Market Overview

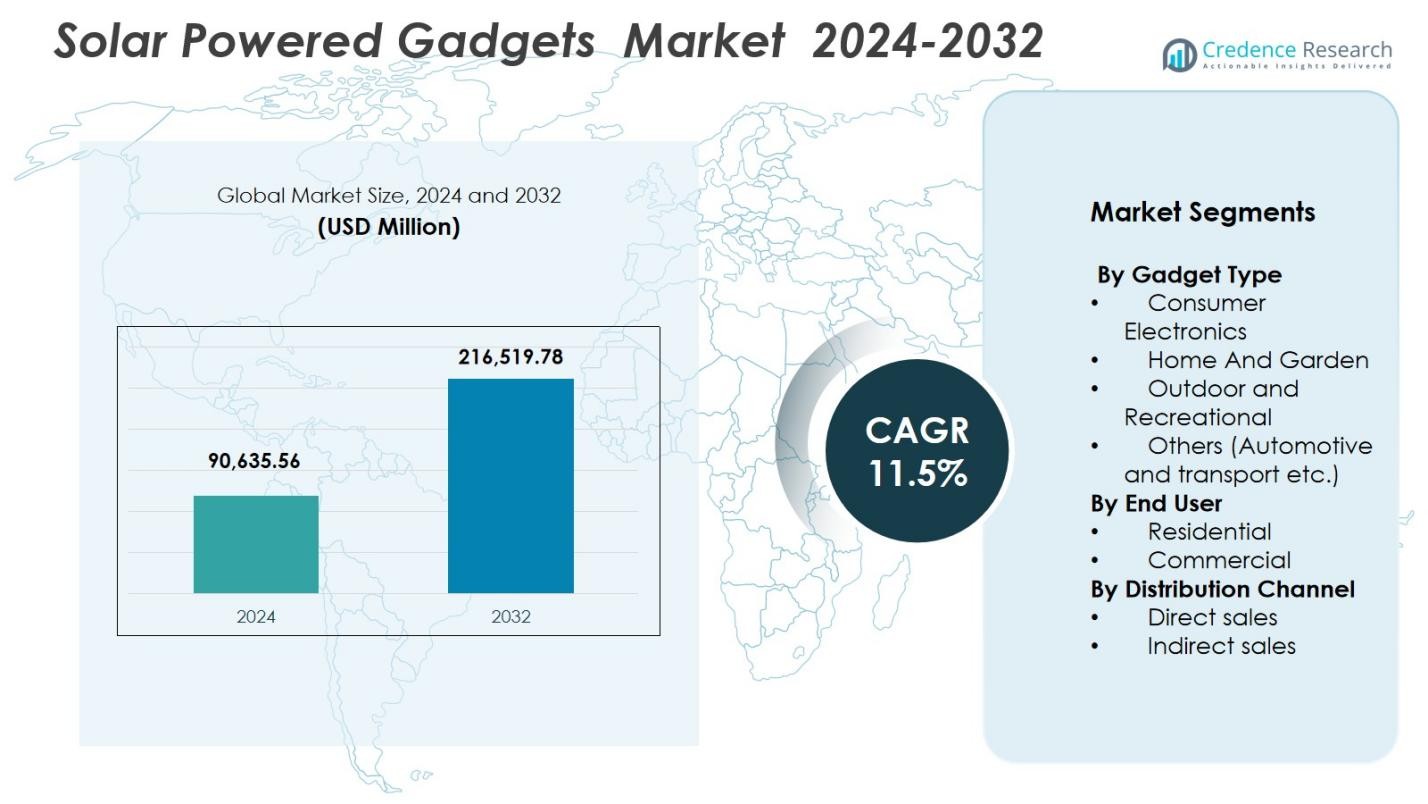

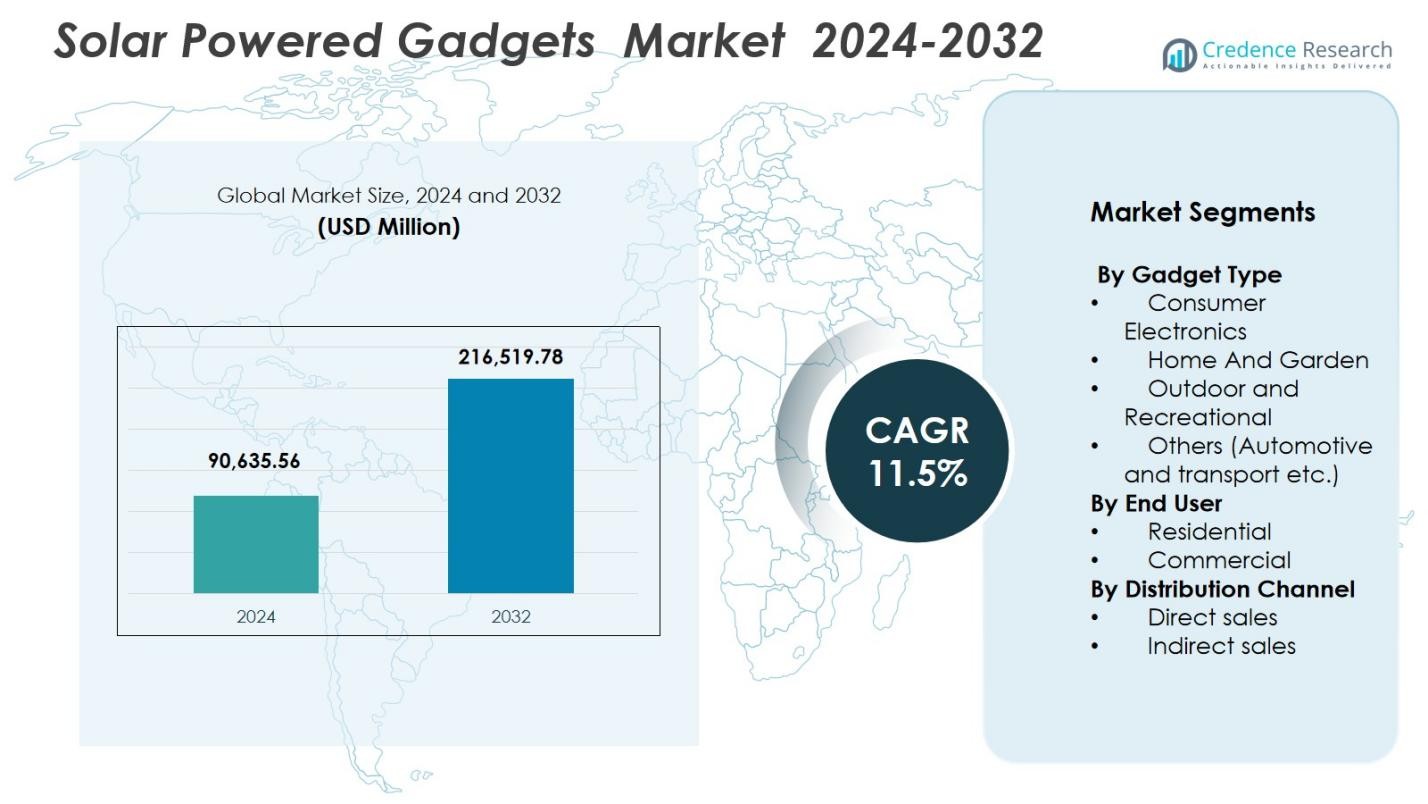

Solar Powered Gadgets market size was valued at USD 90,635.56 Million in 2024 and is anticipated to reach USD 216,519.78 Million by 2032, at a CAGR of 11.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar Powered Gadgets market Size 2024 |

USD 90,635.56 Million |

| Solar Powered Gadgets market , CAGR |

11.5% |

| Solar Powered Gadgets market Size 2032 |

USD 216,519.78 Million |

Solar Powered Gadgets market is shaped by leading players such as Garmin, GoSun, Gemma Lighting, Hikvision Digital Technology, INVT Solar Technology, LS VISION Technology, Pvilion, Solar Solutions AG, Soleos, and Sun Surveillance, all focusing on innovative, energy-efficient, and portable solar solutions. These companies strengthen their presence through advancements in solar cells, battery technologies, and smart integrations for consumer, commercial, and outdoor applications. Regionally, North America leads the market with a 31.4% share in 2024, supported by strong sustainability adoption, smart home penetration, and high consumer spending. Europe and Asia-Pacific follow closely, driven by environmental regulations, rising electrification, and expanding outdoor and residential solar gadget usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Solar Powered Gadgets market was valued at USD 90,635.56 million in 2024 and is projected to reach USD 216,519.78 million by 2032, growing at a CAGR of 11.5%.

- Rising demand for portable, energy-efficient consumer electronics and smart home devices drives market growth, with Consumer Electronics holding the largest share at 46.2% in 2024.

- Increasing trends toward IoT-enabled solar gadgets, smart surveillance, and outdoor recreational devices fuel innovation, supported by improvements in solar cell efficiency and battery storage.

- Key players such as Garmin, GoSun, Gemma Lighting, Hikvision Digital Technology, INVT Solar Technology, and Pvilion expand portfolios through advanced designs and product innovation, intensifying market competition.

- North America leads with 31.4% share, followed by Asia-Pacific at 29.8% and Europe at 27.6%, while Latin America and Middle East & Africa show rising adoption driven by off-grid applications and rural electrification needs.

Market Segmentation Analysis

By Gadget Type

The Solar Powered Gadgets market by gadget type is led by Consumer Electronics, accounting for 46.2% of the market in 2024, driven by rising adoption of solar-powered chargers, smartwatches, power banks, and portable lighting devices. Consumers increasingly prefer renewable and off-grid charging solutions, especially for travel and outdoor activities. The Home and Garden segment grows steadily due to demand for solar lights, lawn devices, and security systems. Outdoor and Recreational gadgets benefit from the surge in adventure tourism, while Others, including automotive and transport applications, expand with growing interest in solar-assisted vehicle accessories and telematics equipment.

- For instance, Anker introduced its 625 Solar Panel with 23% conversion efficiency, enabling faster off-grid power generation for its PowerHouse systems.

By End User

The end-user segmentation is dominated by the Residential sector, holding 58.7% share in 2024, supported by strong consumer preference for energy-efficient household products and reduced dependence on grid electricity. Solar-powered lighting, surveillance devices, and portable chargers experience high installation rates in homes, particularly in regions with frequent power outages. The Commercial segment grows with increasing uptake of solar-based security systems, digital signage, and portable operational tools across retail, hospitality, and industrial facilities. Businesses prioritize sustainability commitments and operational cost reductions, accelerating adoption of solar-integrated gadgets across commercial environments.

- For instance, Panasonic introduced solar-powered security and monitoring solutions designed for commercial premises requiring uninterrupted power.

By Distribution Channel

Within distribution channels, Indirect Sales lead the market with 64.9% share in 2024, driven by the dominance of e-commerce, retail chains, specialty stores, and third-party distributors offering a wide range of solar gadgets at competitive prices. Online platforms significantly influence purchasing decisions through product comparisons, reviews, and promotional bundles. Direct Sales continue to grow, supported by OEM websites, B2B contracts, and institutional procurement, particularly for commercial installations. However, indirect channels remain preferred due to broader accessibility, convenience, and extensive product availability across global consumer and commercial markets.

Key Growth Drivers

Rising Consumer Shift Toward Clean and Portable Energy Solutions

Growing awareness of renewable energy benefits and increasing reliance on portable electronics significantly boost demand for solar-powered gadgets. Consumers prefer energy-independent devices such as solar chargers, lanterns, surveillance cameras, and smart home tools, especially in regions facing high electricity costs or unstable grid access. The convenience of off-grid charging for travel, emergency preparedness, and outdoor recreation further accelerates adoption. Government incentives promoting solar adoption, combined with falling photovoltaic module costs, enhance affordability and accessibility. Additionally, the rising emphasis on sustainability encourages consumers to switch from disposable batteries to solar-integrated solutions. Urban households, students, and frequent travelers increasingly view solar gadgets as essential, expanding mainstream demand across both residential and commercial sectors.

- For instance, Anker’s Solar Power Bank (PowerCore Solar 20000) features IP65 durability and high-efficiency solar cells, making it popular among travelers needing off-grid charging.

Technological Advancements in Solar Efficiency and Device Integration

Rapid innovation in photovoltaic materials, battery storage, and energy-harvesting electronics drives the transition toward more efficient and multifunctional solar-powered gadgets. Thin-film PV, perovskite cells, and flexible solar fabrics enable lightweight, compact, and aesthetically appealing gadget designs suitable for wearables, IoT devices, smart home systems, and outdoor tools. Improved lithium-ion and solid-state batteries extend runtime and durability, allowing continuous performance even in low-light conditions. Integration with IoT platforms, Bluetooth connectivity, and smart control apps enhances functionality, enabling real-time monitoring and automated energy optimization. These technological enhancements not only increase efficiency but also expand the range of feasible applications, encouraging manufacturers to expand product portfolios and accelerate innovation cycles.

- For instance, researchers at Oxford PV achieved over 28% efficiency in perovskite-silicon tandem solar cells, demonstrating real potential for high-performance miniature solar modules used in consumer devices.

Growing Adoption in Outdoor, Recreational, and Emergency Preparedness Use Cases

Increasing participation in hiking, camping, adventure tourism, and remote work boosts demand for solar-powered outdoor gadgets such as lanterns, coolers, power banks, and communication devices. These solutions eliminate dependence on fuel-powered generators, enhancing safety, convenience, and sustainability. Emergency response agencies and households also adopt solar-powered radios, floodlights, and backup chargers to improve disaster preparedness as climate-related events become more frequent. Solar-powered security devices are gaining traction in rural and remote zones where grid connectivity is limited. As awareness of energy resilience grows, consumers and organizations prioritize gadgets that ensure uninterrupted functionality, fueling strong long-term market expansion across global outdoor and emergency-use sectors.

Key Trends & Opportunities

Expansion of Smart Solar Gadgets Integrated with IoT and AI

The convergence of solar technology with IoT and AI presents major growth opportunities, enabling smarter, connected devices that optimize energy usage and extend operational lifespan. Solar-powered cameras with AI-based motion detection, smart garden lights with adaptive brightness control, and wearables that track health and solar energy performance illustrate this shift toward intelligent functionality. Manufacturers are investing in cloud-based monitoring systems that allow users to remotely track device performance and energy output. As smart home ecosystems expand globally, solar gadgets that integrate seamlessly with platforms such as Amazon Alexa, Google Home, and proprietary IoT hubs offer strong commercial potential, especially for residential and small business users seeking modern, sustainable technology solutions.

- For instance, Ring (Amazon) offers several outdoor cameras, including the Solar Panel-powered Ring Stick Up Cam (3rd Gen) and the premium Ring Stick Up Cam Pro, which support cloud-linked monitoring via a paid Ring Protect subscription.

Increasing Commercial Applications Across Retail, Security, and Mobility

Commercial environments increasingly adopt solar-powered gadgets to reduce operating costs and improve environmental performance. Retail spaces deploy solar-powered digital signage, POS accessories, and lighting systems to enhance customer engagement while lowering energy consumption. Corporate campuses and industrial sites adopt solar-powered surveillance units and access control devices to strengthen security without extensive cabling. Transportation and mobility sectors explore opportunities in solar-assisted communication systems, telematics modules, and portable fleet tools that support sustainability mandates. As organizations prioritize ESG goals, solar-powered gadgets present practical, scalable solutions, creating new revenue opportunities for manufacturers targeting commercial and institutional markets.

- For instance, connected-operations vendors offer solar-powered gateways and sensor hubs that transmit vehicle and asset data from trailers and remote equipment yards, supporting emissions monitoring and sustainability dashboards for commercial customers.

Key Challenges

Performance Limitations in Low-Sunlight Regions and Weather-Dependent Conditions

Solar-powered gadgets often face challenges in regions with limited sunlight, frequent cloud cover, or extended winters, leading to inconsistent energy generation and reduced device reliability. This dependency restricts adoption in northern latitudes and densely built urban areas where shading obstructs solar exposure. Weather fluctuations also influence charging time, power output, and battery performance, particularly in high-demand gadgets such as surveillance cameras or emergency tools. Users often require supplementary charging methods, increasing product complexity and cost. Addressing performance variability through improved storage, hybrid charging technologies, and higher-efficiency solar materials remains essential to broadening global adoption.

Higher Upfront Costs and Limited Consumer Awareness in Emerging Markets

Despite long-term savings, solar-powered gadgets typically involve higher initial costs due to advanced PV materials, batteries, and integrated electronics. In price-sensitive markets, consumers may hesitate to shift from conventional battery-powered or grid-powered alternatives. Awareness gaps regarding benefits, durability, and total cost of ownership further slow adoption. Limited retail penetration, inadequate product demonstrations, and insufficient aftersales support also affect market expansion in developing regions. Manufacturers must improve affordability through localized production, government collaborations, and value-driven product offerings to overcome this barrier and unlock demand across emerging global markets.

Regional Analysis

North America

North America leads the Solar Powered Gadgets market with 31.4% share in 2024, driven by strong consumer inclination toward sustainable technologies, high spending on smart home devices, and widespread adoption of solar-powered surveillance, lighting, and portable electronics. The U.S. contributes significantly due to robust innovation, advanced retail distribution, and growing outdoor recreation trends. Government programs supporting renewable energy awareness further accelerate adoption. Rising use of solar gadgets in residential security and commercial applications positions the region as a continued demand center, supported by strong technology integration and high acceptance of off-grid energy solutions.

Europe

Europe accounts for 27.6% of the market in 2024, supported by stringent environmental regulations, strong sustainability culture, and rapid adoption of solar-powered consumer and outdoor gadgets. Countries such as Germany, the U.K., and the Netherlands show high penetration of solar lighting, garden systems, and smart surveillance devices. Growth is further fueled by increasing electricity costs, which make energy-independent gadgets financially appealing. Expanding applications in mobility, camping, and recreational activities strengthen regional demand. Strong emphasis on carbon neutrality initiatives and rapid expansion of smart home ecosystems sustains Europe’s strong position in the global market.

Asia-Pacific

Asia-Pacific holds 29.8% market share in 2024, emerging as the fastest-growing region due to large-scale manufacturing capabilities, rising disposable incomes, and expanding rural electrification initiatives. China, India, Japan, and South Korea drive rapid adoption across residential and commercial sectors, especially in portable solar chargers, lanterns, and surveillance systems. Government-led solar programs and subsidies significantly encourage household adoption. Outdoor and recreational gadget demand continues to rise as tourism and adventure activities grow. Strong cost competitiveness and expanding e-commerce penetration make Asia-Pacific a key growth engine for global solar-powered gadget consumption.

Latin America

Latin America captures 6.1% of the market in 2024, with growth supported by increasing demand for solar-powered lighting, chargers, and security devices in regions with unstable grid supply. Brazil, Mexico, and Chile lead adoption due to expanding renewable energy initiatives and improving awareness of portable solar technologies. Rural communities increasingly rely on solar gadgets for daily utility and safety. Rising outdoor and camping culture, along with growing commercial use cases such as solar signage and surveillance, contributes to market expansion. However, price sensitivity and limited retail infrastructure moderately constrain widespread adoption.

Middle East & Africa

The Middle East & Africa region represents 5.1% market share in 2024, supported by abundant sunlight availability and growing reliance on solar-powered gadgets for off-grid applications. Countries such as the UAE, Saudi Arabia, South Africa, and Kenya increasingly adopt solar lighting, portable chargers, and security systems due to high electricity tariffs or limited rural electrification. Government-backed renewable energy programs enhance market visibility. Demand rises sharply in rural Africa for essential solar tools, improving communication and safety. Despite strong potential, affordability challenges and limited local distribution networks restrain faster penetration.

Market Segmentations

By Gadget Type

- Consumer Electronics

- Home And Garden

- Outdoor and Recreational

- Others (Automotive and transport etc.)

By End User

By Distribution Channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Solar Powered Gadgets market features a diverse and rapidly evolving competitive landscape, with companies focusing on innovation, efficiency improvements, and portfolio expansion to strengthen their market presence. Key players such as Garmin, GoSun, Gemma Lighting, Hikvision Digital Technology, INVT Solar Technology, LS VISION Technology, Pvilion, Solar Solutions AG, Soleos, and Sun Surveillance actively invest in advanced photovoltaic materials, battery technologies, and smart integrations to enhance product performance. Many brands emphasize durability, portability, and energy independence to cater to residential, commercial, and outdoor application needs. Strategic partnerships, product launches, and global distribution expansions remain central to gaining market traction. E-commerce channels and direct-to-consumer models also elevate competition, enabling broader customer reach and faster adoption. As sustainability trends intensify, companies increasingly differentiate through eco-friendly designs, multifunctional features, and IoT-enabled solar gadgets, positioning the market for steady technological advancement and heightened competitive activity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sun Surveillance

- Gemma Lighting

- Soleos

- Garmin

- GoSun

- LS VISION Technology

- Pvilion

- Hikvision Digital Technology

- Solar Solutions AG

- INVT Solar Technology

Recent Developments

- In December 2025, TOYO Co., Ltd. acquired the remaining 24.99% membership interest in its U.S. subsidiary TOYO Solar LLC, making it a wholly owned subsidiary strengthening its foothold in the U.S. solar-module manufacturing supply chain.

- In May 2024, Hikvision introduced a new range of solar-powered security solutions designed for remote and standalone sites. The portfolio spans from cost-effective 4 MP Solar Kits equipped with ColorVu technology to high-end 8 MP models featuring License Plate Recognition, enabling enhanced protection across varied environments, including rural farms and urban parking areas.

- In February 2023, GoSun launched its innovative solar-powered backpack tailored for travelers, hikers, and day packers. The backpack provides ample storage for GoSun devices and essential off-grid gear while generating and storing solar energy for later use. It also functions as an emergency-ready survival bag.

Report Coverage

The research report offers an in-depth analysis based on Gadget Type, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience sustained growth as consumers increasingly prefer renewable, portable, and off-grid energy solutions.

- Advancements in high-efficiency solar cells and durable energy storage systems will enable more powerful and compact gadget designs.

- Integration of IoT, AI, and smart connectivity features will expand applications across residential, commercial, and outdoor environments.

- Outdoor recreation, adventure tourism, and emergency preparedness will continue to drive strong demand for solar-powered portable devices.

- Commercial adoption will rise as businesses deploy solar surveillance, signage, and operational tools to reduce energy costs.

- Flexible, lightweight, and wearable solar materials will open new product opportunities in health, fitness, and mobility sectors.

- E-commerce expansion and direct-to-consumer sales models will accelerate market penetration worldwide.

- Increased climate awareness and sustainability regulations will further encourage solar gadget adoption across all regions.

- Hybrid charging technologies combining solar, kinetic, and wireless power will enhance device versatility.

- Emerging markets will offer strong growth potential as electrification improves and affordability increases