Market Overview:

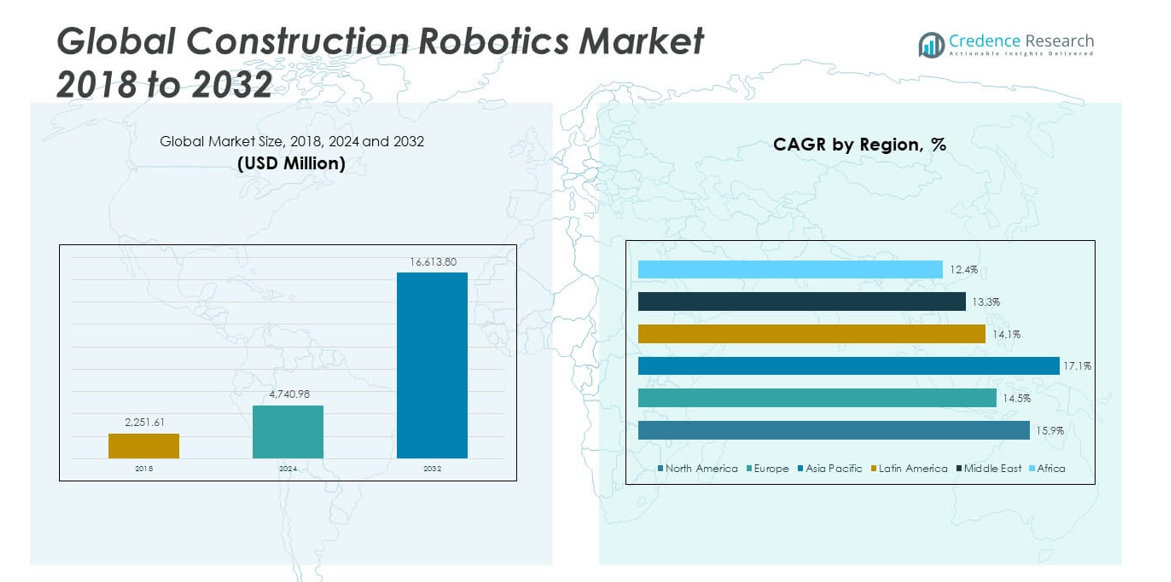

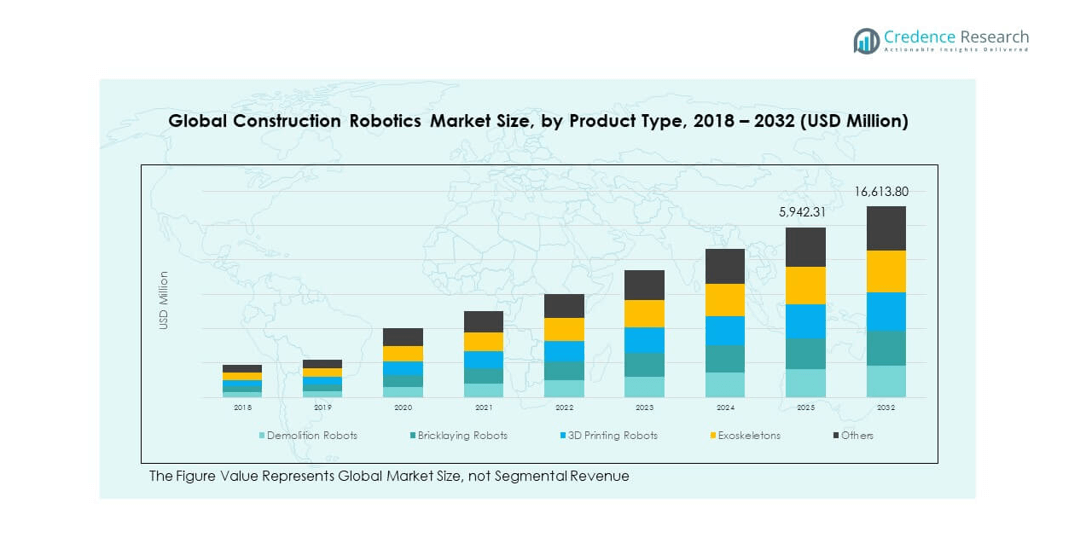

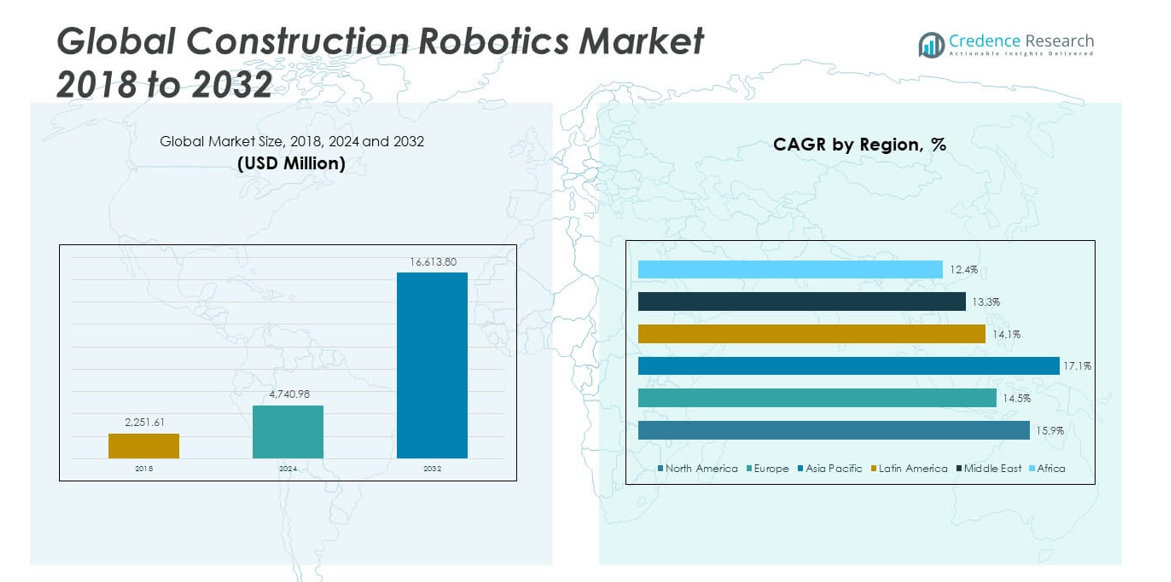

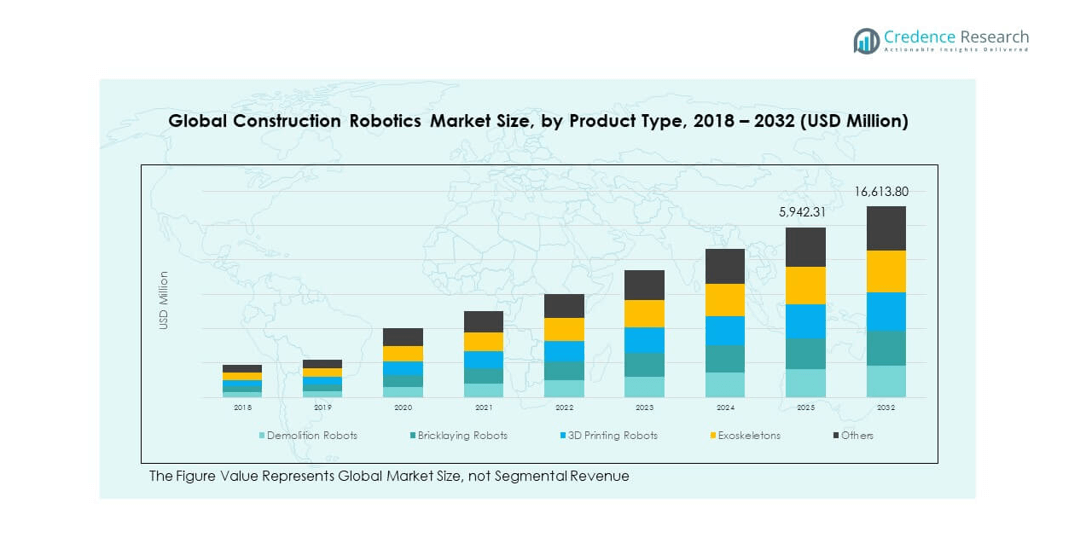

The Global Construction Robotics Market size was valued at USD 2,251.61 million in 2018 to USD 4,740.98 million in 2024 and is anticipated to reach USD 16,613.80 million by 2032, at a CAGR of 15.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Robotics Market Size 2024 |

USD 4,740.98 million |

| Construction Robotics Market, CAGR |

15.82% |

| Construction Robotics Market Size 2032 |

USD 16,613.80 million |

The market is expanding rapidly due to the growing adoption of automation to address labor shortages, enhance productivity, and reduce project timelines. Advancements in AI, machine learning, and sensor technologies are enabling construction robots to perform complex tasks with precision and safety. Rising investments in infrastructure development, increasing demand for prefabrication, and the push for sustainable building practices are accelerating adoption. Additionally, the need for consistent quality and reduced operational costs is motivating contractors to integrate robotics into construction workflows.

North America leads the market owing to high technology adoption, skilled robotics developers, and strong investments in infrastructure modernization. Europe follows closely, supported by stringent safety regulations and a focus on green construction. The Asia-Pacific region is emerging as the fastest-growing market, driven by rapid urbanization, large-scale smart city projects, and supportive government initiatives in countries like China, Japan, and South Korea. Latin America and the Middle East & Africa are gradually gaining momentum as infrastructure investments and construction automation awareness increase.

Market Insights:

- The Global Construction Robotics Market size was valued at USD 2,251.61 million in 2018 to USD 4,740.98 million in 2024 and is anticipated to reach USD 16,613.80 million by 2032, at a CAGR of 15.82% during the forecast period.

- Rising demand for automation to address skilled labor shortages and improve productivity is accelerating adoption across construction projects.

- Integration of advanced technologies such as AI, IoT, and machine learning enhances precision, safety, and operational efficiency in construction robotics.

- High initial investment costs, integration complexity, and workforce training requirements are restraining rapid adoption in small and mid-sized firms.

- Regulatory compliance, safety certifications, and the absence of universal standards create operational and deployment challenges.

- North America leads the market due to strong technology adoption and large-scale infrastructure projects, supported by innovation-driven manufacturers.

- Asia Pacific is the fastest-growing region, driven by rapid urbanization, smart city initiatives, and government-backed infrastructure investments in China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Automation to Address Labor Shortages and Improve Efficiency:

The Global Construction Robotics Market benefits significantly from the pressing need to address skilled labor shortages in the construction industry. Many developed and emerging economies face a decline in available skilled workers, driving companies to adopt robotics to maintain project timelines. Automation reduces dependency on manual labor and allows consistent operations under varying conditions. It helps improve productivity by handling repetitive and physically demanding tasks, enabling human workers to focus on complex decision-making. Robotics solutions also enhance safety by reducing direct human exposure to hazardous environments. Construction firms find automation appealing for its ability to maintain quality standards across projects. Governments are supporting automation adoption with funding and policy frameworks. These factors together create strong momentum for robotics integration in the construction sector.

- For instance, Caterpillar has deployed fully autonomous construction vehicles, such as excavators and bulldozers, which operate 24/7 without direct human intervention. These machines significantly reduce the need for skilled operators and maintain project timelines by consistently executing tasks like grading and excavation using GPS, LiDAR, and IoT sensors.

Integration of Advanced Technologies for Enhanced Accuracy and Performance:

The Global Construction Robotics Market experiences growth from the integration of advanced technologies such as AI, IoT, and machine learning. These capabilities enable robots to perform intricate tasks with precision, such as bricklaying, demolition, and material handling. AI-driven vision systems and sensor technologies improve situational awareness, enhancing productivity and safety. Predictive analytics allows proactive maintenance and minimizes downtime. Connectivity through IoT platforms enables seamless communication between robots and project management systems. The combination of data-driven insights and automation supports efficient resource allocation. Such technology-driven performance improvements attract investment from both large contractors and infrastructure developers. This evolution positions robotics as a cornerstone for future construction workflows.

- For instance, Construction Robotics’ SAM100 (Semi-Automated Mason) robot can lay up to 3,000 bricks per day—six times faster than a typical human mason—and is equipped with AI-powered vision and path-planning systems for precise bricklaying on active sites across the U.S.. Boston Dynamics’ Spot robot, equipped with advanced sensors and cameras, is used by companies globally for site inspection, progress monitoring, and integration with BIM (Building Information Modeling) workflows, improving both accuracy and safety.

Government-Led Infrastructure Development and Smart City Projects:

Large-scale infrastructure investments play a central role in propelling the Global Construction Robotics Market forward. Governments in multiple regions are committing substantial budgets to transport, energy, and public facility projects. Smart city initiatives demand high construction precision and tight schedules, making robotics a critical enabler. Automation accelerates project delivery and helps achieve sustainability goals through reduced waste and energy use. Regulatory requirements for safety and quality compliance further encourage automation adoption. Robotics offers scalability to meet the demands of mega projects without compromising standards. Public-private partnerships are fostering innovation and deployment. This environment supports continuous growth for robotics across diverse infrastructure segments.

Growing Emphasis on Sustainable and Cost-Efficient Building Practices:

Sustainability goals are pushing construction firms to adopt robotics that reduce material waste and optimize energy consumption. The Global Construction Robotics Market responds to this demand with solutions designed for resource-efficient operations. Robots can execute precise measurements and reduce rework, cutting costs over the project lifecycle. The integration of renewable energy-powered machinery supports green building certifications. Automation also enables modular and prefabricated construction, which aligns with low-carbon objectives. Cost efficiencies from faster project completion enhance return on investment for developers. Environmental regulations are reinforcing this shift toward sustainable practices. Robotics thus serves as both an operational and environmental advantage for the sector.

Market Trends:

Adoption of Modular and Prefabricated Construction Methods:

The Global Construction Robotics Market is witnessing a surge in the adoption of modular and prefabricated building methods. Robotics plays a critical role in manufacturing components with consistent quality and speed. Factory-based production reduces weather-related delays and on-site labor requirements. Automated assembly lines allow customization without compromising efficiency. Robotics supports just-in-time delivery, minimizing storage costs and site congestion. This trend aligns with urban development needs where rapid housing and infrastructure deployment is essential. The precision of robotic fabrication ensures structural integrity in prefabricated modules. This approach is becoming integral to modern construction strategies.

- For instance, Skanska and other major contractors now employ robotic arms and AI-driven systems for factory-based prefabrication, enabling components to be manufactured with consistent quality and precision before on-site assembly. In 2025, about 27% of new buildings globally are being constructed using prefabrication methods automated by robotics, improving construction speed and reducing error rates.

Deployment of Robotics for Hazardous and High-Risk Tasks:

Increasing focus on worker safety is accelerating the deployment of robotics in hazardous construction environments. The Global Construction Robotics Market benefits from robots capable of operating in high-risk zones such as demolition sites, underwater works, or contaminated areas. These machines handle tasks involving toxic materials or extreme temperatures, reducing human exposure. Advanced remote-control systems enable operators to manage robots from safe locations. The trend supports compliance with strict occupational safety regulations. Robotics also proves valuable in post-disaster reconstruction by navigating unstable structures. This application extends beyond safety to include faster recovery times for damaged infrastructure.

- For instance, Brokk specializes in remote-controlled demolition robots capable of operating in hazardous environments, such as contaminated industrial sites and disaster zones, minimizing human exposure to risk. These machines are equipped with advanced remote-operating systems that allow operators to safely manage demolition from secure locations.

Integration of Robotics with Building Information Modeling (BIM) Platforms:

BIM integration is emerging as a transformative trend in the Global Construction Robotics Market. Robots connected to BIM systems receive real-time instructions and data for precise execution. This synergy reduces errors between design and construction phases. Automated systems can adapt to design changes quickly, keeping projects aligned with evolving requirements. Data collected by robots feeds back into BIM models, enhancing accuracy for future projects. Integration supports collaborative workflows across contractors, architects, and engineers. The enhanced visibility into project progress helps stakeholders make informed decisions. This fusion of digital and physical construction processes is reshaping the industry.

Rise of 3D Printing and Additive Manufacturing in Construction:

The Global Construction Robotics Market is embracing 3D printing technologies for large-scale building components. Robotics enables precise layer-by-layer construction using sustainable materials. This approach reduces waste and accelerates the building process. 3D printing facilitates complex architectural designs that traditional methods struggle to achieve. The combination of robotics and additive manufacturing opens possibilities for on-site fabrication. It also reduces logistical challenges in remote or disaster-affected areas. The flexibility of material usage supports cost efficiency and sustainability goals. Such innovations are redefining the boundaries of construction capabilities.

Market Challenges Analysis:

High Initial Investment and Integration Complexity:

One of the significant barriers in the Global Construction Robotics Market is the high cost of acquisition and implementation. Advanced robotics systems require substantial upfront investment, which can be prohibitive for small and mid-sized construction firms. Integration with existing workflows and legacy equipment adds to the complexity. Training the workforce to operate and maintain robots demands time and resources. The return on investment may take years, making adoption less attractive in markets with low margins. Infrastructure for robotics deployment, such as connectivity and power supply, is not always readily available. These challenges slow the pace of market penetration in certain regions.

Regulatory and Standardization Barriers Impacting Deployment:

The Global Construction Robotics Market faces regulatory hurdles that can delay deployment. Safety certifications, compliance checks, and adherence to regional labor laws require significant documentation and approvals. Lack of universal standards for interoperability between robotics systems creates compatibility issues. This fragmentation hampers scalability and cross-border deployments. In some regions, labor unions oppose robotics adoption due to job displacement concerns. Rapid technological advancements outpace regulatory updates, leading to uncertainty for manufacturers and users. Addressing these barriers requires collaborative efforts between industry stakeholders and policymakers.

Market Opportunities:

Expanding Applications in Emerging Markets and Infrastructure Projects:

The Global Construction Robotics Market holds significant potential in emerging economies with active infrastructure development programs. Rapid urbanization is creating demand for high-speed, high-precision construction solutions. Governments in these markets are investing heavily in transport, energy, and housing projects. Robotics offers scalability to meet ambitious project timelines while maintaining quality. Adoption in these regions also benefits from the lower cost of technology compared to developed markets. Collaborations between global robotics manufacturers and local construction firms can accelerate market entry. These opportunities will expand as infrastructure investment continues to rise.

Innovation in Autonomous and AI-Driven Robotics Solutions:

Technological advancements are paving the way for autonomous construction robots capable of decision-making and adaptive task execution. AI integration enables predictive maintenance, real-time problem-solving, and optimized resource use. Such capabilities reduce downtime and enhance project efficiency. The Global Construction Robotics Market can leverage these innovations to offer competitive advantages for early adopters. Autonomous navigation in complex job sites expands application scope to include remote and hazardous environments. This opportunity strengthens the appeal of robotics across diverse construction segments.

Market Segmentation Analysis:

By Product Type

The Global Construction Robotics Market is segmented into demolition robots, bricklaying robots, 3D printing robots, exoskeletons, and others. Demolition robots command a significant share due to their efficiency, precision, and ability to operate in hazardous or confined environments. Bricklaying robots are increasingly adopted for their speed and accuracy in repetitive masonry tasks, reducing reliance on manual labor. 3D printing robots are an emerging high-growth segment, enabling the creation of complex architectural designs and promoting sustainable building practices. Exoskeletons enhance worker productivity and reduce physical strain, supporting extended operational capacity on-site. The “others” category includes specialized robots for tasks such as tunneling, road construction, and façade installation, highlighting the market’s broadening technological capabilities.

By Application

The Global Construction Robotics Market is categorized into public infrastructure, commercial and residential buildings, industrial construction, finishing works, and others. Public infrastructure holds the largest share, driven by government-led projects, transportation upgrades, and smart city developments. Commercial and residential buildings show growing adoption of robotics for quality assurance, faster project delivery, and cost control. Industrial construction benefits from automation in heavy-duty material handling, structural assembly, and hazardous operations. Finishing works utilize robotics for precision-driven activities like painting, plastering, and tiling, ensuring consistent quality. The “others” segment comprises niche applications in specialized facilities and remote or extreme environments, reflecting ongoing diversification in market usage.

Segmentation:

By Product Type

- Demolition Robots

- Bricklaying Robots

- 3D Printing Robots

- Exoskeletons

- Others

By Application

- Public Infrastructure

- Commercial and Residential Buildings

- Industrial Construction

- Finishing Works

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global Construction Robotics Market size was valued at USD 957.46 million in 2018 to USD 1,994.53 million in 2024 and is anticipated to reach USD 7,009.35 million by 2032, at a CAGR of 15.9% during the forecast period. The region accounts for approximately 42.06% of the global market in 2024. North America leads the market due to its strong adoption of advanced construction technologies and significant investments in infrastructure modernization. It benefits from a mature robotics ecosystem supported by leading manufacturers and innovative startups. Regulatory emphasis on safety standards and sustainability drives automation in high-risk and labor-intensive tasks. Large-scale commercial, residential, and industrial projects provide continuous demand for robotics integration. Government-backed smart city initiatives and funding for public works projects accelerate adoption. The presence of skilled robotics engineers and R&D facilities fosters innovation. This environment positions North America as a key driver of global construction robotics growth.

Europe

The Europe Global Construction Robotics Market size was valued at USD 444.34 million in 2018 to USD 887.12 million in 2024 and is anticipated to reach USD 2,842.91 million by 2032, at a CAGR of 14.5% during the forecast period. The region represents around 18.71% of the global market in 2024. Europe’s growth is fueled by stringent regulations for construction safety, environmental standards, and energy efficiency. Widespread adoption of modular construction methods aligns with robotics applications in prefabrication and assembly. Countries such as Germany, the UK, and France lead in technology integration, while Eastern Europe is gradually increasing uptake. Investments in urban regeneration and infrastructure renewal create opportunities for advanced automation. Sustainability-focused policies encourage robotics use for material efficiency and waste reduction. The presence of established industrial robotics manufacturers supports deployment. The region’s emphasis on high-quality construction and innovation sustains steady market expansion.

Asia Pacific

The Asia Pacific Global Construction Robotics Market size was valued at USD 646.99 million in 2018 to USD 1,438.79 million in 2024 and is anticipated to reach USD 5,501.16 million by 2032, at a CAGR of 17.1% during the forecast period. The region captures approximately 30.35% of the global market in 2024. Rapid urbanization, large-scale infrastructure development, and smart city projects drive demand for construction robotics. China, Japan, and South Korea lead in both adoption and manufacturing of robotics technologies. High population density in urban areas accelerates the need for efficient, automated construction methods. Government policies support modernization of the construction sector to improve safety and productivity. The region also benefits from cost-effective production and export of robotics systems. Adoption extends to high-rise buildings, transport infrastructure, and industrial parks. Asia Pacific’s strong economic growth and technology adoption rate underpin its position as the fastest-growing regional market.

Latin America

The Latin America Global Construction Robotics Market size was valued at USD 108.35 million in 2018 to USD 225.35 million in 2024 and is anticipated to reach USD 700.65 million by 2032, at a CAGR of 14.1% during the forecast period. The region holds about 4.75% of the global market in 2024. Growth is supported by increasing investments in infrastructure, housing, and commercial real estate. Countries like Brazil, Mexico, and Chile are leading adopters, with gradual interest from smaller economies. Robotics is being used to address labor shortages and improve safety on construction sites. Projects in mining, energy, and industrial sectors also contribute to demand. Economic reforms and foreign direct investment create a favorable environment for technology integration. Adoption remains concentrated in large-scale projects due to high initial costs. Latin America’s market expansion is steady, with potential for acceleration as costs decrease and awareness increases.

Middle East

The Middle East Global Construction Robotics Market size was valued at USD 61.32 million in 2018 to USD 117.71 million in 2024 and is anticipated to reach USD 346.03 million by 2032, at a CAGR of 13.3% during the forecast period. The region accounts for about 2.48% of the global market in 2024. Large-scale infrastructure and mega-projects, especially in the Gulf Cooperation Council (GCC) countries, drive demand. Robotics supports ambitious timelines for smart city developments like NEOM in Saudi Arabia and Expo 2020 legacy projects in the UAE. Harsh environmental conditions and the need for precision construction encourage automation. Government-backed diversification strategies in non-oil sectors create opportunities for robotics adoption. The region also invests in high-end residential and commercial construction. Limited local manufacturing capacity leads to high reliance on imports, presenting opportunities for partnerships. Robotics adoption is expected to grow steadily with continued economic diversification.

Africa

The Africa Global Construction Robotics Market size was valued at USD 33.15 million in 2018 to USD 77.48 million in 2024 and is anticipated to reach USD 213.70 million by 2032, at a CAGR of 12.4% during the forecast period. The region represents around 1.62% of the global market in 2024. Growth is driven by infrastructure needs in transportation, energy, and housing. South Africa, Nigeria, and Kenya are emerging as key adopters of automation in construction. Robotics is being used in large-scale infrastructure and mining projects to improve efficiency. Limited skilled labor availability encourages the use of automated systems. Foreign investment and development aid support modernization of construction practices. High equipment costs and limited technical expertise slow adoption in smaller markets. With increasing urbanization and industrialization, Africa holds long-term potential for robotics adoption in construction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ekso Bionics

- Brokk AB

- Madico, Inc.

- Husqvarna AB

- Apis Cor

- Construction Robotics LLC

- Dusty Robotics

- Fastbrick Robotics Ltd.

- Advanced Construction Robotics Inc.

- Boston Dynamics

Competitive Analysis:

The Global Construction Robotics Market is highly competitive, with players focusing on innovation, product diversification, and strategic collaborations to strengthen market presence. Leading companies invest in advanced technologies such as AI, IoT, and 3D printing to enhance functionality and expand application scope. It features a mix of established multinational corporations and emerging tech startups competing on performance, reliability, and cost efficiency. Companies aim to develop specialized solutions for demolition, bricklaying, and autonomous navigation to address labor shortages and improve productivity. Strategic moves include mergers, acquisitions, and partnerships to expand geographic reach. Strong R&D capabilities, robust distribution networks, and customized offerings remain key competitive advantages in this evolving market landscape.

Recent Developments:

- In May and June 2025, Ekso Bionics unveiled its acceptance into the NVIDIA Connect Program, marking a step towards integrating artificial intelligence into exoskeleton technology. The company has developed an AI voice agent for smarter robot control and launched “eksoUniversity” in July 2025, an online training platform for physical therapists and assistants aimed at expanding industry education.

- In March 2024, Brokk AB announced the acquisition of Aquajet Systems AB, a specialist in hydrodemolition robots. This acquisition bolsters Brokk’s offering in the construction and demolition sector, combining two leading portfolios for greater market reach and innovative demolition solutions.

- In March 2025, Madico, Inc. completed the acquisition of select assets from ClearPlex Corporation, further integrating the glass protection film supplier’s operations. This formalizes their long-term production partnership and expands Madico’s portfolio in protective films for construction and automotive segments.

- For 2025, Husqvarna AB launched new additions to its Automower lineup, the 405XE NERA and 305E NERA, designed for wire-free, advanced robotic mowing for smaller gardens. In March 2025, Husqvarna introduced the Autogrinder, a self-operating floor grinder—an important innovation for automated surface preparation in construction environments.

- In March 2024, Apis Cor received a strategic investment from U.S. home construction leader D.R. Horton. The partnership aims to deploy Apis Cor’s 3D-printing robotics technology for a multi-unit housing project in South Florida, enhancing productivity through automation.

Market Concentration & Characteristics:

The Global Construction Robotics Market exhibits moderate to high concentration, with a few dominant players holding significant shares alongside a growing pool of innovative startups. It is characterized by high entry barriers due to substantial capital investment, technical expertise requirements, and the need for compliance with safety and performance regulations. The market favors companies with strong R&D and global distribution networks. Technological innovation, scalability, and application diversification are defining features driving competitive positioning.

Report Coverage:

The research report offers an in-depth analysis based on product type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of robotics into advanced 3D printing for sustainable construction solutions.

- Increased adoption of AI-driven navigation systems for autonomous site operations.

- Rising demand for modular and prefabricated building methods supported by robotics.

- Strong growth in Asia Pacific driven by infrastructure and smart city initiatives.

- Development of multi-functional robots capable of handling multiple construction tasks.

- Greater focus on energy-efficient and low-carbon construction robotics solutions.

- Enhanced integration with BIM platforms for real-time project execution.

- Wider deployment in hazardous environments to improve worker safety.

- Strategic collaborations between robotics manufacturers and construction firms.

- Growing emphasis on training and workforce adaptation to robotics technologies.