Market Overview

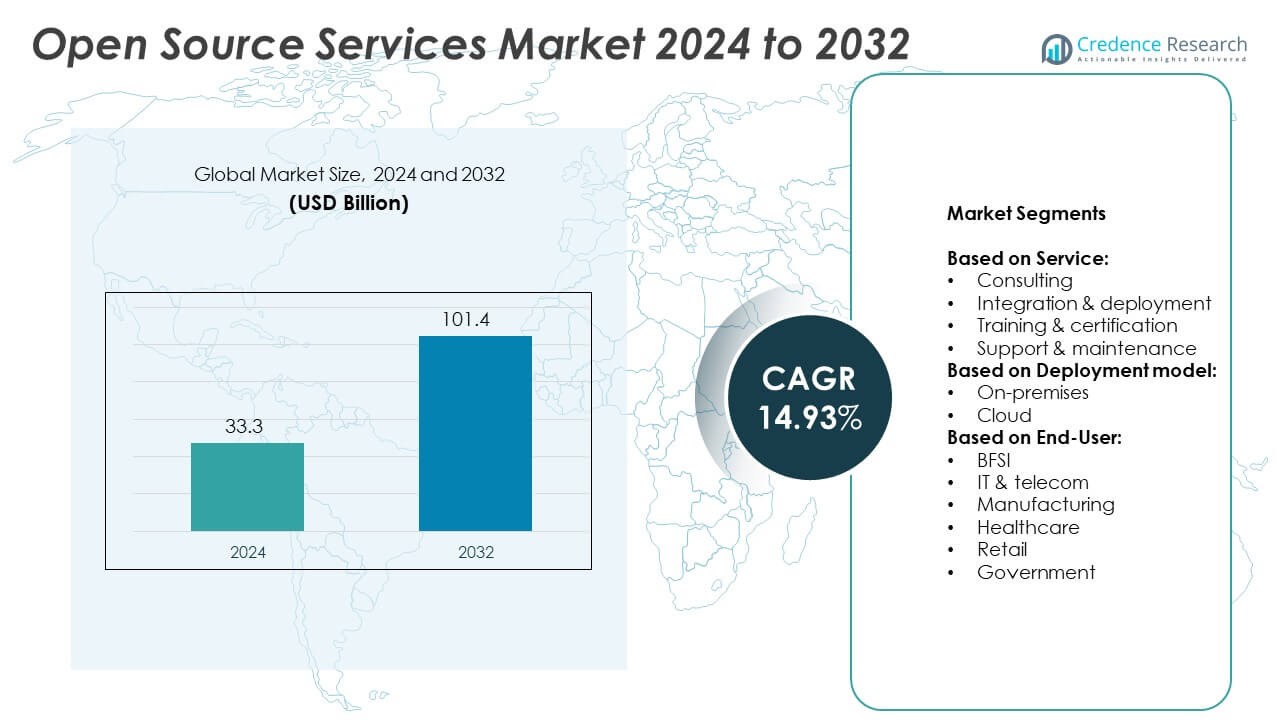

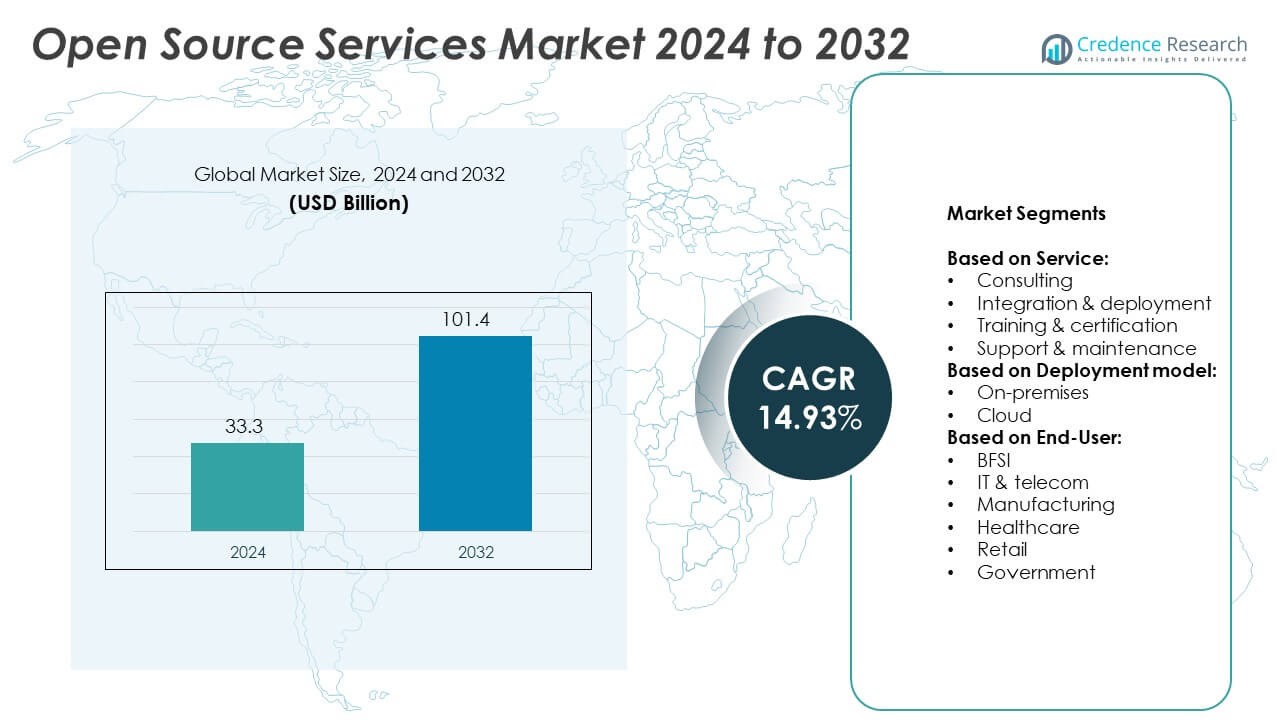

The Open-Source Services Market size was valued at USD 33.3 billion in 2024 and is anticipated to reach USD 101.4 billion by 2032, at a CAGR of 14.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Open-Source Services Market Size 2024 |

USD 33.3 Billion |

| Open-Source Services Market, CAGR |

14.93% |

| Open-Source Services Market Size 2032 |

USD 101.4 Billion |

The Open-Source Services market grows through rising demand for cost-effective, scalable, and flexible IT solutions. Drivers include strong enterprise adoption of cloud-native platforms, increasing focus on cybersecurity, and expansion of AI and analytics within open-source frameworks. Trends highlight rapid integration of containerization, multi-cloud strategies, and developer-led innovation. It advances through ecosystem collaboration, regulatory support, and hybrid deployment models. Together, these factors strengthen market adoption across industries seeking transparency, agility, and long-term sustainability in digital transformation efforts.

The Open-Source Services market shows strong adoption across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads with advanced IT infrastructure and enterprise innovation, while Asia Pacific expands rapidly with digital transformation initiatives in China and India. Europe emphasizes data security and regulatory compliance, supporting steady adoption. Key players shaping the market include Google, IBM, Microsoft, and Amazon, each driving advancements through cloud services, AI integration, and open-source community contributions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Open-Source Services market was valued at USD 33.3 billion in 2024 and is projected to reach USD 101.4 billion by 2032, growing at a CAGR of 14.93%.

- The market grows due to rising demand for cost-effective and scalable IT solutions across industries. Enterprises adopt open-source platforms to reduce licensing costs, achieve flexibility, and modernize infrastructure.

- Key trends include rapid adoption of cloud-native applications, integration of AI and machine learning frameworks, and growing emphasis on security-focused open-source solutions. Containerization and hybrid deployment models also expand the market scope.

- The competitive landscape features major players such as Google, IBM, Microsoft, Amazon, ATOS SE, Oracle C, Cisco, SUSE, HPE, and HCL. These companies strengthen their positions through innovation, strategic partnerships, and contributions to open-source communities.

- Market restraints include challenges with integration into complex enterprise systems, concerns over long-term vendor support, and risks related to security and compliance. Organizations also face difficulties in managing technical expertise for large-scale deployments.

- Regional analysis shows North America leading adoption with advanced infrastructure and enterprise demand, while Asia Pacific grows rapidly through digital transformation in emerging economies. Europe focuses on regulatory compliance and secure IT modernization, with Latin America and the Middle East & Africa showing steady expansion.

- Overall, the market demonstrates strong momentum, driven by collaborative ecosystems, regulatory encouragement, and the rising importance of open-source in enterprise digital strategies, ensuring sustained global growth across diverse industries.

Market Drivers

Rising Demand for Cost-Effective and Scalable IT Solutions

The Open-Source Services Market grows due to increasing enterprise demand for affordable and flexible solutions. Businesses adopt open-source platforms to reduce licensing expenses and gain scalability. It enables organizations to customize software according to operational needs and industry-specific requirements. Companies achieve faster deployment cycles by leveraging community-driven frameworks and reusable components. Vendors enhance competitiveness by offering specialized support and advanced integration features. This shift accelerates adoption across industries aiming to optimize infrastructure investments.

- For instance, Microsoft contributed over 20,000 lines of device driver code to the Linux kernel.

Expansion of Cloud-Native and Container-Based Architectures

The Open-Source Services Market benefits from strong adoption of cloud-native applications and container orchestration platforms. Organizations deploy Kubernetes, Docker, and OpenShift for simplified application management and seamless scalability. It supports multi-cloud strategies, enabling enterprises to avoid vendor lock-in and improve resource allocation. Developers integrate microservices architectures for efficient performance across distributed environments. Growing use of open-source DevOps tools improves automation and operational control. Cloud-driven development models strengthen collaboration and innovation across technology ecosystems.

- For instance, IBM contributed a significant amount of code, specifically around 44,000 lines, to the Hyperledger Fabric project under an open governance model. This contribution was part of IBM’s efforts to advance blockchain technology for business use and was made to the Linux Foundation’s Hyperledger Project, of which IBM was a founding member.

Growing Enterprise Investments in Cybersecurity and Compliance

The Open-Source Services Market witnesses higher investments in open-source security tools and frameworks. Enterprises adopt advanced solutions to detect vulnerabilities, automate patching, and secure digital assets. It enables faster threat response and stronger compliance with global regulatory standards. Providers develop frameworks that integrate security at every stage of the software lifecycle. The market gains momentum as businesses prioritize risk management across complex IT environments. Open-source-driven security models enhance transparency and trust among enterprise users.

Increasing Community-Driven Innovation and Vendor Collaboration

The Open-Source Services Market thrives on active developer communities and strong vendor partnerships. Global contributors accelerate innovation by improving existing frameworks and introducing new features. It fosters interoperability across platforms, enabling faster deployment of emerging technologies. Businesses benefit from ecosystem-driven advancements in AI, big data, and analytics. Technology providers collaborate with open-source foundations to strengthen product reliability and scalability. This collaborative approach enhances solution diversity and drives continuous growth across industries.

Market Trends

Accelerating Shift Toward Cloud-Native Open-Source Platforms

The Open-Source Services Market experiences rapid growth due to increasing adoption of cloud-native solutions. Enterprises implement Kubernetes, Docker, and OpenShift to manage applications with higher flexibility and scalability. It supports seamless migration from legacy systems to modernized infrastructures. Organizations prioritize open-source platforms to achieve faster deployment cycles and improved operational efficiency. Vendors enhance integration capabilities, enabling optimized performance across multi-cloud and hybrid environments. This trend strengthens enterprise adaptability in competitive markets.

- For instance, Linus Torvalds released kernel version 1.0 in March 1994. By February 2015, the Linux kernel had received contributions from nearly 12,000 programmers who were employed by more than 1,200 companies or organizations.

Rising Integration of Artificial Intelligence and Machine Learning Tools

The Open-Source Services Market benefits from growing implementation of AI and machine learning frameworks. Businesses adopt TensorFlow, PyTorch, and Apache MXNet to develop data-driven applications efficiently. It accelerates innovation by leveraging community-built algorithms and libraries for advanced analytics. Organizations utilize open-source models to enhance automation, improve predictions, and optimize decision-making processes. Providers introduce scalable solutions tailored for enterprise AI adoption. Continuous advancements drive stronger demand for collaborative AI-based open-source ecosystems.

- For instance, Google’s TensorFlow Hub provides access to thousands of reusable machine learning models, not over 100,000. The models can be used with Google’s Cloud TPU clusters, which offer immense processing power for training and serving large AI models. The newest Cloud TPU, Trillium, is significantly more powerful than older generations, delivering many exaflops of peak compute performance at a building-scale level.

Increasing Emphasis on Security-First Open-Source Frameworks

The Open-Source Services Market witnesses a shift toward security-focused solutions across industries. Enterprises adopt enhanced frameworks to mitigate vulnerabilities and strengthen infrastructure protection. It enables efficient patching, compliance management, and secure integration within enterprise systems. Vendors invest in open-source security tools to provide real-time monitoring and automated threat detection. Businesses prioritize transparent and reliable frameworks to build trust among users. This growing focus improves overall software quality and boosts adoption rates globally.

Expansion of Collaborative Development and Multi-Vendor Ecosystems

The Open-Source Services Market thrives on active collaboration between developers, enterprises, and technology providers. Organizations contribute to open-source communities to accelerate innovation and create scalable frameworks. It drives interoperability, allowing integration across diverse software stacks and emerging technologies. Vendors form partnerships to enhance platform capabilities and deliver enterprise-ready solutions. Businesses benefit from faster deployment cycles supported by collective research and development efforts. This collaborative ecosystem shapes new business models and broadens market opportunities.

Market Challenges Analysis

Complexity in Integration and Compatibility Across Enterprise Systems

The Open-Source Services Market faces significant challenges due to complex integration requirements within enterprise IT infrastructures. Organizations struggle to align open-source solutions with existing proprietary systems, creating operational inefficiencies. It demands skilled professionals capable of managing compatibility issues and ensuring seamless deployment. Diverse open-source frameworks often lack standardized protocols, leading to inconsistent performance across platforms. Businesses incur additional costs to customize solutions for specific operational needs. Limited interoperability between multi-cloud and on-premise environments further slows adoption rates.

Concerns Over Security, Compliance, and Long-Term Support

The Open-Source Services Market encounters hurdles related to data security and regulatory compliance. Enterprises face risks from vulnerabilities within community-driven software, requiring continuous monitoring and proactive measures. It becomes challenging to manage updates and patches across large-scale deployments without dedicated vendor support. Organizations also struggle to ensure compliance with evolving data protection regulations across regions. Inconsistent support models from multiple vendors add to operational risks. These factors impact enterprise confidence, slowing widespread adoption despite growing demand for open-source innovations.

Market Opportunities

Growing Adoption of Cloud, AI, and Data-Driven Open-Source Solutions

The Open-Source Services Market presents strong opportunities driven by rising demand for cloud-native, AI, and big data technologies. Enterprises increasingly adopt open-source frameworks like Kubernetes, TensorFlow, and Hadoop to accelerate innovation and reduce operational costs. It enables businesses to build scalable solutions while improving efficiency across distributed environments. Organizations leverage open-source analytics platforms to process large datasets and enhance decision-making. Vendors expand offerings to support AI-powered applications and real-time insights. The demand for flexible, customizable frameworks continues to open new growth avenues for technology providers.

Expanding Enterprise Collaboration and Emerging Market Penetration

The Open-Source Services Market benefits from increasing collaboration between enterprises, developers, and technology vendors. Open communities drive faster innovation by improving existing frameworks and introducing advanced functionalities. It fosters stronger partnerships that enable businesses to adopt interoperable solutions across diverse ecosystems. Emerging markets offer untapped potential, with growing digital transformation initiatives fueling adoption. Vendors capitalize on expanding demand by delivering enterprise-grade support and integration services. These opportunities strengthen the market’s ability to address evolving business needs and accelerate global expansion.

Market Segmentation Analysis:

By Service:

The Open-Source Services Market is segmented into consulting, integration and deployment, training and certification, and support and maintenance. Consulting services dominate as enterprises rely on expert guidance to select, implement, and optimize open-source solutions. Integration and deployment gain momentum due to rising demand for seamless incorporation of open-source frameworks into complex IT infrastructures. It drives efficiency by enabling businesses to adopt scalable, cost-effective solutions quickly. Training and certification services grow steadily with enterprises seeking to upskill employees and strengthen technical expertise. Support and maintenance remain essential to ensure consistent performance, security, and long-term reliability across enterprise environments.

- For instance, GitLab’s open-source platform is co-created by over 4,000 contributors from its community, who work on the development of the platform to deliver software faster. The community uses GitLab’s open-source Community Edition, a comprehensive DevSecOps platform that fosters transparency, collaboration, and community-driven development to build better software.

By Deployment Model:

The Open-Source Services Market is categorized into on-premises and cloud-based models. Cloud deployment leads due to growing enterprise adoption of scalable and flexible infrastructures. It enables seamless collaboration, cost optimization, and simplified resource management across diverse environments. On-premises deployment retains demand among organizations prioritizing control, security, and compliance. Hybrid approaches also gain popularity as businesses balance operational flexibility with data protection requirements. Vendors enhance offerings to support both deployment models, catering to varied enterprise strategies and evolving infrastructure needs.

- For instance, Google’s Chromium browser project holds over 32 million lines of source code, showing its massive scale and active development ecosystem.

By End-User:

The Open-Source Services Market serves BFSI, IT and telecom, manufacturing, healthcare, retail, and government sectors. BFSI drives adoption to improve digital banking, secure transactions, and enhance customer experience. IT and telecom lead the market with extensive use of open-source frameworks for automation and advanced software development. It supports manufacturing through efficient production planning, predictive analytics, and IoT integration. Healthcare organizations invest in open-source solutions to manage patient records, enable telemedicine, and ensure compliance. Retailers adopt flexible platforms to enhance omnichannel experiences and improve operational efficiency. Government agencies utilize open-source services to support digital transformation, ensure transparency, and reduce infrastructure costs.

Segments:

Based on Service:

- Consulting

- Integration & deployment

- Training & certification

- Support & maintenance

Based on Deployment model:

Based on End-User:

- BFSI

- IT & telecom

- Manufacturing

- Healthcare

- Retail

- Government

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the Open-Source Services market with a 28% share in 2024. The region dominates due to advanced IT infrastructure, strong enterprise adoption, and an active open-source developer ecosystem. It benefits from the presence of major technology vendors offering consulting, integration, and managed services. Industries like BFSI, healthcare, retail, and government rely heavily on open-source solutions to optimize operations. Growing investments in cloud-native and AI-driven frameworks enhance the region’s technological capabilities. Government-backed initiatives promoting digital transformation and open-source adoption further strengthen the market position.

Asia Pacific

Asia Pacific holds a significant 27% share of the Open-Source Services market in 2024 and records the fastest growth globally. Rapid digitalization in countries such as China, India, Japan, and South Korea drives large-scale enterprise adoption. It experiences growing demand across IT services, manufacturing, telecom, and BFSI sectors due to scalability and cost advantages. Government programs supporting open-source innovation and expanding developer ecosystems accelerate adoption across industries. Enterprises adopt containerization, AI-powered frameworks, and cloud-based platforms to modernize IT infrastructures. Increasing vendor partnerships and community-driven contributions further strengthen regional expansion.

Europe

Europe accounts for about 20% of the Open-Source Services market in 2024. Enterprises adopt open-source platforms to comply with strict data security, interoperability, and digital sovereignty regulations. BFSI, healthcare, and government sectors lead adoption due to high demands for transparency and reliability. It benefits from collaborations between open-source foundations, vendors, and regulators to enhance innovation and ensure compliance. Hybrid deployment models gain popularity as organizations balance cloud flexibility with sensitive data control. Strong regulatory support and ecosystem-driven development maintain the region’s steady growth trajectory.

Latin America

Latin America represents nearly 10% of the Open-Source Services market in 2024. The region witnesses consistent growth due to expanding digital transformation initiatives in banking, retail, and government sectors. Enterprises adopt open-source solutions to lower costs, avoid vendor lock-in, and enable scalable IT systems. It experiences increasing demand for consulting, integration, and deployment services, particularly among SMEs. Governments across Brazil, Mexico, and Argentina promote open-source adoption to improve infrastructure efficiency and transparency. Local vendor partnerships and regional skill development enhance the market’s overall competitiveness.

Middle East & Africa

The Middle East & Africa region contributes approximately 5% to the Open-Source Services market in 2024. Adoption levels remain in the early stages but continue to accelerate with investments in government, telecom, and education sectors. Organizations prioritize secure, flexible, and cost-efficient open-source frameworks to support national digital transformation goals. It benefits from vendor-led training, certifications, and localized support services to close technical skill gaps. Strategic collaborations with global providers enhance infrastructure readiness and increase enterprise-level adoption. The region shows gradual progress, driven by expanding cloud deployments and open-source advocacy.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Open-Source Services market is highly competitive, with leading players including Google, IBM, Microsoft, ATOS SE, Oracle C, Cisco, SUSE, Amazon, HPE, and HCL. These companies focus on delivering innovative, enterprise-grade solutions to meet the rising demand for scalable, secure, and cost-effective open-source services. They invest heavily in developing advanced frameworks, enhancing integration capabilities, and supporting cloud-native platforms. Market leaders strengthen their positions by forming strategic partnerships with open-source foundations and expanding their service portfolios across consulting, deployment, and managed services. Vendors prioritize hybrid and multi-cloud support to address diverse enterprise requirements. Continuous innovation in artificial intelligence, analytics, and containerization drives differentiation among competitors. Service providers also focus on offering robust security features, regulatory compliance, and enterprise-level support to build trust and maintain client loyalty. Growing contributions to community-driven projects and ecosystem collaboration further boost their market presence, ensuring faster adoption of open-source technologies across industries.

Recent Developments

- In 2025, Google at I/O in Bengaluru, localized AI processing of Gemini 2.5 Flash for India, integrated Gemini 2.5 Pro with Firebase and AI Studio, and introduced Gemma 3, an open‑source model supporting 140 languages.

- In 2025, IBM contributed three open-source AI projects—Docling, Data Prep Kit, and BeeAI—to the Linux Foundation. Specifically, these projects were inducted into the LF AI & Data Foundation, an umbrella foundation under the Linux Foundation dedicated to fostering open-source innovation in artificial intelligence and data.

- In May 2025, Microsoft 365 Copilot Tuning—a new, low-code capability in Microsoft Copilot Studio for every organization to tune AI models using their own company data, workflows, and processes—all without needing a team of data scientists or weeks of work.

Report Coverage

The research report offers an in-depth analysis based on Service, Deployment Model, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market continues broad adoption across industries driven by demand for flexible, scalable IT infrastructure.

- Hybrid and multi-cloud models gain traction, pushing more open-source service deployments.

- AI and machine learning frameworks expand within open-source ecosystems, spurring new service opportunities.

- Heightened focus on open-source security frameworks and compliance tools shapes service innovation.

- Developer communities deepen collaborative contributions, accelerating open-source advancements.

- Enterprises increase investments in training, certification, and managed support for open-source platforms.

- Industry partnerships and ecosystem alliances bolster open-source adoption and vendor competitiveness.

- Demand rises for localized and regional support services in emerging markets.

- Open-source frameworks evolve to support real-time analytics, IoT, and edge-computing use cases.

- Service providers refine consulting and integration offerings to deliver enterprise-grade open-source solutions.