Market Overview

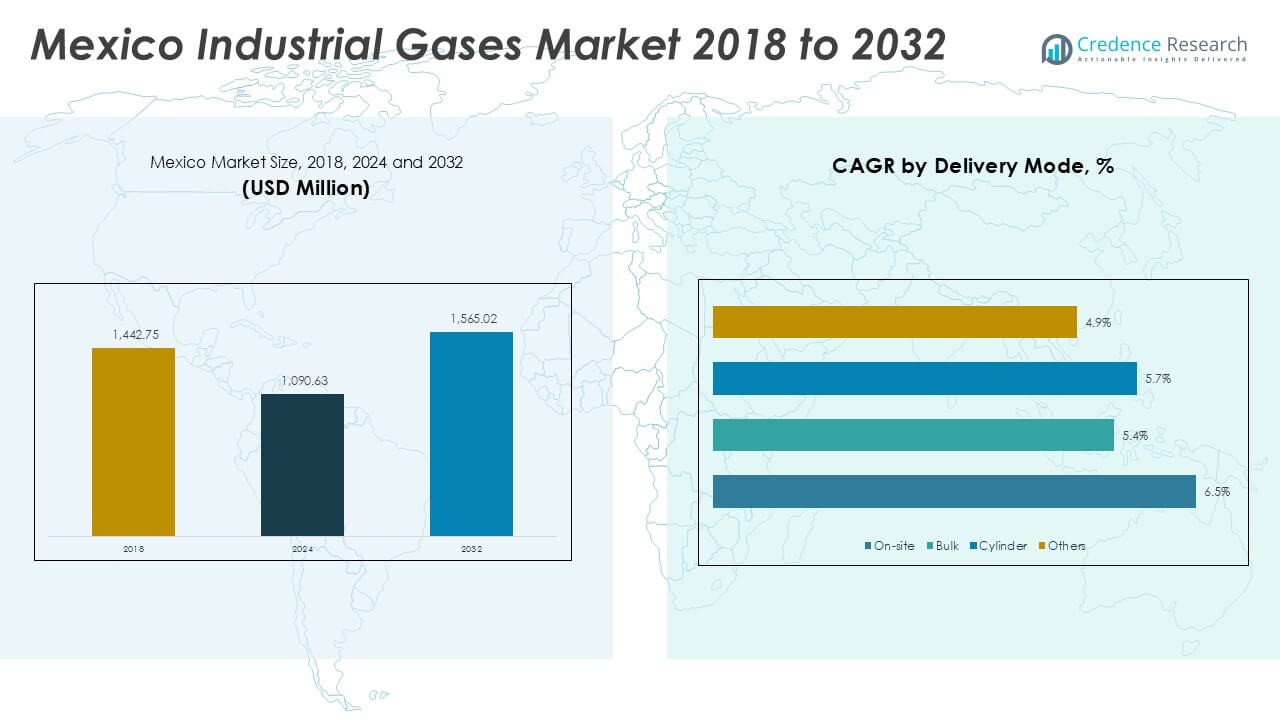

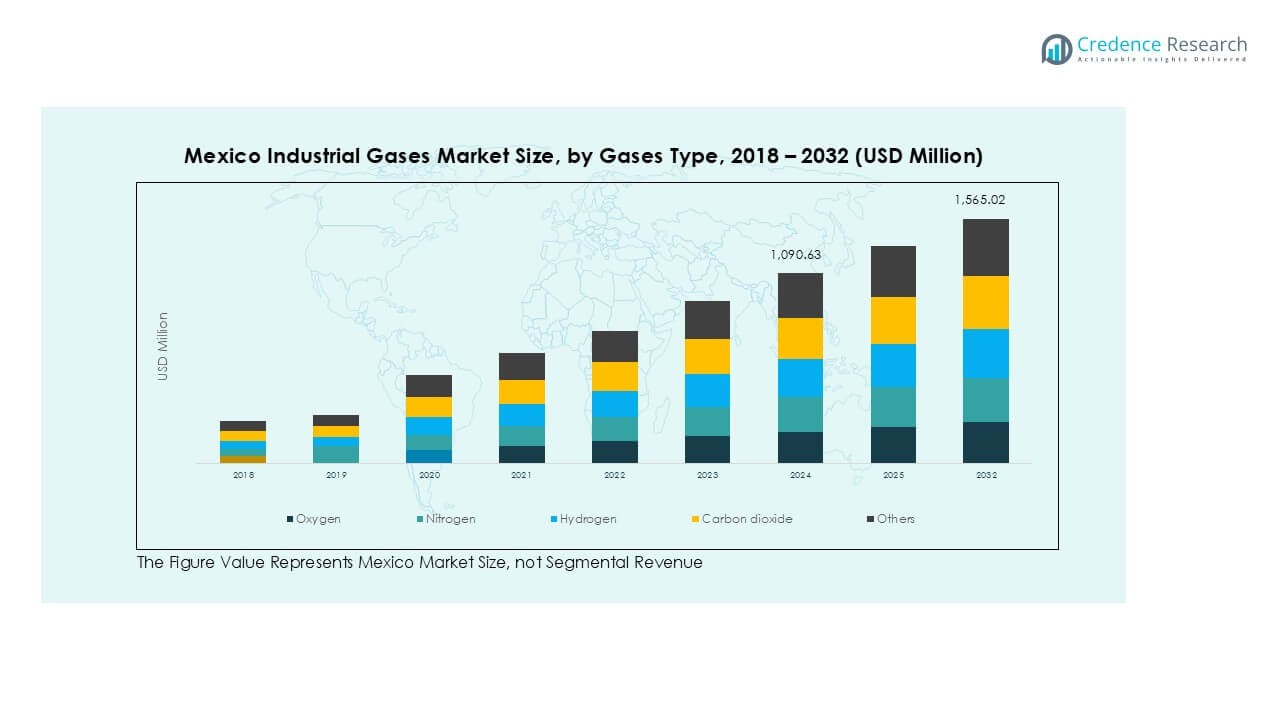

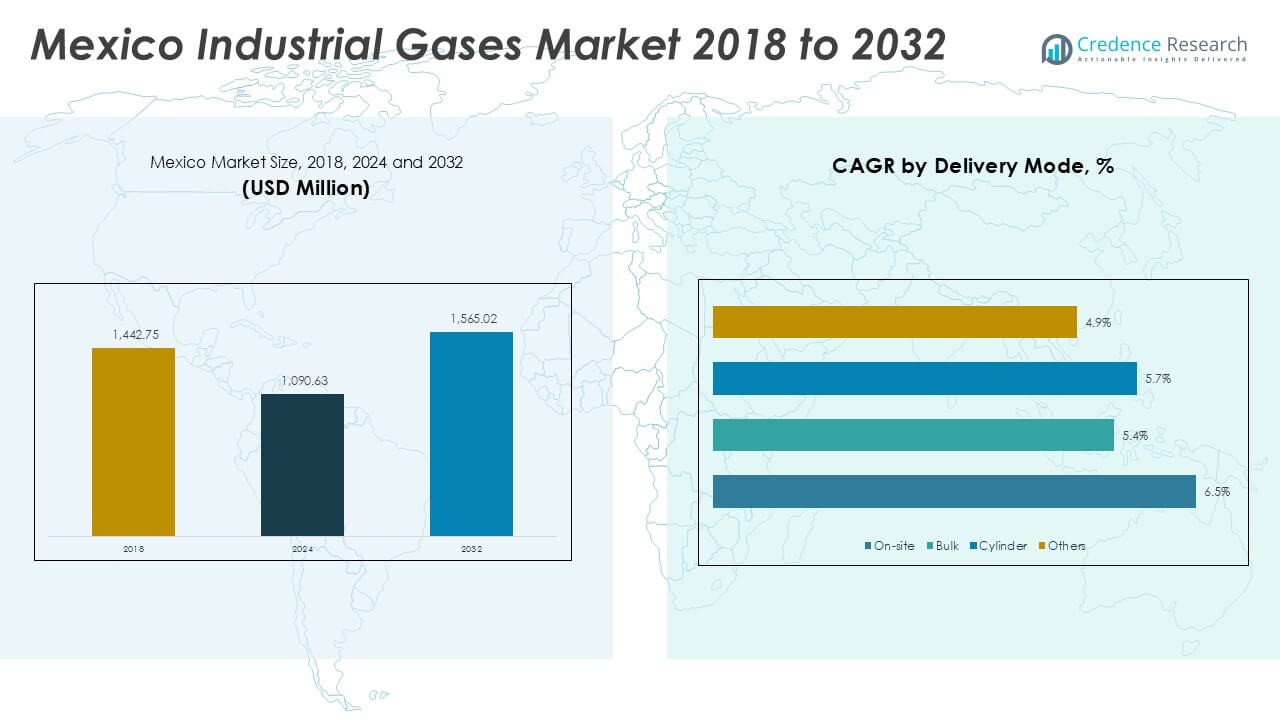

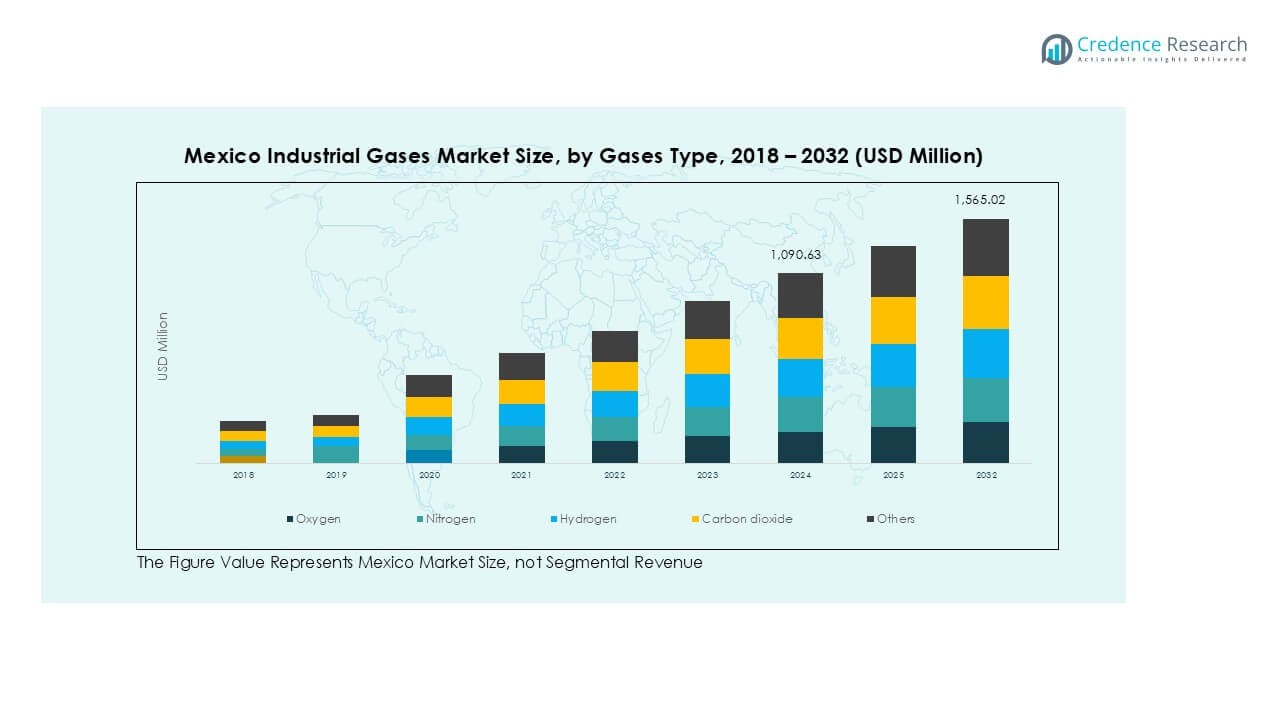

Mexico Industrial Gases market size was valued at USD 1,090.63 million in 2018 and reached USD 1,442.75 million in 2024 and is anticipated to reach USD 1,565.02 million by 2032, growing at a CAGR of 4.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Industrial Gases Market Size 2024 |

USD 1,442.75 Million |

| Mexico Industrial Gases Market, CAGR |

4.62% |

| Mexico Industrial Gases Market Size 2032 |

USD 1,565.02 Million |

The Mexico industrial gases market is led by key players such as Linde plc, Air Liquide Mexico, Matheson Tri-Gas, Inc., Airgas, Inc., and nexAir, LLC. These companies dominate through large-scale production facilities, bulk supply capabilities, and strategic partnerships with manufacturing, healthcare, and food & beverage industries. Northern Mexico emerged as the leading region with 38% market share in 2024, supported by its strong automotive, aerospace, and electronics manufacturing base. Central Mexico followed with 34% share, driven by dense population, healthcare networks, and robust industrial output. Suppliers are focusing on expanding distribution networks and on-site generation solutions to capture growing demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mexico industrial gases market was valued at USD 1,442.75 million in 2024 and is projected to reach USD 1,565.02 million by 2032, growing at a CAGR of 4.62%.

- Demand is driven by expanding healthcare infrastructure, increasing oxygen consumption, and rising manufacturing and automotive sector activities requiring cutting, welding, and process gases.

- Key trends include growing adoption of hydrogen for clean energy initiatives and rising investment in automation and digital monitoring for gas production and distribution efficiency.

- The market is moderately consolidated with major players like Linde plc, Air Liquide Mexico, Matheson Tri-Gas, Inc., Airgas, Inc., and nexAir, LLC focusing on capacity expansion and long-term contracts.

- Northern Mexico accounted for 38% of the market share in 2024, supported by strong manufacturing hubs, followed by Central Mexico with 34% share; oxygen remained the dominant gas type, holding about 35% share due to high demand from healthcare and metallurgy sectors.

Market Segmentation Analysis:

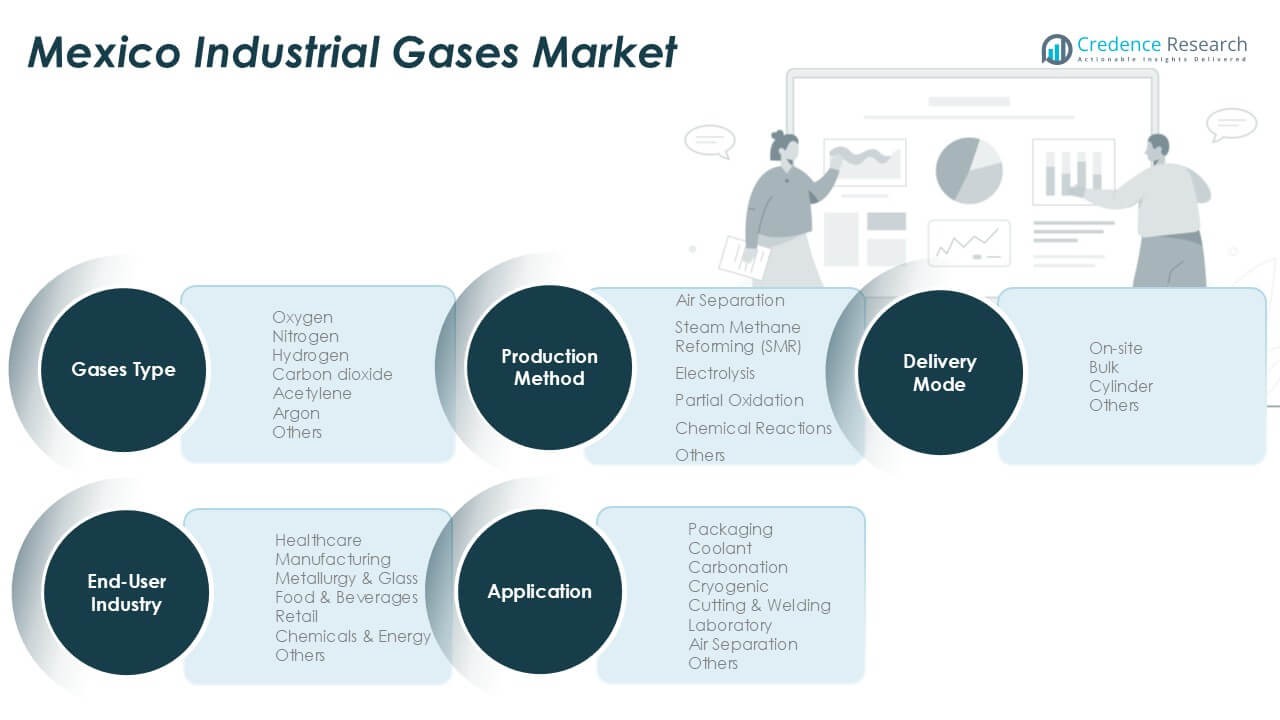

By Gases Type

Oxygen dominated the Mexico industrial gases market, accounting for nearly 35% share in 2024. Its strong demand is driven by healthcare, steel manufacturing, and wastewater treatment applications. Rising medical oxygen consumption, particularly in hospitals and clinics, boosts its share. Nitrogen follows closely, supported by its use in food preservation and electronics manufacturing. Carbon dioxide demand grows with beverage carbonation and welding activities. Hydrogen is gaining traction from clean energy projects, while argon and acetylene remain niche gases used in metal fabrication. Growing industrialization and medical infrastructure expansion continue to drive oxygen demand across the country.

- For instance, Grupo Infra and Praxair México together supply oxygen for over 70% of large-scale hospital oxygen demand in Mexico.

By Application

Cutting & welding held the leading position, representing about 30% market share in 2024. The segment benefits from Mexico’s robust automotive and metal fabrication industries. Increasing infrastructure investments and growth in shipbuilding also strengthen this segment. Carbonation applications see consistent demand from beverage producers, while packaging uses rise in food and pharmaceutical sectors. Cryogenic and laboratory applications are supported by healthcare and research investments. The air separation application segment is expanding with demand for high-purity gases. Growth across these applications is supported by rising manufacturing output and continuous investment in automation and industrial processes.

- For instance, in 2023, Mexico produced roughly 4.0 million cars; metal cutting & welding operations in automotive assembly plants demand high-purity oxygen, argon, and acetylene for thousands of welding stations.

By End-User Industry

Manufacturing emerged as the top end-user, contributing around 32% market share in 2024. This dominance comes from strong gas usage in welding, cutting, and process cooling. Healthcare follows closely due to high oxygen consumption for respiratory therapies and surgeries. The food and beverages sector drives steady demand for carbon dioxide and nitrogen in carbonation and packaging. Metallurgy & glass industries rely on oxygen and argon for smelting and refining processes. Chemicals & energy use hydrogen and nitrogen for production efficiency. Expanding manufacturing facilities and rising healthcare spending in Mexico continue to propel growth in these segments.

Key Growth Drivers

Food & Beverage Industry Growth

The food and beverage sector is a key driver, supported by rising consumption of packaged and carbonated products. Carbon dioxide is widely used in carbonation, freezing, and modified atmosphere packaging. Nitrogen plays a vital role in extending shelf life and preventing spoilage. Growth in quick-service restaurants, beverage producers, and food exports increases gas consumption. Mexico’s growing middle class and urbanization trends are fueling demand for processed foods. This creates consistent opportunities for gas suppliers to expand production and secure long-term supply contracts with major F&B players.

- For instance, in Q3 2024, Mexican beverage consumption volume reached about 25 billion liters, boosting CO₂ usage for soft drinks and carbonated water.

Expanding Manufacturing and Automotive Sector

The growth of Mexico’s manufacturing and automotive industry drives significant demand for cutting, welding, and process gases. Industrial gases like oxygen, nitrogen, and argon are essential for welding and metal fabrication. Automotive production hubs in northern states create large-scale consumption opportunities. Rising foreign direct investments in manufacturing facilities further enhance demand. Mexico’s nearshoring advantage and integration into North American supply chains continue to boost gas usage. This sustained demand supports steady growth for suppliers, encouraging capacity expansions and distribution network upgrades.

- For instance, in 2024 Mexico produced 3,989,403 light vehicles, a record high compared to previous years.

Rising Healthcare Demand

Mexico’s expanding healthcare sector is a major growth driver for industrial gases. Increasing hospital infrastructure and the rising prevalence of respiratory illnesses boost oxygen consumption. Medical-grade gases like oxygen and nitrous oxide are critical for surgeries, anesthesia, and emergency care. Public and private investments in healthcare facilities and homecare services are accelerating demand. The government’s focus on improving medical access and pandemic preparedness also sustains oxygen demand. This strong and recurring requirement ensures the healthcare segment remains a steady contributor to the industrial gases market

Key Trends & Opportunities

Shift Toward Clean Energy and Hydrogen Adoption

Hydrogen is gaining prominence as Mexico explores clean energy solutions and decarbonization efforts. Industrial players are adopting hydrogen for refining, ammonia production, and fuel cell projects. Government initiatives to promote renewable energy create opportunities for green hydrogen development. Partnerships between energy companies and gas producers are accelerating infrastructure projects. This trend supports diversification of the industrial gas mix beyond traditional segments. Suppliers investing in hydrogen production and distribution infrastructure are likely to gain a competitive advantage in the coming years.

- For instance, the Tarafert project in Mexico will deploy 343 megawatts of green hydrogen electrolyzers to enable production of up to 200,000 metric tonnes of green ammonia annually.

Automation and Digital Monitoring in Gas Supply

Digital monitoring and automation are transforming gas production and distribution in Mexico. Smart sensors and IoT-based platforms enable real-time monitoring of storage levels, pressure, and supply chain efficiency. This ensures uninterrupted delivery for critical industries like healthcare and manufacturing. Adoption of automated cylinder tracking systems improves operational efficiency. Gas producers are also using predictive analytics to optimize plant maintenance and reduce downtime. These advancements enhance customer satisfaction and lower operational costs, opening opportunities for suppliers to offer value-added services.

- For instance, during the second wave of COVID-19, India’s peak medical oxygen demand surged to nearly 9,000 metric tons per day, far exceeding the pre-pandemic demand of about 1,000 MT per day.

Key Challenges

High Production and Distribution Costs

Industrial gas production involves energy-intensive processes, leading to high operating costs. Electricity price volatility in Mexico affects profitability for gas manufacturers. Transporting gases, especially cryogenic liquids, adds significant logistical expenses. Suppliers face challenges maintaining margins while meeting competitive pricing demands from industrial clients. Any disruption in natural gas or power supply can affect production continuity. Companies are exploring energy efficiency upgrades and localized production facilities to address these challenges and maintain supply reliability.

Regulatory and Safety Compliance

Strict regulatory frameworks govern the production, transport, and storage of industrial gases in Mexico. Companies must comply with stringent safety standards to prevent leaks, explosions, or occupational hazards. Regular inspections and certification requirements add compliance costs and operational complexity. Failure to meet these standards can lead to fines or shutdowns, impacting revenue. Adapting to evolving environmental norms and emission limits also requires continuous investment. Maintaining compliance while keeping production cost-effective remains a challenge for both global and domestic suppliers.

Regional Analysis

Northern Mexico

Northern Mexico led the industrial gases market with 38% share in 2024, driven by its strong manufacturing base and proximity to the U.S. Automotive, aerospace, and electronics industries dominate gas consumption, especially for welding and metal processing. The region’s maquiladora plants demand large volumes of oxygen, nitrogen, and argon. Cross-border trade and nearshoring initiatives continue to attract foreign investments, boosting industrial activity. Growing healthcare infrastructure in cities like Monterrey and Tijuana also supports rising oxygen demand. Suppliers are expanding production facilities and distribution networks to meet increasing requirements from export-oriented industries and medical institutions.

Central Mexico

Central Mexico accounted for 34% market share in 2024, supported by its dense population and industrial diversity. The region hosts major manufacturing hubs, including automotive and steel plants, which drive demand for oxygen and acetylene in cutting and welding applications. Mexico City and surrounding states contribute significantly to healthcare-related gas consumption due to large hospital networks. Food and beverage production is also strong, creating steady carbon dioxide demand for carbonation and packaging. Infrastructure growth and investment in logistics parks further enhance gas consumption, making this region a critical growth driver for suppliers targeting multiple end-user industries.

Southern Mexico

Southern Mexico held 28% share in 2024, with demand primarily from the energy and chemicals sectors. The region benefits from oil refining and petrochemical complexes in states like Veracruz and Tabasco, where hydrogen and nitrogen consumption is high. Emerging infrastructure projects, including ports and LNG terminals, create opportunities for cryogenic gas suppliers. The healthcare sector is growing, but demand remains moderate compared to other regions. Investments in tourism and food processing are gradually boosting carbon dioxide and nitrogen use. Industrial gas producers are expanding distribution channels to improve accessibility and meet the rising needs of developing industrial clusters.

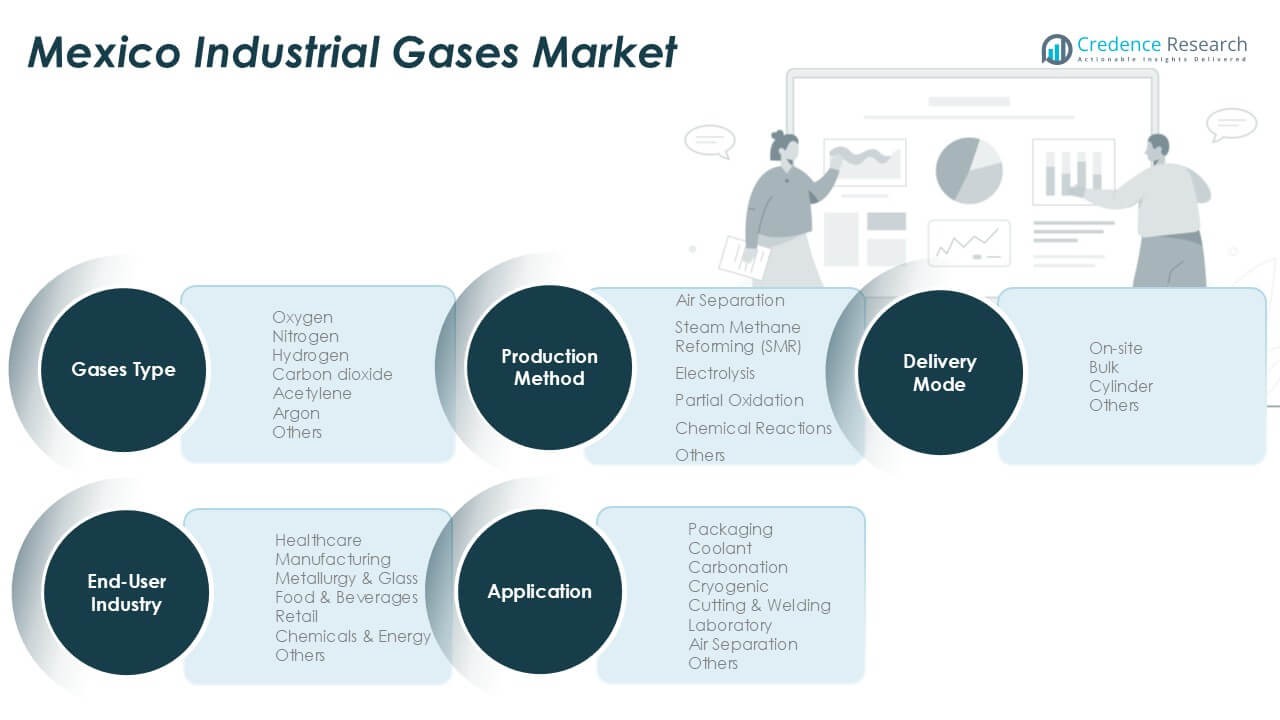

Market Segmentations:

By Gases Type

- Oxygen

- Nitrogen

- Hydrogen

- Carbon Dioxide

- Acetylene

- Argon

- Others

By Application

- Packaging

- Coolant

- Carbonation

- Cryogenic

- Cutting & Welding

- Laboratory

- Air Separation

- Others

By End-User Industry

- Healthcare

- Manufacturing

- Metallurgy & Glass

- Food & Beverages

- Retail

- Chemicals & Energy

- Others

By Production Method

- Air Separation

- Steam Methane Reforming (SMR)

- Electrolysis

- Partial Oxidation

- Chemical Reactions

- Others

By Delivery Mode

- On-site

- Bulk

- Cylinder

- Others

By Geography

- Northern Mexico

- Central Mexico

- Southern Mexico

Competitive Landscape

The Mexico industrial gases market is moderately consolidated, with global leaders and regional suppliers competing for market share. Linde plc and Air Liquide Mexico hold dominant positions, leveraging extensive production facilities, bulk distribution networks, and long-term contracts with key industries. Matheson Tri-Gas, Inc., Airgas, Inc., and nexAir, LLC focus on specialty gases and cylinder distribution, catering to mid-size manufacturing and healthcare clients. Cryogenic Industrial Solutions, LLC and Universal Industrial Gases, Inc. serve niche markets, emphasizing custom gas supply systems and on-site generation solutions. Companies are investing in capacity expansion, digital monitoring, and hydrogen infrastructure to stay competitive. Strategic partnerships with automotive, healthcare, and food & beverage sectors are common, ensuring consistent demand. Players are also strengthening logistics capabilities to serve northern Mexico’s export-driven industries. Competitive intensity is rising as both international and domestic suppliers aim to capture growing demand from manufacturing and clean energy projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Linde plc

- Air Liquide Mexico

- Universal Industrial Gases, Inc.

- nexAir, LLC

- Cryogenic Industrial Solutions, LLC

- Matheson Tri-Gas, Inc.

- Airgas, Inc.

Recent Developments

- In October 2024, Air Liquide announced to supply oxygen to LG Chem for their electric vehicle battery plant in the U.S. Supplying oxygen to LG Chem’s future cathode active material plant, the Group will be supporting the growth of the battery ecosystem in the U.S. This investment will increase the Group’s footprint in a key region and support the development of its industrial merchant market.

- In October 2024, Linde announced an agreement with Tata Steel to obtain and manage two additional Air Separation Units (ASUs) and enhance industrial gas supply to Tata Steel in Odisha, India. This arrangement will more than double Linde’s on-site capacity at Tata Steel’s Kalinganagar facility, where it presently runs two plants. The new ASUs, anticipated to be operational by 2025, will deliver oxygen, nitrogen, and argon to aid Tata Steel’s expansion project and cater to the local merchant market. Linde has additionally acquired renewable energy agreements to lower its scope emissions, in line with its 2035 GHG reduction goals.

- In July 2024, Air Liquide announced an investment of USD 104.914 million to support Aurubis AG, a major global provider of non-ferrous metals and one of the largest recyclers of copper worldwide, in Bulgaria and Germany. This investment will finance a new Air Separation Unit (ASU) in Bulgaria and the upgrading of four existing units in Germany. Besides supplying substantial amounts of oxygen and nitrogen for the rising copper and other metal production by Aurubis, these facilities will also assist in the growth of industrial merchant markets in both areas.

- In January 2024, Air Products, a company in industrial gases and clean hydrogen projects, announced the opening of its expanded Project Delivery Centre in Vadodara, India.

- In July 2023, Nippon Sanso Holdings Corporation announced that Matheson Tri-Gas, Inc, NSHD’s U. S. operating entity, has entered into a gas supply contract with PointFive to deliver oxygen for the carbon capture, utilization, and sequestration company’s inaugural Direct Air Capture (DAC*) facility in Texas. MATHESON will invest in and set up an Air Separation Unit to provide oxygen to “Stratos,” PointFive’s DAC facility currently under construction in Ector County, Texas. The oxygen is utilized in the DAC process to generate a pure stream of CO2, which is subsequently securely sequestered in geological reservoirs.

Report Coverage

The research report offers an in-depth analysis based on Gases Type, Application, End-User Industry, Production Method, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue steady growth driven by rising manufacturing and healthcare demand.

- Adoption of hydrogen will accelerate as clean energy projects and decarbonization efforts expand.

- Food and beverage industry growth will boost demand for carbon dioxide and nitrogen.

- On-site gas generation solutions will gain popularity for cost efficiency and reliable supply.

- Digital monitoring and automation will enhance operational efficiency and supply chain management.

- Expansion of automotive and aerospace sectors will increase demand for welding and cutting gases.

- Cryogenic applications will grow with development of LNG terminals and infrastructure projects.

- Regional players will expand distribution networks to compete with global suppliers.

- Strategic partnerships between gas producers and industrial users will become more common.

- Investments in safety, sustainability, and energy efficiency will remain a priority for market leaders.