Market Overview

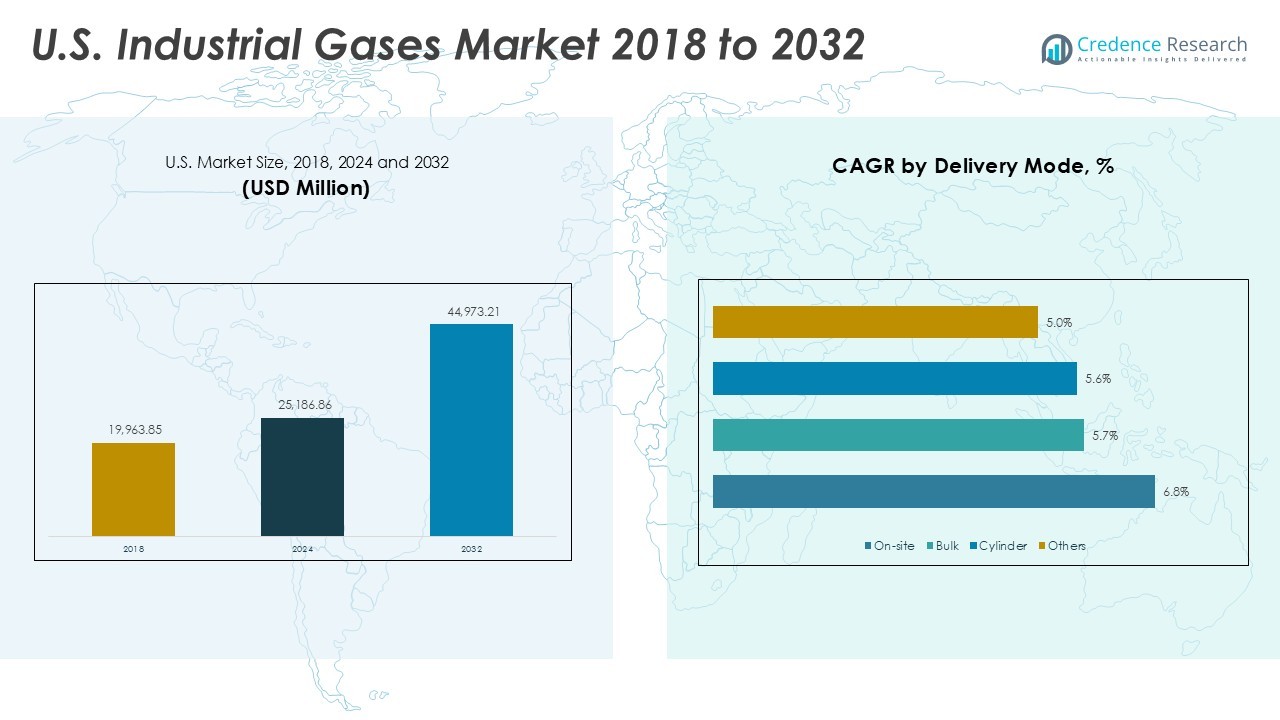

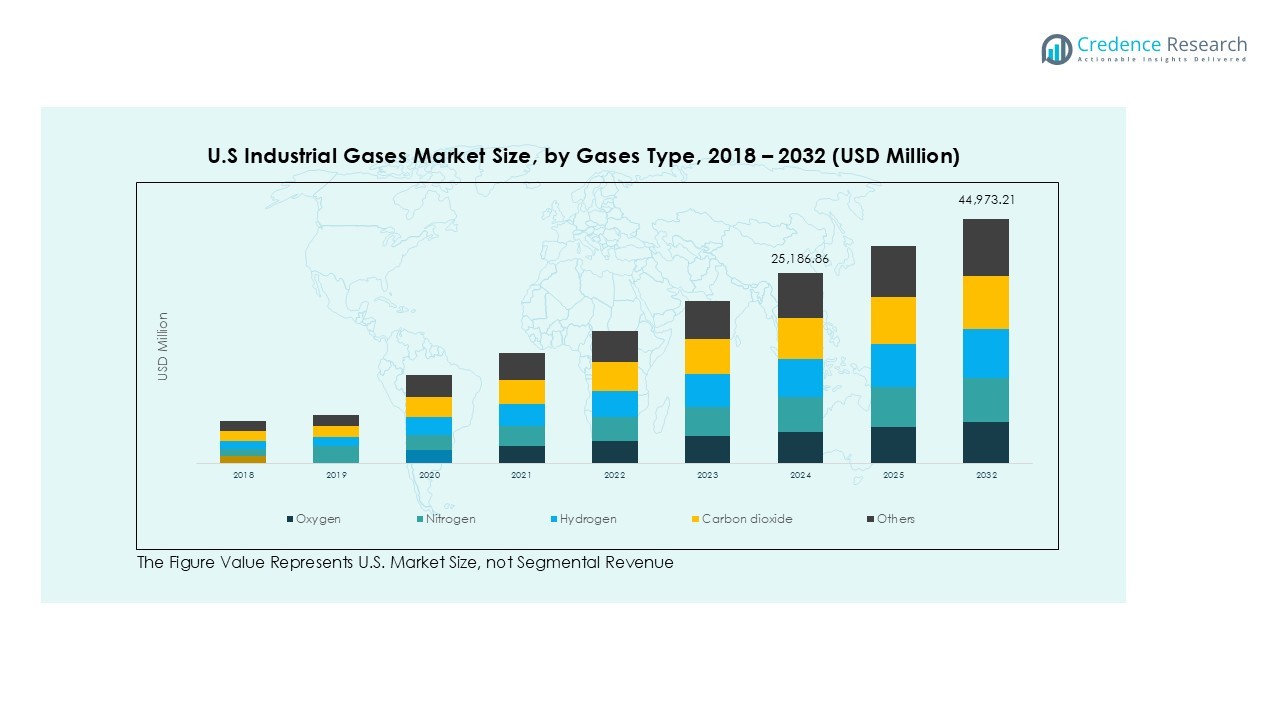

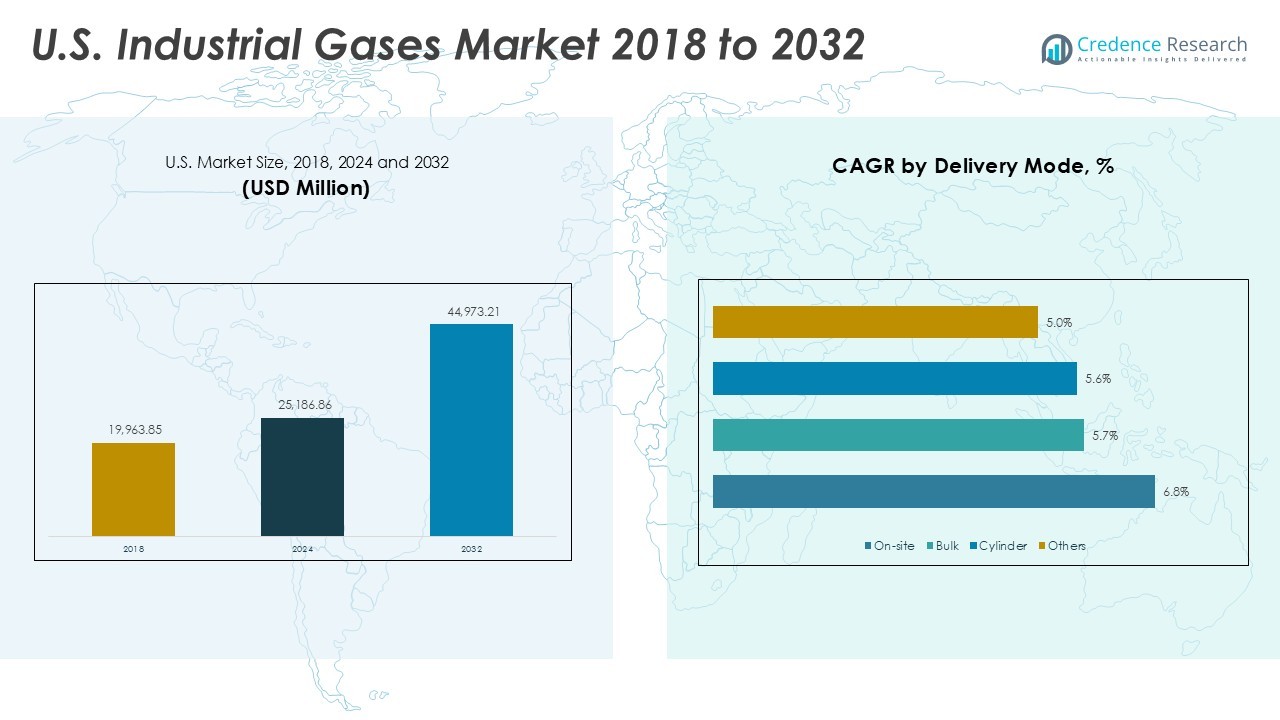

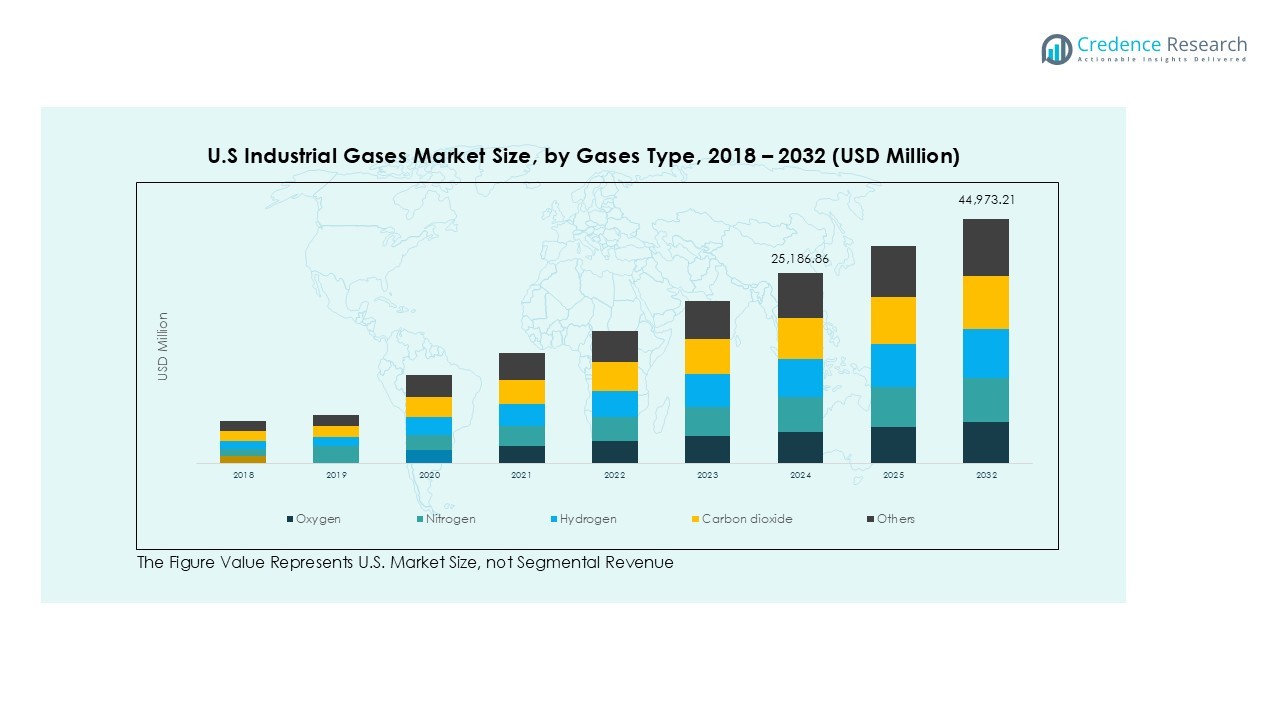

U.S. Industrial Gases market size was valued at USD 19,963.85 million in 2018, reached USD 25,186.86 million in 2024, and is anticipated to reach USD 44,973.21 million by 2032, at a CAGR of 7.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Industrial Gases Market Size 2024 |

USD 25,186.86 Million |

| U.S. Industrial Gases Market, CAGR |

7.52% |

| U.S. Industrial Gases Market Size 2032 |

USD 44,973.21 Million |

The U.S. industrial gases market is dominated by key players such as Air Liquide USA, Air Products and Chemicals, Inc., Matheson Tri-Gas, Inc., Airgas, Inc., nexAir, LLC, Universal Industrial Gases, Inc., and Cryogenic Industrial Solutions, LLC. These companies focus on expanding production capacity, on-site gas generation, and strategic partnerships to strengthen their market presence. The South region leads the market with a 31% share in 2024, driven by strong demand from petrochemical, refining, and healthcare sectors. The Midwest follows with 26% share, supported by robust manufacturing and automotive industries. Both regions are expected to sustain high growth through 2032.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. industrial gases market was valued at USD 25,186.86 million in 2024 and is projected to reach USD 44,973.21 million by 2032, growing at a 7.52% CAGR during the forecast period.

- Rising demand from healthcare, manufacturing, and energy sectors is a major driver, with oxygen and nitrogen leading gas consumption due to medical and fabrication needs.

- Key trends include growth in on-site gas generation, digital monitoring solutions, and increasing adoption of hydrogen for clean energy applications.

- The market is competitive, with leading players such as Air Liquide USA, Air Products and Chemicals, and Matheson Tri-Gas focusing on capacity expansion, partnerships, and sustainable production technologies.

- Regionally, the South holds 31% share, followed by the Midwest at 26%, supported by petrochemical hubs and manufacturing clusters, while oxygen dominates with 32% share among gas types, driven by healthcare and metal processing applications.

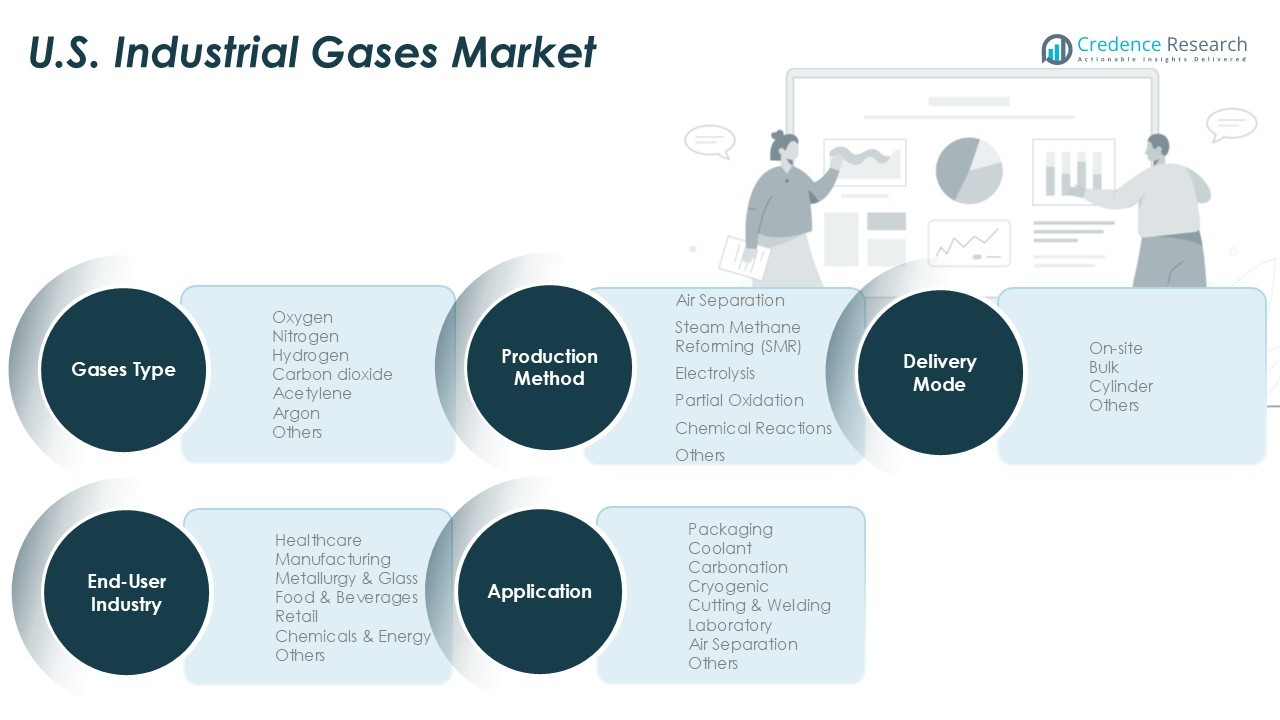

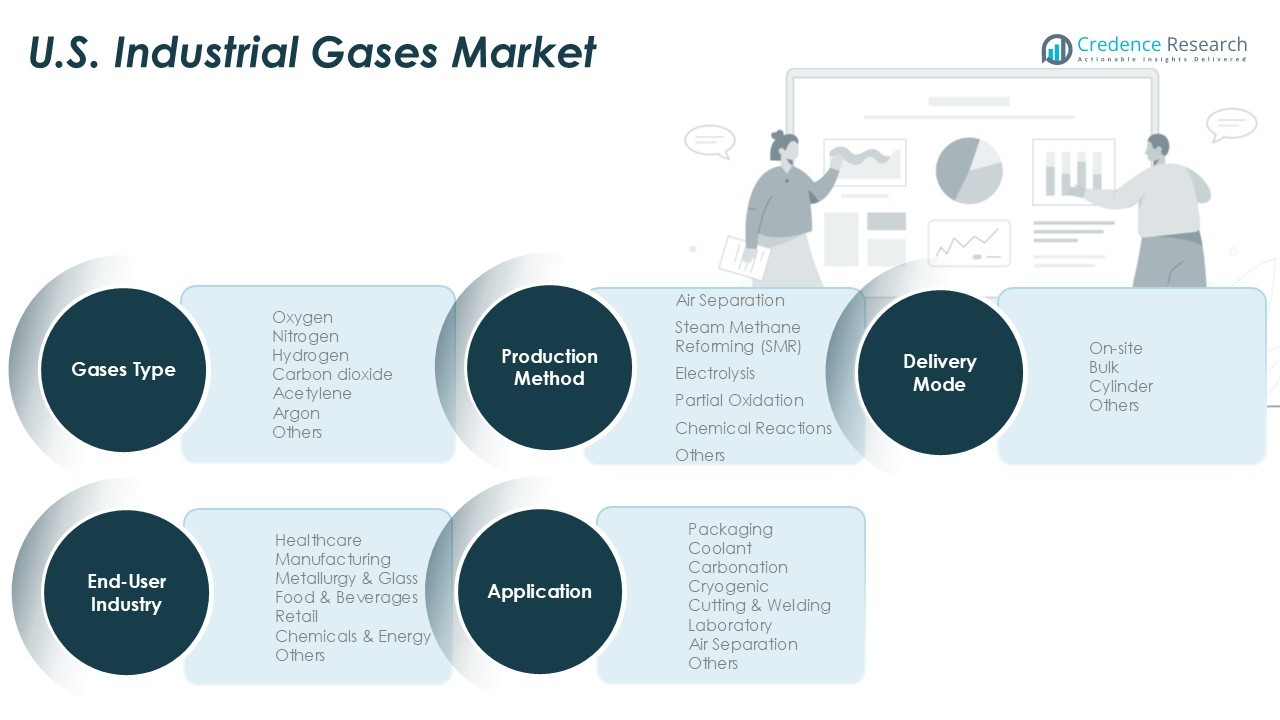

Market Segmentation Analysis:

By Gases Type

Oxygen held the largest share in the U.S. industrial gases market, contributing over 32% of total demand in 2024. Its dominance is driven by extensive use in healthcare for respiratory therapy, metal fabrication, and chemical processing. Nitrogen followed closely, supported by its role in inerting, blanketing, and food packaging to extend shelf life. Hydrogen is gaining traction due to decarbonization efforts and fuel cell applications, while carbon dioxide remains key for carbonation and welding processes. Increasing demand from manufacturing and healthcare sectors is expected to sustain oxygen’s leadership through 2032.

- For instance, the U.S. consumed over 14,000 tons of medical oxygen per day during peak demand periods, prompting major suppliers like Air Products and Linde to expand production capacity.

By Application

Cutting & welding emerged as the leading application segment, accounting for 28% market share in 2024. High consumption from metal fabrication, automotive production, and construction projects supports this dominance. Cryogenic applications are growing rapidly, driven by advancements in liquefied natural gas (LNG) storage and distribution. Carbonation and packaging also remain strong contributors, boosted by rising beverage production and demand for extended shelf-life packaging. Expanding industrial automation and precision manufacturing will continue to fuel growth across cutting & welding applications throughout the forecast period.

- For example, North American automotive production exceeded 15.6 million vehicles in 2024, each requiring thousands of weld points consuming oxygen, argon, and acetylene daily in assembly plants.

By End-User Industry

The manufacturing sector dominated with over 35% market share in 2024, reflecting strong demand for gases in metal fabrication, electronics, and process industries. Healthcare is the second-largest contributor, driven by rising medical oxygen requirements and growing hospital infrastructure. Food and beverages also show steady growth, using gases for carbonation, freezing, and modified atmosphere packaging. Increasing investments in clean energy projects are boosting demand from the chemicals & energy sector. The continued expansion of U.S. manufacturing and healthcare infrastructure will secure manufacturing’s lead through 2032.

Key Growth Drivers

Expanding Healthcare and Medical Applications

The growing demand for medical oxygen is a primary driver for the U.S. industrial gases market. Hospitals and home healthcare facilities rely heavily on oxygen therapy, respiratory support, and anesthesia gases. Rising incidences of respiratory diseases and aging population trends further boost consumption. Investments in hospital infrastructure and government healthcare programs support steady demand growth. Additionally, emergency preparedness initiatives, including pandemic response strategies, are pushing for higher oxygen production capacities, ensuring a resilient supply chain and long-term growth potential for medical and specialty gases.

- For instance, during 2024, U.S. healthcare providers relied on major industrial gas suppliers, including Air Products, Linde, and Messer, for their medical oxygen needs.

Growth in Manufacturing and Fabrication Activities

Robust manufacturing growth fuels demand for industrial gases, particularly in metal cutting, welding, and fabrication. Expanding automotive production, aerospace manufacturing, and infrastructure development projects significantly raise oxygen, acetylene, and argon consumption. Precision manufacturing techniques depend on high-purity gases for efficiency and safety. The shift toward Industry 4.0, automation, and robotics further drives demand for reliable gas supplies. These applications are supported by investments in semiconductor fabrication, electronics, and additive manufacturing, creating opportunities for suppliers to expand distribution networks and develop on-site gas generation systems.

- For example, U.S. light vehicle production reached approximately 10.7 million units in 2024, with each assembly plant consuming thousands of cubic meters of welding gases daily.

Rising Adoption of Clean Energy and Hydrogen Economy

Hydrogen is emerging as a major growth engine as the U.S. accelerates its clean energy transition. Federal and state incentives are promoting green hydrogen projects for fuel cell vehicles, power generation, and industrial decarbonization. Industrial gas suppliers are investing in large-scale hydrogen production, storage, and distribution infrastructure. Carbon capture and utilization technologies are also driving carbon dioxide demand. This transition aligns with net-zero targets and creates a sustainable growth pathway, positioning industrial gases as enablers of decarbonization across transportation, chemicals, and energy-intensive manufacturing industries.

Key Trends & Opportunities

On-Site Gas Generation and Digitalization

The market is witnessing a shift toward on-site gas generation systems, especially for large manufacturing and healthcare facilities. This reduces logistics costs, improves supply security, and ensures continuous operations. Companies are integrating IoT-enabled monitoring systems to track gas purity, pressure, and usage in real time. Digitalization allows predictive maintenance and helps optimize consumption patterns, lowering overall operational costs. This trend offers opportunities for industrial gas suppliers to provide customized solutions, strengthen long-term contracts, and develop service-based business models to enhance customer retention.

- For instance, Air Products and Linde have installed on-site oxygen and nitrogen plants capable of producing more than 2,000 tons per day at U.S. steel and chemical facilities, reducing cylinder and bulk transport needs.

Growth in Specialty and High-Purity Gases

Rising demand for specialty gases in semiconductors, electronics, and pharmaceuticals presents strong growth opportunities. High-purity nitrogen, argon, and helium are critical for chip manufacturing, medical diagnostics, and research labs. The U.S. semiconductor manufacturing expansion, supported by federal incentives, will drive demand for electronic-grade gases. Additionally, increased R&D spending in biotechnology and drug development is boosting laboratory gas consumption. Suppliers focusing on purity assurance and consistent quality will benefit from premium pricing and long-term supply agreements with high-tech and life sciences companies.

- For example, Intel’s new fabs in Ohio and Arizona are designed with on-site nitrogen generation systems capable of supplying thousands of Nm³/hr of electronic-grade nitrogen to support continuous chip production.

Key Challenges

Price Volatility and Energy Costs

Fluctuating energy prices significantly impact production costs of industrial gases, particularly oxygen, hydrogen, and nitrogen. Air separation units and hydrogen production facilities consume large amounts of electricity, making profitability sensitive to energy market swings. Rising fuel and logistics costs further pressure margins. Passing these cost increases to end users can be difficult due to long-term contracts, impacting revenue stability. Companies are investing in energy-efficient production technologies and renewable-powered facilities to mitigate these challenges, but capital requirements remain a barrier for smaller suppliers.

Regulatory and Safety Compliance

Strict regulations for handling, storage, and transportation of industrial gases pose operational challenges. Safety standards for pressurized gases, hazardous material classification, and environmental emission controls require continuous monitoring and compliance investments. Failure to meet regulatory requirements can lead to penalties, legal liabilities, and reputational damage. Frequent audits and worker safety training add to operational costs. Suppliers must adopt advanced monitoring systems and implement robust risk management practices to maintain compliance and ensure safe operations across production and distribution networks.

Regional Analysis

Northeast Region

The Northeast region accounted for 22% of the U.S. industrial gases market in 2024, driven by its strong healthcare infrastructure and pharmaceutical manufacturing presence. High demand for medical oxygen, nitrogen, and specialty gases comes from hospitals, research labs, and biotech facilities. The region’s concentration of food and beverage producers supports significant carbon dioxide consumption for carbonation and packaging. Growth is further boosted by urban development and construction projects requiring cutting and welding gases. Continuous investments in healthcare facilities and innovation hubs in states like New York, New Jersey, and Massachusetts are expected to sustain regional demand through 2032.

Midwest Region

The Midwest region represented 26% of the U.S. industrial gases market in 2024, emerging as the second-largest market. Its dominance is fueled by strong manufacturing and automotive production clusters in Michigan, Ohio, and Illinois. High consumption of oxygen, acetylene, and argon supports welding and metal fabrication industries. Expanding food processing facilities across the region drive demand for nitrogen and carbon dioxide for freezing and preservation. Growing focus on renewable energy and hydrogen infrastructure projects in the Midwest is further supporting demand, positioning this region as a critical hub for industrial gases during the forecast period.

South Region

The South led the U.S. industrial gases market with 31% share in 2024, making it the largest regional contributor. Its dominance is attributed to large petrochemical complexes, energy production facilities, and a rapidly growing healthcare sector. Texas and Louisiana are key demand centers for hydrogen, oxygen, and nitrogen due to refining, chemical manufacturing, and LNG operations. Food and beverage industries in states like Georgia and Florida further drive carbon dioxide demand. Population growth and infrastructure investments are fueling long-term opportunities, reinforcing the South’s position as the leading region for industrial gases consumption through 2032.

West Region

The West region held 21% of the U.S. industrial gases market in 2024, supported by a strong presence of technology, semiconductor, and aerospace industries. High-purity gases such as nitrogen and argon are critical for electronics manufacturing and research applications in California and Arizona. Expanding healthcare networks and biotechnology companies contribute to rising oxygen and specialty gas consumption. Growing clean energy initiatives, including green hydrogen projects, also add to regional demand. Increasing investment in semiconductor fabs and clean energy infrastructure is expected to accelerate market growth, positioning the West as a key innovation-driven market segment by 2032.

Market Segmentations:

By Gases Type

- Oxygen

- Nitrogen

- Hydrogen

- Carbon Dioxide

- Acetylene

- Argon

- Others

By Application

- Packaging

- Coolant

- Carbonation

- Cryogenic

- Cutting & Welding

- Laboratory

- Air Separation

- Others

By End-User Industry

- Healthcare

- Manufacturing

- Metallurgy & Glass

- Food & Beverages

- Retail

- Chemicals & Energy

- Others

By Production Method

- Air Separation

- Steam Methane Reforming (SMR)

- Electrolysis

- Partial Oxidation

- Chemical Reactions

- Others

By Delivery Mode

- On-site

- Bulk

- Cylinder

- Others

By Geography

- Northeast Region

- Midwest Region

- South Region

- West Region

Competitive Landscape

The U.S. industrial gases market is highly competitive, led by major players such as Air Liquide USA, Air Products and Chemicals, Inc., Matheson Tri-Gas, Inc., Airgas, Inc., and nexAir, LLC. These companies compete on product portfolio breadth, distribution networks, and technological innovation. Strategic partnerships, capacity expansions, and investments in hydrogen infrastructure are common growth approaches. For instance, Air Products has invested heavily in blue and green hydrogen projects, strengthening its role in the energy transition. Air Liquide focuses on expanding on-site production facilities and digital monitoring solutions to enhance supply reliability. Regional players like Universal Industrial Gases and Cryogenic Industrial Solutions cater to niche markets with customized solutions. Mergers, acquisitions, and long-term supply agreements with end users in manufacturing, healthcare, and energy sectors remain critical strategies. Continuous innovation in gas purification, storage, and delivery technologies is shaping competition and enabling players to meet rising demand efficiently.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Air Liquide USA

- Air Products and Chemicals, Inc.

- Universal Industrial Gases, Inc.

- nexAir, LLC

- Cryogenic Industrial Solutions, LLC

- Matheson Tri-Gas, Inc.

- Airgas, Inc.

Recent Developments

- In October 2024, Air Liquide announced to supply oxygen to LG Chem for their electric vehicle battery plant in the U.S. Supplying oxygen to LG Chem’s future cathode active material plant, the Group will be supporting the growth of the battery ecosystem in the U.S. This investment will increase the Group’s footprint in a key region and support the development of its industrial merchant market.

- In October 2024, Linde announced an agreement with Tata Steel to obtain and manage two additional Air Separation Units (ASUs) and enhance industrial gas supply to Tata Steel in Odisha, India. This arrangement will more than double Linde’s on-site capacity at Tata Steel’s Kalinganagar facility, where it presently runs two plants. The new ASUs, anticipated to be operational by 2025, will deliver oxygen, nitrogen, and argon to aid Tata Steel’s expansion project and cater to the local merchant market. Linde has additionally acquired renewable energy agreements to lower its scope emissions, in line with its 2035 GHG reduction goals.

- In July 2024, Air Liquide announced an investment of USD 104.914 million to support Aurubis AG, a major global provider of non-ferrous metals and one of the largest recyclers of copper worldwide, in Bulgaria and Germany. This investment will finance a new Air Separation Unit (ASU) in Bulgaria and the upgrading of four existing units in Germany. Besides supplying substantial amounts of oxygen and nitrogen for the rising copper and other metal production by Aurubis, these facilities will also assist in the growth of industrial merchant markets in both areas.

- In January 2024, Air Products, a company in industrial gases and clean hydrogen projects, announced the opening of its expanded Project Delivery Centre in Vadodara, India.

- In July 2023, Nippon Sanso Holdings Corporation announced that Matheson Tri-Gas, Inc, NSHD’s U. S. operating entity, has entered into a gas supply contract with PointFive to deliver oxygen for the carbon capture, utilization, and sequestration company’s inaugural Direct Air Capture (DAC*) facility in Texas. MATHESON will invest in and set up an Air Separation Unit to provide oxygen to “Stratos,” PointFive’s DAC facility currently under construction in Ector County, Texas. The oxygen is utilized in the DAC process to generate a pure stream of CO2, which is subsequently securely sequestered in geological reservoirs.

Report Coverage

The research report offers an in-depth analysis based on Gases Type, Application, End-User Industry, Production Method, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue growing steadily with strong demand from manufacturing and healthcare sectors.

- Hydrogen adoption will rise as clean energy projects and fuel cell technologies expand nationwide.

- On-site gas generation systems will gain popularity to improve supply security and reduce logistics costs.

- Digital monitoring and IoT-enabled solutions will optimize gas usage and lower operational expenses.

- Specialty and high-purity gases will see increased demand from semiconductor and pharmaceutical industries.

- Healthcare will remain a key consumer, driven by rising medical oxygen requirements and infrastructure expansion.

- Strategic partnerships and mergers will strengthen market presence and expand distribution networks.

- Energy-efficient production technologies will be widely adopted to offset high power costs.

- Regional growth will stay strongest in the South due to petrochemical and LNG projects.

- Sustainability initiatives and carbon capture projects will boost demand for industrial and specialty gases.