Market Overview:

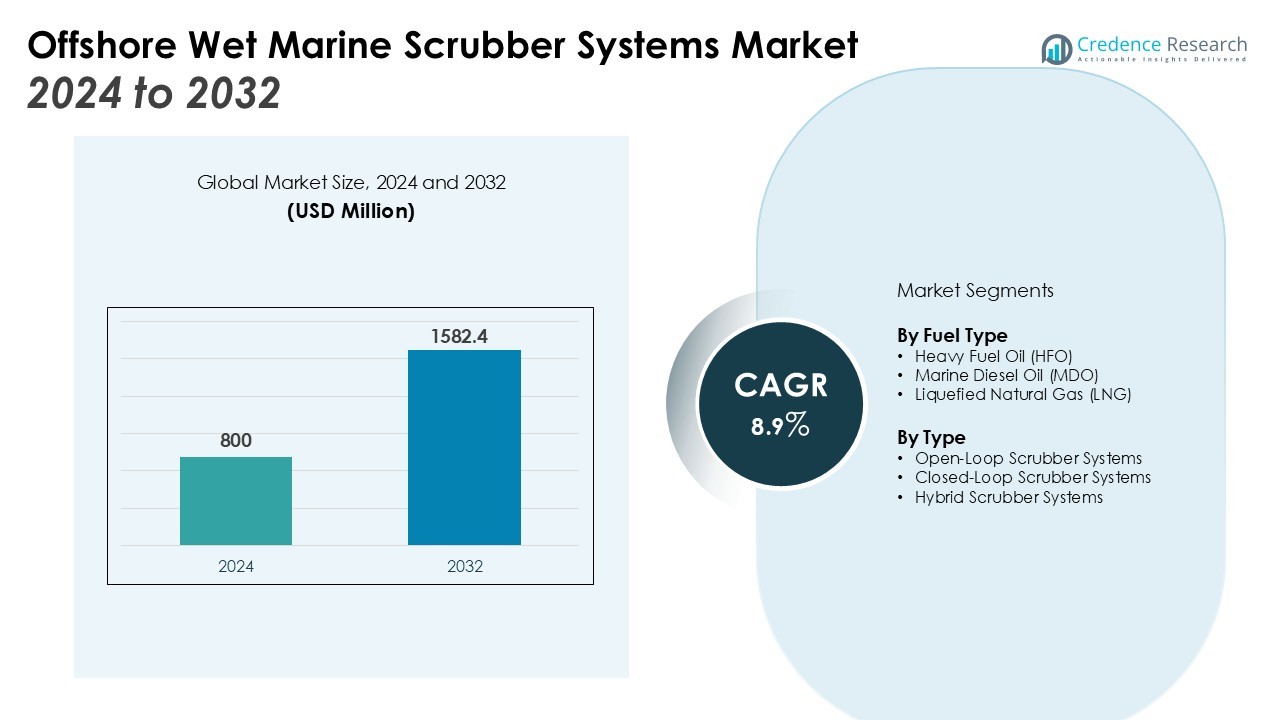

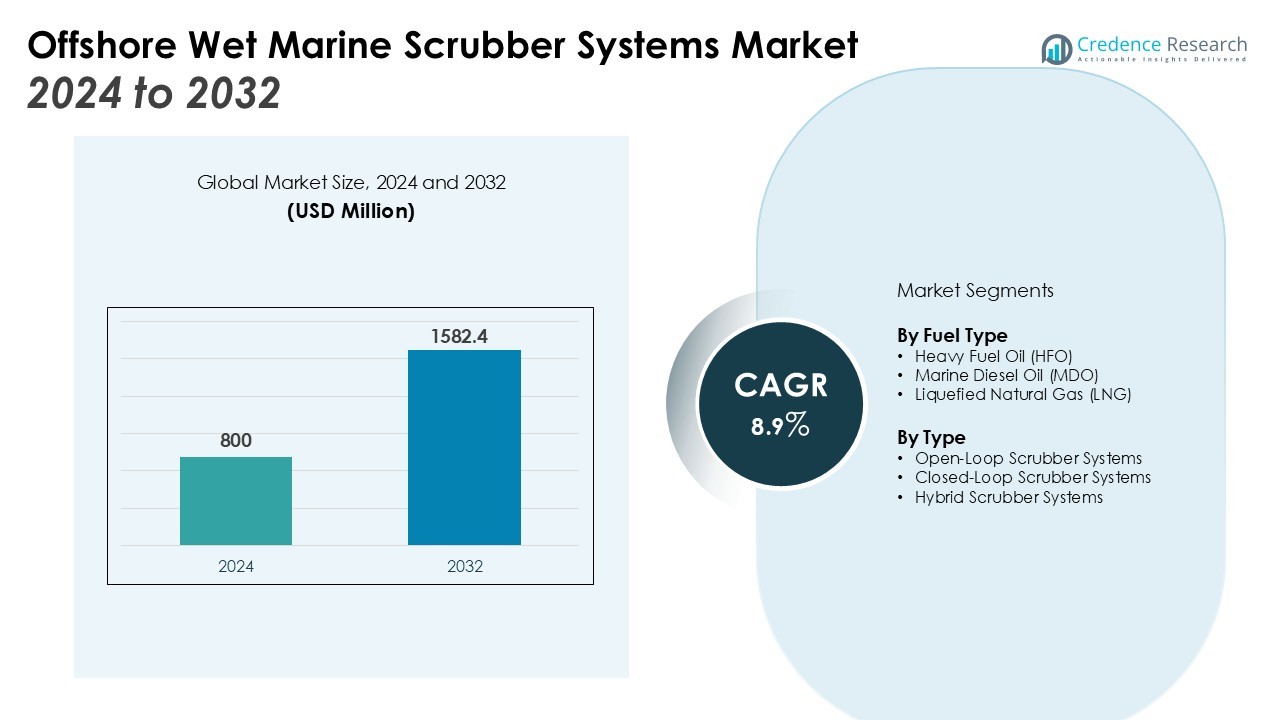

The Offshore Marine Scrubber Systems Market size was valued at USD 1100 million in 2024 and is anticipated to reach USD 2097.1 million by 2032, at a CAGR of 8.4% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Marine Scrubber Systems Market Size 2024 |

USD 1100 Million |

| Offshore Marine Scrubber Systems Market, CAGR |

8.4% |

| Offshore Marine Scrubber Systems Market Size 2032 |

USD 2097.1 Million |

The offshore marine scrubber systems market is advancing under the influence of stringent environmental regulations, particularly IMO sulfur emission limits, coupled with rising corporate sustainability commitments. Tighter compliance requirements are encouraging vessel operators to adopt scrubbers as a cost-effective means of reducing sulfur emissions and improving air quality across global shipping routes. At the same time, technological progress—including hybrid systems, closed-loop technologies, and automation—is enhancing operational efficiency, adaptability, and long-term cost savings, which supports wider deployment across offshore applications.

Regionally, Asia Pacific holds a dominant position and is also registering the fastest expansion. Growth in this region is supported by significant offshore energy activity, expanding shipbuilding industries, and stronger focus on emission compliance in key economies such as China, India, Japan, and South Korea. Europe follows closely, benefiting from early regulatory adoption and the presence of Emission Control Areas that mandate lower sulfur emissions for vessels. North America is witnessing steady growth, with coastal ECAs around the United States driving installations of scrubber systems as operators balance regulatory compliance with the need to sustain competitive operational costs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Offshore Marine Scrubber Systems Market was valued at USD 1100 million in 2024 and is projected to reach USD 2097.1 million by 2032, reflecting a CAGR of 8.4%.

- Stringent IMO sulfur emission limits and global regulatory mandates remain the primary forces driving widespread scrubber adoption across fleets.

- Growing corporate sustainability commitments are encouraging ship operators to integrate scrubbers as a practical solution for reducing sulfur emissions while managing fuel costs.

- Asia Pacific leads with 42% share, fueled by strong shipbuilding capacity, offshore energy operations, and large-scale retrofitting programs across major economies.

- Europe holds 30% share, supported by strict emission control zones and higher adoption of hybrid systems suited to water discharge restrictions.

- North America accounts for 18% share, driven by regulated coastal waters and offshore oil and gas activity, which reinforce steady demand for advanced scrubber systems.

Market Drivers:

Stringent Global Regulations Driving Compliance Demand

The Offshore Marine Scrubber Systems Market is propelled by the enforcement of strict international emission regulations. The International Maritime Organization’s sulfur cap has pushed ship operators to adopt scrubber technologies to remain compliant. These systems enable vessels to continue using conventional fuels while meeting sulfur emission standards. Regulatory compliance is no longer optional but a critical requirement for accessing global shipping routes.

Rising Corporate Sustainability Commitments Supporting Adoption

The shipping industry is under pressure from stakeholders to reduce its environmental footprint. The Offshore Marine Scrubber Systems Market benefits from growing corporate sustainability commitments aimed at achieving cleaner operations. Companies view scrubbers as an effective way to demonstrate environmental responsibility without incurring excessive fuel costs. It allows vessel operators to align operational efficiency with broader sustainability goals.

- For instance, marine technology company Wärtsilä is retrofitting three 3,600 TEU container vessels with its 27.5 MW scrubber systems that are also Carbon Capture and Storage (CCS)-Ready, preparing the ships for future carbon capture integration.

Technological Advancements Enhancing Efficiency and Reliability

Continuous innovation has significantly strengthened the appeal of scrubber systems. The Offshore Marine Scrubber Systems Market is experiencing growth through the development of hybrid and closed-loop systems that deliver higher efficiency. Automation and digital monitoring further enhance performance while reducing operational risks. It supports adaptability to diverse offshore conditions, making these solutions practical for both new builds and retrofits.

- For instance, Valmet’s Valve Performance Monitoring service at the Mercer Stendal pulp mill involves the 24/7 online monitoring of 500 critical valves, helping to predict and prevent failures through expert analysis.

Expansion of Offshore Energy and Shipbuilding Activities

The offshore energy sector and global shipbuilding industry are contributing strongly to demand. The Offshore Marine Scrubber Systems Market gains momentum from increased offshore exploration and rising fleet expansions across Asia Pacific and other regions. Shipbuilders are integrating scrubbers at the design stage, reflecting a shift toward long-term compliance strategies. It ensures vessels are prepared for evolving regulations and operational challenges across emission control areas.

Market Trends:

Increasing Preference for Hybrid and Closed-Loop Systems

The Offshore Marine Scrubber Systems Market is witnessing a clear shift toward hybrid and closed-loop technologies. Ship operators are adopting these solutions due to their ability to function efficiently across different water conditions, including open seas and emission control areas. Hybrid systems provide flexibility, enabling vessels to switch between modes depending on operational needs. Closed-loop systems are gaining traction where water discharge restrictions are in place, ensuring compliance with regional regulations. It is creating demand for advanced scrubbers that balance cost efficiency with environmental performance. Shipbuilders and retrofitting companies are aligning their portfolios to meet this growing preference, strengthening long-term adoption.

- For instance, Alfa Laval’s PureScrub H2O, the water cleaning unit for its closed-loop and hybrid systems, is proven to reduce solids content in wash water to below the required 25 Formazin Turbidity Units (FTU) before it can be discharged.

Digital Integration and Regionalization of Demand

The Offshore Marine Scrubber Systems Market is also shaped by rising digital integration and region-specific dynamics. Automation and remote monitoring tools are becoming standard, giving operators real-time insights into system performance and maintenance needs. It reduces operational risks while improving fuel efficiency and compliance tracking. Regional demand patterns highlight Asia Pacific as the fastest-growing market, driven by strong offshore energy activity and shipbuilding capacity. Europe continues to invest in emission control solutions, supported by strict enforcement across coastal waters. North America demonstrates steady adoption, with operators in emission control zones upgrading fleets to meet evolving standards. These regional trends indicate a broader industry shift toward sustainable, technology-driven compliance strategies.

- For instance, Wärtsilä secured a contract in the third quarter of 2024 to supply its advanced CCS-Ready scrubber systems for three container ships, a move that prepares the vessels for future carbon capture technology adoption.

Market Challenges Analysis:

High Capital Costs and Operational Complexities

The Offshore Marine Scrubber Systems Market faces challenges from the significant upfront investment required for installation. Many shipowners hesitate due to high equipment costs, retrofitting expenses, and downtime associated with integration. It creates financial pressure on smaller operators who struggle to justify the expenditure compared to switching to low-sulfur fuels. Ongoing operational complexities such as maintenance, monitoring of water discharge, and fuel compatibility also present hurdles. Variations in regional regulations make compliance strategies more complicated, forcing operators to adopt tailored solutions. These factors limit adoption among cost-sensitive shipping companies.

Regulatory Uncertainty and Environmental Concerns

The Offshore Marine Scrubber Systems Market must also contend with evolving regulatory frameworks and environmental debates. Some regions are reconsidering the long-term viability of open-loop systems due to water discharge concerns. It generates uncertainty for investors and vessel operators when planning fleet upgrades. Discrepancies between international and local rules can disrupt adoption strategies, creating compliance risks. Growing environmental scrutiny has raised questions about the sustainability of certain scrubber technologies, putting pressure on suppliers to innovate cleaner alternatives. These regulatory and ecological challenges continue to influence purchasing decisions across global shipping markets.

Market Opportunities:

Growing Demand from Expanding Offshore Energy and Shipping Sectors

The Offshore Marine Scrubber Systems Market is well positioned to benefit from the expansion of offshore oil, gas, and renewable energy operations. Rising offshore activity is increasing vessel traffic, creating a larger base for scrubber adoption. It offers shipowners a cost-effective path to comply with emission regulations while maintaining operational flexibility. Global trade recovery and fleet expansions are further boosting opportunities, with shipbuilders integrating scrubbers at the design stage. Retrofit installations also present strong potential, especially among older vessels aiming to extend service life under new emission norms. These factors create long-term opportunities for suppliers and integrators.

Advancements in Technology and Supportive Policy Frameworks

The Offshore Marine Scrubber Systems Market is gaining opportunities from innovation in hybrid, closed-loop, and digitally monitored systems. Enhanced performance and reduced environmental impact make these technologies more attractive for global operators. It allows companies to align compliance strategies with efficiency gains, reinforcing long-term adoption. Governments and regulatory bodies offering incentives, stricter monitoring, and investment in green shipping corridors further strengthen market prospects. Regional emission control areas create demand for advanced scrubbers that meet both international and local standards. The combination of technological advancements and policy support positions the market for sustained growth.

Market Segmentation Analysis:

By Propulsion Type

The Offshore Marine Scrubber Systems Market demonstrates strong adoption across conventional fuel-powered vessels. Operators prefer scrubbers to remain compliant while continuing the use of heavy fuel oil. It offers a cost-effective compliance pathway compared to fully switching to low-sulfur or alternative fuels. LNG-propelled vessels are gaining attention, with scrubbers supporting dual compliance and improving long-term operational efficiency. This diversification strengthens adoption across multiple propulsion categories.

- For instance, Safe Bulkers has successfully retrofitted a significant portion of its fleet, completing the installation of advanced scrubber systems on 21 of its vessels since 2019.

By Vessel Type

Bulk carriers and container ships account for a significant portion of installations due to their global trade routes and exposure to emission control zones. Tankers also contribute strongly, as scrubber integration enables sustained long-haul operations within sulfur limits. It emphasizes that large-capacity vessels with continuous offshore activity remain core demand drivers. Passenger ships and offshore support vessels are emerging as secondary adopters, reflecting gradual compliance alignment across diverse fleets.

- For instance, Mitsubishi Shipbuilding showcased a notable technological achievement by installing its DIA-SOx® marine scrubbers on 22 ships in the first eight months of 2020, even with global operational challenges.

By Scrubber Technology

Open-loop scrubbers have historically dominated installations due to lower capital costs. Regulatory restrictions on wash water discharge, however, are reducing their appeal in several regions. It creates strong demand for hybrid and closed-loop systems that provide greater flexibility and compliance assurance. Hybrid solutions allow vessels to switch modes depending on operational waters, while closed-loop systems are widely preferred in restricted zones. This shift highlights a growing trend toward advanced and environmentally resilient technologies.

Segmentations:

By Propulsion Type

- Conventional Fuel-Powered Vessels

- LNG-Powered Vessels

- Hybrid Fuel Vessels

By Vessel Type

- Bulk Carriers

- Container Ships

- Tankers

- Passenger Ships

- Offshore Support Vessels

By Scrubber Technology

- Open-Loop Scrubbers

- Closed-Loop Scrubbers

- Hybrid Scrubbers

By Size

- Small Vessels

- Medium Vessels

- Large Vessels

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific Emerging as the Dominant and Fastest-Growing Region

Asia Pacific holds 42% share of the Offshore Marine Scrubber Systems Market. It is the fastest-growing region due to strong shipbuilding capacity and offshore energy expansion. Countries such as China, South Korea, Japan, and India are leading adoption with large fleet deployments and strict compliance programs. It benefits from rising retrofits across older vessels that operate in regulated waters. Significant investment in shipping infrastructure and enforcement of emission regulations continue to reinforce regional dominance.

Europe Sustaining Growth Through Strict Emission Norms

Europe accounts for 30% share of the Offshore Marine Scrubber Systems Market, supported by strict emission control measures. The presence of Emission Control Areas across the Baltic and North Seas drives higher adoption rates. It demonstrates the region’s commitment to reducing sulfur emissions in maritime transport. Hybrid and closed-loop systems remain widely preferred where water discharge restrictions apply. Consistent regulatory enforcement sustains investment and ensures Europe’s steady contribution to global revenues.

North America Benefiting from Regulatory Zones and Offshore Operations

North America holds 18% share of the Offshore Marine Scrubber Systems Market. The region benefits from coastal emission regulations in the U.S. and Canada that mandate sulfur compliance. It encourages widespread installation of advanced scrubbers as operators seek efficient compliance strategies. Offshore oil and gas activity in the Gulf of Mexico also supports demand across offshore fleets. A combination of regulated coastal zones and offshore operations secures North America’s position as a stable growth market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bureau Veritas

- ClassNK

- Lloyd’s Register

- American Bureau of Shipping

- Wärtsilä

- DNV GL

- Alfa Laval

- Mitsubishi Heavy Industries Marine Machinery Equipment Company

- Yara Marine Technologies

- MAN Energy Solutions

Competitive Analysis:

The Offshore Marine Scrubber Systems Market is defined by the presence of global technology providers, shipbuilders, and specialized equipment manufacturers competing to deliver cost-efficient and compliant solutions. Leading players focus on hybrid and closed-loop technologies that enhance adaptability in emission control zones while maintaining operational reliability. It is marked by strong investment in research and development aimed at improving automation, digital monitoring, and environmental performance. Strategic partnerships with shipyards and retrofitting service providers strengthen market penetration by ensuring scrubber integration in both new builds and existing fleets. Regional companies are expanding their role through tailored solutions aligned with local regulatory requirements, creating competitive differentiation. The market’s competitive intensity is further shaped by regulatory uncertainty, which drives suppliers to maintain flexible portfolios that can address evolving global and regional standards.

Recent Developments:

- In July 2025, Bureau Veritas launched “Bureau Veritas Cybersecurity” on July 1st to accelerate the integration of its acquired companies in the cybersecurity sector.

- In July 2025, Bureau Veritas announced on July 25th three targeted acquisitions: Dornier Hinneburg in Germany, the Institute For Cyber Risk (IFCR) in Denmark, and EcoPlus in South Korea, to expand its footprint in nuclear services, cybersecurity, and sustainability.

- In April 2025, Lloyd’s Register OneOcean launched a major update to its digital maritime platform, “OneOcean 2025,” on April 1st, introducing enhanced tools for voyage planning and environmental compliance.

Report Coverage:

The research report offers an in-depth analysis based on Propulsion Type, Vessel Type, Scrubber Technology, Size and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Offshore Marine Scrubber Systems Market will expand as global emission rules grow stricter, reinforcing demand across international fleets.

- It will benefit from rising adoption of hybrid and closed-loop systems, offering higher flexibility and compliance across diverse waters.

- Shipowners will increasingly view scrubbers as cost-efficient solutions to balance fuel costs with long-term regulatory obligations.

- It will gain momentum from shipbuilders integrating scrubbers into new vessel designs, reducing retrofitting costs and downtime.

- Expanding offshore oil, gas, and renewable energy projects will drive steady demand for scrubbers on offshore service and support vessels.

- It will reflect technological advancements, with digital monitoring and automation improving reliability, efficiency, and compliance tracking.

- Retrofitting older fleets will remain a key growth avenue, extending vessel lifespans while meeting stricter emission standards.

- Regional adoption will rise, with Asia Pacific maintaining leadership, Europe sustaining growth, and North America delivering stable demand.

- Environmental debates around open-loop systems will push suppliers to invest in cleaner, water-friendly technologies.

- It will continue to attract investment from global players seeking opportunities in sustainability-driven shipping and offshore operation.