Market Overview

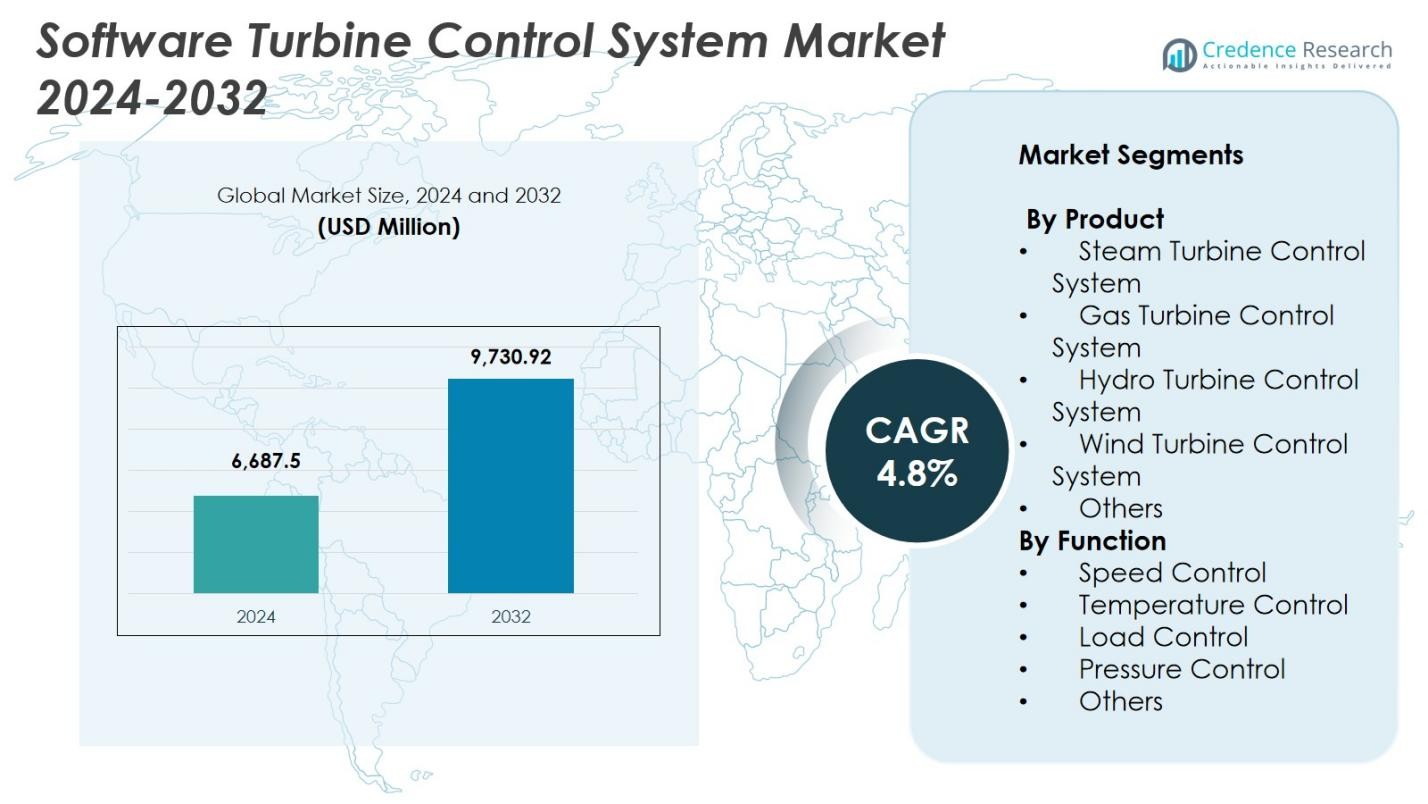

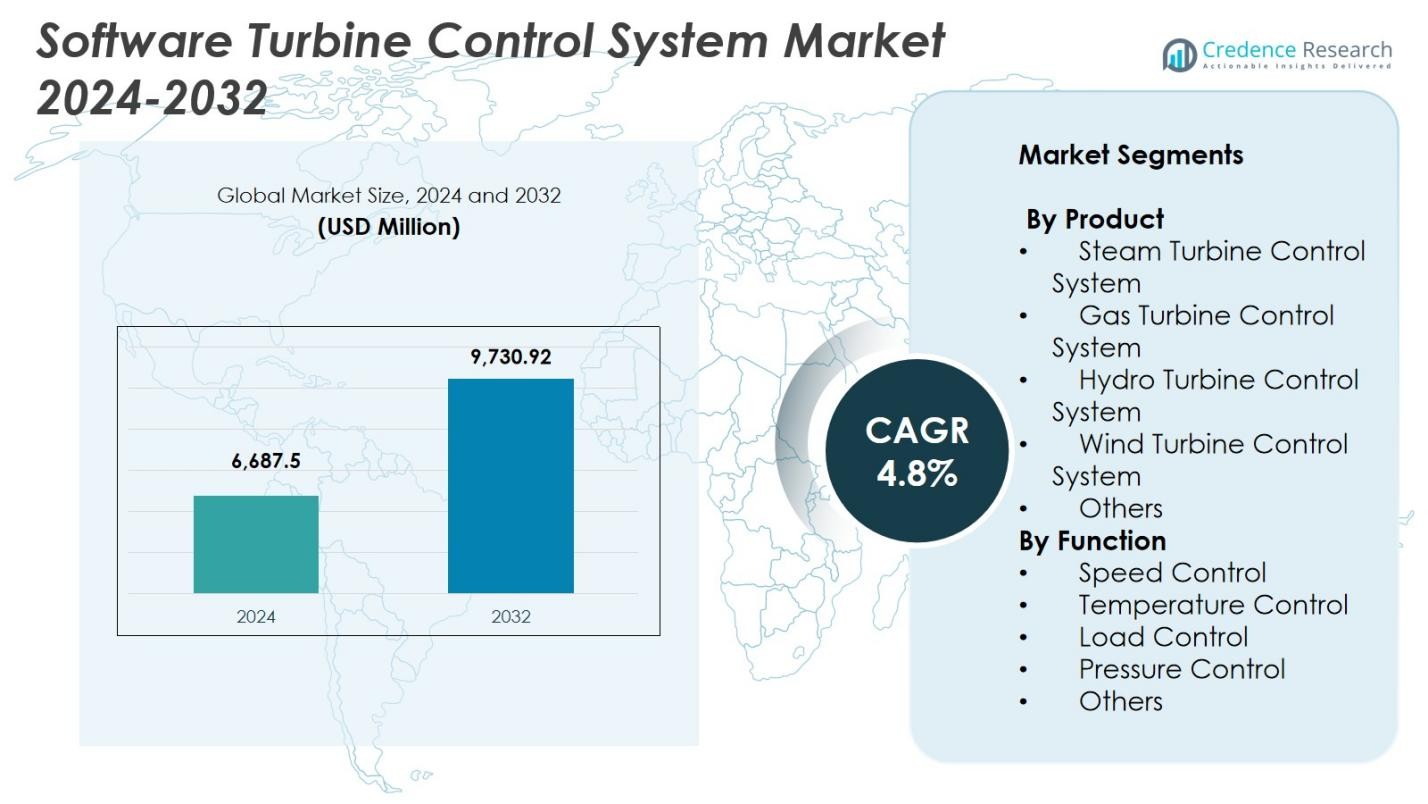

Software Turbine Control System market size was valued at USD 6,687.5 Million in 2024 and is anticipated to reach USD 9,730.92 Million by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Software Turbine Control System market Size 2024 |

USD 6,687.5 Million |

| Software Turbine Control System market, CAGR |

4.8% |

| Software Turbine Control System market Size 2032 |

USD 9,730.92 Million |

Software Turbine Control System market is characterized by strong participation from leading automation and turbine solution providers such as ABB, ANDRITZ, Danfoss, DEIF, Eaton, Emerson Electric, Ethos Energy Group, General Electric, Heinzmann, and Honeywell International. These companies focus on advanced digital control architectures, predictive maintenance capabilities, and integrated monitoring platforms to enhance turbine efficiency and reliability across power generation and industrial applications. Regionally, North America led the market in 2024 with 32.6% share, driven by modernization of gas turbine fleets and rapid digitalization initiatives. Europe and Asia Pacific followed, supported by renewable energy expansion, grid optimization programs, and widespread adoption of automation technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Software Turbine Control System market was valued at USD 6,687.5 million in 2024 and is projected to reach USD 9,730.92 million by 2032, registering a CAGR of 4.8% during the forecast period.

- Market growth is driven by rising demand for high-efficiency turbine operations, digital modernization of aging power plants, and increasing adoption of predictive maintenance and real-time monitoring systems.

- Key trends include the integration of AI, IoT, digital twins, and cloud-based platforms that enhance turbine performance, reduce downtime, and support remote fleet management across gas, steam, hydro, and wind turbines.

- The market features strong activity from players such as ABB, Emerson Electric, Eaton, General Electric, Honeywell International, and others, focusing on advanced automation solutions and retrofitting services to strengthen their presence.

- Regionally, North America held 32.6% share in 2024, followed by Europe at 28.4% and Asia Pacific at 30.2%; gas turbine control systems dominated the product segment with over 38.4% share.

Market Segmentation Analysis

By Product

The Software Turbine Control System market by product is led by gas turbine control systems, accounting for 38.4% share in 2024, driven by their widespread use in power generation, oil & gas, and industrial cogeneration plants. Their strong adoption stems from the increasing demand for high-efficiency, low-emission power solutions and rapid-cycle operations. Steam turbine control systems follow, supported by the modernization of thermal plants and retrofitting activities. Wind and hydro turbine control systems gain traction due to renewable integration, while advanced digital monitoring and predictive maintenance capabilities further encourage system upgrades across all product categories.

- For Instance, ABB offers integrated automation and “digital-package” control solutions for gas, steam, and hydro turbines including predictive-maintenance tools that can cut maintenance costs by 15–30%.

By Function

In terms of function, speed control dominated the Software Turbine Control System market in 2024 with 36.7% share, primarily due to its critical role in ensuring turbine stability, operational safety, and optimal energy conversion across steam, gas, and hydro units. The increasing deployment of automated speed governors and real-time monitoring solutions accelerates demand. Temperature and load control segments also grow steadily as operators focus on efficiency optimization, emissions management, and extended turbine lifespan. Pressure control and other niche functions expand with the rise of digital twin technologies and AI-based predictive algorithms.

- For instance, GE’s Mark VIe control platform incorporates high-precision speed-governing algorithms that enable millisecond-level response to load fluctuations, improving grid stability in combined-cycle plants.

Key Growth Drivers

Increasing Demand for Efficient and Reliable Power Generation

The Software Turbine Control System market expands significantly as industries and utilities prioritize reliable, high-efficiency power generation. Modern turbine operations require precise, real-time control to ensure optimal performance, minimize downtime, and maintain safety across steam, gas, hydro, and wind turbines. Rising global electricity consumption and the transition toward cleaner, more efficient energy sources accelerate investments in advanced digital turbine controls. Real-time monitoring, automated tuning, and condition-based maintenance improve stability and asset performance. Utilities increasingly replace outdated analog systems with intelligent digital platforms to meet stricter efficiency and emissions standards, reinforcing growth for turbine control software.

- For instance, Mitsubishi Power’s TOMONI intelligent monitoring suite supports condition-based maintenance, helping utilities extend inspection intervals and reduce maintenance-related downtime.

Rapid Digitalization and Integration of AI, IoT, and Predictive Maintenance

Digitalization strengthens the market as AI algorithms, IoT sensors, and digital twins transform turbine monitoring and control practices. These technologies provide predictive maintenance insights, fault forecasting, and autonomous performance optimization, helping operators reduce unexpected outages, lower maintenance expenses, and prolong turbine lifespan. Remote monitoring tools and cloud-based analytics enable centralized supervision, especially beneficial for complex gas turbines and dispersed wind assets. As industries adopt Industry 4.0 frameworks, demand rises for intelligent software capable of real-time decision-making and enhanced responsiveness, driving widespread integration of digital turbine control solutions.

- For instance, Siemens Energy applies digital-twin models in its gas-turbine fleet to simulate real-time component behavior, allowing operators to identify anomalies days in advance and optimize turbine firing conditions.

Upgradation of Aging Power Infrastructure and Renewables Expansion

Aging power assets across global markets create substantial demand for modern turbine control systems that offer improved efficiency, automation, and emissions compliance. Retrofit and modernization initiatives in thermal, hydro, and industrial power plants support the need for advanced digital controls that enable real-time diagnostics and load balancing. Simultaneously, the expansion of renewable energy especially wind and hydro drives adoption of turbine control platforms tailored for variable energy profiles and grid stability requirements. As renewable penetration rises, utilities prioritize flexible, intelligent control systems that ensure consistent performance and seamless grid integration.

Key Trends & Opportunities

Growing Adoption of Predictive Analytics and Digital Twin Technologies

Predictive analytics and digital twin technologies play an increasingly central role in enhancing turbine performance and operational reliability. Digital twins replicate real-world turbine conditions, helping operators test scenarios, forecast failures, and optimize efficiency without interrupting operations. This trend offers strong opportunities for vendors to deliver advanced simulation tools, AI-driven diagnostic platforms, and integrated performance modeling solutions. Industries such as energy, oil & gas, and utilities use these technologies to reduce operational risks, extend turbine life, and streamline maintenance planning, creating new avenues for value-added software solutions.

- For instance, Baker Hughes integrated digital twins into steam turbine controls for mechanical drive applications. The system records and analyzes real-time data to enable condition-based performance optimization across oil & gas and power generation.

Expansion of Cloud-Based and Remote Monitoring Solutions

Cloud-integrated control platforms and remote monitoring capabilities continue to gain traction as operators seek scalable, cost-efficient, and transparent turbine management. These systems enable centralized monitoring of multiple turbine assets, support real-time optimization, and enhance decision-making through continuous data analytics. Demand is particularly strong in wind energy and distributed power setups where remote supervision is essential. Cloud-based architectures improve interoperability, enable fast software updates, and reduce on-site maintenance needs. As the power sector shifts toward decentralized and flexible energy systems, cloud-powered control solutions represent a major growth opportunity.

- For instance, GE’s cloud-enabled Predix platform allows operators to remotely monitor gas and wind turbine performance, delivering analytics that support faster troubleshooting and reduced site visits.

Key Challenges

Cybersecurity Risks and Vulnerabilities in Digital Turbine Systems

Increasing digitization of turbine operations exposes critical power infrastructure to cybersecurity threats, including unauthorized access, data breaches, and ransomware attacks. IoT integration and remote-connectivity features expand potential entry points for cyber threats. Operators must enhance security frameworks through robust encryption, multi-layer authentication, and real-time threat detection. Failure to adequately secure turbine control systems could lead to operational disruptions, financial losses, and safety risks. Ensuring cybersecurity resilience becomes essential for maintaining system integrity and meeting evolving regulatory requirements.

High Implementation Costs and Complexity of System Integration

High installation costs, complex integration procedures, and potential downtime during system upgrades remain significant barriers to adoption. Many power plants operate legacy infrastructure that requires extensive retrofitting before deploying modern digital control systems. Integration with existing SCADA, PLC, and grid management platforms demands advanced engineering capabilities, increasing overall project complexity. Budget constraints especially among small and medium operators can delay modernization initiatives. Vendors must prioritize modular, scalable, and easily integrable solutions to overcome adoption resistance and support seamless transition from older systems.

Regional Analysis

North America

North America held a leading position in the Software Turbine Control System market with 32.6% share in 2024, supported by strong investments in power modernization, widespread automation adoption, and the presence of major turbine OEMs and digital solution providers. The region benefits from accelerated upgrades in gas turbine fleets, growth in combined cycle plants, and increasing deployment of wind farms across the U.S. and Canada. Utilities focus heavily on digital optimization, predictive maintenance, and grid stability enhancements, driving the adoption of advanced turbine control platforms. Supportive regulatory frameworks and decarbonization initiatives further reinforce regional demand.

Europe

Europe captured 28.4% share in 2024, driven by aggressive renewable energy expansion, modernization of aging thermal plants, and strict efficiency and emissions regulations. Countries such as Germany, the U.K., and France continue to integrate advanced turbine control systems across wind, hydro, and gas assets to enhance operational reliability and meet clean energy targets. The region’s strong emphasis on digital transformation and grid flexibility boosts demand for predictive maintenance tools and real-time automation software. Ongoing investments in offshore wind and district energy systems further strengthen Europe’s market penetration and long-term adoption.

Asia Pacific

Asia Pacific dominated the growth landscape and accounted for 30.2% share in 2024, supported by large-scale power generation expansion, rapid industrialization, and significant renewable energy investments in China, India, and Southeast Asia. The region witnesses rising adoption of advanced turbine control software across newly built gas, steam, and hydro plants, alongside extensive wind energy installations. Government-led modernization programs and grid reliability initiatives further stimulate demand. Increasing digitalization, industrial automation, and a shift toward efficient, low-emission power systems position Asia Pacific as the fastest-growing regional market for turbine control technologies.

Latin America

Latin America held 5.3% share in 2024, with growth driven by expanding hydroelectric capacity, modernization of aging turbine infrastructure, and the rising integration of wind assets, particularly in Brazil and Chile. The region’s focus on improving energy reliability and operational efficiency supports the adoption of digital turbine control systems. Economic reforms and growing private-sector investments in power generation strengthen demand for advanced automation and monitoring solutions. Although adoption is gradual due to budget limitations, increasing renewable installations and regional grid upgrades create long-term opportunities for turbine control system suppliers.

Middle East & Africa

The Middle East & Africa accounted for 3.5% share in 2024, supported by expanding thermal power infrastructure, ongoing gas turbine installations, and rising industrial energy requirements. Countries like Saudi Arabia, the UAE, and South Africa invest in modernizing turbine fleets to improve efficiency and reduce operational downtime. The region’s shift toward diversification of energy sources, including wind and solar-hybrid projects, encourages adoption of advanced control platforms. However, slower digitalization and budget constraints in several countries moderate growth. Nevertheless, long-term infrastructure development and industrial expansion continue to create demand for next-generation turbine control systems.

Market Segmentations

By Product

- Steam Turbine Control System

- Gas Turbine Control System

- Hydro Turbine Control System

- Wind Turbine Control System

- Others

By Function

- Speed Control

- Temperature Control

- Load Control

- Pressure Control

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Software Turbine Control System market features a strong lineup of global automation leaders, turbine manufacturers, and digital solution providers focused on enhancing operational efficiency, reliability, and predictive capabilities across diverse turbine applications. Key players such as ABB, ANDRITZ, Danfoss, DEIF, Eaton, Emerson Electric, Ethos Energy Group, General Electric, Heinzmann, and Honeywell International continue to invest in advanced control architectures, AI-driven diagnostics, IoT-enabled monitoring, and cloud-based optimization platforms. These companies emphasize product innovation, lifecycle service offerings, and integration of digital twins and predictive maintenance tools to strengthen their market position. Strategic partnerships with power utilities, EPC firms, and renewable energy developers support broader adoption of real-time automation software. Many vendors also focus on retrofitting aging infrastructure and delivering modular, scalable control solutions tailored for gas, steam, hydro, and wind turbines. As competition intensifies, differentiation increasingly depends on cybersecurity resilience, interoperability, and data-driven decision-support capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Honeywell International

- DEIF

- DANFOSS

- Heinzmann

- Emerson Electric

- Eaton

- General Electric

- ABB

- Ethos Energy Group

- ANDRITZ

Recent Developments

- In September 2024, ABB signed a joint-development agreement with Energy Control Technologies (ECT) to deliver an integrated turbomachinery controls solution, integrating compressor/turbomachinery controls into ABB’s ABB Ability™ System 800xA® distributed control system.

- In July 2025, GE Vernova and Crusoe announced a major deal: GE Vernova will deliver 29 units of its LM2500XPRESS aeroderivative gas turbines (with advanced control) to Crusoe’s AI data-centers indicating demand for turbine + control systems in data-center/energy infrastructure.

- In March 2025, Emerson Electric Co. completed the acquisition of AspenTech now operating as an independent business unit within Emerson’s Control Systems & Software division, signaling a shift toward greater software and control-system capabilities.

Report Coverage

The research report offers an in-depth analysis based on Product, Function and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady adoption as power producers continue modernizing turbine assets with advanced digital control platforms.

- Integration of AI, machine learning, and digital twins will enhance predictive maintenance and operational optimization.

- Demand for remote monitoring and cloud-based turbine management solutions will expand across distributed energy sites.

- Gas turbine control upgrades will remain a priority as industries focus on efficiency, flexibility, and reduced emissions.

- Wind and hydro turbine control systems will grow with accelerating renewable energy investments worldwide.

- Vendors will strengthen cybersecurity capabilities to address rising risks in connected turbine systems.

- Modular and scalable software architectures will gain traction for easier retrofitting of aging infrastructure.

- Emerging markets in Asia Pacific and Latin America will drive long-term growth through large-scale power development.

- Partnerships between OEMs, utilities, and digital solution providers will increase to support integrated automation ecosystems.

- Data-driven decision-making tools and real-time analytics will become standard features in next-generation turbine control solutions.