Market Overview:

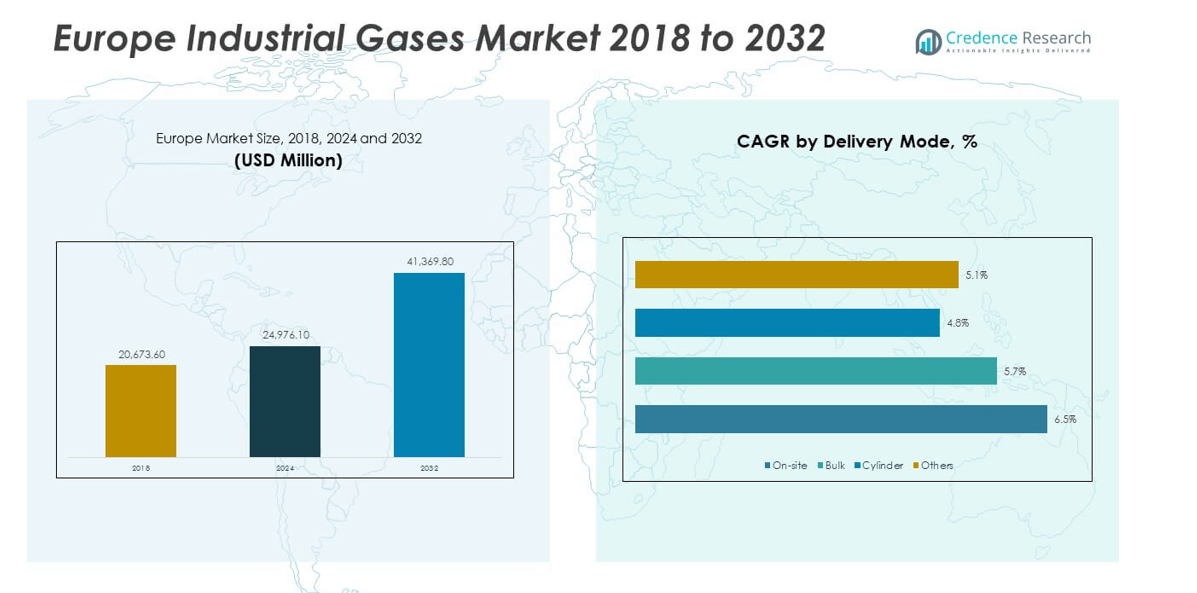

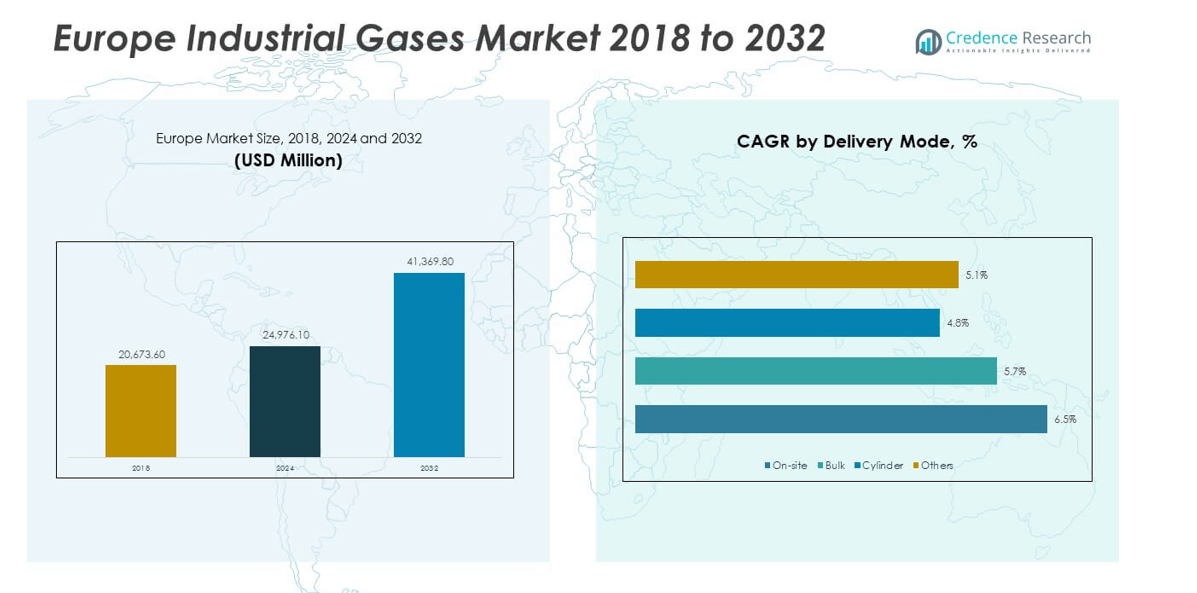

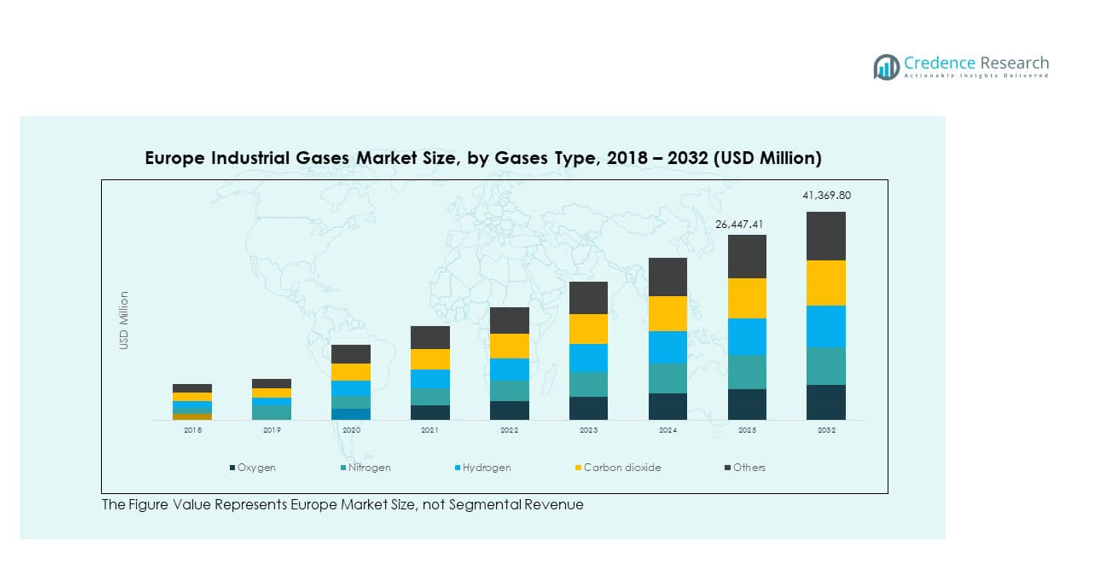

The Europe Industrial Gases Market size was valued at USD 20,673.60 million in 2018, increased to USD 24,976.10 million in 2024, and is anticipated to reach USD 41,369.80 million by 2032, at a CAGR of 6.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Industrial Gases Market Size 2024 |

USD 24,976.10 million |

| Europe Industrial Gases Market, CAGR |

6.47% |

| Europe Industrial Gases Market Size 2032 |

USD 41,369.80 million |

Growth in the Europe Industrial Gases Market is driven by expanding industrial production, increasing healthcare demand, and rising adoption of cleaner manufacturing processes. Industries such as chemicals, metal fabrication, food processing, and electronics use industrial gases for efficient operations. The growing need for oxygen and nitrogen in medical applications and the steel sector’s recovery across major economies further accelerate demand. Technological advancements in gas separation and storage systems also support market expansion across diverse industries.

Western Europe leads the market due to its strong industrial base, advanced infrastructure, and focus on energy-efficient manufacturing. Countries like Germany, France, and the UK dominate because of well-established end-use industries and investments in clean energy. Eastern European nations are emerging rapidly, supported by industrial modernization, foreign investments, and expanding healthcare facilities. The growing emphasis on environmental compliance and low-emission technologies enhances regional market opportunities across Europe.

Market Insights:

- The Europe Industrial Gases Market was valued at USD 20,673.60 million in 2018, increased to USD 24,976.10 million in 2024, and is projected to reach USD 41,369.80 million by 2032, growing at a CAGR of 6.47% during the forecast period.

- Western Europe dominated the market with a 58% share in 2024, driven by advanced industrial infrastructure and high gas consumption in manufacturing, energy, and healthcare sectors across Germany, France, and the UK. Southern Europe followed with a 22% share, supported by Italy and Spain’s expanding food processing, metal fabrication, and construction industries. Eastern and Northern Europe together accounted for 20%, reflecting industrial recovery and ongoing energy transition initiatives.

- The fastest-growing region is Eastern Europe, holding 12% of the total share in 2024. Its rapid expansion is fueled by industrial modernization, foreign investments, and rising demand from metallurgy, energy, and healthcare sectors.

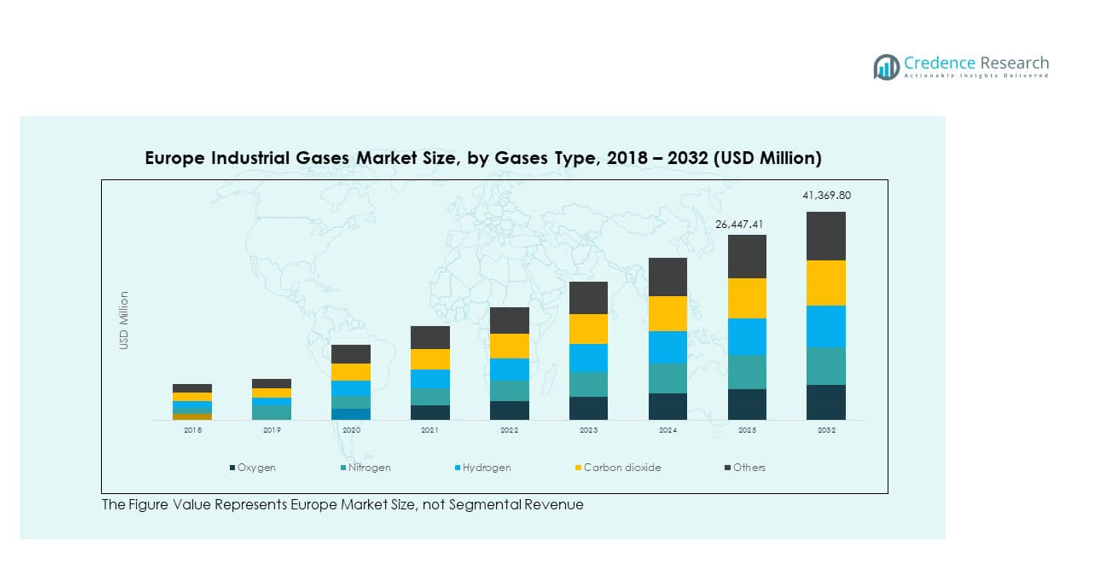

- By gas type, oxygen dominated with an estimated 32% share in 2024, primarily due to its extensive use in steel production, healthcare, and chemical applications across the region.

- Nitrogen held a 25% share, while carbon dioxide captured about 18%, supported by increasing demand in food packaging, beverage carbonation, and refrigeration industries across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Manufacturing and Processing Industries

The Europe Industrial Gases Market experiences strong growth due to the expanding manufacturing and processing sectors. Industrial gases play a key role in metal fabrication, automotive production, and chemical processing. Oxygen, nitrogen, and hydrogen are essential for welding, refining, and material treatment. The rising shift toward automation and high-precision processes increases gas consumption across factories. Food and beverage companies rely on gases for packaging and preservation. Growing investment in advanced production systems supports steady demand. Industrial recovery across Europe ensures long-term market stability and consistent growth.

- For instance, Air Liquide inaugurated a new air separation unit (ASU) in Moerdijk, Netherlands, in December 2022. This facility produces 2,200 tonnes of oxygen per day and supplies high-purity gases for chemical, glass, and steel industries, using 10% less energy compared to earlier plants.

Expanding Healthcare Applications and Medical Gas Utilization

The growing healthcare sector drives significant demand for industrial gases across Europe. Hospitals and clinics use oxygen, nitrous oxide, and carbon dioxide for respiratory care and anesthesia. The aging population increases the need for medical-grade gases in treatment and diagnostic applications. Pharmaceutical manufacturing relies on nitrogen and clean gases for controlled environments. The COVID-19 pandemic highlighted the importance of stable gas supply chains in hospitals. Ongoing healthcare investments and better infrastructure support demand growth. The Europe Industrial Gases Market benefits from this continuous medical reliance and improved gas delivery systems.

- For instance, German healthcare providers are expanding home-based oxygen therapy because of a rising elderly population and demand for portable and high-capacity cylinders. Major players like Linde and Air Liquide are delivering medical oxygen for hospital and home settings to support chronic respiratory care and emergency needs, driving up advanced delivery systems.

Focus on Cleaner Energy and Green Manufacturing Initiatives

The rising emphasis on low-emission production enhances gas adoption in industrial operations. Many manufacturers replace fossil fuels with cleaner hydrogen and oxygen-based energy processes. Governments support green transformation through sustainability programs and emission regulations. Industries adopt hydrogen as a fuel for transport, refining, and energy storage applications. Demand for carbon capture and storage technologies grows across Europe’s power and industrial sectors. The Europe Industrial Gases Market gains traction through its role in decarbonization initiatives. Expanding renewable hydrogen production creates new market opportunities for suppliers and producers.

Technological Advancements in Gas Production and Distribution Systems

Innovation in air separation and gas liquefaction technologies improves energy efficiency and output. Companies deploy digital monitoring and automation to enhance distribution and safety. Improved cryogenic storage and cylinder management systems reduce losses and operational risks. Integration of IoT-enabled systems strengthens reliability and delivery accuracy. Hybrid energy systems further optimize gas generation and blending processes. The Europe Industrial Gases Market benefits from such advanced infrastructure. Growing investments in smart gas networks enhance supply continuity and support industrial productivity. These advancements sustain competitive advantage and operational excellence.

Market Trends:

Transition Toward Hydrogen Economy and Energy Decarbonization

The European region is rapidly adopting hydrogen as a central energy carrier. Governments fund hydrogen infrastructure and pilot projects to reduce carbon emissions. Industrial players shift toward green hydrogen production using renewable power sources. The Europe Industrial Gases Market benefits from rising hydrogen use in transport and manufacturing. Companies expand electrolyzer capacity and invest in large-scale hydrogen hubs. The trend aligns with Europe’s climate goals and energy transition policies. Strong collaboration between industries and governments accelerates the hydrogen economy’s expansion.

- For instance, Iberdrola commissioned Europe’s largest industrial green hydrogen plant in Puertollano, Spain, operating a 20 MW electrolyzer and producing around 3,000 tonnes of green hydrogen per year for ammonia production and fertilizer decarbonization.

Growing Demand for Specialty and High-Purity Gases in Advanced Industries

Advanced industries such as electronics, semiconductors, and pharmaceuticals drive demand for specialty gases. High-purity gases ensure precision, consistency, and safety in complex processes. The Europe Industrial Gases Market experiences strong growth from these sectors. Technological miniaturization and cleanroom requirements elevate gas purity standards. Semiconductor fabrication and medical device production rely on ultra-pure nitrogen and argon. Companies invest in refining technologies to meet strict industry demands. Rising R&D activities in material science further increase specialty gas consumption.

- For instance, Messer commissioned on-site nitrogen plants for electronics and automotive manufacturing, with newly built facilities producing nitrogen on the grounds of Harman Becker Automotive System Manufacturer in Hungary to supply high-purity nitrogen, reducing carbon footprint compared to previous delivery models.

Digitalization and Smart Supply Chain Integration in Gas Operations

Industrial gas suppliers adopt digital technologies to enhance operational efficiency. Smart meters, predictive analytics, and remote monitoring improve delivery scheduling and asset management. The Europe Industrial Gases Market evolves toward intelligent logistics and automation. IoT-based tracking enhances transparency and reduces downtime. AI-driven forecasting models improve inventory optimization. Customers gain better control over gas usage and supply continuity. This digital shift enables cost efficiency, operational reliability, and improved sustainability across gas networks.

Shift Toward Circular Economy and Carbon Utilization Technologies

Sustainability goals encourage industries to reuse and recycle carbon emissions. Companies invest in carbon capture, utilization, and storage (CCUS) technologies to minimize waste. The Europe Industrial Gases Market benefits from growing interest in circular production systems. Captured CO₂ finds applications in beverages, green fuels, and chemicals. Governments promote emission trading and green funding to support adoption. Partnerships between industrial firms and research institutions foster innovation. This trend aligns industrial growth with Europe’s broader climate-neutral objectives.

Market Challenges Analysis:

High Production Costs and Energy Dependence Affecting Competitiveness

The energy-intensive nature of gas production creates significant cost pressure across the industry. Rising electricity prices in Europe affect profitability and limit production scalability. The Europe Industrial Gases Market faces challenges in maintaining competitive pricing. Energy costs directly influence air separation and liquefaction efficiency. Fluctuating natural gas prices impact hydrogen and ammonia synthesis costs. Suppliers struggle to balance affordability with operational sustainability. Dependence on energy imports increases vulnerability to market volatility. Cost optimization through renewables integration remains a critical necessity.

Stringent Environmental Regulations and Complex Compliance Frameworks

Europe enforces strict environmental and safety regulations on gas production and distribution. The compliance process demands continuous monitoring and costly technological upgrades. The Europe Industrial Gases Market encounters operational barriers due to emission limits and storage norms. Companies must adopt eco-friendly technologies to meet regulatory expectations. Safety standards for gas transport and storage add further financial strain. Smaller producers face challenges in adapting to evolving rules. Achieving carbon neutrality while maintaining supply efficiency requires heavy investment. These challenges influence long-term market entry and expansion plans.

Market Opportunities:

Expansion of Green Hydrogen Infrastructure and Renewable Energy Integration

Europe’s strong commitment to renewable energy opens opportunities for industrial gas producers. The continent’s focus on hydrogen infrastructure expansion drives new investment avenues. The Europe Industrial Gases Market gains potential from government-backed hydrogen roadmaps. Partnerships between energy and industrial firms promote large-scale electrolysis projects. Green hydrogen development supports decarbonization of heavy industries. Increased funding for fuel-cell technologies enhances gas market visibility. This transition strengthens the region’s role as a clean energy hub.

Rising Adoption in Emerging Sectors Such as Food, Electronics, and Biotechnology

The growing diversification of industrial applications creates new demand sources. Sectors such as biotechnology, semiconductors, and advanced food processing increasingly rely on gas technologies. The Europe Industrial Gases Market benefits from the expanding use of high-purity gases. Biotechnology firms use gases for fermentation and preservation processes. Electronics producers depend on argon and nitrogen for fabrication precision. Rapid growth in packaged food industries increases gas-based preservation needs. These sectors create scalable and sustainable revenue opportunities across Europe.

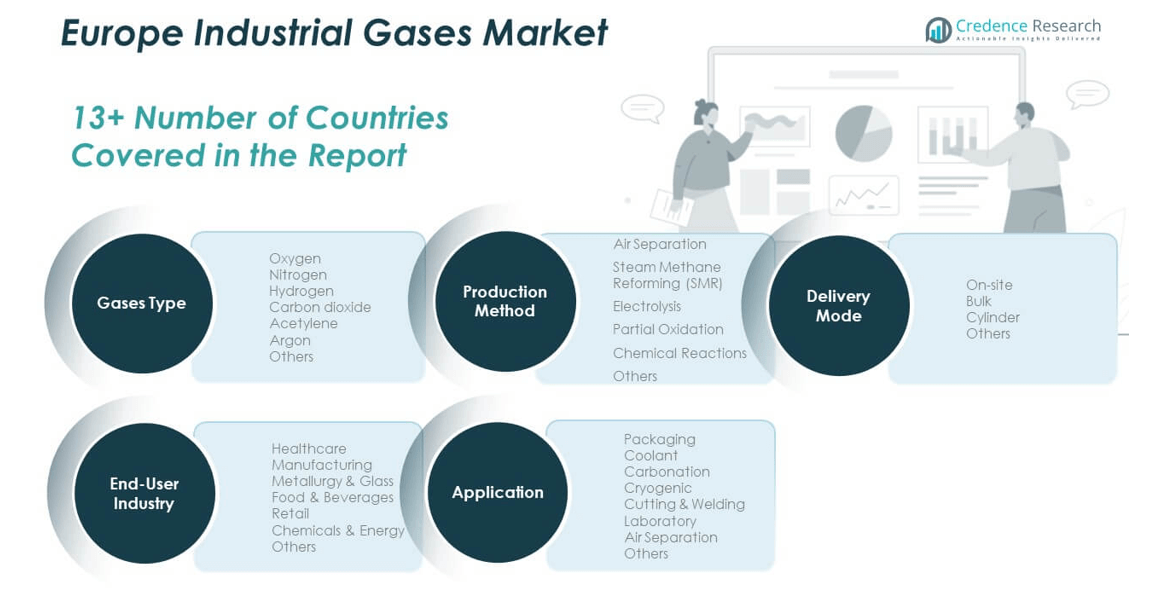

Market Segmentation Analysis:

By Gases Type

The Europe Industrial Gases Market is segmented into oxygen, nitrogen, hydrogen, carbon dioxide, acetylene, argon, and others. Oxygen dominates due to its wide use in steelmaking, healthcare, and chemical processing. Nitrogen holds strong demand in food preservation and electronics. Hydrogen gains traction from energy transition projects, while carbon dioxide remains essential in beverages and refrigeration. Argon supports metal fabrication and welding, ensuring consistent growth across industries.

- For instance, Nippon Gases Europe introduced its first hydrogen-powered truck in Germany in January 2025 for dry ice deliveries, reducing CO₂ emissions by up to 69,000 kilograms annually compared to diesel lorries and representing a major move toward greener industrial gas logistics.

By Application

Industrial gases find extensive applications in packaging, coolant systems, carbonation, cryogenic storage, cutting and welding, laboratories, and air separation. Packaging and welding applications lead the segment due to strong industrial and food sector activity. Cryogenic and laboratory applications rise with medical and research expansion across Europe.

By End-User Industry

Key end-user industries include healthcare, manufacturing, metallurgy and glass, food and beverages, retail, and chemicals and energy. Healthcare and manufacturing remain dominant, supported by medical oxygen use and high industrial output. Food and beverage and metallurgy sectors display steady gas demand due to process precision and quality needs.

By Production Method

Air separation units lead production, followed by steam methane reforming and electrolysis. Growing hydrogen adoption strengthens electrolysis investments. Partial oxidation and chemical reactions provide complementary gas production streams for industrial applications.

By Delivery Mode

On-site and bulk delivery dominate due to continuous large-scale industrial operations. Cylinder distribution supports smaller users requiring flexibility and transport efficiency.\

Segmentation:

By Gases Type:

- Oxygen

- Nitrogen

- Hydrogen

- Carbon Dioxide

- Acetylene

- Argon

- Others

By Application:

- Packaging

- Coolant

- Carbonation

- Cryogenic

- Cutting & Welding

- Laboratory

- Air Separation

- Others

By End-User Industry:

- Healthcare

- Manufacturing

- Metallurgy & Glass

- Food & Beverages

- Retail

- Chemicals & Energy

- Others

By Production Method:

- Air Separation

- Steam Methane Reforming (SMR)

- Electrolysis

- Partial Oxidation

- Chemical Reactions

- Others

By Delivery Mode:

- On-site

- Bulk

- Cylinder

- Others

By Country:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe: Dominant Regional Market with Strong Industrial Integration

Western Europe leads the Europe Industrial Gases Market, accounting for nearly 58% of the total market share in 2024. The region benefits from well-established industries in Germany, France, and the United Kingdom. These countries have strong demand from manufacturing, healthcare, and automotive sectors. Germany remains the largest contributor due to its advanced engineering and high-volume production facilities. France follows with a robust chemical and energy base, while the UK shows consistent growth in healthcare and packaging applications. The presence of key players such as Linde plc and Air Liquide strengthens supply networks and supports innovation.

Southern Europe: Emerging Demand Driven by Construction and Food Processing

Southern Europe holds about 22% of the market share, driven by industrial recovery and rising construction activity. Italy and Spain lead this sub-region with growing use of gases in food processing, metal fabrication, and glass manufacturing. Demand for oxygen and nitrogen has risen due to increased infrastructure projects and export-oriented industries. The region also benefits from government initiatives promoting sustainable industrial operations. Local manufacturers and global suppliers are expanding gas storage and distribution facilities to meet rising needs. It continues to show solid growth potential, particularly in energy and materials sectors.

Eastern and Northern Europe: Expanding Industrial Base and Energy Transition Opportunities

Eastern and Northern Europe collectively represent nearly 20% of the market share, showing steady growth from expanding industrialization. Russia, Poland, and Nordic nations contribute through energy, metallurgy, and chemical production. The Europe Industrial Gases Market in these regions benefits from increasing hydrogen and carbon capture projects. Nordic countries invest in clean energy and sustainable gas infrastructure to reduce emissions. Russia remains a significant exporter of industrial gases, supporting both domestic and international demand. Growing foreign investment and cross-border collaborations drive technology adoption and enhance the regional supply network. These trends strengthen long-term market expansion across emerging European economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Linde plc

- Air Liquide S.A.

- Messer Group GmbH

- SOL Group

- SIAD S.p.A.

- Iwatani Corporation

- Taiyo Nippon Sanso Corporation

- Praxair Europe

- Air Products and Chemicals, Inc.

Competitive Analysis:

The Europe Industrial Gases Market is highly consolidated, with a few global players dominating supply and technology innovation. Linde plc and Air Liquide S.A. maintain strong market leadership supported by extensive production capacity and broad distribution networks. Air Products and Chemicals, Inc., Messer Group GmbH, and SOL Group further strengthen competition through technological expertise and regional partnerships. The market’s focus on clean energy and sustainability drives investment in hydrogen and carbon capture solutions. It remains competitive, with firms prioritizing safety, operational efficiency, and value-added service expansion.

Recent Developments:

- In September 2025, Linde plc secured funding to expand green hydrogen production at its Leuna, Germany facility, in line with its strategy to grow hydrogen infrastructure in Europe.

- In 2025, Air Liquide S.A. and Siemens Energy are continuing their verified joint venture for large-scale electrolyzer manufacturing in Europe, projecting capacity ramp-up to three gigawatts by the end of 2025, with recent deliveries reported in September 2025.

- In November 2023 (close to 2024), Messer Group GmbH completed its acquisition of all shares in Messer Industries, bringing GIC on as a strategic minority partner, and this includes its activities in Europe.

Report Coverage:

The research report offers an in-depth analysis based on gases type, application, end-user industry, production method, delivery mode, and country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing hydrogen adoption will reshape energy and mobility sectors.

- Demand for oxygen and nitrogen will rise in healthcare and metallurgy.

- Technological innovations will enhance gas storage and safety systems.

- Strategic partnerships will accelerate green hydrogen and CCUS projects.

- Food processing and packaging will emerge as strong growth applications.

- Sustainability regulations will favor eco-friendly gas production methods.

- Eastern Europe will show robust expansion in manufacturing and healthcare.

- Digitalization will streamline gas delivery and operational efficiency.

- Mergers and acquisitions will strengthen competitive positioning.

- Investments in renewable-powered gas plants will define the next growth phase.