Market Overview:

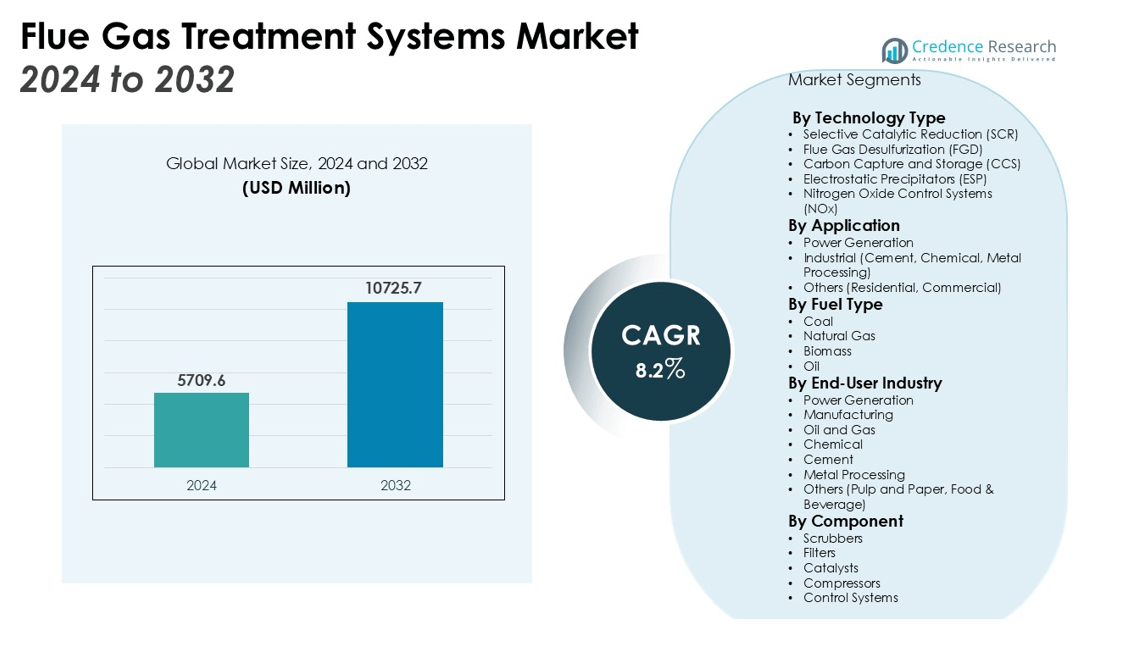

The Flue Gas Treatment Systems Market size was valued at USD 5709.6 million in 2024 and is anticipated to reach USD 10725.7 million by 2032, at a CAGR of 8.2% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flue Gas Treatment Systems Market Size 2024 |

USD 5709.6 million |

| Flue Gas Treatment Systems Market, CAGR |

8.2% |

| Flue Gas Treatment Systems Market Size 2032 |

USD 10725.7 million |

Market drivers include the rising need for industrial air pollution control, driven by tighter regulations on sulfur dioxide (SO2), nitrogen oxide (NOx), particulate matter (PM), and carbon emissions. The growing focus on reducing greenhouse gas emissions and improving air quality standards is encouraging the adoption of advanced flue gas treatment technologies. Moreover, the shift towards renewable energy sources and the modernization of industrial facilities further stimulate market expansion. Increasing investments in carbon capture and storage (CCS) technologies also play a crucial role in the market’s growth trajectory.

Regionally, North America holds a significant share of the flue gas treatment systems market, primarily due to stringent environmental policies in the U.S. and Canada. The Asia Pacific region is expected to witness the highest growth during the forecast period, driven by rapid industrialization, particularly in China and India, and increasing environmental concerns. Europe also presents substantial growth opportunities, with countries like Germany and the UK leading the way in regulatory enforcement and technological advancements in air pollution control systems. The growing focus on sustainability across all regions further amplifies demand for effective flue gas treatment solutions.

Market Insights:

- The Flue Gas Treatment Systems market was valued at USD 5709.6 million in 2024 and is expected to reach USD 10725.7 million by 2032, with a CAGR of 8.2%.

- Stringent environmental regulations, particularly for SO2, NOx, and PM emissions, drive the market’s growth.

- Growing emphasis on reducing greenhouse gas emissions encourages the adoption of advanced flue gas treatment technologies.

- The shift to renewable energy and the modernization of industrial infrastructure stimulate demand for emission control solutions.

- Technological advancements like SCR, FGD, and carbon capture technologies enhance efficiency and performance in emission control.

- High initial and operational costs limit adoption, particularly for small and medium-sized enterprises (SMEs).

- North America holds 35% of the market share, while Asia Pacific shows the highest growth due to rapid industrialization and environmental concerns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Environmental Regulations

The Flue Gas Treatment Systems market is primarily driven by increasing environmental regulations aimed at reducing air pollution. Governments worldwide have implemented stricter standards to control harmful emissions from industries, particularly sulfur dioxide (SO2), nitrogen oxide (NOx), and particulate matter (PM). These regulations have made it mandatory for industrial plants to adopt advanced flue gas treatment systems to comply with air quality standards. Tightening policies in both developed and emerging markets accelerate the adoption of pollution control technologies, thus driving market growth.

- For instance, to meet emissions standards, Mitsubishi Power installed a flue gas treatment system for a new unit at the Niederaussem power plant in Germany, designed to handle emissions for a generating capacity of 1,012 MW.

Growing Focus on Reducing Greenhouse Gas Emissions

Global concerns regarding climate change and the urgent need to curb greenhouse gas emissions significantly influence the Flue Gas Treatment Systems market. Industries are increasingly adopting cleaner technologies to meet carbon reduction targets set by international agreements, such as the Paris Agreement. The pressure to lower carbon footprints and reduce pollutants in the atmosphere pushes industries to invest in efficient flue gas treatment systems, ensuring sustainable operations and compliance with environmental laws.

- For instance, Vistra Corp. has actively reduced its carbon footprint by transitioning its power generation portfolio, which since 2010 has cut nearly 170 million metric tons of CO2 equivalent emissions.

Shift Toward Renewable Energy Sources

The global shift toward renewable energy sources is another important factor driving the Flue Gas Treatment Systems market. As industries transition from fossil fuels to cleaner alternatives, the need for sophisticated emission control technologies becomes more critical. Industries using coal, oil, and natural gas in power generation and manufacturing processes must incorporate flue gas treatment systems to mitigate harmful emissions. The growing adoption of renewable energy makes it necessary to modernize existing infrastructure, thereby creating opportunities for market growth.

Technological Advancements and Industry Modernization

Technological advancements in flue gas treatment systems fuel market growth by providing industries with more efficient, cost-effective solutions. Innovations in systems such as selective catalytic reduction (SCR), flue gas desulfurization (FGD), and carbon capture technologies offer enhanced performance in pollutant removal. Along with regulatory pressure, these advancements allow companies to meet stringent emission standards more effectively, fostering demand for improved systems and driving the overall market forward.

Market Trends:

Integration of Advanced Emission Control Technologies

The Flue Gas Treatment Systems market is witnessing a growing trend of integrating advanced emission control technologies to meet stringent environmental standards. Industries are adopting systems like Selective Catalytic Reduction (SCR), which enhances the removal of nitrogen oxides, and Flue Gas Desulfurization (FGD) systems for sulfur dioxide control. These technologies are increasingly being combined with carbon capture and storage (CCS) solutions to reduce carbon footprints. The integration of real-time monitoring and diagnostic tools also allows for improved performance tracking and system optimization. Such advancements are transforming the efficiency and effectiveness of flue gas treatment, enabling industries to comply with evolving regulations more easily.

- For instance, a selective catalytic reduction system installed by ELEX at the Cementeria di Monselice cement plant in Italy has an operating time of over 3,600 hours.

Shift Toward Modular and Retrofit Solutions

Another significant trend in the Flue Gas Treatment Systems market is the shift toward modular and retrofit solutions. As industries focus on upgrading existing plants rather than constructing new facilities, retrofitting older systems with modern pollution control technologies has gained popularity. Modular systems offer flexibility, cost savings, and quicker implementation, making them an attractive option for industries with limited downtime or capital investment capacity. This trend is particularly prominent in the power generation and industrial sectors, where retrofitting older power plants with advanced flue gas treatment technologies helps meet increasingly stringent emission standards without the need for complete infrastructure overhauls.

- For instance, a GE Vernova-led study on retrofitting the James M. Barry Electric Generating Plant found that integrating an Exhaust Gas Recirculation (EGR) system with the carbon capture facility could lower the total installed cost by $43 million.

Market Challenges Analysis:

High Initial Investment and Operational Costs

A key challenge facing the Flue Gas Treatment Systems market is the high initial investment and operational costs associated with these systems. The installation of advanced emission control technologies, such as Selective Catalytic Reduction (SCR) and Flue Gas Desulfurization (FGD), requires significant capital expenditure, which can be a barrier for small and medium-sized enterprises (SMEs). Furthermore, maintaining and operating these systems involves ongoing costs related to energy consumption, labor, and replacement parts. For many industries, the financial burden of these costs limits their ability to adopt or upgrade flue gas treatment systems, thus slowing market growth.

- For instance, Southern Company demonstrated a successful large-scale implementation of pollution control technology where the capital cost for installing a Selective Catalytic Reduction (SCR) system on a 250 MWe unit was approximately $66 per kilowatt.

Regulatory Complexity and Compliance Pressure

The complexity of regulatory frameworks poses another challenge for the Flue Gas Treatment Systems market. As environmental regulations continue to evolve, industries face difficulty keeping up with compliance requirements. Regulatory bodies in different regions set varying standards for pollutant emissions, making it challenging for companies to implement uniform solutions across global operations. This complexity increases the need for constant monitoring, system updates, and potential redesigns to meet new standards, creating additional pressure on industries.

- For instance, Southern Company effectively addressed stringent emission standards by implementing a Selective Catalytic Reduction (SCR) system that achieved a levelized cost of $1,260 per ton of nitrogen oxide removed.

Market Opportunities:

Growing Demand for Renewable Energy Integration

The Flue Gas Treatment Systems market presents significant opportunities driven by the growing demand for renewable energy integration. As industries transition to renewable energy sources such as wind, solar, and biomass, the need for advanced flue gas treatment systems to ensure clean and sustainable operations is increasing. This shift opens avenues for companies to develop and implement emission control solutions that align with renewable energy practices. In particular, the demand for carbon capture and storage (CCS) technologies in power generation and industrial sectors creates substantial growth potential for the market.

Expanding Environmental Regulations and Policy Support

The expansion of global environmental regulations and government incentives creates substantial opportunities for the Flue Gas Treatment Systems market. As governments worldwide implement stricter air quality standards and enforce emission control policies, the demand for effective treatment solutions is set to rise. Public-private partnerships and government-funded projects are expected to fuel investments in emission control technologies, particularly in emerging economies where industrialization is rapidly progressing. This regulatory support not only accelerates market adoption but also encourages innovation in flue gas treatment technologies.

Market Segmentation Analysis:

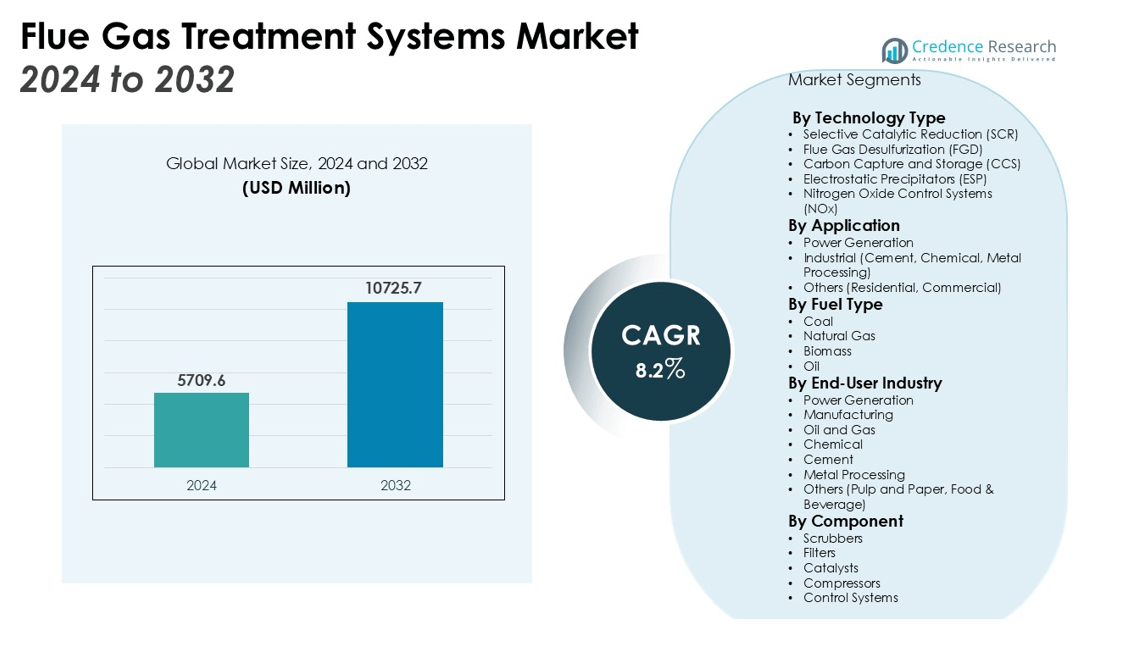

By Technology Type

The Flue Gas Treatment Systems market is segmented by technology type into Selective Catalytic Reduction (SCR), Flue Gas Desulfurization (FGD), and Carbon Capture and Storage (CCS), among others. SCR technology holds the largest market share, driven by its efficiency in reducing nitrogen oxide (NOx) emissions in various industrial applications. FGD systems are also widely adopted for sulfur dioxide (SO2) removal, especially in power generation. The increasing need for carbon capture technologies in both industrial and power sectors is creating new growth opportunities, with CCS technology gaining traction as industries focus on reducing carbon footprints.

- For instance, a large-scale FGD unit from Mitsubishi Heavy Industries for the Tianjin Dagang Power Plant in China was designed to treat 2,262,000 normal cubic meters of flue gas per hour.

By Application

The Flue Gas Treatment Systems market is segmented by application into power generation, industrial, and others. The power generation sector dominates the market due to the high emission levels from thermal power plants. Industries such as cement, chemicals, and metal processing are increasingly adopting flue gas treatment systems to comply with stringent environmental regulations. The demand for emission control technologies in industrial applications is expected to rise steadily as regulatory pressures to control air pollution intensify.

- For instance, a Waste-to-Energy plant from Mitsubishi Heavy Industries utilizes an advanced flue gas treatment system that reduces NOx emissions to 110 mg/Nm³.

By Fuel Type

The market is also segmented by fuel type, primarily into coal, natural gas, and biomass. Coal remains the dominant fuel type, contributing significantly to the global emissions that flue gas treatment systems address. However, the shift towards cleaner fuels such as natural gas and biomass is expected to influence market dynamics, with an increased adoption of cleaner emission control solutions in these sectors. The growing trend of renewable energy sources also plays a role in transforming fuel use in the market.

Segmentations:

By Technology Type

- Selective Catalytic Reduction (SCR)

- Flue Gas Desulfurization (FGD)

- Carbon Capture and Storage (CCS)

- Electrostatic Precipitators (ESP)

- Nitrogen Oxide Control Systems (NOx)

By Application

- Power Generation

- Industrial (Cement, Chemical, Metal Processing)

- Others (Residential, Commercial)

By Fuel Type

- Coal

- Natural Gas

- Biomass

- Oil

By End-User Industry

- Power Generation

- Manufacturing

- Oil and Gas

- Chemical

- Cement

- Metal Processing

- Others (Pulp and Paper, Food & Beverage)

By Component

- Scrubbers

- Filters

- Catalysts

- Compressors

- Control Systems

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Dominating with Strict Environmental Regulations

North America holds a significant share of the Flue Gas Treatment Systems market, accounting for 35% of global demand. This market leadership is driven by stringent environmental regulations and high industrial standards. The United States, in particular, has implemented strict air quality standards, which compel industries to invest in advanced flue gas treatment technologies. The U.S. Environmental Protection Agency (EPA) plays a critical role in enforcing emission limits on sulfur dioxide (SO2), nitrogen oxide (NOx), and particulate matter (PM), creating a robust market for flue gas treatment systems. The region’s focus on sustainability and clean energy also boosts the demand for advanced emission control solutions, further strengthening market growth in North America.

Europe: Progressive Technological Advancements and Strong Regulatory Frameworks

Europe represents 25% of the global Flue Gas Treatment Systems market, driven by progressive technological advancements and stringent regulatory frameworks. The European Union’s goals for reducing carbon emissions and achieving net-zero emissions create a strong demand for pollution control systems. The region has also pioneered the integration of carbon capture and storage (CCS) technologies, spurring innovation in emission reduction systems. The EU’s policy-driven approach ensures a growing market for flue gas treatment solutions, with continued investments in environmental sustainability across multiple industries.

Asia Pacific: Rapid Industrialization and Strong Growth Prospects

The Asia Pacific region is the fastest-growing market for flue gas treatment systems, holding 30% of the global market share. Rapid industrialization, particularly in China, India, and Japan, significantly boosts the demand for effective pollution control systems. The push toward cleaner technologies, coupled with increasing government initiatives and stricter air quality regulations, fuels the adoption of advanced flue gas treatment systems. China’s emphasis on environmental protection and India’s expanding industrial activities will continue to drive market growth, positioning the Asia Pacific region as a key player in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Flue Gas Treatment Systems market is highly competitive, with key players such as Siemens AG, Mitsubishi Heavy Industries, and Aker Solutions leading the way due to their extensive technological expertise and strong global presence. These companies focus on research and development to improve the efficiency of their treatment systems and meet evolving regulatory demands. Regional players like Babcock & Wilcox and Wärtsilä are also expanding their market share by offering cost-effective and customized solutions. Partnerships between companies and governments are shaping the competitive landscape, and as regulatory pressures tighten, the market is seeing an increased emphasis on advanced technologies such as carbon capture and storage (CCS) and selective catalytic reduction (SCR), positioning these firms as leaders in emission control.

Recent Developments:

- In August 2025, GE Appliances announced a historic $3 billion investment to expand its U.S. manufacturing facilities.

- In July 2025, GE HealthCare launched a new advanced digital X-ray system to improve efficiency in high-throughput medical settings.

- In June 2025, FLSmidth also announced the sale of its Air Pollution Control (APC) business to Rubicon Partners, a UK-based investment firm.

Market Concentration & Characteristics:

The Flue Gas Treatment Systems market exhibits moderate concentration, with a few large players holding a significant share, such as Siemens AG, Mitsubishi Heavy Industries, and Aker Solutions. These companies leverage advanced technologies and substantial R&D capabilities to maintain their market position. The market is characterized by a strong focus on innovation, driven by tightening environmental regulations and the need for more efficient, cost-effective emission control solutions. New entrants and regional players, such as Babcock & Wilcox and Wärtsilä, are increasing their presence by offering specialized solutions for various industries. The competition is primarily based on technological advancements, cost efficiency, and the ability to meet stringent regulatory requirements across different regions.

Report Coverage:

The research report offers an in-depth analysis based on Technology Type, Application, Fuel Type, End-User Industry, Component and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for flue gas treatment systems will continue to grow as global environmental regulations become stricter.

- Governments worldwide are likely to implement more stringent emission standards, encouraging industries to adopt advanced treatment solutions.

- Carbon capture and storage (CCS) technologies are expected to play a pivotal role in reducing carbon emissions, driving market adoption.

- Increased focus on renewable energy sources will require modifications to existing infrastructure and enhance the demand for retrofitting solutions.

- Industrial sectors, particularly power generation, cement, and chemical manufacturing, will see heightened investments in emission control systems.

- The trend towards modular and flexible solutions will gain momentum, offering industries cost-effective and easily deployable systems.

- Growing awareness and pressure for sustainable practices will lead to an increased emphasis on eco-friendly technologies in the market.

- Research and development in selective catalytic reduction (SCR) and flue gas desulfurization (FGD) technologies will enhance treatment efficiency and market offerings.

- The Asia Pacific region will remain a key growth area, driven by rapid industrialization and increasing environmental concerns.

- Partnerships and collaborations between government bodies, private enterprises, and technology providers will foster market innovation and growth.