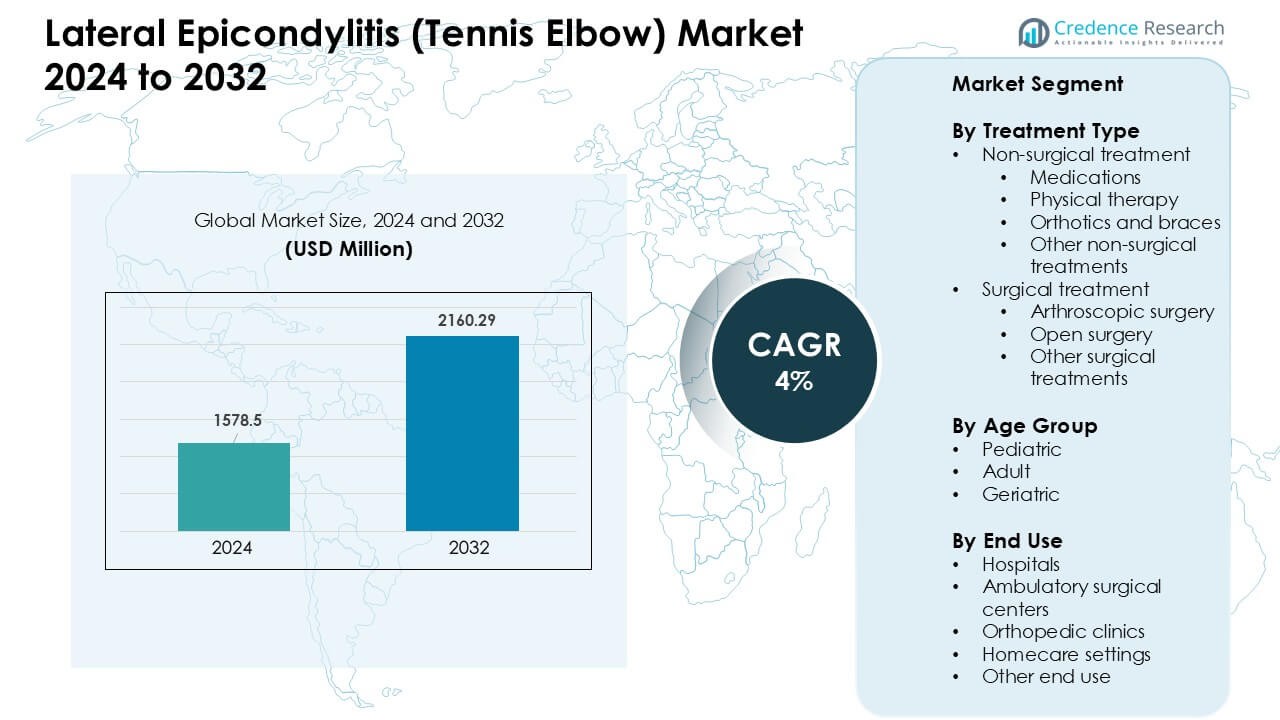

Lateral Epicondylitis (Tennis Elbow) Market was valued at USD 1578.5 million in 2024 and is anticipated to reach USD 2160.29 million by 2032, growing at a CAGR of 4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lateral Epicondylitis (Tennis Elbow) Market Size 2024 |

USD 1578.5 Million |

| Lateral Epicondylitis (Tennis Elbow) Market, CAGR |

4% |

| Lateral Epicondylitis (Tennis Elbow) Market Size 2032 |

USD 2160.29 Million |

The Lateral Epicondylitis (Tennis Elbow) Market is shaped by leading players such as Pfizer, Novartis, Merck & Co, GlaxoSmithKline, Zimmer Biomet, Ossur Corporate, Pharmascience, MedStar Health, ReLiva Physiotherapy & Rehab, and Scandinavian Physiotherapy Center. These companies strengthen their positions through advanced drug therapies, improved braces and orthopedic devices, and expanding physiotherapy networks that support long-term recovery. North America emerged as the leading region in 2024 with about 38% share, driven by strong healthcare access, high sports participation, and broad adoption of non-surgical and minimally invasive treatment approaches.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Lateral Epicondylitis (Tennis Elbow) Market was valued at USD 5 million in 2024 and is projected to reach USD 2160.29 million by 2032, growing at a CAGR of 4%.

- Growing cases linked to repetitive strain, rising sports participation, and wider adoption of non-surgical care drive steady demand across hospitals and orthopedic clinics.

- Trends include expanding physiotherapy networks, rising use of regenerative injections, and increasing uptake of advanced braces that support faster recovery and reduce surgical dependence.

- Competitive activity is shaped by players such as Pfizer, Novartis, Merck & Co, Zimmer Biomet, and Ossur Corporate, all expanding conservative treatment support while physiotherapy centers strengthen outpatient care.

- North America held the largest share at 38%, while adults formed the dominant age segment at 71% in 2024; non-surgical treatments accounted for about 82% of total demand.

Market Segmentation Analysis:

By Treatment Type

Non-surgical treatment held the dominant share in 2024 with about 82% of the Lateral Epicondylitis (Tennis Elbow) Market. Patients favored medications, physical therapy, and braces because these options offered lower risk, quick pain relief, and strong clinical success rates. Physical therapy remained the largest sub-segment due to rising preference for targeted exercises and growing referral rates from primary care providers. Surgical procedures such as arthroscopy and open repair stayed limited to severe or chronic cases, which kept their adoption lower despite improved postoperative outcomes.

- For instance, in a large population-based study, among a sample of 576 patients with lateral elbow tendinosis, 82% received non-steroidal anti-inflammatory drugs (NSAIDs), and 77% used bracing as part of initial management; only 2% went directly to surgery.

By Age Group

Adults accounted for the largest share in 2024 with nearly 71% of the Lateral Epicondylitis (Tennis Elbow) Market. Working-age individuals faced higher repetitive-strain exposure from sports, industrial tasks, and computer-based work, which increased treatment demand. The geriatric group showed steady growth as age-related tendon degeneration raised case prevalence. Pediatric cases remained minimal due to lower participation in high-intensity repetitive activities, resulting in far fewer diagnoses and treatment interventions compared to adults.

- For instance, a population-based study found the highest annual incidence of lateral elbow tendinosis among people aged 40–49 years, at 9.0 per 1,000 persons per year overall (7.8 per 1,000 for men, 10.2 per 1,000 for women).

By End Use

Hospitals led the Lateral Epicondylitis (Tennis Elbow) Market in 2024 with about 46% share. Patients relied on hospitals for advanced diagnostics, specialist consultations, and access to both non-surgical and surgical care. Orthopedic clinics followed due to rising sports-injury consultations and faster outpatient services. Ambulatory surgical centers gained traction for minimally invasive procedures with shorter recovery time. Homecare settings grew steadily as tele-rehabilitation, home physiotherapy, and brace-based management became more accessible for mild to moderate cases.

Key Growth Drivers:

Rising Incidence Linked to Repetitive Strain Activities

Growing cases of Lateral Epicondylitis stem from repetitive wrist and forearm movements across sports, industrial labor, and desk-based work. More people now engage in racquet sports, gym training, and high-intensity home workouts, which raises tendon overuse injuries. Office workers also show higher risk due to continuous typing and mouse use. This widespread strain exposure expands patient pools and drives steady demand for therapy, braces, medications, and outpatient care. As ergonomic awareness improves, early diagnosis rates rise, pushing more individuals toward formal treatment and boosting overall market growth.

- For instance, in a population of 5,036 workers across several studies, those with a Strain Index (SI) score greater than 5.1 had an increased odds ratio (~1.75) of developing Lateral Epicondylitis.

Strong Preference for Non-Surgical and Minimally Invasive Therapies

The market grows as patients shift toward conservative and minimally invasive treatments that offer pain relief without long recovery periods. Physical therapy, steroid injections, shockwave therapy, and orthotic solutions see strong adoption due to their accessibility and lower complication risk. Physicians also recommend staged treatment approaches, which increases patient volume across multiple therapy cycles. Technological advances in therapy devices help clinicians improve tendon healing outcomes. The trend reduces the need for open surgery while expanding revenue across physiotherapy centers, sports clinics, and home-based rehabilitation providers.

- For instance, in a clinical series combining supervised therapeutic exercise with low-energy ESWT, patients saw significant reductions in pain intensity and improvements in grip strength and limb function by the 4th week of treatment suggesting that non-surgical therapies can restore function fairly quickly while avoiding surgical risk.

Growth of Sports Participation and Occupational Health Programs

Higher global participation in recreational and professional sports increases the risk of elbow injuries, which boosts treatment demand. Sports organizations promote early injury reporting, improving diagnosis rates and expanding patient entry points. Workplace safety programs in manufacturing, logistics, and construction also encourage screening and early management of repetitive-motion injuries. Many companies now adopt ergonomic tools and wellness programs, which increase awareness and drive more individuals to seek medical care. This structured focus on injury prevention and rapid intervention amplifies the market for therapy services, braces, and specialist consultations.

Key Trends & Opportunities:

Increasing Adoption of Regenerative Therapies

Regenerative options such as platelet-rich plasma (PRP) and stem-cell-based injections attract growing interest due to their potential to improve tendon healing. Clinics integrate these therapies into sports-injury care as patients seek alternatives to surgery. Research continues to validate their effectiveness, which encourages broader use in chronic cases. As providers refine protocols, treatment demand grows among athletes and active adults looking for faster recovery.

- For instance, in a 2018 retrospective study of 64 patients with chronic lateral epicondylitis resistant to standard care, 87.5% reported significant symptomatic improvement after PRP injection, showing a clear and sustained benefit for many non-responders to conventional therapy.

Expansion of Home-Based and Digital Rehabilitation

Remote physiotherapy platforms, wearable devices, and app-guided exercise programs create new opportunities for patient engagement. These tools support home-based recovery, reduce clinic visits, and improve adherence to therapy plans. Advancements in telehealth make virtual assessments easier, which broadens access to care in rural and underserved regions. The shift enhances treatment convenience and stimulates long-term adoption of digital rehabilitation solutions.

- For instance, a 2022 quasi-experimental study on digital physiotherapy in patients recovering from long COVID-19 found that after a four-week app-guided home-exercise program, participants showed statistically significant improvements in functional capacity (assessed by standard tests) demonstrating feasibility, safety, and good adherence.

Innovations in Bracing and Orthotic Technologies

New lightweight, adjustable, and ergonomically designed braces improve pain reduction and movement support for patients. Manufacturers introduce breathable materials, targeted compression zones, and customizable tension systems. These upgrades enhance comfort and boost daily use, driving higher adoption across both athletes and workers managing chronic strain injuries. Product innovation strengthens the competitive landscape and expands home-use applications.

Key Challenges:

Limited Long-Term Effectiveness of Certain Conservative Therapies

Some widely used treatments, such as corticosteroid injections, provide short-term relief but risk limited long-term benefits. Patients may experience recurring pain, which leads to repeated treatment cycles and inconsistent outcomes. This uncertainty reduces patient confidence and forces providers to explore alternative therapy plans. The variation in results also complicates cost-effectiveness analysis for payers and slows broader adoption in insurance-driven systems.

High Variation in Treatment Access and Clinical Guidelines

Access to specialized physiotherapy, regenerative treatments, and advanced diagnostics varies widely between regions. Patients in rural and low-income areas struggle to obtain consistent care, creating uneven treatment adoption. Differences in clinical guidelines across countries add further complexity and reduce standardization in care pathways. These gaps hinder uniform market growth and limit patient outcomes, especially in systems with constrained reimbursement structures.

Regional Analysis:

North America

North America led the Lateral Epicondylitis (Tennis Elbow) Market in 2024 with about 38% share. The region showed strong demand due to high participation in sports, rising overuse injuries, and broad access to orthopedic and physiotherapy services. Employers also focused on occupational health programs, which improved early diagnosis rates. Advanced treatment adoption, including PRP injections and minimally invasive procedures, grew across clinics. The strong presence of specialty orthopedic centers supported patient inflow and strengthened market leadership.

Europe

Europe held nearly 30% of the Lateral Epicondylitis (Tennis Elbow) Market in 2024. Growth came from expanding physiotherapy networks, strong sports culture, and wider acceptance of conservative treatment methods. Countries like Germany, France, and the UK showed high patient volumes driven by workplace strain injuries and active aging populations. Reimbursement support for therapy and diagnostics improved treatment access. Increasing use of ergonomic devices in industrial sectors also contributed to steady regional growth.

Asia-Pacific

Asia-Pacific captured about 24% share of the Lateral Epicondylitis (Tennis Elbow) Market in 2024. Rising sports participation, growing fitness awareness, and expanding middle-class healthcare spending pushed treatment demand. Countries such as China, Japan, and India saw more repetitive-strain cases linked to industrial and office-based work. Physiotherapy adoption increased as private clinics and urban healthcare centers expanded. The region also showed rising interest in regenerative injections and home-based therapy options, supporting its strong growth trajectory.

Latin America

Latin America accounted for nearly 5% of the Lateral Epicondylitis (Tennis Elbow) Market in 2024. The region experienced moderate demand driven by expanding physiotherapy access and higher awareness of musculoskeletal injuries. Brazil and Mexico led treatment volumes due to larger urban populations and sports activity levels. Limited reimbursement and uneven specialist availability slowed wider adoption. However, growing private healthcare investment and more orthopedic clinics supported steady improvement in patient management.

Middle East & Africa

The Middle East & Africa held about 3% share of the Lateral Epicondylitis (Tennis Elbow) Market in 2024. Market growth remained gradual due to limited specialist coverage and lower adoption of advanced therapies. Urban centers in the UAE, Saudi Arabia, and South Africa drove most of the demand, supported by better diagnostic capabilities and expanding private hospitals. Sports injuries and occupational strain cases increased as fitness participation rose. Ongoing healthcare modernization is expected to improve access and support future treatment uptake.

Market Segmentations:

By Treatment Type

- Medications

- Physical Therapy

- Orthotics and Braces

- Other non- surgical Treatments

- Arthroscopic Surgery

- Open Surgery

- Other surgical Treatments

By Age Group

- Pediatric

- Adult

- Geriatric

By End Use

- Hospitals

- Ambulatory surgical centers

- Orthopedic clinics

- Homecare settings

- Other end use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The Lateral Epicondylitis (Tennis Elbow) Market features active competition among key players such as Pfizer, Novartis, Merck & Co, GlaxoSmithKline, Zimmer Biomet, Ossur Corporate, Pharmascience, MedStar Health, ReLiva Physiotherapy & Rehab, and Scandinavian Physiotherapy Center. Companies strengthen their positions by expanding non-surgical therapies, improving targeted medications, and enhancing physical rehabilitation services. Major orthopedic manufacturers focus on advanced braces and supportive devices designed to reduce strain and improve tendon recovery. Healthcare networks and physiotherapy centers widen their treatment programs with personalized exercise protocols and tele-rehabilitation support. Drug makers invest in improved anti-inflammatory options and regenerative-care research to address chronic cases. Rising partnerships between pharmaceutical firms, orthopedic specialists, and physiotherapy groups help streamline patient pathways and increase access to combined treatment plans. The competitive environment continues to shift toward conservative care solutions, advanced rehabilitation models, and evidence-backed therapies that improve long-term outcomes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Pfizer

- ReLiva Physiotherapy & Rehab

- Novartis

- Zimmer Biomet

- Scandinavian Physiotherapy Center

- Ossur Corporate

- MedStar Health

- Pharmascience

- GlaxoSmithKline

- Merck & Co

Recent Developments:

- In 2024–2025, Novartis has been actively advancing a tendinopathy pipeline relevant to lateral-epicondylitis–type biology: their clinical-trials pages and investor materials show ongoing development of tendinopathy candidates. Specifically, a Phase 2 program for NGI226 microparticles has been ongoing in mid-portion Achilles tendinopathy since early 2023 (NCT05592990). The company also has an ongoing Phase 3 program for Cosentyx (secukinumab) in rotator cuff tendinopathy (e.g., NCT05758415), signaling increased pharma investment in biologic/minimally-invasive approaches for tendon disorders.

- In 2024–2025, ReLiva Physiotherapy & Rehab continued to expand and publish region-focused patient education and clinic guides for tennis elbow (examples: the Ultimate Guide on Where to Treat Tennis Elbow in Bangalore and several clinic pages describing physiotherapy programs, home exercises, bracing and clinic treatments). This reflects their ongoing service expansion and content updates to support conservative (physiotherapy) care for lateral epicondylitis.

- In November 2024, Pfizer published general patient-facing guidance on exercises and self-care for tennis elbow (lateral epicondylitis) as part of their standard health education content, with the article medically reviewed and published on November 14, 2024. This was routine health content publication, not a major investor event.

Report Coverage:

The research report offers an in-depth analysis based on Treatment Type, Age Group, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for non-surgical care will rise as patients prefer faster recovery options.

- Digital physiotherapy platforms will expand access to guided home-based rehabilitation.

- Regenerative treatments like PRP will gain broader clinical acceptance.

- Advanced orthopedic braces will see higher adoption due to better comfort and support.

- Early diagnosis rates will increase with improved workplace screening programs.

- Sports medicine clinics will widen treatment capacity as participation in fitness activities grows.

- Minimally invasive procedures will gain traction for chronic and severe cases.

- Partnerships between pharmaceutical companies and physiotherapy networks will strengthen care pathways.

- Aging populations will drive more cases linked to tendon degeneration.

- Emerging markets will record stronger growth as physiotherapy infrastructure improves.