Market Overview:

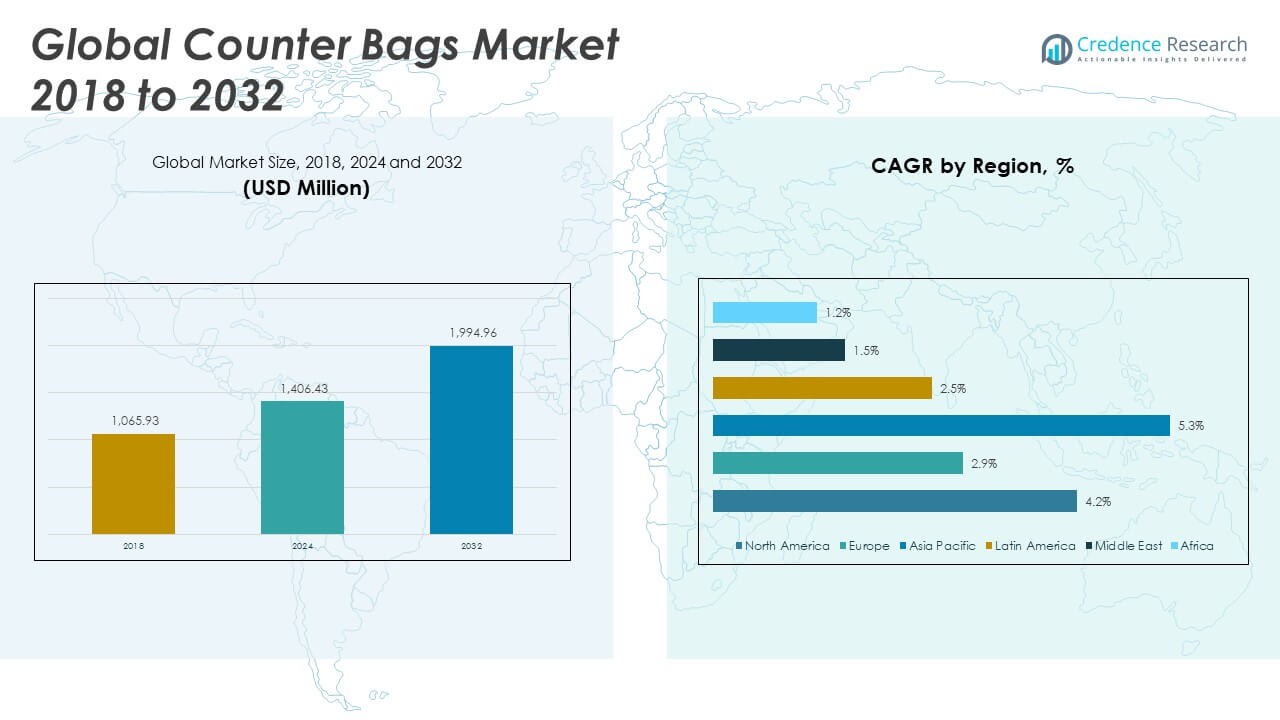

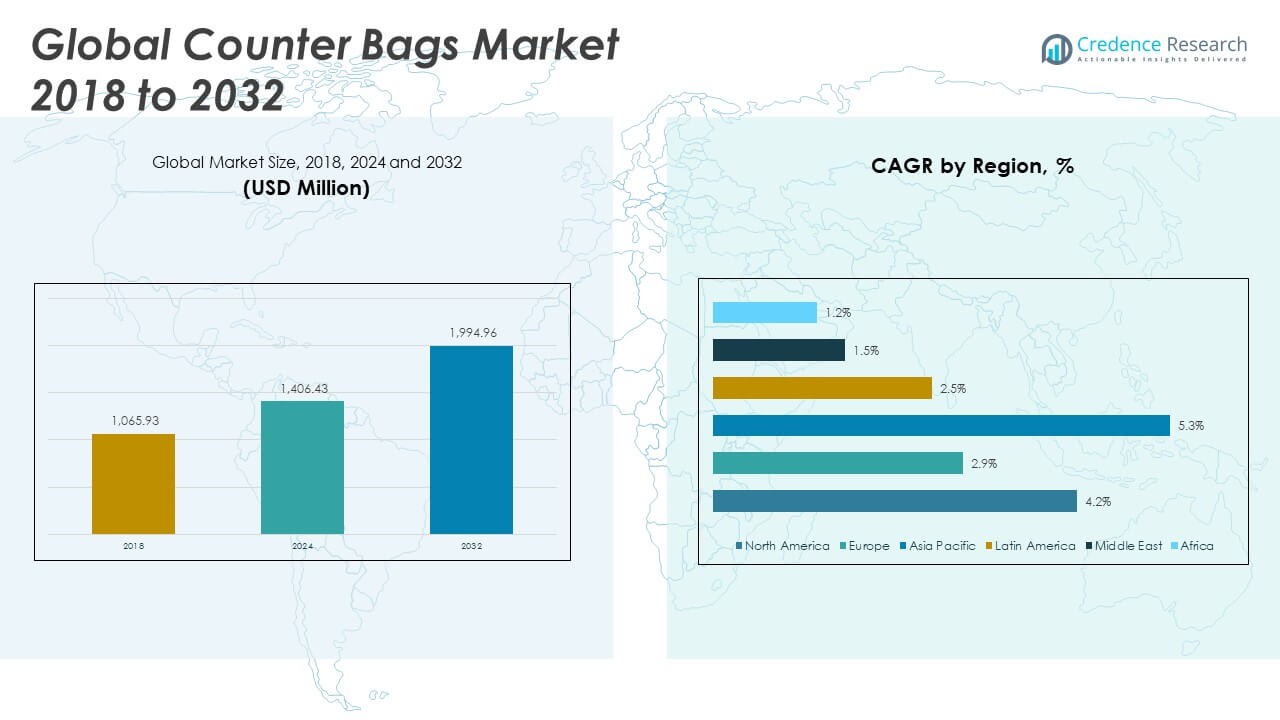

The Global Counter Bags Market size was valued at USD 1,065.93 million in 2018 to USD 1,406.43 million in 2024 and is anticipated to reach USD 1,994.96 million by 2032, at a CAGR of 4.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Counter Bags Market Size 2024 |

USD 1,406.43 Million |

| Counter Bags Market, CAGR |

4.16% |

| Counter Bags Market Size 2032 |

USD 1,994.96 Million |

The market is driven by the growing demand for convenient and sustainable retail packaging solutions across supermarkets, grocery stores, and specialty outlets. Counter bags support efficient storage, product protection, and customer-friendly handling, making them vital for modern retail operations. Rising consumer preference for eco-friendly alternatives and stricter government regulations on single-use plastics are prompting manufacturers to innovate with recyclable, biodegradable, and reusable options, further boosting market adoption.

Geographically, North America and Europe lead the market due to strong retail infrastructure, advanced packaging solutions, and stringent environmental policies encouraging sustainable alternatives. Asia-Pacific is emerging as a high-growth region, driven by rapid urbanization, expanding retail chains, and increasing awareness of eco-conscious packaging among consumers. Meanwhile, Latin America and the Middle East are witnessing gradual adoption, largely influenced by growing organized retail formats and rising consumer expectations for convenience and sustainability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Counter Bags Market was valued at USD 1,065.93 million in 2018, reached USD 1,406.43 million in 2024, and is projected to attain USD 1,994.96 million by 2032, expanding at a CAGR of 4.16%.

- North America (43.2%), Asia Pacific (31.1%), and Europe (17.2%) accounted for the top regional shares in 2024, driven by advanced retail infrastructure, urban expansion, and strict sustainability regulations.

- Asia Pacific is the fastest-growing region with a 31.1% share, supported by rapid urbanization, expanding retail networks, and government policies encouraging eco-friendly packaging.

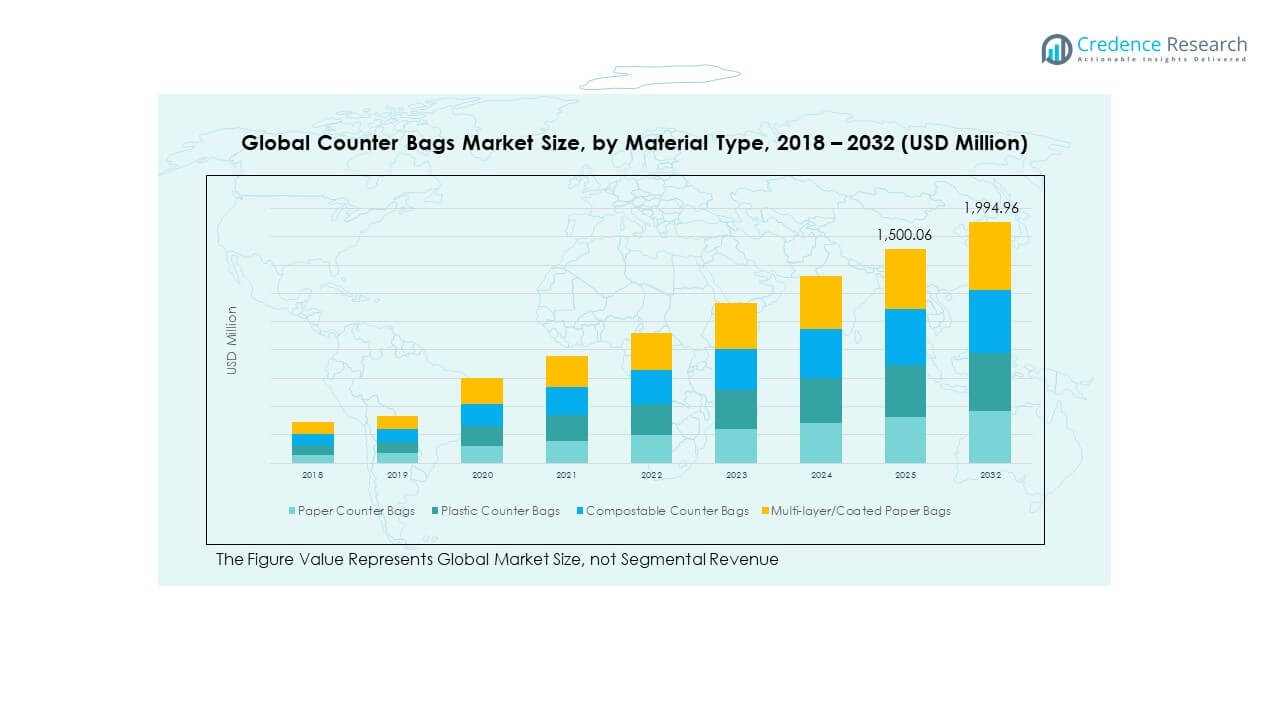

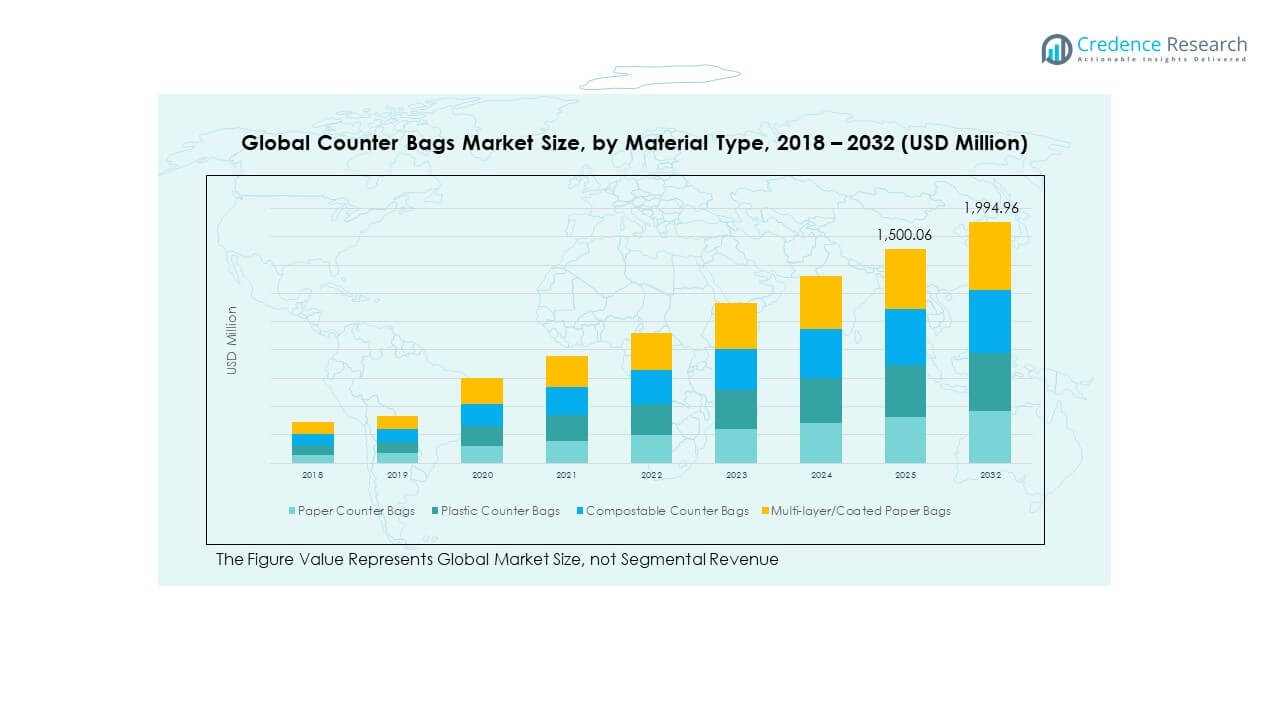

- Paper counter bags held the largest segment share in 2024 at 42%, supported by strong demand for recyclable and low-cost alternatives.

- Plastic counter bags represented 28% of the market in 2024, retaining significance in cost-sensitive markets while gradually losing share to compostable and coated paper formats.

Market Drivers:

Rising Demand for Convenient and Sustainable Retail Packaging Solutions

The Global Counter Bags Market benefits from increasing retail activity where businesses seek efficient packaging formats that enhance convenience and sustainability. Counter bags enable quick handling and secure storage of items, making them highly relevant in supermarkets, grocery outlets, and specialty shops. Growing consumer awareness about eco-friendly packaging motivates retailers to shift from traditional plastic toward biodegradable and recyclable materials. Regulatory frameworks targeting single-use plastics are strengthening this shift, pushing innovation across the sector. It benefits from rising consumer preference for lightweight yet durable bags that align with modern retail operations. Retailers focus on cost efficiency while ensuring compliance with environmental standards, boosting adoption. The ability of counter bags to balance functionality with sustainability continues to establish them as a preferred solution across multiple industries.

- For instance, Mondi introduced its paper-based “EcoWicketBag” for food, retail, and hygiene products, designed to replace traditional plastic wicket bags. The solution is fully recyclable within existing paper waste streams and is compatible with automated filling lines, offering both sustainability and operational efficiency.

Expanding Foodservice and Takeaway Packaging Requirements

Foodservice expansion fuels demand for counter bags that maintain hygiene, portability, and customer convenience. Restaurants, cafes, and bakeries increasingly rely on packaging solutions that ensure freshness and promote their brand identity. The Global Counter Bags Market experiences growth from the rise in takeaway and quick-service formats, where packaging performance directly affects customer experience. Consumer demand for tamper-evident and safe food packaging enhances the relevance of counter bags across this sector. It supports both traditional dine-out models and digital food delivery platforms requiring flexible solutions. Growth in e-commerce for groceries and meal delivery strengthens the requirement for reliable counter bags that safeguard products. Market participants explore customized designs to cater to diverse food applications, enhancing competitiveness. Rising disposable incomes and shifting eating habits add further impetus to demand from foodservice outlets.

Technological Innovations and Shift Toward Eco-Friendly Materials

Innovation in materials and manufacturing technologies is shaping the expansion of sustainable counter bags. The Global Counter Bags Market witnesses product development in compostable, biodegradable, and recyclable solutions that reduce environmental impact. It benefits from advancements in bio-based polymers and paper-based formats designed to replace traditional plastics. Companies are investing in processes that enhance tensile strength, printability, and moisture resistance, ensuring broad usability. Demand from environmentally conscious consumers is influencing retailers to adopt innovative materials that align with their sustainability commitments. Customized branding on eco-friendly counter bags helps retailers create differentiation and attract loyal customers. Integration of smart features such as QR codes or eco-label certifications builds consumer trust and supports compliance. These innovations provide long-term growth momentum by aligning retail packaging with global sustainability targets.

- For instance, Novolex offers paper bags made from FSC-certified paper under its Duro® and Bagcraft® brands, with the option for water-based flexographic printing in multiple colors. These bags are designed to be kerbside recyclable while providing strong performance for retail and foodservice applications.

Expanding Organized Retail and E-Commerce Penetration Globally

The rapid growth of organized retail and e-commerce platforms fuels demand for flexible packaging solutions that cater to diverse product categories. The Global Counter Bags Market gains traction from increasing online and offline retail integration where packaging durability and branding are vital. It is driven by consumer expectations for reliable packaging that ensures product safety during transport. Counter bags are widely adopted in apparel, groceries, and personal care sectors due to their adaptability. Urbanization and rising household spending stimulate purchasing activity, creating steady demand for counter bags in multiple regions. Retail chains implement sustainable packaging policies, reinforcing usage in everyday transactions. The growth of omnichannel retailing requires packaging formats that balance cost, performance, and customer appeal. This evolving retail ecosystem significantly supports the adoption of counter bags globally.

Market Trends:

Rising Consumer Preference for Customizable Packaging Solutions

The Global Counter Bags Market is witnessing increasing adoption of customizable bags that meet diverse retail needs. Retailers are prioritizing packaging that supports branding and enhances customer loyalty through personalized designs. It is influenced by consumer demand for packaging that reflects aesthetics, convenience, and sustainability. Brands are integrating logos, eco-labels, and product information directly on counter bags to build stronger identity. Retailers across fashion and food sectors use customized bags as marketing tools to reinforce brand presence. Evolving digital printing technologies allow cost-effective customization in small or large batches. This trend creates opportunities for suppliers offering innovative designs at scale. Consumer expectation for packaging to reflect brand values continues to strengthen the role of customizable counter bags.

- For instance, the HP Indigo 25K digital press delivers print speeds of up to 42 meters per minute in Enhanced Productivity Mode and is designed for short-run, customized packaging. HP highlights that the press can cut setup and printing waste by as much as 95% compared with conventional methods, offering a more sustainable solution for flexible packaging converters.

Strong Uptake of Counter Bags in Health, Wellness, and Organic Retail Segments

Health and wellness markets rely heavily on packaging that conveys safety, hygiene, and eco-friendliness. The Global Counter Bags Market benefits from strong adoption across organic grocery stores and specialty outlets promoting sustainable lifestyles. It aligns with consumer behavior where packaging acts as a symbol of product authenticity. Retailers catering to organic and natural goods use recyclable or compostable bags to highlight eco-conscious values. Rising health-focused consumption patterns in developed and emerging economies drive consistent demand. It supports packaging that enhances shelf appeal while meeting strict quality standards. Growth in wellness retail and specialty organic chains directly stimulates the need for counter bags. The increasing alignment of packaging with wellness branding continues to expand this application area.

Digital Integration Across Retail Supply Chains to Enhance Packaging Efficiency

Digital transformation in retail supply chains is influencing packaging procurement, design, and compliance strategies. The Global Counter Bags Market experiences growing impact from digital platforms that streamline inventory and order management. It benefits from tools that optimize packaging material sourcing and reduce waste across operations. Smart supply chain systems allow retailers to track packaging sustainability performance in real time. E-commerce platforms integrate packaging standards to align with delivery logistics, reinforcing counter bag usage. It reflects the convergence of packaging with technology-driven efficiency. Retailers invest in digital platforms that provide analytics on consumer behavior related to packaging choices. This integration strengthens operational control and enhances decision-making for packaging investments.

- For example, Smurfit Kappa’s PackExpert tool has been used in over 100,000 packaging design cases to benchmark performance and optimize right-weighted solutions. The company also employs its SupplySmart platform, which digitally models supply chains to enhance packaging sustainability and efficiency.

Premiumization and Shift Toward Lifestyle-Oriented Packaging Formats

Consumers increasingly value packaging that offers both functionality and premium appeal, creating opportunities for innovative counter bag designs. The Global Counter Bags Market reflects this trend in lifestyle-oriented packaging across luxury retail and specialty sectors. It benefits from consumer demand for reusable, durable, and stylish packaging that aligns with modern aesthetics. Premium brands employ high-quality materials and finishes in counter bags to enhance customer experience. It enables packaging to act as a product extension, adding value beyond its basic function. Growing middle-class populations in emerging economies fuel demand for upscale packaging solutions. Retailers leverage premium counter bags to differentiate in competitive markets and reinforce brand perception. This trend expands the role of counter bags as lifestyle products rather than simple utility items.

Market Challenges Analysis:

Rising Raw Material Costs and Volatility in Supply Chains

Volatility in raw material prices poses a significant challenge for companies supplying packaging solutions globally. The Global Counter Bags Market faces difficulties due to fluctuating costs of paper, polymers, and biodegradable alternatives, which directly affect profit margins. It becomes more challenging when supply chains experience disruptions caused by global trade restrictions or logistics delays. Small and mid-sized manufacturers struggle to maintain cost competitiveness while offering sustainable alternatives. Retailers seeking cost-effective packaging often push suppliers to absorb rising material costs, creating pressure on margins. Regulatory changes demanding eco-friendly materials also increase operational expenditures. It highlights the need for strategic sourcing and investment in alternative materials. The combination of raw material volatility and supply chain instability continues to hinder consistent market growth.

Regulatory Pressures and Competition From Alternative Packaging Formats

Governments worldwide are strengthening regulations on single-use plastics and encouraging sustainable packaging, increasing compliance costs for manufacturers. The Global Counter Bags Market must adapt to evolving policies, certifications, and consumer expectations while maintaining affordability. It faces competition from alternative packaging options such as reusable fabric bags and rigid containers. Retailers experimenting with substitutes challenge the long-term dominance of counter bags in retail transactions. Consumer preference for durable and reusable solutions further intensifies competitive pressure. It becomes critical for manufacturers to innovate without compromising cost efficiency. Strict labeling and eco-compliance requirements create further complexities across diverse markets. Regulatory uncertainty and competition from alternatives remain major challenges restraining industry growth.

Market Opportunities:

Growth in Sustainable Packaging Initiatives and Circular Economy Models

Sustainability initiatives present long-term growth opportunities by aligning packaging formats with environmental goals. The Global Counter Bags Market benefits from the adoption of circular economy models emphasizing recyclable and reusable materials. It opens pathways for innovation in biodegradable counter bags that appeal to eco-conscious consumers. Retailers adopting carbon-neutral commitments increasingly prefer sustainable packaging providers. Brands using green credentials as marketing tools enhance demand for certified eco-friendly counter bags. Investments in advanced compostable technologies create competitive differentiation. The global push for sustainable packaging reinforces opportunities across both developed and emerging markets.

Rising Penetration in Emerging Economies and Expanding Retail Infrastructure

Emerging markets provide significant opportunities due to rapid retail expansion, rising disposable incomes, and evolving consumer expectations. The Global Counter Bags Market benefits from the growth of supermarkets, hypermarkets, and specialty stores across these regions. It aligns with increasing urbanization and rising demand for convenient yet sustainable packaging solutions. Government initiatives promoting eco-friendly alternatives further encourage adoption. Retailers exploring new store formats and e-commerce platforms seek reliable packaging partners. The opportunity lies in providing innovative designs suited to diverse retail environments. Strategic partnerships with local distributors and retailers expand reach in untapped markets.

Market Segmentation Analysis:

The Global Counter Bags Market is segmented

By material type

Into paper counter bags, plastic counter bags, compostable counter bags, and multi-layer/coated paper bags. Paper counter bags dominate demand due to their eco-friendly nature and cost-effectiveness, while compostable variants gain traction with stricter sustainability mandates. Plastic counter bags still retain relevance in price-sensitive markets, supported by durability and availability. Multi-layer and coated paper formats address specific retail and foodservice needs where moisture resistance and strength are priorities, creating niche adoption opportunities across premium applications.

- For example, Huhtamaki achieves paper packaging with a minimum of 95% fiber content for hot and cold cups significantly reducing plastic usage by using ultra-thin dispersion coatings designed to maintain recyclability and resource efficiency.

By application

The market covers retail outlets, bakeries and foodservice, pharmacies and drug stores, specialty stores and pharmacies, and others. Retail outlets remain the primary users as counter bags ensure customer convenience and branding opportunities. Bakeries and foodservice providers drive usage where freshness, hygiene, and portability matter most. Pharmacies and specialty stores emphasize secure, lightweight, and compact packaging formats that suit regulated products and branded experiences. It adapts to diverse end-use industries where counter bags enhance functionality while supporting sustainable practices.

- For example, WestRock offers a range of bakery and deli packaging solutions using paper-based materials that provide oil and grease resistance and temperature retention for prepared foods. These paper-based bakery packaging solutions help reduce reliance on single-use plastics while maintaining the quality and freshness of baked goods.

By distribution channel

Segment includes direct sales to retail chains, packaging distributors, and online packaging suppliers. Direct sales lead in large-volume retail chains that prioritize customized designs and consistent supply contracts. Packaging distributors serve small and mid-sized businesses that require varied material choices in smaller lots. Online packaging suppliers are expanding their footprint, catering to digitally driven retailers and foodservice operators seeking cost transparency and flexible ordering. This balanced distribution network ensures wide accessibility and scalability for manufacturers across global regions.

Segmentation:

By Material Type

- Paper Counter Bags

- Plastic Counter Bags

- Compostable Counter Bags

- Multi-layer/Coated Paper Bags

By Application

- Retail Outlets

- Bakeries and Foodservice

- Pharmacies and Drug Stores

- Specialty Stores and Pharmacies

- Others

By Distribution Channel

- Direct Sales to Retail Chains

- Packaging Distributors

- Online Packaging Suppliers

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Counter Bags Market size was valued at USD 465.11 million in 2018 to USD 607.30 million in 2024 and is anticipated to reach USD 863.83 million by 2032, at a CAGR of 4.2% during the forecast period. The region holds a dominant 43.2% share of the global market, supported by a mature retail ecosystem and advanced packaging innovation. The market benefits from strong regulatory pressure to adopt sustainable alternatives, prompting retailers to favor paper and compostable counter bags. It is influenced by rising demand from supermarkets, hypermarkets, and foodservice chains that prioritize hygiene and brand identity in packaging. Growth in e-commerce grocery delivery strengthens the adoption of flexible packaging formats. Regional manufacturers invest in lightweight designs and recyclable materials to meet evolving consumer expectations. Customization and digital printing technologies gain traction as branding becomes a critical differentiator. North America remains at the forefront of sustainable packaging transformation, reinforcing its leadership position in the global landscape.

Europe

The Europe Global Counter Bags Market size was valued at USD 194.48 million in 2018 to USD 242.23 million in 2024 and is anticipated to reach USD 311.67 million by 2032, at a CAGR of 2.9% during the forecast period. Europe represents 17.2% of the global share, driven by strict environmental policies and strong adoption of eco-friendly packaging. The European Union’s regulations on single-use plastics encourage a rapid shift toward paper and compostable alternatives. It is shaped by consumer demand for sustainable retail formats, particularly in foodservice and specialty stores. Growth in premium retail outlets boosts usage of multi-layer coated paper bags offering durability and aesthetics. Retailers across the UK, France, and Germany emphasize carbon-neutral supply chains, increasing demand for certified sustainable products. Market players actively invest in recyclable innovations to align with regional green commitments. Europe maintains steady growth through regulatory leadership and consumer preference for eco-conscious packaging.

Asia Pacific

The Asia Pacific Global Counter Bags Market size was valued at USD 314.70 million in 2018 to USD 437.92 million in 2024 and is anticipated to reach USD 676.31 million by 2032, at a CAGR of 5.3% during the forecast period. Asia Pacific holds 31.1% of the global market, emerging as a high-growth region due to rapid urbanization and expanding organized retail. Strong population growth and rising disposable incomes increase consumption across foodservice, grocery, and pharmacy channels. It is driven by rising awareness of sustainable packaging and supportive government policies across China, India, and Japan. Growth of e-commerce platforms accelerates demand for flexible packaging that ensures durability and cost efficiency. Regional manufacturers focus on balancing affordability with eco-friendly innovations to serve diverse markets. Retailers increasingly adopt branded counter bags to capture customer loyalty in competitive urban centers. Asia Pacific is projected to outpace other regions in long-term growth, supported by dynamic retail expansion.

Latin America

The Latin America Global Counter Bags Market size was valued at USD 49.28 million in 2018 to USD 64.20 million in 2024 and is anticipated to reach USD 80.37 million by 2032, at a CAGR of 2.5% during the forecast period. Latin America accounts for 4.6% of the global share, supported by steady retail modernization and growing preference for sustainable packaging. The market is led by Brazil and Mexico, where urban growth and supermarket expansion increase adoption. It is influenced by gradual regulatory enforcement on plastics, creating opportunities for paper-based counter bags. Bakeries and foodservice outlets are strong contributors to demand, emphasizing hygiene and portability. Regional players face challenges in balancing cost with eco-friendly product development. Online packaging suppliers are gaining traction with small and medium retailers seeking cost-effective solutions. Latin America shows modest growth but offers potential through rising environmental awareness and expanding retail networks.

Middle East

The Middle East Global Counter Bags Market size was valued at USD 25.83 million in 2018 to USD 30.69 million in 2024 and is anticipated to reach USD 35.56 million by 2032, at a CAGR of 1.5% during the forecast period. The region represents 2.2% of the global market, reflecting moderate adoption of counter bags across retail and foodservice outlets. It is influenced by premium retail chains and foodservice sectors that seek packaging aligned with international standards. Government focus on sustainability is gradually reshaping packaging choices, especially in GCC countries. Regional demand is concentrated in urban centers where modern retail is expanding. Limited domestic manufacturing capacity creates reliance on imports for eco-friendly counter bags. Packaging distributors play a vital role in supplying retailers with diverse options. The Middle East demonstrates incremental growth potential, with opportunities linked to regulatory developments and luxury retail expansion.

Africa

The Africa Global Counter Bags Market size was valued at USD 16.53 million in 2018 to USD 24.09 million in 2024 and is anticipated to reach USD 27.23 million by 2032, at a CAGR of 1.2% during the forecast period. Africa contributes 1.7% of the global market, reflecting early-stage adoption of sustainable packaging practices. It is shaped by the expansion of supermarkets and retail chains in South Africa, Nigeria, and Egypt. Limited consumer awareness of eco-friendly options slows growth compared to other regions. Cost sensitivity in local markets sustains demand for traditional plastic counter bags. International retailers entering Africa create opportunities for paper and compostable alternatives. Local manufacturers face challenges in scaling production with limited infrastructure. Despite slow growth, rising environmental campaigns and urban retail expansion hold long-term potential. Africa remains a developing market with gradual shifts toward modern packaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Counter Bags Market features strong competition among multinational packaging leaders and regional manufacturers striving to balance sustainability with cost efficiency. Key players such as Novolex, Mondi Group, DS Smith Plc, Huhtamaki Oyj, International Paper Company, and WestRock Company focus on expanding portfolios of paper and compostable bags to address regulatory pressure and rising consumer demand for eco-friendly solutions. It is marked by frequent product innovations, acquisitions, and capacity expansions to strengthen market positioning. Companies invest in advanced printing, lightweight materials, and recyclable designs to attract retailers and foodservice operators. Competition is also shaped by pricing strategies, branding customization, and supply chain resilience. Emerging players target niche segments like specialty retail and premium packaging, creating opportunities for differentiated offerings. Strategic partnerships with distributors and online suppliers support broader geographic reach and reinforce competitive presence across developed and emerging markets.

Recent Developments:

- In August 2025, International Paper Company announced the sale of its global cellulose fibers business to American Industrial Partners for $1.5 billion, anticipated to close by the end of 2025. This transaction represents a significant move to streamline International Paper’s operations toward sustainable packaging, following its $7.2 billion acquisition of UK-based DS Smith earlier in the year.

- In April 2025, Novolex completed its $6.7 billion acquisition of Pactiv Evergreen, marking one of the year’s largest moves in the food and specialty packaging sector. The all-cash deal made Novolex one of the largest producers of food packaging globally, with strategic priorities now focused on operational optimization and accelerated product innovation for food and beverage customers.

- In March 2024, Novolex (Bagcraft) introduced a new line of compostable and grease-resistant counter bags tailored for bakeries and delis. These innovative bags are designed to enhance food safety and environmental compliance while providing premium branding options.

Market Concentration & Characteristics:

The Global Counter Bags Market demonstrates moderate concentration with leading players controlling a significant share through global supply networks and diversified product portfolios. It is characterized by a strong push toward sustainability, where innovation in paper-based and compostable solutions shapes industry growth. The market combines established multinational companies with regional firms serving cost-sensitive segments. Competitive dynamics are influenced by environmental regulations, retail expansion, and consumer preference for eco-friendly packaging. Barriers to entry remain moderate due to regulatory compliance and investment requirements in sustainable production technologies.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Application and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Counter Bags Market will expand with rising demand for sustainable and recyclable packaging across retail and foodservice industries.

- Strong regulatory frameworks on plastic reduction will accelerate adoption of paper and compostable counter bags worldwide.

- Digital printing advancements will enhance customization, supporting branding strategies for retailers and specialty outlets.

- Growth in e-commerce grocery and meal delivery services will strengthen demand for durable and lightweight counter bags.

- Emerging economies will provide new opportunities with expanding organized retail infrastructure and rising consumer awareness.

- Innovation in coated and multi-layer formats will improve strength and moisture resistance for diverse applications.

- Partnerships between packaging producers and retailers will drive product innovation and supply chain efficiency.

- Investments in circular economy models will promote compostable and biodegradable materials across multiple regions.

- Competitive pressures will encourage mergers, acquisitions, and strategic expansions among leading packaging companies.

- Consumer preference for premium and lifestyle-oriented designs will push manufacturers to explore reusable and stylish formats.