Market Overview

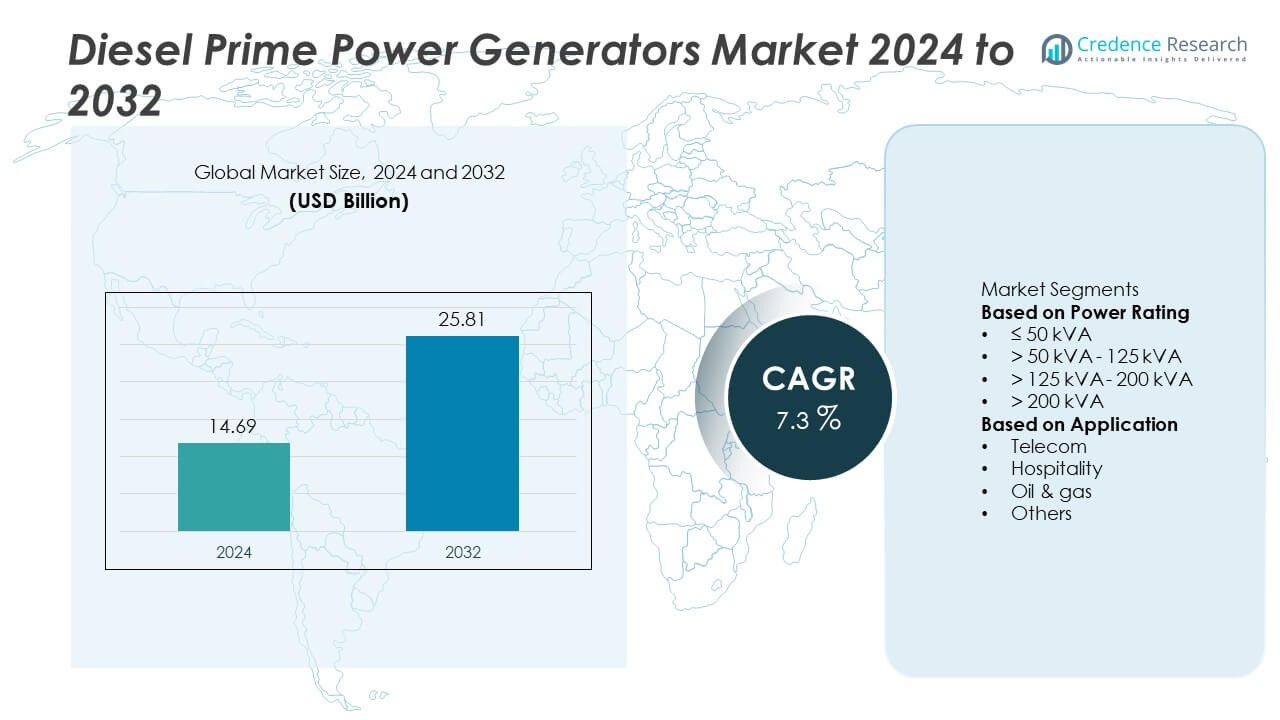

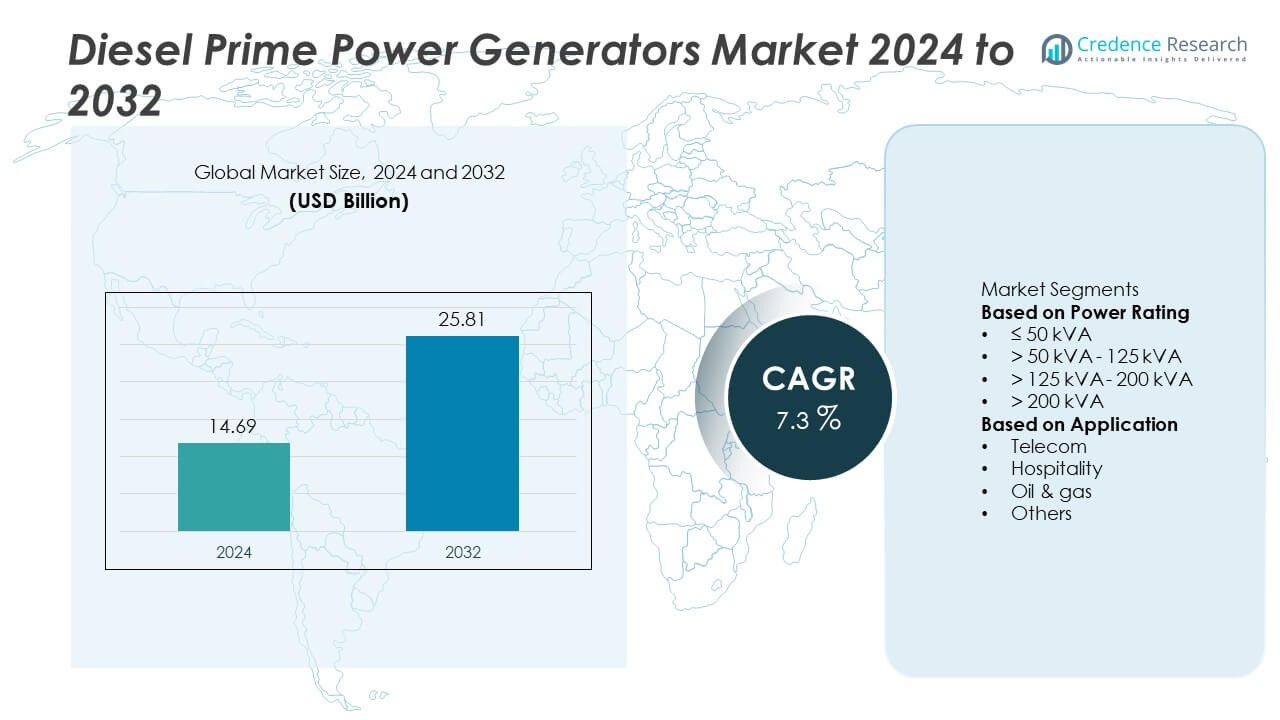

The Diesel Prime Power Generators Market was valued at USD 14.69 billion in 2024 and is expected to reach USD 25.81 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Prime Power Generators Market Size 2024 |

USD 14.69 Billion |

| Diesel Prime Power Generators Market, CAGR |

7.3% |

| Diesel Prime Power Generators Market Size 2032 |

USD 25.81 Billion |

The Diesel Prime Power Generators Market is led by prominent players such as Caterpillar, Cummins, Generac Power Systems, Mahindra POWEROL, Ashok Leyland, Deere & Company, Atlas Copco, HIMOINSA, Briggs & Stratton, and Kirloskar. These companies dominate through extensive product portfolios, global distribution networks, and advanced emission-compliant technologies. Asia-Pacific emerged as the leading region in 2024, holding a 37% market share due to rapid industrialization, infrastructure expansion, and frequent grid outages. North America followed with 28%, driven by strong demand from data centers, oil and gas, and construction sectors requiring reliable prime power solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Diesel Prime Power Generators Market was valued at USD 14.69 billion in 2024 and is projected to reach USD 25.81 billion by 2032, growing at a CAGR of 7.3%.

- Rising demand for reliable off-grid power in construction, mining, and manufacturing sectors is driving market growth, supported by increasing industrialization and infrastructure development across emerging economies.

- A growing shift toward hybrid power systems combining diesel and renewables is shaping industry trends, while technological advancements in fuel efficiency and digital monitoring enhance generator performance.

- The market is moderately consolidated, with major players such as Caterpillar, Cummins, Generac Power Systems, and Mahindra POWEROL focusing on cleaner engines, hybrid-ready models, and regional expansion strategies.

- Asia-Pacific led the market with a 37% share, followed by North America at 28% and Europe at 22%; by power rating, the >200 kVA segment dominated with 46% share, supported by large-scale industrial applications.

Market Segmentation Analysis:

By Power Rating

The >200 kVA segment dominated the Diesel Prime Power Generators Market in 2024, capturing around 46% of the total share. This dominance stems from widespread use in heavy industries, mining operations, and large infrastructure projects that require continuous and high-load power supply. The segment benefits from rising demand for reliable backup power in regions with unstable grids. Manufacturers are developing advanced high-capacity generator sets with improved fuel efficiency and emission compliance to meet growing industrial and commercial requirements.

- For instance, cummins inc. manufactures the c900d5b diesel generator rated at 900 kva standby power or 820 kva prime power, powered by a qsk23-g3 engine producing 701 kw at 1500 rpm. the unit includes an electronic governor and fuel consumption of approximately 161 liters per hour at 100% prime load.

By Application

The oil & gas segment led the market in 2024, holding approximately 38% of the total share. Its leadership is driven by extensive use of diesel prime power generators in offshore rigs, drilling sites, and remote exploration facilities where grid connectivity is limited. These generators ensure uninterrupted operations during exploration and production activities. Expanding upstream and midstream projects across the Middle East, Africa, and Asia-Pacific further strengthen the demand for robust, high-performance prime power units in the oil and gas industry.

- For instance, Himoinsa supplies its HGY series generators, which use the Yanmar GY engine platform, for critical power applications in demanding environments. These generators cover a power range up to 4000 kVA. The HGY series is engineered for durability and reliability, with a major overhaul interval of up to 30,000 hours in continuous operation.

Key Growth Drivers

Expanding Industrial and Infrastructure Projects

Rapid industrialization and ongoing infrastructure development are major drivers for diesel prime power generators. Construction, mining, and manufacturing sites depend on these systems for continuous electricity during grid instability and high load conditions. The growth of large-scale industrial facilities in developing economies is increasing the need for reliable off-grid power. Diesel generators remain essential for ensuring operational stability and productivity in remote and demanding environments.

- For instance, Kirloskar Oil Engines Ltd. manufactures industrial-grade diesel generators under its Green Prime Series, with a range of 320 kVA to 1,010 kVA. The generators are powered by various in-house designed engines, including the DV12 and DV16 models. The series offers a range of power outputs at 1,500 rpm, with the 1,010 kVA model having a rated output of 808 kW.

Rising Power Outages and Grid Instability

Frequent power interruptions and unstable grid networks are fueling generator adoption across critical sectors. Diesel prime power units ensure uninterrupted operations for industries such as telecom, healthcare, and data centers. In developing regions with limited electricity infrastructure, these generators serve as dependable primary power sources. The combination of rising energy consumption and unreliable grids continues to strengthen demand for diesel-based power systems.

- For instance, Generac Power Systems supplies the MPS 2000 modular diesel generator system, which integrates up to 32 paralleled units to achieve a combined output of 64 MW. Each generator provides 2,000 kW prime power and is equipped with a Tier 4 Final-compliant engine, reducing NOₓ emissions to 0.4 g/kWh.

Technological Advancements in Generator Efficiency

Advances in diesel engine design and digital monitoring systems are improving efficiency and reliability. Modern generator models feature electronic control systems, optimized fuel combustion, and remote operation capabilities. Manufacturers are focusing on developing cleaner, smarter, and hybrid-ready power units that meet global emission standards. These innovations enhance performance, reduce operational costs, and align with sustainability goals in industrial and commercial applications.

Key Trends & Opportunities

Shift Toward Hybrid Power Systems

The integration of diesel generators with renewable energy sources is becoming a key market trend. Hybrid setups combining solar or wind power with diesel engines reduce fuel use and emissions. This approach provides stable, long-duration power for remote or off-grid projects. The shift supports energy diversification and aligns with global sustainability targets while maintaining consistent reliability.

- For instance, Atlas Copco developed its QAS+ Hybrid Power System, which integrates a 330 kVA diesel generator with a 45 kWh lithium-ion energy storage module. The system automatically switches between stored renewable power and diesel generation, reducing fuel consumption by up to 12 liters per hour during partial load operation. It provides continuous power for remote industrial and construction projects, supporting 24-hour runtime with minimal maintenance and noise output below 65 dBA.

Adoption in Data Centers and Telecom Networks

Growing digitalization and expansion of telecom infrastructure are creating strong opportunities for diesel generators. Data centers and mobile networks require consistent and high-capacity power to support continuous operation. Diesel units are widely used due to their rapid startup capability and dependable performance. The expansion of digital ecosystems, especially in emerging markets, is reinforcing steady demand for reliable prime power solutions.

- For instance, Caterpillar Inc. supplies the Cat C175-16 generator, rated at 3,200 kW prime power output and powered by a 16-cylinder, 105-liter diesel engine. The system achieves startup readiness within 10 seconds, making it ideal for hyperscale data centers requiring immediate power continuity.

Key Challenges

Strict Emission Regulations

Tighter environmental standards are creating operational and design challenges for diesel generator manufacturers. Regulations aimed at lowering emissions compel companies to adopt cleaner engine technologies and advanced filtration systems. Meeting these standards increases production costs and limits the use of older models. The industry faces constant pressure to innovate while maintaining compliance and performance reliability.

Competition from Renewable Alternatives

The increasing availability of solar and energy storage systems is reducing dependence on diesel generators. Businesses are choosing cleaner energy solutions to lower emissions and long-term costs. Incentives for renewable adoption and declining technology prices are accelerating this transition. To remain competitive, manufacturers are focusing on hybrid integration and advanced fuel-efficient technologies.

Regional Analysis

North America

North America held a market share of 28% in the Diesel Prime Power Generators Market in 2024. The region’s dominance is supported by strong industrial infrastructure, extensive oil and gas operations, and frequent weather-related power disruptions. The United States leads demand with heavy use in data centers, construction projects, and emergency power systems. Manufacturers are investing in advanced emission-compliant diesel units to meet environmental standards. Ongoing upgrades in power reliability and grid resilience across commercial and industrial sectors continue to drive steady adoption across the region.

Europe

Europe accounted for 22% of the Diesel Prime Power Generators Market in 2024. The region’s growth is driven by expanding construction, manufacturing, and healthcare sectors demanding uninterrupted power supply. Western European countries such as Germany, the United Kingdom, and France are integrating low-emission diesel generators that comply with strict Stage V standards. Investments in smart grid infrastructure and distributed energy systems further support market stability. The ongoing energy transition has encouraged manufacturers to develop hybrid diesel systems that align with sustainability goals while maintaining operational efficiency.

Asia-Pacific

Asia-Pacific dominated the Diesel Prime Power Generators Market in 2024, capturing a 37% market share. Rapid industrialization, urban expansion, and infrastructure investments in China, India, and Southeast Asia fuel regional demand. Frequent power shortages and unreliable grid networks increase reliance on diesel prime power systems. The construction and mining industries represent key end-users, while telecom expansion drives smaller-capacity generator demand. Governments are supporting cleaner, high-efficiency diesel technologies to balance energy reliability and environmental compliance. The region remains the most dynamic market, supported by strong economic growth and rising off-grid power applications.

Latin America

Latin America captured a 7% share of the Diesel Prime Power Generators Market in 2024. Demand is primarily driven by mining, oil exploration, and industrial sectors in Brazil, Mexico, and Chile. Remote operations in mountainous and forested areas rely heavily on diesel prime generators for consistent power supply. Increasing energy demand and limited grid access continue to sustain growth across the region. Manufacturers are introducing fuel-efficient and low-emission models to meet evolving environmental standards. Infrastructure modernization and the expansion of renewable–diesel hybrid systems are creating new market opportunities.

Middle East & Africa

The Middle East & Africa region accounted for 6% of the Diesel Prime Power Generators Market in 2024. The market is supported by large-scale oil and gas activities, construction projects, and remote industrial operations. The United Arab Emirates and Saudi Arabia are leading markets, with growing investments in backup and continuous power solutions. In Africa, underdeveloped grid systems and frequent blackouts drive widespread generator usage. Increasing infrastructure projects and off-grid electrification programs are fueling further adoption, while local governments encourage low-sulfur fuel technologies to enhance efficiency and reduce emissions.

Market Segmentations:

By Power Rating

- ≤ 50 kVA

- > 50 kVA – 125 kVA

- > 125 kVA – 200 kVA

- > 200 kVA

By Application

- Telecom

- Hospitality

- Oil & gas

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Diesel Prime Power Generators Market features key players such as Caterpillar, Cummins, Generac Power Systems, Mahindra POWEROL, Ashok Leyland, Deere & Company, Atlas Copco, HIMOINSA, Briggs & Stratton, and Kirloskar. These companies focus on expanding product portfolios with advanced, fuel-efficient, and low-emission generators to meet diverse industrial and commercial requirements. Leading manufacturers are integrating digital monitoring, predictive maintenance, and hybrid-ready systems to enhance operational reliability. Strategic partnerships and regional expansion remain central to strengthening market presence. Many players are also investing in cleaner engine technologies and smart power management platforms to align with tightening global emission norms. The competition is intensifying as companies emphasize localized production, after-sales services, and customized generator solutions to cater to remote and off-grid applications across emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, HIMOINSA launched its HGY Series generator line, delivering power from 1,250 kVA to 3,500 kVA, built with Yanmar GY engine technology and designed for mission-critical continuous and prime power applications.

- In October 2024, HIMOINSA launched its new HGY series of generators and announced plans for a new 17,000 m² Power Solutions production center in Murcia, Spain, to support the new line.

- In July 2024, Cummins Inc. extended its Centum™ Series product line by unveiling 2,750 kW and 3,000 kW generator models based on its 78-liter engine platform, targeting large-scale prime power and data center markets.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily driven by industrial expansion and infrastructure development.

- Adoption of hybrid diesel-renewable power systems will increase across off-grid and remote applications.

- Manufacturers will focus on developing low-emission and fuel-efficient generator models.

- Digital monitoring and IoT-based control systems will become standard features in prime power units.

- Demand from data centers and telecom infrastructure will remain a key growth driver.

- Stricter global emission norms will push innovation in cleaner combustion technologies.

- Asia-Pacific will maintain leadership due to rising energy demand and rapid urbanization.

- Partnerships between OEMs and local distributors will strengthen regional supply networks.

- Continuous advancements in engine durability and maintenance efficiency will enhance product lifespan.

- The market will see growing competition from hybrid and renewable alternatives, encouraging further technological evolution.