Market Overview:

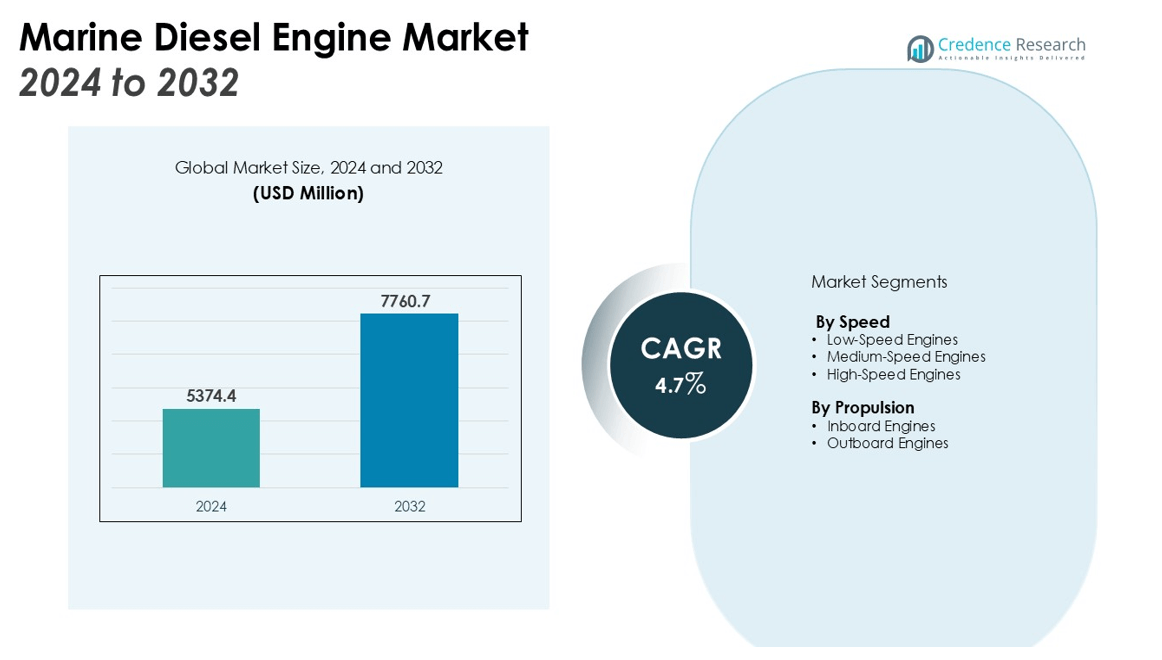

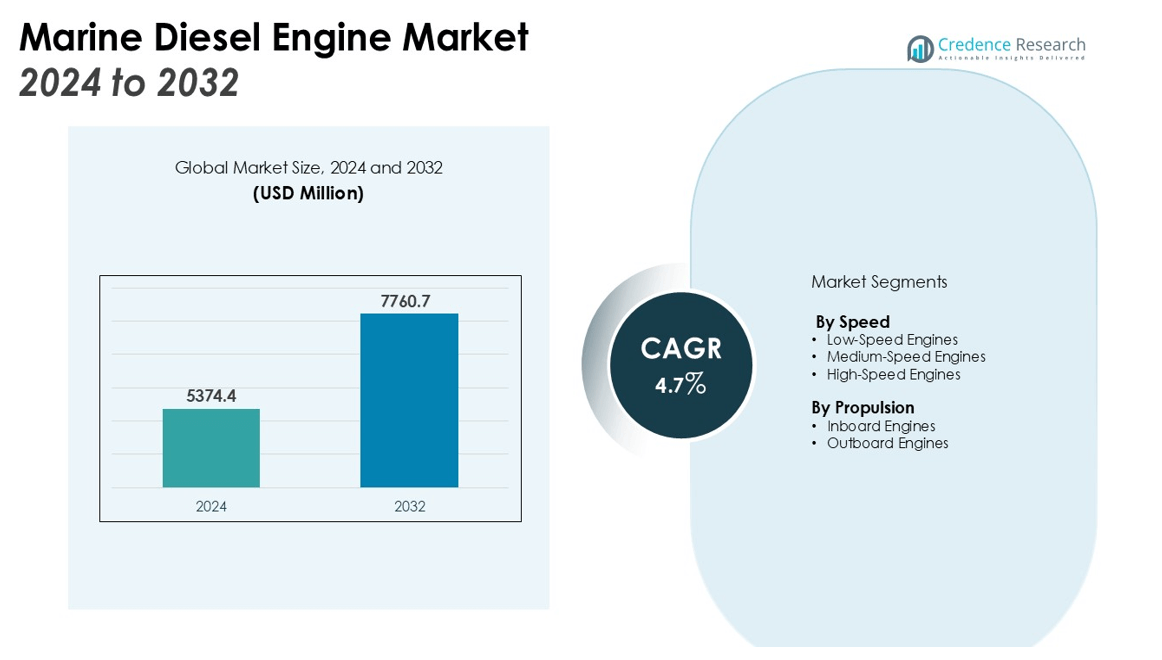

The Marine Diesel Engine Market size was valued at USD 5374.4 million in 2024 and is anticipated to reach USD 7760.7 million by 2032, at a CAGR of 4.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Diesel Engine Market Size 2024 |

USD 5374.4 million |

| Marine Diesel Engine Market, CAGR |

4.7% |

| Marine Diesel Engine Market Size 2032 |

USD 7760.7 million |

Key drivers fueling the growth of the Marine Diesel Engine Market include the rising demand for commercial vessels, advancements in engine technologies for reducing emissions, and the growing trend of adopting environmentally friendly regulations. Additionally, the shift towards cleaner marine fuel options, such as LNG, is also promoting the development of new engine technologies that meet stringent environmental standards. The increasing international trade and maritime transport activities further bolster the demand for high-performance marine diesel engines. Furthermore, the implementation of stricter global emission norms, such as IMO 2020, is driving the adoption of low-emission marine engines.

Regionally, Asia-Pacific dominates the Marine Diesel Engine Market, owing to its robust shipbuilding industry and the presence of major maritime trade hubs such as China, Japan, and South Korea. Europe follows closely, driven by the implementation of stringent environmental regulations and the shift towards eco-friendly marine engines. North America is also a significant market player, with growing investments in the development of energy-efficient technologies for marine vessels. The growing demand for renewable energy-powered vessels and the increasing focus on maritime sustainability further support market growth in these regions.

Market Insights:

- The Marine Diesel Engine Market was valued at USD 5374.4 million in 2024 and is expected to reach USD 7760.7 million by 2032, growing at a CAGR of 4.7%.

- Rising demand for commercial vessels, driven by international trade, boosts the market, particularly in Asia-Pacific’s maritime hubs.

- Advancements in engine technologies, focusing on emission reductions, are driving demand for hybrid and LNG-powered engines to meet IMO 2020 regulations.

- The shift towards cleaner fuels like LNG is fostering the development of engines that comply with stringent environmental standards.

- Growing investments in energy-efficient technologies by manufacturers and shipowners are enhancing fuel efficiency and reducing environmental impact.

- The adoption of hybrid and LNG-powered marine engines is increasing as a sustainable alternative to traditional diesel engines.

- Integration of IoT and AI-powered monitoring systems in marine engines improves operational efficiency, driving market demand for digitalized technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Commercial Vessels

The rising global demand for commercial vessels is one of the primary drivers of the Marine Diesel Engine Market. With the expansion of international trade and the need for efficient transportation of goods, the shipping industry is witnessing significant growth. As shipping remains the most cost-effective mode of transporting large quantities of goods, the demand for new commercial vessels is increasing, leading to a higher need for marine diesel engines. This growth is especially notable in regions such as Asia-Pacific, where maritime trade hubs are experiencing booming activity.

- For instance, A.P. Moller – Maersk is expanding its fleet with a new class of methanol dual-fuel vessels in 2025, with the company taking delivery of six of these large container ships from Hyundai Heavy Industries to meet modern shipping demands.

Advancements in Engine Technologies and Emission Regulations

The ongoing advancements in engine technologies aimed at reducing emissions are significantly impacting the Marine Diesel Engine Market. With stricter environmental regulations being imposed by the International Maritime Organization (IMO) and other governing bodies, shipbuilders and engine manufacturers are focusing on developing technologies that comply with these standards. The introduction of hybrid and LNG-powered marine engines offers cleaner alternatives while maintaining operational efficiency, driving market demand for advanced marine diesel engines.

- For instance, Yanmar introduced its new Common Rail 6GY135W marine engine, a 6-cylinder unit developed to meet IMO Tier 3 certification standards while delivering a power output of up to 599 kW.

Shifting to Cleaner Marine Fuel Options

The shift towards cleaner marine fuel options, such as liquefied natural gas (LNG), is promoting the development of new engine technologies within the Marine Diesel Engine Market. LNG is becoming a preferred fuel choice due to its lower carbon emissions and its ability to meet stringent environmental regulations. As more vessels are built to accommodate LNG as fuel, demand for engines that are capable of running on these cleaner alternatives is steadily increasing, enhancing overall market growth.

Increasing Investment in Energy-Efficient Technologies

The growing focus on energy-efficient technologies is another significant driver in the Marine Diesel Engine Market. With rising fuel costs and environmental concerns, both shipowners and manufacturers are prioritizing efficiency improvements. Innovations in engine design, fuel management systems, and exhaust treatment technologies contribute to lower fuel consumption and reduced environmental impact, appealing to both economic and regulatory demands in the industry. This trend supports the widespread adoption of advanced marine diesel engines globally.

Market Trends:

Rising Adoption of Hybrid and LNG-powered Marine Engines

A key trend in the Marine Diesel Engine Market is the increasing adoption of hybrid and LNG-powered marine engines. These engines are being developed to comply with stringent emission regulations, including IMO 2020, which mandates reduced sulfur content in marine fuels. Hybrid marine engines, which combine conventional diesel power with electric or LNG technology, offer a more sustainable and cost-effective solution for reducing environmental impact. LNG engines, known for their lower carbon emissions, are becoming a preferred choice for both new builds and retrofitting existing vessels. This trend reflects the industry’s shift toward cleaner, greener technologies, responding to both regulatory pressures and growing environmental awareness in the maritime sector.

- For instance, in a vessel study, switching from diesel to LNG fuel demonstrated a notable environmental benefit where the nitrogen oxide (NOx) emission factor was measured at 0.63 g/kWhr.

Focus on Smart and Digitalized Marine Engine Technologies

Another emerging trend in the Marine Diesel Engine Market is the integration of smart and digitalized technologies in marine engines. The growing emphasis on digitalization in the maritime industry is driving the demand for engines equipped with IoT (Internet of Things) capabilities and AI-powered monitoring systems. These technologies enable real-time performance tracking, predictive maintenance, and fuel efficiency optimization, all of which contribute to operational cost reductions and enhanced engine lifespan. As digital technologies continue to evolve, the demand for more sophisticated, connected marine engines is expected to rise, offering fleet operators advanced tools to enhance operational efficiency and meet evolving environmental standards.

- For instance, MAN Energy Solutions’ digital platform, MAN CEON, provides real-time monitoring by collecting and evaluating operating data from the hundreds of sensors that are equipped on each of its engines.

Market Challenges Analysis:

Stricter Environmental Regulations and Compliance Costs

One of the primary challenges facing the Marine Diesel Engine Market is the increasing pressure to comply with stringent environmental regulations. Global organizations like the International Maritime Organization (IMO) are imposing stricter emission standards to reduce the environmental impact of maritime operations. These regulations require engine manufacturers to invest heavily in developing technology that meets new sulfur and nitrogen oxide (NOx) emissions limits. As compliance becomes more complex, the associated costs for both manufacturers and operators rise, adding financial strain and slowing down market adoption of new technologies. Meeting these regulatory requirements while maintaining operational efficiency is a significant hurdle for many stakeholders.

Fluctuating Fuel Prices and Operational Costs

Fluctuating fuel prices are another challenge for the Marine Diesel Engine Market. Marine operators are heavily reliant on diesel fuel, and volatility in fuel prices can significantly impact operational expenses. The shift toward alternative fuels like LNG offers long-term cost benefits but requires a significant initial investment in engine retrofits or new vessels, creating financial constraints. These fluctuations not only affect the economic viability of marine operations but also complicate long-term planning for fleet operators and manufacturers. Balancing operational costs with regulatory compliance and fuel efficiency is an ongoing challenge in the market.

Market Opportunities:

Expansion of LNG Infrastructure and Alternative Fuels

A key opportunity in the Marine Diesel Engine Market lies in the expansion of LNG infrastructure and the adoption of alternative fuels. As maritime industries shift toward sustainable practices, LNG is becoming a preferred fuel choice due to its lower emissions compared to traditional marine diesel. The growing number of LNG fueling stations and increased investments in alternative fuel technologies provide significant opportunities for the market. Manufacturers of marine diesel engines can capitalize on this trend by developing engines that are compatible with LNG and other eco-friendly fuels, which will enable them to meet stricter regulatory standards while attracting a broader customer base.

Integration of Advanced Digital and Smart Technologies

Another significant opportunity in the Marine Diesel Engine Market is the integration of advanced digital and smart technologies. The growing demand for efficiency and operational optimization opens avenues for integrating IoT, AI, and machine learning into marine diesel engines. These technologies allow for real-time performance monitoring, predictive maintenance, and enhanced fuel management. By offering engines that provide better connectivity and advanced analytics, manufacturers can address the need for improved fuel efficiency and reduced downtime, which will appeal to fleet operators seeking cost-effective and reliable solutions. This trend towards smart, connected engines presents long-term growth prospects in the market.

Market Segmentation Analysis:

By Speed

The Marine Diesel Engine Market is segmented by speed into low, medium, and high-speed engines. Medium-speed engines hold the largest market share, especially in commercial vessels and large cargo ships, offering a balance of power and efficiency for long voyages. Low-speed engines are typically used in large container vessels and tankers, providing high efficiency at reduced operational costs, making them ideal for prolonged operations. High-speed engines are most common in smaller vessels like ferries and patrol boats, where faster acceleration and higher power output are necessary.

- For instance, the twin ultra-long stroke two-stroke engines from MAN are a key technological feature of Maersk’s Triple-E class container ships, designed to achieve maximum efficiency while running at a speed of just 73 revolutions per minute.

By Propulsion

The propulsion segment of the Marine Diesel Engine Market includes inboard and outboard engines. Inboard engines are predominantly used in larger commercial vessels due to their durability and long operational life. These engines provide better fuel efficiency and are capable of sustained use over extended periods. Outboard engines, commonly found in smaller boats and recreational crafts, offer enhanced maneuverability and ease of maintenance. The demand for outboard engines is rising with the growing popularity of recreational boating and technological innovations aimed at improving engine performance and fuel efficiency.

- For instance, Yanmar’s 8EY33W medium-speed propulsion engine exemplifies technological advancement, providing a continuous rated power of 4500 kilowatts for marine applications.

Segmentations:

By Speed:

- Low-Speed Engines

- Medium-Speed Engines

- High-Speed Engines

By Propulsion:

- Inboard Engines

- Outboard Engines

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific: Leading in Shipbuilding and Maritime Trade

Asia-Pacific holds 38% of the Marine Diesel Engine Market share, driven by its dominance in global shipbuilding and maritime trade. Countries such as China, Japan, and South Korea are major hubs for ship manufacturing, significantly contributing to the region’s share. The increasing demand for commercial vessels, along with substantial investments in port infrastructure, fuels the growth of marine diesel engine adoption. The region is also embracing LNG-powered vessels, driven by both environmental regulations and the growing interest in alternative fuels, presenting substantial opportunities for manufacturers to cater to this demand.

Europe: Emphasizing Sustainability and Environmental Regulations

Europe accounts for 30% of the Marine Diesel Engine Market share, mainly influenced by stringent environmental regulations and a strong focus on sustainability. The European Union’s emphasis on reducing greenhouse gas emissions and improving air quality in maritime transport is prompting an increase in the demand for high-efficiency and low-emission marine diesel engines. Countries such as Germany, the Netherlands, and France are leading the way in adopting hybrid and LNG-powered engines. The shift towards greener marine technology aligns with Europe’s broader efforts to meet international environmental standards, creating a strong market for advanced diesel engines and alternative fuel technologies.

North America: Advancing Technology and Energy Efficiency

North America holds 20% of the Marine Diesel Engine Market share due to technological advancements and a focus on energy efficiency. The U.S. has significant investments in energy-efficient marine technologies, with a particular emphasis on reducing operational costs and environmental impact. The market is further supported by the increasing adoption of LNG and other alternative fuels. This region’s robust maritime infrastructure and the growing demand for modernized fleets are driving the need for high-performance engines that comply with regulatory requirements. As environmental awareness grows, North America continues to foster innovations in marine diesel engine technology.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Steyr Motors Gmbh

- MTU

- Volvo Group

- Perkins Engines Company Limited

- YANMAR Marine International B.V.

- John Deere

- Cummins Inc.

- Ashok Leyland

- Volvo Penta

- Doosan Infracore

- Caterpillar Inc.

- MAN Engines – A Division of MAN Truck & Bus SE

Competitive Analysis:

The Marine Diesel Engine Market is competitive, with key players such as MAN Energy Solutions, Wärtsilä Corporation, and Caterpillar Inc. leading the industry. These companies focus on technological innovations, fuel efficiency, and compliance with stringent environmental regulations. They invest heavily in research and development to produce advanced marine engines, including hybrid and LNG-powered solutions, to meet the demand for eco-friendly alternatives. Regional players also compete by providing localized, cost-effective solutions. As environmental standards become stricter, manufacturers are focused on developing engines that reduce emissions and optimize fuel consumption. The integration of digital technologies, such as predictive maintenance and fuel management systems, further enhances engine performance, driving the market forward through continuous advancements in operational efficiency and sustainability.

Recent Developments:

- In September 2024, Perkins Engines Company Limited launched its new 2600 Series, a 13-litre engine designed for the power generation industry.

- In June 2025, Perkins Marine announced it was preparing to launch a new range of propulsion engines.

- In August 2025, Caterpillar Inc. announced an agreement with Joule Capital Partners and Wheeler Machinery Co. to provide a power solution for Joule’s new High-Performance Compute Data Center Campus in Utah.

Market Concentration & Characteristics:

The Marine Diesel Engine Market is moderately concentrated, with a few key players dominating the landscape. Major companies such as MAN Energy Solutions, Wärtsilä Corporation, and Caterpillar Inc. hold significant market shares due to their technological advancements, strong brand presence, and extensive global distribution networks. These leaders focus on continuous innovation, particularly in fuel-efficient and environmentally friendly engine solutions. The market also includes regional players that offer cost-effective and localized alternatives, contributing to its competitive dynamics. Despite the dominance of a few large companies, the market remains dynamic, with increasing demand for hybrid, LNG-powered, and digitally integrated marine engines. The trend toward sustainability and compliance with international emission standards drives manufacturers to adopt new technologies, ensuring a constantly evolving market.

Report Coverage:

The research report offers an in-depth analysis based on Speed, Propulsion and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Marine Diesel Engine Market will continue to grow due to increasing global trade and the demand for commercial vessels.

- Advancements in hybrid and LNG-powered engines will drive innovation, as shipping companies seek more sustainable fuel alternatives.

- Stringent environmental regulations, such as IMO 2020, will lead to the widespread adoption of low-emission marine engines.

- The growing emphasis on fuel efficiency will result in the development of more energy-efficient engine technologies to reduce operational costs.

- Smart and digital technologies, such as IoT and AI, will play a significant role in enhancing engine performance, predictive maintenance, and fuel management.

- The rise of renewable energy-powered vessels will create new opportunities for the integration of marine diesel engines with alternative power sources.

- Increased investment in port infrastructure, particularly in Asia-Pacific, will support the growth of the market by improving accessibility and efficiency.

- The adoption of cleaner fuels like LNG will continue to expand as more fueling stations and infrastructure are developed globally.

- Regional market dynamics, particularly in Asia-Pacific, will remain a major influence on global market trends.

- The demand for more sustainable and eco-friendly solutions will push manufacturers to continuously innovate and improve marine diesel engine technologies.