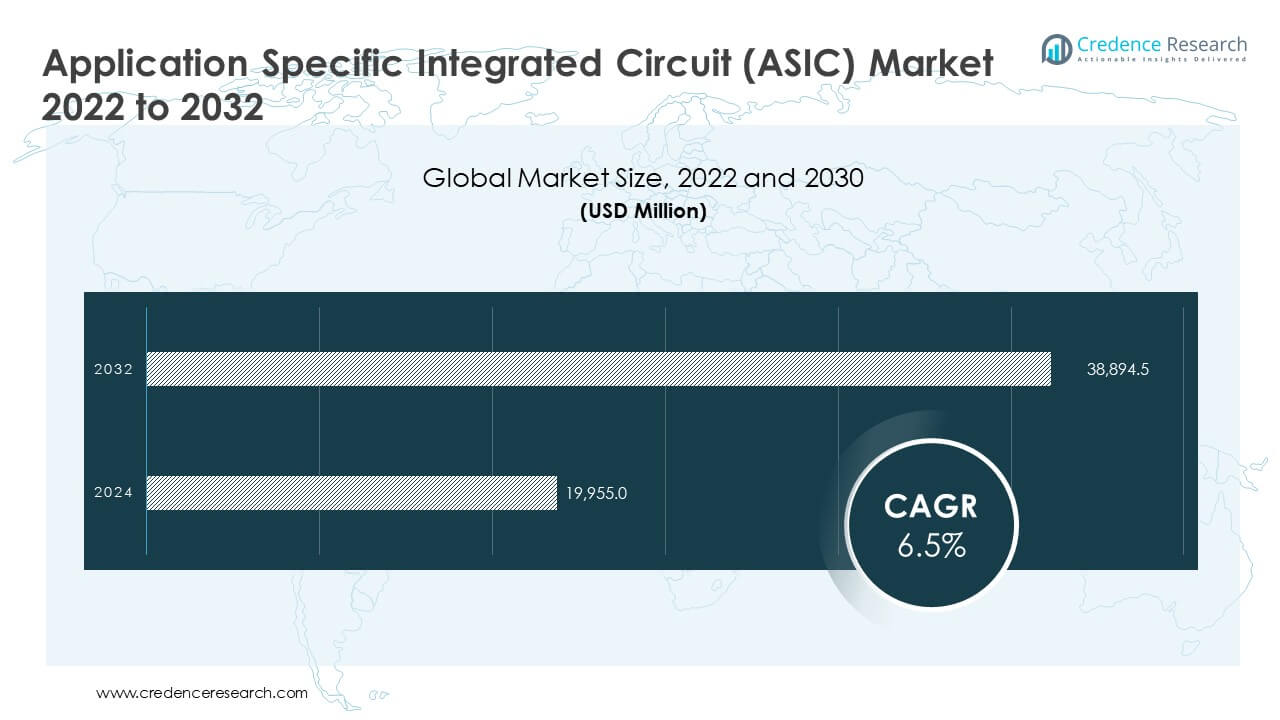

Rising Demand for Customized and Energy-Efficient Solutions Driving ASIC Market Growth

According to a new market report published by Credence Research, “Application Specific Integrated Circuit (ASIC) Market – Growth, Share, Opportunities, Competitive Analysis, 2024 – 2032”, the global ASIC market was valued at USD 19,955.0 million in 2024 and is expected to reach USD 38,894.5 million by 2032, expanding at a CAGR of 8.7% during the forecast period.

Rising Demand for Customized and Energy-Efficient Solutions

The growing requirement for task-specific processing is accelerating the adoption of ASICs across industries. Companies in automotive, consumer electronics, and data centers are prioritizing chips tailored to deliver optimal performance at minimal energy consumption. ASICs meet this need by replacing general-purpose processors with efficient, application-focused architectures.

In electric vehicles, ASICs manage battery systems, inverters, and motor control units with higher efficiency. In consumer electronics, they support processing in smart devices, wearables, and multimedia systems. In data centers, ASICs enable faster execution of fixed operations, such as encryption and compression, while reducing heat generation and power usage.

This demand is growing alongside the global shift toward 5G networks, autonomous vehicles, and Internet of Things (IoT) ecosystems. These technologies require low-latency, energy-conscious chips that general-purpose integrated circuits cannot support at scale. ASICs enable engineers to deliver performance consistency while managing system power budgets effectively.

Browse market data figures spread through 220+ pages and an in-depth TOC on “Application Specific Integrated Circuit (ASIC) Market“

Download Free Sample Report

Growing Adoption of 5G and Edge Computing

The global rollout of 5G and expansion of edge computing are increasing the need for ASICs in telecom and network infrastructure. ASICs are well suited to manage high-frequency data traffic and low-latency computing requirements in edge devices and 5G base stations. Their deterministic performance and hardware-level optimization make them essential for supporting the growing density of user and device connectivity.

Telecom service providers require ASICs to reduce latency and increase throughput in core and edge network nodes. Edge computing systems, deployed in smart cities, factories, and vehicles, rely on ASICs for localized processing that minimizes dependence on central servers. ASICs reduce bottlenecks and improve system responsiveness.

For instance, Qualcomm has introduced custom ASICs optimized for 5G small cells, enabling more efficient signal processing and data transmission in dense urban environments. These ASICs improve power efficiency and reduce thermal stress, supporting the stable operation of edge infrastructure. Similar trends are emerging in industrial automation and consumer IoT applications where edge AI and localized control systems benefit from ASIC deployment.

High Design and Development Costs

Despite their advantages, ASICs face limitations due to high development costs. ASIC design requires significant financial and technical investment. Unlike general-purpose processors, each ASIC is built for a specific application, resulting in longer design cycles and extensive prototyping. This increases financial risk and restricts access for small and mid-sized enterprises.

Creating a 7nm ASIC, for example, may require over USD 25 million in design and mask production costs. Advanced fabrication nodes, intellectual property licensing, and engineering resources add to the total expense. These costs are justifiable only when production volumes are high enough to amortize fixed expenses.

This barrier limits ASIC adoption in startups or low-volume products where return on investment is uncertain. The risk of commercial failure further discourages market entry by emerging firms, restricting innovation. As a result, the ASIC market is concentrated among large semiconductor manufacturers that can afford the high upfront investment and have the volume to support long-term deployment.

Market Segmentation

By Type

- Full Custom ASIC

- Semi-Custom ASIC

- Programmable ASIC

By Application

- Consumer Electronics

- Automotive

- Telecommunications

- Industrial

- Aerospace and Defense

- Healthcare

By End-User Industry

- IT and Telecommunications

- Automotive

- Consumer Electronics

- Industrial

- Others (Healthcare, Defense)

By Geography

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis: North America Dominates Global ASIC Market

North America accounted for the largest market share in 2024, contributing approximately 40% to global ASIC revenue. The region is home to a strong ecosystem of semiconductor design, electronics manufacturing, and technology integration. This concentration of expertise and capital enables rapid adoption of custom chip solutions.

Leading technology firms in the U.S. are deploying ASICs to improve the performance of their server infrastructure, networking systems, and autonomous platforms. These companies invest heavily in proprietary chip development to gain a competitive advantage in speed, efficiency, and reliability.

The automotive industry in North America is another major consumer of ASICs. Automakers and suppliers use ASICs in advanced driver assistance systems (ADAS), electric powertrains, and connectivity modules. As vehicle electrification and automation expand, demand for customized chipsets continues to grow.

Government-backed research and commercial R&D partnerships further support the regional ASIC supply chain. The U.S. government has funded domestic semiconductor initiatives aimed at reducing reliance on overseas manufacturing. These policies favor investments in high-performance, application-specific chips across critical infrastructure, defense, and telecommunications.

Key Players

Key participants in the global ASIC market focus on innovation, fabrication capabilities, and volume scalability. Major players include:

- Intel Corporation

- Broadcom Inc.

- Infineon Technologies AG

- STMicroelectronics

- FUJITSU

- Faraday Technology Corporation

- Semiconductor Components Industries, LLC

- Comport Data

- OmniVision Technologies, Inc.

- ASIX Electronics

These firms maintain long-term supply contracts with major electronics manufacturers and systems integrators. Their expertise in system-on-chip (SoC) integration, advanced packaging, and foundry collaboration positions them to address growing ASIC demand. Strategic alliances, such as design partnerships and IP licensing agreements, enable product differentiation and market expansion.

About Us:

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 2000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives.

Contact Us

Credence Research Inc.

North America – +1 304 308 1216

Australia – +61 4192 46279

Asia Pacific – +81 5050 50 9250

+64 22 017 0275

India – +91 6232 49 3207

sales@credenceresearch.com

www.credenceresearch.com