Market Overview

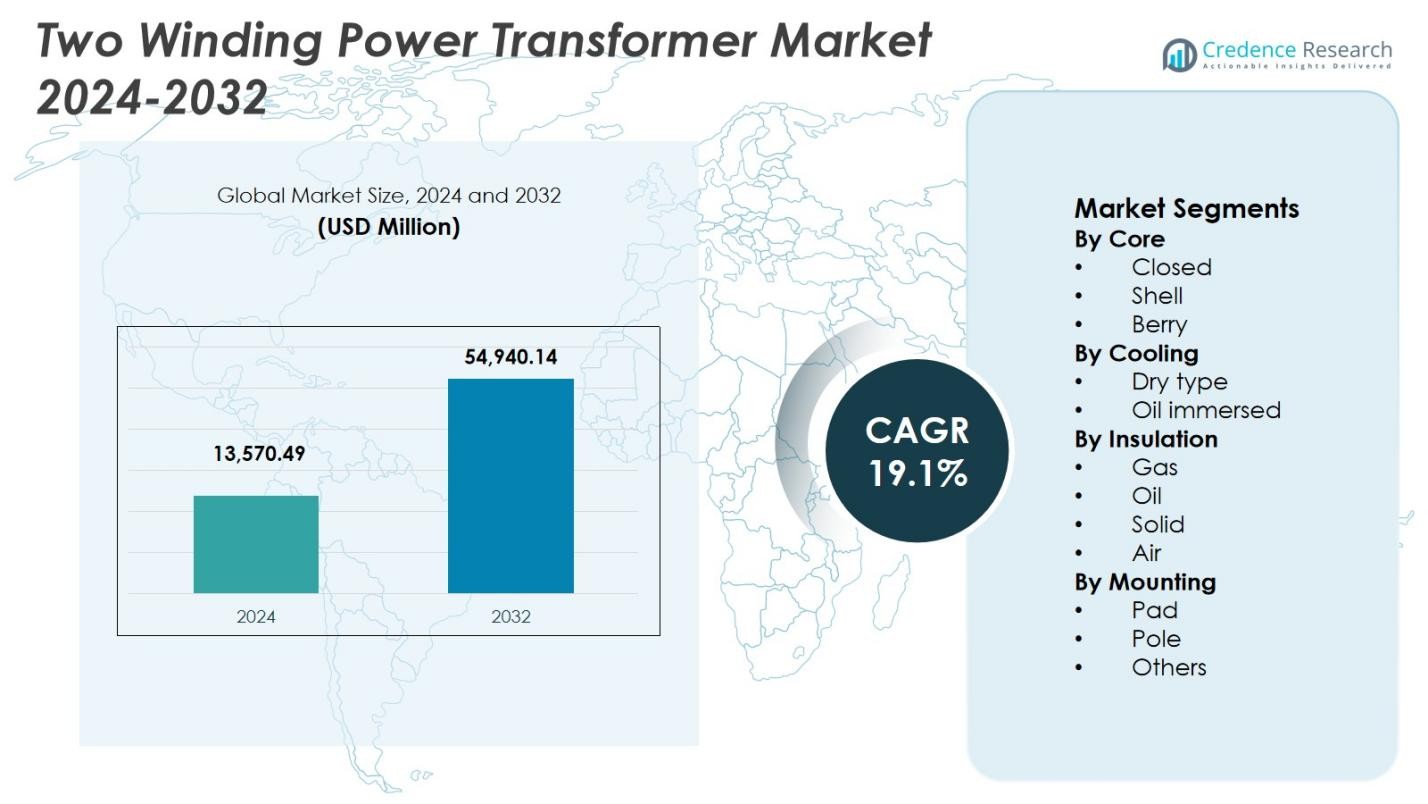

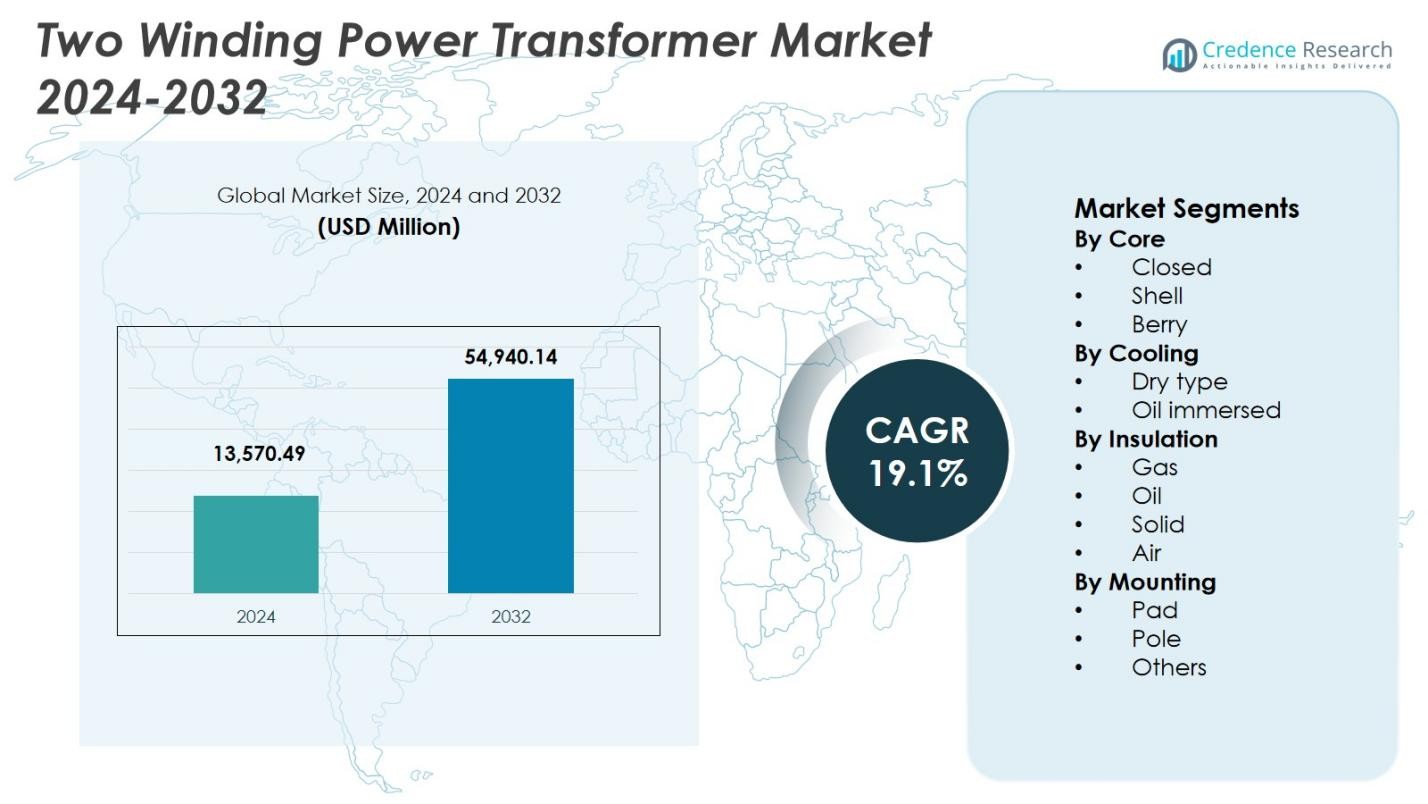

Two Winding Power Transformer Market size was valued at USD 13,570.49 million in 2024 and is anticipated to reach USD 54,940.14 million by 2032, at a CAGR of 19.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Two Winding Power Transformer Market Size 2024 |

USD 13,570.49 Million |

| Two Winding Power Transformer Market, CAGR |

19.1% |

| Two Winding Power Transformer Market Size 2032 |

USD 54,940.14 Million |

Two Winding Power Transformer Market is characterized by the strong presence of established global and regional manufacturers such as ABB, Hitachi Energy Ltd., General Electric, Mitsubishi Electric Corporation, CG Power & Industrial Solutions Ltd., Hyundai Electric & Energy Systems Co., Ltd., Hyosung Heavy Industries, Bharat Heavy Electricals Limited (BHEL), Celme S.r.l., and JSHP Transformer. These players focus on high-efficiency designs, large-capacity transformers, and advanced insulation and cooling technologies to meet evolving grid requirements. Asia Pacific leads the market with a 38.6% share in 2024, driven by large-scale transmission projects, rapid urbanization, and renewable energy expansion in China, India, and Southeast Asia. North America and Europe follow, supported by grid modernization and replacement of aging infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Two Winding Power Transformer Market was valued at USD 13,570.49 million in 2024 and is projected to reach USD 54,940.14 million by 2032, growing at a CAGR of 19.1%, supported by long-term investments in power infrastructure and grid expansion projects.

- Expansion of transmission and distribution networks, replacement of aging grid assets, and rising electricity demand from industrialization and urbanization act as key drivers, with utilities increasing deployment of high-capacity two winding power transformers to ensure reliable voltage regulation and efficient power flow.

- Oil-immersed cooling dominates with a 9% segment share, while closed core designs lead core types with 47.6% share, reflecting strong preference for high thermal efficiency, low losses, and suitability for high-voltage applications across utility-scale projects.

- Leading players such as ABB, Hitachi Energy Ltd., General Electric, Mitsubishi Electric Corporation, CG Power & Industrial Solutions Ltd., and Hyundai Electric focus on efficiency improvement, digital monitoring, and large-scale project execution to strengthen market presence.

- Asia Pacific leads with a 6% regional share, followed by North America at 26.8% and Europe at 24.1%, driven by grid modernization, renewable integration, and large transmission investments.

Market Segmentation Analysis:

By Core:

The Two Winding Power Transformer Market, by core type, is led by the closed core segment, which accounted for 47.6% market share in 2024. Closed core transformers dominate due to their superior magnetic efficiency, reduced flux leakage, and lower core losses compared to shell and berry core designs. Utilities and transmission operators increasingly prefer closed core configurations for high-voltage and extra-high-voltage applications, where energy efficiency and long-term operational reliability are critical. Rising investments in grid modernization, replacement of aging transmission infrastructure, and growing renewable energy integration continue to reinforce demand for closed core two winding power transformers.

- For instance, Hitachi Energy will supply 765 kV transformers to Power Grid Corporation of India, featuring closed core designs that enable efficient bulk power transfer over long distances with reduced losses.

By Cooling:

By cooling type, the oil-immersed segment held the dominant share of 72.9% in 2024 in the Two Winding Power Transformer Market. Oil-immersed transformers are widely adopted due to their higher thermal performance, longer service life, and suitability for high-capacity power transmission applications. They offer efficient heat dissipation, making them ideal for substations, power plants, and industrial grids operating under heavy load conditions. Expanding transmission networks, rising electricity demand, and increasing deployment of high-voltage transformers across utility-scale projects are the key drivers supporting the strong dominance of oil-immersed cooling systems.

- For instance, Mahati manufactured a 2500 kVA oil-immersed power transformer for an industrial facility requiring low-maintenance and high efficiency. The custom design complies with IEC and ISO standards, addressing outdated equipment issues by reducing heat losses and downtime.

By Insulation:

Based on insulation type, the oil insulation segment dominated the Two Winding Power Transformer Market with a 58.3% share in 2024. Oil insulation is preferred for its excellent dielectric strength, effective cooling properties, and proven performance in high-voltage environments. Utilities and industrial users favor oil-insulated transformers for long-distance power transmission and bulk electricity distribution. Growing investments in cross-border transmission lines, renewable power evacuation infrastructure, and large-scale grid expansion projects are driving adoption. Additionally, advancements in insulating oil formulations that enhance safety and thermal stability further support the segment’s continued dominance.

Key Growth Drivers

Expansion of Power Transmission and Distribution Infrastructure

The Two Winding Power Transformer Market is driven by sustained investments in transmission and distribution infrastructure across both developed and emerging economies. Utilities are modernizing aging grids to enhance reliability, reduce technical losses, and accommodate rising electricity demand. Large-scale projects such as new substations, high-voltage transmission corridors, and cross-border interconnections increase the deployment of two winding power transformers. These transformers play a vital role in voltage regulation and efficient power transfer, making them essential for grid expansion and long-term power system resilience.

- For instance, Siemens Energy supports the Viking Link project, a 765-kilometer high-voltage direct current (HVDC) interconnector between Denmark and the UK with 1,400 megawatts capacity, enabling bidirectional clean power flow to stabilize grids.

Growing Integration of Renewable Energy Sources

Increasing integration of renewable energy significantly supports growth in the Two Winding Power Transformer Market. Solar, wind, and hydropower projects require reliable voltage transformation to connect generation assets to transmission networks. Two winding power transformers enable efficient evacuation and distribution of renewable electricity while maintaining grid stability. Government decarbonization targets, renewable capacity additions, and energy transition policies continue to stimulate transformer demand, particularly for high-capacity units capable of handling variable and intermittent power generation profiles.

- For instance, Daelim Transformer supplies double-winding step-up units rated at 1000 kVA for single 1 MW solar power generation systems, ensuring electrical isolation between inverters to reduce interference and enhance power quality.

Rising Electricity Demand from Industrialization and Urbanization

Rapid industrialization and urban expansion are key drivers shaping the Two Winding Power Transformer Market. Growing manufacturing activity, expanding data centers, transportation electrification, and commercial infrastructure development increase the need for stable and uninterrupted power supply. Two winding power transformers support voltage conversion across industrial and urban grids, ensuring efficient energy distribution. Population growth and urban electrification further elevate load requirements, encouraging utilities to deploy higher-capacity and more reliable transformer solutions.

Key Trends & Opportunities

Adoption of Smart and Digitally Enabled Transformers

Digital transformation represents a major trend and opportunity in the Two Winding Power Transformer Market. Utilities increasingly deploy transformers equipped with sensors, monitoring systems, and digital communication capabilities. These features enable real-time performance monitoring, predictive maintenance, and early fault detection, reducing downtime and lifecycle costs. Integration with smart grid platforms enhances operational efficiency and grid visibility. Manufacturers offering digitally enabled two winding power transformers are well positioned to capture growing demand for intelligent power infrastructure.

- For instance, Zetwerk equips its power transformers with IoT-enabled monitoring, featuring sensors for real-time tracking of load, temperature, oil levels, and predictive alerts on insulation health. These integrate via SCADA for seamless smart grid connectivity and minimal retrofitting needs.

Shift Toward Energy-Efficient and Low-Loss Designs

The focus on energy efficiency is creating strong opportunities within the Two Winding Power Transformer Market. Utilities and regulators emphasize reducing transmission losses to improve overall grid efficiency and sustainability. Advances in core materials, winding techniques, and insulation systems enable the development of low-loss transformer designs. Adoption of energy-efficient transformers lowers operational costs and supports compliance with stringent efficiency standards, driving long-term demand for high-performance two winding power transformers.

- For instance, GE Vernova offers green power transformers from 10 to 500 MVA and up to 550 kV, using natural ester insulation like VG-100 fluid for biodegradability and overload capability. These hermetically sealed designs with vacuum-switch on-load tap-changers reduce maintenance by preventing oil contact with humidity.

Key Challenges

High Capital Investment and Extended Project Timelines

High capital requirements pose a significant challenge in the Two Winding Power Transformer Market. Manufacturing large-capacity transformers involves high costs for raw materials, engineering precision, and rigorous testing. In addition, lengthy project approval processes and extended procurement cycles delay deployment and revenue realization. Budget constraints among utilities can further slow replacement and upgrade initiatives, affecting short-term market growth and increasing financial pressure on manufacturers.

Supply Chain Disruptions and Raw Material Price Volatility

Supply chain instability and raw material price volatility present ongoing challenges for the Two Winding Power Transformer Market. Critical inputs such as copper, electrical steel, and insulating materials are subject to frequent price fluctuations, impacting production costs and margins. Global logistics disruptions and geopolitical uncertainties further affect component availability and lead times. These factors complicate production planning and project execution, requiring manufacturers to adopt robust sourcing and risk management strategies.

Regional Analysis

North America

North America accounted for 26.8% market share in 2024 in the Two Winding Power Transformer Market, supported by strong investments in grid modernization and replacement of aging transmission infrastructure. Utilities across the United States and Canada focus on upgrading substations and expanding high-voltage transmission networks to improve reliability and resilience. Rising integration of renewable energy and growing electricity demand from data centers and industrial facilities further drive transformer deployment. Regulatory emphasis on energy efficiency and grid security continues to support demand for advanced two winding power transformers across the region.

Europe

Europe held 24.1% market share in 2024 in the Two Winding Power Transformer Market, driven by extensive renewable energy integration and cross-border transmission projects. Countries across Western and Northern Europe invest heavily in upgrading transmission networks to support offshore wind, solar power, and interconnection initiatives. Aging grid infrastructure replacement and stringent efficiency regulations increase demand for high-performance transformers. Additionally, electrification of transportation and industrial decarbonization programs contribute to sustained transformer installations, reinforcing Europe’s strong position in the global market.

Asia Pacific

Asia Pacific dominated the Two Winding Power Transformer Market with a 38.6% market share in 2024, supported by rapid urbanization, industrial expansion, and large-scale grid development projects. China, India, and Southeast Asian countries invest heavily in new transmission lines, substations, and renewable energy capacity additions. Rising electricity consumption, expansion of manufacturing hubs, and rural electrification initiatives drive high transformer demand. Government-backed infrastructure programs and increasing deployment of high-capacity power networks position Asia Pacific as the fastest-growing and largest regional market.

Latin America

Latin America captured 6.1% market share in 2024 in the Two Winding Power Transformer Market, supported by power infrastructure expansion and renewable energy projects. Countries such as Brazil, Chile, and Mexico continue to invest in transmission upgrades to support wind, solar, and hydropower generation. Grid expansion in remote and industrial regions drives demand for reliable two winding power transformers. Although investment levels remain lower than in developed regions, improving energy access and modernization initiatives contribute to steady regional market growth.

Middle East & Africa

The Middle East & Africa region accounted for 4.4% market share in 2024 in the Two Winding Power Transformer Market. Growth is driven by power generation and transmission investments linked to urban development, industrialization, and renewable energy projects. Gulf countries focus on grid expansion to support large-scale infrastructure and diversification initiatives, while African nations invest in electrification and transmission upgrades. Increasing demand for stable power supply across utilities and industrial sectors supports gradual adoption of two winding power transformers across the region.

Market Segmentations:

By Core

By Cooling

By Insulation

By Mounting

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Two Winding Power Transformer Market highlights the presence of major players including ABB, Bharat Heavy Electricals Limited (BHEL), CG Power & Industrial Solutions Ltd., General Electric, Hitachi Energy Ltd., Hyundai Electric & Energy Systems Co., Ltd., Hyosung Heavy Industries, Mitsubishi Electric Corporation, Celme S.r.l., and JSHP Transformer. These companies compete through technological innovation, capacity expansion, and strong regional distribution networks. Leading manufacturers focus on developing high-efficiency, low-loss transformers to meet stringent grid performance and regulatory requirements. Strategic initiatives such as new product launches, localization of manufacturing facilities, and long-term supply agreements with utilities strengthen market positioning. Players also invest in digital monitoring, advanced insulation systems, and customized transformer solutions to address diverse voltage and application needs. Additionally, partnerships with power utilities and EPC contractors enable companies to secure large-scale infrastructure projects, intensifying competition while supporting long-term market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Premier Energies Ltd acquired a 51% stake in Transcon Ind Ltd, marking its strategic entry into the power transformer manufacturing segment to expand its footprint in transformer production.

- In September 2025, Hitachi Energy announced a major investment to expand its large power transformer manufacturing capacity in Varennes, Quebec, nearly tripling production output to address growing global demand.

- In May 2025, Nextalia SGR acquired Westrafo, a leading producer of electrical transformers including power types for the energy industry.

Report Coverage

The research report offers an in-depth analysis based on Core, Cooling, Insulation, Mounting and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Two Winding Power Transformer Market will continue to benefit from sustained investments in transmission and distribution infrastructure upgrades.

- Rising renewable energy integration will drive demand for high-capacity transformers supporting grid stability and power evacuation.

- Utilities will increasingly replace aging transformer fleets to improve reliability and reduce technical losses.

- Adoption of energy-efficient and low-loss transformer designs will accelerate to meet stricter regulatory standards.

- Digital monitoring and smart transformer technologies will gain wider adoption across utility networks.

- Growing industrialization and urban electrification will support long-term transformer demand.

- Expansion of cross-border transmission projects will increase deployment of high-voltage transformer systems.

- Manufacturers will focus on localization of production to improve supply chain resilience.

- Custom-designed transformers for specific voltage and load requirements will see higher adoption.

- Emerging economies will play a critical role in driving future market expansion.