Market Overview

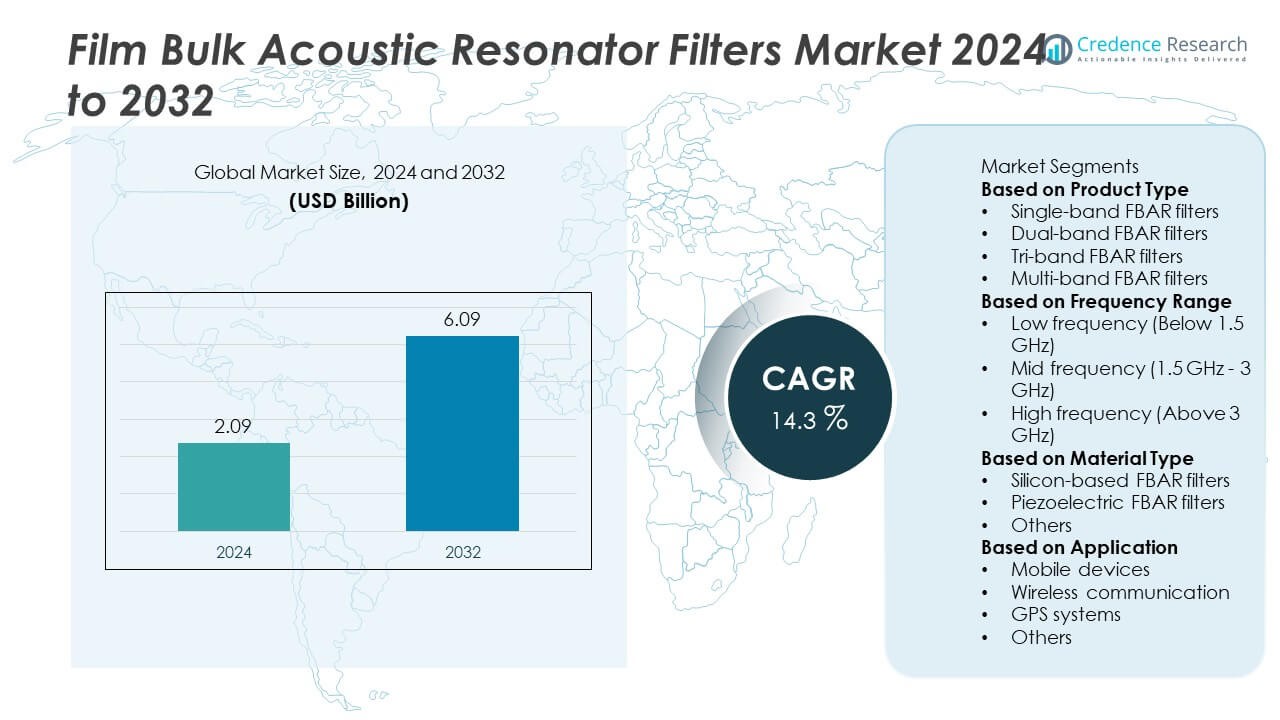

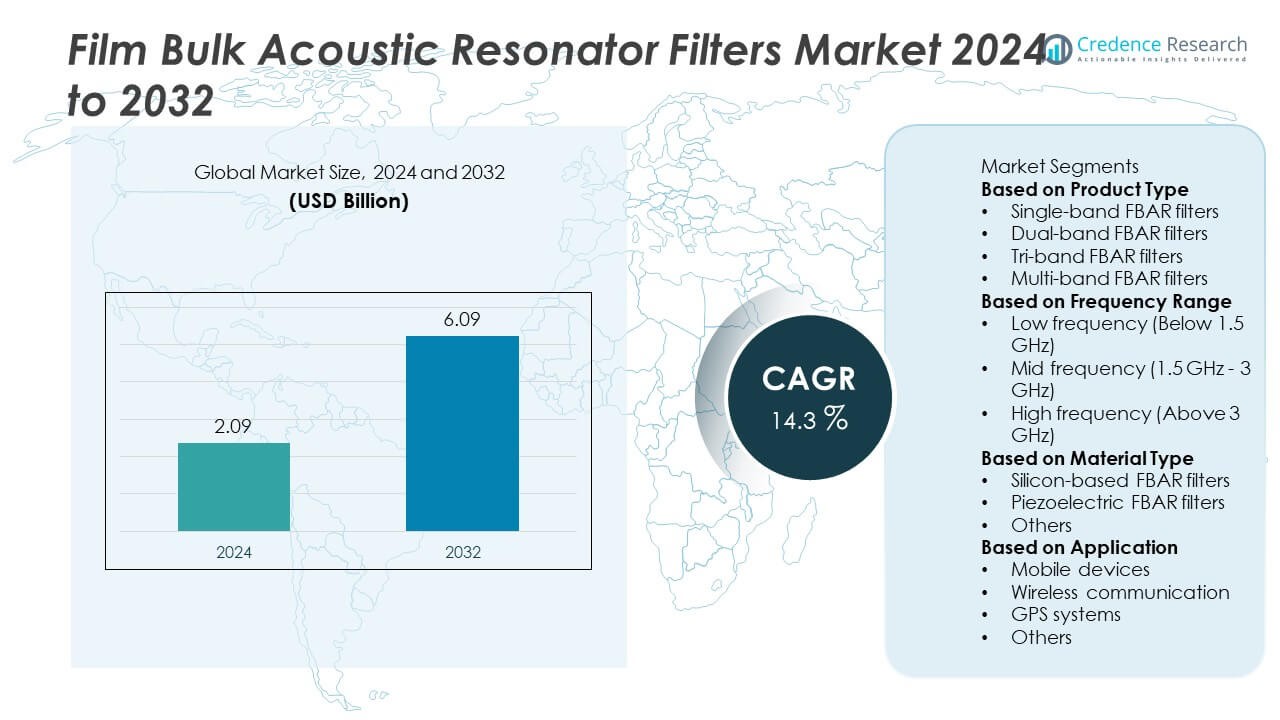

The Film Bulk Acoustic Resonator Filters market was valued at USD 2.09 billion in 2024 and is projected to reach USD 6.09 billion by 2032, growing at a CAGR of 14.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Film Bulk Acoustic Resonator Filters market Size 2024 |

USD 2.09 Billion |

| Film Bulk Acoustic Resonator Filters market , CAGR |

14.3% |

| Film Bulk Acoustic Resonator Filters market Size 2032 |

USD 6.09 Billion |

The Film Bulk Acoustic Resonator (FBAR) Filters market is led by prominent players such as Broadcom Inc., Kyocera Corporation, CTS Corporation, OmniVision Technologies, Infineon Technologies AG, Anatech Electronics, Inc., Akoustis Technologies, Inc., Murata Manufacturing Co., Ltd., Analog Devices, Inc., and API Technologies Corp. These companies dominate through strong product innovation, advanced RF solutions, and global distribution networks. Broadcom leads with high-performance FBAR modules integrated into 5G and Wi-Fi systems, while Murata and Kyocera emphasize miniaturized designs for consumer electronics. Regionally, North America held 34% of the market share in 2024, driven by strong 5G adoption and advanced semiconductor manufacturing capabilities supporting continuous FBAR development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Film Bulk Acoustic Resonator (FBAR) Filters market was valued at USD 2.09 billion in 2024 and is projected to reach USD 6.09 billion by 2032, growing at a CAGR of 14.3% during the forecast period.

- Rising demand for 5G-enabled smartphones and high-frequency communication systems drives market expansion, supported by increased adoption in IoT and automotive radar applications.

- A key trend includes the development of multi-band and tunable FBAR filters that enhance spectral efficiency and support compact RF module integration across advanced devices.

- Leading players such as Broadcom Inc., Murata Manufacturing Co., Ltd., and Infineon Technologies AG focus on R&D, product miniaturization, and strategic collaborations to maintain a competitive edge.

- North America held 34% of the market share in 2024, while the mid-frequency (1.5–3 GHz) segment led with 47%, driven by extensive deployment in 4G LTE and Sub-6 GHz 5G network infrastructure.

Market Segmentation Analysis:

By Product Type

The single-band FBAR filters segment dominated the market in 2024, accounting for around 42% of the total share. These filters are widely used in mobile devices and wireless communication systems due to their simplicity, compact size, and cost efficiency. Demand remains strong across 4G and early 5G networks where single-band filtering provides stable frequency performance. Meanwhile, multi-band filters are gaining traction with the expansion of multi-frequency smartphones and IoT applications. Ongoing R&D for integration into compact modules supports product diversification and performance improvements.

- For instance, Broadcom (via its acquisition of Avago) developed Film Bulk Acoustic Resonator (FBAR) filter and duplexer technology. This FBAR technology is widely used in smartphones and other wireless devices. FBAR filters are known for having lower insertion loss and superior performance compared to older Surface Acoustic Wave (SAW) filters, a factor that helps extend battery life.

By Frequency Range

The mid-frequency range (1.5–3 GHz) segment held the largest market share of approximately 47% in 2024, driven by heavy deployment in 4G LTE and Sub-6 GHz 5G bands. These filters ensure low signal loss and high selectivity, essential for maintaining call quality and data speed. Their growing use in Wi-Fi routers and connected automotive systems strengthens market leadership. Rising adoption of advanced telecommunication standards continues to push demand for high-performance mid-frequency FBAR solutions in global network infrastructure.

- For instance, Akoustis Technologies’ XBAW filters achieved quality factors exceeding 2,000 at 2.4 GHz and rejection levels greater than 55 dB, enabling deployment in over 30 Wi-Fi 6E and 5G infrastructure products. This advancement improved mid-band spectral efficiency and reduced interference in dense signal environments.

By Material Type

Piezoelectric FBAR filters led the market in 2024 with an estimated 58% share, attributed to superior acoustic properties and high-frequency stability. Materials like aluminum nitride and zinc oxide provide efficient signal transmission and strong temperature resistance, enhancing device reliability. The rising integration of these materials in smartphones and radar systems boosts demand. Manufacturers continue to focus on improving piezoelectric thin-film deposition techniques to increase yield and performance consistency, supporting widespread adoption in next-generation communication and sensor technologies.

Key Growth Drivers

Rising Demand for 5G and Advanced Wireless Communication

The global rollout of 5G networks is a major force behind the growth of the Film Bulk Acoustic Resonator (FBAR) filters market. FBAR filters deliver high frequency precision and low signal loss, making them vital for 5G base stations, smartphones, and IoT devices. Telecom operators are enhancing network efficiency through compact RF modules that depend on FBAR technology. As mobile devices expand to multiple frequency bands, the need for advanced filtering and signal stability continues to drive strong market demand.

- For instance, Qorvo has manufactured high-performance bulk acoustic wave (BAW) filters for 5G RF front-end modules, with some filters in its portfolio, like those from its NoDrift™ line, achieving exceptional temperature stability within ±2 ppm/°C.

Miniaturization and Integration in Consumer Electronics

Growing demand for smaller and multifunctional devices is propelling FBAR filter adoption. These filters enable efficient signal processing while minimizing component size, supporting sleek designs and improved battery performance. Their integration with system-on-chip (SoC) architectures enhances both power efficiency and reliability. Smartphones, wearables, and connected devices increasingly rely on miniaturized FBAR components to deliver high-speed connectivity in compact spaces. This trend toward micro-integration continues to expand the market’s reach across consumer electronics.

- For instance, Murata Manufacturing has developed and mass-produced high-frequency XBAR filters for wireless applications such as 5G, Wi-Fi 7, and IoT devices like wearables and communication gateways. The filters are designed to be integrated into compact devices and achieve high attenuation with low insertion loss, improving signal clarity and efficiency.

Expanding Use in Defense and Automotive Applications

FBAR filters are gaining traction in defense and automotive systems due to their stability and precision. In military applications, they enhance radar accuracy and secure communication under extreme conditions. Automotive manufacturers use FBAR filters in radar, collision avoidance, and vehicle-to-everything (V2X) systems, supporting advanced driver assistance and autonomous vehicles. The technology’s ability to perform reliably across high frequencies and temperatures drives its use in mission-critical environments, widening the market beyond consumer and telecom applications.

Key Trends and Opportunities

Emergence of Multi-band and Reconfigurable Filter Technologies

The market is witnessing strong momentum toward multi-band and reconfigurable FBAR filters. These designs support multiple communication standards such as 4G, 5G, and Wi-Fi 6, enabling seamless frequency switching and improved signal performance. Manufacturers are focusing on reducing component count and production costs while increasing functionality. Such innovations benefit high-performance smartphones, IoT modules, and wireless communication systems, creating strong opportunities for companies investing in adaptable RF filter technologies.

- For instance, Infineon Technologies AG develops various RF components, including antenna tuners, RF switches, and low-noise amplifiers, suitable for 5G and IoT applications. These solutions leverage silicon-germanium technology, with LNAs operating at frequencies covering up to 7.2 GHz for 5G NR-U. Infineon’s RF products are used in devices like smartphones, wearables, 5G base stations, and automotive communication systems.

Sustainability and Energy-efficient Manufacturing Processes

Sustainability is emerging as a defining opportunity in FBAR production. Leading manufacturers are adopting eco-friendly fabrication processes that reduce waste and energy consumption. Advanced thin-film deposition and low-temperature processing improve yield and minimize material use. These practices help meet global environmental regulations and enhance brand credibility. As the electronics sector embraces green manufacturing, energy-efficient FBAR production positions companies to gain competitive advantages and long-term operational efficiency.

- For instance, Kyocera Corporation uses plasma processing technology to produce high-performance quartz wafers for ultra-compact crystal resonators used in smartphones and other devices. This manufacturing process reduces environmental impact and conserves energy through various initiatives, including the use of renewable energy sources at its production sites.

Key Challenges

High Production Cost and Fabrication Complexity

Manufacturing FBAR filters involves intricate processes such as thin-film deposition and etching that require high capital investment. Cleanroom environments and advanced equipment drive up production costs, making scalability difficult for smaller firms. The precision needed in layer thickness and acoustic design limits yield rates, increasing per-unit costs. Maintaining cost competitiveness while ensuring high-performance standards remains a significant challenge for market players, particularly in high-volume consumer electronics segments.

Material and Performance Limitations at High Frequencies

FBAR filters face challenges when operating at very high or millimeter-wave frequencies. Acoustic losses, limited piezoelectric properties, and thermal instability can degrade signal performance. These limitations hinder their full deployment in ultra-high-frequency 5G and radar applications. Researchers are exploring new materials such as scandium-doped aluminum nitride to improve frequency range and power handling. However, until such materials are widely commercialized, achieving consistent performance at higher bands will remain a key technical barrier.

Regional Analysis

North America

North America held the largest share of 34% in 2024, driven by strong adoption of 5G infrastructure and advanced communication technologies. The United States leads the region with heavy investments in RF components for smartphones, defense systems, and network equipment. Major semiconductor manufacturers and research institutions support continuous innovation in FBAR technology. Increasing use of these filters in IoT devices, aerospace applications, and automotive radar systems further strengthens regional demand. Government initiatives promoting domestic chip production and next-generation communication development are boosting the long-term growth outlook for FBAR filters across the region.

Europe

Europe accounted for 26% of the global market in 2024, fueled by rapid advancements in 5G deployment and expanding automotive electronics. Germany, France, and the United Kingdom are key contributors, focusing on high-frequency filters for connected vehicles and industrial IoT systems. The region benefits from strong R&D capabilities and collaborations between semiconductor companies and defense organizations. The European Union’s emphasis on technology sovereignty and energy-efficient communication infrastructure also supports growth. Increased demand for reliable and compact RF components across telecommunication and automotive sectors continues to propel the FBAR filters market in Europe.

Asia-Pacific

Asia-Pacific dominated the production landscape and captured 31% of the total share in 2024. The region’s growth is driven by massive smartphone manufacturing in China, South Korea, Japan, and Taiwan. Rapid 5G network rollout, coupled with rising IoT and consumer electronics demand, accelerates FBAR adoption. Local companies invest heavily in low-cost fabrication and integration technologies, making Asia-Pacific a key supplier in the global market. Governments promoting semiconductor self-reliance and technological innovation further enhance competitiveness. The growing automotive electronics sector, especially in Japan and China, also boosts the use of FBAR filters in radar and communication modules.

Latin America

Latin America represented 5% of the global market in 2024, supported by steady progress in mobile connectivity and digital transformation. Brazil and Mexico lead regional demand, driven by the expansion of 4G and emerging 5G infrastructure. Increasing use of smartphones and connected devices creates opportunities for RF filter suppliers. The region’s adoption remains in an early stage but is gaining traction as telecom operators modernize networks. Ongoing collaborations with global electronics manufacturers and improving industrial policies are expected to strengthen regional production and distribution of FBAR-based components in the coming years.

Middle East & Africa

The Middle East & Africa accounted for 4% of the global FBAR filters market in 2024, driven by growing investments in telecom and defense communication infrastructure. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are adopting advanced RF technologies to enhance connectivity. Expansion of smart city projects and industrial IoT systems supports gradual market development. Although the region’s semiconductor base is limited, import partnerships with Asian and European manufacturers sustain supply chains. Rising defense modernization efforts and digital transformation initiatives are expected to drive moderate growth in the coming decade.

Market Segmentations:

By Product Type

- Single-band FBAR filters

- Dual-band FBAR filters

- Tri-band FBAR filters

- Multi-band FBAR filters

By Frequency Range

- Low frequency (Below 1.5 GHz)

- Mid frequency (1.5 GHz – 3 GHz)

- High frequency (Above 3 GHz)

By Material Type

- Silicon-based FBAR filters

- Piezoelectric FBAR filters

- Others

By Application

- Mobile devices

- Wireless communication

- GPS systems

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Film Bulk Acoustic Resonator (FBAR) Filters market is characterized by strong technological innovation and strategic expansion among leading players such as Broadcom Inc., Kyocera Corporation, CTS Corporation, OmniVision Technologies, Infineon Technologies AG, Anatech Electronics, Inc., Akoustis Technologies, Inc., Murata Manufacturing Co., Ltd., Analog Devices, Inc., and API Technologies Corp. These companies focus on developing high-performance RF filters to meet growing demand across 5G, IoT, and automotive applications. Broadcom continues to dominate through its advanced FBAR product line and large-scale integration in mobile devices. Akoustis Technologies and Murata Manufacturing are investing heavily in wafer-level packaging and new piezoelectric materials to enhance signal precision and scalability. Meanwhile, Infineon and Analog Devices leverage their semiconductor expertise to integrate FBAR components into high-frequency communication systems. Strategic partnerships, R&D collaborations, and product miniaturization remain key tactics shaping competition and sustaining long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Broadcom Inc.

- Kyocera Corporation

- CTS Corporation

- OmniVision Technologies

- Infineon Technologies AG

- Anatech Electronics, Inc.

- Akoustis Technologies, Inc.

- Murata Manufacturing Co., Ltd.

- Analog Devices, Inc.

- API Technologies Corp.

Recent Developments

- In January 2025, Kyocera Corporation (KYOCERA AVX) released two thin-film band-pass filter series for high-power RF uses.

- In 2025, Anatech Electronics, Inc. introduced three new RF filters, including a 9.58 GHz waveguide band-pass model.

- In June 2024, API Technologies Corp. (now Spectrum Control) launched a high-Q RF filter family and continued brand transition communications.

- In May 2023, Broadcom Inc. announced a multiyear Apple deal to supply U.S.-made RF components including FBAR filters.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Frequency Range, Material Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for FBAR filters will rise with global 5G and Wi-Fi 7 network expansion.

- Miniaturized and integrated RF modules will gain traction across smartphones and IoT devices.

- Advances in piezoelectric materials will enhance performance and reduce signal losses.

- Multi-band and reconfigurable FBAR filters will dominate next-generation wireless communication systems.

- Automotive radar and V2X communication adoption will strengthen filter demand in connected vehicles.

- Defense and aerospace sectors will increasingly deploy FBAR filters for secure, high-frequency communication.

- Sustainable and energy-efficient manufacturing processes will become a key industry focus.

- Strategic mergers and R&D partnerships will accelerate product innovation and cost efficiency.

- Asia-Pacific will remain the leading production hub, driven by strong semiconductor manufacturing capacity.

- Continuous focus on high-frequency and millimeter-wave applications will shape future technological advancements.