Market Overview

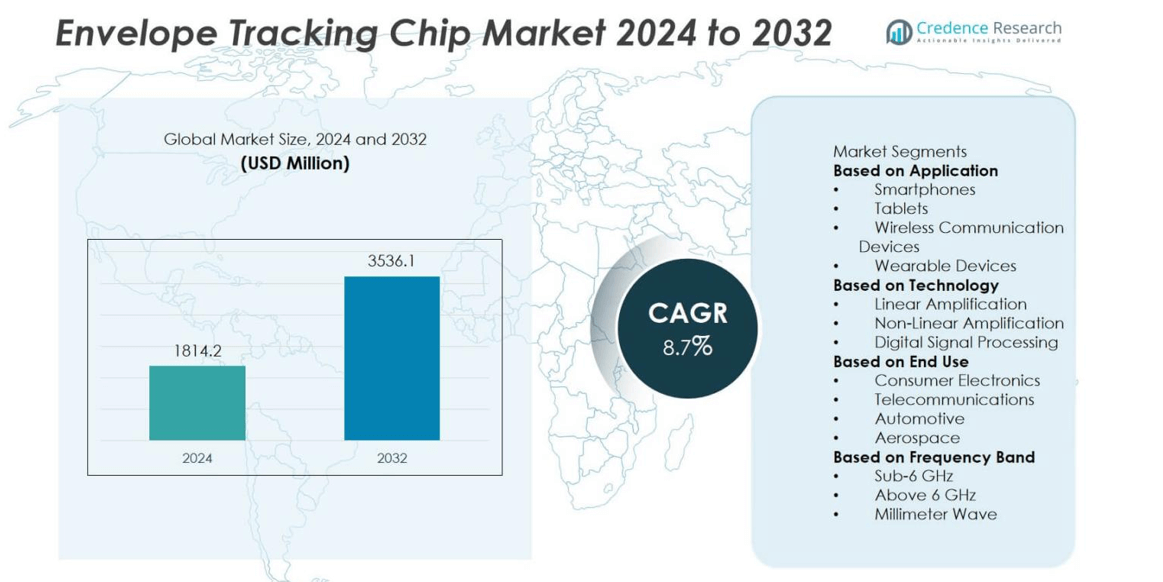

The Envelope Tracking Chip Market was valued at USD 1,814.2 million in 2024 and is projected to reach USD 3,536.1 million by 2032, reflecting a CAGR of 8.7% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Envelope Tracking Chip Market Size 2024 |

USD 1,814.2 million |

| Envelope Tracking Chip Market, CAGR |

8.7% |

| Envelope Tracking Chip Market Size 2032 |

USD 3,536.1 million |

The Envelope Tracking Chip Market grows through rising demand for energy-efficient power amplifiers in smartphones, IoT devices, and 5G infrastructure. It benefits from the ability to optimize battery performance and reduce heat generation in high-frequency communication systems. Increasing adoption in automotive telematics, satellite communication, and defense electronics supports expansion. The market trends toward miniaturized, multi-band compatible chips that enhance integration with modern RF front-end modules.

The Envelope Tracking Chip Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific leading due to its extensive electronics manufacturing base and rapid 5G network expansion. North America benefits from high adoption in defense systems, advanced communication infrastructure, and strong semiconductor R&D capabilities. Europe sees steady growth driven by automotive telematics and industrial IoT applications. Latin America and the Middle East & Africa are emerging markets with increasing investments in telecom upgrades and connected devices. Key players in the market include Qualcomm, Analog Devices, Texas Instruments, and Skyworks Solutions, all focusing on enhancing chip efficiency, supporting multi-band operations, and reducing power consumption in high-performance devices.

Market Insights

- The Envelope Tracking Chip Market was valued at USD 1814.2 million in 2024 and is projected to reach USD 3536.1 million by 2032, registering a CAGR of 8.7% during the forecast period.

- Demand is increasing due to the rising adoption of 4G LTE and 5G-enabled devices, as envelope tracking technology improves power amplifier efficiency and extends battery life.

- Trends include integration of envelope tracking solutions in high-end smartphones, IoT devices, and satellite communication systems, along with advancements in multi-band and multi-mode chip designs.

- The market is competitive, with players such as Qualcomm, Analog Devices, Skyworks Solutions, and Texas Instruments focusing on developing compact, high-performance chips and forming partnerships with OEMs to strengthen their product portfolios.

- A key restraint is the complexity of integrating envelope tracking chips into compact device architectures, which increases development costs and time-to-market.

- North America sees strong adoption driven by advanced telecom infrastructure and defense applications, while Asia-Pacific dominates due to large-scale electronics manufacturing and rapid network deployments.

- Europe maintains steady growth through its automotive, aerospace, and industrial IoT sectors, whereas Latin America and the Middle East & Africa show potential through expanding telecom networks and growing demand for connected devices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Power-Efficient Mobile Devices

The Envelope Tracking Chip Market benefits from the surge in demand for mobile devices with extended battery life and improved power efficiency. These chips optimize power usage in RF power amplifiers, reducing energy waste during signal transmission. It enables smartphone manufacturers to meet consumer expectations for longer usage between charges without compromising performance. Adoption rates increase as 5G-enabled devices require more efficient power management solutions. Integration into flagship and mid-range smartphones strengthens market penetration. Growing awareness of energy-efficient components in consumer electronics reinforces this trend globally.

- For instance, Qualcomm’s wideband envelope tracker QET7100 handles up to 1 GHz channel bandwidth and can drive multiple power amplifiers simultaneously, which shrinks board space and boosts power efficiency.

Growth of 5G and Advanced Wireless Communication Technologies

The transition to 5G networks accelerates the adoption of envelope tracking chips in mobile and IoT devices. It supports high-frequency, wideband applications that demand precise power modulation for optimal network performance. Telecom equipment manufacturers incorporate these chips to handle varying power requirements efficiently in massive MIMO systems. Enhanced network reliability and lower heat generation further encourage deployment. The rising number of connected devices and expanding network infrastructure projects fuel demand. Ongoing advancements in LTE-Advanced and future 6G technologies will sustain this driver over the forecast period.

- For instance, Qualcomm has demonstrated that its ENVELOPE TRACKING solution can deliver 30% better power efficiency compared to traditional power amplifiers, enabling leaner, high-performance designs.

Expansion of IoT Ecosystem and Connected Applications

The Envelope Tracking Chip Market grows with the proliferation of IoT applications across industrial, automotive, and consumer sectors. It enables efficient power control in devices ranging from wearables to connected sensors, where battery longevity is critical. Demand rises in automotive telematics, smart home devices, and remote monitoring systems that operate on low-power networks. The versatility of these chips in supporting different frequency bands and protocols enhances adoption. Manufacturers develop compact, cost-effective chipsets tailored for IoT integration. This broad applicability secures steady growth opportunities across multiple verticals.

Advancements in Semiconductor Manufacturing and Integration

Continuous improvements in semiconductor fabrication drive higher performance and smaller footprint for envelope tracking chips. It benefits from advanced process nodes that allow integration with RF front-end modules, reducing component count and system size. Enhanced thermal management and lower signal distortion boost adoption in high-performance applications. Suppliers invest in R&D to deliver chips compatible with emerging communication standards. The ability to integrate with system-on-chip (SoC) architectures supports streamlined device design. These technological advancements create competitive differentiation for manufacturers and stimulate market expansion.

Market Trends

Integration with 5G and Advanced RF Technologies

The Envelope Tracking Chip Market is experiencing rapid integration with 5G and advanced RF communication technologies. It supports wideband frequency operation and enables efficient modulation in high-speed data transmission environments. Manufacturers are designing chips that can handle multiple frequency bands for global network compatibility. Adoption rises in both consumer devices and network infrastructure, where low power loss is essential. Enhanced capabilities in dynamic power adjustment improve signal quality and extend device battery life. The compatibility with emerging LTE-Advanced Pro and future 6G standards strengthens its role in next-generation connectivity.

- For instance, Qualcomm’s QET7100 wideband envelope tracker supports up to 100 MHz channel bandwidth per carrier and operates across up to 8 simultaneous carriers, enabling full compatibility with global 5G NR and LTE-Advanced Pro bands.

Miniaturization and Multi-Function Integration

Advancements in chip design are driving miniaturization and multi-function integration in envelope tracking solutions. It allows manufacturers to combine envelope tracking functionality with RF front-end modules, reducing space and cost in compact devices. The trend supports thinner smartphones, wearables, and IoT devices without compromising performance. Semiconductor firms are focusing on high-density layouts to increase power efficiency and reduce thermal output. This design evolution improves scalability across various device categories. The push toward integrating multiple features in a single chipset enhances product value and adoption rates.

- For instance, Qualcomm integrated envelope tracking into its Snapdragon 8 Gen 1 platform, which shipped in over 56 million smartphones globally in 2022, reducing PCB footprint and improving power efficiency.

Growing Adoption in IoT and Automotive Applications

The Envelope Tracking Chip Market is expanding beyond smartphones into IoT and automotive applications. It is being deployed in connected vehicles to optimize telematics systems and V2X communications. Low-power operation capabilities make it suitable for IoT devices that require long operational lifespans. Demand is increasing in industrial automation, healthcare monitoring devices, and smart home systems. Chip designs are evolving to accommodate diverse environmental and operational conditions. This diversification of application areas ensures sustained growth and market resilience.

Focus on Energy Efficiency and Thermal Management

Energy efficiency and improved thermal management are becoming defining trends in envelope tracking chip development. It enables RF components to operate at peak efficiency while minimizing heat generation, critical for compact and high-performance devices. Innovations in semiconductor materials and circuit architecture are reducing signal distortion and improving power conversion rates. Manufacturers are incorporating advanced cooling techniques and low-loss components to enhance reliability. These developments align with global sustainability goals and user demand for eco-friendly electronics. The emphasis on balancing performance with power conservation continues to shape product innovation.

Market Challenges Analysis

High Design Complexity and Manufacturing Costs

The Envelope Tracking Chip Market faces challenges related to the high design complexity and production costs of advanced semiconductor components. It requires precise engineering to ensure compatibility with multiple frequency bands and high-speed data transmission standards. The integration of envelope tracking circuits with RF front-end modules demands advanced lithography and packaging technologies, increasing development expenses. Smaller device footprints intensify thermal management challenges, requiring additional engineering solutions. The high cost of R&D limits accessibility for smaller manufacturers, concentrating innovation within major players. Market expansion depends on balancing design sophistication with

High Design Complexity and Manufacturing Costs

The Envelope Tracking Chip Market faces significant challenges due to the high design complexity and manufacturing expenses of advanced semiconductor solutions. It requires precise engineering to operate across wide frequency ranges while maintaining high efficiency in 5G and LTE-Advanced environments. Integrating envelope tracking into compact RF front-end modules demands advanced lithography, specialized packaging, and stringent thermal management measures. These technical requirements increase production costs and limit economies of scale for smaller manufacturers. The need for extensive prototyping and validation further delays product rollout. Addressing these cost and design barriers is critical to broadening market adoption.

Compatibility and Integration Constraints

Compatibility with diverse network standards and seamless integration into existing device architectures present ongoing challenges for the Envelope Tracking Chip Market. It must function effectively across multiple carrier aggregation scenarios without causing signal distortion or power inefficiencies. Adapting chips to various smartphone, IoT, and automotive platforms requires customization, adding to development timelines and costs. Variations in regional spectrum allocations complicate standardization efforts, leading to fragmented production strategies. Manufacturers also face hurdles in ensuring long-term reliability under high thermal and operational stress. Overcoming these constraints is essential to achieving widespread, cross-industry implementation.

Market Opportunities

Expansion through 5G and Advanced Wireless Networks

The Envelope Tracking Chip Market has significant opportunities driven by the global deployment of 5G and other advanced wireless communication technologies. It enhances power amplifier efficiency in devices operating across higher frequency bands, enabling improved battery life and reduced heat generation. The rising adoption of smartphones, tablets, and IoT devices with multi-band capabilities supports demand for high-performance envelope tracking solutions. Network operators and equipment manufacturers are integrating these chips to meet stringent energy efficiency standards. The growing need for faster data transmission in applications such as augmented reality, virtual reality, and connected vehicles further strengthens its market potential. Integration into small-cell base stations offers an additional growth avenue.

Adoption in Emerging Applications and Vertical Markets

Opportunities for the Envelope Tracking Chip Market extend beyond consumer electronics into sectors such as automotive, aerospace, and industrial IoT. It enables efficient communication modules for connected cars, supporting vehicle-to-everything (V2X) technology and advanced driver-assistance systems. In aerospace and defense, these chips contribute to high-reliability communication systems with extended operational range. Industrial automation and remote monitoring applications benefit from enhanced signal performance and reduced power consumption. The expansion of smart city infrastructure with integrated sensors and communication devices further increases adoption prospects. Manufacturers that tailor solutions to these diverse applications can gain a competitive advantage in untapped markets.

Market Segmentation Analysis:

By Application

The Envelope Tracking Chip Market segments by application into smartphones, tablets, IoT devices, wearables, base stations, and other wireless communication equipment. Smartphones remain the dominant application, driven by the demand for higher battery efficiency and improved radio frequency performance in multi-band 4G and 5G devices. Tablets and wearables also adopt these chips to extend operational life and maintain performance under high data usage. IoT devices benefit from envelope tracking through optimized power usage in low-power wide-area networks, supporting long-term deployments. Base stations, particularly in small-cell architectures, integrate these chips to enhance energy efficiency and reduce operational costs. The growing number of connected devices worldwide ensures continued expansion across all application segments.

- For instance, Qualcomm shipped over 56 million Snapdragon processors with integrated envelope tracking in 2022 for flagship and mid-range smartphones, contributing significantly to power efficiency improvements.

By Technology

The market divides by technology into complementary metal–oxide–semiconductor (CMOS), gallium arsenide (GaAs), and other semiconductor processes. CMOS-based envelope tracking chips dominate due to their cost efficiency, scalability, and integration capability with existing system-on-chip designs. They enable compact, low-power solutions suited for consumer electronics. GaAs-based chips, while costlier, offer superior performance in high-frequency and high-power applications, making them ideal for advanced communication infrastructure and defense systems. Hybrid approaches combining CMOS and GaAs technologies are emerging to deliver a balance between performance and affordability. Technological advancements continue to push the boundaries of power efficiency, heat management, and multi-band compatibility.

- For instance, early GaN-based amplifier research using envelope tracking architecture achieved a measured power-added efficiency of 50.7% with linear output around 37.2 W and a gain of 10 dB—benchmark figures for base-station amplifier performance

By End Use

The Envelope Tracking Chip Market segments by end use into consumer electronics, telecommunications, automotive, aerospace and defense, and industrial sectors. Consumer electronics hold the largest share, supported by the mass adoption of smartphones, wearables, and tablets. The telecommunications sector, including network infrastructure providers, uses these chips to enhance the efficiency of base stations and network equipment. Automotive applications are expanding rapidly, particularly for V2X communications, infotainment systems, and telematics units. Aerospace and defense sectors demand high-performance chips for secure and reliable communications in mission-critical environments. Industrial end uses include automation systems, remote monitoring devices, and connected machinery, where energy efficiency and reliable connectivity are critical. The diversification of end-use industries broadens the market’s growth potential and resilience.

Segments:

Based on Application

- Smartphones

- Tablets

- Wireless Communication Devices

- Wearable Devices

Based on Technology

- Linear Amplification

- Non-Linear Amplification

- Digital Signal Processing

Based on End Use

- Consumer Electronics

- Telecommunications

- Automotive

- Aerospace

Based on Frequency Band

- Sub-6 GHz

- Above 6 GHz

- Millimeter Wave

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds approximately 34% share of the Envelope Tracking Chip Market, driven by advanced telecommunications infrastructure and strong demand for high-performance mobile devices. The region benefits from early adoption of 5G networks, with operators and device manufacturers integrating envelope tracking chips to optimize power efficiency and enhance radio frequency performance. The presence of leading semiconductor companies and R&D facilities supports rapid innovation in chip design and manufacturing. The U.S. accounts for the majority of the regional market, supported by large-scale smartphone penetration, defense communication projects, and IoT deployments. Canada contributes through telecom upgrades and expanding consumer electronics adoption, while Mexico shows growth potential in electronics manufacturing and automotive telematics integration. Government initiatives to strengthen domestic semiconductor supply chains further enhance regional growth prospects.

Europe

Europe represents around 27% of the market share, supported by strong adoption of energy-efficient communication solutions and stringent regulatory standards on power consumption. Countries such as Germany, the U.K., and France lead in deploying envelope tracking technology across 4G and 5G infrastructure. The European mobile device market increasingly integrates these chips to improve battery performance and meet consumer expectations for longer usage times. The region’s automotive industry, particularly in Germany, incorporates envelope tracking chips in connected vehicle systems and V2X communication modules. R&D investments in semiconductor fabrication and collaborations between telecom operators and chipmakers strengthen the regional supply base. Eastern Europe is emerging as a cost-effective manufacturing hub, expanding the production capabilities for these chips.

Asia-Pacific

Asia-Pacific commands the largest share at 35%, driven by high smartphone production volumes and rapid expansion of 5G networks. China, South Korea, and Japan are key contributors, with domestic semiconductor firms scaling envelope tracking chip production to meet demand from major device manufacturers. South Korea’s leading smartphone brands integrate these chips into flagship and mid-range models to improve efficiency in multi-band communication. Japan emphasizes high-reliability chips for automotive, industrial, and telecom applications. India’s growing smartphone user base and expanding telecom sector create strong adoption potential. The region’s competitive manufacturing ecosystem and availability of low-cost labor contribute to cost-efficient chip production, making it a global hub for supply and export.

Latin America

Latin America holds a market share of approximately 3%, with Brazil and Mexico as the primary markets. The region’s adoption of envelope tracking chips is tied to gradual 4G upgrades and early-stage 5G rollouts. Consumer electronics imports, particularly smartphones and tablets, are the main drivers of demand. Brazil’s manufacturing sector is beginning to explore local assembly of communication devices with integrated energy-efficient chips. Market growth is moderate due to lower average consumer spending, but infrastructure modernization efforts are expected to support long-term adoption.

Middle East & Africa

The Middle East & Africa account for about 1% of the Envelope Tracking Chip Market, with adoption centered in telecom network upgrades and high-end consumer electronics imports. Gulf countries, led by the UAE and Saudi Arabia, invest in advanced 5G infrastructure where envelope tracking chips enhance network performance and device efficiency. In Africa, South Africa leads adoption due to its relatively developed mobile network and growing smartphone penetration. However, the market remains nascent, with limited local manufacturing and dependence on imported devices. Government-led digital transformation initiatives could increase future demand across both regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Envelope Tracking Chip Market features leading players such as Qualcomm, Analog Devices, Skyworks Solutions, Texas Instruments, Infineon Technologies, Broadcom, Maxim Integrated, STMicroelectronics, EPCOS, and Cypress Semiconductor. These companies focus on technological innovation, strategic collaborations, and portfolio diversification to strengthen their market presence. Qualcomm leads with advanced envelope tracking solutions optimized for 4G LTE and 5G devices, supporting higher data rates and improved battery efficiency. Analog Devices emphasizes high-performance, multi-band designs for smartphones, IoT devices, and wireless infrastructure. Skyworks Solutions targets RF front-end integration, enhancing performance in compact device architectures. Texas Instruments and Infineon Technologies leverage expertise in power management and semiconductor design to deliver chips with superior thermal efficiency and reduced power consumption. Broadcom and Maxim Integrated focus on high-frequency, low-power solutions for satellite communications and defense applications. STMicroelectronics, EPCOS, and Cypress Semiconductor expand offerings into industrial and automotive IoT, aligning with emerging connectivity demands across multiple sectors.

Recent Developments

- In May 2025, Analog Devices released new Class-D amplifier models (MAX98425A and MAX98415A) that implement an envelope-tracking algorithm. These chips generate a PWM output to dynamically regulate DC-DC converter voltage, boosting system efficiency and improving thermal performance.

- In May 2025, STMicroelectronics introduced an AI-enabled inertial measurement unit (IMU) with a dual MEMS accelerometer capable of accurately measuring impacts up to 320 g full-scale. This miniature sensor targets personal electronics and IoT applications requiring high-impact resilience.

- In March 2025, Murata claimed the industry’s first digital envelope tracking technology, showcased at MWC 2025. The technology improves RF circuit efficiency for 5G and 6G devices, demonstrated in collaboration with Rohde & Schwarz via advanced RF measurement setups

Market Concentration & Characteristics

The Envelope Tracking Chip Market demonstrates a moderately concentrated structure, with a limited number of global semiconductor companies holding significant influence through advanced R&D capabilities, proprietary designs, and established supply chains. It is characterized by high technological barriers, requiring expertise in RF power management, integration with 4G, 5G, and emerging 6G networks, and compliance with stringent efficiency and thermal performance standards. Leading players maintain competitive advantage through continuous innovation in power amplifier efficiency, miniaturization, and integration with system-on-chip architectures. The market favors companies with strong partnerships across telecommunications, consumer electronics, and automotive sectors, enabling early adoption of next-generation connectivity solutions. It also benefits from rising demand for energy-efficient mobile devices and IoT applications, driving consistent investment in low-power, high-performance chipsets. Industry growth is further supported by a focus on sustainable manufacturing practices and the development of envelope tracking solutions compatible with diverse frequency bands and modulation schemes.

Report Coverage

The research report offers an in-depth analysis based on Application, Technology, End-User, Frequency Band and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for envelope tracking chips will grow with the expansion of 5G and upcoming 6G network deployments.

- Integration of envelope tracking technology into IoT devices will increase for enhanced power efficiency.

- Automotive electronics adoption will expand, particularly in connected and autonomous vehicle systems.

- Miniaturization of chip designs will advance to support compact, high-performance mobile devices.

- Energy efficiency improvements will remain a key driver in smartphone and wearable device applications.

- Collaboration between semiconductor companies and telecom equipment manufacturers will strengthen.

- AI-driven design tools will accelerate the development of optimized envelope tracking architectures.

- Multi-band compatibility will expand to meet diverse global spectrum requirements.

- Growth in AR and VR devices will create new demand for high-efficiency RF power management solutions.

- Sustainable semiconductor manufacturing processes will gain more focus in product development strategies.