Market Overview:

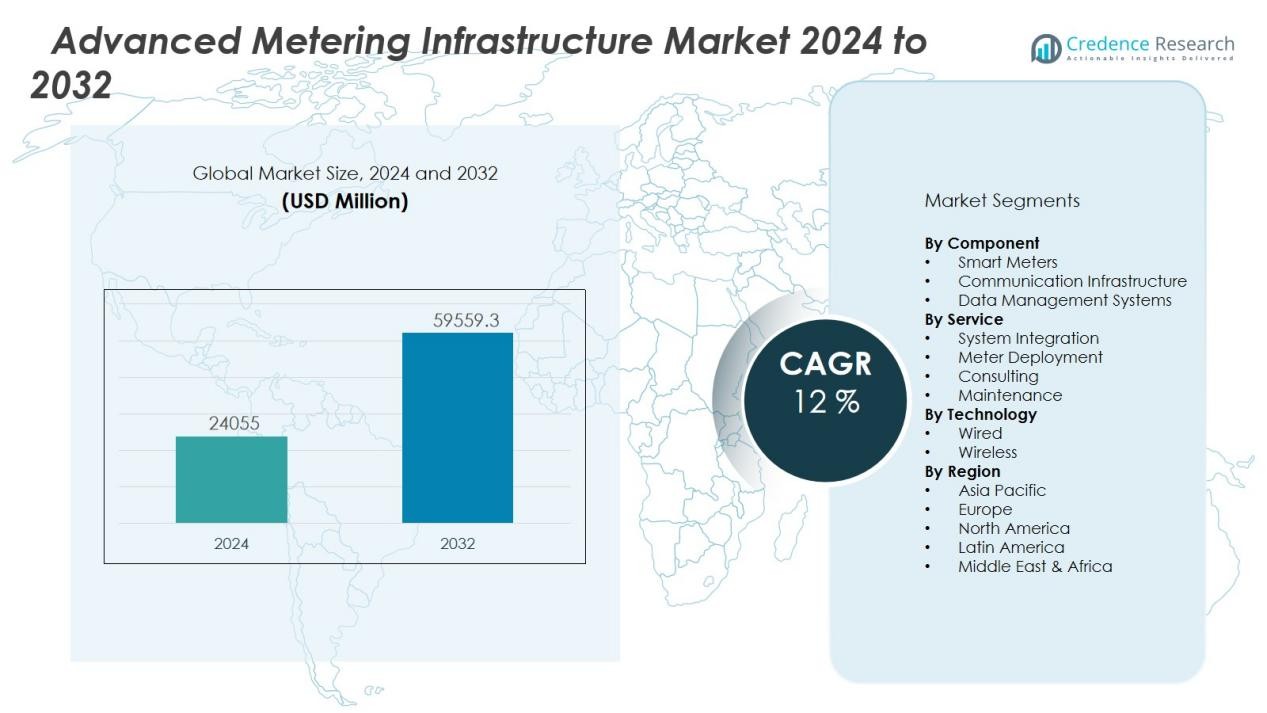

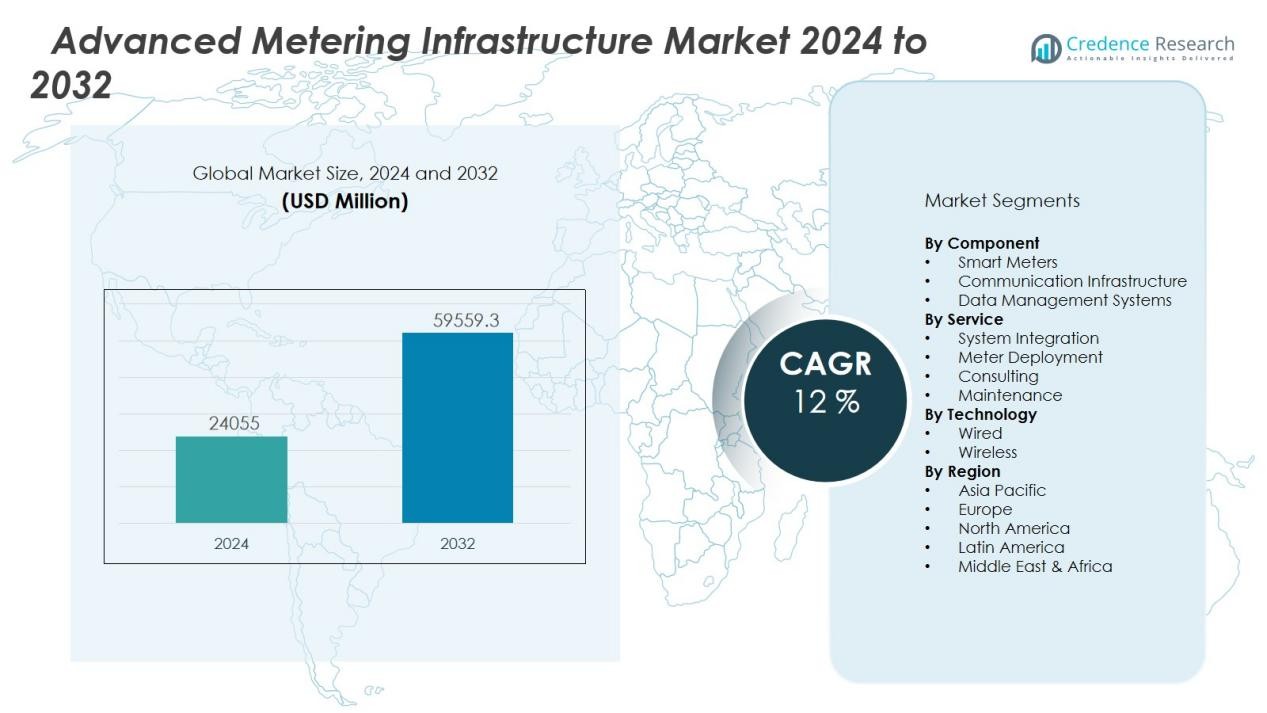

The advanced metering infrastructure market size was valued at USD 24055 million in 2024 and is anticipated to reach USD 59559.3 million by 2032, at a CAGR of 12 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Advanced Metering Infrastructure Market Size 2024 |

USD 24055 Million |

| Advanced Metering Infrastructure Market, CAGR |

12 % |

| Advanced Metering Infrastructure Market Size 2032 |

USD 59559.3 Million |

Key drivers of the AMI market include the global push toward energy efficiency, integration of renewable power sources, and regulatory mandates for grid modernization. Rising urbanization, smart city initiatives, and the proliferation of IoT-enabled devices are further accelerating adoption. AMI enables two-way communication between consumers and utilities, offering benefits such as demand-side management, dynamic pricing, and outage detection, which are critical to enhancing energy reliability and customer engagement.

Regionally, North America leads the market, supported by early adoption of smart grid technologies and robust policy frameworks. Europe follows closely, driven by stringent energy efficiency targets and sustainability commitments. Asia-Pacific is expected to record the fastest growth, with large-scale government-led smart grid projects in China, India, and Japan fueling market expansion. Latin America and the Middle East & Africa are gradually adopting AMI as utilities seek to improve grid resilience and reduce non-technical losses.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The advanced metering infrastructure market was valued at USD 24055 million in 2024 and is expected to reach USD 59559.3 million by 2032, growing at a CAGR of 12% during 2024–2032.

- Rising global focus on energy efficiency and demand-side management is a major driver, as AMI enables utilities and consumers to monitor, control, and optimize energy use.

- Integration of renewable energy sources and grid modernization strengthens AMI adoption, supporting real-time monitoring and balancing of variable power generation.

- Supportive government policies, regulatory mandates, and funding programs are accelerating large-scale smart meter rollouts across both developed and emerging markets.

- Rapid urbanization and expansion of smart city initiatives increase demand for reliable, efficient, and scalable AMI systems with advanced features like outage detection and dynamic pricing.

- High deployment costs, complex integration with legacy systems, and limited standardization remain major challenges for utilities in scaling AMI solutions.

- North America leads the market with strong policy support, Europe follows with sustainability-driven investments, and Asia-Pacific emerges as the fastest-growing region through government-led projects in China, India, and Japan.

Market Drivers:

Rising Global Focus on Energy Efficiency and Demand-Side Management:

The advanced metering infrastructure market is strongly driven by the growing emphasis on energy efficiency and conservation. Governments and utilities worldwide are implementing strict efficiency standards to reduce energy wastage and carbon emissions. AMI provides consumers with detailed insights into their consumption patterns, enabling better energy management. It also allows utilities to introduce demand response programs that balance peak loads and improve grid stability. This focus on efficiency aligns with global sustainability goals and creates long-term growth opportunities.

- For instance, Xcel Energy completed deployment of 2 million Itron smart meters across its service territory, enabling customers to receive detailed usage data and participate in demand response programs that optimize energy consumption patterns.

Integration of Renewable Energy Sources and Grid Modernization Efforts:

The transition toward renewable energy is reshaping power distribution systems, and AMI plays a critical role in supporting this shift. It facilitates real-time monitoring and integration of variable renewable sources such as solar and wind into the grid. Utilities rely on AMI to optimize distributed energy resources and maintain balance between generation and demand. By enabling accurate measurement and faster response, it strengthens grid resilience against fluctuations. This driver positions AMI as a key enabler of the evolving energy ecosystem.

- For instance, in the U.S., Memphis Light, Gas and Water (MLGW) is also advancing AMI with Elster (Honeywell) technology, having installed over 1 Million smart meters since 2014 with the goal of reaching all customers by 2020.

Supportive Government Policies and Regulatory Mandates:

Government initiatives and regulations are a major driver for the advanced metering infrastructure market. Many countries mandate the deployment of smart meters and digital infrastructure to enhance transparency and accountability in energy use. Subsidies and funding programs further encourage utilities to adopt AMI solutions at scale. Compliance with energy regulations pushes utilities to upgrade legacy systems and invest in digital technologies. These supportive frameworks accelerate market adoption and create a favorable investment climate.

Growing Urbanization and Expansion of Smart City Initiatives:

Rapid urbanization and the rise of smart cities are increasing the demand for intelligent energy management systems. AMI enables utilities to provide reliable, efficient, and scalable energy distribution in high-demand urban environments. It supports advanced features such as outage detection, theft reduction, and dynamic pricing, which are vital for smart city operations. The ability to integrate AMI with IoT and communication technologies further enhances its value proposition. This expanding urban infrastructure trend continues to fuel market growth.

Market Trends:

Adoption of IoT, Data Analytics, and Cloud Platforms to Enhance Grid Intelligence:

The advanced metering infrastructure market is witnessing rapid adoption of IoT-enabled devices, cloud platforms, and advanced data analytics to strengthen grid intelligence. Utilities are investing in smart meters that collect granular consumption data, which is analyzed to improve demand forecasting and load management. Cloud-based platforms support scalability and real-time access to information, reducing reliance on traditional infrastructure. It enables predictive maintenance, faster outage response, and proactive identification of energy theft. The integration of artificial intelligence and machine learning further enhances the accuracy of insights derived from AMI data. These innovations are transforming utilities into data-driven enterprises that deliver higher efficiency and customer engagement.

- For instance, Honeywell’s A4 smart meter features expanded memory and processing power to analyze voltage, current, and usage data, with deployments enabling utilities to process time- and event-based data from millions of endpoints to proactively reduce outage risks.

Shift Toward Decentralized Energy Systems and Consumer-Centric Solutions:

A key trend shaping the advanced metering infrastructure market is the increasing focus on decentralized energy systems and consumer empowerment. With the growth of renewable power generation, electric vehicles, and distributed energy resources, AMI is essential for managing two-way energy flows. It provides consumers with greater visibility and control over their energy use, enabling dynamic pricing models and participation in demand response programs. Utilities are shifting toward customer-centric solutions that enhance billing transparency and reliability. The interoperability of AMI with home energy management systems and smart appliances is also gaining traction. This trend reflects the industry’s move toward a more flexible, sustainable, and consumer-driven energy ecosystem.

- For instance, Italian utility Enel has deployed more than 30 million smart meters equipped to handle bidirectional energy flows and remote consumer participation, strengthening both grid flexibility and cost transparency for customers.

Market Challenges Analysis:

High Deployment Costs and Complex Integration with Legacy Systems:

The advanced metering infrastructure market faces significant challenges due to high upfront deployment costs and the complexity of integrating with existing legacy systems. Utilities must invest heavily in smart meters, communication networks, and data management platforms, which can strain budgets, especially in developing regions. It also requires large-scale infrastructure upgrades and workforce training to ensure smooth adoption. Many utilities struggle with aligning new AMI solutions with outdated grid components, creating delays and operational inefficiencies. Limited standardization across vendors further complicates integration efforts. These cost and compatibility barriers often slow down large-scale rollouts.

Cybersecurity Risks and Consumer Data Privacy Concerns:

Cybersecurity threats and privacy issues remain a major challenge for the advanced metering infrastructure market. AMI systems generate and transmit large volumes of sensitive consumer data, making them attractive targets for cyberattacks. It requires robust encryption, monitoring, and compliance measures to protect against unauthorized access and data breaches. Utilities also face increasing scrutiny from regulators and consumers regarding how data is collected, stored, and used. Public mistrust in data handling practices can hinder acceptance and adoption rates. The need to balance innovation with strict data protection standards adds further complexity for utilities and technology providers.

Market Opportunities:

Expansion of Smart Cities and Rising Demand for Digital Energy Solutions:

The advanced metering infrastructure market holds strong opportunities through the expansion of smart cities and the rising demand for intelligent energy management. Governments and municipalities are investing in smart city projects that require efficient power distribution, real-time monitoring, and consumer-centric energy services. It enables utilities to integrate AMI with IoT-based platforms, supporting dynamic pricing, outage management, and energy theft detection. Smart city frameworks create opportunities for large-scale deployments that enhance grid efficiency and customer satisfaction. The growing demand for sustainable, resilient, and digitally enabled infrastructure positions AMI as a key enabler of urban transformation.

Integration with Renewable Energy and Distributed Energy Resources:

The transition toward renewable energy and distributed energy resources presents another major opportunity for the advanced metering infrastructure market. AMI provides the tools needed to manage two-way energy flows between consumers and the grid, supporting the integration of solar, wind, and battery storage systems. It also enables utilities to design flexible demand response programs that reduce strain during peak periods. Rising adoption of electric vehicles and decentralized power systems further strengthens the case for advanced metering solutions. Utilities can leverage AMI to improve forecasting, enhance grid stability, and meet regulatory targets for clean energy adoption. This integration trend opens new pathways for market expansion across both developed and emerging regions.

Market Segmentation Analysis:

By Component:

The advanced metering infrastructure market is segmented by components into smart meters, communication infrastructure, and data management systems. Smart meters dominate due to widespread utility adoption for accurate billing and real-time consumption monitoring. Communication infrastructure, including RF mesh, PLC, and cellular networks, plays a critical role in enabling two-way data exchange. Data management systems gain traction as utilities demand advanced analytics and secure platforms for handling large volumes of energy data. It is these components together that form the backbone of AMI deployments.

- For instance, Itron successfully deployed more than 4.2 million intelligent electricity, water, and gas meters for ComEd (U.S.), enabling interval data collection and reducing field visits significantly.

By Service:

Services in the advanced metering infrastructure market include system integration, meter deployment, consulting, and maintenance. System integration holds the largest share as utilities seek seamless interoperability between meters, networks, and software platforms. Deployment services are in high demand due to large-scale rollouts across developed and emerging regions. Consulting services help utilities design regulatory-compliant strategies, while ongoing maintenance ensures operational reliability and customer satisfaction. It is through these service offerings that long-term efficiency and performance are sustained.

- For instance, Oracle Utilities’ cloud-based maintenance analytics for Pacific Gas & Electric covers 4.2 million meters, leading to a 23% reduction in service disturbances and faster customer response.

By Technology:

By technology, the market is categorized into wired and wireless communication systems. Wireless technology leads due to its scalability, cost-effectiveness, and suitability for diverse geographic conditions. RF mesh networks and cellular connectivity are widely deployed for real-time data transfer and remote meter management. Wired technologies, such as PLC, remain relevant in regions with strong grid infrastructure. It is the growing preference for wireless solutions that drives innovation and faster adoption in smart grid modernization.

Segmentations:

By Component:

- Smart Meters

- Communication Infrastructure

- Data Management Systems

By Service:

- System Integration

- Meter Deployment

- Consulting

- Maintenance

By Technology:

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America:

North America holds the largest market share of 38% in the advanced metering infrastructure market, supported by strong adoption of smart grid technologies and robust regulatory frameworks. The United States and Canada lead with large-scale deployments driven by federal mandates and state-level energy transformation initiatives. Mature infrastructure, advanced communication networks, and significant utility investments enable widespread smart meter rollouts that improve billing accuracy and efficiency. It benefits further from the presence of global technology leaders accelerating innovation. Strong emphasis on sustainability and carbon reduction ensures the region’s continued dominance in the global landscape.

Europe:

Europe accounts for 28% of the advanced metering infrastructure market, driven by EU directives targeting energy efficiency and decarbonization. The United Kingdom, Germany, France, and Italy are implementing nationwide smart meter rollouts under strict timelines. Commitments to carbon neutrality boost investments in grid modernization and renewable integration. It reinforces AMI’s role in balancing distributed resources and enhancing consumer participation in demand response. Utilities in Europe prioritize interoperability and data privacy, supported by stringent regulatory compliance. Policy-driven initiatives and innovation place Europe as a dynamic growth hub.

Asia-Pacific:

Asia-Pacific commands 24% of the advanced metering infrastructure market and is the fastest-growing regional segment, driven by large-scale government programs and surging electricity demand. China leads with extensive smart grid investments, while India expands adoption under digitalization and electrification programs. Japan, South Korea, and Australia enhance efficiency and resilience through AMI deployments. It supports renewable integration and urban infrastructure development across the region. Rapid urbanization, expanding populations, and government-backed projects drive long-term opportunities. Asia-Pacific’s aggressive grid modernization positions it to capture an increasing global share in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- General Electric

- Schneider Electric SE

- IBM Corporation

- Trilliant, Inc.

- Elster Group GmbH

- Cisco Systems, Inc.

- Aclara Technologies LLC

- Sensus

- Itron, Inc.

- Tieto Corporation.

Competitive Analysis:

The advanced metering infrastructure market is highly competitive, shaped by global technology leaders and specialized solution providers. Key players include General Electric, Schneider Electric SE, IBM Corporation, Trilliant, Inc., Elster Group GmbH, Cisco Systems, Inc., and Aclara Technologies LLC. These companies focus on developing smart meters, advanced communication networks, and secure data management platforms to strengthen their positions. It is driven by continuous innovation, where vendors invest in IoT, cloud integration, and analytics to enhance system intelligence and reliability. Partnerships between utilities, telecom operators, and software providers are expanding to deliver scalable and interoperable solutions. Competition is also defined by an emphasis on cybersecurity, regulatory compliance, and customer-centric services. Regional vendors compete by offering cost-effective, customized deployments tailored to local utility needs. The market reflects a balance between large multinational corporations with broad portfolios and niche players addressing specific technological or regional demands.

Recent Developments:

- In January 2025, GE Lighting (Savant) began launching its updated GE reveal® LED bulb portfolio and outdoor Cync smart products, with expanded options rolling out through the second half of the year.

- In August 2025, Trilliant Health announced a strategic collaboration with Duke Health to provide its market-leading analytics platform for growth planning and community engagement at the academic medical center.

- In July 2025, Cisco has heavily invested in AI and quantum networking in 2025, introduced new AI Defense and AI Canvas tools, and updated its partner program to accelerate innovation within its channel ecosystem.

Market Concentration & Characteristics:

The advanced metering infrastructure market is moderately concentrated, with global players and regional vendors competing for utility contracts and government-backed projects. Leading companies invest in large-scale deployments, advanced communication technologies, and integration with IoT and data analytics to strengthen their position. It is characterized by long-term utility partnerships, regulatory-driven adoption, and high entry barriers due to capital-intensive infrastructure and compliance requirements. The market also reflects growing collaboration between technology providers, telecom companies, and energy utilities to deliver scalable solutions. Competition intensifies as vendors emphasize cybersecurity, interoperability, and data privacy to differentiate offerings in a rapidly evolving energy landscape.

Report Coverage:

The research report offers an in-depth analysis based on Component, Service, Technology and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The advanced metering infrastructure market will expand further as utilities accelerate digital transformation and modernize outdated grid systems.

- Governments will continue to enforce regulatory mandates and funding programs that drive large-scale smart meter rollouts.

- Integration with renewable energy and distributed energy resources will strengthen the role of AMI in balancing two-way energy flows.

- Utilities will adopt advanced data analytics, artificial intelligence, and machine learning to optimize forecasting and load management.

- Cybersecurity will remain a critical priority, leading to stronger investments in secure communication protocols and data protection frameworks.

- Smart city initiatives will boost demand for AMI solutions, linking energy systems with broader digital infrastructure.

- Interoperability and standardization efforts will gain importance, ensuring seamless integration of AMI across diverse platforms and technologies.

- Utilities will leverage AMI to enhance customer engagement through transparent billing, demand response programs, and personalized energy services.

- Emerging economies in Asia-Pacific, Latin America, and Africa will present significant opportunities through government-backed electrification and grid modernization projects.

- Strategic collaborations between technology providers, telecom operators, and utilities will shape the competitive landscape, enabling scalable, efficient, and consumer-centric solutions.